Reports

Reports

Analysts’ Viewpoint

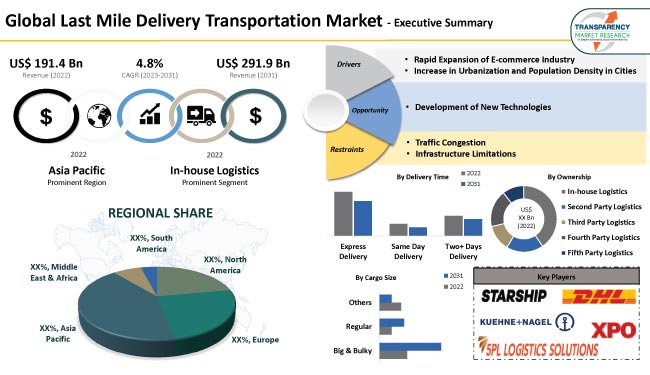

Increase in urbanization and population density in cities has led to higher concentration of potential customers in smaller geographic areas. This is creating significant last mile delivery transportation market opportunities for companies operating in the industry. Rapid expansion of the e-commerce sector is a key factor driving the last mile delivery transportation market size.

Surge in online shopping is encouraging last mile transportation companies to innovate and invest in efficient, technology-driven solutions to meet the evolving demands of consumers and ensure timely and convenient deliveries. Leading players are increasingly offering value-added services, such as flexible delivery options and real-time package tracking, to increase their last mile delivery transportation market share.

Last mile delivery transportation refers to the final stage of the delivery process, where goods are transported from a distribution center or retailer's location to end-consumer's doorstep. It is called the ‘last mile,’ as it represents the last leg of the supply chain, covering the shortest distance but often involving complex logistics and high costs.

Traditionally, last mile delivery was primarily carried out by postal services, courier companies, or local delivery providers. However, growth of e-commerce and increase in demand for quick and convenient deliveries have led to the emergence of new transportation methods and technologies to optimize this stage of the delivery process. Thus, the global last mile delivery transportation market value is expected to rise at a steady pace during the forecast period.

Last mile delivery transportation market growth can also be ascribed to the rise in urbanization and increase in population density in cities across the globe. Demand for efficient and localized delivery services is high in densely populated areas with higher concentration of potential customers.

Growth of on-demand services, such as food and grocery delivery, has significantly contributed to market progress. These services require quick and efficient delivery of goods to end-consumers, thus creating high demand for last mile couriers.

Rise in online shopping has led to a surge in demand for efficient and timely delivery of products to consumers. E-commerce sales have been experiencing significant growth since the last decade, led by the convenience of shopping from anywhere and increase in adoption of digital platforms. This has fueled the need for robust final mile transportation services.

Environmental impact of last mile delivery has become a significant concern. Expansion of e-commerce has led to an increase in delivery vehicles on the road, thus resulting in higher carbon emissions and congestion. Companies are exploring alternative delivery methods, such as electric vehicles, bicycle couriers, and other eco-friendly options, to address these concerns.

Thus, sustainable last mile delivery solutions are gaining traction, as consumers and companies prioritize environmental responsibility. This is expected to bolster the overall last mile delivery transportation market revenue in the near future.

Higher concentration of potential customers in urban areas means that delivery companies can serve a larger number of customers in a relatively small geographic area. This leads to economies of scale and operational efficiencies, as multiple deliveries can be made within a short distance or time frame. Delivery companies can improve their productivity and reduce costs by optimizing routes and utilizing technology.

The convenience of online shopping has increased consumer expectations for faster and more efficient deliveries. Customers now expect same-day or next-day deliveries, which has further fueled last mile delivery transportation market demand.

Delivery companies have been increasingly investing in fleet expansion. They are also employing more delivery personnel and adopting innovative technologies, such as autonomous vehicles and drones, to meet the rise in demand.

Higher concentration of potential customers also provides opportunities for delivery companies to offer value-added services such as flexible delivery options, real-time package tracking, and personalized customer experiences. These additional services can differentiate delivery providers and attract more customers, thereby driving market expansion.

Last mile delivery plays a key role in shaping the overall customer experience. By bringing logistics operations in-house, companies have greater control over the delivery process. This allows them to enhance customer satisfaction. Companies can implement their own delivery strategies, track shipments more closely, offer flexible delivery options, and improve communication with customers.

They can follow the latest trends and innovations in last mile delivery transportation to improve service quality, reduce delivery times, and provide better overall customer experience.

As companies grow, they often face challenges in scaling their logistics operations to meet the increasing demand. Taking ownership of logistics processes allows companies to have more control and flexibility to adapt to changing market conditions and scale their operations accordingly. They can allocate resources more efficiently, make quick adjustments to meet demand fluctuations, and ensure the availability of transportation capacity during peak seasons or unforeseen events.

In-house logistics ownership enables companies to collect and analyze valuable data throughout the delivery process. By leveraging advanced analytics and machine learning, companies can gain insights into customer behavior, delivery patterns, route optimization, and other factors that can lead to operational improvements. These data-driven insights can help companies make informed decisions, optimize their last mile delivery processes, and enhance efficiency.

Asia Pacific is poised for significant growth and expansion, according to the latest last mile delivery transportation market forecast. Increase in purchasing power of the middle class population in the region is boosting the demand for goods. This, in turn, is augmenting growth prospects of the last mile delivery transportation market.

Asia Pacific is witnessing rapid urbanization, with large population concentrated in cities. This urban population relies significantly on delivery services for their daily needs, including groceries, food, and other consumer goods. Furthermore, advancements in technology, such as route optimization algorithms, GPS tracking, and real-time delivery tracking systems, have substantially improved the efficiency and accuracy of last mile delivery services.

As per last mile delivery transportation market analysis, the global landscape is highly competitive, with the presence of several key players. Prominent companies are adopting various strategies, such as collaborations and mergers and acquisitions, to gain competitive edge and capture a larger market share.

Some of the major companies identified in the last mile delivery transportation market research report are DHL Global Forwarding, 5PI Logistics Solutions, Amazon, CJ Logistics Corporation, Darkstore, DB SCHENKER, FedEx Corporation, J&J Global Limited, Uber, Instacart, Doordash, Hitch, KART, Kerry Logistics Network Limited, Kintetsu World Express, KUEHNE + NAGEL, Logistics Plus, Nippon Express Co., Ltd., Cargo Carriers Limited, Postmates, Shiphawk, Swift Transport, United Parcel Service Inc., USPS, XPO Logistics, Inc., Walmart, Onfleet, Nuro, Starship Technologies, Matternet, and PiggyBee.

The last mile delivery transportation market report profiles the leading players in terms of parameters such as company overview, business strategies, financial overview, product portfolio, recent developments, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 191.4 Bn |

|

Market Forecast Value in 2031 |

US$ 291.9 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It is valued at US$ 191.4 Bn in 2022

It is anticipated to grow at a CAGR of 4.8% by 2031

It would be worth US$ 291.9 Bn in 2031

Expansion of the e-commerce industry and increase in urbanization and population density in cities

The in-house logistics ownership segment holds major share

Asia Pacific is anticipated to be a highly lucrative region during the forecast period

5Pl Logistics Solutions, Amazon, Cargo Carriers Limited, CJ Logistics Corporation, Darkstore, DB SCHENKER, DHL Global Forwarding, FedEx Corporation, J&J Global Limited, Uber, Instacart, Doordash, Hitch, KART, Kerry Logistics Network Limited, Kintetsu World Express, KUEHNE + NAGEL, Logistics Plus, Nippon Express Co., Ltd., Postmates, Shiphawk, Swift Transport, United Parcel Service Inc., USPS, XPO Logistics, Inc., Walmart, Onfleet, Nuro, Starship Technologies, Matternet, and PiggyBee.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Value Chain Analysis

2.7. Go to Market Strategy

2.7.1. Demand & Supply Side Trends

2.7.1.1. GAP Analysis

2.7.2. Identification of Potential Market Spaces

2.7.3. Understanding Buying Process of Customers

2.7.4. Preferred Sales & Marketing Strategy

2.8. Key Trend Analysis - Technology and Industry Trends

2.8.1. IOT and 5G

2.8.2. Artificial Intelligence and Machine Learning

2.8.3. Cybersecurity and Data Privacy

2.9. Case Study Analysis

3. Global Last Mile Delivery Transportation Market, by Vehicle Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

3.2.1. Cargo Bike

3.2.2. Two Wheeler Vehicle

3.2.3. Drone

3.2.4. Robot

3.2.5. AGV

3.2.6. Van

3.2.7. Light Duty Vehicle

3.2.8. Medium & Heavy Duty Vehicle

4. Global Last Mile Delivery Transportation Market, by Solution

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Solution

4.2.1. Real Time Tracking

4.2.2. Automated Planning & Optimization

4.2.3. Electronic Proof of Delivery

4.2.4. Dynamic Re-routing

4.2.5. Hardware Agnostic Platform

4.2.6. Real Time ETA Calculation

4.2.7. Interactive Planning Dashboard

4.2.8. Delivery Route Planning Visualization

4.2.9. Others

5. Global Last Mile Delivery Transportation Market, by End-use Industry

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use Industry

5.2.1. Food Delivery

5.2.2. FMCG Products Delivery

5.2.3. Health Products Delivery

5.2.4. Postal Delivery

5.2.5. Automotive Products Delivery

5.2.6. Electronic Products Delivery

5.2.7. Apparel

5.2.8. Other E-commerce Products Delivery

5.2.9. Others

6. Global Last Mile Delivery Transportation Market, by Propulsion

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion

6.2.1. Electric Delivery Vehicle

6.2.2. ICE Delivery Vehicle

7. Global Last Mile Delivery Transportation Market, By Cargo Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

7.2.1. Perishable Goods

7.2.2. Non-perishable Goods

8. Global Last Mile Delivery Transportation Market, by Ownership

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Ownership

8.2.1. In-house Logistics

8.2.2. Second Party Logistics (2PL)

8.2.3. Third Party Logistics (3PL)

8.2.4. Fourth Party Logistics (4PL)

8.2.5. Fifth Party Logistics (5PL)

9. Global Last Mile Delivery Transportation Market, by Service Type

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Service Type

9.2.1. Business-to-Business (B2B)

9.2.2. Business-to-Consumer (B2C)

9.2.3. Customer-to-Customer (C2C)

10. Global Last Mile Delivery Transportation Market, by Delivery Time

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Delivery Time

10.2.1. Express Delivery

10.2.2. Same Day Delivery

10.2.3. Two+ Days Delivery

11. Global Last Mile Delivery Transportation Market, by Cargo Size

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Size

11.2.1. Big & Bulky

11.2.2. Regular

11.2.3. Others

12. Global Last Mile Delivery Transportation Market, by Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Last Mile Delivery Transportation Market

13.1. Market Snapshot

13.2. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

13.2.1. Cargo Bike

13.2.2. Two Wheeler Vehicle

13.2.3. Drone

13.2.4. Robot

13.2.5. AGV

13.2.6. Van

13.2.7. Light Duty Vehicle

13.2.8. Medium & Heavy Duty Vehicle

13.3. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Solution

13.3.1. Real Time Tracking

13.3.2. Automated Planning & Optimization

13.3.3. Electronic Proof of Delivery

13.3.4. Dynamic Re-routing

13.3.5. Hardware Agnostic Platform

13.3.6. Real Time ETA Calculation

13.3.7. Interactive Planning Dashboard

13.3.8. Delivery Route Planning Visualization

13.3.9. Others

13.4. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use Industry

13.4.1. Food Delivery

13.4.2. FMCG Products Delivery

13.4.3. Health Products Delivery

13.4.4. Postal Delivery

13.4.5. Automotive Products Delivery

13.4.6. Electronic Products Delivery

13.4.7. Apparel

13.4.8. Other E-commerce Products Delivery

13.4.9. Others

13.5. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion

13.5.1. Electric Delivery Vehicle

13.5.2. ICE Delivery Vehicle

13.6. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

13.6.1. Perishable Goods

13.6.2. Non-perishable Goods

13.7. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Ownership

13.7.1. In-house Logistics

13.7.2. Second Party Logistics (2PL)

13.7.3. Third Party Logistics (3PL)

13.7.4. Fourth Party Logistics (4PL)

13.7.5. Fifth Party Logistics (5PL)

13.8. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Service Type

13.8.1. Business-to-Business (B2B)

13.8.2. Business-to-Consumer (B2C)

13.8.3. Customer-to-Customer (C2C)

13.9. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Delivery Time

13.9.1. Express Delivery

13.9.2. Same Day Delivery

13.9.3. Two+ Days Delivery

13.10. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Size

13.10.1. Big & Bulky

13.10.2. Regular

13.10.3. Others

13.11. North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

13.11.1. U.S.

13.11.2. Canada

13.11.3. Mexico

14. Europe Last Mile Delivery Transportation Market

14.1. Market Snapshot

14.2. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

14.2.1. Cargo Bike

14.2.2. Two Wheeler Vehicle

14.2.3. Drone

14.2.4. Robot

14.2.5. AGV

14.2.6. Van

14.2.7. Light Duty Vehicle

14.2.8. Medium & Heavy Duty Vehicle

14.3. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Solution

14.3.1. Real Time Tracking

14.3.2. Automated Planning & Optimization

14.3.3. Electronic Proof of Delivery

14.3.4. Dynamic Re-routing

14.3.5. Hardware Agnostic Platform

14.3.6. Real Time ETA Calculation

14.3.7. Interactive Planning Dashboard

14.3.8. Delivery Route Planning Visualization

14.3.9. Others

14.4. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use Industry

14.4.1. Food Delivery

14.4.2. FMCG Products Delivery

14.4.3. Health Products Delivery

14.4.4. Postal Delivery

14.4.5. Automotive Products Delivery

14.4.6. Electronic Products Delivery

14.4.7. Apparel

14.4.8. Other E-commerce Products Delivery

14.4.9. Others

14.5. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion

14.5.1. Electric Delivery Vehicle

14.5.2. ICE Delivery Vehicle

14.6. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

14.6.1. Perishable Goods

14.6.2. Non-perishable Goods

14.7. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Ownership

14.7.1. In-house Logistics

14.7.2. Second Party Logistics (2PL)

14.7.3. Third Party Logistics (3PL)

14.7.4. Fourth Party Logistics (4PL)

14.7.5. Fifth Party Logistics (5PL)

14.8. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Service Type

14.8.1. Business-to-Business (B2B)

14.8.2. Business-to-Consumer (B2C)

14.8.3. Customer-to-Customer (C2C)

14.9. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Delivery Time

14.9.1. Express Delivery

14.9.2. Same Day Delivery

14.9.3. Two+ Days Delivery

14.10. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Size

14.10.1. Big & Bulky

14.10.2. Regular

14.10.3. Others

14.11. Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

14.11.1. Germany

14.11.2. U. K.

14.11.3. France

14.11.4. Italy

14.11.5. Spain

14.11.6. Nordic Countries

14.11.7. Russia & CIS

14.11.8. Rest of Europe

15. Asia Pacific Last Mile Delivery Transportation Market

15.1. Market Snapshot

15.2. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

15.2.1. Cargo Bike

15.2.2. Two Wheeler Vehicle

15.2.3. Drone

15.2.4. Robot

15.2.5. AGV

15.2.6. Van

15.2.7. Light Duty Vehicle

15.2.8. Medium & Heavy Duty Vehicle

15.3. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Solution

15.3.1. Real Time Tracking

15.3.2. Automated Planning & Optimization

15.3.3. Electronic Proof of Delivery

15.3.4. Dynamic Re-routing

15.3.5. Hardware Agnostic Platform

15.3.6. Real Time ETA Calculation

15.3.7. Interactive Planning Dashboard

15.3.8. Delivery Route Planning Visualization

15.3.9. Others

15.4. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use Industry

15.4.1. Food Delivery

15.4.2. FMCG Products Delivery

15.4.3. Health Products Delivery

15.4.4. Postal Delivery

15.4.5. Automotive Products Delivery

15.4.6. Electronic Products Delivery

15.4.7. Apparel

15.4.8. Other E-commerce Products Delivery

15.4.9. Others

15.5. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion

15.5.1. Electric Delivery Vehicle

15.5.2. ICE Delivery Vehicle

15.6. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

15.6.1. Perishable Goods

15.6.2. Non-perishable Goods

15.7. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Ownership

15.7.1. In-house Logistics

15.7.2. Second Party Logistics (2PL)

15.7.3. Third Party Logistics (3PL)

15.7.4. Fourth Party Logistics (4PL)

15.7.5. Fifth Party Logistics (5PL)

15.8. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Service Type

15.8.1. Business-to-Business (B2B)

15.8.2. Business-to-Consumer (B2C)

15.8.3. Customer-to-Customer (C2C)

15.9. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Delivery Time

15.9.1. Express Delivery

15.9.2. Same Day Delivery

15.9.3. Two+ Days Delivery

15.10. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Size

15.10.1. Big & Bulky

15.10.2. Regular

15.10.3. Others

15.11. Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

15.11.1. China

15.11.2. India

15.11.3. Japan

15.11.4. ASEAN Countries

15.11.5. South Korea

15.11.6. ANZ

15.11.7. Rest of Asia Pacific

16. Middle East & Africa Last Mile Delivery Transportation Market

16.1. Market Snapshot

16.2. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

16.2.1. Cargo Bike

16.2.2. Two Wheeler Vehicle

16.2.3. Drone

16.2.4. Robot

16.2.5. AGV

16.2.6. Van

16.2.7. Light Duty Vehicle

16.2.8. Medium & Heavy Duty Vehicle

16.3. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Solution

16.3.1. Real Time Tracking

16.3.2. Automated Planning & Optimization

16.3.3. Electronic Proof of Delivery

16.3.4. Dynamic Re-routing

16.3.5. Hardware Agnostic Platform

16.3.6. Real Time ETA Calculation

16.3.7. Interactive Planning Dashboard

16.3.8. Delivery Route Planning Visualization

16.3.9. Others

16.4. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use Industry

16.4.1. Food Delivery

16.4.2. FMCG Products Delivery

16.4.3. Health Products Delivery

16.4.4. Postal Delivery

16.4.5. Automotive Products Delivery

16.4.6. Electronic Products Delivery

16.4.7. Apparel

16.4.8. Other E-commerce Products Delivery

16.4.9. Others

16.5. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion

16.5.1. Electric Delivery Vehicle

16.5.2. ICE Delivery Vehicle

16.6. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

16.6.1. Perishable Goods

16.6.2. Non-perishable Goods

16.7. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Ownership

16.7.1. In-house Logistics

16.7.2. Second Party Logistics (2PL)

16.7.3. Third Party Logistics (3PL)

16.7.4. Fourth Party Logistics (4PL)

16.7.5. Fifth Party Logistics (5PL)

16.8. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Service Type

16.8.1. Business-to-Business (B2B)

16.8.2. Business-to-Consumer (B2C)

16.8.3. Customer-to-Customer (C2C)

16.9. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Delivery Time

16.9.1. Express Delivery

16.9.2. Same Day Delivery

16.9.3. Two+ Days Delivery

16.10. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Size

16.10.1. Big & Bulky

16.10.2. Regular

16.10.3. Others

16.11. Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

16.11.1. GCC

16.11.2. South Africa

16.11.3. Turkey

16.11.4. Rest of Middle East & Africa

17. South America Last Mile Delivery Transportation Market

17.1. Market Snapshot

17.2. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

17.2.1. Cargo Bike

17.2.2. Two Wheeler Vehicle

17.2.3. Drone

17.2.4. Robot

17.2.5. AGV

17.2.6. Van

17.2.7. Light Duty Vehicle

17.2.8. Medium & Heavy Duty Vehicle

17.3. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Solution

17.3.1. Real Time Tracking

17.3.2. Automated Planning & Optimization

17.3.3. Electronic Proof of Delivery

17.3.4. Dynamic Re-routing

17.3.5. Hardware Agnostic Platform

17.3.6. Real Time ETA Calculation

17.3.7. Interactive Planning Dashboard

17.3.8. Delivery Route Planning Visualization

17.3.9. Others

17.4. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By End-use Industry

17.4.1. Food Delivery

17.4.2. FMCG Products Delivery

17.4.3. Health Products Delivery

17.4.4. Postal Delivery

17.4.5. Automotive Products Delivery

17.4.6. Electronic Products Delivery

17.4.7. Apparel

17.4.8. Other E-commerce Products Delivery

17.4.9. Others

17.5. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Propulsion

17.5.1. Electric Delivery Vehicle

17.5.2. ICE Delivery Vehicle

17.6. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Type

17.6.1. Perishable Goods

17.6.2. Non-perishable Goods

17.7. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Ownership

17.7.1. In-house Logistics

17.7.2. Second Party Logistics (2PL)

17.7.3. Third Party Logistics (3PL)

17.7.4. Fourth Party Logistics (4PL)

17.7.5. Fifth Party Logistics (5PL)

17.8. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Service Type

17.8.1. Business-to-Business (B2B)

17.8.2. Business-to-Consumer (B2C)

17.8.3. Customer-to-Customer (C2C)

17.9. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Delivery Time

17.9.1. Express Delivery

17.9.2. Same Day Delivery

17.9.3. Two+ Days Delivery

17.10. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Cargo Size

17.10.1. Big & Bulky

17.10.2. Regular

17.10.3. Others

17.11. South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Country

17.11.1. Brazil

17.11.2. Argentina

17.11.3. Rest of South America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2022

18.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

19. Company Profile/ Key Players - Last Mile Delivery Transportation Market

19.1. 5Pl Logistics Solutions

19.1.1. Company Overview

19.1.2. Company Footprints

19.1.3. Production Locations

19.1.4. Product Portfolio

19.1.5. Competitors & Customers

19.1.6. Subsidiaries & Parent Organization

19.1.7. Recent Developments

19.1.8. Financial Analysis

19.1.9. Profitability

19.1.10. Revenue Share

19.1.11. Executive Bios

19.2. Amazon

19.2.1. Company Overview

19.2.2. Company Footprints

19.2.3. Production Locations

19.2.4. Product Portfolio

19.2.5. Competitors & Customers

19.2.6. Subsidiaries & Parent Organization

19.2.7. Recent Developments

19.2.8. Financial Analysis

19.2.9. Profitability

19.2.10. Revenue Share

19.2.11. Executive Bios

19.3. Cargo Carriers Limited

19.3.1. Company Overview

19.3.2. Company Footprints

19.3.3. Production Locations

19.3.4. Product Portfolio

19.3.5. Competitors & Customers

19.3.6. Subsidiaries & Parent Organization

19.3.7. Recent Developments

19.3.8. Financial Analysis

19.3.9. Profitability

19.3.10. Revenue Share

19.3.11. Executive Bios

19.4. CJ Logistics Corporation

19.4.1. Company Overview

19.4.2. Company Footprints

19.4.3. Production Locations

19.4.4. Product Portfolio

19.4.5. Competitors & Customers

19.4.6. Subsidiaries & Parent Organization

19.4.7. Recent Developments

19.4.8. Financial Analysis

19.4.9. Profitability

19.4.10. Revenue Share

19.4.11. Executive Bios

19.5. Darkstore

19.5.1. Company Overview

19.5.2. Company Footprints

19.5.3. Production Locations

19.5.4. Product Portfolio

19.5.5. Competitors & Customers

19.5.6. Subsidiaries & Parent Organization

19.5.7. Recent Developments

19.5.8. Financial Analysis

19.5.9. Profitability

19.5.10. Revenue Share

19.5.11. Executive Bios

19.6. DB SCHENKER

19.6.1. Company Overview

19.6.2. Company Footprints

19.6.3. Production Locations

19.6.4. Product Portfolio

19.6.5. Competitors & Customers

19.6.6. Subsidiaries & Parent Organization

19.6.7. Recent Developments

19.6.8. Financial Analysis

19.6.9. Profitability

19.6.10. Revenue Share

19.6.11. Executive Bios

19.7. DHL Global Forwarding

19.7.1. Company Overview

19.7.2. Company Footprints

19.7.3. Production Locations

19.7.4. Product Portfolio

19.7.5. Competitors & Customers

19.7.6. Subsidiaries & Parent Organization

19.7.7. Recent Developments

19.7.8. Financial Analysis

19.7.9. Profitability

19.7.10. Revenue Share

19.7.11. Executive Bios

19.8. FedEx Corporation

19.8.1. Company Overview

19.8.2. Company Footprints

19.8.3. Production Locations

19.8.4. Product Portfolio

19.8.5. Competitors & Customers

19.8.6. Subsidiaries & Parent Organization

19.8.7. Recent Developments

19.8.8. Financial Analysis

19.8.9. Profitability

19.8.10. Revenue Share

19.8.11. Executive Bios

19.9. J&J Global Limited

19.9.1. Company Overview

19.9.2. Company Footprints

19.9.3. Production Locations

19.9.4. Product Portfolio

19.9.5. Competitors & Customers

19.9.6. Subsidiaries & Parent Organization

19.9.7. Recent Developments

19.9.8. Financial Analysis

19.9.9. Profitability

19.9.10. Revenue Share

19.9.11. Executive Bios

19.10. Uber

19.10.1. Company Overview

19.10.2. Company Footprints

19.10.3. Production Locations

19.10.4. Product Portfolio

19.10.5. Competitors & Customers

19.10.6. Subsidiaries & Parent Organization

19.10.7. Recent Developments

19.10.8. Financial Analysis

19.10.9. Profitability

19.10.10. Revenue Share

19.10.11. Executive Bios

19.11. Instacart

19.11.1. Company Overview

19.11.2. Company Footprints

19.11.3. Production Locations

19.11.4. Product Portfolio

19.11.5. Competitors & Customers

19.11.6. Subsidiaries & Parent Organization

19.11.7. Recent Developments

19.11.8. Financial Analysis

19.11.9. Profitability

19.11.10. Revenue Share

19.11.11. Executive Bios

19.12. Doordash

19.12.1. Company Overview

19.12.2. Company Footprints

19.12.3. Production Locations

19.12.4. Product Portfolio

19.12.5. Competitors & Customers

19.12.6. Subsidiaries & Parent Organization

19.12.7. Recent Developments

19.12.8. Financial Analysis

19.12.9. Profitability

19.12.10. Revenue Share

19.12.11. Executive Bios

19.13. Hitch

19.13.1. Company Overview

19.13.2. Company Footprints

19.13.3. Production Locations

19.13.4. Product Portfolio

19.13.5. Competitors & Customers

19.13.6. Subsidiaries & Parent Organization

19.13.7. Recent Developments

19.13.8. Financial Analysis

19.13.9. Profitability

19.13.10. Revenue Share

19.13.11. Executive Bios

19.14. KART

19.14.1. Company Overview

19.14.2. Company Footprints

19.14.3. Production Locations

19.14.4. Product Portfolio

19.14.5. Competitors & Customers

19.14.6. Subsidiaries & Parent Organization

19.14.7. Recent Developments

19.14.8. Financial Analysis

19.14.9. Profitability

19.14.10. Revenue Share

19.14.11. Executive Bios

19.15. Kerry Logistics Network Limited

19.15.1. Company Overview

19.15.2. Company Footprints

19.15.3. Production Locations

19.15.4. Product Portfolio

19.15.5. Competitors & Customers

19.15.6. Subsidiaries & Parent Organization

19.15.7. Recent Developments

19.15.8. Financial Analysis

19.15.9. Profitability

19.15.10. Revenue Share

19.15.11. Executive Bios

19.16. Kintetsu World Express

19.16.1. Company Overview

19.16.2. Company Footprints

19.16.3. Production Locations

19.16.4. Product Portfolio

19.16.5. Competitors & Customers

19.16.6. Subsidiaries & Parent Organization

19.16.7. Recent Developments

19.16.8. Financial Analysis

19.16.9. Profitability

19.16.10. Revenue Share

19.16.11. Executive Bios

19.17. KUEHNE + NAGEL

19.17.1. Company Overview

19.17.2. Company Footprints

19.17.3. Production Locations

19.17.4. Product Portfolio

19.17.5. Competitors & Customers

19.17.6. Subsidiaries & Parent Organization

19.17.7. Recent Developments

19.17.8. Financial Analysis

19.17.9. Profitability

19.17.10. Revenue Share

19.17.11. Executive Bios

19.18. Logistics Plus

19.18.1. Company Overview

19.18.2. Company Footprints

19.18.3. Production Locations

19.18.4. Product Portfolio

19.18.5. Competitors & Customers

19.18.6. Subsidiaries & Parent Organization

19.18.7. Recent Developments

19.18.8. Financial Analysis

19.18.9. Profitability

19.18.10. Revenue Share

19.18.11. Executive Bios

19.19. Nippon Express Co., Ltd.

19.19.1. Company Overview

19.19.2. Company Footprints

19.19.3. Production Locations

19.19.4. Product Portfolio

19.19.5. Competitors & Customers

19.19.6. Subsidiaries & Parent Organization

19.19.7. Recent Developments

19.19.8. Financial Analysis

19.19.9. Profitability

19.19.10. Revenue Share

19.19.11. Executive Bios

19.20. Postmates

19.20.1. Company Overview

19.20.2. Company Footprints

19.20.3. Production Locations

19.20.4. Product Portfolio

19.20.5. Competitors & Customers

19.20.6. Subsidiaries & Parent Organization

19.20.7. Recent Developments

19.20.8. Financial Analysis

19.20.9. Profitability

19.20.10. Revenue Share

19.20.11. Executive Bios

19.21. Shiphawk

19.21.1. Company Overview

19.21.2. Company Footprints

19.21.3. Production Locations

19.21.4. Product Portfolio

19.21.5. Competitors & Customers

19.21.6. Subsidiaries & Parent Organization

19.21.7. Recent Developments

19.21.8. Financial Analysis

19.21.9. Profitability

19.21.10. Revenue Share

19.21.11. Executive Bios

19.22. Swift Transport

19.22.1. Company Overview

19.22.2. Company Footprints

19.22.3. Production Locations

19.22.4. Product Portfolio

19.22.5. Competitors & Customers

19.22.6. Subsidiaries & Parent Organization

19.22.7. Recent Developments

19.22.8. Financial Analysis

19.22.9. Profitability

19.22.10. Revenue Share

19.22.11. Executive Bios

19.23. United Parcel Service Inc.

19.23.1. Company Overview

19.23.2. Company Footprints

19.23.3. Production Locations

19.23.4. Product Portfolio

19.23.5. Competitors & Customers

19.23.6. Subsidiaries & Parent Organization

19.23.7. Recent Developments

19.23.8. Financial Analysis

19.23.9. Profitability

19.23.10. Revenue Share

19.23.11. Executive Bios

19.24. USPS

19.24.1. Company Overview

19.24.2. Company Footprints

19.24.3. Production Locations

19.24.4. Product Portfolio

19.24.5. Competitors & Customers

19.24.6. Subsidiaries & Parent Organization

19.24.7. Recent Developments

19.24.8. Financial Analysis

19.24.9. Profitability

19.24.10. Revenue Share

19.24.11. Executive Bios

19.25. XPO Logistics, Inc.

19.25.1. Company Overview

19.25.2. Company Footprints

19.25.3. Production Locations

19.25.4. Product Portfolio

19.25.5. Competitors & Customers

19.25.6. Subsidiaries & Parent Organization

19.25.7. Recent Developments

19.25.8. Financial Analysis

19.25.9. Profitability

19.25.10. Revenue Share

19.25.11. Executive Bios

19.26. Walmart

19.26.1. Company Overview

19.26.2. Company Footprints

19.26.3. Production Locations

19.26.4. Product Portfolio

19.26.5. Competitors & Customers

19.26.6. Subsidiaries & Parent Organization

19.26.7. Recent Developments

19.26.8. Financial Analysis

19.26.9. Profitability

19.26.10. Revenue Share

19.26.11. Executive Bios

19.27. Onfleet

19.27.1. Company Overview

19.27.2. Company Footprints

19.27.3. Production Locations

19.27.4. Product Portfolio

19.27.5. Competitors & Customers

19.27.6. Subsidiaries & Parent Organization

19.27.7. Recent Developments

19.27.8. Financial Analysis

19.27.9. Profitability

19.27.10. Revenue Share

19.27.11. Executive Bios

19.28. Nuro

19.28.1. Company Overview

19.28.2. Company Footprints

19.28.3. Production Locations

19.28.4. Product Portfolio

19.28.5. Competitors & Customers

19.28.6. Subsidiaries & Parent Organization

19.28.7. Recent Developments

19.28.8. Financial Analysis

19.28.9. Profitability

19.28.10. Revenue Share

19.28.11. Executive Bios

19.29. Starship Technologies

19.29.1. Company Overview

19.29.2. Company Footprints

19.29.3. Production Locations

19.29.4. Product Portfolio

19.29.5. Competitors & Customers

19.29.6. Subsidiaries & Parent Organization

19.29.7. Recent Developments

19.29.8. Financial Analysis

19.29.9. Profitability

19.29.10. Revenue Share

19.29.11. Executive Bios

19.30. Matternet

19.30.1. Company Overview

19.30.2. Company Footprints

19.30.3. Production Locations

19.30.4. Product Portfolio

19.30.5. Competitors & Customers

19.30.6. Subsidiaries & Parent Organization

19.30.7. Recent Developments

19.30.8. Financial Analysis

19.30.9. Profitability

19.30.10. Revenue Share

19.30.11. Executive Bios

19.31. PiggyBee

19.31.1. Company Overview

19.31.2. Company Footprints

19.31.3. Production Locations

19.31.4. Product Portfolio

19.31.5. Competitors & Customers

19.31.6. Subsidiaries & Parent Organization

19.31.7. Recent Developments

19.31.8. Financial Analysis

19.31.9. Profitability

19.31.10. Revenue Share

19.31.11. Executive Bios

19.32. Other Key Players

19.32.1. Company Overview

19.32.2. Company Footprints

19.32.3. Production Locations

19.32.4. Product Portfolio

19.32.5. Competitors & Customers

19.32.6. Subsidiaries & Parent Organization

19.32.7. Recent Developments

19.32.8. Financial Analysis

19.32.9. Profitability

19.32.10. Revenue Share

19.32.11. Executive Bios

19.33. Other Start-ups

19.33.1. Company Overview

19.33.2. Company Footprints

19.33.3. Production Locations

19.33.4. Product Portfolio

19.33.5. Competitors & Customers

19.33.6. Subsidiaries & Parent Organization

19.33.7. Recent Developments

19.33.8. Financial Analysis

19.33.9. Profitability

19.33.10. Revenue Share

19.33.11. Executive Bios

List of Tables

Table 1: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 2: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Table 3: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 4: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 5: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 6: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 7: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 8: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Table 9: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Table 10: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 12: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Table 13: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 14: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 15: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 16: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 17: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 18: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Table 19: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Table 20: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 22: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Table 23: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 24: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 25: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 26: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 27: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 28: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Table 29: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Table 30: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 32: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Table 33: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 34: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 35: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 36: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 37: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 38: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Table 39: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Table 40: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 42: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Table 43: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 44: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 45: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 46: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 47: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 48: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Table 49: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Table 50: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 51: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 52: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Table 53: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 54: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 55: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Table 56: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 57: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Table 58: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Table 59: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Table 60: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 2: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 3: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Figure 4: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2023-2031

Figure 5: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 6: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 7: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 8: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 9: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 10: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2023-2031

Figure 11: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 12: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 13: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 14: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 15: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Figure 16: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by Delivery Time, Value (US$ Bn), 2023-2031

Figure 17: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Figure 18: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Size, Value (US$ Bn), 2023-2031

Figure 19: Global Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 20: Global Last Mile Delivery Transportation Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 21: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 22: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 23: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Figure 24: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2023-2031

Figure 25: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 26: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 27: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 28: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 29: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 30: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2023-2031

Figure 31: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 32: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 33: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 34: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 35: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Figure 36: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by Delivery Time, Value (US$ Bn), 2023-2031

Figure 37: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Figure 38: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Size, Value (US$ Bn), 2023-2031

Figure 39: North America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 40: North America Last Mile Delivery Transportation Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 41: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 42: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 43: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Figure 44: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2023-2031

Figure 45: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 46: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 47: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 48: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 49: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 50: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2023-2031

Figure 51: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 52: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 53: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 54: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 55: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Figure 56: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by Delivery Time, Value (US$ Bn), 2023-2031

Figure 57: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Figure 58: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Size, Value (US$ Bn), 2023-2031

Figure 59: Europe Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Europe Last Mile Delivery Transportation Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 62: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 63: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Figure 64: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2023-2031

Figure 65: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 66: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 68: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 69: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 70: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2023-2031

Figure 71: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 72: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 73: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 74: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 75: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Figure 76: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by Delivery Time, Value (US$ Bn), 2023-2031

Figure 77: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Figure 78: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Size, Value (US$ Bn), 2023-2031

Figure 79: Asia Pacific Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 80: Asia Pacific Last Mile Delivery Transportation Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 81: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 82: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 83: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Figure 84: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 86: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 87: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 88: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 89: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 90: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2023-2031

Figure 91: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 92: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 93: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 94: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 95: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Figure 96: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by Delivery Time, Value (US$ Bn), 2023-2031

Figure 97: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Figure 98: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Size, Value (US$ Bn), 2023-2031

Figure 99: Middle East & Africa Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 100: Middle East & Africa Last Mile Delivery Transportation Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 101: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 102: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 103: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Solution, 2017-2031

Figure 104: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2023-2031

Figure 105: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 106: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 107: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 108: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 109: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Type, 2017-2031

Figure 110: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Type, Value (US$ Bn), 2023-2031

Figure 111: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 112: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 113: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 114: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2023-2031

Figure 115: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Delivery Time, 2017-2031

Figure 116: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by Delivery Time, Value (US$ Bn), 2023-2031

Figure 117: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Cargo Size, 2017-2031

Figure 118: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by Cargo Size, Value (US$ Bn), 2023-2031

Figure 119: South America Last Mile Delivery Transportation Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 120: South America Last Mile Delivery Transportation Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031