Reports

Reports

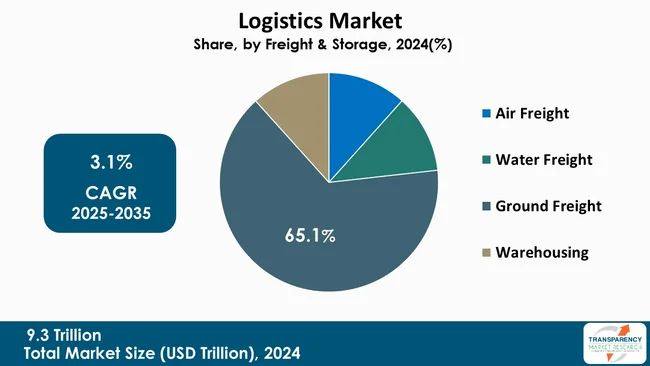

The global logistics market size was valued at USD 9.3 trillion in 2024 and is projected to reach USD 13.1 trillion by 2035, expanding at a CAGR of 3.1% from 2025 to 2035. The market growth is fueled by expanding e-commerce, rising parcel logistics demand, and infrastructure modernization that enhances multimodal connectivity, automation, and customs efficiency across global transport and fulfillment networks.

The logistics market is at a point of structural repositioning, rather than simple volume growth. Apart from the increasing pressures to decarbonize global supply chains from regulators and society, demand trends indicate flows regarding Asia-centric manufacturing corridors; short-haul and last-mile movements; and unpredictable fluctuations in air cargo. Market dynamics are hybrid, where established incumbents are competing regarding integrated service portfolios such as end-to-end service and value-added warehousing, while active digital entrants erode pricing opacity and onboarding speed.

Fragmented regional infrastructure quality creates uneven margins for well-connected corridors, which attract investment by third-party contract logistics investment, but underserved regions seek opportunities for project logistics and finished vehicle logistics (FVL) specialists. Port congestion, equipment shortages, and geopolitical changes continue to create operational risks, leading to pricing premiums, especially for time-sensitive cold chain logistics and hazardous materials. Overall, the near-term trajectory of the sector will be determined by how quickly players upgrade their digital capabilities and reconfigure their assets to achieve a balance of resilience, sustainability, service quality, and cost efficiency.

The logistics industry includes transportation, warehousing, freight forwarding, shipping, rail, road, port, air and water freight, customs clearance, and last-mile delivery services. The primal role of the market is to transform spatial and temporal dislocations between production and consumption into the steady, affordable flow.

Current market-driving factors are largely structural. They include trade flows and port capacity, which determine international routing and container demand, national and sub-national infrastructure investment like roads, rail spurs, inland terminals, digitalization and data visibility that reduce reside time and improve asset utilization, and changing consumption patterns, especially the proliferation of small-parcel e-commerce shipments that stress last-mile networks.

| Attribute | Detail |

|---|---|

| Logistics Market Drivers |

|

The growth in e-Commerce and its associated parceling of freight remains one of the proactive demand drivers of modern logistics. With buyers' growing requirement for the rapid and reliable delivery of small orders of goods rather than large bulk shipments, carriers and warehousing operators will also have to adapt their handling/transport networks toward dense urban fulfillment, micro-fulfillment centers, and scalable last-mile fleets.

With the increased fragmentation of goods, the number of handling events per unit of goods grows, and the relative importance of automated sortation, parcel tracking, and reverse logistics capacity further increases. The operational consequence is higher network complexity and a premium on proximity warehousing and flexible labor models during peak seasons.

For instance, a recent expansion of a major express operator in DHL's expansion into the rapidly growing Saudi Arabian parcel market and AJEX expansion across the Middle East development reflects the broader industry pattern of investment in dedicated parcel infrastructure to keep pace with e-commerce demand spikes and cross-border parcel flows.

e-Commerce also drives demand for value-added capabilities such as temperature control, modified packaging, and integrated returns processing services that shift margin pools toward third-party providers that can offer scalable, technology-enabled fulfilment. The net effect is persistent demand for urban warehousing capacity, investments in automation for high-throughput sortation, and new pricing models that account for higher handling frequency per shipment.

By adding port capacity, inland container depots, intermodal connectors, and dedicated corridors for freight traffic, it is possible to improve the maximum throughput and the overall integration of transport modes in the key location of the intersection of maritime and road networks. Regulatory changes eliminate paperwork and reduce insecurity. In addition, these changes can materially reduce lead-time dispersion and shipping inventories, freeing up working capital and encouraging time patterns.

For instance, a sub-national government announced an ambitious logistics strategy to develop multiple new ports and connect them to inland corridors while establishing a state logistics corporation to coordinate multimodal transport and investments. That public initiative drives the infrastructure plans, turns assets into governance changes, and attracts private logistics developers and commitments from shippers.

Internationally, UNCTAD published its 2024 maritime review, which referred to chokepoint vulnerabilities and port congestion, which directly correlated with increased shipping costs and rerouting risk. Thus, the governments prioritize resilience and corridor reliability. Infrastructure investments, in conjunction with customs modernization that involves digitizing documents and adopting consistent load and customs delivery plans among stakeholders, enable carriers and forwarders to re-optimize their networks in terms of speed and cost, which boosts the infrastructure expansion and the logistics market.

Due to geographic flexibility, density of demand, and access to capital, ground freight occupies a dominant position with market share of 65.1% in the freight-and-storage segment. The efficiency of road networks connects the manufacturers, distributors, and retail points that sea and rail transport cannot readily compete with, either in terms of door-to-door service, especially over shorter to medium distances. Road freight dominates the final-mile and middle-mile part of the supply chains, where timing and flexibility in route planning take priority over the cost per freight unit.

When port congestion and maritime delays occur, shippers have increasingly counted on road solutions to keep the flow of inventories, as central ground freight is integrated into networks. Consequently, logistics providers place road freight in their investment priority list to qualify the business for high-frequency and high-service contracts.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific has positioned itself as the dominant leader with 35.5% share in the logistics industry due to its exclusive confluence of characteristics like scale of manufacturing, growth of intra-regional trade, urbanization, and ongoing infrastructure investment. The region contains robust manufacturing value chains continually producing flows crossing borders; containerized and bulk seaborne trade, which remains dominant.

Public and private investment in ports, expressways, and inland terminals across several Asia Pacific regions has materially raised throughput capacity and reduced domestic lead times, making the region attractive for nearshoring and regional distribution hubs. Benchmarking also shows improvement in logistics performance in many Asian countries where customs modernization and digital tracking are increasingly standard, thereby lowering friction for international shippers.

Recent national and industry developments represent changes in response to future developments, such as regional operators and government stakeholders pursuing sorting and handling facilities to reduce transit times to core trading partners. Current and projected multilateral analyses forecast increased growth in containerized trade and emphasize that minimizing chokepoint exposure for Asian seaborne flows remains tactically important.

Deutsche Post AG, Kuehne + Nagel Management AG, DSV Road, Inc., Schenker AG, FedEx Corporation, United Parcel Service of America, Inc., Maersk Logistics and Services UK Ltd., C.H. Robinson Worldwide, Inc., NIPPON EXPRESS HOLDINGS, INC., Expeditors International of Washington, Inc., CMA CGM Group, GEODIS SA, J.B. Hunt Transport, Inc., XPO, Inc., Ryder System, Inc. are some of the leading manufacturers operating in the global logistics market.

Each of these companies has been profiled in the logistics market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 9.3 Tn |

| Market Forecast Value in 2035 | US$ 13.1 Tn |

| Growth Rate (CAGR 2025 to 2035) | 3.1 % |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Tn for Value |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Service

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global logistics market was valued at US$ 9.37 Tn in 2024

The global logistics industry is projected to reach at US$ 13.1 Tn by the end of 2035

Expansion of e-commerce & parcel-based logistics infrastructure demand, and regulatory reforms & infrastructure upgrades improving freight connectivity are some of the factors driving the expansion of logistics market.

The CAGR is anticipated to be 3.1 % from 2025 to 2035

Deutsche Post AG, Kuehne + Nagel Management AG, DSV Road, Inc., Schenker AG, FedEx Corporation, United Parcel Service of America, Inc., Maersk Logistics and Services UK Ltd., C.H. Robinson Worldwide, Inc., NIPPON EXPRESS HOLDINGS, INC., Expeditors International of Washington, Inc., CMA CGM Group, GEODIS SA, J.B. Hunt Transport, Inc., XPO, Inc., Ryder System, Inc., and other players

Table 01: Global Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 02: Global Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 03: Global Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 04: Global Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 05: Global Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 06: Global Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 07: Global Logistics Market Value (US$ Tn) Projection, By Region 2020 to 2035

Table 08: North America Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 09: North America Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 10: North America Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 11: North America Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 12: North America Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 13: North America Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 14: North America Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Table 15: U.S. Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 16: U.S. Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 17: U.S. Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 18: U.S. Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 19: U.S. Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 20: U.S. Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 21: Canada Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 22: Canada Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 23: Canada Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 24: Canada Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 25: Canada Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 26: Canada Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 27: Europe Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 28: Europe Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 29: Europe Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 30: Europe Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 31: Europe Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 32: Europe Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 33: Europe Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Table 34: U.K. Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 35: U.K. Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 36: U.K. Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 37: U.K. Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 38: U.K. Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 39: U.K. Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 40: Germany Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 41: Germany Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 42: Germany Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 43: Germany Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 44: Germany Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 45: Germany Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 46: France Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 47: France Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 48: France Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 49: France Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 50: France Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 51: France Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 52: Italy Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 53: Italy Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 54: Italy Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 55: Italy Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 56: Italy Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 57: Italy Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 58: Spain Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 59: Spain Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 60: Spain Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 61: Spain Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 62: Spain Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 63: Spain Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 64: The Netherlands Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 65: The Netherlands Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 66: The Netherlands Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 67: The Netherlands Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 68: The Netherlands Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 69: The Netherlands Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 70: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 71: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 72: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 73: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 74: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 75: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 76: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Table 77: China Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 78: China Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 79: China Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 80: China Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 81: China Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 82: China Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 83: India Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 84: India Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 85: India Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 86: India Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 87: India Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 88: India Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 89: Japan Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 90: Japan Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 91: Japan Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 92: Japan Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 93: Japan Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 94: Japan Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 95: Australia Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 96: Australia Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 97: Australia Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 98: Australia Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 99: Australia Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 100: Australia Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 101: South Korea Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 102: South Korea Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 103: South Korea Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 104: South Korea Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 105: South Korea Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 106: South Korea Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 107: ASEAN Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 108: ASEAN Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 109: ASEAN Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 110: ASEAN Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 111: ASEAN Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 112: ASEAN Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 113: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 114: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 115: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 116: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 117: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 118: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 119: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Table 120: GCC Countries Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 121: GCC Countries Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 122: GCC Countries Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 123: GCC Countries Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 124: GCC Countries Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 125: GCC Countries Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 126: South Africa Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 127: South Africa Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 128: South Africa Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 129: South Africa Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 130: South Africa Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 131: South Africa Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 132: Latin America Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 133: Latin America Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 134: Latin America Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 135: Latin America Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 136: Latin America Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 137: Latin America Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 138: Latin America Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Table 139: Brazil Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 140: Brazil Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 141: Brazil Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 142: Brazil Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 143: Brazil Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 144: Brazil Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 145: Mexico Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 146: Mexico Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 147: Mexico Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 148: Mexico Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 149: Mexico Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 150: Mexico Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Table 151: Argentina Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Table 152: Argentina Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Table 153: Argentina Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Table 154: Argentina Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Table 155: Argentina Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Table 156: Argentina Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 01: Global Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 02: Global Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 03: Global Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 04: Global Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 05: Global Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 06: Global Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 07: Global Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 08: Global Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 09: Global Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 10: Global Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 11: Global Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 12: Global Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 13: Global Logistics Market Value (US$ Tn) Projection, By Region 2020 to 2035

Figure 14: Global Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Region 2025 to 2035

Figure 15: North America Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 16: North America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 17: North America Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 18: North America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 19: North America Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 20: North America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 21: North America Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 22: North America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 23: North America Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 24: North America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 25: North America Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 26: North America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 27: North America Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Figure 28: North America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Country 2025 to 2035

Figure 29: U.S. Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 30: U.S. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 31: U.S. Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 32: U.S. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 33: U.S. Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 34: U.S. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 35: U.S. Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 36: U.S. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 37: U.S. Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 38: U.S. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 39: U.S. Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 40: U.S. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 41: Canada Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 42: Canada Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 43: Canada Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 44: Canada Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 45: Canada Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 46: Canada Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 47: Canada Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 48: Canada Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 49: Canada Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 50: Canada Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 51: Canada Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 52: Canada Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 53: Europe Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 54: Europe Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 55: Europe Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 56: Europe Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 57: Europe Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 58: Europe Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 59: Europe Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 60: Europe Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 61: Europe Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 62: Europe Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 63: Europe Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 64: Europe Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 65: Europe Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Figure 66: Europe Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Country 2025 to 2035

Figure 67: U.K. Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 68: U.K. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 69: U.K. Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 70: U.K. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 71: U.K. Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 72: U.K. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 73: U.K. Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 74: U.K. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 75: U.K. Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 76: U.K. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 77: U.K. Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 78: U.K. Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 79: Germany Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 80: Germany Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 81: Germany Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 82: Germany Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 83: Germany Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 84: Germany Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 85: Germany Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 86: Germany Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 87: Germany Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 88: Germany Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 89: Germany Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 90: Germany Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 91: France Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 92: France Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 93: France Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 94: France Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 95: France Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 96: France Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 97: France Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 98: France Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 99: France Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 100: France Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 101: France Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 102: France Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 103: Italy Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 104: Italy Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 105: Italy Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 106: Italy Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 107: Italy Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 108: Italy Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 109: Italy Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 110: Italy Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 111: Italy Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 112: Italy Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 113: Italy Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 114: Italy Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 115: Spain Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 116: Spain Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 117: Spain Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 118: Spain Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 119: Spain Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 120: Spain Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 121: Spain Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 122: Spain Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 123: Spain Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 124: Spain Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 125: Spain Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 126: Spain Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 127: The Netherlands Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 128: The Netherlands Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 129: The Netherlands Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 130: The Netherlands Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 131: The Netherlands Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 132: The Netherlands Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 133: The Netherlands Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 134: The Netherlands Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 135: The Netherlands Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 136: The Netherlands Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 137: The Netherlands Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 138: The Netherlands Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 139: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 140: Asia Pacific Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 141: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 142: Asia Pacific Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 143: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 144: Asia Pacific Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 145: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 146: Asia Pacific Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 147: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 148: Asia Pacific Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 149: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 150: Asia Pacific Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 151: Asia Pacific Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Figure 152: Asia Pacific Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Country 2025 to 2035

Figure 153: China Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 154: China Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 155: China Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 156: China Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 157: China Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 158: China Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 159: China Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 160: China Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 161: China Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 162: China Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 163: China Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 164: China Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 165: India Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 166: India Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 167: India Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 168: India Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 169: India Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 170: India Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 171: India Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 172: India Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 173: India Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 174: India Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 175: India Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 176: India Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 177: Japan Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 178: Japan Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 179: Japan Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 180: Japan Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 181: Japan Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 182: Japan Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 183: Japan Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 184: Japan Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 185: Japan Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 186: Japan Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 187: Japan Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 188: Japan Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 189: Australia Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 190: Australia Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 191: Australia Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 192: Australia Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 193: Australia Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 194: Australia Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 195: Australia Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 196: Australia Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 197: Australia Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 198: Australia Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 199: Australia Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 200: Australia Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 201: South Korea Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 202: South Korea Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 203: South Korea Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 204: South Korea Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 205: South Korea Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 206: South Korea Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 207: South Korea Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 208: South Korea Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 209: South Korea Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 210: South Korea Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 211: South Korea Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 212: South Korea Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 213: ASEAN Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 214: ASEAN Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 215: ASEAN Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 216: ASEAN Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 217: ASEAN Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 218: ASEAN Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 219: ASEAN Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 220: ASEAN Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 221: ASEAN Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 222: ASEAN Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 223: ASEAN Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 224: ASEAN Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 225: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 226: Middle East & Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 227: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 228: Middle East & Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 229: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 230: Middle East & Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 231: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 232: Middle East & Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 233: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 234: Middle East & Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 235: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 236: Middle East & Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 237: Middle East & Africa Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Figure 238: Middle East & Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Country 2025 to 2035

Figure 239: GCC Countries Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 240: GCC Countries Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 241: GCC Countries Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 242: GCC Countries Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 243: GCC Countries Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 244: GCC Countries Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 245: GCC Countries Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 246: GCC Countries Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 247: GCC Countries Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 248: GCC Countries Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 249: GCC Countries Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 250: GCC Countries Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 251: South Africa Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 252: South Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 253: South Africa Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 254: South Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 255: South Africa Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 256: South Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 257: South Africa Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 258: South Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 259: South Africa Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 260: South Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 261: South Africa Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 262: South Africa Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 263: Latin America Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 264: Latin America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 265: Latin America Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 266: Latin America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 267: Latin America Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 268: Latin America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 269: Latin America Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 270: Latin America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 271: Latin America Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 272: Latin America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 273: Latin America Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 274: Latin America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 275: Latin America Logistics Market Value (US$ Tn) Projection, By Country 2020 to 2035

Figure 276: Latin America Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Country 2025 to 2035

Figure 277: Brazil Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 278: Brazil Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 279: Brazil Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 280: Brazil Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 281: Brazil Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 282: Brazil Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 283: Brazil Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 284: Brazil Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 285: Brazil Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 286: Brazil Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 287: Brazil Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 288: Brazil Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 289: Mexico Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 290: Mexico Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 291: Mexico Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 292: Mexico Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 293: Mexico Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 294: Mexico Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 295: Mexico Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 296: Mexico Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 297: Mexico Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 298: Mexico Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 299: Mexico Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 300: Mexico Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035

Figure 301: Argentina Logistics Market Value (US$ Tn) Projection, By Service 2020 to 2035

Figure 302: Argentina Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Service 2025 to 2035

Figure 303: Argentina Logistics Market Value (US$ Tn) Projection, By Freight & Storage 2020 to 2035

Figure 304: Argentina Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Freight & Storage 2025 to 2035

Figure 305: Argentina Logistics Market Value (US$ Tn) Projection, By Model 2020 to 2035

Figure 306: Argentina Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Model 2025 to 2035

Figure 307: Argentina Logistics Market Value (US$ Tn) Projection, By Application 2020 to 2035

Figure 308: Argentina Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Application 2025 to 2035

Figure 309: Argentina Logistics Market Value (US$ Tn) Projection, By Geographical Scope 2020 to 2035

Figure 310: Argentina Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Geographical Scope 2025 to 2035

Figure 311: Argentina Logistics Market Value (US$ Tn) Projection, By Usage 2020 to 2035

Figure 312: Argentina Logistics Market Incremental Opportunities (US$ Tn) Forecast, By Usage 2025 to 2035