Reports

Reports

The clinical trials market is being driven by a combination of factors including increasing R&D budgets, shorter clinical timelines, and regulatory initiatives to facilitate easier study initiation. Harmonization models and risk-based monitoring processes reduce redundancies and facilitate expedited approvals, encouraging sponsors to initiate multiple protocols.

Digitally facilitated recruitment, eConsent, and electronic source capture facilitate patient enrollment and data integrity costs. Greater engagement of community networks and primary care hospitals open access to the previously underrepresented, thereby accelerating enrollment and enhancing retention. With these business gains and regulatory facilitators, pipeline flow is being unleashed, and addressable demand is being stretched.

Another structural catalyst is the movement toward outsourcing and integrated alliance, where sponsors engage with full-service partners for end-to-end study design, data handling, pharmacovigilance, and regulatory affairs. Governmental agencies are providing funding, offering tax benefits and expedient pathways for the trial initiation across therapeutic areas. Heightened expectations from regulators and payers for real world evidence is fueling phase IV and pragmatic research and leading to growth in activities beyond traditional efficacy studies.

Sponsors are also prioritizing reduction in the burden to patients, which involves simplifying protocols, creating patient-friendly models, and utilizing more of a concierge service model to reduce burden as well as recruitment failures. Availability of patient pool within unserved markets involving site training optimizes recruitment and maintains per-patient expenses in check.

New developments in the industry include decentralized, and hybrid operating models, combining home health, telemedicine, and community locations to improve access and reduce participant burden. Master protocols—platform, basket and umbrella designs—are being increasingly used to evaluate varying interventions under one structure and shorten study timelines.

Sponsors are using synthetic or external control arms, eSource, and direct-from-device data capture methods to reduce placebo exposure and accelerate readouts. AI-enabled feasibility, site selection, and patient matching are being shifted from pilots to production, with interoperable data standards.

Competition is focused on a breadth of capabilities, geographic footprint, data assets, and technology depth. Leading providers are creating end-to-end, integrated operating platforms that anchor EDC (Electronic Data Capture), CTMS (Clinical Trial Management System), RTSM (Randomization and Trial Supply Management), safety, and eCOA to ensure continuity of seamless, auditable data management.

Some companies are acquiring boutique providers such as home nursing or imaging core labs, and they are executing partnerships with hospital networks to capture patient access. In addition, investments are underway in such fields as AI engines, data lakes, and interfacing with EHRs, with the ambition of reducing cycle times; along with operation activities like risk-adjusted quality management and cybersecurity.

More business models now include outcome-based pricing, estimated performance guarantees, and integrated patient engagement services, mixed with cross-trained site personnel and standardized SOPs to maximize throughput and reliability.

Clinical trials are a mandated, systematic method of investigation to determine safety and efficacy of new drugs, therapy techniques, and devices. Clinical trials are performed sequentially: starting with Phase I small-group trials for testing safety and dosing; followed by Phase II trials for increasing efficacy and side effect evaluation; and lastly, Phase III trials for comparison with current therapy with the use of a larger sample to determine the intervention.

As with all good investigations, there is a comprehensive plan that states the purpose, criteria for participant inclusion, randomization, and controls to enhance the validity of the results. The data gathered are subjected to a thorough review to assess the benefits and risks of the intervention, warranting its clearance for public use.

Clinical trials are conventionally divided into phases with definite purposes. Phase I trials cover safety and dosing with small numbers of healthy volunteers or patients. Phase II trials test effectiveness and monitor potential side-effects with a higher number of patients. Phase III trials determine efficacy, contrast with controls, and recruit larger number of patients. While Phase IV or post-licensing trials assess long-term safety and efficacy following the licensure of treatment.

A significant aspect of clinical trials is patient recruitment to offer researchers the option of obtaining information on how patients respond to experimental therapy in actual life situations. Ethical standards, informed consent, and constant monitoring guarantee safety to participants. Diversity of recruitment is more vital to ensure that trial outcomes are representative for many sub-populations.

A wide range of services are provided by market players in the clinical trials industry, some of which include, protocol designing, patient recruitment & site identification, and laboratory services. Protocol designing is essentially the creation of a scientific and operational framework for a clinical trial that specifies the objectives, methodology, inclusion/exclusion criteria, and endpoints. The aim is to guarantee that the outcomes of the trial are reliable and that it complies with the regulations.

On the other hand, patient recruitment & site identification service is all about identifying the right clinical sites and recruiting the right participants in an efficient manner. This helps to have a study that is completed on time and also has a diverse representation. Laboratory services is the provision of necessary testing, sample analysis, biomarker evaluation, and data reporting to support the safety monitoring and efficacy assessment that happens during the entire trial lifecycle.

| Attribute | Detail |

|---|---|

| Clinical Trials Market Drivers |

|

The increasing incidence of chronic diseases like diabetes, cardiovascular diseases, cancer, and respiratory diseases is one of the most important drivers to the clinical trials market. Since these diseases still afflict millions of people worldwide, need for novel modalities and better therapy has seen enormous growth.

Clinical trials are the inevitable route to evaluate and demonstrate new interventions to treat or cure chronic diseases with improved effectiveness, and thus they are indispensable in order to combat the increasing burden on healthcare.

With increased life expectancy and aging population, chronic illnesses have evolved to be more complex and there is a need of ongoing therapeutic advancement. This has resulted in immense stipulation for trials targeting the multi-drug regimen, lifestyle disorder, and comorbid test trials. There is a huge investment in clinical trial by pharmaceutical and biotechnology companies to establish safe and effective treatments, thus accelerating trial launches across diverse therapeutic classes.

For instance, the information reported by World Health Organization indicates that in 2022, over 14% of adults aged 18 and above had diabetes, approximately twice its figure as compared to in 1990, which was 7%. Data also suggests that among diabetic adults who are 30 years and older, 59% were not on medication. Besides, according to the Global Cancer Observatory, in 2022, there were more than 19.9 million new cancer cases reported worldwide.

Growing incidence of such chronic conditions is forcing the healthcare industry to invest significant amounts in novel therapeutic approaches, thus driving a majority of clinical trials. For instance, it is worth noting that as of September 2025 over 4,350 clinical trials are being conducted to test different treatment schedules for breast cancer.

Higher attention paid to new treatments including cell-based therapies, gene therapies, biologics, and personalized medications are significant drivers to the for clinical trials market. A significant factor in consideration with gene therapies and cell therapies is that as of September 2025, there are over 740 ongoing clinical trials for gene therapy and around 5,500 ongoing clinical trials for cell therapy.

Gene and cell therapies, however, require a specialized clinical study designs given that they are innovative in their action mode. Conduct of trials for such treatments involves sophisticated protocols, novel endpoints, and tailored study designs. The advent of immunotherapies and RNA-based therapies has added more areas of focus in clinical trials. These therapies need to be tested in varied patient population for extended periods so as to ensure their safety and effectiveness.

Another emerging therapy driving the clinical trials market is the mRNA-based therapy that gained traction after COVID-19 vaccine successes.

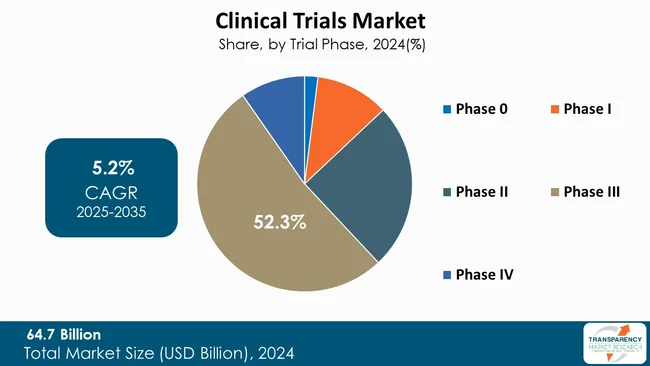

The phase III segment leads the market for clinical trials since it is the most decisive phase for proving new therapy safety and efficacy to a large group of patients. These trials usually enroll a large number of patients across various sites. They produce extensive data necessary for regulatory approval and commercialization.

The enormous amount of data generated can result in compelling evidence for marketing, so pharmaceutical companies give priority to Phase III trials. The high expenses and time involved in these tests ensure that favorable results will have a significant impact on the status of a company within the market. Thus, the strategic value of Phase III trials commands heavy investment and priority within the clinical trials market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest clinical trials market analysis, North America dominated in 2024. This is due to the fact that the region boasts an established healthcare infrastructure, supportive regulatory landscape, and considerable research and development spending. There are plenty of top pharmaceutical and biotech firms, research centers, and contract research organizations (CROs) based in North America that ensure that an environment exists that is conducive to conducting trials. Strong policies by organizations such as the U.S. FDA also speed up the approvals of studies and ensure thorough regulation.

Furthermore, North America enjoys the benefits of technological adoption pioneer efforts, patient population diversity, and robust funding assistance via private and public entities. Being adequately staffed with capable professionals, possessing developed infrastructure, and strategic partnerships even further strengthens its worldwide leadership in clinical trials.

The key players are pioneering decentralized and hybrid trial models, technological innovations, and strategic partnerships such as real time monitoring and AI-automated patient enrollment. They are investing in adaptive trial design, global site expansion, and patient-centered methodologies.

IQVIA Inc., Labcorp, Syneos Health, Charles River Laboratories, Thermo Fisher Scientific Inc., Parexel International (MA) Corporation, WuXi AppTec, Pfizer Inc., ICON plc, ACM Global Laboratories, Medpace, Invivoscribe, Inc., Velocity Clinical Research, PSI, BioAgile Therapeutics Private Limited, and Verily are some of the leading players operating in the global clinical trials market.

Each of these players has been profiled in the clinical trials market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 64.7 Bn |

| Forecast Value in 2035 | US$ 112.9 Bn |

| CAGR | 5.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Clinical Trial Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Service Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global clinical trials market was valued at US$ 64.7 Bn in 2024

The global clinical trials industry is projected to reach more than US$ 112.9 Bn by the end of 2035

The increasing global burden of chronic diseases, advancements in biotechnology and personalized medicine, the globalization of trials for cost-effectiveness and diverse patient populations, and the growing use of advanced technologies like AI and blockchain to improve efficiency are some of the factors driving the expansion of clinical trials market.

The CAGR is anticipated to be 5.2% from 2025 to 2035

IQVIA Inc., Labcorp, Syneos Health, Charles River Laboratories, Thermo Fisher Scientific Inc., Parexel International (MA) Corporation, WuXi AppTec, Pfizer Inc., ICON plc, ACM Global Laboratories, Medpace, Invivoscribe, Inc., Velocity Clinical Research, PSI, BioAgile Therapeutics Private Limited, and Verily

Table 01: Global Clinical Trials Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 02: Global Clinical Trials Market Value (US$ Bn) Forecast, By Bioanalytical Testing Services, 2020 to 2035

Table 03: Global Clinical Trials Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 04: Global Clinical Trials Market Value (US$ Bn) Forecast, By Trial Phase, 2020 to 2035

Table 05: Global Clinical Trials Market Value (US$ Bn) Forecast, By Study Design, 2020 to 2035

Table 06: Global Clinical Trials Market Value (US$ Bn) Forecast, By Type of Intervention, 2020 to 2035

Table 07: Global Clinical Trials Market Value (US$ Bn) Forecast, By Sponsor Type, 2020 to 2035

Table 08: Global Clinical Trials Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America Clinical Trials Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 10: North America Clinical Trials Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 11: North America Clinical Trials Market Value (US$ Bn) Forecast, By Bioanalytical Testing Services, 2020 to 2035

Table 12: North America Clinical Trials Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 13: North America Clinical Trials Market Value (US$ Bn) Forecast, By Trial Phase, 2020 to 2035

Table 14: North America Clinical Trials Market Value (US$ Bn) Forecast, By Study Design, 2020 to 2035

Table 15: North America Clinical Trials Market Value (US$ Bn) Forecast, By Type of Intervention, 2020 to 2035

Table 16: North America Clinical Trials Market Value (US$ Bn) Forecast, By Sponsor Type, 2020 to 2035

Table 17: Europe Clinical Trials Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 18: Europe Clinical Trials Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 19: Europe Clinical Trials Market Value (US$ Bn) Forecast, By Bioanalytical Testing Services, 2020 to 2035

Table 20: Europe Clinical Trials Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 21: Europe Clinical Trials Market Value (US$ Bn) Forecast, By Trial Phase, 2020 to 2035

Table 22: Europe Clinical Trials Market Value (US$ Bn) Forecast, By Study Design, 2020 to 2035

Table 23: Europe Clinical Trials Market Value (US$ Bn) Forecast, By Type of Intervention, 2020 to 2035

Table 24: Europe Clinical Trials Market Value (US$ Bn) Forecast, By Sponsor Type, 2020 to 2035

Table 25: Asia Pacific Clinical Trials Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 26: Asia Pacific Clinical Trials Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 27: Asia Pacific Clinical Trials Market Value (US$ Bn) Forecast, By Bioanalytical Testing Services, 2020 to 2035

Table 28: Asia Pacific Clinical Trials Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 29: Asia Pacific Clinical Trials Market Value (US$ Bn) Forecast, By Trial Phase, 2020 to 2035

Table 30: Asia Pacific Clinical Trials Market Value (US$ Bn) Forecast, By Study Design, 2020 to 2035

Table 31: Asia Pacific Clinical Trials Market Value (US$ Bn) Forecast, By Type of Intervention, 2020 to 2035

Table 32: Asia Pacific Clinical Trials Market Value (US$ Bn) Forecast, By Sponsor Type, 2020 to 2035

Table 33: Latin America Clinical Trials Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 34: Latin America Clinical Trials Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 35: Latin America Clinical Trials Market Value (US$ Bn) Forecast, By Bioanalytical Testing Services, 2020 to 2035

Table 36: Latin America Clinical Trials Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 37: Latin America Clinical Trials Market Value (US$ Bn) Forecast, By Trial Phase, 2020 to 2035

Table 38: Latin America Clinical Trials Market Value (US$ Bn) Forecast, By Study Design, 2020 to 2035

Table 39: Latin America Clinical Trials Market Value (US$ Bn) Forecast, By Type of Intervention, 2020 to 2035

Table 40: Latin America Clinical Trials Market Value (US$ Bn) Forecast, By Sponsor Type, 2020 to 2035

Table 41: Middle East & Africa Clinical Trials Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 42: Middle East & Africa Clinical Trials Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 43: Middle East & Africa Clinical Trials Market Value (US$ Bn) Forecast, By Bioanalytical Testing Services, 2020 to 2035

Table 44: Middle East & Africa Clinical Trials Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 45: Middle East & Africa Clinical Trials Market Value (US$ Bn) Forecast, By Trial Phase, 2020 to 2035

Table 46: Middle East & Africa Clinical Trials Market Value (US$ Bn) Forecast, By Study Design, 2020 to 2035

Table 47: Middle East & Africa Clinical Trials Market Value (US$ Bn) Forecast, By Type of Intervention, 2020 to 2035

Table 48: Middle East & Africa Clinical Trials Market Value (US$ Bn) Forecast, By Sponsor Type, 2020 to 2035

Figure 01: Global Clinical Trials Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 02: Global Clinical Trials Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 03: Global Clinical Trials Market Revenue (US$ Bn), by Protocol Designing, 2020 to 2035

Figure 04: Global Clinical Trials Market Revenue (US$ Bn), by Patient Recruitment & Site Identification, 2020 to 2035

Figure 05: Global Clinical Trials Market Revenue (US$ Bn), by Laboratory Services, 2020 to 2035

Figure 06: Global Clinical Trials Market Revenue (US$ Bn), by Bioanalytical Testing Services, 2020 to 2035

Figure 07: Global Clinical Trials Market Revenue (US$ Bn), by Clinical Trial Supply & Logistic Services, 2020 to 2035

Figure 08: Global Clinical Trials Market Revenue (US$ Bn), by Clinical Trial Data Management Services, 2020 to 2035

Figure 09: Global Clinical Trials Market Revenue (US$ Bn), by Patient Engagement Services, 2020 to 2035

Figure 10: Global Clinical Trials Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 11: Global Clinical Trials Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 12: Global Clinical Trials Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 13: Global Clinical Trials Market Revenue (US$ Bn), by Cardiovascular Disorders, 2020 to 2035

Figure 14: Global Clinical Trials Market Revenue (US$ Bn), by Neurological Disorders, 2020 to 2035

Figure 15: Global Clinical Trials Market Revenue (US$ Bn), by Oncological Disorders, 2020 to 2035

Figure 16: Global Clinical Trials Market Revenue (US$ Bn), by Metabolic Disorders, 2020 to 2035

Figure 17: Global Clinical Trials Market Revenue (US$ Bn), by Respiratory Disorders, 2020 to 2035

Figure 18: Global Clinical Trials Market Revenue (US$ Bn), by Autoimmune Disorders, 2020 to 2035

Figure 19: Global Clinical Trials Market Revenue (US$ Bn), by Pain Management, 2020 to 2035

Figure 20: Global Clinical Trials Market Revenue (US$ Bn), by Infectious Diseases, 2020 to 2035

Figure 21: Global Clinical Trials Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 22: Global Clinical Trials Market Value Share Analysis, By Trial Phase, 2024 and 2035

Figure 23: Global Clinical Trials Market Attractiveness Analysis, By Trial Phase, 2025 to 2035

Figure 24: Global Clinical Trials Market Revenue (US$ Bn), by Phase 0, 2020 to 2035

Figure 25: Global Clinical Trials Market Revenue (US$ Bn), by Phase I, 2020 to 2035

Figure 26: Global Clinical Trials Market Revenue (US$ Bn), by Phase II, 2020 to 2035

Figure 27: Global Clinical Trials Market Revenue (US$ Bn), by Phase III, 2020 to 2035

Figure 28: Global Clinical Trials Market Revenue (US$ Bn), by Phase IV, 2020 to 2035

Figure 29: Global Clinical Trials Market Value Share Analysis, By Study Design, 2024 and 2035

Figure 30: Global Clinical Trials Market Attractiveness Analysis, By Study Design, 2025 to 2035

Figure 31: Global Clinical Trials Market Revenue (US$ Bn), by Interventional, 2020 to 2035

Figure 32: Global Clinical Trials Market Revenue (US$ Bn), by Observational, 2020 to 2035

Figure 33: Global Clinical Trials Market Revenue (US$ Bn), by Expanded Access, 2020 to 2035

Figure 34: Global Clinical Trials Market Value Share Analysis, By Type of Intervention, 2024 and 2035

Figure 35: Global Clinical Trials Market Attractiveness Analysis, By Type of Intervention, 2025 to 2035

Figure 36: Global Clinical Trials Market Revenue (US$ Bn), by Vaccine, 2020 to 2035

Figure 37: Global Clinical Trials Market Revenue (US$ Bn), by Monoclonal Antibodies, 2020 to 2035

Figure 38: Global Clinical Trials Market Revenue (US$ Bn), by Cell & Gene Therapy, 2020 to 2035

Figure 39: Global Clinical Trials Market Revenue (US$ Bn), by Small Molecules, 2020 to 2035

Figure 40: Global Clinical Trials Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 41: Global Clinical Trials Market Value Share Analysis, By Sponsor Type, 2024 and 2035

Figure 42: Global Clinical Trials Market Attractiveness Analysis, By Sponsor Type, 2025 to 2035

Figure 43: Global Clinical Trials Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 44: Global Clinical Trials Market Revenue (US$ Bn), by Government Organizations, 2020 to 2035

Figure 45: Global Clinical Trials Market Revenue (US$ Bn), by Non-Government Organizations, 2020 to 2035

Figure 46: Global Clinical Trials Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 47: Global Clinical Trials Market Value Share Analysis, By Region, 2024 and 2035

Figure 48: Global Clinical Trials Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 49: North America Clinical Trials Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: North America Clinical Trials Market Value Share Analysis, by Country, 2024 and 2035

Figure 51: North America Clinical Trials Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 52: North America Clinical Trials Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 53: North America Clinical Trials Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 54: North America Clinical Trials Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 55: North America Clinical Trials Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 56: North America Clinical Trials Market Value Share Analysis, By Trial Phase, 2024 and 2035

Figure 57: North America Clinical Trials Market Attractiveness Analysis, By Trial Phase, 2025 to 2035

Figure 58: North America Clinical Trials Market Value Share Analysis, By Study Design, 2024 and 2035

Figure 59: North America Clinical Trials Market Attractiveness Analysis, By Study Design, 2025 to 2035

Figure 60: North America Clinical Trials Market Value Share Analysis, By Type of Intervention, 2024 and 2035

Figure 61: North America Clinical Trials Market Attractiveness Analysis, By Type of Intervention, 2025 to 2035

Figure 62: North America Clinical Trials Market Value Share Analysis, By Sponsor Type, 2024 and 2035

Figure 63: North America Clinical Trials Market Attractiveness Analysis, By Sponsor Type, 2025 to 2035

Figure 64: Europe Clinical Trials Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 65: Europe Clinical Trials Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 66: Europe Clinical Trials Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 67: Europe Clinical Trials Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 68: Europe Clinical Trials Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 69: Europe Clinical Trials Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 70: Europe Clinical Trials Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 71: Europe Clinical Trials Market Value Share Analysis, By Trial Phase, 2024 and 2035

Figure 72: Europe Clinical Trials Market Attractiveness Analysis, By Trial Phase, 2025 to 2035

Figure 73: Europe Clinical Trials Market Value Share Analysis, By Study Design, 2024 and 2035

Figure 74: Europe Clinical Trials Market Attractiveness Analysis, By Study Design, 2025 to 2035

Figure 75: Europe Clinical Trials Market Value Share Analysis, By Type of Intervention, 2024 and 2035

Figure 76: Europe Clinical Trials Market Attractiveness Analysis, By Type of Intervention, 2025 to 2035

Figure 77: Europe Clinical Trials Market Value Share Analysis, By Sponsor Type, 2024 and 2035

Figure 78: Europe Clinical Trials Market Attractiveness Analysis, By Sponsor Type, 2025 to 2035

Figure 79: Asia Pacific Clinical Trials Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 80: Asia Pacific Clinical Trials Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 81: Asia Pacific Clinical Trials Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 82: Asia Pacific Clinical Trials Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 83: Asia Pacific Clinical Trials Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 84: Asia Pacific Clinical Trials Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 85: Asia Pacific Clinical Trials Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 86: Asia Pacific Clinical Trials Market Value Share Analysis, By Trial Phase, 2024 and 2035

Figure 87: Asia Pacific Clinical Trials Market Attractiveness Analysis, By Trial Phase, 2025 to 2035

Figure 88: Asia Pacific Clinical Trials Market Value Share Analysis, By Study Design, 2024 and 2035

Figure 89: Asia Pacific Clinical Trials Market Attractiveness Analysis, By Study Design, 2025 to 2035

Figure 90: Asia Pacific Clinical Trials Market Value Share Analysis, By Type of Intervention, 2024 and 2035

Figure 91: Asia Pacific Clinical Trials Market Attractiveness Analysis, By Type of Intervention, 2025 to 2035

Figure 92: Asia Pacific Clinical Trials Market Value Share Analysis, By Sponsor Type, 2024 and 2035

Figure 93: Asia Pacific Clinical Trials Market Attractiveness Analysis, By Sponsor Type, 2025 to 2035

Figure 94: Latin America Clinical Trials Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 95: Latin America Clinical Trials Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 96: Latin America Clinical Trials Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 97: Latin America Clinical Trials Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 98: Latin America Clinical Trials Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 99: Latin America Clinical Trials Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 100: Latin America Clinical Trials Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 101: Latin America Clinical Trials Market Value Share Analysis, By Trial Phase, 2024 and 2035

Figure 102: Latin America Clinical Trials Market Attractiveness Analysis, By Trial Phase, 2025 to 2035

Figure 103: Latin America Clinical Trials Market Value Share Analysis, By Study Design, 2024 and 2035

Figure 104: Latin America Clinical Trials Market Attractiveness Analysis, By Study Design, 2025 to 2035

Figure 105: Latin America Clinical Trials Market Value Share Analysis, By Type of Intervention, 2024 and 2035

Figure 106: Latin America Clinical Trials Market Attractiveness Analysis, By Type of Intervention, 2025 to 2035

Figure 107: Latin America Clinical Trials Market Value Share Analysis, By Sponsor Type, 2024 and 2035

Figure 108: Latin America Clinical Trials Market Attractiveness Analysis, By Sponsor Type, 2025 to 2035

Figure 109: Middle East & Africa Clinical Trials Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 110: Middle East & Africa Clinical Trials Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 111: Middle East & Africa Clinical Trials Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 112: Middle East & Africa Clinical Trials Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 113: Middle East & Africa Clinical Trials Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 114: Middle East & Africa Clinical Trials Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 115: Middle East & Africa Clinical Trials Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 116: Middle East & Africa Clinical Trials Market Value Share Analysis, By Trial Phase, 2024 and 2035

Figure 117: Middle East & Africa Clinical Trials Market Attractiveness Analysis, By Trial Phase, 2025 to 2035

Figure 118: Middle East & Africa Clinical Trials Market Value Share Analysis, By Study Design, 2024 and 2035

Figure 119: Middle East & Africa Clinical Trials Market Attractiveness Analysis, By Study Design, 2025 to 2035

Figure 120: Middle East & Africa Clinical Trials Market Value Share Analysis, By Type of Intervention, 2024 and 2035

Figure 121: Middle East & Africa Clinical Trials Market Attractiveness Analysis, By Type of Intervention, 2025 to 2035

Figure 122: Middle East & Africa Clinical Trials Market Value Share Analysis, By Sponsor Type, 2024 and 2035

Figure 123: Middle East & Africa Clinical Trials Market Attractiveness Analysis, By Sponsor Type, 2025 to 2035