Reports

Reports

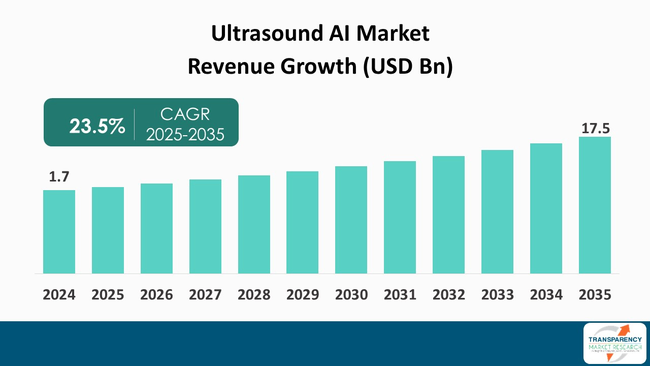

The global Ultrasound AI Market size was valued at US $ 1.7 billion in 2024 and is projected to reach US $ 17.5 billion by 2035, expanding at a CAGR of 23.5% from 2025 to 2035. The market growth is driven by increasing demand for diagnostic imaging and rising adoption of point-of-care ultrasound.

The ultrasound AI market is expected to witness a staggering CAGR during the forecast period. This could be credited to the fact that AI-powered ultrasound technology facilitates diagnosis and speeds up the work; hence, human error is less likely to happen when reading the output images. AI algorithms are capable of processing large amounts of ultrasound data within a very short time, and thus the insights that they generate are helpful and up-to-date decision making is possible by healthcare professionals.

Additionally, there is an increasing preference for non-invasive diagnostic methods, which is a result of the patient-centered care approach that has been gaining popularity, and the continuous demand for cost-effective solutions. An AI-enabled ultrasound device can be the provider of a good imaging service and at the same time, the operational costs will be lowered, thus healthcare organizations will be more willing to invest in such instruments as they can make resources work more efficiently.

Ultrasound AI denotes the incorporation of artificial intelligence (AI) technologies with ultrasound imaging, thus changing the way medical practitioners diagnose and monitor diseases. The new method applies machine learning algorithms and deep learning methods to medical ultrasound, thereby resulting in faster and more accurate interpretations.

Image analysis, which is automated in Ultrasound AI, reduces the load of the radiologists and sonographers, and thus the latter can concentrate on the more complex and difficult cases that require the level of human expertise.

This technique improves diagnosis by locating the regularities and deviations even if they are too subtle for the human eye, hence, saving lives. The use of Ultrasound AI is not limited to only one field of medicine. It, in fact, helps in detection of congenital abnormalities in fetuses in pediatrics, cardiac diseases in cardiological areas, and joint disorders in Musculoskeletal imaging, to name a few.

Besides, the combination of AI technology's capabilities with the traditionally safe ultrasound method results in a quicker as well as more affordable way of diagnosis, thus, a healthcare institution aiming for an efficient operation will most likely opt for this method.

The adoption of ultrasound AI is gaining momentum with fewer regulatory challenges for AI-assisted ultrasound machines and the healthcare systems moving toward digital transformation.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The rising need for diagnostic imaging to the point is one of the major factors that contributes to the growth of the ultrasound AI industry. As healthcare systems are making efforts globally to improve patient outcomes, the demand for correct and fast diagnostics has become the most important thing.

Among the different imaging techniques, the use of ultrasound, which is a non-invasive method and gives results instantly, is witnessing steadiness.

Furthermore, the increased geriatric population and the widespread chronic diseases are the main factors behind use in healthcare, which is the main reason behind the loud demand for different diagnostic imaging procedures.

Moreover, this trend can be seen in obstetrics, cardiology, and emergency medicine, whereby ultrasound is an indispensable tool for the evaluation of patients. AI-powered ultrasound machines can perform complex image processing tasks to keep technologists and physicians updated while at the same time reducing the potential for mistakes in human judgment and also expediting decision-making.

On top of that, the commitment to the early detection of diseases has become the main factor for healthcare systems to be more open to adopting advanced imaging solutions. Hence, the demand for fast and precise diagnostic imaging solutions in different medical disciplines is the major driver to the ultrasound AI market to be forthcoming with a strong and consistent expansion over the period of time.

POCUS means ultrasound imaging that is done right at the patient's bedside or the closest possible location to the patient, thus giving the doctor immediate diagnostic insights and helping him/her in his/her in rapid decision-making.

The use of artificial intelligence in POCUS makes the technology more usable and accurate and therefore, a wider group of health professionals, including non-radiologists, can have access to it.

Moreover, the ever-growing concern for the need of personalized medicine and patient-centered care is the main reason behind the increasing demand for portable and efficient diagnostic devices.

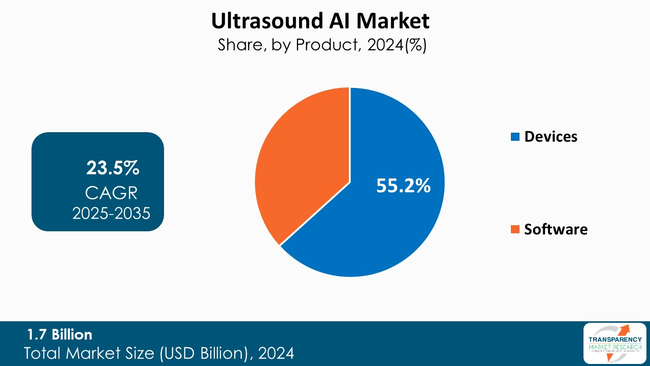

The devices product segment is the one through which the growth of the ultrasound AI Market has been heavily driven by various factors. Firstly, the progress in the ultrasound devices, especially those that are AI-powered, has, in a major way, contributed to diagnostic accuracy and efficiency. Consequently, the AI-driven equipment is able to do an image analysis all by itself, detect patterns, and even point out the probable diagnosis, and thus, they are the ones that give the doctors the power to make a decision quickly and in a more informed manner.

Additionally, the market for portable ultrasound instruments is turning out to be more vibrant due to consumers' rising needs in this area. Small, user-friendly devices are the instruments through which point-of-care imaging becomes possible; hence, medical practitioners are the ones who have the access to ultrasounds right in front of the patient's bed. Apart from this, the convenience being talked about here greatly benefits patients and, on top of that, it is a morale booster and time-saving approach as patient transferring to the department of radiology becomes unnecessary.

Furthermore, the turning of the wheel to telemedicine has been the main reason for the uptake of ultrasound equipment that is used from a distance. Such an innovation gives the doctors the license to make a check-up for a patient they do not have physical access to, while AI is there at their disposal to ease the techno-based diagnosis. Thus, with technology advancements, the growing need for portability and transition to integrated healthcare solutions, the device segment is the one that is going to increase the ultrasound AI market to a great extent.

| Attribute | Detail |

|---|---|

| Leading Region |

|

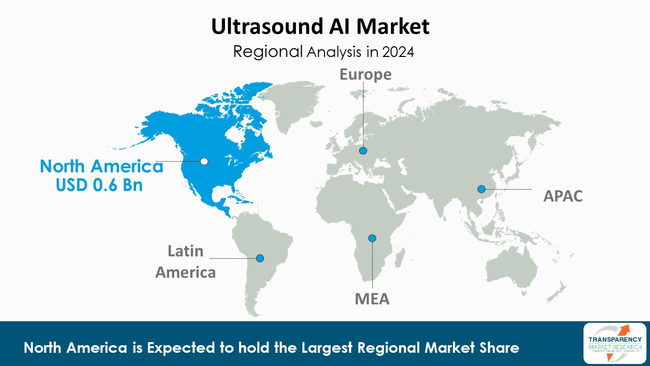

North America is at the forefront of the ultrasound AI Market holding the largest revenue share of 37.7%, as a result of a well-developed healthcare system, a large amount of money being put into medical technology, and a great focus on research and development. The region, and especially the United States, is home to some of the most advanced healthcare facilities in the world, which are very well equipped with the latest diagnostic imaging technologies.

Such a strong infrastructure makes it possible to quickly implement innovative solutions including AI-enabled ultrasound instruments.

In addition, a great amount of money is being injected into the healthcare and technology sectors, thus the development of AI applications in ultrasound is being propelled. The medical device industry has its major players in North America. Thus a competitive environment is created, which, very much favors technological advancements and innovative breakthroughs. Also, the presence of top research institutions and universities encourages cooperation between the academic world and the industry, thereby speeding up the implementation of AI solutions for ultrasound even more.

Additionally, the well-organized regulatory system in North America is also a significant factor. The U.S. Food and Drug Administration (FDA) and the other regulatory authorities are getting more receptive to AI technologies. Thus the new devices’ approval process is becoming less time-consuming. This aggressive strategy contributes to the expansion of the market by making it easier for the latest ultrasound solutions to reach patients in a shorter period of time, thereby consolidating North America’s leadership position in the Ultrasound AI Market.

Esaote SPA, Sonio SAS, EchoNous, Inc., GE HealthCare, NVIDIA Corporation, Koninklijke Philips N.V., Siemens Healthineers, Canon Medical Systems Corporation, Fujifilm Holdings, Clarius, MedSol AI Solutions, Exo, Inc., Koninklijke Philips N.V., Sonavex Surgical, Kitware, Inc are the key players governing the global ultrasound AI Market.

Each of these players has been profiled in the ultrasound AI Market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.7 Bn |

| Forecast Value in 2035 | More than US$ 17.5 Bn |

| CAGR | 23.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.7 Bn in 2024

It is projected to cross US$ 17.5 Bn by the end of 2035

Increasing demand for diagnostic imaging and rising adoption of point-of-care ultrasound

It is anticipated to grow at a CAGR of 23.5% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Esaote SPA, Sonio SAS, EchoNous, Inc., GE HealthCare, NVIDIA Corporation, Koninklijke Philips N.V., Siemens Healthineers, Canon Medical Systems Corporation, Fujifilm Holdings, Clarius, MedSol AI Solutions, Exo, Inc., Koninklijke Philips N.V., Sonavex Surgical, Kitware, Inc, and others

Table 01: Global Ultrasound AI Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 02: Global Ultrasound AI Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 03: Global Ultrasound AI Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Ultrasound AI Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Ultrasound AI Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Ultrasound AI Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Ultrasound AI Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 08: North America Ultrasound AI Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 09: North America Ultrasound AI Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America Ultrasound AI Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Ultrasound AI Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 12: Europe Ultrasound AI Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 13: Europe Ultrasound AI Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 14: Europe Ultrasound AI Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe Ultrasound AI Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific Ultrasound AI Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Asia Pacific Ultrasound AI Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 18: Asia Pacific Ultrasound AI Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 19: Asia Pacific Ultrasound AI Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific Ultrasound AI Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Ultrasound AI Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Latin America Ultrasound AI Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 23: Latin America Ultrasound AI Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 24: Latin America Ultrasound AI Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America Ultrasound AI Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa Ultrasound AI Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 27: Middle East & Africa Ultrasound AI Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 28: Middle East & Africa Ultrasound AI Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 29: Middle East & Africa Ultrasound AI Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East & Africa Ultrasound AI Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Ultrasound AI Market Value Share Analysis, By Product, 2024 and 2035

Figure 02: Global Ultrasound AI Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 03: Global Ultrasound AI Market Revenue (US$ Bn), by Devices, 2020 to 2035

Figure 04: Global Ultrasound AI Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 05: Global Ultrasound AI Market Value Share Analysis, By Application, 2024 and 2035

Figure 06: Global Ultrasound AI Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 07: Global Ultrasound AI Market Revenue (US$ Bn), by Radiology, 2020 to 2035

Figure 08: Global Ultrasound AI Market Revenue (US$ Bn), by Obstetrics and Gynecology, 2020 to 2035

Figure 09: Global Ultrasound AI Market Revenue (US$ Bn), by Cardiovascular, 2020 to 2035

Figure 10: Global Ultrasound AI Market Revenue (US$ Bn), by Gastroenterology, 2020 to 2035

Figure 11: Global Ultrasound AI Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 12: Global Ultrasound AI Market Value Share Analysis, By End-user, 2024 and 2035

Figure 13: Global Ultrasound AI Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 14: Global Ultrasound AI Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 15: Global Ultrasound AI Market Revenue (US$ Bn), by Diagnostic Imaging Centers, 2020 to 2035

Figure 16: Global Ultrasound AI Market Revenue (US$ Bn), by Ambulatory Surgical Centers (ASCs), 2020 to 2035

Figure 17: Global Ultrasound AI Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Ultrasound AI Market Value Share Analysis, By Region, 2024 and 2035

Figure 19: Global Ultrasound AI Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 20: North America Ultrasound AI Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: North America Ultrasound AI Market Value Share Analysis, by Country, 2024 and 2035

Figure 22: North America Ultrasound AI Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 23: North America Ultrasound AI Market Value Share Analysis, By Product, 2024 and 2035

Figure 24: North America Ultrasound AI Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 25: North America Ultrasound AI Market Value Share Analysis, By Application, 2024 and 2035

Figure 26: North America Ultrasound AI Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 27: North America Ultrasound AI Market Value Share Analysis, By End-user, 2024 and 2035

Figure 28: North America Ultrasound AI Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 29: Europe Ultrasound AI Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: Europe Ultrasound AI Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 31: Europe Ultrasound AI Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 32: Europe Ultrasound AI Market Value Share Analysis, By Product, 2024 and 2035

Figure 33: Europe Ultrasound AI Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 34: Europe Ultrasound AI Market Value Share Analysis, By Application, 2024 and 2035

Figure 35: Europe Ultrasound AI Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 36: Europe Ultrasound AI Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: Europe Ultrasound AI Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 38: Asia Pacific Ultrasound AI Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Asia Pacific Ultrasound AI Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 40: Asia Pacific Ultrasound AI Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 41: Asia Pacific Ultrasound AI Market Value Share Analysis, By Product, 2024 and 2035

Figure 42: Asia Pacific Ultrasound AI Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 43: Asia Pacific Ultrasound AI Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Asia Pacific Ultrasound AI Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: Asia Pacific Ultrasound AI Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Asia Pacific Ultrasound AI Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Latin America Ultrasound AI Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Latin America Ultrasound AI Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 49: Latin America Ultrasound AI Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 50: Latin America Ultrasound AI Market Value Share Analysis, By Product, 2024 and 2035

Figure 51: Latin America Ultrasound AI Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 52: Latin America Ultrasound AI Market Value Share Analysis, By Application, 2024 and 2035

Figure 53: Latin America Ultrasound AI Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 54: Latin America Ultrasound AI Market Value Share Analysis, By End-user, 2024 and 2035

Figure 55: Latin America Ultrasound AI Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 56: Middle East & Africa Ultrasound AI Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Middle East & Africa Ultrasound AI Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 58: Middle East & Africa Ultrasound AI Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 59: Middle East & Africa Ultrasound AI Market Value Share Analysis, By Product, 2024 and 2035

Figure 60: Middle East & Africa Ultrasound AI Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 61: Middle East & Africa Ultrasound AI Market Value Share Analysis, By Application, 2024 and 2035

Figure 62: Middle East & Africa Ultrasound AI Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 63: Middle East & Africa Ultrasound AI Market Value Share Analysis, By End-user, 2024 and 2035

Figure 64: Middle East & Africa Ultrasound AI Market Attractiveness Analysis, By End-user, 2025 to 2035