Reports

Reports

The rapid movement of goods through aircraft drives growth of air cargo market across the international and domestic routes. It is important for transporting high-value, time-sensitive, and perishable goods such as electronics, pharmaceuticals, automotive parts, and fresh produce. The market has expanded due to the increasing needs for faster and more reliable supply chain, especially in the industries that heavily depend on just-in-time delivery systems. Increasing globalization has influenced the growth of e-Commerce, which increased the demand of air cargo services.

Trends like rapid growth of e-Commerce are shaping the evolution of air cargo market. This has led to a sharp increase in demand for fast and effective logistics solutions. Consumers expect next-day or same-day delivery, which push the companies to adopt air cargo for quicker turnaround. Digital transformation of air cargo operations is also one of the trends. Companies are integrating AI, machine learning, and blockchain to improve tracking, automate processes, and enhance transparency to the customers.

Increasing need for faster delivery times drives the market, particularly for the sectors like pharmaceuticals and electronics, where products need to reach safely and quickly. The rise in globalization and growing demand for cold chain logistics for vaccines and temperature sensitive goods- are also contributors to the growth of air cargo market.

Players are taking various initiatives to meet these growing demands of air cargo. Airlines are investing in the expansion of their dedicated freighter fleets and converting passenger planes into cargo carriers. Logistics providers are making advancements in facilities and also focusing on the digitalization, which will help to perform smart tracking, paperless documentation, and automated warehousing technology.

Air cargo implies the transportation of goods by aircraft. It is a crucial part of international logistics, and offers fast, efficient, and secure delivery over longer distance. It is useful for high-value, time-sensitive or perishable items that require quick transit, like medicines, electronics, fresh fruits or dairy products, and emergency products.

These serveries are provided by specialized passenger airlines, cargo airlines with available space and freight forwarders who co-ordinate logistics on the behalf of shippers. The industry does support global commerce by connecting manufacturers, exporters, importers, and retailers effectively and quickly enabling trade in global economy.

There are mainly two types of cargo: general cargo including textiles, machinery, consumer electronic goods; and special cargo, which requires specialized handling. It could be inclusive of perishable goods like food products or flowers; dangerous goods like temperature-sensitive products like vaccines, live animals; chemicals or batteries; and high-value items like jewelry.

Air cargo is widely used for supply chain reliability, urgent deliveries, and just-in-time inventory systems. It plays a main role in e-Commerce, healthcare, automotive, aerospace, electronics, agriculture, and defense. The ability of airfreight to offer dependable and quick transport makes it indispensable for modern trade and global business operations.

| Attribute | Detail |

|---|---|

| Air Cargo Market Drivers |

|

Increasing demand for fast and time-sensitive deliveries is a key driver for air cargo market. Rise of e-Commerce also leads the same-day and next-day delivery expectations of the customers, especially in consumer goods and online retail. For Instance, in March 2024, McKinsey reported at the IATA World Cargo Symposium that e-Commerce now accounts for nearly one-third of total air cargo volumes, up from just 10% in 2017. This surge reflects a fundamental shift in the industry, driven by rapid growth in cross-border orders—estimated at 8.2 billion in 2022, with projections continuing to rise through 2027.

On the other-hand, goods like medicines and vaccines need strict temperature control and quick delivery, which rely on air frights to meet the safety standards. Air cargo provides quick and safe delivery to critical goods, which make it a preferred mode of transport for urgent and high-value shipments.

One of the major drivers to the market is globalization and expansion of international trade, which has increased the import and export of goods. As businesses are entering the international market and exploring global supply chain, need for effective transformation has increased. Air cargo offers speed and fulfills all the requirements to support this interconnected trade environment, which make it an important component of the industry that relies on fast global logistics.

For Instance, in 2024, International Air Transport Association (IATA) reported that demand for air cargo, measured in cargo ton-kilometers (CTK), grew by 11.3% as compared to the previous year. It further stated that international shipments were the main driver, increasing by 12.2%, showing how important airfreight is for keeping global supply chains moving.

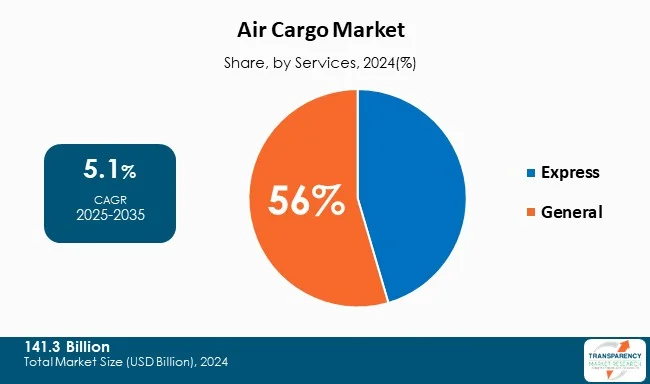

The general services segment continues to lead the global air cargo market due to a full suite of logistical and transportation services provided to a variety of industries. General services typically include standard freight forwarding, consolidated cargo services, customs brokerage, and warehousing. As such, general services are a vital part of the global supply chain.

Its leadership is primarily based on the rise in demand for reliable, efficient cargo handling in e-commerce, pharmaceuticals, and electronics. General services’ scalability and flexibility support businesses' needs to quickly adapt to changing demands and global trade changes. As cross border trade continues to rise, and the advent of digital tracking and logistics management systems grows, general services segment continues to lead in velocity and visibility for cargo movement. Global trade is expected to continue to rise, and the general services segment will remain the leader in the air cargo segment.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific is leading region of global air cargo market, due to the strong industrial base, growing economic development, and growth of cross-border e-Commerce. Major countries of the region such as China, Japan, South Korea, and India have major manufacturing and export hubs, and generate sustainable cargo volumes for both - regional and international ways. Asia Pacific’s geographical location connects the major global markets across North America, Europe, and the Middle East, which make it a center of international supply chain.

In addition, the region is investing in modernizing the airport infrastructure, higher cargo capacity, and advanced logistics technologies, which will help to enhance operational effectiveness and transportation speed. The growing demand for time-sensitive shipment, particularly in sectors such as pharmaceuticals, electronics, and fashion are major factors affecting the demand of airfreight services. These increasing demands will help the region to grow more in global market.

Key players of the market are incorporating digital advancements. Additionally, certain players are adopting sustainability efforts by adopting green fuels, improving fuel efficiency, and aligning with the global initiatives like IATA’s Fly Net Zero.

All Nippon Airways Co. Ltd (ANA), Atlas Air Cargo, Cargolux, Cathay Pacific Airways Limited, Capricorn Logistics, China Eastern Airlines Corporation Limited, DHL International GmbH (Deutsche Post DHL Group), DSV Panalpina, Emirates SkyCargo, Etihad Cargo, Expeditors International of Washington, Inc., FedEx Corporation, Hellmann Worldwide Logistics, Japan Airlines Co. Ltd., Kuehne+Nagel International AG, Lufthansa Cargo AG, Nippon Express., Singapore Airlines Cargo, United Parcel Service of America, Inc., Zela Aviation the Air Charter Company, Chapman Freeborn Airchartering, and Qatar Airways Cargo are the key players in market.

Each of these players has been profiled in the air cargo industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 141.3 Bn |

| Forecast Value in 2035 | US$ 239.8 Bn |

| CAGR | 5.1% |

| Forecast Period | 2025-;2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Air Cargo Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Services

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The air cargo market was valued at US$ 141.3 Bn in 2024

The air cargo market is projected to reach US$ 239.8 Bn by 2035

Demand for fast and time-sensitive deliveries and globalization and expansion of international trade

The CAGR is anticipated to be 5.1% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

All Nippon Airways Co. Ltd (ANA), Atlas Air Cargo, Cargolux, Cathay Pacific Airways Limited, Capricorn Logistics, China Eastern Airlines Corporation Limited, DHL International GmbH (Deutsche Post DHL Group), DSV Panalpina, Emirates SkyCargo, Etihad Cargo, Expeditors International of Washington, Inc., FedEx Corporation, Hellmann Worldwide Logistics, Japan Airlines Co. Ltd., Kuehne+Nagel International AG, Lufthansa Cargo AG, Nippon Express., Singapore Airlines Cargo, United Parcel Service of Ameri

Table 01: Global Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 02: Global Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 03: Global Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 04: Global Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 05: Global Air Cargo Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 06: North America Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 07: North America Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 08: North America Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 09: North America Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 10: North America Air Cargo Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 11: U.S. Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 12: U.S. Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 13: U.S. Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 14: U.S. Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 15: Canada Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 16: Canada Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 17: Canada Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 18: Canada Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 19: Europe Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 20: Europe Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 21: Europe Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 22: Europe Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 23: Europe Air Cargo Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Germany Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 25: Germany Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 26: Germany Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 27: Germany Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 28: U.K. Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 29: U.K. Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 30: U.K. Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 31: U.K. Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 32: France Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 33: France Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 34: France Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 35: France Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 36: Italy Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 37: Italy Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 38: Italy Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 39: Italy Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 40: Spain Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 41: Spain Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 42: Spain Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 43: Spain Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 44: Switzerland Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 45: Switzerland Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 46: Switzerland Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 47: Switzerland Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 48: The Netherlands Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 49: The Netherlands Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 50: The Netherlands Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 51: The Netherlands Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 52: Rest of Europe Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 53: Rest of Europe Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 54: Rest of Europe Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 55: Rest of Europe Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 56: Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 57: Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 58: Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 59: Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 60: Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 61: China Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 62: China Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 63: China Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 64: China Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 65: Japan Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 66: Japan Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 67: Japan Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 68: Japan Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 69: India Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 70: India Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 71: India Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 72: India Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 73: South Korea Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 74: South Korea Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 75: South Korea Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 76: South Korea Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 77: Australia and New Zealand Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 78: Australia and New Zealand Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 79: Australia and New Zealand Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 80: Australia and New Zealand Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 81: Rest of Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 82: Rest of Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 83: Rest of Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 84: Rest of Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 85: Latin America Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 86: Latin America Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 87: Latin America Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 88: Latin America Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 89: Latin America Air Cargo Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 90: Brazil Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 91: Brazil Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 92: Brazil Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 93: Brazil Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 94: Mexico Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 95: Mexico Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 96: Mexico Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 97: Mexico Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 98: Argentina Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 99: Argentina Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 100: Argentina Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 101: Argentina Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 102: Rest of Latin America Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 103: Rest of Latin America Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 104: Rest of Latin America Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 105: Rest of Latin America Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 106: Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 107: Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 108: Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 109: Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 110: Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: GCC Countries Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 112: GCC Countries Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 113: GCC Countries Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 114: GCC Countries Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 115: South Africa Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 116: South Africa Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 117: South Africa Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 118: South Africa Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 119: Rest of Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, by Services, 2020 to 2035

Table 120: Rest of Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 121: Rest of Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, by Destination, 2020 to 2035

Table 122: Rest of Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Figure 01: Global Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 03: Global Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 04: Global Air Cargo Market Revenue (US$ Mn), by Express, 2020 to 2035

Figure 05: Global Air Cargo Market Revenue (US$ Mn), by General, 2020 to 2035

Figure 06: Global Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 07: Global Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 08: Global Air Cargo Market Revenue (US$ Mn), by Air Freight, 2020 to 2035

Figure 09: Global Air Cargo Market Revenue (US$ Mn), by Air Mail, 2020 to 2035

Figure 10: Global Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 11: Global Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 12: Global Air Cargo Market Revenue (US$ Mn), by Domestic, 2020 to 2035

Figure 13: Global Air Cargo Market Revenue (US$ Mn), by International, 2020 to 2035

Figure 14: Global Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 15: Global Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 16: Global Air Cargo Market Revenue (US$ Mn), by Pharmaceuticals & healthcare, 2020 to 2035

Figure 17: Global Air Cargo Market Revenue (US$ Mn), by Consumer electronics, 2020 to 2035

Figure 18: Global Air Cargo Market Revenue (US$ Mn), by Automotive, 2020 to 2035

Figure 19: Global Air Cargo Market Revenue (US$ Mn), by Retail & E-commerce, 2020 to 2035

Figure 20: Global Air Cargo Market Revenue (US$ Mn), by Food & beverages, 2020 to 2035

Figure 21: Global Air Cargo Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 22: Global Air Cargo Market Value Share Analysis, by Region, 2024 and 2035

Figure 23: Global Air Cargo Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 24: North America Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 25: North America Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 26: North America Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 27: North America Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 28: North America Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 29: North America Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 30: North America Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 31: North America Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 32: North America Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 33: North America Air Cargo Market Value Share Analysis, by Country, 2024 and 2035

Figure 34: North America Air Cargo Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 35: U.S. Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 36: U.S. Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 37: U.S. Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 38: U.S. Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 39: U.S. Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 40: U.S. Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 41: U.S. Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 42: U.S. Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 43: U.S. Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 44: Canada Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 45: Canada Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 46: Canada Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 47: Canada Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 48: Canada Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 49: Canada Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 50: Canada Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 51: Canada Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 52: Canada Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 53: Europe Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 54: Europe Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 55: Europe Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 56: Europe Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 57: Europe Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 58: Europe Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 59: Europe Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 60: Europe Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 61: Europe Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 62: Europe Air Cargo Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 63: Europe Air Cargo Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 64: Germany Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 65: Germany Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 66: Germany Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 67: Germany Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 68: Germany Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 69: Germany Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 70: Germany Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 71: Germany Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 72: Germany Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 73: U.K. Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 74: U.K. Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 75: U.K. Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 76: U.K. Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 77: U.K. Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 78: U.K. Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 79: U.K. Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 80: U.K. Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 81: U.K. Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 82: France Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 83: France Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 84: France Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 85: France Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 86: France Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 87: France Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 88: France Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 89: France Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 90: France Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 91: Italy Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 92: Italy Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 93: Italy Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 94: Italy Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 95: Italy Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 96: Italy Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 97: Italy Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 98: Italy Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 99: Italy Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 100: Spain Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 101: Spain Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 102: Spain Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 103: Spain Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 104: Spain Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 105: Spain Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 106: Spain Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 107: Spain Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 108: Spain Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 109: Switzerland Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 110: Switzerland Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 111: Switzerland Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 112: Switzerland Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 113: Switzerland Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 114: Switzerland Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 115: Switzerland Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 116: Switzerland Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 117: Switzerland Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 118: The Netherlands Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 119: The Netherlands Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 120: The Netherlands Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 121: The Netherlands Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 122: The Netherlands Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 123: The Netherlands Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 124: The Netherlands Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 125: The Netherlands Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 126: The Netherlands Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 127: Rest of Europe Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 128: Rest of Europe Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 129: Rest of Europe Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 130: Rest of Europe Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 131: Rest of Europe Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 132: Rest of Europe Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 133: Rest of Europe Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 134: Rest of Europe Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 135: Rest of Europe Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 136: Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 137: Asia Pacific Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 138: Asia Pacific Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 139: Asia Pacific Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 140: Asia Pacific Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 141: Asia Pacific Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 142: Asia Pacific Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 143: Asia Pacific Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 144: Asia Pacific Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 145: Asia Pacific Air Cargo Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 146: Asia Pacific Air Cargo Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 147: China Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 148: China Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 149: China Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 150: China Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 151: China Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 152: China Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 153: China Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 154: China Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 155: China Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 156: Japan Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 157: Japan Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 158: Japan Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 159: Japan Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 160: Japan Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 161: Japan Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 162: Japan Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 163: Japan Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 164: Japan Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 165: India Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 166: India Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 167: India Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 168: India Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 169: India Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 170: India Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 171: India Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 172: India Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 173: India Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 174: South Korea Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 175: South Korea Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 176: South Korea Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 177: South Korea Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 178: South Korea Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 179: South Korea Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 180: South Korea Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 181: South Korea Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 182: South Korea Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 183: Australia and New Zealand Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 184: Australia and New Zealand Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 185: Australia and New Zealand Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 186: Australia and New Zealand Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 187: Australia and New Zealand Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 188: Australia and New Zealand Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 189: Australia and New Zealand Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 190: Australia and New Zealand Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 191: Australia and New Zealand Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 192: Rest of Asia Pacific Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 193: Rest of Asia Pacific Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 194: Rest of Asia Pacific Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 195: Rest of Asia Pacific Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 196: Rest of Asia Pacific Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 197: Rest of Asia Pacific Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 198: Rest of Asia Pacific Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 199: Rest of Asia Pacific Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 200: Rest of Asia Pacific Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 201: Latin America Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 202: Latin America Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 203: Latin America Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 204: Latin America Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 205: Latin America Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 206: Latin America Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 207: Latin America Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 208: Latin America Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 209: Latin America Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 210: Latin America Air Cargo Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 211: Latin America Air Cargo Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 212: Brazil Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 213: Brazil Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 214: Brazil Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 215: Brazil Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 216: Brazil Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 217: Brazil Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 218: Brazil Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 219: Brazil Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 220: Brazil Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 221: Mexico Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 222: Mexico Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 223: Mexico Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 224: Mexico Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 225: Mexico Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 226: Mexico Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 227: Mexico Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 228: Mexico Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 229: Mexico Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 230: Argentina Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 231: Argentina Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 232: Argentina Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 233: Argentina Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 234: Argentina Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 235: Argentina Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 236: Argentina Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 237: Argentina Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 238: Argentina Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 239: Rest of Latin America Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 240: Rest of Latin America Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 241: Rest of Latin America Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 242: Rest of Latin America Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 243: Rest of Latin America Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 244: Rest of Latin America Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 245: Rest of Latin America Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 246: Rest of Latin America Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 247: Rest of Latin America Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 248: Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 249: Middle East and Africa Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 250: Middle East and Africa Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 251: Middle East and Africa Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 252: Middle East and Africa Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 253: Middle East and Africa Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 254: Middle East and Africa Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 255: Middle East and Africa Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 256: Middle East and Africa Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 257: Middle East and Africa Air Cargo Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 258: Middle East and Africa Air Cargo Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 259: GCC Countries Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 260: GCC Countries Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 261: GCC Countries Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 262: GCC Countries Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 263: GCC Countries Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 264: GCC Countries Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 265: GCC Countries Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 266: GCC Countries Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 267: GCC Countries Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 268: South Africa Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 269: South Africa Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 270: South Africa Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 271: South Africa Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 272: South Africa Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 273: South Africa Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 274: South Africa Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 275: South Africa Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 276: South Africa Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 277: Rest of Middle East and Africa Air Cargo Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 278: Rest of Middle East and Africa Air Cargo Market Value Share Analysis, by Services, 2024 and 2035

Figure 279: Rest of Middle East and Africa Air Cargo Market Attractiveness Analysis, by Services, 2025 to 2035

Figure 280: Rest of Middle East and Africa Air Cargo Market Value Share Analysis, by Type, 2024 and 2035

Figure 281: Rest of Middle East and Africa Air Cargo Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 282: Rest of Middle East and Africa Air Cargo Market Value Share Analysis, by Destination, 2024 and 2035

Figure 283: Rest of Middle East and Africa Air Cargo Market Attractiveness Analysis, by Destination, 2025 to 2035

Figure 284: Rest of Middle East and Africa Air Cargo Market Value Share Analysis, by End-use, 2024 and 2035

Figure 285: Rest of Middle East and Africa Air Cargo Market Attractiveness Analysis, by End-use, 2025 to 2035