Reports

Reports

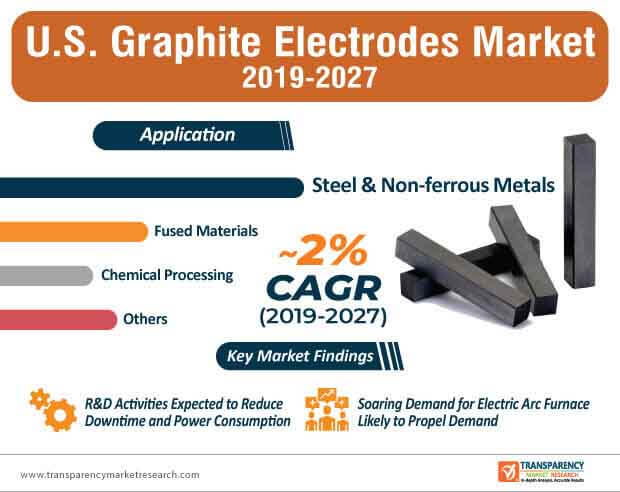

The U.S. graphite electrodes market is expected to witness steady growth during the forecast period. The consistent demand growth for graphite electrodes from various end-use industries coupled with encouraging government initiatives has played a pivotal role in boosting the prospects of the U.S. graphite electrodes market in the past few years. Moreover, the swelling demand for special steel for the production of automotive parts in the U.S. is another factor that is projected to strongly influence the growth trajectory of the market for graphite electrodes. Graphite electrodes are increasingly being used in the production of electric arc furnace (EAF) steel and an array of ferrous and non-ferrous metals.

Companies operating in the current market landscape are expected to primarily focus on the quality of their products, production technologies, pricing strategies, and sales to improve their market position. Although the cost of graphite electrodes accounts for around 1% to 5% of the overall production cost of steel, it is an important material in the EAF steel production. Furthermore, as graphite electrodes are one of the very few products that exhibit high levels of electrical conductivity and the ability to withstand high temperatures during steel production, the demand for the same is on the rise. At the back of these factors, the U.S. graphite electrodes market is set to attain a market value of ~US$ 1 Bn by the end of 2027.

The International Maritime Organization (IMO) 2020 regulations are expected to have a strong influence on the operations of participants involved in the U.S. graphite electrodes market. Stability in the prices of graphite electrodes, along with a considerable surge in supply from China over the past few years has played a key role in boosting the growth of the market for graphite electrodes in the U.S. However, new IMO regulations that are effective from 1 January 2020 are projected to have a high impact on the supply chain of needle coke supplies and prices. Amidst soaring environmental concerns, the new regulations would require ships to minimize emissions and comply with these regulations. The new regulations are expected to impact the prices of needle coke, which is one of the most vital raw materials in the production of graphite electrodes.

The fluctuating prices of needle coke due to the IMO 2020 regulations are expected to hamper the demand for graphite electrodes in the U.S. However, on the bright side, due to the minute changes in the supply structure in China, EAF has gained significant popularity, due to which, the demand for graphite electrode is anticipated to grow. The new IMO 2020 regulations are likely to exercise pressure on needle coke users, including graphite electrode manufacturers. The growth of the U.S. graphite electrodes market is anticipated to hinge its hope on the demand from steel manufacturers and market players involved in the lithium-ion battery industry.

Participants in the current U.S. graphite electrodes market are increasingly investing resources in research & development to improve the quality of their products. Additionally, the ascending interest in uplifting the overall performance of graphite electrolytes is projected to further augment the demand for graphite electrodes during the forecast period. At present, technological advancements within the U.S. graphite electrodes market are primarily aimed at improving the service life and reduce the rate of consumption. Companies are likely to continue to invest efforts and resources to launch products with improved capabilities and fulfill the requirements of their customers.

In October 2019, Hexagon Resources Limited revealed that the company had successfully completed tests that were predominantly aimed at improving the overall service life of graphite electrodes. The demand for graphite electrodes is set to grow at a steady rate due to its high thermal shock resistance. Companies in the U.S. graphite electrodes market are also expected to lower downtime, minimize carbon footprint, and manufacture cost-effective products. Companies may also offer customized products to their customers and focus on their pricing strategies to gain an edge in the current market landscape.

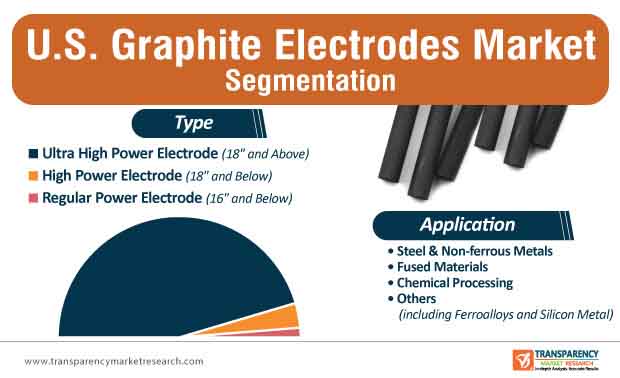

The U.S. graphite electrodes market is expected to grow at a CAGR of ~2% during the forecast period. The consistent growth in the demand for graphite electrodes from end-use industries, surge in supply from China, and government initiatives to maximize scrap utilization are some of the leading factors that are expected to drive the market for graphite electrodes in the U.S. during the forecast period. Furthermore, the ascending demand for special steel for the production of automotive components will directly impact the demand for graphite electrodes in the coming years. Market participants should focus on improving the quality of their products and simultaneously allocate funds for research and development. The growth prospects of the U.S. graphite electrodes market will continue to hinge on the demand from steel manufacturers and manufacturers of ferrous and non-ferrous metals.

U.S. Graphite Electrodes Market: Overview

Key Growth Drivers of U.S. Graphite Electrodes Market

Ultra High Power Electrodes to Offer Lucrative Opportunities in U.S. Graphite Electrodes Market

Lucrative Opportunities in U.S. Graphite Electrodes Market

Leading Players in U.S. Graphite Electrodes Market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Secondary Sources & Acronyms Used

2.3. Research Methodology

3. Executive Summary: U.S. Graphite Electrode Market

4. Market Overview

4.1. Introduction

4.2. Key Market Developments/Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. U.S. Graphite Electrode Market Analysis and Forecast, 2018–2027

4.4.1. U.S. Graphite Electrode Market Volume (Kilo Tons)

4.4.2. U.S. Graphite Electrode Market Value (US$ Mn)

4.5. Porters Five Forces Analysis

4.6. Value Chain Analysis: U.S. Graphite Electrode Market

5. U.S. Production Output Analysis

6. U.S. Import-Export Analysis (HS Code: 854511, 854519), 2015–2018

7. Pricing Analysis, 2018

8. U.S. Graphite Electrode Market Analysis and Forecast, by Type

8.1. Introduction

8.2. U.S. Graphite Electrode Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2019–2027

8.2.1. Ultra-high Power (18” and Above)

8.2.2. High power (18” and Below)

8.2.3. Regular power (16” and Below)

8.3. U.S. Graphite Electrode Market Attractiveness Analysis, by Type

9. U.S. Graphite Electrode Market Analysis and Forecast, by Application

9.1. Introduction

9.2. U.S. Graphite Electrode Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.2.1. Steel & Non-ferrous Metals

9.2.2. Fused Materials

9.2.3. Chemical Processing

9.2.4. Others

9.3. U.S. Graphite Electrode Market Attractiveness Analysis, by Application

10. Competition Landscape

10.1. U.S. Graphite Electrode Market Share Analysis, by Company, 2018

10.2. Competition Matrix

10.3. GrafTech International

10.4. Showa Denko K.K.

10.5. Tokai Carbon Co., Ltd.

10.6. Ameri-Source Specialty Products

List of Tables

Table 01: U.S. Graphite Electrode Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 02: U.S. Graphite Electrode Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 03: U.S. Graphite Electrode Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 04: U.S. Graphite Electrode Market Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 01: U.S. Graphite Electrode Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 02: U.S. Steel Production Volume (Million Tons), 2006–2018

Figure 03: U.S. Needle Coke Prices (US$/ton), 2007–2018

Figure 04: U.S. Graphite Electrode Production (Kilo Tons) Forecast, 2016–2017

Figure 05: Average Price Comparison of Graphite Electrode, by Type

Figure 06: U.S. Graphite Electrode Price Trend (US$/Ton), 2018-2027

Figure 07: U.S. Graphite Electrode Market Value Share Analysis, by Type, 2018 and 2027

Figure 08: U.S. Graphite Electrode Market Attractiveness Analysis, by Type

Figure 09: U.S. Graphite Electrode Market Value Share Analysis, by Application, 2018 and 2027

Figure 10: U.S. Graphite Electrode Market Attractiveness Analysis, by Application

Figure 11: U.S. Graphite Electrode Market Share Analysis, by Company, 2018