Reports

Reports

The coronavirus crisis has caused a slowdown in business activities in the needle coke market. Poor market sentiments have lowered the demand for goods and services, thus stalling the manufacturing activities at steel plants resulting in a decline in the use of needle coke. Manufacturers in the market are adopting the plug-and-play mode for the production of needle coke as per consumer demand. They are using contingency planning to predict uncertainties caused due to the pandemic since the risk of new COVID-19 variants is prevalent.

Thus, to stay financially afloat by adapting to fluctuating demand and supply trends, companies in the needle coke market are conducting strategic planning of their investments and debts. They are focusing on essential industries and its mission-critical projects to keep economies running during the pandemic. Manufacturers are maintaining robust supply chains with end users in the steel industry and the lithium-ion battery market.

In terms of both value and volume, Asia Pacific is taking the lead among all regions in the needle coke market. Companies in India such as HEG Ltd - a premier company of the LNJ Bhilwara group and graphite electrode manufacturer, is bullish on maximizing its production and exports on a global level. Despite having proprietary technology to produce graphite electrodes, manufacturers face volatility in prices and availability of needle coke, especially when the demand for graphite electrode gauges an upward trend. Hence, manufacturers are expecting an increase in the prices of graphite electrodes, which will help to increase business margins.

Manufacturers are increasing efforts to broaden their supply network for the production of lithium-ion batteries, specialty carbon, and in nuclear furnaces to overcome the volatility in prices for raw materials and products.

R&D investments in production technologies are gaining importance in the needle coke market. Gazprom Neft - a vertically integrated oil company engaged primarily in oil & gas explorations, announced that its needle coke production technology has been included in state pending agency; Rospatent’s annual ratings of Russia’s top-10 most important inventions. Companies in the needle coke market are taking cues from such innovations and anticipated to collaborate with specialists to advance in the production of needle coke.

Though graphite electrodes are estimated to dominate the highest revenue share among all application types in the market, the revenue of lithium-ion batteries is predicted for exponential growth during the assessment period. Patent-worthy production technologies are modernizing coking units.

Needle coke is being increasingly used to produce graphite electrodes that are consumed in steel and aluminum production furnaces. Mott Corporation - a specialist in filtration and flow control engineering, is creating awareness about their filter, which can be utilized to filter the needle coke production feedstock to remove contaminants. This ensures the consistent production of high-quality needle coke products.

Companies in the needle coke market are increasing efforts to achieve scientific and technological advancements to improve the production of graphite electrodes. Manufacturers in Russia are increasing their R&D expenditure to reduce the industry’s dependence on international supplies for needle coke and its related products. This will help Russian stakeholders to increase exports for needle coke and its products including graphite electrodes.

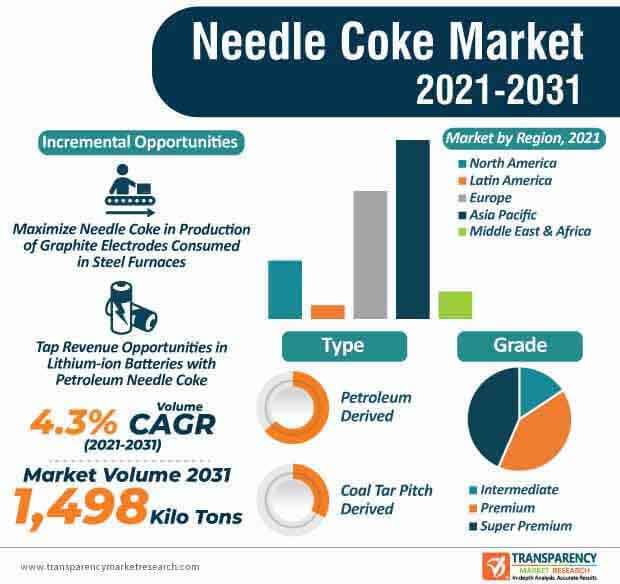

The needle coke market is expected to cross US$ 5 Bn by the end of 2031. GrafTech International Ltd. - a manufacturer of graphite electrodes and petroleum coke, is gaining recognition for one-of-its-kind standalone petroleum needle coke plant Seadrift. As such, petroleum derived needle coke is predicted to register a higher revenue and volume share as compared to coal tar pitch derived needle coke.

Companies in the needle coke market are investing in plants that are unfettered by the demand and constraints of typical oil refineries. This ensures an integrated and premium supply of petroleum derived needle coke. Sophisticated carbonization and microscopy technologies are being deployed to increase the availability of high value petroleum-based needle coke.

Calcined needle coke is used in graphite electrode manufacturing for the steel industry. However, in the past three to four years, lithium-ion batteries are emerging as the new demand center for needle coke. Manufacturers in the needle coke market are increasing their production capabilities to help end users utilize calcined needle coke for the production of carbon anode of lithium-ion batteries. These carbon anodes are emerging as an alternative to natural graphite, owing to technological advancements and quality consistency being achieved with carbon anodes.

Petroleum needle coke is preferred over coal pitch needle coke, due to its greater energy density. In this way, manufacturers in the needle coke market are unlocking revenue opportunities in lithium-ion batteries with long driving ranges and longevity.

The high quality carbon products are fueling the demand for needle coke. C-Chem Co. Ltd. - a carbon subsidiary of Nippon Steel & Sumikin Chemical Co. Ltd., is being publicized for its flagship products in high-grade pitch coke specializing in the production of synthetic graphite electrodes and specialty carbon. Companies in the needle coke market are improving their coal-based needle coke production technology to innovate in specialty carbon products that are in high demand for advanced fields such as nuclear power and semiconductor manufacturing equipment.

Specialty carbon products are being used in solar power generation. Manufacturers are procuring large volumes of raw materials to increase the availability of high value carbon material products. The abundance of raw materials ensures a stable supply of needle coke and its related products for specialty carbon materials, graphite electrodes, and for lithium-ion batteries.

Analysts’ Viewpoint

Since the graphite electrode business is dependent on the steel industry, a slowdown in the steel sector during the COVID-19 crisis has caused a negative impact in the graphite electrode sector. The needle coke market is slated to clock a modest CAGR of ~5% in terms of value during the forecast period. This is evident since availability and price fluctuations of needle coke tend to exert pressure on business margins. Hence, companies should increase their stock of raw materials and increase R&D in proprietary technologies to overcome price uncertainties linked with needle coke. Manufacturers should leverage incremental opportunities in lithium-ion batteries and specialty carbon products.

Needle Coke Market: Overview

Increase in Demand for Graphite Electrodes: Key Driver of Needle Coke Market

Rise in Usage of Lithium-ion Batteries to Drive Needle Coke Market

Graphite Electrodes Dominate Needle Coke Market

Needle Coke Market: Competition Landscape

Needle Coke Market: Key Developments

Needle Coke Market is expected to reach US$ 5 Bn By 2031

Needle Coke Market is estimated to rise at a CAGR of 5% during forecast period

The usage of needle coke in battery manufacturing industry is expected to drive the Needle Coke Market

Asia Pacific is more attractive for vendors in the Needle Coke Market

Key players of Needle Coke Market are Lanxess, Perstorp Group, Geo Specialty Chemicals, American Elements, Henan Botai Chemical Building Material Co., Ltd., and Zibo Ruibao Chemical co., LTD

1. Executive Summary

1.1. Needle Coke Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

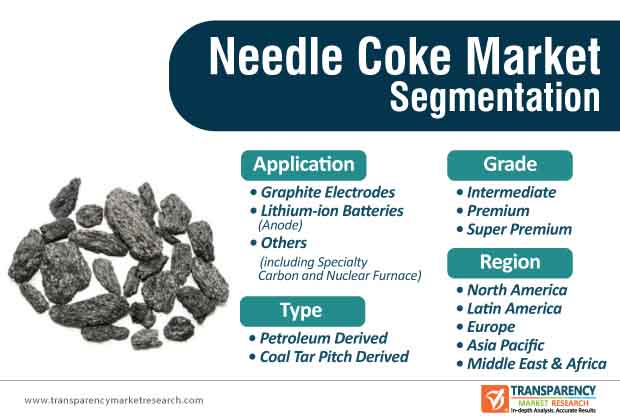

2.1. Market Segmentation

2.2. Market Definition

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Global Needle Coke Market Analysis and Forecast, 2017-2031

2.5. Porter’s Five Forces Analysis

2.6. Regulatory Landscape

2.7. Value Chain Analysis

2.7.1. List of Raw Materials Suppliers

2.7.2. List of Manufacturers

2.7.3. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis

5. Price Trend Analysis

6. Global Needle Coke Market Analysis and Forecast, by Type, 2017-2031

6.1. Introduction and Definitions

6.2. Global Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

6.2.1. Petroleum Derived

6.2.2. Coal Tar Pitch Derived

6.3. Global Needle Coke Market Attractiveness, by Type

7. Global Needle Coke Market Analysis and Forecast, by Grade, 2017-2031

7.1. Introduction and Definitions

7.2. Global Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

7.2.1. Intermediate

7.2.2. Premium

7.2.3. Super Premium

7.3. Global Needle Coke Market Attractiveness, by Grade

8. Global Needle Coke Market Analysis and Forecast, by Application, 2017-2031

8.1. Introduction and Definitions

8.2. Global Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

8.2.1. Graphite Electrodes

8.2.2. Lithium-ion Batteries (Anode)

8.2.3. Others (including Specialty Carbon and Nuclear Furnace)

8.3. Global Needle Coke Market Attractiveness, by Application

9. Global Needle Coke Market Analysis and Forecast, by Region, 2017-2031

9.1. Key Findings

9.2. Global Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Needle Coke Market Attractiveness, by Region

10. North America Needle Coke Market Analysis and Forecast, 2017-2031

10.1. Key Findings

10.2. North America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

10.3. North America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

10.4. North America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

10.5. North America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2021–2031

10.5.1. U.S. Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

10.5.2. U.S. Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

10.5.3. U.S. Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

10.5.4. Canada Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

10.5.5. Canada Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

10.5.6. Canada Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

10.6. North America Needle Coke Market Attractiveness Analysis

11. Europe Needle Coke Market Analysis and Forecast, 2017-2031

11.1. Key Findings

11.2. Europe Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

11.3. Europe Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

11.4. Europe Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

11.5. Europe Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

11.5.1. Germany Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

11.5.2. Germany Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

11.5.3. Germany Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

11.5.4. France Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

11.5.5. France Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

11.5.6. France Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

11.5.7. U.K. Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

11.5.8. U.K. Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

11.5.9. U.K. Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

11.5.10. Italy Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

11.5.11. Italy Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-203

11.5.12. Italy Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

11.5.13. Russia & CIS Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

11.5.14. Russia & CIS Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

11.5.15. Russia & CIS Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

11.5.16. Rest of Europe Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

11.5.17. Rest of Europe Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

11.5.18. Rest of Europe Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

11.6. Europe Needle Coke Market Attractiveness Analysis

12. Asia Pacific Needle Coke Market Analysis and Forecast, 2017-2031

12.1. Key Findings

12.2. Asia Pacific Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

12.3. Asia Pacific Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

12.4. Asia Pacific Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

12.5. Asia Pacific Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

12.5.1. China Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

12.5.2. China Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

12.5.3. China Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

12.5.4. Japan Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

12.5.5. Japan Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

12.5.6. Japan Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

12.5.7. India Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

12.5.8. India Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

12.5.9. India Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

12.5.10. ASEAN Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

12.5.11. ASEAN Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

12.5.12. ASEAN Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

12.5.13. Rest of Asia Pacific Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

12.5.14. Rest of Asia Pacific Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

12.5.15. Rest of Asia Pacific Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

12.6. Asia Pacific Needle Coke Market Attractiveness Analysis

13. Latin America Needle Coke Market Analysis and Forecast, 2017-2031

13.1. Key Findings

13.2. Latin America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

13.3. Latin America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

13.4. Latin America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

13.5. Latin America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

13.5.1. Brazil Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

13.5.2. Brazil Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

13.5.3. Brazil Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

13.5.4. Mexico Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

13.5.5. Mexico Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

13.5.6. Mexico Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

13.5.7. Rest of Latin America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

13.5.8. Rest of Latin America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

13.5.9. Rest of Latin America Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

13.6. Latin America Needle Coke Market Attractiveness Analysis

14. Middle East & Africa Needle Coke Market Analysis and Forecast, 2017-2031

14.1. Key Findings

14.2. Middle East & Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

14.3. Middle East & Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

14.4. Middle East & Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

14.5. Middle East & Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

14.5.1. GCC Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

14.5.2. GCC Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

14.5.3. GCC Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

14.5.4. South Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

14.5.5. South Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

14.5.6. South Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

14.5.7. Rest of Middle East & Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2017-2031

14.5.8. Rest of Middle East & Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2017-2031

14.5.9. Rest of Middle East & Africa Needle Coke Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2017-2031

14.6. Middle East & Africa Needle Coke Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Needle Coke Company Market Share Analysis, 2020

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Mitsubishi Chemical Holding Corporation

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.2. Indian Oil Corporation

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.3. Phillips 66

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.4. JXTG Holdings Inc.

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.5. Seadrift Coke L.P.

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.6. C-Chem Co.,LTD

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.7. Petroleum Coke Industries Company K.S.C

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.8. Baotailong New Material Co., Ltd.

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.9. Bao-steel Group

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.10. Sinopec Shanghai Petrochemical Company Limited

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.11. Shanxi Hongte Coal Chemical Co Ltd

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.12. Sinosteel Anshan Research Institute of Thermo-Energy Co.

15.2.12.1. Company Description

15.2.12.2. Business Overview

15.2.13. Petrochina International Jinzhou Petrochemical Co., Ltd

15.2.13.1. Company Description

15.2.13.2. Business Overview

15.2.14. Shijiazhuang Deli Chemical Co.

15.2.14.1. Company Description

15.2.14.2. Business Overview

15.2.15. PetroCokes Japan Ltd

15.2.15.1. Company Description

15.2.15.2. Business Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables:

Table 1: Global Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 2: Global Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 3: Global Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 4: Global Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 5: Global Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 6: Global Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 7: Global Needle Coke Market Volume (Kilo Tons) Forecast, by Region, 2017-2031

Table 8: Global Needle Coke Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 9: North America Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 10: North America Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 11: North America Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 12: North America Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 13: North America Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 14: North America Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 15: North America Needle Coke Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Table 16: North America Needle Coke Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 17: U.S. Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 18: U.S. Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 19: U.S. Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 20: U.S. Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 21: U.S. Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 22: U.S. Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 23: Canada Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 24: Canada Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 25: Canada Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 26: Canada Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 27: Canada Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 28: Canada Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 29: Europe Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 30: Europe Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 31: Europe Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 32: Europe Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 33: Europe Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 34: Europe Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 35: Europe Needle Coke Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017-2031

Table 36: Europe Needle Coke Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 37: Germany Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 38: Germany Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 39: Germany Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 40: Germany Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 41: Germany Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 42: Germany Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 43: U.K. Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 44: U.K. Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 45: U.K. Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 46: U.K. Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 47: U.K. Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 48: U.K. Needle Coke Market Volume Value (US$ Mn) Forecast, by Application, 2017-2031

Table 49: France Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 50: France Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 51: France Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 52: France Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 53: France Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 54: France Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 55: Italy Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 56: Italy Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 57: Italy Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 58: Italy Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 59: Italy Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 60: Italy Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 61: Russia & CIS Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 62: Russia & CIS Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 63: Russia & CIS Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 64: Russia & CIS Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 65: Russia & CIS Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 66: Russia & CIS Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 67: Rest of Europe Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 68: Rest of Europe Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 69: Rest of Europe Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 70: Rest of Europe Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 71: Rest of Europe Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 72: Rest of Europe Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 73: Asia Pacific Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 74: Asia Pacific Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 75: Asia Pacific Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 76: Asia Pacific Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 77: Asia Pacific Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 78: Asia Pacific Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 79: Asia Pacific Needle Coke Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017-2031

Table 80: Asia Pacific Needle Coke Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 81: China Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 82: China Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 83: China Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 84: China Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 85: China Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 86: China Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 87: Japan Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 88: Japan Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 89: Japan Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 90: Japan Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 91: Japan Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 92: Japan Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 93: India Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 94: India Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 95: India Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 96: India Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 97: India Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 98: India Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 99: ASEAN Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 100: ASEAN Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 101: ASEAN Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 102: ASEAN Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 103: ASEAN Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 104: ASEAN Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 105: Rest of Asia Pacific Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 106: Rest of Asia Pacific Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 107: Rest of Asia Pacific Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 108: Rest of Asia Pacific Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 109: Rest of Asia Pacific Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 110: Rest of Asia Pacific Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 111: Latin America Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 112: Latin America Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 113: Latin America Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 114: Latin America Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 115: Latin America Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 116: Latin America Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 117: Latin America Needle Coke Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017-2031

Table 118: Latin America Needle Coke Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 119: Brazil Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 120: Brazil Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 121: Brazil Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 122: Brazil Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 123: Brazil Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 124: Brazil Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 125: Mexico Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 126: Mexico Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 127: Mexico Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 128: Mexico Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 129: Mexico Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 130: Mexico Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 131: Rest of Latin America Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 132: Rest of Latin America Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 133: Rest of Latin America Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 134: Rest of Latin America Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 135: Rest of Latin America Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 136: Rest of Latin America Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 137: Middle East & Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 138: Middle East & Africa Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 139: Middle East & Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 140: Middle East & Africa Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 141: Middle East & Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 142: Middle East & Africa Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 143: Middle East & Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017-2031

Table 144: Middle East & Africa Needle Coke Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 145: GCC Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 146: GCC Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 147: GCC Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 148: GCC Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 149: GCC Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 150: GCC Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 151: South Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 152: South Africa Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 153: South Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 154: South Africa Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 155: South Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 156: South Africa Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 157: Rest of Middle East & Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Type, 2017-2031

Table 158: Rest of Middle East & Africa Needle Coke Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 159: Rest of Middle East & Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Grade, 2017-2031

Table 160: Rest of Middle East & Africa Needle Coke Market Value (US$ Mn) Forecast, by Grade, 2017-2031

Table 161: Rest of Middle East & Africa Needle Coke Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 162: Rest of Middle East & Africa Needle Coke Market Value (US$ Mn) Forecast, by Application, 2017-2031

List of Figures:

Figure 1: Global Needle Coke Market Analysis, by Type, 2017, 2025, and 2031

Figure 2: Global Needle Coke Market Attractiveness, by Type

Figure 3: Global Needle Coke Market Analysis, by Grade, 2017, 2025, and 2031

Figure 4: Global Needle Coke Market Attractiveness, by Grade

Figure 5: Global Needle Coke Market Share Analysis, by Application, 2017, 2025, and 2031

Figure 6: Global Needle Coke Market Attractiveness, by Application

Figure 7: Global Needle Coke Market Share Analysis, by Region, 2017, 2025, and 2031

Figure 8: Global Needle Coke Market Attractiveness, by Region

Figure 9: North America Needle Coke Market Share Analysis, by Type, 2017, 2025, and 2031

Figure 10: North America Needle Coke Market Attractiveness, by Type

Figure 11: North America Needle Coke Market Share Analysis, by Grade, 2017, 2025, and 2031

Figure 12: North America Needle Coke Market Attractiveness, by Grade

Figure 13: North America Needle Coke Market Share Analysis, by Application, 2017, 2025, and 2031

Figure 14: North America Needle Coke Market Attractiveness, by Application

Figure 15: North America Needle Coke Market Share Analysis, by Country, 2017, 2025, and 2031

Figure 16: North America Needle Coke Market Attractiveness, by Country

Figure 17: Europe Needle Coke Market Share Analysis, by Type, 2017, 2025, and 2031

Figure 18: Europe Needle Coke Market Attractiveness, by Type

Figure 19: Europe Needle Coke Market Share Analysis, by Grade, 2017, 2025, and 2031

Figure 20: Europe Needle Coke Market Attractiveness, by Grade

Figure 21: Europe Needle Coke Market Share Analysis, by Application, 2017, 2025, and 2031

Figure 22: Europe Needle Coke Market Attractiveness, by Application

Figure 23: Europe Needle Coke Market Share Analysis, by Country and Sub-region, 2017, 2025, and 2031

Figure 24: Europe Needle Coke Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Needle Coke Market Share Analysis, by Type, 2017, 2025, and 2031

Figure 26: Asia Pacific Needle Coke Market Attractiveness, by Type

Figure 27: Asia Pacific Needle Coke Market Share Analysis, by Grade, 2017, 2025, and 2031

Figure 28: Asia Pacific Needle Coke Market Attractiveness, by Grade

Figure 29: Asia Pacific Needle Coke Market Share Analysis, by Application, 2017, 2025, and 2031

Figure 30: Asia Pacific Needle Coke Market Attractiveness, by Application

Figure 31: Asia Pacific Needle Coke Market Share Analysis, by Country and Sub-region, 2017, 2025, and 2031

Figure 32: Asia Pacific Needle Coke Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Needle Coke Market Share Analysis, by Type, 2017, 2025, and 2031

Figure 34: Latin America Needle Coke Market Attractiveness, by Type

Figure 35: Latin America Needle Coke Market Share Analysis, by Grade, 2017, 2025, and 2031

Figure 36: Latin America Needle Coke Market Attractiveness, by Grade

Figure 37: Latin America Needle Coke Market Share Analysis, by Application, 2017, 2025, and 2031

Figure 38: Latin America Needle Coke Market Attractiveness, by Application

Figure 39: Latin America Needle Coke Market Share Analysis, by Country and Sub-region, 2017, 2025, and 2031

Figure 40: Latin America Needle Coke Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Needle Coke Market Share Analysis, by Type, 2017, 2025, and 2031

Figure 42: Middle East & Africa Needle Coke Market Attractiveness, by Type

Figure 43: Middle East & Africa Needle Coke Market Share Analysis, by Grade, 2017, 2025, and 2031

Figure 44: Middle East & Africa Needle Coke Market Attractiveness, by Grade

Figure 45: Middle East & Africa Needle Coke Market Share Analysis, by Application, 2017, 2025, and 2031

Figure 46: Middle East & Africa Needle Coke Market Attractiveness, by Application

Figure 47: Middle East & Africa Needle Coke Market Share Analysis, by Country and Sub-region, 2017, 2025, and 2031

Figure 48: Middle East & Africa Needle Coke Market Attractiveness, by Country and Sub-region