Reports

Reports

The freight forwarding market is witnessing a significant growth, mainly due to the anticipated growth in global trade, as well as the increasing complexity of supply chains. Rise of e-Commerce with global reach of the internet and social media boost the growth for freight forwarding industry. Global brands and manufacturers can now use online sales and marketing tools to penetrate non-native markets easily. Then they can directly fulfill orders from existing inventory in native country warehouses and/or factories.

Additionally, global trade has led to more number of international shipments, and, therefore increased utilization of freight forwarders in their know-how surrounding international logistics, compliance, and documentation. Third, advancements in technology (to include digital platforms, artificial intelligence, and block chain technology) continue to disrupt freight forwarding as they improve transparency and visibility of cargo and minimize delays and inefficiencies in operations.

Freight Forwarding is a way to carry goods (cargo) via different modes of transportation such as air, marine, rail or highway. Freight forwarding involves complex logistics and extensive regulation. It is an essential feature of the global supply chain as it provides a bridge between shippers and the transportation services to facilitate the movement of goods across air, water, and land across borders efficiently. Freight forwarding market has changed vastly as a result of globalization, e-Commerce, and technology.

Additionally, freight forwarders provide a wide variety of services, including booking cargo, documentation, customs clearance, warehousing, and insurance, which are essential for businesses navigating international logistics and the long and complex supply chains that many businesses use.

Increasing volumes of international trade and an increased demand for integrated logistics services are driving the market. The digital transformation of freight forwarding companies influenced by new platforms that allow shippers real-time information, route optimization using AI technology, and automation and documentation represents the modern freight forwarding market in general. Each represents a modern approach to the long-held freight forwarding traditions of the past. Hence, global players and regional players are looking for strategic collaboration and investment to take the market forward.

| Attribute | Detail |

|---|---|

| Freight Forwarding Market Drivers |

|

The increased adoption of e-Commerce and digital marketing has had a strong impact on the expansion of freight forwarding by disrupting traditional logistics and global supply chains.

As a result of the significant growth in online shopping over the last few years - especially with online shopping facilitators like Amazon, Flipkart, Alibaba, and D2C brand websites - the amount and speed of shipments crossing international and domestic borders have dramatically increased.

Instead of bulk shipments and shipping as seen in B2B trade, e-Commerce employs higher volume and higher frequency small parcel shipments that require logistics to be fast, flexible, and affordable. This shift has increased the demand for freight forwarding services that are more complex and casual, including multi-modal freight, last mile delivery, warehousing, and customs.

Additionally, online marketing reaches mass audience by targeted advertisements, influencer marketing, and flash sales, which would often create unpredictable spikes in consumer demand. Freight forwarders must now respond in a timely, agile manner with scalable logistics solutions to accommodate these rapid fluctuations in order volume.

The implementation of advanced technologies is accelerating the growth of the freight forwarding industry, thereby promoting efficiency, transparency, and scalability in international supply chains. Digital transformation is no longer a choice. Freight forwarders are required to undergo digital transformation in order to maintain a competitive edge in an increasingly customer-centric and accelerated experience.

Telematics is used for predictive analytics, route optimization, and demand forecasting. As such, freight companies can reduce transit times and operating costs. Block chain is also gaining traction due to its ability to improve security and transparency of documentation and cargo tracking, thereby reducing fraud and improving trust between the parties engaged in the supply chain. Finally, IoT devices and sensors permit real-time cargo monitoring, which gives clients greater visibility and control over their shipments, especially those items that value time, such as temperature controlled goods or higher value goods.

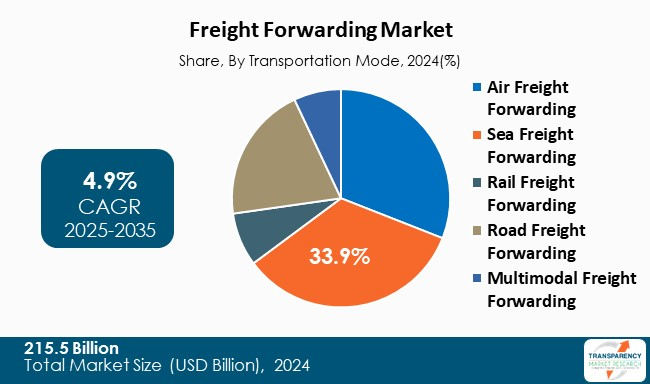

Sea freight forwarding continues to lead the freight forwarding market worldwide mostly as it is affordable, has a large capacity, and can be used for international trade. Sea freight is the preferred transportation option for bulky, heavy goods that are also not likely to perish, which is a large portion of global trade—especially for goods in the automotive, manufacturing, agriculture, and raw materials sectors.

One of the key factors for sea freight leading the market is the ability to haul large quantities of cargo at a much lower cost than air and ground transportation, particularly over long distances. As global trade routes expand and imports and exports increase between Asia, Europe, and North America, the use of ocean freight services is likely to continue to increase. Furthermore, the growth of large and medium ports and shipping alliances will improve interconnectivity, efficient delivery, and overall transit times, all which will lead to continued growth of the sea freight segment.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific holds the largest share in the global freight forwarding market due to global manufacturing hub and developing economics. Expanding international trade, export & import from countries like China, India, Japan, South Korea improve the global supply chain and play a crucial role in massive manufacturing and export capabilities. Its strategic investments in logistics infrastructure—such as ports, railways, and trade corridors (e.g., the Belt and Road Initiative)—have noticeably boosted freight forwarding efficiency.

In addition to a thriving e-Commerce sector, especially within China and Southeast Asia, the demand for faster and economical freight forwarding—such as last mile and cross-border—has increased. As an outcome, the APAC region is experiencing growth and acceleration in the use of digital technologies like AI, IoT and block chain in logistics, which can improve efficiency and reduce costs.

Key players operating in the freight forwarding market are investing into innovation, strategic partnerships, and technological advancements. They emphasize improvement of imaging clarity and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

DHL Service Point, DB Schenker, Kuehne + Nagel, Maersk, C.H. Robinson, CEVA Logistics, Hellmann Worldwide Logistics, Om Freight Forwarders Private Limited, Seal Freight Forwarders Pvt Ltd, Sinotrans Ltd., SVP logistics, Geodis logistic., Nippon Express are the key players in freight forwarding market.

Each of these players has been profiled in the freight forwarding market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

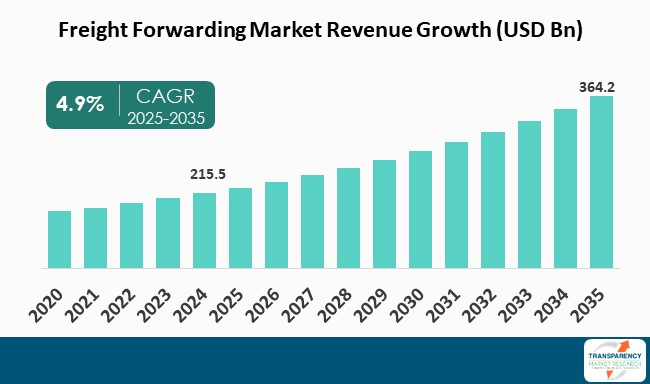

| Size in 2024 | US$ 215.5 Bn |

| Forecast Value in 2035 | US$ 364.2 Bn |

| CAGR | 4.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Freight Forwarding Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Transportation Mode

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The freight forwarding market was valued at US$ 215.5 Bn in 2024

The freight forwarding market is projected to reach US$ 364.2 Bn by the end of 2035

Rise of e-Commerce and online marketing, adoption of advanced technologies are some of the driving factor of freight forwarding market.

The CAGR is anticipated to be 4.9% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

DHL Service Point, DB Schenker, Kuehne + Nagel, Maersk, C.H. Robinson, CEVA Logistics, Hellmann Worldwide Logistics, Om Freight Forwarders Private Limited, Seal Freight Forwarders Pvt Ltd., Sinotrans Ltd., SVP logistics, Geodis logistic., and Nippon Express among others.

Table 01: Global Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 02: Global Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 03: Global Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 04: Global Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 05: Global Freight Forwarding Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 06: North America Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 07: North America Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 08: North America Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 09: North America Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 10: North America Freight Forwarding Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 11: U.S. Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 12: U.S. Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 13: U.S. Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 14: U.S. Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 15: Canada Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 16: Canada Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 17: Canada Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 18: Canada Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 19: Europe Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 20: Europe Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 21: Europe Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 22: Europe Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 23: Europe Freight Forwarding Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Germany Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 25: Germany Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 26: Germany Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 27: Germany Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 28: U.K. Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 29: U.K. Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 30: U.K. Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 31: U.K. Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 32: France Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 33: France Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 34: France Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 35: France Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 36: Italy Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 37: Italy Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 38: Italy Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 39: Italy Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 40: Spain Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 41: Spain Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 42: Spain Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 43: Spain Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 44: Switzerland Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 45: Switzerland Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 46: Switzerland Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 47: Switzerland Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 48: The Netherlands Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 49: The Netherlands Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 50: The Netherlands Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 51: The Netherlands Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 52: Rest of Europe Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 53: Rest of Europe Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 54: Rest of Europe Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 55: Rest of Europe Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 56: Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 57: Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 58: Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 59: Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 60: Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 61: China Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 62: China Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 63: China Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 64: China Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 65: Japan Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 66: Japan Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 67: Japan Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 68: Japan Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 69: India Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 70: India Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 71: India Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 72: India Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 73: South Korea Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 74: South Korea Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 75: South Korea Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 76: South Korea Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 77: Australia and New Zealand Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 78: Australia and New Zealand Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 79: Australia and New Zealand Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 80: Australia and New Zealand Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 81: Rest of Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 82: Rest of Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 83: Rest of Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 84: Rest of Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 85: Latin America Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 86: Latin America Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 87: Latin America Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 88: Latin America Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 89: Latin America Freight Forwarding Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 90: Brazil Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 91: Brazil Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 92: Brazil Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 93: Brazil Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 94: Mexico Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 95: Mexico Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 96: Mexico Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 97: Mexico Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 98: Argentina Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 99: Argentina Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 100: Argentina Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 101: Argentina Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 102: Rest of Latin America Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 103: Rest of Latin America Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 104: Rest of Latin America Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 105: Rest of Latin America Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 106: Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 107: Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 108: Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 109: Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 110: Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: GCC Countries Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 112: GCC Countries Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 113: GCC Countries Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 114: GCC Countries Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 115: South Africa Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 116: South Africa Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 117: South Africa Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 118: South Africa Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 119: Rest of Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, by Transportation Mode, 2020 to 2035

Table 120: Rest of Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, By Cargo Type, 2020 to 2035

Table 121: Rest of Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, By Customer Type, 2020 to 2035

Table 122: Rest of Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Figure 01: Global Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 03: Global Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 04: Global Freight Forwarding Market Revenue (US$ Bn), by Air Freight Forwarding, 2020 to 2035

Figure 05: Global Freight Forwarding Market Revenue (US$ Bn), by Sea Freight Forwarding, 2020 to 2035

Figure 06: Global Freight Forwarding Market Revenue (US$ Bn), by Rail Freight Forwarding, 2020 to 2035

Figure 07: Global Freight Forwarding Market Revenue (US$ Bn), by Road Freight Forwarding, 2020 to 2035

Figure 08: Global Freight Forwarding Market Revenue (US$ Bn), by Multimodal Freight Forwarding, 2020 to 2035

Figure 09: Global Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 10: Global Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 11: Global Freight Forwarding Market Revenue (US$ Bn), by Manufacturing & Industrial Goods, 2020 to 2035

Figure 12: Global Freight Forwarding Market Revenue (US$ Bn), by Retail & E-commerce, 2020 to 2035

Figure 13: Global Freight Forwarding Market Revenue (US$ Bn), by Food, Beverages & Perishables, 2020 to 2035

Figure 14: Global Freight Forwarding Market Revenue (US$ Bn), by Pharmaceuticals & Healthcare, 2020 to 2035

Figure 15: Global Freight Forwarding Market Revenue (US$ Bn), by Transportation Mode, 2020 to 2035

Figure 16: Global Freight Forwarding Market Revenue (US$ Bn), by Others (Automotive, Aerospace Parts, etc.), 2020 to 2035

Figure 17: Global Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 18: Global Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 19: Global Freight Forwarding Market Revenue (US$ Bn), by B2B, 2020 to 2035

Figure 20: Global Freight Forwarding Market Revenue (US$ Bn), by B2C, 2020 to 2035

Figure 21: Global Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 22: Global Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 23: Global Freight Forwarding Market Revenue (US$ Bn), by Transportation & Warehousing, 2020 to 2035

Figure 24: Global Freight Forwarding Market Revenue (US$ Bn), by Value Added Services, 2020 to 2035

Figure 25: Global Freight Forwarding Market Revenue (US$ Bn), by Packaging & Documentation, 2020 to 2035

Figure 26: Global Freight Forwarding Market Revenue (US$ Bn), by Other Service Types, 2020 to 2035

Figure 27: Global Freight Forwarding Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 28: Global Freight Forwarding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 29: North America Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: North America Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 31: North America Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 32: North America Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 33: North America Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 34: North America Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 35: North America Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 36: North America Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 37: North America Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 38: North America Freight Forwarding Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 39: North America Freight Forwarding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 40: U.S. Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: U.S. Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 42: U.S. Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 43: U.S. Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 44: U.S. Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 45: U.S. Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 46: U.S. Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 47: U.S. Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 48: U.S. Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 49: Canada Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: Canada Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 51: Canada Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 52: Canada Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 53: Canada Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 54: Canada Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 55: Canada Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 56: Canada Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 57: Canada Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 58: Europe Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Europe Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 60: Europe Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 61: Europe Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 62: Europe Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 63: Europe Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 64: Europe Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 65: Europe Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 66: Europe Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 67: Europe Freight Forwarding Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 68: Europe Freight Forwarding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 69: Germany Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 70: Germany Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 71: Germany Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 72: Germany Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 73: Germany Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 74: Germany Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 75: Germany Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 76: Germany Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 77: Germany Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 78: U.K. Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 79: U.K. Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 80: U.K. Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 81: U.K. Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 82: U.K. Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 83: U.K. Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 84: U.K. Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 85: U.K. Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 86: U.K. Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 87: France Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 88: France Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 89: France Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 90: France Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 91: France Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 92: France Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 93: France Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 94: France Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 95: France Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 96: Italy Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 97: Italy Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 98: Italy Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 99: Italy Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 100: Italy Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 101: Italy Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 102: Italy Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 103: Italy Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 104: Italy Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 105: Spain Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 106: Spain Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 107: Spain Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 108: Spain Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 109: Spain Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 110: Spain Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 111: Spain Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 112: Spain Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 113: Spain Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 114: Switzerland Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 115: Switzerland Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 116: Switzerland Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 117: Switzerland Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 118: Switzerland Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 119: Switzerland Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 120: Switzerland Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 121: Switzerland Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 122: Switzerland Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 123: The Netherlands Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 124: The Netherlands Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 125: The Netherlands Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 126: The Netherlands Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 127: The Netherlands Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 128: The Netherlands Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 129: The Netherlands Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 130: The Netherlands Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 131: The Netherlands Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 132: Rest of Europe Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 133: Rest of Europe Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 134: Rest of Europe Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 135: Rest of Europe Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 136: Rest of Europe Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 137: Rest of Europe Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 138: Rest of Europe Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 139: Rest of Europe Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 140: Rest of Europe Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 141: Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 142: Asia Pacific Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 143: Asia Pacific Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 144: Asia Pacific Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 145: Asia Pacific Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 146: Asia Pacific Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 147: Asia Pacific Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 148: Asia Pacific Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 149: Asia Pacific Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 150: Asia Pacific Freight Forwarding Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 151: Asia Pacific Freight Forwarding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 152: China Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 153: China Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 154: China Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 155: China Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 156: China Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 157: China Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 158: China Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 159: China Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 160: China Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 161: Japan Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 162: Japan Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 163: Japan Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 164: Japan Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 165: Japan Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 166: Japan Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 167: Japan Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 168: Japan Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 169: Japan Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 170: India Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 171: India Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 172: India Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 173: India Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 174: India Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 175: India Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 176: India Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 177: India Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 178: India Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 179: South Korea Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 180: South Korea Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 181: South Korea Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 182: South Korea Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 183: South Korea Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 184: South Korea Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 185: South Korea Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 186: South Korea Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 187: South Korea Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 188: Australia and New Zealand Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 189: Australia and New Zealand Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 190: Australia and New Zealand Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 191: Australia and New Zealand Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 192: Australia and New Zealand Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 193: Australia and New Zealand Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 194: Australia and New Zealand Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 195: Australia and New Zealand Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 196: Australia and New Zealand Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 197: Rest of Asia Pacific Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 198: Rest of Asia Pacific Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 199: Rest of Asia Pacific Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 200: Rest of Asia Pacific Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 201: Rest of Asia Pacific Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 202: Rest of Asia Pacific Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 203: Rest of Asia Pacific Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 204: Rest of Asia Pacific Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 205: Rest of Asia Pacific Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 206: Latin America Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 207: Latin America Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 208: Latin America Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 209: Latin America Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 210: Latin America Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 211: Latin America Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 212: Latin America Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 213: Latin America Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 214: Latin America Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 215: Latin America Freight Forwarding Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 216: Latin America Freight Forwarding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 217: Brazil Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 218: Brazil Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 219: Brazil Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 220: Brazil Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 221: Brazil Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 222: Brazil Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 223: Brazil Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 224: Brazil Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 225: Brazil Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 226: Mexico Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 227: Mexico Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 228: Mexico Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 229: Mexico Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 230: Mexico Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 231: Mexico Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 232: Mexico Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 233: Mexico Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 234: Mexico Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 235: Argentina Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 236: Argentina Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 237: Argentina Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 238: Argentina Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 239: Argentina Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 240: Argentina Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 241: Argentina Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 242: Argentina Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 243: Argentina Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 244: Rest of Latin America Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 245: Rest of Latin America Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 246: Rest of Latin America Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 247: Rest of Latin America Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 248: Rest of Latin America Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 249: Rest of Latin America Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 250: Rest of Latin America Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 251: Rest of Latin America Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 252: Rest of Latin America Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 253: Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 254: Middle East and Africa Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 255: Middle East and Africa Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 256: Middle East and Africa Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 257: Middle East and Africa Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 258: Middle East and Africa Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 259: Middle East and Africa Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 260: Middle East and Africa Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 261: Middle East and Africa Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 262: Middle East and Africa Freight Forwarding Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 263: Middle East and Africa Freight Forwarding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 264: GCC Countries Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 265: GCC Countries Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 266: GCC Countries Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 267: GCC Countries Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 268: GCC Countries Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 269: GCC Countries Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 270: GCC Countries Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 271: GCC Countries Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 272: GCC Countries Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 273: South Africa Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 274: South Africa Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 275: South Africa Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 276: South Africa Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 277: South Africa Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 278: South Africa Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 279: South Africa Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 280: South Africa Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 281: South Africa Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 282: Rest of Middle East and Africa Freight Forwarding Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 283: Rest of Middle East and Africa Freight Forwarding Market Value Share Analysis, by Transportation Mode, 2024 and 2035

Figure 284: Rest of Middle East and Africa Freight Forwarding Market Attractiveness Analysis, by Transportation Mode, 2025 to 2035

Figure 285: Rest of Middle East and Africa Freight Forwarding Market Value Share Analysis, By Cargo Type, 2024 and 2035

Figure 286: Rest of Middle East and Africa Freight Forwarding Market Attractiveness Analysis, By Cargo Type, 2025 to 2035

Figure 287: Rest of Middle East and Africa Freight Forwarding Market Value Share Analysis, By Customer Type, 2024 and 2035

Figure 288: Rest of Middle East and Africa Freight Forwarding Market Attractiveness Analysis, By Customer Type, 2025 to 2035

Figure 289: Rest of Middle East and Africa Freight Forwarding Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 290: Rest of Middle East and Africa Freight Forwarding Market Attractiveness Analysis, By Service Type, 2025 to 2035