Reports

Reports

The white coal industry is gaining momentum as companies and governments across the globe are increasingly focusing on renewable and clean sources of energy. White coal, produced by pressurizing farm waste such as husk, sawdust, and crop residue, is soon emerging as a cleaner option to conventional fossil fuels such as coal and firewood. Its major advantage is that it is carbon-neutral, low-cost, and readily available, and therefore can be utilized in power plants, industrial boilers, and cement kilns.

White coal market growth is propelled by growing carbon emission concerns, governments’ initiatives in favor of biofuels, and growing energy security needs in emerging economies. In addition, white coal offers a cost-effective way of eliminating agricultural residue, which otherwise contributes to stubble burning and consequential environmental hazard.

Industry majors are focusing on building production plants, adopting cost-efficient briquetting technologies, and forming alliances with end-use sectors to have more robust supply chains. This, combined with increased green energy benefits consciousness, is creating a favorable growth opportunity for the market.

The white coal market is defined as the industry producing and utilizing biomass briquettes derived from agricultural residues such as bagasse, husk, sawdust, and the other agricultural waste. Biomass briquettes are an eco-friendly replacement for conventional fossil fuels such as firewood, coal, and lignite. Biomass briquettes can provide a carbon-neutral source of energy.

The process of producing white coal entails the compression of biomass under high pressure with no binding agents left to create dense briquettes that have a high calorific value. These briquettes are produced in large quantities and used in industrial boilers, power plants, brick kilns, and cement factories, which have a consistent heat requirement.

White coal also helps solve some issues with waste management by making use of the agricultural by-product waste, which reduces stubble burning in the fields, and cuts down on greenhouse gas emissions. White coal is also popular with a lot of industries as it supports their use of renewable energy.

| Attribute | Detail |

|---|---|

| White Coal Market Drivers |

|

Industries around the world are facing increasing pressure to cut down on operational costs while improving sustainability performance, which is one of the motivators behind the rapid growth of white coal. As energy use is a major part of industrial spending, and especially in energy-intensive sectors such as cement, steel, brick kilns, textile, and power generation, industries are actively looking for cheaper alternatives to conventional fuels.

White coal, which is produced by briquetting agricultural waste, is a new option when compared to the other alternatives, since it is relatively inexpensive, has a better calorific value in comparison with traditional firewood and has one of the least volatile supply chains. It is also cheap for use in developing economies where coal prices are extremely variable and the cost of importing petroleum based fuels is increasing.

White coal's economic benefits aren't just restricted to replacing fuels. By converting agricultural residues that are typically burnt in the field to charcoal or electricity, companies can set up local supply chains that will ultimately lessen their dependency on costly fossil fuel imports and better shield their operations from changes in international energy markets.

This is primarily meant for lower energy costs, and also to provide the company improved supply security that is needed for continued industrial activity. Industries who decide to use white coal still have additional financial benefits related to lower emissions. Government and regulatory agencies are offering tax reductions, subsidies or carbon credits for using renewable fuels for many businesses.

White coal is largely being promoted due to governments’ programs and incentives. In general, the governments are trying to promote renewable and sustainable energy adoption by including regulations, subsidies, and financial assistance for all types of industries, to help them shift from fossil fuels to renewable sources.

The governments recognize that white coal is a carbon-neutral, cheap, and effective source of energy obtained from agricultural residues and is beneficial to the governments' climate ambitions at national and international levels. White coal is considered as an eligible renewable energy source, and industries that invest in it receive the opportunity to attain savings through tax credits, carbon credits, and discounted tariffs on renewable fuel technologies.

In several developing economies, particularly in Asia and Africa, government programs are promoting biomass-based fuels. Additionally, governments-led research and development initiatives are creating opportunities to further the technological advancements of white coal that improves efficient use and calorific value, which aids in making it more competitive relative to fossil fuels.

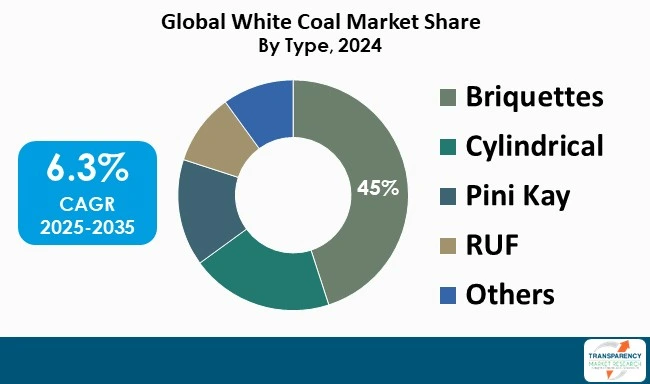

Briquettes dominate the white coal market due to their high energy density, price-value, storage advantages, versatility, which could be leveraged in many different industries as well as households. Briquettes are easier to use in boilers, kilns, and stoves due to their size and shape. There has been an increasing demand for clean, renewable, and carbon-neutral fuels, with supportive government legislations for biomass usage, which have spurred the growth and rapid expansion of briquettes around the world.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America holds the highest share of the white coal market, which is attributed to advanced energy infrastructure, government funding for renewable fuels, and industry recognition of sustainable alternatives. The continent has a history in combining briquetting technology and investments undertaken in biomass energy along with regulations that are pro-carbon neutrality. Corporate ESG commitments are increasing in many organizations along with government incentives to substitute fossil fuels with white coal for economic applications in industry and residential sectors.

Airex Energy, TorrCoal, SSGE Bio-Energy Company Ltd., and Vega Biofuels Inc. are engaged in producing bio-coal or torrefied biomass briquettes/pellets, which are carbon-neutral substitutes for traditional coal. Where conventional coal is inefficient and harmful to the environment, white coal products provide a higher energy density, higher combustion efficiency, and less emissions making them suitable for combustion applications in the industrial space for heating and cement kilns, and for generating power.

Additionally, Global Bio-Coal Energy (GBCE), NextCoal International (NCI), BMK Woods, and VIGIDAS PACK also play a major role in the consolidated white coal market, with competitive landscape governed by innovation and productivity.

| Attribute | Detail |

|---|---|

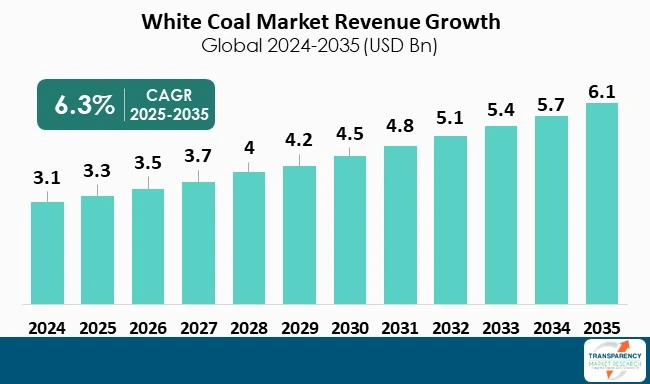

| Market Size Value in 2024 | US$ 3.1 Bn |

| Market Forecast Value in 2035 | US$ 6.1 Bn |

| Growth Rate (CAGR) | 6.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 3.1 Bn in 2024

The white coal industry is expected to grow at a CAGR of 6.3% from 2025 to 2035

Rising industrial demand for cost-effective energy alternatives and increased government incentives supporting renewable energy adoption

Briquette held the largest share under type segment in 2024

North America was the most lucrative region of the white coal market in 2024

Airex Energy, TorrCoal, ETIA SAS, Global Bio-Coal Energy (GBCE), SSGE BIO-ENERGY COMPANY LIMITED., Vega Biofuels Inc., NextCoal International (NCI), CSC Bio Coal Sdn. Bhd., BMK Woods, VIGIDAS PACK and Balaji Agro Coal Industries

Table 1 Global White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 2 Global White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 3 Global White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 4 Global White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 5 Global White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 6 Global White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 7 Global White Coal Market Volume (Tons) Forecast, by Region, 2025 to 2035

Table 8 Global White Coal Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9 North America White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 10 North America White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 11 North America White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 12 North America White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 13 North America White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 14 North America White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 15 North America White Coal Market Volume (Tons) Forecast, by Country, 2025 to 2035

Table 16 North America White Coal Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17 USA White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 18 USA White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 19 USA White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 20 USA White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 21 USA White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 22 USA White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 23 Canada White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 24 Canada White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 25 Canada White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 26 Canada White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 27 Canada White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 28 Canada White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 29 Europe White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 30 Europe White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 31 Europe White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 32 Europe White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 33 Europe White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 34 Europe White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 35 Europe White Coal Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 36 Europe White Coal Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37 Germany White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 38 Germany White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 39 Germany White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 40 Germany White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 41 Germany White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 42 Germany White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 43 France White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 44 France White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 45 France White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 46 France White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 47 France White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 48 France White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 49 UK White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 50 UK White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 51 UK White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 52 UK White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 53 UK White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 54 UK White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 55 Italy White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 56 Italy White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 57 Italy White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 58 Italy White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 59 Italy White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 60 Italy White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 61 Spain White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 62 Spain White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 63 Spain White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 64 Spain White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 65 Spain White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 66 Spain White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 67 Russia & CIS White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 68 Russia & CIS White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 69 Russia & CIS White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 70 Russia & CIS White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 71 Russia & CIS White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 72 Russia & CIS White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 73 Rest of Europe White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 74 Rest of Europe White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 75 Rest of Europe White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 76 Rest of Europe White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 77 Rest of Europe White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 78 Rest of Europe White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 79 Asia Pacific White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 80 Asia Pacific White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 81 Asia Pacific White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 82 Asia Pacific White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 83 Asia Pacific White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 84 Asia Pacific White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 85 Asia Pacific White Coal Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Asia Pacific White Coal Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 China White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 88 China White Coal Market Value (US$ Bn) Forecast, by Type 2025 to 2035

Table 89 China White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 90 China White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 91 China White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 92 China White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 93 Japan White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 94 Japan White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 95 Japan White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 96 Japan White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 97 Japan White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 98 Japan White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 99 India White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 100 India White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 101 India White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 102 India White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 103 India White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 104 India White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 105 India White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 106 India White Coal Market Value (US$ Bn) Forecast, by End-use 2025 to 2035

Table 107 ASEAN White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 108 ASEAN White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 109 ASEAN White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 110 ASEAN White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 111 ASEAN White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 112 ASEAN White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 113 Rest of Asia Pacific White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 114 Rest of Asia Pacific White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 115 Rest of Asia Pacific White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 116 Rest of Asia Pacific White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 117 Rest of Asia Pacific White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 118 Rest of Asia Pacific White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 119 Latin America White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 120 Latin America White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 121 Latin America White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 122 Latin America White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 123 Latin America White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 124 Latin America White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 125 Latin America White Coal Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 126 Latin America White Coal Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127 Brazil White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 128 Brazil White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 129 Brazil White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 130 Brazil White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 131 Brazil White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 132 Brazil White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 133 Mexico White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 134 Mexico White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 135 Mexico White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 136 Mexico White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 137 Mexico White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 138 Mexico White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 139 Rest of Latin America White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 140 Rest of Latin America White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 141 Rest of Latin America White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 142 Rest of Latin America White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 143 Rest of Latin America White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 144 Rest of Latin America White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 145 Middle East & Africa White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 146 Middle East & Africa White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 147 Middle East & Africa White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 148 Middle East & Africa White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 149 Middle East & Africa White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 150 Middle East & Africa White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 151 Middle East & Africa White Coal Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 152 Middle East & Africa White Coal Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153 GCC White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 154 GCC White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 155 GCC White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 156 GCC White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 157 GCC White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 158 GCC White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 159 South Africa White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 160 South Africa White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 161 South Africa White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 162 South Africa White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 163 South Africa White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 164 South Africa White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 165 Rest of Middle East & Africa White Coal Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 166 Rest of Middle East & Africa White Coal Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 167 Rest of Middle East & Africa White Coal Market Volume (Tons) Forecast, by Process, 2025 to 2035

Table 168 Rest of Middle East & Africa White Coal Market Value (US$ Bn) Forecast, by Process, 2025 to 2035

Table 169 Rest of Middle East & Africa White Coal Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 170 Rest of Middle East & Africa White Coal Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Figure 1 Global White Coal Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 2 Global White Coal Market Attractiveness, by Type

Figure 3 Global White Coal Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 4 Global White Coal Market Attractiveness, by Process

Figure 5 Global White Coal Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 6 Global White Coal Market Attractiveness, by End-use

Figure 7 Global White Coal Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 8 Global White Coal Market Attractiveness, by Region

Figure 9 North America White Coal Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 10 North America White Coal Market Attractiveness, by Type

Figure 11 North America White Coal Market Attractiveness, by Type

Figure 12 North America White Coal Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 13 North America White Coal Market Attractiveness, by Process

Figure 14 North America White Coal Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 15 North America White Coal Market Attractiveness, by End-use

Figure 16 North America White Coal Market Attractiveness, by Country and Sub-region

Figure 17 Europe White Coal Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 18 Europe White Coal Market Attractiveness, by Type

Figure 19 Europe White Coal Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 20 Europe White Coal Market Attractiveness, by Process

Figure 21 Europe White Coal Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 22 Europe White Coal Market Attractiveness, by End-use

Figure 23 Europe White Coal Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Europe White Coal Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific White Coal Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 26 Asia Pacific White Coal Market Attractiveness, by Type

Figure 27 Asia Pacific White Coal Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 28 Asia Pacific White Coal Market Attractiveness, by Process

Figure 29 Asia Pacific White Coal Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 30 Asia Pacific White Coal Market Attractiveness, by End-use

Figure 31 Asia Pacific White Coal Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 32 Asia Pacific White Coal Market Attractiveness, by Country and Sub-region

Figure 33 Latin America White Coal Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 34 Latin America White Coal Market Attractiveness, by Type

Figure 35 Latin America White Coal Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 36 Latin America White Coal Market Attractiveness, by Process

Figure 37 Latin America White Coal Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 38 Latin America White Coal Market Attractiveness, by End-use

Figure 39 Latin America White Coal Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Latin America White Coal Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa White Coal Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 42 Middle East & Africa White Coal Market Attractiveness, by Type

Figure 43 Middle East & Africa White Coal Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 44 Middle East & Africa White Coal Market Attractiveness, by Process

Figure 45 Middle East & Africa White Coal Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 46 Middle East & Africa White Coal Market Attractiveness, by End-use

Figure 47 Middle East & Africa White Coal Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Middle East & Africa White Coal Market Attractiveness, by Country and Sub-region