Reports

Reports

Analysts’ Viewpoint

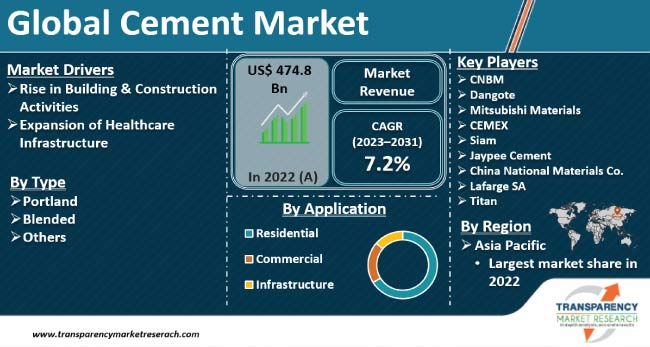

Expanding economies in Asia Pacific, such as China and India, are witnessing rapid urbanization owing to the rise in migration of the population to urban areas for better job prospects. This is driving the need for housing and infrastructure in order to accommodate migrants. Consequently, Asia Pacific is experiencing a rise in construction and infrastructure development activity, which in turn is boosting the cement market demand in the region.

Renovation, remodeling, and reconstruction activities of existing infrastructure are rising considerably in Europe and North America. This is estimated to offer significant opportunities for the cement industry growth in these regions. The healthcare sector is expanding at a notable pace across the globe; especially in the post-pandemic era. Accordingly, governments across the globe are increasing investment in the expansion of healthcare infrastructure. This need for dedicated infrastructure is expected to offer cement market opportunities for manufacturers during the forecast period.

Cement is a vital material used in the building & construction industry. It constitutes a fine powder-like substance produced using bauxite, iron ore, sand, clay, and limestone. Increase in spending on expansion of public infrastructure and non-residential buildings, including hospitals and healthcare centers, is driving the demand for cement worldwide.

Raw materials such as silica sand, clay, shale, shells, chalk, and limestone that are used for producing cement are detrimental to human health. As per the United States Environmental Protection Agency, the cement industry is the third-largest polluter, which releases more than 500 kilotons of carbon monoxide, sulfur dioxide, and nitrogen oxide, annually. Stringent regulations are being enacted to mitigate these health hazards. As per European Concrete Standard EN 206-1, cement conforming to European Concrete Standard EN 197-1 is suitable to manufacture concrete. Consequently, these regulations are likely to restrain cement market expansion in the near future.

Stringent regulations are prompting cement manufacturers to develop alternatives, such as green cement, for the construction of sustainable and eco-friendly buildings. Carbon-negative manufacturing techniques are used to produce green cement; which helps comply with pollution regulations governing its application.

In 2021, Hima Cement announced the launch of a Fundi masonry product with a lower carbon footprint that could be effectively used in mortar works, plastering, and bricklaying. The United Nations Environment Program (UNEP) mandates the utilization of environmentally sustainable products for the building & construction industry.

Major economies in Asia Pacific, such as India and China, are increasing investment in the building & construction sector to cater to the demand for housing and infrastructure owing to the increase in migration of the population to urban areas for better job prospects. According to the Migration in India report 2021, 34% of people in India moved to urban areas in search of work opportunities – business or employment. Moreover, according to the Federation of Indian Chambers of Commerce and Industry (FICCI), in 2022, under the PMAY plan, the number of constructed and sanctioned residences in metropolitan areas in India were around 5.5 million and 11.4 million, respectively.

China’s 14th Five-Year Plan focuses on new-fangled infrastructure projects in water systems, transportation, energy, and urbanization. According to the International Trade Administration, overall investment during 14th Five-Year Plan period (2021-2025) would reach US$ 4.2 Tn.

In developed economies in Europe and North America, the ongoing trend of refurbishment and renovation of old or existing infrastructure is fueling the demand for cement. The Alberta Government has reported that it had committed ~US$ 1.16 Bn to 172 such projects between 2020 and 2021. These factors are projected to positively impact the cement market forecast in the near future.

In the post-pandemic era, governments across the globe are focusing on the expansion and in upgrade of accessible healthcare infrastructure. Accordingly Healthcare Information and Management Systems Society (HIMSS) of the U.S., recommends a total investment of about US$ 36.7 Bn to modernize state, territorial, local, and tribal public health infrastructure in the U.S.

Government spending on healthcare in China has been rising for the last decade to reach US$ 822 Bn. This increase in focus on expansion of healthcare infrastructure across the globe is boosting the construction of hospitals and research facilities. This in turn is fueling the cement market development across the globe.

Asia Pacific accounts for a dominant cement market share owing to significant demand for cement from the booming building & construction sector in major economies such as India and China. According to the National Statistics Bureau of China, the construction industry in China was valued at US$ 1.2 Trn in 2022, which expanded by 4% as compared to the previous year. This boom in construction is projected to propel the cement industry size in the region in the next few years.

Europe is a major consumer of cement with the U.K., France, Germany, and Russia being prominent markets. Growth of the cement industry in the region could be attributed to an increase in the frequency of renovation of potentially risky and old structures. Furthermore, rise in demand for eco-friendly and sustainable materials is anticipated to propel the cement business in the region during the forecast period.

North America holds a significant share of the global market owing to adoption of advanced and modern practices in the construction industry, which includes 3D concrete printing and precast concrete. Moreover, governments in the region are focusing on the renovation and refurbishment of old existing infrastructure.

The construction sector in Middle East and Africa is booming due to an increase in investment in infrastructure expansion owing to growing economic and political importance of the region. Qatar is witnessing sustained inflation with construction activity carried out extensively during and post FIFA World Cup 2022.

The global market is highly consolidated with a few prominent players accounting for major market share. Renowned cement manufacturers are following the latest cement market trends and engaging in expansion of manufacturing facilities, entering into joint ventures. A few of the prominent players operating in the global market are Dangote, CNBM, Mitsubishi Materials, Jaypee Cement, Siam, CEMEX, Lafarge SA, China National Materials Co., and Titan.

Key players in the cement market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 474.8 Bn |

| Market Forecast Value in 2031 | US$ 825.1 Bn |

| Growth Rate (CAGR) | 7.2% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

The global market was valued at US$ 474.8 Bn in 2022

It is projected to grow at a CAGR of 7.2% from 2023 to 2031

Rise in building or construction activities and improvement in healthcare infrstructure

In terms of application, the residential segment held largest share in 2022

Asia Pacific is estimated to dominate during the forecast period

CNBM, Dangote, Mitsubishi Materials, CEMEX, Siam, Jaypee Cement, China National Materials Co., Lafarge SA, and Titan

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Cement Market Analysis and Forecast, 2023-2031

2.6.1. Global Cement Market Volume (Kilo Tons)

2.6.2. Global Cement Market Value (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Cement Industry

3.2. Impact on the Demand for Cement– Pre & Post Crisis

4. Production Output Analysis(Tons), 2023

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East and Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis, by Type

6.2. Price Trend Analysis by Region

7. Cement Market Analysis and Forecast, by Type, 2023-2031

7.1. Introduction and Definitions

7.2. Global Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

7.2.1. Epoxy

7.2.2. Acrylic

7.2.3. Urethanes

7.2.4. Cyanoacrylates

7.2.5. Others

7.3. Global Cement Market Attractiveness, by Type

8. Global Cement Market Analysis and Forecast, Application, 2023-2031

8.1. Introduction and Definitions

8.2. Global Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

8.2.1. Automotive

8.2.2. Building & Construction

8.2.3. Wind Energy

8.2.4. Aerospace

8.2.5. Marine

8.2.6. Others

8.3. Global Cement Market Attractiveness, by Application

9. Global Cement Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Global Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Cement Market Attractiveness, by Region

10. North America Cement Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

10.3. North America Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.4. North America Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2023-2031

10.4.1. U.S. Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

10.4.2. U.S. Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

10.4.3. Canada Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

10.4.4. Canada Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

10.5. North America Cement Market Attractiveness Analysis

11. Europe Cement Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.3. Europe Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.4. Europe Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

11.4.1. Germany Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.2. Germany. Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.3. France Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.4. France. Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.5. U.K. Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.6. U.K. Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.7. Italy Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.8. Italy Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.9. Russia & CIS Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.10. Russia & CIS Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.11. Rest of Europe Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.12. Rest of Europe Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.5. Europe Cement Market Attractiveness Analysis

12. Asia Pacific Cement Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type

12.3. Asia Pacific Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.4. Asia Pacific Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

12.4.1. China Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.2. China Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.4.3. Japan Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.4. Japan Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.4.5. India Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.6. India Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.4.7. ASEAN Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.8. ASEAN Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.4.9. Rest of Asia Pacific Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.10. Rest of Asia Pacific Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.5. Asia Pacific Cement Market Attractiveness Analysis

13. Latin America Cement Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.3. Latin America Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.4. Latin America Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

13.4.1. Brazil Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.4.2. Brazil Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

13.4.3. Mexico Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.4.4. Mexico Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

13.4.5. Rest of Latin America Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.4.6. Rest of Latin America Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

13.5. Latin America Cement Market Attractiveness Analysis

14. Middle East & Africa Cement Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.3. Middle East & Africa Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.4. Middle East & Africa Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.4.1. GCC Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.4.2. GCC Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

14.4.3. South Africa Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.4.4. South Africa Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

14.4.5. Rest of Middle East & Africa Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.4.6. Rest of Middle East & Africa Cement Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

14.5. Middle East & Africa Cement Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Structural Adhesives Company Market Share Analysis, 2023

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. CNBM

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. Dangote

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.3. Mitsubishi Materials

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.4. Jaypee Cement

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.5. Siam

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.6. CEMEX

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.7. Lafarge SA

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.8. China National Materials Co.

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.9. Titan

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 2: Global Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 3: Global Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 4: Global Cement Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 5: Global Cement Market Volume (Kilo Tons) Forecast, by Region, 2023-2031

Table 6: Global Cement Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 7: North America Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 8: North America Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 9: North America Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 10: North America Cement Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 11: North America Cement Market Volume (Kilo Tons) Forecast, by Country, 2023-2031

Table 12: North America Cement Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 13: U.S. Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 14: U.S. Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 15: U.S. Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 16: U.S. Cement Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 17: Canada Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 18: Canada Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 19: Canada Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 20: Canada Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 21: Europe Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 22: Europe Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 23: Europe Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 24: Europe Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 25: Europe Cement Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 26: Europe Cement Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 27: Germany Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 28: Germany Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 29: Germany Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 30: Germany Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 31: France Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 32: France Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 33: France Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 34: France Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 35: U.K. Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 36: U.K. Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 37: U.K. Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 38: U.K. Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 39: Italy Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 40: Italy Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 41: Italy Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 42: Italy Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 43: Spain Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 44: Spain Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 45: Spain Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 46: Spain Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 47: Russia & CIS Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 48: Russia & CIS Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 49: Russia & CIS Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 50: Russia & CIS Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 51: Rest of Europe Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 52: Rest of Europe Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 53: Rest of Europe Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 54: Rest of Europe Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 55: Asia Pacific Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 56: Asia Pacific Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 57: Asia Pacific Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 58: Asia Pacific Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 59: Asia Pacific Cement Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 60: Asia Pacific Cement Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 61: China Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 62: China Cement Market Value (US$ Bn) Forecast, by Type 2023-2031

Table 63: China Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 64: China Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 65: Japan Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 66: Japan Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 67: Japan Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 68: Japan Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 69: India Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 70: India Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 71: India Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 72: India Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 73: ASEAN Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 74: ASEAN Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 75: ASEAN Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 76: ASEAN Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 77: Rest of Asia Pacific Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 78: Rest of Asia Pacific Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 79: Rest of Asia Pacific Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 80: Rest of Asia Pacific Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 81: Latin America Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 82: Latin America Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 83: Latin America Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 84: Latin America Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 85: Latin America Cement Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 86: Latin America Cement Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 87: Brazil Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 88: Brazil Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 89: Brazil Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 90: Brazil Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 91: Mexico Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 92: Mexico Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 93: Mexico Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 94: Mexico Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 95: Rest of Latin America Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 96: Rest of Latin America Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 97: Rest of Latin America Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 98: Rest of Latin America Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 99: Middle East & Africa Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 100: Middle East & Africa Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 101: v Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 102: Middle East & Africa Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 103: Middle East & Africa Cement Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 104: Middle East & Africa Cement Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 105: GCC Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 106: GCC Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 107: GCC Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 108: GCC Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 109: South Africa Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 110: South Africa Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 111: South Africa Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 112: South Africa Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 113: Rest of Middle East & Africa Cement Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 114: Rest of Middle East & Africa Cement Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 115: Rest of Middle East & Africa Cement Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 116: Rest of Middle East & Africa Cement Market Value (US$ Bn) Forecast, by Application 2023-2031

Figure 1: Global Cement Market Volume Share Analysis, by Type, 2023, 2027, and 2031

Figure 2: Global Cement Market Attractiveness, by Type

Figure 3: Global Cement Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 4: Global Cement Market Attractiveness, by Application

Figure 5: Global Cement Market Volume Share Analysis, by Region, 2023, 2027, and 2031

Figure 6: Global Cement Market Attractiveness, by Region

Figure 7: North America Cement Market Volume Share Analysis, by Type, 2023, 2027, and 2031

Figure 8: North America Cement Market Attractiveness, by Type

Figure 9: North America Cement Market Attractiveness, by Type

Figure 10: North America Cement Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 11: North America Cement Market Attractiveness, by Application

Figure 12: North America Cement Market Attractiveness, by Country and Sub-region

Figure 13: Europe Cement Market Volume Share Analysis, by Type, 2023, 2027, and 2031

Figure 14: Europe Cement Market Attractiveness, by Type

Figure 15: Europe Cement Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 16: Europe Cement Market Attractiveness, by Application

Figure 17: Europe Cement Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 18: Europe Cement Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Cement Market Volume Share Analysis, by Type, 2023, 2027, and 2031

Figure 20: Asia Pacific Cement Market Attractiveness, by Type

Figure 21: Asia Pacific Cement Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 22: Asia Pacific Cement Market Attractiveness, by Application

Figure 23: Asia Pacific Cement Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 24: Asia Pacific Cement Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Cement Market Volume Share Analysis, by Type, 2023, 2027, and 2031

Figure 26: Latin America Cement Market Attractiveness, by Type

Figure 27: Latin America Cement Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 28: Latin America Cement Market Attractiveness, by Application

Figure 29: Latin America Cement Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 30: Latin America Cement Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Cement Market Volume Share Analysis, by Type, 2023, 2027, and 2031

Figure 32: Middle East & Africa Cement Market Attractiveness, by Type

Figure 33: Middle East & Africa Cement Market Volume Share Analysis, by Application, 2023, 2027, and 2031

Figure 34: Middle East & Africa Cement Market Attractiveness, by Application

Figure 35: Middle East & Africa Cement Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 36: Middle East & Africa Cement Market Attractiveness, by Country and Sub-region