Reports

Reports

Analyst’s Viewpoint regarding Patient Engagement Solutions Market

The global patient engagement solutions market is growing exponentially, and governments across the globe are providing incentives and subsidies to people to persuade them to play an active role in healthcare. Growing focus on active patient engagement in disease management is also driving the demand for patient engagement solutions. Increased focus on the active involvement of patients in disease care is likely to propel the market, as the active participation of patients and healthcare providers is necessary for better health outcomes.

The market is, however, plagued, particularly in the emerging economies, where the lack of adequately trained healthcare staff and low health literacy levels might hinder the adoption of patient engagement solutions. Regardless of these challenges, the increasing demand for personalized medicine and the relentless evolution of technology are expected to drive the market over the forecast period. The ongoing creation of patient engagement technology will probably solve these issues, making healthcare more convenient and efficient for patients globally.

The patient engagement solutions market worldwide is growing at a high rate as healthcare systems across the globe are working on enhancing patient outcomes and patient care experience. Patient engagement solutions, including patient portals, mobile health apps, wearables, and remote monitoring solutions, empower patients to become more actively involved in their health. The solutions enable easy communication between patients and healthcare providers with real-time data sharing, customized care plans, and timely interventions.

The major drivers to market growth are the growing adoption of digital health solutions, the increasing focus on patient-centric care, and technological innovation. Healthcare providers are employing patient engagement platforms for improving patient satisfaction, reducing hospital readmission, and promoting healthier lifestyles. The shift toward value-based care models, which emphasize long-term results over episodic treatment, also drives the adoption of engagement technology.

Inhibitors to growth such as data privacy issues, integration problems, and resistance in some geographies may slow growth, but overall the patient engagement solutions industry will grow as healthcare systems are rushing toward digitalization to provide improved patient care and outcomes.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One of the major growth factors to the patient engagement solutions market worldwide is the rising adoption of digital health technologies. Healthcare providers are increasingly adopting digital health technologies like patient portals, mobile apps, and wearables for patient engagement and care delivery improvement.

The COVID-19 pandemic greatly impacted the use of digital health technologies, and virtual care, telemedicine, and remote consultation became key to maintaining continuity of access to healthcare services with reduced physical contact. This has been sustained after the pandemic, with healthcare organizations having understood the long-term use of such technology in patient engagement, administrative cost savings, and improved health outcomes. As digital transformation in healthcare keeps gaining traction, there will be increased need for innovative patient engagement solutions, thus further propelling the market.

Increase in the incidence of chronic diseases is one of the major drivers to the patient engagement solutions market across the globe. Hypertension, diabetes, and cardiovascular disease are some chronic diseases that have to be treated for a long period of time, and patient engagement plays a significant role in chronic disease management over a long period of time. Patient engagement technologies allow ongoing monitoring and tailored care, and this plays a significant role in chronic disease care over a long period of time. With an increase in age and unhealthy living, chronic diseases are increasing in the world, and healthcare systems are attempting to empower patients with devices to take charge of their health actively. Patient engagement solutions like remote monitoring devices, health apps, and telehealth platforms allow patients to track lifestyle, medication, and vital signs. These devices allow real-time feedback, and this makes the patient understand his condition easily and respond accordingly.

Besides, patient engagement solutions enable healthcare professionals to intervene in time and avoid complications, thereby reducing hospitalization and the economic burden on healthcare systems. This transition to preventive care and ongoing monitoring has turned patient engagement into a core element of chronic disease management. With the prevalence of chronic diseases still on the rise globally, patient engagement solutions that enable long-term health management will keep increasing manifold in demand, driving the market ahead.

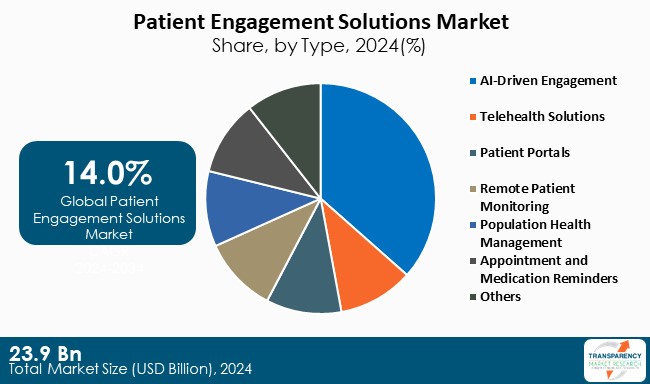

By type, the remote patient monitoring segment leads the patient engagement solutions market globally and is forecast to continue with the winning streak between 2024 and 2035. RPM monitors vital indicators like blood pressure, blood glucose, and the other parameters and is thus capable of monitoring chronic conditions like diabetes, hypertension, and cardiovascular disease in real time.

The integration of RPM with patient engagement technology is improving patient-physician communication, thereby facilitating proactive management and early intervention.

This move toward RPM is being driven by growing demand for affordable, tailored care. By limiting on-site visits, RPM can lower healthcare costs and increase access to care, especially for patients who reside in rural or underserved areas. RPM also facilitates patient adherence to treatment regimens through real-time feedback, thereby allowing patients to become more engaged in taking control of their health.

Use of RPM across disease specialties is revolutionizing chronic illness management by ensuring constant monitoring and improving patient-provider interactions. This trend is part of the broader movement in patient engagement technology that is personalizing, streamlining, and democratizing healthcare to make it more individualized, effective, and accessible to patients worldwide.

| Attribute | Detail |

|---|---|

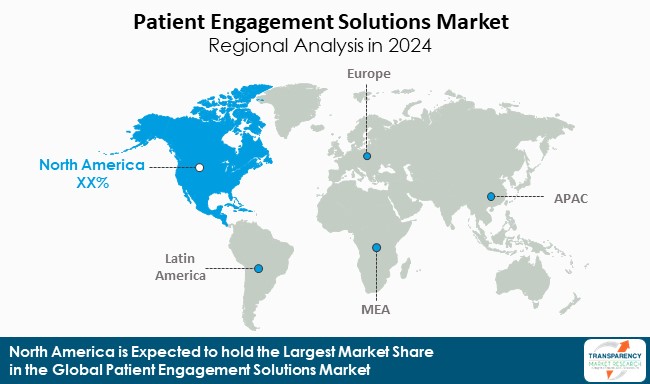

| Leading Region | North America |

According to the latest trends in the patient engagement solutions market, North America is expected to retain the highest percentage of the global market share. Several key factors contribute to this dominant position. Adoption of digital health technologies like telemedicine, patient portals, and remote patient monitoring is well-established in the region.

The healthcare infrastructure of North America has been swift in adopting innovations for enhanced patient engagement and delivery of healthcare, especially due to the COVID-19 pandemic, which has hastened the mass adoption of remote care solutions.

Further, the strong regulatory support to patient engagement solutions in North America, specifically in the U.S. under the HITECH Act and Affordable Care Act, has compelled the take-up of digital health solutions. The legislation encourages the adoption of electronic health records (EHRs) and telemedicine services, which are constituent elements of patient engagement solutions.

Healthcare expenditure is also a dominant feature, with North American nations investing huge sums of money in a bid to enhance healthcare outcomes. The value-based care model, which is dominant in the region, focuses on patient outcomes and proactive management of health conditions, and therefore is in close alignment with the goals of patient engagement solutions, leading to widespread adoption.

Cerner Corporation (Oracle), NextGen Healthcare, Inc., Epic Systems Corporation, Allscripts Healthcare, LLC, McKesson Corporation, ResMed, Koninklijke Philips N.V., Klara Technologies, Inc., CPSI, Ltd., Experian Information Solutions, Inc., Athenahealth Solutionreach, Inc., IBM, MEDHOST, and Nuance Communications, Inc. are some of the players covered in the global patient engagement solutions market report.

Each of these players has been profiled in the carrier screening market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Key Developments in Patient Engagement Solutions Market

| Attribute | Detail |

|---|---|

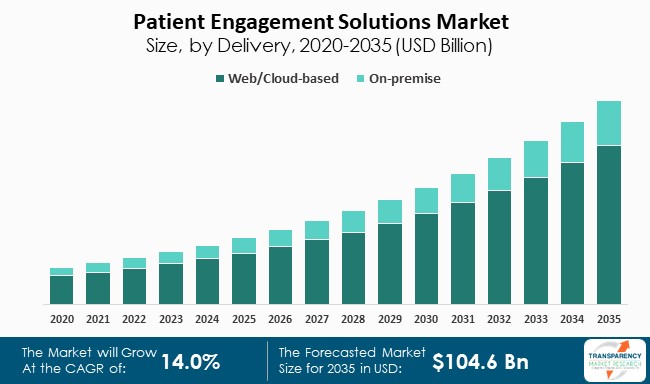

| Size in 2024 | US$ 23.9 Bn |

| Forecast Value in 2035 | US$ 104.6 Bn |

| CAGR | 14.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The patient engagement solutions market was valued at US$ 23.9 Bn in 2024

The patient engagement solutions market is projected to cross US$ 104.6 Bn by the end of 2035

Rise in adoption of medical wearables and expansion of hospitals and healthcare sectors

The CAGR is anticipated to be 14.0% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Cerner Corporation (Oracle), NextGen Healthcare, Inc., Epic Systems Corporation, Allscripts Healthcare, LLC, McKesson Corporation, ResMed, Koninklijke Philips N.V., Klara Technologies, Inc., CPSI, Ltd., Experian Information Solutions, Inc., Athenahealth Solutionreach, Inc., IBM, MEDHOST, Nuance Communications, Inc., and Others

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Patient Engagement Solutions Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Patient Engagement Solutions Market Analysis and Forecast, 2020-2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key Industry Events

5.2. Impact Analysis

5.3. PESTEL Analysis

5.4. Regulatory Scenario by Key Countries/Regions

5.5. PORTER’s Five Forces Analysis

5.6. Technological Advancements

5.7. End-user Preference

5.8. Consumers Behaviour Analysis

5.9. Healthcare IT Spending by Country

6. Global Patient Engagement Solutions Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2020-2035

6.3.1. AI-Driven Engagement

6.3.2. Telehealth Solutions

6.3.3. Patient Portals

6.3.4. Remote Patient Monitoring

6.3.5. Population Health Management

6.3.6. Appointment and Medication Reminders

6.3.7. Others

6.4. Market Attractiveness Analysis, by Type

7. Global Patient Engagement Solutions Market Analysis and Forecast, by Delivery

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Delivery, 2020-2035

7.3.1. Web/Cloud-based

7.3.2. On-premise

7.4. Market Attractiveness Analysis, by Delivery

8. Global Patient Engagement Solutions Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2020-2035

8.3.1. Enhanced Communication

8.3.2. Patient Education

8.3.3. Predictive Analytics

8.3.4. Streamlined Operations

8.3.5. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Patient Engagement Solutions Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2020-2035

9.3.1. Hospitals & Other Healthcare Facilities

9.3.1.1. Inpatient Facilities

9.3.1.2. Outpatient Facilities

9.3.2. Pharmacies

9.3.2.1. Retail Pharmacies

9.3.2.2. Online Pharmacies

9.3.2.3. Others

9.3.3. Pharmaceutical Companies

9.3.4. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Patient Engagement Solutions Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2020-2035

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Region

11. North America Patient Engagement Solutions Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2020-2035

11.2.1. AI-Driven Engagement

11.2.2. Telehealth Solutions

11.2.3. Patient Portals

11.2.4. Remote Patient Monitoring

11.2.5. Population Health Management

11.2.6. Appointment and Medication Reminders

11.2.7. Others

11.3. Market Value Forecast, by Delivery, 2020-2035

11.3.1. Web/Cloud-based

11.3.2. On-premise

11.4. Market Value Forecast, by Application, 2020-2035

11.4.1. Enhanced Communication

11.4.2. Patient Education

11.4.3. Predictive Analytics

11.4.4. Streamlined Operations

11.4.5. Others

11.5. Market Value Forecast, by End-user, 2020-2035

11.5.1. Hospitals & Other Healthcare Facilities

11.5.1.1. Inpatient Facilities

11.5.1.2. Outpatient Facilities

11.5.2. Pharmacies

11.5.2.1. Retail Pharmacies

11.5.2.2. Online Pharmacies

11.5.2.3. Others

11.5.3. Pharmaceutical Companies

11.5.4. Others

11.6. Market Value Forecast, by Country, 2020-2035

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Delivery

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Patient Engagement Solutions Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2020-2035

12.2.1. AI-Driven Engagement

12.2.2. Telehealth Solutions

12.2.3. Patient Portals

12.2.4. Remote Patient Monitoring

12.2.5. Population Health Management

12.2.6. Appointment and Medication Reminders

12.2.7. Others

12.3. Market Value Forecast, by Delivery, 2020-2035

12.3.1. Web/Cloud-based

12.3.2. On-premise

12.4. Market Value Forecast, by Application, 2020-2035

12.4.1. Enhanced Communication

12.4.2. Patient Education

12.4.3. Predictive Analytics

12.4.4. Streamlined Operations

12.4.5. Others

12.5. Market Value Forecast, by End-user, 2020-2035

12.5.1. Hospitals & Other Healthcare Facilities

12.5.1.1. Inpatient Facilities

12.5.1.2. Outpatient Facilities

12.5.2. Pharmacies

12.5.2.1. Retail Pharmacies

12.5.2.2. Online Pharmacies

12.5.2.3. Others

12.5.3. Pharmaceutical Companies

12.5.4. Others

12.6. Market Value Forecast, by Country/Sub-region, 2020-2035

12.6.1. Germany

12.6.2. UK

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Delivery

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Patient Engagement Solutions Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2020-2035

13.2.1. AI-Driven Engagement

13.2.2. Telehealth Solutions

13.2.3. Patient Portals

13.2.4. Remote Patient Monitoring

13.2.5. Population Health Management

13.2.6. Appointment and Medication Reminders

13.2.7. Others

13.3. Market Value Forecast, by Delivery, 2020-2035

13.3.1. Web/Cloud-based

13.3.2. On-premise

13.4. Market Value Forecast, by Application, 2020-2035

13.4.1. Enhanced Communication

13.4.2. Patient Education

13.4.3. Predictive Analytics

13.4.4. Streamlined Operations

13.4.5. Others

13.5. Market Value Forecast, by End-user, 2020-2035

13.5.1. Hospitals & Other Healthcare Facilities

13.5.1.1. Inpatient Facilities

13.5.1.2. Outpatient Facilities

13.5.2. Pharmacies

13.5.2.1. Retail Pharmacies

13.5.2.2. Online Pharmacies

13.5.2.3. Others

13.5.3. Pharmaceutical Companies

13.5.4. Others

13.6. Market Value Forecast, by Country/Sub-region, 2020-2035

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Delivery

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Patient Engagement Solutions Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2020-2035

14.2.1. AI-Driven Engagement

14.2.2. Telehealth Solutions

14.2.3. Patient Portals

14.2.4. Remote Patient Monitoring

14.2.5. Population Health Management

14.2.6. Appointment and Medication Reminders

14.2.7. Others

14.3. Market Value Forecast, by Delivery, 2020-2035

14.3.1. Web/Cloud-based

14.3.2. On-premise

14.4. Market Value Forecast, by Application, 2020-2035

14.4.1. Enhanced Communication

14.4.2. Patient Education

14.4.3. Predictive Analytics

14.4.4. Streamlined Operations

14.4.5. Others

14.5. Market Value Forecast, by End-user, 2020-2035

14.5.1. Hospitals & Other Healthcare Facilities

14.5.1.1. Inpatient Facilities

14.5.1.2. Outpatient Facilities

14.5.2. Pharmacies

14.5.2.1. Retail Pharmacies

14.5.2.2. Online Pharmacies

14.5.2.3. Others

14.5.3. Pharmaceutical Companies

14.5.4. Others

14.6. Market Value Forecast, by Country/Sub-region, 2020-2035

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Type

14.7.2. By Delivery

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Patient Engagement Solutions Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Type, 2020-2035

15.2.1. AI-Driven Engagement

15.2.2. Telehealth Solutions

15.2.3. Patient Portals

15.2.4. Remote Patient Monitoring

15.2.5. Population Health Management

15.2.6. Appointment and Medication Reminders

15.2.7. Others

15.3. Market Value Forecast, by Delivery, 2020-2035

15.3.1. Web/Cloud-based

15.3.2. On-premise

15.4. Market Value Forecast, by Application, 2020-2035

15.4.1. Enhanced Communication

15.4.2. Patient Education

15.4.3. Predictive Analytics

15.4.4. Streamlined Operations

15.4.5. Others

15.5. Market Value Forecast, by End-user, 2020-2035

15.5.1. Hospitals & Other Healthcare Facilities

15.5.1.1. Inpatient Facilities

15.5.1.2. Outpatient Facilities

15.5.2. Pharmacies

15.5.2.1. Retail Pharmacies

15.5.2.2. Online Pharmacies

15.5.2.3. Others

15.5.3. Pharmaceutical Companies

15.5.4. Others

15.6. Market Value Forecast, by Country/Sub-region, 2020-2035

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Type

15.7.2. By Delivery

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis, by Company (2023)

16.3. Company Profiles

16.3.1. Cerner Corporation (Oracle)

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. NextGen Healthcare, Inc.

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. Epic Systems Corporation

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. Allscripts Healthcare, LLC

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. McKesson Corporation

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. ResMed

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

16.3.7. Koninklijke Philips N.V.

16.3.7.1. Company Overview

16.3.7.2. Financial Overview

16.3.7.3. Product Portfolio

16.3.7.4. Business Strategies

16.3.7.5. Recent Developments

16.3.8. Klara Technologies, Inc.

16.3.8.1. Company Overview

16.3.8.2. Financial Overview

16.3.8.3. Product Portfolio

16.3.8.4. Business Strategies

16.3.8.5. Recent Developments

16.3.9. CPSI, Ltd.

16.3.9.1. Company Overview

16.3.9.2. Financial Overview

16.3.9.3. Product Portfolio

16.3.9.4. Business Strategies

16.3.9.5. Recent Developments

16.3.10. Experian Information Solutions, Inc.

16.3.10.1. Company Overview

16.3.10.2. Financial Overview

16.3.10.3. Product Portfolio

16.3.10.4. Business Strategies

16.3.10.5. Recent Developments

16.3.11. Athenahealth

16.3.11.1. Company Overview

16.3.11.2. Financial Overview

16.3.11.3. Product Portfolio

16.3.11.4. Business Strategies

16.3.11.5. Recent Developments

16.3.12. Solutionreach, Inc.

16.3.12.1. Company Overview

16.3.12.2. Financial Overview

16.3.12.3. Product Portfolio

16.3.12.4. Business Strategies

16.3.12.5. Recent Developments

16.3.13. IBM

16.3.13.1. Company Overview

16.3.13.2. Financial Overview

16.3.13.3. Product Portfolio

16.3.13.4. Business Strategies

16.3.13.5. Recent Developments

16.3.14. MEDHOST

16.3.14.1. Company Overview

16.3.14.2. Financial Overview

16.3.14.3. Product Portfolio

16.3.14.4. Business Strategies

16.3.14.5. Recent Developments

16.3.15. Nuance Communications, Inc.

16.3.15.1. Company Overview

16.3.15.2. Financial Overview

16.3.15.3. Product Portfolio

16.3.15.4. Business Strategies

16.3.15.5. Recent Developments

List of Tables

Table 01: Global Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Type, 2020-2035

Table 02: Global Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Delivery, 2020-2035

Table 03: Global Patient Engagement Solutions Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 04: Global Patient Engagement Solutions Market Value (US$ Bn) Forecast, by End-user, 2020-2035

Table 05: Global Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Hospitals & other Healthcare Facilities, 2020-2035

Table 06: Global Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Pharmacies, 2020-2035

Table 07: Global Patient Engagement Solutions Market Value (US$ Bn) Forecast, By Region, 2020-2035

Table 08: North America - Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Type, 2020-2035

Table 10: North America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Delivery, 2020-2035

Table 11: North America Patient Engagement Solutions Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 12: North America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by End-user, 2020-2035

Table 13: North America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Hospitals & other Healthcare Facilities, 2020-2035

Table 14: North America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Pharmacies, 2020-2035

Table 15: Europe - Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 16: Europe Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Type, 2020-2035

Table 17: Europe Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Delivery, 2020-2035

Table 18: Europe Patient Engagement Solutions Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 19: Europe Patient Engagement Solutions Market Value (US$ Bn) Forecast, by End-user, 2020-2035

Table 20: Europe Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Hospitals & other Healthcare Facilities, 2020-2035

Table 21: Europe Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Pharmacies, 2020-2035

Table 22: Asia Pacific - Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 23: Asia Pacific Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Type, 2020-2035

Table 24: Asia Pacific Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Delivery, 2020-2035

Table 25: Asia Pacific Patient Engagement Solutions Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 26: Asia Pacific Patient Engagement Solutions Market Value (US$ Bn) Forecast, by End-user, 2020-2035

Table 27: Asia Pacific Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Hospitals & other Healthcare Facilities, 2020-2035

Table 28: Asia Pacific Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Pharmacies, 2020-2035

Table 29: Latin America - Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 30: Latin America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Type, 2020-2035

Table 31: Latin America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Delivery, 2020-2035

Table 32: Latin America Patient Engagement Solutions Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 33: Latin America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by End-user, 2020-2035

Table 34: Latin America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Hospitals & other Healthcare Facilities, 2020-2035

Table 35: Latin America Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Pharmacies, 2020-2035

Table 36: Middle East & Africa - Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 37: Middle East and Africa Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Type, 2020-2035

Table 38: Middle East and Africa Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Delivery, 2020-2035

Table 39: Middle East and Africa Patient Engagement Solutions Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 40: Middle East and Africa Patient Engagement Solutions Market Value (US$ Bn) Forecast, by End-user, 2020-2035

Table 41: Middle East and Africa Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Hospitals & other Healthcare Facilities, 2020-2035

Table 42: Middle East and Africa Patient Engagement Solutions Market Value (US$ Bn) Forecast, by Pharmacies, 2020-2035

List of Figures

Figure 01: Global Patient Engagement Solutions Market Value Share Analysis, by Type, 2024 and 2035

Figure 02: Global Patient Engagement Solutions Market Attractiveness Analysis, by Type, 2025-2035

Figure 03: Global Patient Engagement Solutions Market Revenue (US$ Bn), by AI-Driven Engagement, 2020-2035

Figure 04: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Telehealth Solutions, 2020-2035

Figure 05: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Patient Portals, 2020-2035

Figure 06: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Remote Patient Monitoring, 2020-2035

Figure 07: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Population Health Management, 2020-2035

Figure 08: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Appointment and Medication Reminders, 2020-2035

Figure 09: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Others, 2020-2035

Figure 10: Global Patient Engagement Solutions Market Value Share Analysis, by Delivery, 2024 and 2035

Figure 11: Global Patient Engagement Solutions Market Attractiveness Analysis, by Delivery, 2025-2035

Figure 12: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Web/Cloud-based, 2020-2035

Figure 13: Global Patient Engagement Solutions Market Revenue (US$ Bn), by On-premise, 2020-2035

Figure 14: Global Patient Engagement Solutions Market Value Share Analysis, by Application, 2024 and 2035

Figure 15 Global Patient Engagement Solutions Market Attractiveness Analysis, by Application, 2025-2035

Figure 16: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Enhanced Communication, 2020-2035

Figure 17: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Patient Education, 2020-2035

Figure 18: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Predictive Analytics, 2020-2035

Figure 19: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Streamlined Operations, 2020-2035

Figure 20: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Others, 2020-2035

Figure 21: Global Patient Engagement Solutions Market Value Share Analysis, by End-user, 2024 and 2035

Figure 22: Global Patient Engagement Solutions Market Attractiveness Analysis, by End-user, 2025-2035

Figure 23: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Hospitals & other Healthcare Facilities, 2020-2035

Figure 24: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Pharmacies, 2020-2035

Figure 25: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Pharmaceutical Companies, 2020-2035

Figure 26: Global Patient Engagement Solutions Market Revenue (US$ Bn), by Others, 2020-2035

Figure 27: Global Patient Engagement Solutions Market Value Share Analysis, By Region, 2024 and 2035

Figure 28: Global Patient Engagement Solutions Market Attractiveness Analysis, By Region, 2025-2035

Figure 29: North America - Patient Engagement Solutions Market Value (US$ Bn) Forecast, 2020-2035

Figure 30: North America - Patient Engagement Solutions Market Value Share Analysis, by Country, 2024 and 2035

Figure 31: North America - Patient Engagement Solutions Market Attractiveness Analysis, by Country, 2025-2035

Figure 32: North America Patient Engagement Solutions Market Value Share Analysis, by Type, 2024 and 2035

Figure 33: North America Patient Engagement Solutions Market Attractiveness Analysis, by Type, 2025-2035

Figure 34: North America Patient Engagement Solutions Market Value Share Analysis, by Delivery, 2024 and 2035

Figure 35: North America Patient Engagement Solutions Market Attractiveness Analysis, by Delivery, 2025-2035

Figure 36: North America Patient Engagement Solutions Market Value Share Analysis, by Application, 2024 and 2035

Figure 37: North America Patient Engagement Solutions Market Attractiveness Analysis, by Application, 2025-2035

Figure 38: North America Patient Engagement Solutions Market Value Share Analysis, by End-user, 2024 and 2035

Figure 39: North America Patient Engagement Solutions Market Attractiveness Analysis, by End-user, 2025-2035

Figure 40: Europe Patient Engagement Solutions Market Value (US$ Bn) Forecast, 2020-2035

Figure 41: Europe - Patient Engagement Solutions Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 42: Europe - Patient Engagement Solutions Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 43: Europe Patient Engagement Solutions Market Value Share Analysis, by Type, 2024 and 2035

Figure 44: Europe Patient Engagement Solutions Market Attractiveness Analysis, by Type, 2025-2035

Figure 45: Europe Patient Engagement Solutions Market Value Share Analysis, By Delivery, 2024 and 2035

Figure 46: Europe Patient Engagement Solutions Market Attractiveness Analysis, By Delivery, 2025-2035

Figure 47: Europe Patient Engagement Solutions Market Value Share Analysis, by Application, 2024 and 2035

Figure 48: Europe Patient Engagement Solutions Market Attractiveness Analysis, by Application, 2025-2035

Figure 49: Europe Patient Engagement Solutions Market Value Share Analysis, by End-user, 2024 and 2035

Figure 50: Europe Patient Engagement Solutions Market Attractiveness Analysis, by End-user, 2025-2035

Figure 51: Asia Pacific - Patient Engagement Solutions Market Value (US$ Bn) Forecast, 2020-2035

Figure 52: Asia Pacific - Patient Engagement Solutions Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 53: Asia Pacific - Patient Engagement Solutions Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 54: Asia Pacific Patient Engagement Solutions Market Value Share Analysis, by Type, 2024 and 2035

Figure 55: Asia Pacific Patient Engagement Solutions Market Attractiveness Analysis, by Type, 2025-2035

Figure 56: Asia Pacific Patient Engagement Solutions Market Value Share Analysis, By Delivery, 2024 and 2035

Figure 57: Asia Pacific Patient Engagement Solutions Market Attractiveness Analysis, By Delivery, 2025-2035

Figure 58: Asia Pacific Patient Engagement Solutions Market Value Share Analysis, by Application, 2024 and 2035

Figure 59: Asia Pacific Patient Engagement Solutions Market Attractiveness Analysis, by Application, 2025-2035

Figure 60: Asia Pacific Patient Engagement Solutions Market Value Share Analysis, by End-user, 2024 and 2035

Figure 61: Asia Pacific Patient Engagement Solutions Market Attractiveness Analysis, by End-user, 2025-2035

Figure 62: Latin America - Patient Engagement Solutions Market Value (US$ Bn) Forecast, 2020-2035

Figure 63: Latin America - Patient Engagement Solutions Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 64: Latin America - Patient Engagement Solutions Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 65: Latin America Patient Engagement Solutions Market Value Share Analysis, by Type, 2024 and 2035

Figure 66: Latin America Patient Engagement Solutions Market Attractiveness Analysis, by Type, 2025-2035

Figure 67: Latin America Patient Engagement Solutions Market Value Share Analysis, By Delivery, 2024 and 2035

Figure 68: Latin America Patient Engagement Solutions Market Attractiveness Analysis, By Delivery, 2025-2035

Figure 69: Latin America Patient Engagement Solutions Market Value Share Analysis, by Application, 2024 and 2035

Figure 70: Latin America Patient Engagement Solutions Market Attractiveness Analysis, by Application, 2025-2035

Figure 71: Latin America Patient Engagement Solutions Market Value Share Analysis, by End-user, 2024 and 2035

Figure 72: Latin America Patient Engagement Solutions Market Attractiveness Analysis, by End-user, 2025-2035

Figure 73: Middle East & Africa - Patient Engagement Solutions Market Value (US$ Bn) Forecast, 2020-2035

Figure 74: Middle East & Africa - Patient Engagement Solutions Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 75: Middle East & Africa - Patient Engagement Solutions Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 76: Middle East and Africa Patient Engagement Solutions Market Value Share Analysis, by Type, 2024 and 2035

Figure 77: Middle East and Africa Patient Engagement Solutions Market Attractiveness Analysis, by Type, 2025-2035

Figure 78: Middle East and Africa Patient Engagement Solutions Market Value Share Analysis, by Delivery, 2024 and 2035

Figure 79: Middle East and Africa Patient Engagement Solutions Market Attractiveness Analysis, By Delivery, 2025-2035

Figure 80: Middle East and Africa Patient Engagement Solutions Market Value Share Analysis, by Application, 2024 and 2035

Figure 811: Middle East and Africa Patient Engagement Solutions Market Attractiveness Analysis, by Application, 2025-2035

Figure 82: Middle East and Africa Patient Engagement Solutions Market Value Share Analysis, by End-user, 2024 and 2035

Figure 83: Middle East and Africa Patient Engagement Solutions Market Attractiveness Analysis, by End-user, 2025-2035