Reports

Reports

Analysts’ Viewpoint

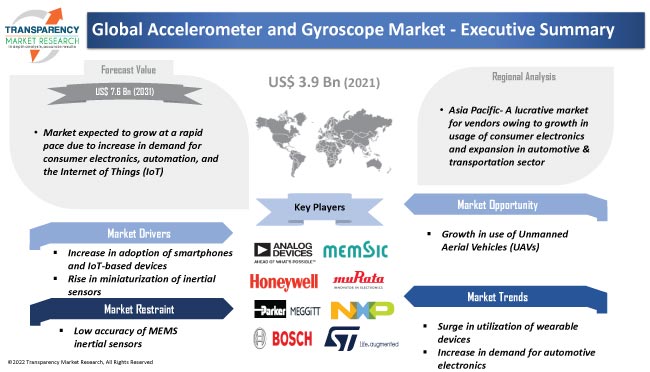

Increase in adoption of smartphones and IoT-based devices and rise in miniaturization of inertial sensors are expected to fuel the global accelerometer and gyroscope market size during the forecast period. Accelerometers and gyroscopes measure acceleration and angular velocity, respectively.

Surge in usage of wearable devices and growth in demand for automotive electronics are anticipated to boost market expansion in the near future. However, low accuracy of MEMS inertial sensors is limiting the demand for accelerometers and gyroscopes.

Manufacturers are focusing on advancements in MEMS technology and development of more accurate and reliable sensors. They are offering MEMS sensors with multiple degrees of freedom or multiple sensor elements capable of providing more accurate measurements.

Accelerometers and gyroscopes are inertial sensing devices used to measure motion and orientation by detecting changes in linear acceleration and angular velocity, respectively. Inertial Measurement Unit (IMU) is a combination gyroscope and accelerometer. It can also include a magnetometer and a barometer.

IMU communicates sensor readings to a control system, which processes the data and uses it to control the movement of the object. The combination of high accuracy and low cost makes IMUs a popular choice for a wide range of applications.

Accelerometers are employed in smartphones to detect their orientation. The gyroscope tracks rotations or twists, thereby complementing the information supplied by the accelerometer. IMUs are a critical component of smartphone hardware. They facilitate pedometer measurements, gesture recognition, and image stabilization. Thus, rise in usage of smartphones is estimated to spur accelerometer and gyroscope market growth in the near future.

Increase in trend of 5G, foldable phones, and low-tier smartphones is boosting the demand for gyroscopes and accelerometers. The global penetration rate of 5G mobile phones was expected to increase from 37% in 2021 to 47% in 2022. It is anticipated to reach 50% by the end of 2023.

The U.S. and China are major markets for 5G smartphones, with China accounting for more than 80% of shipments. The number of smartphones in China is projected to rise from 255.2 million units in 2022 to 260.1 million units in 2023, with Y-o-Y growth of 1.9%.

UAVs are gaining traction in the military & defense sector due to advancements in the flight control technology. Navigation and flight attitude control are the primary functions of the flight control system. The current status of an aircraft is determined by its position, velocity, acceleration, angle, and angular velocity.

Flight control systems, particularly those used in UAVs, rely significantly on IMUs, which provide essential information about the orientation and movement of the aircraft. This information is used by the flight control system to maintain stability and control the aircraft's movements. Thus, increase in demand for UAVs is estimated to fuel market progress in the next few years.

Governments of countries across the globe are investing significantly in drone technologies to enhance their defense capabilities. In September 2021, the Government of India announced plans to provide more than US$ 14.5 Mn as incentives for the manufacture of drones and drone components over the next three years. Thus, rise in investment in the military & defense sector is projected to bolster market dynamics in the near future.

Accelerometers and gyroscopes play an important role in various automotive applications such as airbags, electronic stability control, rollover detection, navigation, security systems, and active suspension. These systems use gyroscopes, accelerometers, and steering angle sensors to detect any difference between the driver's intention and the vehicle's actual motion. These systems are used to control the vehicle in case of a sudden variation.

Accelerometers and gyroscopes are employed in Advanced Driver Assistance Systems (ADAS) to measure the vehicle's movements and orientation. This information is used to provide advanced safety features, such as lane departure warnings, collision avoidance, and adaptive cruise control. Hence, growth in adoption of automotive safety systems is estimated to boost market statistics in the next few years.

Automotive electronics such as electronic stability control, active suspension systems, tire pressure monitoring systems, and in-vehicle navigation systems are gaining traction in the automotive sector.

Automakers are launching autonomous cars, all-electric vehicles, and hybrid cars to cater to changing consumer demands. This, in turn, is likely to augment the demand for accelerometers and gyroscopes in the near future.

Leading players are focusing on launching advanced products for the automotive sector to increase their accelerometer and gyroscope market share. For instance, in 2021, STMicroelectronics developed the AIS2IH three-axis linear accelerometer that enhances resolution, temperature stability, and mechanical robustness of non-safety automotive applications, including infotainment, telematics, anti-theft, tilt/inclination measurement, and vehicle navigation.

According to the latest accelerometer and gyroscope market trends, the Inertial Measurement Unit (IMU) type segment is anticipated to account for the largest share during the forecast period. The segment held 43.7% share in 2021. Rise in complexity of smart devices and increase in adoption of 3D applications are driving the demand for IMUs.

IMUs are widely used in a variety of mobile applications. They may also be employed in the aerospace sector in combination with other sensors to provide a more complete picture of the aircraft's movement and environment. The usage of IMUs in flight control systems has improved the stability and control of UAVs and other aircraft.

The accelerometer segment is projected to grow at a significant pace during the forecast period, as per the latest accelerometer and gyroscope market research. Low-power accelerometers are designed for smartphones and wearable technologies. These accelerometers employ the capacitive detection sensing principle to determine changes in linear motion.

According to the latest accelerometer and gyroscope market forecast, Asia Pacific is projected to dominate the industry from 2022 to 2031. The region accounted for more than 50.0% share in 2021.

Rapid growth in the automotive sector is driving market revenue in Asia Pacific. The region is home to some of the largest automotive markets in the world, such as China and India, and has experienced rapid growth in recent years. This is likely to boost the demand for accelerometers and gyroscopes in the automotive sector, particularly for ADAS and electronic stability control systems.

Accelerometer and gyroscope manufacturers are focusing on the production of sensors that are accurate, reliable, and cost-effective for various applications. These sensors are widely employed in consumer electronics, aerospace, automotive, industrial, and medical industries. Vendors are also emphasizing on the miniaturization of sensors to integrate them into smaller devices.

Key players in the accelerometer and gyroscope industry are developing sensors with multiple axes to provide more comprehensive motion tracking. They are also offering sensors that can withstand extreme temperatures, vibrations, and harsh environments.

Analog Devices Inc., Dytran Instruments Incorporated, Hansford Sensors, Honeywell International Inc., InnaLabs, Kionix Inc., Meggitt PLC, MEMSIC Semiconductor Co., Ltd., Murata Manufacturing Co., Ltd., Northrop Grumman, NXP Semiconductors, Robert Bosch GmbH, Safran Colibrys SA, STMicroelectronics, Systron Donner Inertial (EMCORE Corporation), and TE Connectivity are leading companies operating in this market.

Each of these players has been profiled in the accelerometer and gyroscope market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.9 Bn |

|

Market Forecast Value in 2031 |

US$ 7.6 Bn |

|

Growth Rate (CAGR) |

7.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 3.9 Bn in 2021

It is estimated to grow at a CAGR of 7.0% from 2022 to 2031

It is expected to reach US$ 7.6 Bn by the end of 2031

Increase in adoption of smartphones and rise in demand for automotive electronics

Asia Pacific is a highly lucrative region for vendors

Analog Devices Inc., Dytran Instruments Incorporated, Hansford Sensors, Honeywell International Inc., InnaLabs, Kionix Inc., Meggitt PLC, MEMSIC Semiconductor Co., Ltd., Murata Manufacturing Co., Ltd., Northrop Grumman, NXP Semiconductors, Robert Bosch GmbH, Safran Colibrys SA, STMicroelectronics, Systron Donner Inertial (EMCORE Corporation), and TE Connectivity

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Accelerometer and Gyroscope Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Inertial Sensors Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Accelerometer and Gyroscope Market Analysis, by Type

5.1. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

5.1.1. Accelerometer

5.1.1.1. Piezoresistive Accelerometer

5.1.1.2. Capacitive Accelerometer

5.1.1.3. Piezoelectric Accelerometer

5.1.2. Gyroscope

5.1.2.1. MEMS Gyroscope

5.1.2.2. Fiber-optic Gyroscope

5.1.2.3. Ring Laser Gyroscope

5.1.2.4. Dynamically Tuned Gyroscope (DTG)

5.1.2.5. Others

5.1.3. Inertial Measurement Unit (IMU)

5.2. Market Attractiveness Analysis, By Type

6. Global Accelerometer and Gyroscope Market Analysis, by Dimension

6.1. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By Dimension, 2017–2031

6.1.1. 1-Axis

6.1.2. 2-Axis

6.1.3. 3-Axis

6.2. Market Attractiveness Analysis, By Dimension

7. Global Accelerometer and Gyroscope Market Analysis, by End-use Industry

7.1. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

7.1.1. Automotive & Transportation

7.1.2. Consumer Electronics

7.1.3. Aerospace & Defense

7.1.4. Electronics & Semiconductor

7.1.5. Healthcare

7.1.6. Others

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global Accelerometer and Gyroscope Market Analysis and Forecast, by Region

8.1. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Accelerometer and Gyroscope Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

9.3.1. Accelerometer

9.3.1.1. Piezoresistive Accelerometer

9.3.1.2. Capacitive Accelerometer

9.3.1.3. Piezoelectric Accelerometer

9.3.2. Gyroscope

9.3.2.1. MEMS Gyroscope

9.3.2.2. Fiber-optic Gyroscope

9.3.2.3. Ring Laser Gyroscope

9.3.2.4. Dynamically Tuned Gyroscope (DTG)

9.3.2.5. Others

9.3.3. Inertial Measurement Unit (IMU)

9.4. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By Dimension, 2017–2031

9.4.1. 1-Axis

9.4.2. 2-Axis

9.4.3. 3-Axis

9.5. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

9.5.1. Automotive & Transportation

9.5.2. Consumer Electronics

9.5.3. Aerospace & Defense

9.5.4. Electronics & Semiconductor

9.5.5. Healthcare

9.5.6. Others

9.6. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Dimension

9.7.3. By Application

9.7.4. By End-use Industry

9.7.5. By Country/Sub-region

10. Europe Accelerometer and Gyroscope Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

10.3.1. Accelerometer

10.3.1.1. Piezoresistive Accelerometer

10.3.1.2. Capacitive Accelerometer

10.3.1.3. Piezoelectric Accelerometer

10.3.2. Gyroscope

10.3.2.1. MEMS Gyroscope

10.3.2.2. Fiber-optic Gyroscope

10.3.2.3. Ring Laser Gyroscope

10.3.2.4. Dynamically Tuned Gyroscope (DTG)

10.3.2.5. Others

10.3.3. Inertial Measurement Unit (IMU)

10.4. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By Dimension, 2017–2031

10.4.1. 1-Axis

10.4.2. 2-Axis

10.4.3. 3-Axis

10.5. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

10.5.1. Automotive & Transportation

10.5.2. Consumer Electronics

10.5.3. Aerospace & Defense

10.5.4. Electronics & Semiconductor

10.5.5. Healthcare

10.5.6. Others

10.6. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Dimension

10.7.3. By Application

10.7.4. By End-use Industry

10.7.5. By Country/Sub-region

11. Asia Pacific Accelerometer and Gyroscope Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

11.3.1. Accelerometer

11.3.1.1. Piezoresistive Accelerometer

11.3.1.2. Capacitive Accelerometer

11.3.1.3. Piezoelectric Accelerometer

11.3.2. Gyroscope

11.3.2.1. MEMS Gyroscope

11.3.2.2. Fiber-optic Gyroscope

11.3.2.3. Ring Laser Gyroscope

11.3.2.4. Dynamically Tuned Gyroscope (DTG)

11.3.2.5. Others

11.3.3. Inertial Measurement Unit (IMU)

11.4. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By Dimension, 2017–2031

11.4.1. 1-Axis

11.4.2. 2-Axis

11.4.3. 3-Axis

11.5. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

11.5.1. Automotive & Transportation

11.5.2. Consumer Electronics

11.5.3. Aerospace & Defense

11.5.4. Electronics & Semiconductor

11.5.5. Healthcare

11.5.6. Others

11.6. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Dimension

11.7.3. By Application

11.7.4. By End-use Industry

11.7.5. By Country/Sub-region

12. Middle East & Africa Accelerometer and Gyroscope Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

12.3.1. Accelerometer

12.3.1.1. Piezoresistive Accelerometer

12.3.1.2. Capacitive Accelerometer

12.3.1.3. Piezoelectric Accelerometer

12.3.2. Gyroscope

12.3.2.1. MEMS Gyroscope

12.3.2.2. Fiber-optic Gyroscope

12.3.2.3. Ring Laser Gyroscope

12.3.2.4. Dynamically Tuned Gyroscope (DTG)

12.3.2.5. Others

12.3.3. Inertial Measurement Unit (IMU)

12.4. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By Dimension, 2017–2031

12.4.1. 1-Axis

12.4.2. 2-Axis

12.4.3. 3-Axis

12.5. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

12.5.1. Automotive & Transportation

12.5.2. Consumer Electronics

12.5.3. Aerospace & Defense

12.5.4. Electronics & Semiconductor

12.5.5. Healthcare

12.5.6. Others

12.6. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Dimension

12.7.3. By Application

12.7.4. By End-use Industry

12.7.5. By Country/Sub-region

13. South America Accelerometer and Gyroscope Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

13.3.1. Accelerometer

13.3.1.1. Piezoresistive Accelerometer

13.3.1.2. Capacitive Accelerometer

13.3.1.3. Piezoelectric Accelerometer

13.3.2. Gyroscope

13.3.2.1. MEMS Gyroscope

13.3.2.2. Fiber-optic Gyroscope

13.3.2.3. Ring Laser Gyroscope

13.3.2.4. Dynamically Tuned Gyroscope (DTG)

13.3.2.5. Others

13.3.3. Inertial Measurement Unit (IMU)

13.4. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By Dimension, 2017–2031

13.4.1. 1-Axis

13.4.2. 2-Axis

13.4.3. 3-Axis

13.5. Accelerometer and Gyroscope Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

13.5.1. Automotive & Transportation

13.5.2. Consumer Electronics

13.5.3. Aerospace & Defense

13.5.4. Electronics & Semiconductor

13.5.5. Healthcare

13.5.6. Others

13.6. Accelerometer and Gyroscope Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Dimension

13.7.3. By Application

13.7.4. By End-use Industry

13.7.5. By Country/Sub-region

14. Competition Assessment

14.1. Global Accelerometer and Gyroscope Market Competition Matrix - a Dashboard View

14.1.1. Global Accelerometer and Gyroscope Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Analog Devices Inc.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Dytran Instruments Incorporated

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Hansford Sensors

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Honeywell International Inc.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. InnaLabs

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Kionix Inc.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Meggitt PLC

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. MEMSIC Semiconductor Co., Ltd.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Murata Manufacturing Co., Ltd.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Northrop Grumman

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. NXP Semiconductors

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Robert Bosch GmbH

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Safran Colibrys SA

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

15.14. STMicroelectronics

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Key Subsidiaries or Distributors

15.14.5. Strategy and Recent Developments

15.14.6. Key Financials

15.15. Systron Donner Inertial (EMCORE Corporation)

15.15.1. Overview

15.15.2. Product Portfolio

15.15.3. Sales Footprint

15.15.4. Key Subsidiaries or Distributors

15.15.5. Strategy and Recent Developments

15.15.6. Key Financials

15.16. TE Connectivity

15.16.1. Overview

15.16.2. Product Portfolio

15.16.3. Sales Footprint

15.16.4. Key Subsidiaries or Distributors

15.16.5. Strategy and Recent Developments

15.16.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Type

16.1.2. By Dimension

16.1.3. By End-use Industry

16.1.4. By Region/Country/Sub-region

List of Tables

Table 1: Global Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 2: Global Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 3: Global Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Dimension, 2017‒2031

Table 4: Global Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 5: Global Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 6: Global Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 7: North America Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 8: North America Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 9: North America Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Dimension, 2017‒2031

Table 10: North America Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 11: North America Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 12: North America Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 13: Europe Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 14: Europe Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 15: Europe Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Dimension, 2017‒2031

Table 16: Europe Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 17: Europe Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 18: Europe Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 19: Asia Pacific Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 20: Asia Pacific Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 21: Asia Pacific Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Dimension, 2017‒2031

Table 22: Asia Pacific Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 23: Asia Pacific Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 24: Asia Pacific Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 25: Middle East & Africa Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 26: Middle East & Africa Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 27: Middle East & Africa Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Dimension, 2017‒2031

Table 28: Middle East & Africa Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 29: Middle East & Africa Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 30: Middle East & Africa Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 31: South America Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 32: South America Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 33: South America Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Dimension, 2017‒2031

Table 34: South America Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 35: South America Accelerometer and Gyroscope Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 36: South America Accelerometer and Gyroscope Market Volume (Million Units) & Forecast, by Region, 2017‒2031

List of Figures

Figure 01: Global Accelerometer and Gyroscope Market Size & Forecast Value (US$ Mn), 2017‒2031

Figure 02: Global Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 03: Global Accelerometer and Gyroscope Market Size & Forecast Volume (Million Units), 2017‒2031

Figure 04: Global Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 05: Global Accelerometer and Gyroscope Market Projections by Type, and Value (US$ Mn), 2017‒2031

Figure 06: Global Accelerometer and Gyroscope Market Share Analysis, by Type, 2021 and 2031

Figure 07: Global Accelerometer and Gyroscope Market, Incremental Opportunity, by Type, 2021‒2031

Figure 08: Global Accelerometer and Gyroscope Market Projections by Dimension, 2017‒2031

Figure 09: Global Accelerometer and Gyroscope Market Share Analysis, by Dimension, 2021 and 2031

Figure 10: Global Accelerometer and Gyroscope Market, Incremental Opportunity, by Dimension, 2021‒2031

Figure 11: Global Accelerometer and Gyroscope Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 12: Global Accelerometer and Gyroscope Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 13: Global Accelerometer and Gyroscope Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 14: Global Accelerometer and Gyroscope Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 15: Global Accelerometer and Gyroscope Market Share Analysis, by Region 2021 and 2031

Figure 16: Global Accelerometer and Gyroscope Market, Incremental Opportunity, by Region, 2021‒2031

Figure 17: North America Accelerometer and Gyroscope Market Size & Forecast Value (US$ Mn), 2017‒2031

Figure 18: North America Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 19: North America Accelerometer and Gyroscope Market Size & Forecast Volume (Million Units), 2017‒2031

Figure 20: North America Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 21: North America Accelerometer and Gyroscope Market Projections by Type, and Value (US$ Mn), 2017‒2031

Figure 22: North America Accelerometer and Gyroscope Market Share Analysis, by Type, 2021 and 2031

Figure 23: North America Accelerometer and Gyroscope Market, Incremental Opportunity, by Type, 2021‒2031

Figure 24: North America Accelerometer and Gyroscope Market Projections by Dimension, 2017‒2031

Figure 25: North America Accelerometer and Gyroscope Market Share Analysis, by Dimension, 2021 and 2031

Figure 26: North America Accelerometer and Gyroscope Market, Incremental Opportunity, by Dimension, 2021‒2031

Figure 27: North America Accelerometer and Gyroscope Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 28: North America Accelerometer and Gyroscope Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 29: North America Accelerometer and Gyroscope Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 30: North America Accelerometer and Gyroscope Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 31: North America Accelerometer and Gyroscope Market Share Analysis, by Country, 2021 and 2031

Figure 32: North America Accelerometer and Gyroscope Market, Incremental Opportunity, by Country, 2021‒2031

Figure 33: Europe Accelerometer and Gyroscope Market Size & Forecast Value (US$ Mn), 2017‒2031

Figure 34: Europe Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 35: Europe Accelerometer and Gyroscope Market Size & Forecast Volume (Million Units), 2017‒2031

Figure 36: Europe Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 37: Europe Accelerometer and Gyroscope Market Projections by Type, and Value (US$ Mn), 2017‒2031

Figure 38: Europe Accelerometer and Gyroscope Market Share Analysis, by Type, 2021 and 2031

Figure 39: Europe Accelerometer and Gyroscope Market, Incremental Opportunity, by Type, 2021‒2031

Figure 40: Europe Accelerometer and Gyroscope Market Projections by Dimension, 2017‒2031

Figure 41: Europe Accelerometer and Gyroscope Market Share Analysis, by Dimension, 2021 and 2031

Figure 42: Europe Accelerometer and Gyroscope Market, Incremental Opportunity, by Dimension, 2021‒2031

Figure 43: Europe Accelerometer and Gyroscope Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 44: Europe Accelerometer and Gyroscope Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 45: Europe Accelerometer and Gyroscope Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 46: Europe Accelerometer and Gyroscope Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 47: Europe Accelerometer and Gyroscope Market Share Analysis, by Country, 2021 and 2031

Figure 48: Europe Accelerometer and Gyroscope Market, Incremental Opportunity, by Country, 2021‒2031

Figure 49: Asia Pacific Accelerometer and Gyroscope Market Size & Forecast Value (US$ Mn), 2017‒2031

Figure 50: Asia Pacific Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 51: Asia Pacific Accelerometer and Gyroscope Market Size & Forecast Volume (Million Units), 2017‒2031

Figure 52: Asia Pacific Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 53: Asia Pacific Accelerometer and Gyroscope Market Projections by Type, and Value (US$ Mn), 2017‒2031

Figure 54: Asia Pacific Accelerometer and Gyroscope Market Share Analysis, by Type, 2021 and 2031

Figure 55: Asia Pacific Accelerometer and Gyroscope Market, Incremental Opportunity, by Type, 2021‒2031

Figure 56: Asia Pacific Accelerometer and Gyroscope Market Projections by Dimension, 2017‒2031

Figure 57: Asia Pacific Accelerometer and Gyroscope Market Share Analysis, by Dimension, 2021 and 2031

Figure 58: Asia Pacific Accelerometer and Gyroscope Market, Incremental Opportunity, by Dimension, 2021‒2031

Figure 59: Asia Pacific Accelerometer and Gyroscope Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 60: Asia Pacific Accelerometer and Gyroscope Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 61: Asia Pacific Accelerometer and Gyroscope Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 62: Asia Pacific Accelerometer and Gyroscope Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 63: Asia Pacific Accelerometer and Gyroscope Market Share Analysis, by Country, 2021 and 2031

Figure 64: Asia Pacific Accelerometer and Gyroscope Market, Incremental Opportunity, by Country, 2021‒2031

Figure 65: Middle East & Africa Accelerometer and Gyroscope Market Size & Forecast Value (US$ Mn), 2017‒2031

Figure 66: Middle East & Africa Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 67: Middle East & Africa Accelerometer and Gyroscope Market Size & Forecast Volume (Million Units), 2017‒2031

Figure 68: Middle East & Africa Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 69: Middle East & Africa Accelerometer and Gyroscope Market Projections by Type, and Value (US$ Mn), 2017‒2031

Figure 70: Middle East & Africa Accelerometer and Gyroscope Market Share Analysis, by Type, 2021 and 2031

Figure 71: Middle East & Africa Accelerometer and Gyroscope Market, Incremental Opportunity, by Type, 2021‒2031

Figure 72: Middle East & Africa Accelerometer and Gyroscope Market Projections by Dimension, 2017‒2031

Figure 73: Middle East & Africa Accelerometer and Gyroscope Market Share Analysis, by Dimension, 2021 and 2031

Figure 74: Middle East & Africa Accelerometer and Gyroscope Market, Incremental Opportunity, by Dimension, 2021‒2031

Figure 75: Middle East & Africa Accelerometer and Gyroscope Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 76: Middle East & Africa Accelerometer and Gyroscope Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 77: Middle East & Africa Accelerometer and Gyroscope Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 78: Middle East & Africa Accelerometer and Gyroscope Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 79: Middle East & Africa Accelerometer and Gyroscope Market Share Analysis, by Country, 2021 and 2031

Figure 80: Middle East & Africa Accelerometer and Gyroscope Market, Incremental Opportunity, by Country, 2021‒2031

Figure 81: South America Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 82: South America Accelerometer and Gyroscope Market Size & Forecast Volume (Million Units), 2017‒2031

Figure 83: South America Accelerometer and Gyroscope Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 84: South America Accelerometer and Gyroscope Market Projections by Type, and Value (US$ Mn), 2017‒2031

Figure 85: South America Accelerometer and Gyroscope Market Share Analysis, by Type, 2021 and 2031

Figure 86: South America Accelerometer and Gyroscope Market, Incremental Opportunity, by Type, 2021‒2031

Figure 87: South America Accelerometer and Gyroscope Market Projections by Dimension, 2017‒2031

Figure 88: South America Accelerometer and Gyroscope Market Share Analysis, by Dimension, 2021 and 2031

Figure 89: South America Accelerometer and Gyroscope Market, Incremental Opportunity, by Dimension, 2021‒2031

Figure 90: South America Accelerometer and Gyroscope Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 91: South America Accelerometer and Gyroscope Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 92: South America Accelerometer and Gyroscope Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 93: South America Accelerometer and Gyroscope Market Projections by Country and Value (US$ Mn), 2017‒2031

Figure 94: South America Accelerometer and Gyroscope Market Share Analysis, by Country, 2021 and 2031

Figure 95: South America Accelerometer and Gyroscope Market, Incremental Opportunity, by Country, 2021‒2031

Figure 96: Company Share Analysis 2021