Reports

Reports

Therapeutic ultrasound is being linked to the treatment of COVID-19 pneumonia. Giovanni Durando, a technologist from the National Institute for Metrological Research (INRIM) has been working closely with neurosurgeon Francesco Prada from the Istituto Neurologico Carlo Besta to gain findings about low-intensity ultrasound treatment for COVID-19 pneumonia. Such research studies are translating into revenue opportunities for companies in the ultrasound devices market now and in the future.

The low-intensity ultrasound treatment is being referred to as a therapy for interstitial pneumonia, which is found to be affecting some of the patients who have tested positive for coronavirus. This has led to the popularity of low-intensity ultrasound treatment of pulmonary pathology. Stakeholders in the global ultrasound market are taking advantage of this opportunity to gain a strong research base for ultrasound therapy in order to treat inflamed lung tissues, which become fibrotic due to interstitial pneumonia that affects patients.

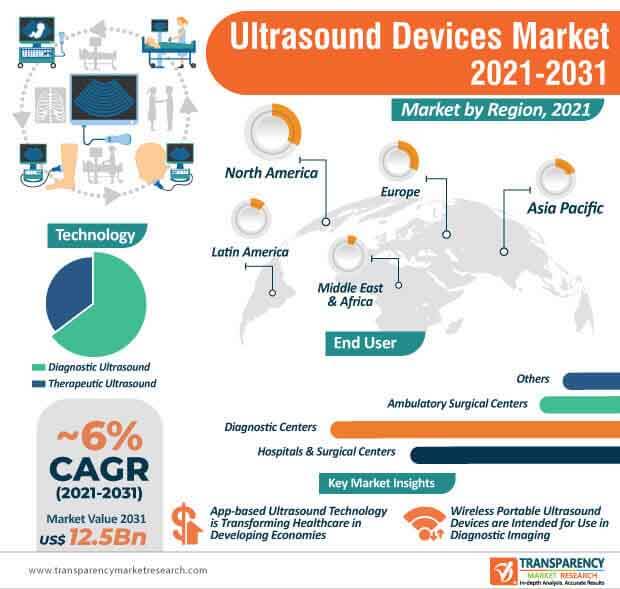

The global ultrasound devices market is expected to surpass the US$ 12.5 Bn mark by 2031. However, regulatory science gaps and challenges as stated by the Food & Drug Administration (FDA) such as lack of acoustic & thermal measurement and simulation techniques for therapeutic ultrasound device output characterization are affecting the market growth. Hence, the U.S. Food & Drug Administration is creating awareness about Therapeutic Ultrasound Program Activities such as techniques for measurement of ultrasound power accurately over all frequencies of regulatory interest.

The innovative app-based handheld ultrasound technology is empowering healthcare professionals to gain diagnostic insight for point-of-care (POC) treatment and is gaining prominence in the emergency department (E.D). The Philips Lumify, a one-of-its-kind app-based handheld ultrasound is gaining popularity for the 2020 IEEE Spectrum Technology in the Service of Society Award since the technology is benefitting E.D. in hospitals of remote villages. This explains why the ultrasound devices market is estimated to advance at a healthy CAGR of ~6% during the assessment period.

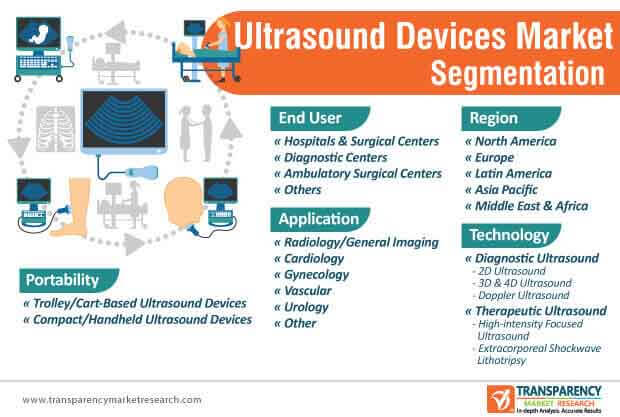

The app-based handheld ultrasound technology holds the promising potential to transform healthcare by generating diagnostic images with the help of an ultrasound transducer that is connected to a smartphone or a tablet.

Although trolley or cart-based ultrasound devices are likely to dominate a high revenue share, the demand for compact or handheld ultrasound devices in the ultrasound devices market is projected to grow at an exponential rate during the forecast period. This is evident since GE Healthcare - a subsidiary of U.S. multinational conglomerate General Electric, has announced its first wireless portable ultrasound device Vscan Air, which is intended for use in diagnostic ultrasound imaging and fluid flow analysis.

In order to bolster their credibility credentials, med-tech companies in the ultrasound market are increasing their R&D muscle to gain FDA clearance for handheld devices. They are increasing efforts to develop battery-powered handheld ultrasound devices with two-sided probe designs for quick swapping between shallow and deep exams.

Ultrasound devices have the potential to treat chronic wounds. Significant innovations in wound care are contributing to the growth of the ultrasound devices business, as companies are collaborating with researchers to innovate in ultrasound debridement technology. This has led to advancements in non-contact low-frequency (NCLF) ultrasound, which demonstrates the potential of ultrasound debridement to effectively remove devitalized tissue, alleviate pain, and control bio-burden caused by chronic wounds.

Since chronic wounds lead to considerable morbidity and utilize significant healthcare resources, manufacturers in the ultrasound devices market are increasing the availability of ultrasound debridement technology, which is effective in expediting the healing process of wounds.

Analysts’ Viewpoint

POC ultrasound has acquired importance in the toolkit of clinicians to facilitate fast assessment of pulmonary symptoms of the disease, while minimizing the spread of the novel coronavirus. The app-based handheld ultrasound technology is gaining popularity in rural community settings to increase access to real-time clinical information. However, lack of regulatory tools for manufacturers to provide appropriate thermal safety data has limited the progress of the ultrasound devices market. Hence, manufacturers in the global market for ultrasound devices are gaining knowledge about FDA’s Therapeutic Ultrasound Program Activities that help to establish standards and guidance for thermal safety of therapeutic ultrasound devices. Manufacturers are increasing the availability for dual-headed probe design in wireless and portable ultrasound devices to help users quickly store and share auto-anonymized images.

The ultrasound market is expected to surpass the US$ 12.5 Bn mark by 2031

The global market for ultrasound devices is projected to expand at a CAGR of 6% from 2021 to 2031

The global market for ultrasound devices is driven by a rise in the prevalence of chronic diseases and technological advancements and new product launches in ultrasound systems

North America dominated the global market for ultrasound devices and the trend is anticipated to continue during the forecast period

Key players operating in the global market include GE Healthcare, Koninklijke Philips N.V, Canon Medical Systems Corporation, Hitachi Ltd., Siemens Healthineers

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Ultrasound Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ultrasound Devices Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Top 3 players operating in the market space

5.2. Key Industry Events (mergers, acquisitions, partnerships, collaborations, etc.)

5.3. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

5.4. Regulatory Scenario, by Region/globally

5.5. Porter's Five Forces

6. Global Ultrasound Devices Market Analysis and Forecast, by Technology

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Technology, 2017–2031

6.3.1. Diagnostic Ultrasound

6.3.1.1. 2D Ultrasound

6.3.1.2. 3D & 4D Ultrasound

6.3.1.3. Doppler Ultrasound

6.3.2. Therapeutic Ultrasound

6.3.2.1. High-intensity Focused Ultrasound

6.3.2.2. Extracorporeal Shockwave Lithotripsy

6.4. Market Attractiveness Analysis, by Technology

7. Global Ultrasound Devices Market Analysis and Forecast, by Portability

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Portability, 2017–2031

7.3.1. Trolley/Cart-Based Ultrasound Devices

7.3.2. Compact/Handheld Ultrasound Devices

7.4. Market Attractiveness Analysis, by Portability

8. Global Ultrasound Devices Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Radiology/General Imaging

8.3.2. Cardiology

8.3.3. Gynecology

8.3.4. Vascular

8.3.5. Urology

8.3.6. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Ultrasound Devices Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospital & Surgical Centers

9.3.2. Diagnostic Centers

9.3.3. Ambulatory Surgical Centers

9.3.4. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Ultrasound Devices Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Country/Region

11. North America Ultrasound Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Technology, 2017–2031

11.2.1. Diagnostic Ultrasound

11.2.1.1. 2D Ultrasound

11.2.1.2. 3D & 4D Ultrasound

11.2.1.3. Doppler Ultrasound

11.2.2. Therapeutic Ultrasound

11.2.2.1. High-intensity Focused Ultrasound

11.2.2.2. Extracorporeal Shockwave Lithotripsy

11.3. Market Value Forecast, by Portability, 2017–2031

11.3.1. Trolley/Cart-Based Ultrasound Devices

11.3.2. Compact/Handheld Ultrasound Devices

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Radiology/General Imaging

11.4.2. Cardiology

11.4.3. Gynecology

11.4.4. Vascular

11.4.5. Urology

11.4.6. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospital & Surgical Centers

11.5.2. Diagnostic Centers

11.5.3. Ambulatory Surgical Centers

11.5.4. Others

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Technology

11.7.2. By Portability

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Ultrasound Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Technology, 2017–2031

12.2.1. Diagnostic Ultrasound

12.2.1.1. 2D Ultrasound

12.2.1.2. 3D & 4D Ultrasound

12.2.1.3. Doppler Ultrasound

12.2.2. Therapeutic Ultrasound

12.2.2.1. High-intensity Focused Ultrasound

12.2.2.2. Extracorporeal Shockwave Lithotripsy

12.3. Market Value Forecast, by Portability, 2017–2031

12.3.1. Trolley/Cart-Based Ultrasound Devices

12.3.2. Compact/Handheld Ultrasound Devices

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Radiology/General Imaging

12.4.2. Cardiology

12.4.3. Gynecology

12.4.4. Vascular

12.4.5. Urology

12.4.6. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospital & Surgical Centers

12.5.2. Diagnostic Centers

12.5.3. Ambulatory Surgical Centers

12.5.4. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Technology

12.7.2. By Portability

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Ultrasound Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Technology, 2017–2031

13.2.1. Diagnostic Ultrasound

13.2.1.1. 2D Ultrasound

13.2.1.2. 3D & 4D Ultrasound

13.2.1.3. Doppler Ultrasound

13.2.2. Therapeutic Ultrasound

13.2.2.1. High-intensity Focused Ultrasound

13.2.2.2. Extracorporeal Shockwave Lithotripsy

13.3. Market Value Forecast, by Portability, 2017–2031

13.3.1. Trolley/Cart-Based Ultrasound Devices

13.3.2. Compact/Handheld Ultrasound Devices

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Radiology/General Imaging

13.4.2. Cardiology

13.4.3. Gynecology

13.4.4. Vascular

13.4.5. Urology

13.4.6. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospital & Surgical Centers

13.5.2. Diagnostic Centers

13.5.3. Ambulatory Surgical Centers

13.5.4. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Technology

13.7.2. By Portability

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Ultrasound Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Technology, 2017–2031

14.2.1. Diagnostic Ultrasound

14.2.1.1. 2D Ultrasound

14.2.1.2. 3D & 4D Ultrasound

14.2.1.3. Doppler Ultrasound

14.2.2. Therapeutic Ultrasound

14.2.2.1. High-intensity Focused Ultrasound

14.2.2.2. Extracorporeal Shockwave Lithotripsy

14.3. Market Value Forecast, by Portability, 2017–2031

14.3.1. Trolley/Cart-Based Ultrasound Devices

14.3.2. Compact/Handheld Ultrasound Devices

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Radiology/General Imaging

14.4.2. Cardiology

14.4.3. Gynecology

14.4.4. Vascular

14.4.5. Urology

14.4.6. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospital & Surgical Centers

14.5.2. Diagnostic Centers

14.5.3. Ambulatory Surgical Centers

14.5.4. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Technology

14.7.2. By Portability

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Ultrasound Devices Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Technology, 2017–2031

15.2.1. Diagnostic Ultrasound

15.2.1.1. 2D Ultrasound

15.2.1.2. 3D & 4D Ultrasound

15.2.1.3. Doppler Ultrasound

15.2.2. Therapeutic Ultrasound

15.2.2.1. High-intensity Focused Ultrasound

15.2.2.2. Extracorporeal Shockwave Lithotripsy

15.3. Market Value Forecast, by Portability, 2017–2031

15.3.1. Trolley/Cart-Based Ultrasound Devices

15.3.2. Compact/Handheld Ultrasound Devices

15.4. Market Value Forecast, by Application, 2017–2031

15.4.1. Radiology/General Imaging

15.4.2. Cardiology

15.4.3. Gynecology

15.4.4. Vascular

15.4.5. Urology

15.4.6. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Hospital & Surgical Centers

15.5.2. Diagnostic Centers

15.5.3. Ambulatory Surgical Centers

15.5.4. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Technology

15.7.2. By Portability

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Share Analysis, by Company, 2020

16.2. Company Profiles

16.2.1. GE Healthcare

16.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.1.2. Product Portfolio

16.2.1.3. SWOT Analysis

16.2.1.4. Strategic Overview

16.2.2. Koninklijke Philips N.V.

16.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.2.2. Product Portfolio

16.2.2.3. SWOT Analysis

16.2.2.4. Strategic Overview

16.2.3. Canon Medical Systems Corporation

16.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.3.2. Product Portfolio

16.2.3.3. SWOT Analysis

16.2.3.4. Strategic Overview

16.2.4. Hitachi Ltd.

16.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.4.2. Product Portfolio

16.2.4.3. SWOT Analysis

16.2.4.4. Strategic Overview

16.2.5. Siemens Healthineers

16.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.5.2. Product Portfolio

16.2.5.3. SWOT Analysis

16.2.5.4. Strategic Overview

16.2.6. Mindray Medical International Limited

16.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.6.2. Product Portfolio

16.2.6.3. SWOT Analysis

16.2.6.4. Strategic Overview

16.2.7. Samsung Medison Co., Ltd.

16.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.7.2. Product Portfolio

16.2.7.3. SWOT Analysis

16.2.7.4. Strategic Overview

16.2.8. Fujifilm Holdings Corporation

16.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.8.2. Product Portfolio

16.2.8.3. SWOT Analysis

16.2.8.4. Strategic Overview

16.2.9. Esaote SpA

16.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.9.2. Product Portfolio

16.2.9.3. SWOT Analysis

16.2.9.4. Strategic Overview

16.2.10. Neusoft Corporation

16.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.10.2. Product Portfolio

16.2.10.3. SWOT Analysis

16.2.10.4. Strategic Overview

16.2.11. CHISON Medical Technologies Co., Ltd.

16.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.11.2. Product Portfolio

16.2.11.3. SWOT Analysis

16.2.11.4. Strategic Overview

16.2.12. Konica Minolta, Inc.

16.2.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.12.2. Product Portfolio

16.2.12.3. SWOT Analysis

16.2.12.4. Strategic Overview

16.2.13. Hologic, Inc.

16.2.13.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.13.2. Product Portfolio

16.2.13.3. SWOT Analysis

16.2.13.4. Strategic Overview

16.2.14. Shantou Institute of Ultrasonic Instruments Co., Ltd.

16.2.14.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.14.2. Product Portfolio

16.2.14.3. SWOT Analysis

16.2.14.4. Strategic Overview

16.2.15. Terason

16.2.15.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.15.2. Product Portfolio

16.2.15.3. SWOT Analysis

16.2.15.4. Strategic Overview

16.2.16. Analogic Corporation

16.2.16.1. Company Overview (HQ, Business Segments, Employee Strength)

16.2.16.2. Product Portfolio

16.2.16.3. SWOT Analysis

16.2.16.4. Strategic Overview

List of Tables

Table 01: Global Ultrasound Devices Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 02: Global Ultrasound Devices Market Value (US$ Mn) Forecast, by Diagnostic Ultrasound Technology, 2017–2031

Table 03: Global Ultrasound Devices Market Value (US$ Mn) Forecast, by Therapeutic Ultrasound Technology, 2017–2031

Table 04: Global Ultrasound Devices Market Value (US$ Mn) Forecast, by Portability, 2017–2031

Table 05: Global Ultrasound Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 06: Global Ultrasound Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Global Ultrasound Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 08: North America Ultrasound Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: North America Ultrasound Devices Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 10: North America Ultrasound Devices Market Value (US$ Mn) Forecast, by Diagnostic Ultrasound Technology, 2017–2031

Table 11: North America Ultrasound Devices Market Value (US$ Mn) Forecast, by Therapeutic Ultrasound

Table 12: North America Ultrasound Devices Market Value (US$ Mn) Forecast, by Portability, 2017–2031

Table 13: North America Ultrasound Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 14: North America Ultrasound Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Europe Ultrasound Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Europe Ultrasound Devices Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 17: Europe Ultrasound Devices Market Value (US$ Mn) Forecast, by Diagnostic Ultrasound Technology, 2017–2031

Table 18: Europe Ultrasound Devices Market Value (US$ Mn) Forecast, by Therapeutic Ultrasound Technology, 2017–2031

Table 19: Europe Ultrasound Devices Market Value (US$ Mn) Forecast, by Portability, 2017–2031

Table 20: Europe Ultrasound Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 21: Europe Ultrasound Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 22: Asia Pacific Ultrasound Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 23: Asia Pacific Ultrasound Devices Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 24: Asia Pacific Ultrasound Devices Market Value (US$ Mn) Forecast, by Diagnostic Ultrasound Technology, 2017–2031

Table 25: Asia Pacific Ultrasound Devices Market Value (US$ Mn) Forecast, by Therapeutic Ultrasound

Table 26: Asia Pacific Ultrasound Devices Market Value (US$ Mn) Forecast, by Portability, 2017–2031

Table 27: Asia Pacific Ultrasound Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 28: Asia Pacific Ultrasound Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 29: Latin America Ultrasound Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 30: Latin America Ultrasound Devices Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 31: Latin America Ultrasound Devices Market Value (US$ Mn) Forecast, by Diagnostic Ultrasound Technology, 2017–2031

Table 32: Latin America Ultrasound Devices Market Value (US$ Mn) Forecast, by Therapeutic Ultrasound

Table 33: Latin America Ultrasound Devices Market Value (US$ Mn) Forecast, by Portability, 2017–2031

Table 34: Latin America Ultrasound Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 35: Latin America Ultrasound Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 36: Middle East & Africa Ultrasound Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 37: Middle East and Africa Ultrasound Devices Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 38: Middle East and Africa Ultrasound Devices Market Value (US$ Mn) Forecast, by Diagnostic Ultrasound Technology, 2017–2031

Table 39: Middle East and Africa Ultrasound Devices Market Value (US$ Mn) Forecast, by Therapeutic Ultrasound Technology, 2017–2031

Table 40: Middle East and Africa Ultrasound Devices Market Value (US$ Mn) Forecast, by Portability, 2017–2031

Table 41: Middle East and Africa Ultrasound Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 42: Middle East and Africa Ultrasound Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Ultrasound Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Ultrasound Devices Market Value Share, by Technology, 2020

Figure 03: Global Ultrasound Devices Market Value Share, by Portability, 2020

Figure 04: Global Ultrasound Devices Market Value Share, by End-user, 2020

Figure 05: Global Ultrasound Devices Market Value Share, by Region, 2020

Figure 06: Global Ultrasound Devices Market Value Share, by Application, 2020

Figure 07: Global Ultrasound Devices Market Value Share Analysis, by Technology, 2020 and 2031

Figure 08: Global Ultrasound Devices Market Attractiveness Analysis, by Technology, 2021–2031

Figure 09: Global Ultrasound Devices Market Value (US$ Mn), by Diagnostic Ultrasound Devices Technology, 2017–2031

Figure 10: Global Ultrasound Devices Market Value (US$ Mn), by Therapeutic Ultrasound Devices Technology, 2017–2031

Figure 11: Global Ultrasound Devices Market Value Share Analysis, by Portability, 2020 and 2031

Figure 12: Global Ultrasound Devices Market Attractiveness Analysis, by Portability, 2021–2031

Figure 13: Global Ultrasound Devices Market Value (US$ Mn), by Trolley/Cart-Based Ultrasound Devices, 2017–2031

Figure 14: Global Ultrasound Devices Market Value (US$ Mn), by Compact/Handheld Ultrasound Devices, 2017–2031

Figure 15: Global Ultrasound Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 16: Global Ultrasound Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 17: Global Ultrasound Devices Market Value (US$ Mn), by Radiology/General Imaging, 2017–2031

Figure 18: Global Ultrasound Devices Market Value (US$ Mn), by Cardiology, 2017–2031

Figure 19: Global Ultrasound Devices Market Value (US$ Mn), by Gynecology, 2017–2031

Figure 20: Global Ultrasound Devices Market Value (US$ Mn), by Vascular, 2017–2031

Figure 21: Global Ultrasound Devices Market Value (US$ Mn), by Urology, 2017–2031

Figure 22: Global Ultrasound Devices Market Value (US$ Mn), by Others, 2017–2031

Figure 23: Global Ultrasound Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 24: Global Ultrasound Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 25: Global Ultrasound Devices Market Value (US$ Mn), by Hospital & Surgical Centers, 2017–2031

Figure 26: Global Ultrasound Devices Market Value (US$ Mn), by Specialty Clinics, 2017–2031

Figure 27: Global Ultrasound Devices Market Value (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 28: Global Ultrasound Devices Market Value (US$ Mn), by Others, 2017–2031

Figure 29: Global Ultrasound Devices Market Value Share Analysis, by Region, 2020 and 2031

Figure 30: Global Ultrasound Devices Market Attractiveness Analysis, by Region, 2021–2031

Figure 31: North America Ultrasound Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 32: North America Ultrasound Devices Market Value Share, by Country, 2020–2031

Figure 33: North America Ultrasound Devices Market Attractiveness Analysis, by Country, 2021–2031

Figure 34: North America Ultrasound Devices Market Value Share Analysis, by Technology, 2020 and 2031

Figure 35: North America Ultrasound Devices Market Attractiveness Analysis, by Technology, 2021–2031

Figure 36: North America Ultrasound Devices Market Value Share Analysis, by Portability, 2020 and 2031

Figure 37: North America Ultrasound Devices Market Attractiveness Analysis, by Portability, 2021–2031

Figure 38: North America Ultrasound Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 39: North America Ultrasound Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 40: North America Ultrasound Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 41: North America Ultrasound Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 42: Europe Ultrasound Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 43: Europe Ultrasound Devices Market Value Share, by Country/Sub-region, 2020–2031

Figure 44: Europe Ultrasound Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 45: Europe Ultrasound Devices Market Value Share Analysis, by Technology, 2020 and 2031

Figure 46: Europe Ultrasound Devices Market Attractiveness Analysis, by Technology, 2021–2031

Figure 47: Europe Ultrasound Devices Market Value Share Analysis, by Portability, 2020 and 2031

Figure 48: Europe Ultrasound Devices Market Attractiveness Analysis, by Portability, 2021–2031

Figure 49: Europe Ultrasound Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 50: Europe Ultrasound Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 51: Europe Ultrasound Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 52: Europe Ultrasound Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 53: Asia Pacific Ultrasound Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 54: Asia Pacific Ultrasound Devices Market Value Share, by Country/Sub-region, 2020–2031

Figure 55: Asia Pacific Ultrasound Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 56: Asia Pacific Ultrasound Devices Market Value Share Analysis, by Technology, 2020 and 2031

Figure 57: Asia Pacific Ultrasound Devices Market Attractiveness Analysis, by Technology, 2021–2031

Figure 58: Asia Pacific Ultrasound Devices Market Value Share Analysis, by Portability, 2020 and 2031

Figure 59: Asia Pacific Ultrasound Devices Market Attractiveness Analysis, by Portability, 2021–2031

Figure 60: Asia Pacific Ultrasound Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 61: Asia Pacific Ultrasound Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 62: Asia Pacific Ultrasound Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 63: Asia Pacific Ultrasound Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 64: Latin America Ultrasound Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 65: Latin America Ultrasound Devices Market Value Share, by Country/Sub-region, 2020–2031

Figure 66: Latin America Ultrasound Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 67: Latin America Ultrasound Devices Market Value Share Analysis, by Technology, 2020 and 2031

Figure 68: Latin America Ultrasound Devices Market Attractiveness Analysis, by Technology, 2021–2031

Figure 69: Latin America Ultrasound Devices Market Value Share Analysis, by Portability, 2020 and 2031

Figure 70: Latin America Ultrasound Devices Market Attractiveness Analysis, by Portability, 2021–2031

Figure 71: Latin America Ultrasound Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 72: Latin America Ultrasound Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 73: Latin America Ultrasound Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 74: Latin America Ultrasound Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 75: Middle East & Africa Ultrasound Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 76: Middle East & Africa Ultrasound Devices Market Value Share, by Country/Sub-region, 2020–2031

Figure 77: Middle East & Africa Ultrasound Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 78: Middle East and Africa Ultrasound Devices Market Value Share Analysis, by Technology, 2020 and 2031

Figure 79: Middle East and Africa Ultrasound Devices Market Attractiveness Analysis, by Technology, 2021–2031

Figure 80: Middle East and Africa Ultrasound Devices Market Value Share Analysis, by Portability, 2020 and 2031

Figure 81: Middle East and Africa Ultrasound Devices Market Attractiveness Analysis, by Portability, 2021–2031

Figure 82: Middle East and Africa Ultrasound Devices Market Value Share Analysis, by Application, 2020 and 2031

Figure 83: Middle East and Africa Ultrasound Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 84: Middle East and Africa Ultrasound Devices Market Value Share Analysis, by End-user, 2020 and 2031

Figure 85: Middle East and Africa Ultrasound Devices Market Attractiveness Analysis, by End-user, 2021–2031

Figure 86: Global Ultrasound Devices Market Share, by Company, 2020