Reports

Reports

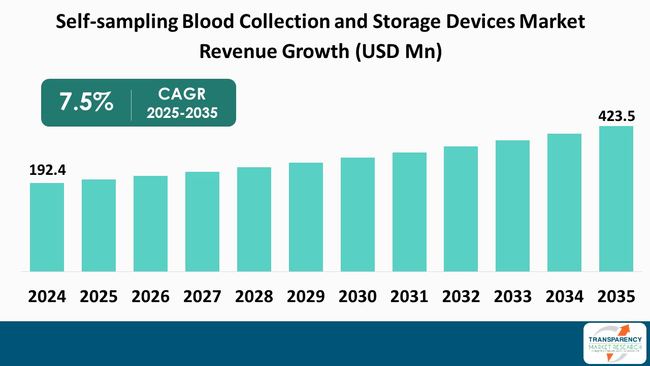

The global self-sampling blood collection and storage devices market size was valued at US$ 192.4 Mn in 2024 and is projected to reach US$ 423.5 Mn by 2035, expanding at a CAGR of 7.5% from 2025 to 2035. The market growth is driven by an increasing demand for rapid infectious disease screening and technological advancements improving sensitivity and multiplexing.

The market for self-collected, self-collected blood collection and storage products is evolving from a niche convenience product to a key enabler for decentralized diagnostics and virtual clinical trials. There is a growing interest in patient-centric care, provided by advancements in volumetric microsampling, improved methods for standardization of dried blood spots (DBS), and supply chains that are streamlined and integrated into a clinical laboratory, which are prompting laboratories and sponsors to review workflow and methods for remote collection of samples while maintaining a chain of custody.

Established manufacturers and dedicated medtech companies are expediting the development and combination of commercially available products to minimize analytical variability, pre-analytical stability and regulatory compliance for buyers, thereby allowing for risk mitigation and openness of acceptance for clinical use.

Broadbased collaboration between device manufacturers and clinical laboratories will improve end-to-end service delivery – from collection to receipt and analysis at the laboratory, thus increasing confidence with payers and clinicians. As such, the influence of leading manufacturers designating usability, regulatory compliance, and laboratory acceptance serves as a critical growth driver to support overall industry adoption.

Demand for remote and patient-collected samples is on the rise as a consequence of longstanding needs: a need for equitable access for underserved population, to relieve phlebotomy services, and support decentralized clinical trials involving larger and more diverse cohorts.

Methodological improvements with things like precision volumetric sampling, passive plasma separation, and simplified collection workflows minimize pre-analytical variability, and the prospect of shipping remote specimens is becoming more palatable for central laboratories.

Regulatory momentum and increasing clarity around validation of microsamples lessens the barriers to clinical and diagnostic use, while innovations in logistics – stabilizers for storage formats and validated transportation media – enhance integration with supply chain logistics.

| Attribute | Detail |

|---|---|

| Self-sampling Blood Collection and Storage Devices Market Drivers |

|

Improvements in volumetric microsampling, passive plasma separation, and improved storage chemistries have substantially improved analytical compatibility between capillary samples and laboratory assays/protocols. These technical improvements lessen one of the challenges marketers have faced for some time: variability in sample volume and matrix effects that impact assay’s accuracy.

For example, companies focused on volumetric dried blood spot and microfluidic plasma separation mitigate sample-to-sample variability and have a greater scope of analytes that can be accurately measured, enhancing laboratory acceptance.

For instance, Tasso's recent roll-out of next-generation dried blood spot collection systems and expanded service offerings for prescreening and trial recruitment, which exhibit advances in innovation that respond to clinical trial use and diagnostic use cases. This spurs the sponsors' confidence. Therefore, the improvements facilitated with device design and sample stabilization relates directly to improved clinical utility and more rapid adoption in the clinical operation.

Commercial collaborations are merging self-sampling devices with established lab capabilities to reach real-world scale through validated workflows that align collection, transport, and analytics. When device manufacturers connect with reference labs or clinical networks, they create ready-to-deploy capabilities that aid end-user validation burden while speeding up payer and sponsor acceptance. For Instance, Manufacturer YourBio Health has joined forces with clinical customers and test providers to deploy their TAP devices in real-world programs and biomarker testing. Their partnerships show how manufacturer – lab and manufacturer – services partnerships broaden reach and establish repeatable pathways from at-home sampling to actionable results.

Manufacturer – lab and manufacturer - service alliances also enable pilot studies and data collection that support important resource allocation for payers and regulators to assess clinical utility, which is essential for long-term adoption across routine diagnostics and decentralized trials.

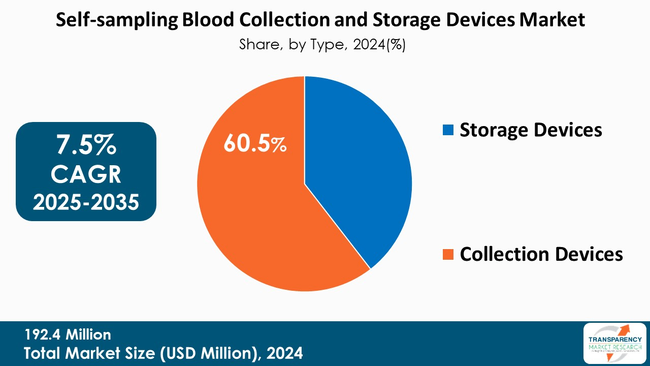

Collection devices — such as volumetric microsamplers, whole blood capillary collectors, and quantitative DBS products — take center stage among system components as they directly influence sample quality, user adherence, and downstream laboratory compatibility.

The device itself drives user experience (pain, ease of use and time) and sample integrity (volume numbers, hematocrit effect, contamination potential), and therefore brand names that have functional usability and have demonstrated validated analytical performance win the day.

For example, Capitainer's recent expansion into regional healthcare projects and the utilization of their collection technology for a new quantitative DBS product demonstrates how a well-established and validated collection technology can be utilized across screening and epidemiology, as well as the other decentralized care programs. Due to this, collection devices that minimize user error, and allow for or are operated in a way that meets the criteria of laboratory processing, appear to dominate procurement priority for sponsors, payers and providers.

| Attribute | Detail |

|---|---|

| Leading Region |

|

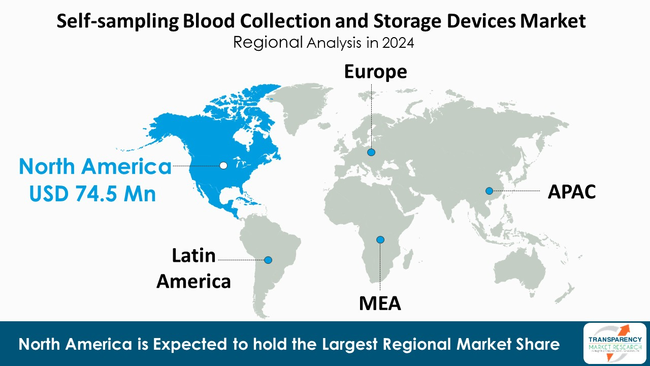

The self-sampling blood collection and storage devices market is dominated by North America with 38.7% share in 2024. Adoption is driven in North America due to the availability of diagnostic infrastructure, elevated healthcare digitalization, large-scale clinical trial activity, and flexible regulatory environments that support new, and sometimes disruptive, methods of specimen collection, screening, and diagnostic testing.

The United States, in particular, has one of the highest concentrations of reference laboratories, as well as large-scale sponsors of clinical trials and large telehealth providers, which generates solid demand for validated remote sampling solutions for blood collection.

Manufacturers have recently taken strategic steps to align with laboratories in the United States, through partnerships between device manufacturers and reference laboratories in the United States to support decentralized clinical research and decentralized biomarker testing, which demonstrates the readiness of the U.S. ecosystem to accelerate commercialization and clinical use.

In addition, the addition of patient preference and provider willingness to pilot remote sampling blood collection for monitoring chronic disease and trial decentralization reinforces North America's leadership position in scaling blood collection and storage for self-sampling.

Companies operating in the self-sampling blood collection and storage devices market focus on forging strategic collaborations, innovating their products, and validating the performance of their products across various clinical settings. These firms invest significantly in R&D pertaining to cutting-edge microfluidic and non-invasive techniques, broaden their distribution channels, and provide integrated service solutions to have a strong market presence and a high customer loyalty.

Neoteryx, LLC, DBS System SA, PanoHealth, Tasso, Inc, Seventh Sense Biosystems, LAMEDITECH, Capitainer, Spot On Sciences, Trajan Scientific and Medical, Drawbridge Health, Weavr Health, Microdrop, Hemex Health, Eastern Business Forms, Inc, YourBio Health, Others, are some of the leading players operating in the global self-sampling blood collection and storage devices market.

Each of these players has been profiled in the self-sampling blood collection and storage devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 192.4 Mn |

| Forecast Value in 2035 | US$ 423.5 Mn |

| CAGR | 7.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn |

| Self-sampling Blood Collection and Storage Devices Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global self-sampling blood collection and storage devices market was valued at US$ 192.4 Mn in 2024

The global self-sampling blood collection and storage devices industry is projected to reach more than US$ 423.5 Mn by the end of 2035

Technological innovation in volumetric and stabilization methods and strategic partnerships and laboratory integrations

The CAGR is anticipated to be 7.5% from 2025 to 2035

Neoteryx, LLC., DBS System SA, PanoHealth, Tasso, Inc, Seventh Sense Biosystems, LAMEDITECH, Capitainer, Spot On Sciences, Trajan Scientific and Medical, Drawbridge Health, Weavr Health, Microdrop, Hemex Health, Eastern Business Forms, Inc, YourBio Health, Others

Table 01: Global Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 02: Global Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 03: Global Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 04: Global Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 05: North America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 06: North America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 07: North America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 08: North America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 09: Europe Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 10: Europe Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 11: Europe Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 12: Europe Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 13: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 14: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 15: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 16: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 17: Latin America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 18: Latin America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 19: Latin America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 20: Latin America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 21: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 22: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 23: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 24: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Figure 01: Global Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Type, 2024 and 2035

Figure 03: Global Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 04: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Collection Devices, 2020 to 2035

Figure 05: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Storage Devices, 2020 to 2035

Figure 06: Global Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application, 2024 and 2035

Figure 07: Global Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 08: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Disease Management, 2020 to 2035

Figure 09: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Health & Wellness, 2020 to 2035

Figure 10: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Drug Discovery & Development, 2020 to 2035

Figure 11: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Epidemiological Population Health Studies, 2020 to 2035

Figure 12: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 13: Global Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 14: Global Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 15: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Diagnostic Laboratories, 2020 to 2035

Figure 16: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Academic & Research Institutes, 2020 to 2035

Figure 17: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Pharmaceutical Industries, 2020 to 2035

Figure 18: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Home care Settings, 2020 to 2035

Figure 19: Global Self-sampling Blood Collection and Storage Devices Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 20: Global Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 21: Global Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 22: North America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 23: North America Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Type, 2024 and 2035

Figure 24: North America Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 25: North America Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application, 2024 and 2035

Figure 26: North America Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 27: North America Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 28: North America Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 29: North America Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 30: North America Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 31: Europe Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 32: Europe Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Type, 2024 and 2035

Figure 33: Europe Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 34: Europe Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application, 2024 and 2035

Figure 35: Europe Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 36: Europe Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 37: Europe Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 38: Europe Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 39: Europe Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 40: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 41: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Type, 2024 and 2035

Figure 42: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 43: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application, 2024 and 2035

Figure 44: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 45: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 46: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 47: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 48: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 49: Latin America Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 50: Latin America Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Type, 2024 and 2035

Figure 51: Latin America Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 52: Latin America Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application, 2024 and 2035

Figure 53: Latin America Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 54: Latin America Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 55: Latin America Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 56: Latin America Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 57: Latin America Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 58: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 59: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Type, 2024 and 2035

Figure 60: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 61: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application, 2024 and 2035

Figure 62: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 63: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 64: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 65: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 66: Middle East and Africa Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Region, 2025 to 2035