Reports

Reports

The blood collection market is expanding decently on the waves of medical advancement and increasing demand for blood products. All these are propelled by increasing incidence of chronic diseases and need for safe transfusion of blood. Developments in blood collection technology like automated blood collection and improved safety features are optimizing efficiency and lowering the risk of contamination. Besides, the consciousness of the requirement to donate blood has led to increased donations and, consequently, increased availability of blood.

The government agencies are also shaping the market with stringent demands for the quality and safety of the acquisition of blood. The ongoing trend toward minimally invasive procedures such as fingerstick blood testing is gaining in popularity with it now being easier for patients and less hassle for doctors.

Furthermore, point-of-care testing has transformed testing and blood drawing process by initiating early treatment and diagnosis. Overall, the market for blood collection will experience high growth rate due to technological progress, government program, and heightened awareness among the public regarding the importance of blood donation and transfusion in medical application.

Blood collection are a major medical procedure required for diagnostic testing, transfusion and research. Blood sampling from donors or patients is done via various techniques including venipuncture, arterial puncture, and capillary collection. The process is accompanied by adherence to strict guidelines that minimize pain, ensure safety, and maintain the integrity of the sample. Technological advancements have introduced new collection equipment such as vacuum blood collection systems and microneedles, which improve efficiency and reduce risk of infections.

Demand is stimulated by the increased cases of chronic disease and consequently demand for blood products such as plasma and platelets. Awareness campaigns about blood donation also helps to encourage participation and thus ensure regular supply. To the majority, donating blood is a respectable practice of modern medicine and a necessary part of treating patients and medical research.

| Attribute | Detail |

|---|---|

| Blood Collection Market Drivers |

|

Growing demand for blood products is one of the primary growth drivers for blood collection, with health systems around the world always looking to treat more aging population and cases of chronic diseases. Blood products such as red blood cells, whole blood, platelets, and plasma are needed in various types of medical interventions such as trauma care, surgery, hemophilia, and cancer treatment. With rising transfusion needs, medical facilities and hospitals are obligated to have an on-hand supply of compatible and safe blood products.

Also, spurring the demand for blood components in the upward direction is the increasing rate of surgical procedures and specialized medical interventions. Moreover, access to technology that facilitates preservation and storage of blood is also making it simpler for healthcare organizations to stock more blood products.

Rising awareness followed by participation in blood donation are pivotal drivers to the blood collection industry, thereby significantly impacting the availability of blood products necessary for medical treatments. More extensive educational efforts and public campaigns have also helped to raise the profiles of blood donation as something more than an essential, utilitarian civic duty, i.e. an opportunity to save a life.

With increased awareness among the people/community about criticality of blood requirement, especially for emergency cases, those undergoing surgeries and patients of chronic diseases, number of people donating blood voluntarily has gone up.

Social media and public health bodies are instrumental, such that they are performing outreach and reaching out to various populations. The public has become more involved in events such as blood drives and community-based endurance challenges, helping to make donating blood more convenient and interesting.

Public awareness also promulgates a donation culture that creates a more supply of blood. As a result, the blood collection market is benefiting from an increasing group of donors and more efficient and effective collection methods to provide better patient outcomes for health systems internationally.

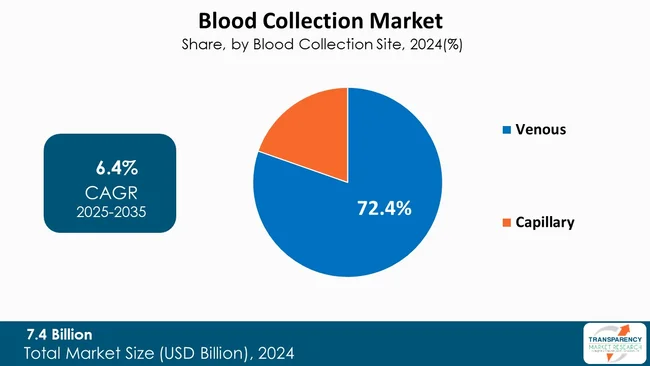

Venous blood collection is the most popular blood collection procedure in the blood collection industry on the account of its reliability, convenience, and accuracy. This method consists of sample collection from a vein, usually the arm that can collect bigger blood quantities than capillary can. Venous collection is method of choice, as it is able to collect adequate volume of blood for full laboratory examination greater than capillary.

In addition, taking blood from veins can make the sample purer, which is essential for the accuracy of testing. The universally accepted protocols in venipuncture practice may be one of the reasons for the preference of healthcare workers for this method. Furthermore, improvement of venous access devices has increased patient comfort and safety, consolidating its position in the clinical context. Demand for blood collection market will be led by venous blood collection to ensure proper diagnosis and patient safety by healthcare providers.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America dominates the blood collection market as it possesses advanced healthcare infrastructure and witnesses high incidence of chronic diseases such as diabetes, cardiovascular diseases and cancer.

The established and emerging blood collection devices market players in North America further drive the advanced blood collection devices market by providing safety and ease of use. Regional regulatory agencies have laid down strict rules for blood collection to guarantee its quality and safety for collection and to promote trust among the public. Taken together, these elements place North America among the leading participants in the worldwide blood collection industry.

Key players in the global blood collection market are investing in innovation, technological advancements, and forming alliances/joint ventures. Their objective is to enhance the precision of testing, diversify the products, and gain a robust market presence in order to be ahead of the curve in the evolving healthcare market.

Abbott Laboratories, Becton, Dickinson and Company, Terumo Corp., Medtronic Plc, Qiagen, FL Medical s.r.l., Greiner Holding AG, Haemonetics Corp., Sarstedt AG & Co., ICU Medical, Inc., CML Biotech, SB-KAWASUMI LABORATORIES, INC., Mitra Industries Private Limited are some of the leading players in the blood collection industry.

Each of these players has been profiled in the blood collection market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

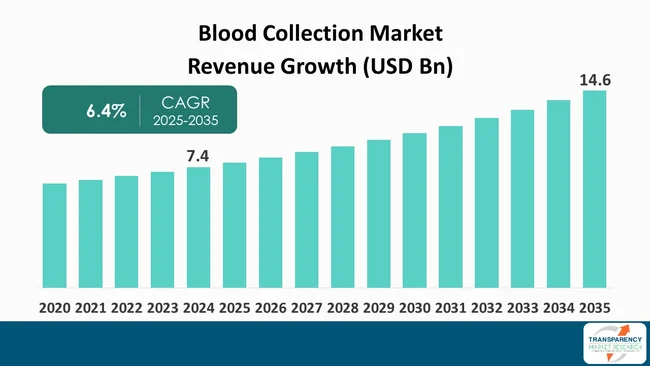

| Size in 2024 | US$ 7.4 Bn |

| Forecast Value in 2035 | US$ 14.6 Bn |

| CAGR | 6.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Blood Collection Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 7.4 Bn in 2024

It is projected to cross US$ 14.6 Bn by the end of 2035

Growing demand for blood products and rising awareness and participation in blood donation

It is anticipated to grow at a CAGR of 6.4% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Abbott Laboratories, Becton, Dickinson and Company, Terumo Corp., Medtronic Plc, Qiagen, FL Medical s.r.l., Greiner Holding AG, Haemonetics Corp., Sarstedt AG & Co., ICU Medical, Inc., CML Biotech, SB-KAWASUMI LABORATORIES, INC., Mitra Industries Private Limited and Others

Table 01: Global Blood Collection Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Blood Collection Market Value (US$ Bn) Forecast, By Collection Method, 2020 to 2035

Table 03: Global Blood Collection Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Blood Collection Market Value (US$ Bn) Forecast, By Disease Diagnosis & Management, 2020 to 2035

Table 05: Global Blood Collection Market Value (US$ Bn) Forecast, By Blood Collection Site, 2020 to 2035

Table 06: Global Blood Collection Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Global Blood Collection Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America - Blood Collection Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 09: North America Blood Collection Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 10: North America Blood Collection Market Value (US$ Bn) Forecast, By Collection Method, 2020 to 2035

Table 11: North America Blood Collection Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: North America Blood Collection Market Value (US$ Bn) Forecast, By Disease Diagnosis & Management, 2020 to 2035

Table 13: North America Blood Collection Market Value (US$ Bn) Forecast, By Blood Collection Site, 2020 to 2035

Table 14: North America Blood Collection Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 15: Europe - Blood Collection Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 16: Europe Blood Collection Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 17: Europe Blood Collection Market Value (US$ Bn) Forecast, By Collection Method, 2020 to 2035

Table 18: Europe Blood Collection Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 19: Europe Blood Collection Market Value (US$ Bn) Forecast, By Disease Diagnosis & Management, 2020 to 2035

Table 20: Europe Blood Collection Market Value (US$ Bn) Forecast, By Blood Collection Site, 2020 to 2035

Table 21: Europe Blood Collection Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 22: Asia Pacific - Blood Collection Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 23: Asia Pacific Blood Collection Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 24: Asia Pacific Blood Collection Market Value (US$ Bn) Forecast, By Collection Method, 2020 to 2035

Table 25: Asia Pacific Blood Collection Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 26: Asia Pacific Blood Collection Market Value (US$ Bn) Forecast, By Disease Diagnosis & Management, 2020 to 2035

Table 27: Asia Pacific Blood Collection Market Value (US$ Bn) Forecast, By Blood Collection Site, 2020 to 2035

Table 28: Asia Pacific Blood Collection Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 29: Latin America - Blood Collection Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 30: Latin America Blood Collection Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 31: Latin America Blood Collection Market Value (US$ Bn) Forecast, By Collection Method, 2020 to 2035

Table 32: Latin America Blood Collection Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 33: Latin America Blood Collection Market Value (US$ Bn) Forecast, By Disease Diagnosis & Management, 2020 to 2035

Table 34: Latin America Blood Collection Market Value (US$ Bn) Forecast, By Blood Collection Site, 2020 to 2035

Table 35: Latin America Blood Collection Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 36: Middle East & Africa - Blood Collection Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 37: Middle East & Africa Blood Collection Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 38: Middle East & Africa Blood Collection Market Value (US$ Bn) Forecast, By Collection Method, 2020 to 2035

Table 39: Middle East & Africa Blood Collection Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 40: Middle East & Africa Blood Collection Market Value (US$ Bn) Forecast, By Disease Diagnosis & Management, 2020 to 2035

Table 41: Middle East & Africa Blood Collection Market Value (US$ Bn) Forecast, By Blood Collection Site, 2020 to 2035

Table 42: Middle East & Africa Blood Collection Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Blood Collection Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Blood Collection Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Blood Collection Market Revenue (US$ Bn), by Blood Collection Needles and Syringes, 2020 to 2035

Figure 04: Global Blood Collection Market Revenue (US$ Bn), by Blood Collection Tubes, 2020 to 2035

Figure 05: Global Blood Collection Market Revenue (US$ Bn), by Blood Collection Lancets, 2020 to 2035

Figure 06: Global Blood Collection Market Revenue (US$ Bn), by Blood Bags, 2020 to 2035

Figure 07: Global Blood Collection Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Blood Collection Market Value Share Analysis, By Collection Method, 2024 and 2035

Figure 09: Global Blood Collection Market Attractiveness Analysis, By Collection Method, 2025 to 2035

Figure 10: Global Blood Collection Market Revenue (US$ Bn), by Automated, 2020 to 2035

Figure 11: Global Blood Collection Market Revenue (US$ Bn), by Manual, 2020 to 2035

Figure 12: Global Blood Collection Market Value Share Analysis, By Application, 2024 and 2035

Figure 13: Global Blood Collection Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 14: Global Blood Collection Market Revenue (US$ Bn), by Disease Diagnosis & Management, 2020 to 2035

Figure 15: Global Blood Collection Market Revenue (US$ Bn), by Drug and Alcohol Testing, 2020 to 2035

Figure 16: Global Blood Collection Market Revenue (US$ Bn), by Medication Management, 2020 to 2035

Figure 17: Global Blood Collection Market Revenue (US$ Bn), by Specimen Validation Testing, 2020 to 2035

Figure 18: Global Blood Collection Market Revenue (US$ Bn), by Pain and Rehabilitation Management, 2020 to 2035

Figure 19: Global Blood Collection Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Blood Collection Market Value Share Analysis, By Blood Collection Site, 2024 and 2035

Figure 21: Global Blood Collection Market Attractiveness Analysis, By Blood Collection Site, 2025 to 2035

Figure 22: Global Blood Collection Market Revenue (US$ Bn), by Venous, 2020 to 2035

Figure 23: Global Blood Collection Market Revenue (US$ Bn), by Capillary, 2020 to 2035

Figure 24: Global Blood Collection Market Value Share Analysis, By End-user, 2024 and 2035

Figure 25: Global Blood Collection Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 26: Global Blood Collection Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 27: Global Blood Collection Market Revenue (US$ Bn), by Diagnostics Centers, 2020 to 2035

Figure 28: Global Blood Collection Market Revenue (US$ Bn), by Blood Banks, 2020 to 2035

Figure 29: Global Blood Collection Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 30: Global Blood Collection Market Value Share Analysis, By Region, 2024 and 2035

Figure 31: Global Blood Collection Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 32: North America - Blood Collection Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: North America - Blood Collection Market Value Share Analysis, by Country, 2024 and 2035

Figure 34: North America - Blood Collection Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 35: North America Blood Collection Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 36: North America Blood Collection Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 37: North America Blood Collection Market Value Share Analysis, By Collection Method, 2024 and 2035

Figure 38: North America Blood Collection Market Attractiveness Analysis, By Collection Method, 2025 to 2035

Figure 39: North America Blood Collection Market Value Share Analysis, By Application, 2024 and 2035

Figure 40: North America Blood Collection Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 41: North America Blood Collection Market Value Share Analysis, By Blood Collection Site, 2024 and 2035

Figure 42: North America Blood Collection Market Attractiveness Analysis, By Blood Collection Site, 2025 to 2035

Figure 43: North America Blood Collection Market Value Share Analysis, By End-user, 2024 and 2035

Figure 44: North America Blood Collection Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 45: Europe - Blood Collection Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Europe - Blood Collection Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 47: Europe - Blood Collection Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 48: Europe Blood Collection Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 49: Europe Blood Collection Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 50: Europe Blood Collection Market Value Share Analysis, By Collection Method, 2024 and 2035

Figure 51: Europe Blood Collection Market Attractiveness Analysis, By Collection Method, 2025 to 2035

Figure 52: Europe Blood Collection Market Value Share Analysis, By Application, 2024 and 2035

Figure 53: Europe Blood Collection Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 54: Europe Blood Collection Market Value Share Analysis, By Blood Collection Site, 2024 and 2035

Figure 55: Europe Blood Collection Market Attractiveness Analysis, By Blood Collection Site, 2025 to 2035

Figure 56: Europe Blood Collection Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Europe Blood Collection Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Asia Pacific - Blood Collection Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Asia Pacific - Blood Collection Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 60: Asia Pacific - Blood Collection Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 61: Asia Pacific Blood Collection Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 62: Asia Pacific Blood Collection Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 63: Asia Pacific Blood Collection Market Value Share Analysis, By Collection Method, 2024 and 2035

Figure 64: Asia Pacific Blood Collection Market Attractiveness Analysis, By Collection Method, 2025 to 2035

Figure 65: Asia Pacific Blood Collection Market Value Share Analysis, By Application, 2024 and 2035

Figure 66: Asia Pacific Blood Collection Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 67: Asia Pacific Blood Collection Market Value Share Analysis, By Blood Collection Site, 2024 and 2035

Figure 68: Asia Pacific Blood Collection Market Attractiveness Analysis, By Blood Collection Site, 2025 to 2035

Figure 69: Asia Pacific Blood Collection Market Value Share Analysis, By End-user, 2024 and 2035

Figure 70: Asia Pacific Blood Collection Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 71: Latin America - Blood Collection Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 72: Latin America - Blood Collection Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 73: Latin America - Blood Collection Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 74: Latin America Blood Collection Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 75: Latin America Blood Collection Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 76: Latin America Blood Collection Market Value Share Analysis, By Collection Method, 2024 and 2035

Figure 77: Latin America Blood Collection Market Attractiveness Analysis, By Collection Method, 2025 to 2035

Figure 78: Latin America Blood Collection Market Value Share Analysis, By Application, 2024 and 2035

Figure 79: Latin America Blood Collection Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 80: Latin America Blood Collection Market Value Share Analysis, By Blood Collection Site, 2024 and 2035

Figure 81: Latin America Blood Collection Market Attractiveness Analysis, By Blood Collection Site, 2025 to 2035

Figure 82: Latin America Blood Collection Market Value Share Analysis, By End-user, 2024 and 2035

Figure 83: Latin America Blood Collection Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 84: Middle East & Africa - Blood Collection Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 85: Middle East & Africa - Blood Collection Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 86: Middle East & Africa - Blood Collection Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 87: Middle East & Africa Blood Collection Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 88: Middle East & Africa Blood Collection Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 89: Middle East & Africa Blood Collection Market Value Share Analysis, By Collection Method, 2024 and 2035

Figure 90: Middle East & Africa Blood Collection Market Attractiveness Analysis, By Collection Method, 2025 to 2035

Figure 91: Middle East & Africa Blood Collection Market Value Share Analysis, By Application, 2024 and 2035

Figure 92: Middle East & Africa Blood Collection Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 93: Middle East & Africa Blood Collection Market Value Share Analysis, By Blood Collection Site, 2024 and 2035

Figure 94: Middle East & Africa Blood Collection Market Attractiveness Analysis, By Blood Collection Site, 2025 to 2035

Figure 95: Middle East & Africa Blood Collection Market Value Share Analysis, By End-user, 2024 and 2035