Reports

Reports

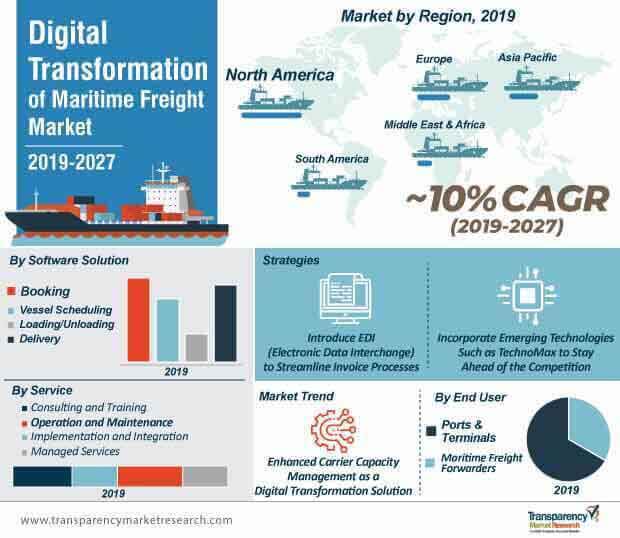

A mounting number of companies across various industrial verticals are modifying their business models with increased importance of consumer satisfaction, and the maritime freight landscape is no exception. With the market for maritime freight witnessing incremental growth in the service industry, it is undergoing digital transformation to improve transparency and offer a quicker response to customers’ needs in this landscape.

One of the recent developments in the technologically-advancing maritime freight landscape reflects a rise in the digital transformation of booking software. Digitization of sea freight booking through automation and cloud-based technologies is showing unprecedented growth in the digital transformation of maritime freight market.

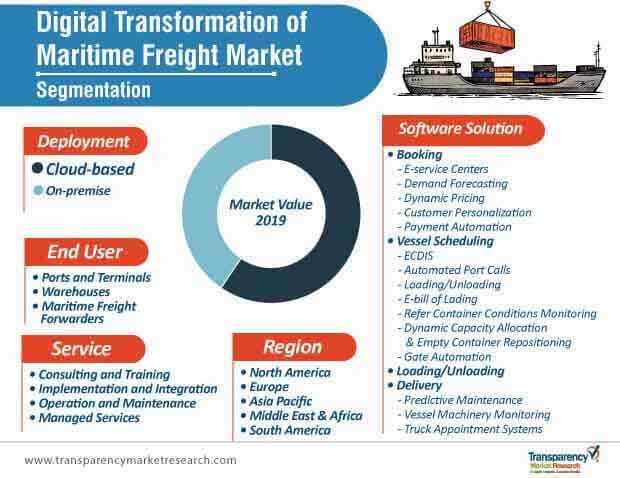

Cloud-based software solutions are poised to hold ~60% of the digital transformation of maritime freight market share by 2027; cloud-based solutions and cloud management tools are gaining popularity with their cost-saving benefits for stakeholders in the maritime supply space, thus triggering growth in the digital transformation of maritime freight.

For instance, in March 2018, Hapag Lloyd launched its cloud-based rate management platform - Cargo Sphere - which gives its customers fully-automated access to all its rates. The company further declared that, the platform can also deliver sales-related benefits, including more frequent selection of optimal booking and faster quoting to customers, ultimately to improve customer satisfaction by sharing accurate Hapag-Lloyd rates in real-time with its partners.

Automated contract management at the booking stage can enhance accuracy and significantly reduce business overheads by decreasing processing time. By obliterating email-driven spreadsheets and PDFs, such a robust innovation will move the digital transformation of maritime freight industry beyond incremental gains.

Such innovations come at an opportune time when automated software solutions at the booking stage are set to grow at a CAGR of ~10% during the forecast period. Maximum digital transformational spending is likely to be recorded at the booking stage, giving market players in the maritime freight industry key insights on directing business development strategies towards these business operations.

Making the vision of a digitally-transformed maritime freight market a reality will need many different tacks. Shipping giants tantalized by the prospects of digitization are channelizing all their energies by developing a hi-tech online marketplace, which allows shipping customers to make reservations via a digital portal. This would help stakeholders in gaining more transparency in an industry that is opaque and fraught with volatility. Effecting a reconciliation between invoices and bookings can be error-prone, onerous, and time-consuming. Settling of freight invoices via EDI (Electronic Data Interchange) can be much more efficient at just the push of a button, and can enable stakeholders in streamlining their invoice processes, thus improving their bottom line.

The technological juggernaut has already accelerated to a new level, holding the potential to completely transform the maritime freight sector. An emerging technology, dubbed TechnoMax, is all set to change the face of the shipping sector. A TechnoMax LNG carrier can be made of advanced materials such as graphene, to make a ship lighter, while sensors made of the same material will detect the ship’s emissions and pollution levels. In addition, Big Data Analytics on board will allow it to smartly monitor cargo information, navigation, and communication, and the right mix of diesel and biofuels will reduce the cost of oil, thus, driving the growth of the digital transformation of maritime freight sector.

Enhanced carrier capacity management and robust operational efficiencies should be a major emphasis point for maritime freight sectors that are looking at digital transformation. Increasing cargo intake has always been the foremost strategy of key market players in the maritime freight industry. Furthermore, the IMO (International Maritime Organization) has taken proactive steps; in 2018, it issued guidelines that all maritime freight containers will have to reduce their emissions by at least 50% by the year 2050. This will propel stakeholders to increase their investments in technologies that allow them to track and analyze cargo vessels for operational viability and environmental sustainability.

Since the maritime freight industry has a very high turnover, most businesses are now focused on reducing worker attrition and enhancing their productivity. With the adoption of voice technology, stakeholders are successfully improving productivity at warehouses, and consequently, the digital transformation of maritime freight market is gaining traction with a significant rise in revenue margins.

Furthermore, the applications of connected technologies and Internet of Things (IoT) in maritime freight will give businesses a vantage point to peek into the merchandise that is present inside the cargo. A robust and complex IoT application provides protection for expensive and sensitive cargo, and with the combination of IoT and cloud technology, suppliers can track and connect with cargo moving from one part of the globe to another.

Trade wars and global trade relations have always made headlines and brought about significant changes in the market landscape. Case in point, the massive trade war between the U.S. and China in 2018 saw the introduction of many tariffs on goods imported by both countries, and strained the relations between the two. Such impositions will restrict trade and the movement of cargo, and obviate the benefits of digital transformation of maritime freight and curtail its demand in the maritime sector.

New regulations, dubbed IMO 2020, will enforce a 0.5% sulfur emission cap, globally, on the maritime freight industry. Its economic impact will lead to a drop in the demand for high sulfur fuel oil and an increased demand for diesel. These dramatic fuel regulations will significantly impact freight rates, causing them to rise, which will be passed on to consumers. The hike in freight rates will have a cascading effect, leading to a reduction in the demand for digitized solutions in the digital transformation of maritime freight market.

Rising volumes of cargo bring bigger ships that cannot traverse narrow sea channels. Stringent rules of sea channels limit the entry of big containerized ships. The impact is heightened when two-way traffic on narrow channels is prohibited. Such restrictions hamper port growth, forcing maritime freight conglomerates to take their business elsewhere. This will negatively impact the growth of the digital transformation of maritime freight market over the forecast period.

North America is expected to hold ~36% share of the global digital transformation of maritime freight market by 2027. This can largely be attributed to the proliferation of cloud-based solutions vis-à-vis on premise deployment. Advanced analytics, storage, and data mining can be done on the cloud without incurring exorbitant storage costs. The volume of merchandise that is exported has increased dramatically in North America, propelling digitization in the segment of vessel scheduling. Within vessel scheduling, ECDIS will be the main technology driving the growth of the digital transformation of maritime freight market. Along with this, automated port calls are also likely to be deployed soon.

On the other hand, the digital transformation maritime freight market in Europe is also witnessing positive growth, with shipping companies in the region aggressively pursuing digitization, as maximum trade activities are taking place at ports in France and Germany. With rising competition among key market players, more and more companies are opting for digital transformation solutions to enhance their operational efficiency.

IBM Corporation and Oracle Corporation are among the leading market players in the arena of digitization, with their prowess lying in the field of advanced cloud platforms, AI, analytics, SaaS solutions, Blockchain, and cognitive solutions. They have continued to dominate the market landscape of digital transformation of maritime freight, due to expertise in product diversification and strategic partnerships & acquisitions in order to enhance their product portfolio and customer base.

In March 2018, Oracle Corporation spearheaded the launch of a fully-autonomous data warehousing cloud platform as a supply chain management solution. This solution is highly innovative and path-breaking, as it self-drives, self-secures, and self-repairs. The solution boasts of an industry-defying performance, and will serve as a role model to emerging market players to embrace digitization and stay competitive.

In August 2018, shipping giant Maersk and IBM announced the creation of TradeLens, jointly developed by the two companies to introduce Blockchain into the entire supply chain market of the globe. Such timely collaborations spur industry-defying innovation, and also bolster information sharing and transparency.

Both, Advantech and Mindtree Ltd are emerging players who are pioneering robust solutions in the spheres of IoT, digital transformation, and technology services, with prime focus on customized digital solutions across the value chain. Advantech and Mindtree’s prime focus is to provide state-of-the-art solutions for their clients in order to enable them to outperform their competition.

In May 2019, Mindtree announced the launch of QuikDeploy, an IP-driven approach to rapidly deploy SAP S/4HANA into the Microsoft Azure cloud. This enables rapid digital transformation and customer-focused innovations on different platforms. Likewise, Advantech is majorly focused on industrial IoT due to its myriad applications and benefits.

In April 2019, it announced the launch of a modular data collection gateway for edge IoT application. Its thrust into the innovation of newer technologies is allowing it to capture larger market shares, globally.

Analysts’ Viewpoint

A comprehensive view of the digital transformation of maritime freight market has led our analysts to conclude that, the market is growing at an impressive rate, with North America and Europe holding a large chunk of the global demand for digital transformation of maritime freight and its applications. The rising demand for digitization and its versatile usage in diverse fields such as booking, vessel scheduling, and delivery is spurring its demand. The impact of the high demand for digitization for bookings on the digital transformation of maritime freight market will remain high, globally. Strong financial position and technological innovations of key market players will also give impetus to the digital transformation of maritime freight market.

Technological breakthroughs such as AI, IoT, Blockchain, robotics, and sensor technology could provide timely succor as a cost-effective and time-saving strategy, thereby increasing the profit margins of market players. Companies with research & development capabilities and technological prowess will gather momentum and profitability in the digital transformation of maritime freight market. Leading players who are leveraging technology will continue to grow exponentially and have a vast market revenue share. However, cyber security and trade restrictions could restrain the growth of the digital transformation of maritime freight market.

Digital Transformation of Maritime Freight Market in Brief

Digital Transformation of Maritime Freight Market: Definition

Asia Pacific Digital Transformation of Maritime Freight Market: Snapshot

Asia Pacific is one of the fastest growing regions in digital transformation of maritime freight market, where countries such as India and China are dominating the digital transformation of maritime freight market with rapid advancements in technology, and integrating them with shipping companies. Moreover, Asia holds the largest population in the word, which leads to the increased demand for products, and this has resulted in a rise in trade across the globe. The adoption rate of digitization in maritime freight, specifically in this region, is high in order to effectively and optimally manage such high volumes of data related to ships and vessels, quantity to be traded, and number of ports.

Key Growth Drivers of the Digital Transformation of Maritime Freight Market

Key Challenges Faced by Digital Transformation of Maritime Freight Market Players

Digital Transformation of Maritime Freight Market: Competitive Landscape

Digital Transformation of Maritime Freight Market: Company Profile Snapshot

IBM Corporation: Founded in 1911, IBM Corporation is a prominent player in the field of cognitive solutions and cloud platforms. The company was founded as Computing-Tabulating-Recording (CTR), and was renamed as ‘International Business Machines’ in 1924. IBM manufactures and markets computer hardware, middleware, and software. It also provides hosting and consulting services in diverse fields, ranging from mainframe computers to nanotechnology. Currently, it is working with Maersk Line to provide solutions related to the digital transformation of maritime freight.

SAP SE: Founded in 1972, SAP SE is a leading global player in the field of software and software-related services. The company provides advisory services, support and success plans, premium engagements, cloud services, and implementation services. Based on market capitalization, SAP is the third-largest independent software manufacturer in the world, and has 130 regional offices, globally.

Oracle Corporation: Founded in 1977, Oracle Corporation provides a complete suite of services, including software as a service, platform as a service, infrastructure as a service, and data as a service. It has its presence in 175 countries across the globe. The company is focused on offering applications, platforms, and IT infrastructure products and services. It operates through three business segments: Cloud and Licensing, Hardware, and Services.

Other major players operating in the global digital transformation of maritime freight market and profiled in the report include

Companies are shifting toward the adoption of AI, machine learning, blockchain, and upgrading their skills to gain a competitive advantage in the digital transformation of maritime freight market, apart from maintaining their position in the market.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary: Global Digital Transformation of Maritime Freight

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World Seaborne Trade (%), by Region - 2017

4.2.2. World Seaborne Trade in Cargo (Ton-Miles), 2013–2018

4.2.3. World Container Port Throughput (Mn TEU), 2013–2018

4.3. Market Factor Analysis

4.3.1. Porter’s Five Forces Analysis

4.3.2. PESTEL Analysis

4.3.3. Value Chain Analysis

4.3.4. Market Dynamics (Growth Influencers)

4.3.4.1. Drivers

4.3.4.2. Restraints

4.3.4.3. Opportunities

4.3.4.4. Impact Analysis of Drivers & Restraints

4.4. Regulations and Policies

4.5. Penetration of Digitalization Across the Shipping Process (%)

4.5.1. Booking

4.5.2. Vessel Scheduling

4.5.3. Loading/ Unloading

4.5.4. Delivery

4.6. Adoption Analysis of Digitalization in Logistics

4.7. Overview of Significant Themes for Digital Transformation of the Logistics Industry

4.8. Adoption Analysis of Logistics Control Towers, 2015 & 2025

4.8.1. By Road Freight

4.8.2. By Marine Freight

4.8.3. By Air Freight

4.9. Implementation Stage of Technologies in Logistics

4.10. Adoption Analysis of Analytics as a Service in Logistics, 2015 & 2025

4.10.1. By Road Freight

4.10.2. By Marine Freight

4.10.3. By Air Freight

4.11. Analysis of Impact of Trade War on Maritime Industry

4.12. Overview of Major Technologies Causing Disruption in Maritime Freight

4.12.1. Big Data and Analytics

4.12.2. Block chain

4.12.3. Cyber Technologies

4.12.4. Autonomous Vessels & Drones

4.12.5. Robotics

4.12.6. AR & VR

4.13. Analysis of Automation Levels Across Maritime Order-to-Cash Cycle

4.14. Global Digital Transformation of Maritime Freight Analysis and Forecast, 2017 - 2027

4.14.1. Market Revenue Analysis (US$ Mn)

4.14.1.1. Historic Growth Trends, 2016-2018

4.14.1.2. Forecast Trends, 2019-2027

4.15. Market Opportunity Assessment– By Region (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.15.1. By Software

4.15.2. By Deployment

4.15.3. By Services

4.15.4. By End-user

4.16. Competitive Scenario and Trends

4.16.1. List of Emerging, Prominent and Leading Players

4.16.2. Mergers & Acquisitions, Expansions

4.17. Market Outlook

5. Global Digital Transformation of Maritime Freight Analysis and Forecast, by Software

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Software, 2017 - 2027

5.3.1. Booking

5.3.1.1. E-service centers

5.3.1.2. Demand Forecasting

5.3.1.3. Dynamic Pricing

5.3.1.4. Customer Personalization

5.3.1.5. Payment Automation

5.3.2. Vessel Scheduling

5.3.2.1. ECDIS

5.3.2.2. Automated port calls

5.3.2.3. Loading/ Unloading

5.3.2.4. E bill of lading

5.3.2.5. Reefer Container Conditions Monitoring

5.3.2.6. Dynamic Capacity Allocation & Empty Container Repositioning

5.3.2.7. Gate Automation

5.3.3. Delivery

5.3.3.1. Predictive Maintenance

5.3.3.2. Vessel Machinery Monitoring

5.3.3.3. Truck Appointment System

6. Global Digital Transformation of Maritime Freight Analysis and Forecast, by Deployment

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

6.3.1. Cloud based

6.3.2. On-premise

7. Global Digital Transformation of Maritime Freight Analysis and Forecast, By Services

7.1. Key Segment Analysis

7.2. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By Services, 2017 - 2027

7.2.1. Consulting & Training

7.2.2. Implementation & Integration

7.2.3. Operation & Maintenance

7.2.4. Managed Services

8. Global Digital Transformation of Maritime Freight Analysis and Forecast, By End-user

8.1. Key Segment Analysis

8.2. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By End-user, 2017 - 2027

8.2.1. Ports & Terminals

8.2.2. Maritime Freight Forwarders

9. Global Digital Transformation of Maritime Freight Analysis and Forecast, by Region

9.1. Overview

9.2. Key Segment Analysis

9.3. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Region, 2017 - 2027

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Middle East & Africa

9.3.5. South America

10. North America Digital Transformation of Maritime Freight Analysis and Forecast

10.1. Key Findings

10.2. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Software, 2017 - 2027

10.2.1. Booking

10.2.1.1. E-service centers

10.2.1.2. Demand Forecasting

10.2.1.3. Dynamic Pricing

10.2.1.4. Customer Personalization

10.2.1.5. Payment Automation

10.2.2. Vessel Scheduling

10.2.2.1. ECDIS

10.2.2.2. Automated port calls

10.2.2.3. Loading/ Unloading

10.2.2.4. E bill of lading

10.2.2.5. Reefer Container Conditions Monitoring

10.2.2.6. Dynamic Capacity Allocation & Empty Container Repositioning

10.2.2.7. Gate Automation

10.2.3. Delivery

10.2.3.1. Predictive Maintenance

10.2.3.2. Vessel Machinery Monitoring

10.2.3.3. Truck Appointment System

10.3. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

10.3.1. Cloud based

10.3.2. On-premise

10.4. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By Services, 2017 - 2027

10.4.1. Consulting & Training

10.4.2. Implementation & Integration

10.4.3. Operation & Maintenance

10.4.4. Managed Services

10.5. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By End-user, 2017 - 2027

10.5.1. Ports & Terminals

10.5.2. Maritime Freight Forwarders

10.6. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

10.6.1. The U.S.

10.6.2. Canada

10.6.3. Rest of North America

11. Europe Digital Transformation of Maritime Freight Analysis and Forecast

11.1. Key Findings

11.2. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Software, 2017 - 2027

11.2.1. Booking

11.2.1.1. E-service centers

11.2.1.2. Demand Forecasting

11.2.1.3. Dynamic Pricing

11.2.1.4. Customer Personalization

11.2.1.5. Payment Automation

11.2.2. Vessel Scheduling

11.2.2.1. ECDIS

11.2.2.2. Automated port calls

11.2.2.3. Loading/ Unloading

11.2.2.4. E bill of lading

11.2.2.5. Reefer Container Conditions Monitoring

11.2.2.6. Dynamic Capacity Allocation & Empty Container Repositioning

11.2.2.7. Gate Automation

11.2.3. Delivery

11.2.3.1. Predictive Maintenance

11.2.3.2. Vessel Machinery Monitoring

11.2.3.3. Truck Appointment System

11.3. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

11.3.1. Cloud based

11.3.2. On-premise

11.4. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By Services, 2017 - 2027

11.4.1. Consulting & Training

11.4.2. Implementation & Integration

11.4.3. Operation & Maintenance

11.4.4. Managed Services

11.5. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By End-user, 2017 - 2027

11.5.1. Ports & Terminals

11.5.2. Maritime Freight Forwarders

11.6. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Country& Sub-region, 2017 - 2027

11.6.1. Germany

11.6.2. The U.K.

11.6.3. France

11.6.4. Rest of Europe

12. Asia Pacific Digital Transformation of Maritime Freight Analysis and Forecast

12.1. Key Findings

12.2. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Software, 2017 - 2027

12.2.1. Booking

12.2.1.1. E-service centers

12.2.1.2. Demand Forecasting

12.2.1.3. Dynamic Pricing

12.2.1.4. Customer Personalization

12.2.1.5. Payment Automation

12.2.2. Vessel Scheduling

12.2.2.1. ECDIS

12.2.2.2. Automated port calls

12.2.2.3. Loading/ Unloading

12.2.2.4. E bill of lading

12.2.2.5. Reefer Container Conditions Monitoring

12.2.2.6. Dynamic Capacity Allocation & Empty Container Repositioning

12.2.2.7. Gate Automation

12.2.3. Delivery

12.2.3.1. Predictive Maintenance

12.2.3.2. Vessel Machinery Monitoring

12.2.3.3. Truck Appointment System

12.3. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

12.3.1. Cloud based

12.3.2. On-premise

12.4. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By Services, 2017 - 2027

12.4.1. Consulting & Training

12.4.2. Implementation & Integration

12.4.3. Operation & Maintenance

12.4.4. Managed Services

12.5. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By End-user, 2017 - 2027

12.5.1. Ports & Terminals

12.5.2. Maritime Freight Forwarders

12.6. Size (US$ Mn) Forecast, by Country& Sub-region, 2017 - 2027

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Rest of Asia Pacific

13. Middle East & Africa (MEA) Digital Transformation of Maritime Freight Analysis and Forecast

13.1. Key Findings

13.2. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Software, 2017 - 2027

13.2.1. Booking

13.2.1.1. E-service centers

13.2.1.2. Demand Forecasting

13.2.1.3. Dynamic Pricing

13.2.1.4. Customer Personalization

13.2.1.5. Payment Automation

13.2.2. Vessel Scheduling

13.2.2.1. ECDIS

13.2.2.2. Automated port calls

13.2.2.3. Loading/ Unloading

13.2.2.4. E bill of lading

13.2.2.5. Reefer Container Conditions Monitoring

13.2.2.6. Dynamic Capacity Allocation & Empty Container Repositioning

13.2.2.7. Gate Automation

13.2.3. Delivery

13.2.3.1. Predictive Maintenance

13.2.3.2. Vessel Machinery Monitoring

13.2.3.3. Truck Appointment System

13.3. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

13.3.1. Cloud based

13.3.2. On-premise

13.4. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By Services, 2017 - 2027

13.4.1. Consulting & Training

13.4.2. Implementation & Integration

13.4.3. Operation & Maintenance

13.4.4. Managed Services

13.5. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By End-user, 2017 - 2027

13.5.1. Ports & Terminals

13.5.2. Maritime Freight Forwarders

13.6. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Country& Sub-region, 2017 - 2027

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of MEA

14. South America Digital Transformation of Maritime Freight Analysis and Forecast

14.1. Key Findings

14.2. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Software, 2017 - 2027

14.2.1. Booking

14.2.1.1. E-service centers

14.2.1.2. Demand Forecasting

14.2.1.3. Dynamic Pricing

14.2.1.4. Customer Personalization

14.2.1.5. Payment Automation

14.2.2. Vessel Scheduling

14.2.2.1. ECDIS

14.2.2.2. Automated port calls

14.2.2.3. Loading/ Unloading

14.2.2.4. E bill of lading

14.2.2.5. Reefer Container Conditions Monitoring

14.2.2.6. Dynamic Capacity Allocation & Empty Container Repositioning

14.2.2.7. Gate Automation

14.2.3. Delivery

14.2.3.1. Predictive Maintenance

14.2.3.2. Vessel Machinery Monitoring

14.2.3.3. Truck Appointment System

14.3. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

14.3.1. Cloud based

14.3.2. On-premise

14.4. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By Services, 2017 - 2027

14.4.1. Consulting & Training

14.4.2. Implementation & Integration

14.4.3. Operation & Maintenance

14.4.4. Managed Services

14.5. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, By End-user, 2017 - 2027

14.5.1. Ports & Terminals

14.5.2. Maritime Freight Forwarders

14.6. Digital Transformation of Maritime Freight Size (US$ Mn) Forecast, by Country& Sub-region, 2017 - 2027

14.6.1. Brazil

14.6.2. Rest of South America

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Revenue Share Analysis (%), by Company (2018)

16. Company Profiles(Details – Business Overview, Sales Area/Geographical Presence, Revenue and Strategy)

16.1. 3GTMS, Inc.

16.1.1. Business Overview

16.1.2. Sales Area/Geographical Presence

16.1.3. Revenue and Strategy

16.2. 4 Flow AG

16.2.1. Business Overview

16.2.2. Sales Area/Geographical Presence

16.2.3. Revenue and Strategy

16.3. ABB Ltd

16.3.1. Business Overview

16.3.2. Sales Area/Geographical Presence

16.3.3. Revenue and Strategy

16.4. Advantech Co., Ltd.

16.4.1. Business Overview

16.4.2. Sales Area/Geographical Presence

16.4.3. Revenue and Strategy

16.5. Digital Logistics Group Ltd.

16.5.1. Business Overview

16.5.2. Sales Area/Geographical Presence

16.5.3. Revenue and Strategy

16.6. Hexaware Technologies

16.6.1. Business Overview

16.6.2. Sales Area/Geographical Presence

16.6.3. Revenue and Strategy

16.7. IBM Corporation

16.7.1. Business Overview

16.7.2. Sales Area/Geographical Presence

16.7.3. Revenue and Strategy

16.8. Kintetsu World Express, Inc. (KWE)

16.8.1. Business Overview

16.8.2. Sales Area/Geographical Presence

16.8.3. Revenue and Strategy

16.9. LOGITECH Corporation

16.9.1. Business Overview

16.9.2. Sales Area/Geographical Presence

16.9.3. Revenue and Strategy

16.10. Mindtree Ltd.

16.10.1. Business Overview

16.10.2. Sales Area/Geographical Presence

16.10.3. Revenue and Strategy

16.11. Oracle Corporation

16.11.1. Business Overview

16.11.2. Sales Area/Geographical Presence

16.11.3. Revenue and Strategy

16.12. PartnerTech

16.12.1. Business Overview

16.12.2. Sales Area/Geographical Presence

16.12.3. Revenue and Strategy

16.13. SAP SE

16.13.1. Business Overview

16.13.2. Sales Area/Geographical Presence

16.13.3. Revenue and Strategy

16.14. Syntel, Inc.

16.14.1. Business Overview

16.14.2. Sales Area/Geographical Presence

16.14.3. Revenue and Strategy

16.15. Tech Mahindra Limited

16.15.1. Business Overview

16.15.2. Sales Area/Geographical Presence

16.15.3. Revenue and Strategy

16.16. Key Takeaways

List of Tables

Table 1. List of New Players

Table 2. Alliances & Expansions in Content Moderation Solutions Market

Table 3. Global Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Software Solutions, 2017 - 2027

Table 4. Global Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Deployment, 2017 - 2027

Table 5. Global Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Services, 2017 - 2027

Table 6. Global Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By End-user, 2017 - 2027

Table 7. Global Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Region, 2017 - 2027

Table 8. North America Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Software Solutions, 2017 - 2027

Table 9. North America Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Deployment, 2017 - 2027

Table 10. North America Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Services, 2017 - 2027

Table 11. North America Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By End-user, 2017 - 2027

Table 12. North America Digital Transformation of Maritime Freight Analysis and Forecast, By Country, 2017 - 2027

Table 13. Europe Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Software Solutions, 2017 - 2027

Table 14. Europe Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Deployment, 2017 - 2027

Table 15. Europe Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Services, 2017 - 2027

Table 16. Europe Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By End-user, 2017 - 2027

Table 17. Europe Digital Transformation of Maritime Freight Analysis and Forecast, By Country, 2017 - 2027

Table 18. Asia Pacific Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Software Solutions, 2017 - 2027

Table 19. Asia Pacific Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Deployment, 2017 - 2027

Table 20. Asia Pacific Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Services, 2017 - 2027

Table 21. Asia Pacific Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By End-user, 2017 - 2027

Table 22. Asia Pacific Digital Transformation of Maritime Freight Analysis and Forecast, By Country, 2017 - 2027

Table 23. MEA Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Software Solutions, 2017 - 2027

Table 24. MEA Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Deployment, 2017 - 2027

Table 25. MEA Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Services, 2017 - 2027

Table 26. MEA Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By End-user, 2017 - 2027

Table 27. MEA Digital Transformation of Maritime Freight Analysis and Forecast, By Country, 2017 - 2027

Table 28. South America Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Software Solutions, 2017 - 2027

Table 29. South America Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Deployment, 2017 - 2027

Table 30. South America Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By Services, 2017 - 2027

Table 31. South America Digital Transformation of Maritime Freight Analysis and Forecast (US$ Mn), By End-user, 2017 - 2027

Table 32. South America Digital Transformation of Maritime Freight Analysis and Forecast, By Country, 2017 - 2027

List of Figures

Figure 1: Global Digital Transformation of Maritime Freight Market Size (US$ Mn) and Forecast, 2017–2027

Figure 2. World Seaborne Trade, by Region, 2017 (% Share in World Tonnage)

Figure 3. World Seaborne Trade in Cargo (Ton-Miles), 2013–2018

Figure 4. World Container Port Throughput (Mn TEU), 2013–2018

Figure 5. Adoption Analysis of Logistics Control Towers, 2015 & 2025

Figure 6. Adoption Analysis of Analytics as a Service in Logistics, 2015 & 2025

Figure 7. Digital Transformation of Maritime Freight Analysis, by Software Solutions (2019)

Figure 8. Digital Transformation of Maritime Freight Analysis, by Deployment (2019)

Figure 9. Digital Transformation of Maritime Freight Analysis, by Services (2019)

Figure 10. Digital Transformation of Maritime Freight Analysis, by End-user (2019)

Figure 11. Digital Transformation of Maritime Freight Analysis, by Region (2019)

Figure 12. Historic Growth Trends, 2012-2018

Figure 13. Forecast Trends, 2019-2027

Figure 14. Global Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2019)

Figure 15. Global Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2027)

Figure 16. Global Digital Transformation of Maritime Freight Share Analysis, by Deployment (2019)

Figure 17. Global Digital Transformation of Maritime Freight Share Analysis, by Deployment (2027)

Figure 18. Global Digital Transformation of Maritime Freight Share Analysis, by Services (2019)

Figure 19. Global Digital Transformation of Maritime Freight Share Analysis, by Services (2027)

Figure 20. Global Digital Transformation of Maritime Freight Share Analysis, by End-user (2019)

Figure 21. Global Digital Transformation of Maritime Freight Share Analysis, by End-user (2027)

Figure 22. Global Digital Transformation of Maritime Freight Share Analysis, by Region (2019)

Figure 23. Global Digital Transformation of Maritime Freight Share Analysis, by Region (2027)

Figure 24. North America Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2019)

Figure 25. North America Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2027)

Figure 26. North America Digital Transformation of Maritime Freight Share Analysis, by Deployment (2019)

Figure 27. North America Digital Transformation of Maritime Freight Share Analysis, by Deployment (2027)

Figure 28. North America Digital Transformation of Maritime Freight Share Analysis, by Services (2019)

Figure 29. North America Digital Transformation of Maritime Freight Share Analysis, by Services (2027)

Figure 30. North America Digital Transformation of Maritime Freight Share Analysis, by End-user (2019)

Figure 31. North America Digital Transformation of Maritime Freight Share Analysis, by End-user (2027)

Figure 32. North America Digital Transformation of Maritime Freight Share Analysis, by Country (2019)

Figure 33. North America Digital Transformation of Maritime Freight Share Analysis, by Country (2027)

Figure 34. Europe Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2019)

Figure 35. Europe Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2027)

Figure 36. Europe Digital Transformation of Maritime Freight Share Analysis, by Deployment (2019)

Figure 37. Europe Digital Transformation of Maritime Freight Share Analysis, by Deployment (2027)

Figure 38. Europe Digital Transformation of Maritime Freight Share Analysis, by Services (2019)

Figure 39. Europe Digital Transformation of Maritime Freight Share Analysis, by Services (2027)

Figure 40. Europe Digital Transformation of Maritime Freight Share Analysis, by End-user (2019)

Figure 41. Europe Digital Transformation of Maritime Freight Share Analysis, by End-user (2027)

Figure 42. Europe Digital Transformation of Maritime Freight Share Analysis, by Country (2019)

Figure 43. Europe Digital Transformation of Maritime Freight Share Analysis, by Country (2027)

Figure 44. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2019)

Figure 45. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2027)

Figure 46. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by Deployment (2019)

Figure 47. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by Deployment (2027)

Figure 48. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by Services (2019)

Figure 49. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by Services (2027)

Figure 50. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by End-user (2019)

Figure 51. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by End-user (2027)

Figure 52. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by Country (2019)

Figure 53. Asia Pacific Digital Transformation of Maritime Freight Share Analysis, by Country (2027)

Figure 54. MEA Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2019)

Figure 55. MEA Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2027)

Figure 56. MEA Digital Transformation of Maritime Freight Share Analysis, by Deployment (2019)

Figure 57. MEA Digital Transformation of Maritime Freight Share Analysis, by Deployment (2027)

Figure 58. MEA Digital Transformation of Maritime Freight Share Analysis, by Services (2019)

Figure 59. MEA Digital Transformation of Maritime Freight Share Analysis, by Services (2027)

Figure 60. MEA Digital Transformation of Maritime Freight Share Analysis, by End-user (2019)

Figure 61. MEA Digital Transformation of Maritime Freight Share Analysis, by End-user (2027)

Figure 62. MEA Digital Transformation of Maritime Freight Share Analysis, by Country (2019)

Figure 63. MEA Digital Transformation of Maritime Freight Share Analysis, by Country (2027)

Figure 64. South America Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2019)

Figure 65. South America Digital Transformation of Maritime Freight Share Analysis, by Software Solutions (2027)

Figure 66. South America Digital Transformation of Maritime Freight Share Analysis, by Deployment (2019)

Figure 67. South America Digital Transformation of Maritime Freight Share Analysis, by Deployment (2027)

Figure 68. South America Digital Transformation of Maritime Freight Share Analysis, by Services (2019)

Figure 69. South America Digital Transformation of Maritime Freight Share Analysis, by Services (2027)

Figure 70. South America Digital Transformation of Maritime Freight Share Analysis, by End-user (2019)

Figure 71. South America Digital Transformation of Maritime Freight Share Analysis, by End-user (2027)

Figure 72. South America Digital Transformation of Maritime Freight Share Analysis, by Country (2019)

Figure 73. South America Digital Transformation of Maritime Freight Share Analysis, by Country (2027)