Reports

Reports

Analysts view global managed security services (MSS) market as a sector that is growing rapidly and driven by the escalating frequency of the complex cyberattacks, the rising digital transformation across different industries, and the continuous shortage of skilled cybersecurity professionals.

Several organizations are choosing the services of managed security service providers (MSSPs) as a way to strengthen their security posture and also reduce the burden on their internal IT teams. The market is anticipated to experience robust expansion for the next several years, driven by substantial demand in such areas as cloud security, threat detection and response, and compliance management.

Analysts also emphasize the increasing prevalence of advanced technologies such as AI, automation, and machine learning in leveraging the MSS offerings scalability and efficiency. The overall market outlook remains majorly positive, despite the challenges such as integration complexity and data privacy concerns, with MSS playing an important role in modern cybersecurity strategies.

Managed security services market is referred as a sector providing outsourced monitoring and management of security systems and functions to organization. Many businesses that are lacking in-house expertise are shifting toward managed security service providers (MSSPs) due to growing cyber threats in scale and complexity.

For instance, the U.K.’s National Cyber Security Center named China as the dominant threat to national cybersecurity after a series of hacks and breaches involving British government departments and critical infrastructure, including alleged attacks against the Electoral Commission and Members of Parliament.

The managed security services market has opened new venture with a shift toward cloud technology. Bring Your Own Device has been gaining a momentum in enterprises for recent few decades along with advancement of Industry 4.0 is propelling the market for managed security services.

There is growing importance of stringent government regulations post pandemic to further strengthen digital security services. For instance, Australia’s NDB scheme mandates that companies, such as MSSPs, disclose any major data breaches to the Australian Information Commissioner. The Security of Critical Infrastructure Act, passed in 2021, extends the requirements for MSSPs who collaborate with critical infrastructure operators to ensure the safety of their systems.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Growing incidents of cyber threats is the major driver of increasing managed security services (MSS) adoption on global scale. Organizations are encountering an escalating threat landscape that consists of phishing schemes, complex malware, ransomware, and supply chain attacks. MSSPs offer proactive approach that offers organizations with threat detection, risk mitigation, and incident response with their specialized expertise and advanced technologies.

According to IBM’s Data Breach Report, the average cost of a data breach is US$ 418 Mn, with 82% of breaches involving human error. In addition, ransomware attacks have increased by over 13% in the past year alone targeting government, manufacturing, telecom, and media sectors.

Moreover, the organizations can access latest threat intelligence and cybersecurity tools without any extensive in-house resources. This shift helps business overcome emerging threats and are also cost-effective, which leverage security posture in critical digital ecosystem. For instance, The Software Engineering Institute’s Networked Systems Survivability (NSS) Program has created the Operationally Critical Threat, Asset, and Vulnerability Evaluation (OCTAVE) framework to outline a method for assessing information security risks. OCTAVE guides organizations through a series of steps to help them identify and address their security risks effectively.

Regulatory compliance ensures organizations adhere to relevant laws, industry standards, and regulations associated with security. Given compliances consist of implementing and understanding requirements such as industry-specific standards,data protection laws, and the other regulatory obligations.

According to Thomson Reuters studies, financial services organization may spend 10-15% of their revenue on regulatory compliance, healthcare organizations typically allocate 2-8% of their budget to HIPAA compliance alone, and manufacturing companies often invest millions in environmental compliance systems. A pharmaceutical company might spend US$ 50-100 Mn annually on FDA compliance, while a mid-sized bank could allocate US$ 5-20 Mn for regulatory requirements.

Consequently, companies can avoid legal penalties and fines, which eventually build trust with stakeholders and consumers by demonstrating a commitment to maintaining standards for high-security in organizations.

The regulatory landscape is consistently changing, with new regulatory compliance emerging at a global scale and the ones that exist are updated frequently. Organizations that follow compliance standards can achieve benefits by simplifying their procedures, which results in enhanced operational efficiency and reduced expenses.

Organizations following regulatory compliance standards guarantee operational processes that follow established regulations and maintain efficient operations. For instance, Microsoft invested over US$1 Bn in GDPR compliance, creating automated data deletion processes, consent management systems, and privacy-by-design (PbD) development protocols. This has positioned them as a trusted cloud provider in the EU market, generating US$ 2.3 Bn in Europe’s revenue growth.

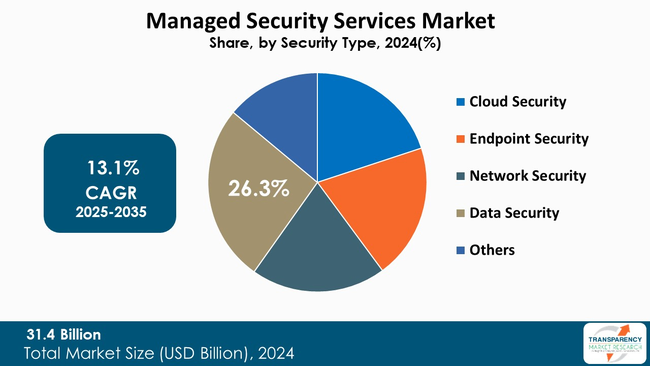

In Security type segment, data security holds the highest market share of 26.3%. Data security is usually the major part that comes up in discussions about security by type when addressing cybersecurity issues. This is due to the fact that safeguarding sensitive data is the primary concern of businesses in all sectors. Data security measures such as encryption, tokenization, data leakage prevention (DLP), and access control are the basic necessities for the protection of customer data, trade secrets, and accounting data.

Moreover, increase in frequency of remote work, the use of cloud services, and the implementation of strict data privacy laws (such as GDPR and CCPA) have raised the need for reliable data security structures. Methods such as encryption, tokenization, data leakage prevention (DLP), and authorization that are implemented with the aim of data security are the key factors in safeguarding the data security structures. Consequently, companies are making large investments in security measures that focus on data; therefore, this segment is leading the cybersecurity market significantly.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America holds the highest market share of 36.6% of global managed security services market. North America dominates the managed security services industry majorly due to advanced cybersecurity infrastructure, and significant investments in digital transformation in various industries and enterprises with strong base of technology.

North America has presence in major research institutions and global tech companies driving advancements and innovation in cybersecurity, automation, and threat intelligence that make the region dominant in MSS market. R&D investment in next generation security architectures and partnerships between public and private sectors contribute to continuous advancements in managed services.

With increasing need for constant compliance, growing dependency on hybrid and remote work models and highly digitalized economy, North America is anticipated to maintain its leadership in global MSS market throughout the forecast period.

The United States commands a major portion of the MSS market as it leads in high AI and machine learning adoption for security operations and develops compliance standards like CCPA and HIPAA and sector-specific cybersecurity frameworks. For instance, The Health Insurance Portability and Accountability Act (HIPAA) together with Cybersecurity Maturity Model Certification (CMMC) and ISO 27001 establish the industry-wide standards for protecting data while maintaining privacy and cybersecurity measures. The standards establish distinct sets of requirements which MSPs need to fulfill for their clients particularly when they handle sensitive data.

IBM, NTT, Kyndryl Inc., Accenture, Atos SE, DXC Technology Company, Secnap Network Security Corporation, Deloitte, Secureworks, Inc., F5, Inc, Verizon, Fujitsu, Hewlett Packard Enterprise Development LP, TATA Consultancy Services Limited, Capgemini are some of the leading manufacturers operating in the global managed security services market.

Each of these companies has been profiled in the managed security services market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments

| Attribute | Detail |

|---|---|

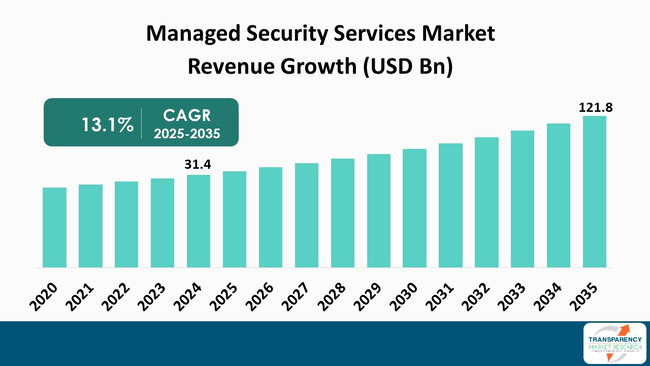

| Size in 2024 | US$ 31.4 Bn |

| Forecast Value in 2035 | More than US$ 121.8 Bn |

| CAGR | 13.1 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Security Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The managed security services market was valued at US$ 31.4 Bn in 2024

The managed security services market is projected to cross US$ 121.8 Bn by the end of 2035

Rising sophistication of cyber threats and regulatory compliance mandate managed security services globally

The CAGR is anticipated to be 13.1% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

IBM, NTT, Kyndryl Inc., Accenture, Atos SE, DXC Technology Company, Secnap Network Security Corporation, Deloitte, Secureworks, Inc., F5, Inc., Verizon, Fujitsu, Hewlett Packard Enterprise Development LP, TATA Consultancy Services Limited, Capgemini, and other prominent players.

Table 01: Global Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 02: Global Managed Security Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 03: Global Managed Security Services Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 04: Global Managed Security Services Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 05: Global Managed Security Services Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Managed Security Services Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 08: North America Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 09: North America Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 10: North America Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 11: U.S. Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 12: U.S. Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 13: U.S. Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 14: U.S. Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 15: Canada Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 16: Canada Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 17: Canada Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 18: Canada Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 19: Europe Managed Security Services Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Europe Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 21: Europe Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 22: Europe Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 23: Europe Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 24: Germany Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 25: Germany Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 26: Germany Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 27: Germany Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 28: U.K. Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 29: U.K. Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 30: U.K. Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 31: U.K. Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 32: France Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 33: France Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 34: France Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 35: France Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 36: Italy Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 37: Italy Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 38: Italy Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 39: Italy Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 40: Spain Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 41: Spain Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 42: Spain Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 43: Spain Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 44: The Netherlands Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 45: The Netherlands Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 46: The Netherlands Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 47: The Netherlands Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 48: Rest of Europe Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 49: Rest of Europe Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 50: Rest of Europe Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 51: Rest of Europe Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 52: Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 53: Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 54: Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 55: Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 56: Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 57: China Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 58: China Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 59: China Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 60: China Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 61: India Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 62: India Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 63: India Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 64: India Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 65: Japan Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 66: Japan Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 67: Japan Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 68: Japan Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 69: South Korea Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 70: South Korea Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 71: South Korea Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 72: South Korea Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 73: Australia Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 74: Australia Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 75: Australia Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 76: Australia Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 77: ASEAN Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 78: ASEAN Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 79: ASEAN Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 80: ASEAN Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 81: Rest of Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 82: Rest of Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 83: Rest of Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 84: Rest of Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 85: Latin America Managed Security Services Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 86: Latin America Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 87: Latin America Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 88: Latin America Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 89: Latin America Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 90: Brazil Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 91: Brazil Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 92: Brazil Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 93: Brazil Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 94: Mexico Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 95: Mexico Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 96: Mexico Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 97: Mexico Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 98: Argentina Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 99: Argentina Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 100: Argentina Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 101: Argentina Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 102: Rest of Latin America Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 103: Rest of Latin America Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 104: Rest of Latin America Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 105: Rest of Latin America Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 106: Middle East and Africa Managed Security Services Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 107: Middle East and Africa Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 108: Middle East and Africa Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 109: Middle East and Africa Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 110: Middle East and Africa Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 111: GCC Countries Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 112: GCC Countries Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 113: GCC Countries Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 114: GCC Countries Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 115: South Africa Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 116: South Africa Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 117: South Africa Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 118: South Africa Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 119: Rest of Middle East Managed Security Services Market Value (US$ Bn) Forecast, by Security Type, 2020 to 2035

Table 120: Rest of Middle East Managed Security Services Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 121: Rest of Middle East Managed Security Services Market Value (US$ Bn) Forecast, by Enterprise Size, 2020 to 2035

Table 122: Rest of Middle East Managed Security Services Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Figure 01: Global Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 02: Global Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 03: Global Managed Security Services Market Revenue (US$ Bn), by Cloud Security, 2020 to 2035

Figure 04: Global Managed Security Services Market Revenue (US$ Bn), by Endpoint Security, 2020 to 2035

Figure 05: Global Managed Security Services Market Revenue (US$ Bn), by Network Security, 2020 to 2035

Figure 06: Global Managed Security Services Market Revenue (US$ Bn), by Data Security, 2020 to 2035

Figure 07: Global Managed Security Services Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Managed Security Services Market Value Share Analysis, by Service Type, 2024 and 2035

Figure 09: Global Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 10: Global Managed Security Services Market Revenue (US$ Bn), by Managed SIEM, 2020 to 2035

Figure 11: Global Managed Security Services Market Revenue (US$ Bn), by Managed UTM, 2020 to 2035

Figure 12: Global Managed Security Services Market Revenue (US$ Bn), by Managed DDoS, 2020 to 2035

Figure 13: Global Managed Security Services Market Revenue (US$ Bn), by Managed XDR, 2020 to 2035

Figure 14: Global Managed Security Services Market Revenue (US$ Bn), by Managed IAM, 2020 to 2035

Figure 15: Global Managed Security Services Market Revenue (US$ Bn), by Managed Risk & Compliance, 2020 to 2035

Figure 16: Global Managed Security Services Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 18: Global Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 19: Global Managed Security Services Market Revenue (US$ Bn), by Small and medium-sized enterprises, 2020 to 2035

Figure 20: Global Managed Security Services Market Revenue (US$ Bn), by Large enterprises, 2020 to 2035

Figure 21: Global Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 22: Global Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2024 and 2035

Figure 23: Global Managed Security Services Market Revenue (US$ Bn), by BFSI, 2025 to 2035

Figure 24: Global Managed Security Services Market Revenue (US$ Bn), by Government and Defense, 2020 to 2035

Figure 25: Global Managed Security Services Market Revenue (US$ Bn), by Healthcare and Life Sciences, 2020 to 2035

Figure 26: Global Managed Security Services Market Revenue (US$ Bn), by Manufacturing and Industrial, 2020 to 2035

Figure 27: Global Managed Security Services Market Revenue (US$ Bn), by Retail and e-Commerce, 2020 to 2035

Figure 28: Global Managed Security Services Market Revenue (US$ Bn), by Energy and Utilities, 2020 to 2035

Figure 29: Global Managed Security Services Market Value Share Analysis, By Region, 2024 and 2035

Figure 30: Global Managed Security Services Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 31: North America Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 32: North America Managed Security Services Market Value Share Analysis, by Country, 2024 and 2035

Figure 33: North America Managed Security Services Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 34: North America Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 35: North America Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 36: North America Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 37: North America Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 38: North America Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 39: North America Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 40: North America Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 41: North America Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 42: U.S. Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: U.S. Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 44: U.S. Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 45: U.S. Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 46: U.S. Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 47: U.S. Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 48: U.S. Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 49: U.S. Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 50: U.S. Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 51: Canada Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 52: Canada Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 53: Canada Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 54: Canada Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 55: Canada Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 56: Canada Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 57: Canada Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 58: Canada Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 59: Canada Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 60: Europe Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Europe Managed Security Services Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 62: Europe Managed Security Services Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 63: Europe Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 64: Europe Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 65: Europe Managed Security Services Market Value Share Analysis, by Service Type, 2024 and 2035

Figure 66: Europe Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 67: Europe Managed Security Services Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 68: Europe Managed Security Services Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 69: Europe Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 70: Europe Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 71: Germany Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 72: Germany Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 73: Germany Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 74: Germany Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 75: Germany Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 76: Germany Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 77: Germany Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 78: Germany Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 79: Germany Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 80: U.K. Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 81: U.K. Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 82: U.K. Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 83: U.K. Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 84: U.K. Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 85: U.K. Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 86: U.K. Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 87: U.K. Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 88: U.K. Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 89: France Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 90: France Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 91: France Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 92: France Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 93: France Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 94: France Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 95: France Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 96: France Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 97: France Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 98: Italy Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 99: Italy Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 100: Italy Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 101: Italy Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 102: Italy Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 103: Italy Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 104: Italy Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 105: Italy Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 106: Italy Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 107: Spain Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 108: Spain Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 109: Spain Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 110: Spain Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 111: Spain Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 112: Spain Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 113: Spain Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 114: Spain Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 115: Spain Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 116: The Netherlands Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 117: The Netherlands Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 118: The Netherlands Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 119: The Netherlands Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 120: The Netherlands Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 121: The Netherlands Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 122: The Netherlands Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 123: The Netherlands Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 124: The Netherlands Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 125: Rest of Europe Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 126: Rest of Europe Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 127: Rest of Europe Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 128: Rest of Europe Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 129: Rest of Europe Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 130: Rest of Europe Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 131: Rest of Europe Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 132: Rest of Europe Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 133: Rest of Europe Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 134: Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 135: Asia Pacific Managed Security Services Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 136: Asia Pacific Managed Security Services Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 137: Asia Pacific Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 138: Asia Pacific Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 139: Asia Pacific Managed Security Services Market Value Share Analysis, by Service Type, 2024 and 2035

Figure 140: Asia Pacific Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 141: Asia Pacific Managed Security Services Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 142: Asia Pacific Managed Security Services Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 143: Asia Pacific Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 144: Asia Pacific Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 145: China Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 146: China Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 147: China Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 148: China Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 149: China Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 150: China Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 151: China Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 152: China Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 153: China Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 154: India Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 155: India Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 156: India Managed Security Services Market Value Share Analysis, by Security Type, 2025 to 2035

Figure 157: India Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 158: India Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 159: India Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 160: India Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 161: India Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 162: India Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 163: Japan Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 164: Japan Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 165: Japan Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 166: Japan Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 167: Japan Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 168: Japan Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 169: Japan Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 170: Japan Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 171: Japan Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 172: South Korea Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 173: South Korea Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 174: South Korea Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 175: South Korea Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 176: South Korea Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 177: South Korea Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 178: South Korea Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 179: South Korea Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 180: South Korea Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 181: Australia Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 182: Australia Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 183: Australia Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 184: Australia Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 185: Australia Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 186: Australia Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 187: Australia Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 188: Australia Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 189: Australia Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 190: ASEAN Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 191: ASEAN Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 192: ASEAN Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 193: ASEAN Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 194: ASEAN Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 195: ASEAN Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 196: ASEAN Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 197: ASEAN Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 198: ASEAN Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 199: Rest of Asia Pacific Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 200: Rest of Asia Pacific Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 201: Rest of Asia Pacific Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 202: Rest of Asia Pacific Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 203: Rest of Asia Pacific Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 204: Rest of Asia Pacific Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 205: Rest of Asia Pacific Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 206: Rest of Asia Pacific Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 207: Rest of Asia Pacific Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 208: Latin America Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 209: Latin America Managed Security Services Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 210: Latin America Managed Security Services Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 211: Latin America Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 212: Latin America Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 213: Latin America Managed Security Services Market Value Share Analysis, by Service Type, 2024 and 2035

Figure 214: Latin America Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 215: Latin America Managed Security Services Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 216: Latin America Managed Security Services Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 217: Latin America Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 218: Latin America Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 219: Brazil Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 220: Brazil Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 221: Brazil Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 222: Brazil Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 223: Brazil Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 224: Brazil Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 225: Brazil Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 226: Brazil Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 227: Brazil Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 228: Mexico Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 229: Mexico Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 230: Mexico Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 231: Mexico Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 232: Mexico Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 233: Mexico Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 234: Mexico Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 235: Mexico Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 236: Mexico Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 237: Argentina Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 238: Argentina Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 239: Argentina Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 240: Argentina Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 241: Argentina Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 242: Argentina Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 243: Argentina Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 244: Argentina Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 245: Argentina Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 246: Rest of Latin America Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 247: Rest of Latin America Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 248: Rest of Latin America Managed Security Services Market Value Share Analysis, by Security Type, 2025 to 2035

Figure 249: Rest of Latin America Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 250: Rest of Latin America Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 251: Rest of Latin America Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 252: Rest of Latin America Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 253: Rest of Latin America Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 254: Rest of Latin America Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 255: Middle East & Africa Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 256: Middle East & Africa Managed Security Services Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 257: Middle East & Africa Managed Security Services Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 258: Middle East and Africa Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 259: Middle East and Africa Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 260: Middle East and Africa Managed Security Services Market Value Share Analysis, by Service Type, 2024 and 2035

Figure 261: Middle East and Africa Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 262: Middle East and Africa Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 263: Middle East and Africa Managed Security Services Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 264: Middle East and Africa Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 265: Middle East and Africa Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 266: GCC Countries Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 267: GCC Countries Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 268: GCC Countries Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 269: GCC Countries Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 270: GCC Countries Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 271: GCC Countries Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 272: GCC Countries Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 273: GCC Countries Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 274: GCC Countries Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 275: South Africa Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 276: South Africa Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 277: South Africa Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 278: South Africa Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 279: South Africa Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 280: South Africa Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 281: South Africa Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 282: South Africa Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 283: South Africa Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 284: Rest of Middle East Managed Security Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 285: Rest of Middle East Managed Security Services Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 286: Rest of Middle East Managed Security Services Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 287: Rest of Middle East Managed Security Services Market Value Share Analysis, by Service Type, 2025 to 2035

Figure 288: Rest of Middle East Managed Security Services Market Attractiveness Analysis, by Service Type, 2025 to 2035

Figure 289: Rest of Middle East Managed Security Services Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 290: Rest of Middle East Managed Security Services Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 291: Rest of Middle East Managed Security Services Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 292: Rest of Middle East Managed Security Services Market Attractiveness Analysis, by End-use Industry, 2025 to 2035