Reports

Reports

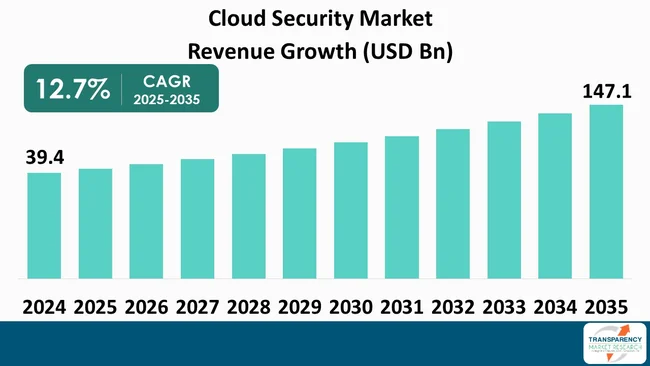

The global cloud security market size was valued at US$ 39.4 Bn in 2024 and is projected to reach US$ 147.1 Bn by 2035, expanding at a CAGR of 12.7% from 2025 to 2035. The growth of cloud security industry is substantially influenced by the rapid cloud adoption of the cloud as enterprises are shifting their operations to cloud for both scalability and cost efficiency.

The market is entering a phase of maturity, in which the need for the existing technology has changed from fundamental protection to the advanced ones that are represented by the zero trust architecture, cloud native application protection platforms (CNAPP), and AI- driven threat detection.

Pressure from regulatory authorities and strong emphasis on data privacy are two more factors prompting organizations to spend more on security cloud infrastructures. Due to the growing adoption of hybrid and multi-cloud environment, the demand for consolidated, scalable, and smart security solutions is high, thus making security in the cloud a strategic priority not only for enterprises but also for vendors in the near future.

The complexity of security management has increased as organizations have scaled their cloud usage. Consequently, these organizations require more integrated security solutions that can provide them with a complete and up-to-date view of their security status as well as offer them threat intelligence. Among the vulnerabilities that have been the source of various infections in the cloud are misconfigurations in the cloud, ransomware, and insider threats. Therefore, the implementation of reliable and anticipatory security strategies has been underlined even more.

Cloud security market also implies products and services that protect relatively sensitive information, programs, and the general architecture of the cloud network. Cloud security industry has been gaining tremendous momentum primarily due to the rapid pace at which cloud computing has been embraced, along with the proliferation and sophistication of cyber threats and the application of tougher data privacy policies.

For instance, the United Nations International Computing Centre (UNICC) declared that it has established UNIQCloud, a next-generation cloud facility specially made for the entire UN system and any other global bodies. Such an original service incorporates the benefits of private cloud computing for the different needs of the sector, thereby allowing partners and customers to have a secure and reliable digital space.

Some of the latest trends in the cloud security market are the adoption of Zero Trust security models and the use of cloud-native application protection platforms (CNAPP). Al and machine learning have become more important for the continuous identification of threats and their immediate handling. Besides, security automation and the integration of DevSecOps are becoming more demanding to organizations as a means of improving their compliance and agility.

For instance, the Cloud Security Alliance (CSA) has introduced an innovative addition to its suite of Security, Trust, Assurance and Risk (STAR) Registry assessments with the launch of Valid-AI-ted, an AI-powered, automated validation system. The new tool provides an automated quality check of assurance information of STAR Level 1 self-assessments using state-of-the-art LLM technology for cloud security & privacy controls.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

An important factor that accelerates the implementation of security solutions in the cloud is a higher number of more complex cyber-attacks. Any organization that decides to utilize the cloud services for their operations and data will be on the radar of cyber attackers since the latter will have more opportunities to launch different types of attacks such as ransomware, phishing, data breaches, and insider threats.

According to World Economic Forum, the cloud security incidents at the global scale increased by 154% from 2023 to 2024. Moreover, World Economic Forum research shows that only 4% of organizations have the capability to quickly and effectively remediate risks.

Moreover, the changing nature of these threats leads to more disadvantages in the cloud infrastructure that makes organizations spend more on security measures to keep their data safe and ensure that they will be able to operate continuously. The requirement for constant surveillance, instant threat identification, and computer-run reaction has turned cloud security into an essential part of the risk management programs of enterprises.

In addition, the occurrence of several high-profile security breaches has resulted in an increased awareness amongst the top-level management about both - the monetary and the reputational harm that can be brought to them by cyberattacks. Consequently, organizations are allocating more funds towards cloud security and moving from reactive to preventive threat management in their security policies. Organizations are embracing the security solutions that are all-inclusive, Al-powered, and compliance-ready, thus ensuring that they are not outpaced by the emerging threats.

Regulatory compliance, which has been a significant factor leading to the global use of cloud security, is also among the aspects that are pushing the cloud security market. The foremost reason is that a large number of government and industry organizations are imposing stringent regulations that concern data protection and privacy rules.

Security standards such as GDPR in Europe, CCPA in California, and HIPAA in the U.S. have set security requirements for companies that they need to establish strong security measures to protect the highly sensitive data stored in the cloud. For instance, in January 2025, Digital Operations Resilience Act (DORA) mandated banks and the other financial organizations in the EU to establish detailed plans for managing risks associated with information and communications technology, reporting of incidents, and supervision of third parties. The regulation highlights preventive resiliency measures such as unchangeable backups and Al-supported anomaly detection, where the penalties for violations can be as high as 2% of global turnover.

Consequently, the cloud security is changing from a simple protection measure to a management necessity, which lets organizations to go beyond the mere protection of data to stay out of legal problems and retain customer confidence in a dynamic regulatory environment.

Cloud security strategies are being reshaped by the compliance driven approach, which makes regulatory alignment an important aspect in cloud architecture design and vendor selection.

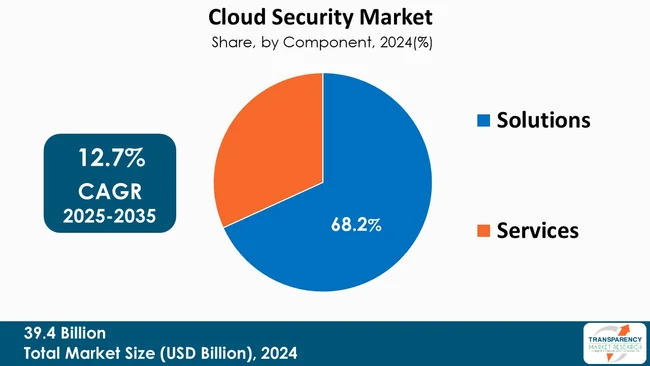

The solution segment led the market in 2024 with more than 68.2% of the revenue share, where the rising complexity and size of cloud environments have been the main drivers of this demand for strong, scalable, and integrated security tools.

As organizations are shifting their processes to cloud platforms that cover Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), the requirement for tailored security measures such as cloud access security brokers (CASBs), cloud workload protection platforms (CWPPs), cloud security management (CSPM), and identity and access management (IAM) has become stronger. Organizations can manage configurations and detect vulnerabilities with cloud solutions.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The cloud security market is largely dominated by the North American region with 39.8% share, which is the mainstay that has been supporting the leadership through its high technology infrastructure, rapid cloud adoption rates, and stringent regulations. Besides, the presence of major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud is contributing immensely to the region's leading position.

The U.S. government's increased budget for cybersecurity measures and partnerships between the public and private sectors are the additional factors that help the region dominate the market. Furthermore, the accelerated development of areas such as healthcare, finance, and e-Commerce, each of which have been managing sensitive data, is the main reason for the continuous need for sophisticated cloud security frameworks.

For instance, Crowd Strike’s examination, which was communicated at Black Hat USA 2025, highlighted the increase in cloud compromises year-by-year by 136% for the first half of the year. The major part of this surge was made up of Chinese-related groups like Genesis Panda and Murky Panda, who aim at the cloud environments in North America. These break-ins typically exploit the system and the lateral movement tactics.

IBM, Amazon Web Services, Inc., Broadcom, Microsoft, Cisco Systems, Inc., Check Point Software Technologies Ltd., Google, Zscaler, Inc., Akamai Technologies, Forcepoint, Fortinet, Inc., F5, Inc., Qualys, Inc., Trend Micro Incorporated., Palo Alto Networks, and others are some of the leading manufacturers operating in the global cloud security market.

Each of these companies has been profiled in the cloud security market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 39.4 Bn |

| Forecast Value in 2035 | US$ 147.1 Bn |

| CAGR | 12.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Cloud Security Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The cloud security market was valued at US$ 39.4 Bn in 2024

The cloud security market is projected to cross US$ 147.1 Bn by the end of 2035

Rising cyber threats drives adoption of cloud security and regulatory compliance mandate cloud security globally are some of the driving factor of cloud security market.

The CAGR is anticipated to be 12.7% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

IBM, Amazon Web Services, Inc., Broadcom, Microsoft, Cisco Systems, Inc., Check Point Software Technologies Ltd., Google, Zscaler, Inc., Akamai Technologies, Forcepoint, Fortinet, Inc., F5, Inc., Qualys, Inc., Trend Micro Incorporated., Palo Alto Networks, and others

Table 01: Global Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 02: Global Cloud Security Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 03: Global Cloud Security Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 04: Global Cloud Security Market Value (US$ Bn) Forecast, By End User Industry, 2020 to 2035

Table 05: Global Cloud Security Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Cloud Security Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 08: North America Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 09: North America Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 10: North America Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 11: U.S. Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 12: U.S. Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 13: U.S. Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 14: U.S. Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 15: Canada Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 16: Canada Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 17: Canada Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 18: Canada Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 19: Europe Cloud Security Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Europe Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 21: Europe Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 22: Europe Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 23: Europe Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 24: Germany Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 25: Germany Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 26: Germany Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 27: Germany Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 28: U.K. Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 29: U.K. Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 30: U.K. Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 31: U.K. Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 32: France Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 33: France Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 34: France Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 35: France Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 36: Italy Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 37: Italy Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 38: Italy Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 39: Italy Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 40: Spain Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 41: Spain Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 42: Spain Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 43: Spain Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 44: The Netherlands Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 45: The Netherlands Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 46: The Netherlands Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 47: The Netherlands Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 48: Rest of Europe Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 49: Rest of Europe Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 50: Rest of Europe Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 51: Rest of Europe Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 52: Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 53: Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 54: Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 55: Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 56: Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 57: China Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 58: China Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 59: China Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 60: China Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 61: India Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 62: India Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 63: India Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 64: India Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 65: Japan Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 66: Japan Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 67: Japan Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 68: Japan Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 69: South Korea Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 70: South Korea Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 71: South Korea Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 72: South Korea Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 73: Australia Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 74: Australia Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 75: Australia Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 76: Australia Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 77: ASEAN Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 78: ASEAN Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 79: ASEAN Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 80: ASEAN Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 81: Rest of Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 82: Rest of Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 83: Rest of Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 84: Rest of Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 85: Latin America Cloud Security Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 86: Latin America Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 87: Latin America Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 88: Latin America Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 89: Latin America Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 90: Brazil Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 91: Brazil Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 92: Brazil Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 93: Brazil Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 94: Mexico Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 95: Mexico Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 96: Mexico Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 97: Mexico Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 98: Argentina Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 99: Argentina Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 100: Argentina Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 101: Argentina Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 102: Rest of Latin America Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 103: Rest of Latin America Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 104: Rest of Latin America Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 105: Rest of Latin America Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 106: Middle East and Africa Cloud Security Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 107: Middle East and Africa Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 108: Middle East and Africa Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 109: Middle East and Africa Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 110: Middle East and Africa Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 111: GCC Countries Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 112: GCC Countries Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 113: GCC Countries Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 114: GCC Countries Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 115: South Africa Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 116: South Africa Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 117: South Africa Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 118: South Africa Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Table 119: Rest of Middle East Cloud Security Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 120: Rest of Middle East Cloud Security Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 121: Rest of Middle East Cloud Security Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 122: Rest of Middle East Cloud Security Market Value (US$ Bn) Forecast, by End User Industry, 2020 to 2035

Figure 01: Global Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 02: Global Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 03: Global Cloud Security Market Revenue (US$ Bn), by Solution, 2020 to 2035

Figure 04: Global Cloud Security Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 05: Global Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 06: Global Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 07: Global Cloud Security Market Revenue (US$ Bn), by Private, 2020 to 2035

Figure 08: Global Cloud Security Market Revenue (US$ Bn), by Hybrid, 2020 to 2035

Figure 09: Global Cloud Security Market Revenue (US$ Bn), by Public, 2020 to 2035

Figure 10: Global Cloud Security Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 11: Global Cloud Security Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 12: Global Cloud Security Market Revenue (US$ Bn), by Large Enterprises, 2020 to 2035

Figure 13: Global Cloud Security Market Revenue (US$ Bn), by SMEs, 2020 to 2035

Figure 14: Global Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 15: Global Cloud Security Market Attractiveness Analysis, by End User, 2024 and 2035

Figure 16: Global Cloud Security Market Revenue (US$ Bn), by BSFI, 2025 to 2035

Figure 17: Global Cloud Security Market Revenue (US$ Bn), by Retail & E-commerce, 2020 to 2035

Figure 18: Global Cloud Security Market Revenue (US$ Bn), by IT & Telecom, 2020 to 2035

Figure 19: Global Cloud Security Market Revenue (US$ Bn), by Healthcare, 2020 to 2035

Figure 20: Global Cloud Security Market Revenue (US$ Bn), by Manufacturing, 2020 to 2035

Figure 21: Global Cloud Security Market Revenue (US$ Bn), by Government, 2020 to 2035

Figure 22: Global Cloud Security Market Revenue (US$ Bn), by Energy & Utilities, 2020 to 2035

Figure 23: Global Cloud Security Market Revenue (US$ Bn), by Transportation & Logistics, 2020 to 2035

Figure 24: Global Cloud Security Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 25: Global Cloud Security Market Value Share Analysis, By Region, 2024 and 2035

Figure 26: Global Cloud Security Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 27: North America Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America Cloud Security Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America Cloud Security Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 31: North America Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 32: North America Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 33: North America Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 34: North America Cloud Security Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 35: North America Cloud Security Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 36: North America Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 37: North America Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 38: U.S. Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: U.S. Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 40: U.S. Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 41: U.S. Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 42: U.S. Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 43: U.S. Cloud Security Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 44: U.S. Cloud Security Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 45: U.S. Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 46: U.S. Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 47: Canada Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Canada Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 49: Canada Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 50: Canada Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 51: Canada Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 52: Canada Cloud Security Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 53: Canada Cloud Security Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 54: Canada Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 55: Canada Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 56: Europe Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Europe Cloud Security Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 58: Europe Cloud Security Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 59: Europe Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 60: Europe Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 61: Europe Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 62: Europe Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 63: Europe Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 64: Europe Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 65: Europe Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 66: Europe Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 67: Germany Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Germany Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 69: Germany Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 70: Germany Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 71: Germany Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 72: Germany Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 73: Germany Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 74: Germany Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 75: Germany Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 76: U.K. Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: U.K. Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 78: U.K. Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 79: U.K. Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 80: U.K. Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 81: U.K. Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 82: U.K. Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 83: U.K. Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 84: U.K. Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 85: France Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 86: France Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 87: France Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 88: France Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 89: France Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 90: France Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 91: France Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 92: France Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 93: France Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 94: Italy Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 95: Italy Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 96: Italy Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 97: Italy Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 98: Italy Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 99: Italy Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 100: Italy Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 101: Italy Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 102: Italy Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 103: Spain Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 104: Spain Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 105: Spain Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 106: Spain Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 107: Spain Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 108: Spain Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 109: Spain Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 110: Spain Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 111: Spain Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 112: The Netherlands Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 113: The Netherlands Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 114: The Netherlands Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 115: The Netherlands Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 116: The Netherlands Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 117: The Netherlands Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 118: The Netherlands Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 119: The Netherlands Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 120: The Netherlands Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 121: Rest of Europe Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 122: Rest of Europe Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 123: Rest of Europe Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 124: Rest of Europe Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 125: Rest of Europe Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 126: Rest of Europe Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 127: Rest of Europe Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 128: Rest of Europe Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 129: Rest of Europe Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 130: Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 131: Asia Pacific Cloud Security Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 132: Asia Pacific Cloud Security Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 133: Asia Pacific Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 134: Asia Pacific Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 135: Asia Pacific Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 136: Asia Pacific Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 137: Asia Pacific Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 138: Asia Pacific Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 139: Asia Pacific Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 140: Asia Pacific Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 141: China Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 142: China Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 143: China Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 144: China Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 145: China Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 146: China Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 147: China Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 148: China Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 149: China Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 150: India Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 151: India Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 152: India Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 153: India Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 154: India Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 155: India Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 156: India Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 157: India Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 158: India Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 159: Japan Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 160: Japan Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 161: Japan Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 162: Japan Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 163: Japan Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 164: Japan Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 165: Japan Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 166: Japan Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 167: Japan Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 168: South Korea Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 169: South Korea Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 170: South Korea Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 171: South Korea Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 172: South Korea Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 173: South Korea Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 174: South Korea Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 175: South Korea Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 176: South Korea Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 177: Australia Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 178: Australia Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 179: Australia Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 180: Australia Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 181: Australia Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 182: Australia Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 183: Australia Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 184: Australia Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 185: Australia Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 186: ASEAN Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 187: ASEAN Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 188: ASEAN Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 189: ASEAN Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 190: ASEAN Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 191: ASEAN Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 192: ASEAN Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 193: ASEAN Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 194: ASEAN Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 195: Rest of Asia Pacific Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 196: Rest of Asia Pacific Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 197: Rest of Asia Pacific Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 198: Rest of Asia Pacific Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 199: Rest of Asia Pacific Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 200: Rest of Asia Pacific Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 201: Rest of Asia Pacific Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 202: Rest of Asia Pacific Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 203: Rest of Asia Pacific Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 204: Latin America Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 205: Latin America Cloud Security Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 206: Latin America Cloud Security Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 207: Latin America Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 208: Latin America Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 209: Latin America Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 210: Latin America Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 211: Latin America Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 212: Latin America Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 213: Latin America Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 214: Latin America Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 215: Brazil Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: Brazil Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 217: Brazil Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 218: Brazil Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 219: Brazil Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 220: Brazil Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 221: Brazil Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 222: Brazil Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 223: Brazil Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 224: Mexico Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 225: Mexico Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 226: Mexico Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 227: Mexico Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 228: Mexico Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 229: Mexico Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 230: Mexico Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 231: Mexico Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 232: Mexico Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 233: Argentina Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 234: Argentina Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 235: Argentina Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 236: Argentina Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 237: Argentina Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 238: Argentina Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 239: Argentina Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 240: Argentina Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 241: Argentina Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 242: Rest of Latin America Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 243: Rest of Latin America Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 244: Rest of Latin America Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 245: Rest of Latin America Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 246: Rest of Latin America Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 247: Rest of Latin America Cloud Security Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 248: Rest of Latin America Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 249: Rest of Latin America Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 250: Rest of Latin America Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 251: Middle East and Africa Data Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 252: Middle East and Africa Data Cloud Security Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 253: Middle East and Africa Data Cloud Security Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 254: Middle East and Africa Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 255: Middle East and Africa Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 256: Middle East and Africa Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 257: Middle East and Africa Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 258: Middle East and Africa Cloud Security Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 259: Middle East and Africa Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 260: Middle East and Africa Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 261: Middle East and Africa Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 262: GCC Countries Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 263: GCC Countries Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 264: GCC Countries Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 265: GCC Countries Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 266: GCC Countries Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 267: GCC Countries Cloud Security Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 268: GCC Countries Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 269: GCC Countries Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 270: GCC Countries Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 271: South Africa Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 272: South Africa Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 273: South Africa Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 274: South Africa Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 275: South Africa Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 276: South Africa Cloud Security Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 277: South Africa Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 278: South Africa Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 279: South Africa Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 280: Rest of Middle East Cloud Security Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 281: Rest of Middle East Cloud Security Market Value Share Analysis, by Component, 2024 and 2035

Figure 282: Rest of Middle East Cloud Security Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 283: Rest of Middle East Cloud Security Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 284: Rest of Middle East Cloud Security Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 285: Rest of Middle East Cloud Security Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 286: Rest of Middle East Cloud Security Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 287: Rest of Middle East Cloud Security Market Value Share Analysis, by End User, 2024 and 2035

Figure 288: Rest of Middle East Cloud Security Market Attractiveness Analysis, by End User, 2025 to 2035