Reports

Reports

The diagnostic imaging market continues to grow on a healthy note, with demand for early disease identification, new imaging technologies, and rising healthcare spending driving stimulation. Modalities inclusive of X-Ray, MRI, CT, ultrasound, and nuclear imaging improve diagnostic accuracy, work-up, and monitoring of patients when required.

The diagnostic imaging market also continues to expand owing to the rise in aging population and growing prevalence of chronic diseases including cardiovascular diseases, neurological disorders, and cancers. Innovative technologies — including 3D and 4D imaging, AI-backed imaging, and portable imaging devices — are leading to improved outcomes, all of which are reshaping the marketplace.

Players such as Siemens Healthineers, GE HealthCare, Philips, and Canon Medical Systems are investing heavily in new AI solutions as well as product development. Moreover, commercialization and increasing partnerships between hospital imaging departments and standalone imaging centers offer improvement to diagnostic imaging accessibility. Despite challenges with high cost of equipment and regulatory restraints, the outlook for the diagnostic imaging market is positive, and innovations and preventive care trends will be medium to long term market growth drivers.

The market for diagnostic imaging is largely dictated by the rising incidences of chronic diseases, increasing awareness about preventive health, and ongoing technological advancements.

Innovations in imaging such as low dose CT, hybrid PET/CT, and portable ultrasound systems act as enablers toward the rapid uptake of imaging across hospitals and outpatient diagnostic centers. The rapid expansion of healthcare infrastructure in developing medical markets, coupled with increased demand for diagnostic imaging services in outpatient or ambulatory services represents tremendous opportunity.

Both - government and private investments in diagnostic imaging represent an effort to modernize their healthcare delivery systems and enhance the performance of diagnostic imaging, which has become integral to contemporary medicine.

| Attribute | Detail |

|---|---|

| Diagnostic Imaging Market Drivers |

|

The growing prevalence of chronic diseases including cardiovascular disease, cancer, and neurological diseases has been a major contributor to the demand for diagnostic imaging solutions.

Improved patient outcomes rest on early, precise detection of disease. Imaging modalities including MRI, CT, and PET scans are vital in the precise diagnosis of these conditions. Further, it is equally important to use imaging not only for diagnosis of disease but also for intervention and treatment plans and disease progression monitoring.

For example, the American Cancer Society had estimated that in 2023 there were nearly 1.9 million new cases of cancer in the United States. MRI and PET imaging technologies have, for years, been the cornerstone for accurate tumor localization and cancer staging.

The steady rise in the prevalence of cancer has motivated hospitals and cancer centers to purchase next-generation imaging technologies that will consequently improve diagnosis and improve the probability of better survival rates.

Technology is perhaps the biggest driver for change in the diagnostic imaging sector. Imaging technologies are equipped with new capabilities, including artificial intelligence (AI), 3D/4D imaging, and dose lowering technology, which, by improving the accuracy of diagnosis and increasing the safety of patients, will change the practice of diagnostic imaging.

Hybrid modalities such as PET/CT and PET/MRI are influencing the availability of a combined measure of anatomical data and functional data, resulting in improvements in disease identification and characterization of improvement with treatment.

For instance, Siemens Healthineers launched the first 0.55 Tesla Magnetom Free Max MRI in 2022 using state-of-the-art AI technology to improve imaging quality and efficiency of workflows. Lower magnetic field strength reduces cost, while allowing access to patients previously limited to who was eligible for MRI.

Similar developments in portable ultrasound or handheld imaging devices are offering the possibilities for point-of-care diagnostics in resource limited settings or remote locations. These innovations are enabling more personalized, accurate, and efficient care delivery options. Technology continues to reinforce growth of the global diagnostic imaging industry as hospitals and diagnostic centers adopt these solutions.

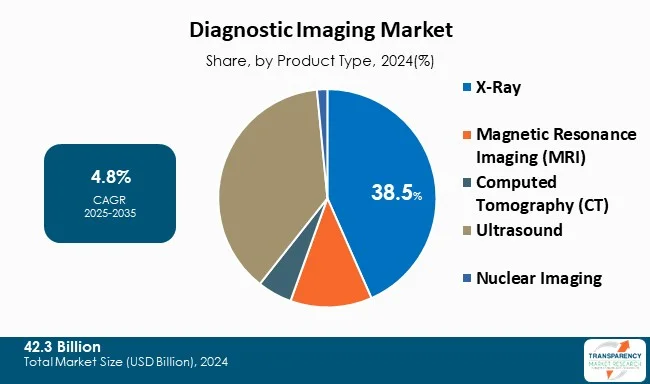

X-Ray imaging is by far the most recognized area in diagnostic imaging globally, basically owing to its cost-effectiveness, accessibility, and a broad range of clinical applicability. X-Rays are usually the first-line diagnostic imaging study utilized in healthcare while evaluating infections, fractures, diseases pertaining to the chest, and dental conditions.

As an illustrative point, X-Ray equipment is available at a lower price-point as compared to MR or CT scans, thereby making it a vital clinical tool. In under-developed economies, X-Rays are vital due to their easy availability. As digital X-Ray systems and portable X-Ray equipment are being developed and distributed, costs have decreased due to faster results, limited radiation, and better storage of images.

For example, as per the National Health Service (NHS, UK), chest X-Ray is one of the most commonly performed tests of diagnostic imaging. In fact, a recent report stated there are > 20 million chest X-Rays are performed every year in England. These statistics show the importance of chest X-Ray as a common diagnostic imaging study in the health care field.

The importance of chest X-Rays increased during the COVID-19 pandemic after they played an important role in determining health trauma associated with lung difficulties from the virus. Healthcare stakeholders are focused on more efficient and cost-effective medical management,. As a result, X-Rays will continue to be the most recognized imaging devices in terms of reliable, cost-effective imaging with developing technologies. X-Rays image systems will thus continue to lead the diagnostic imagining market

| Attribute | Detail |

|---|---|

| Leading Region |

|

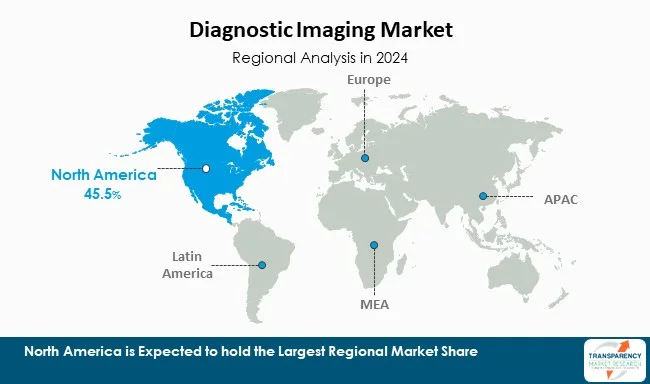

North America continues to lead the global diagnostic imaging market, primarily due to its advanced healthcare infrastructure, higher rate of adoption of new technologies, and overall high spending on healthcare. The robust focus on preventing and diagnosing diseases early in this region has also resulted in increased demand for imaging solutions such as MRI, CT, and ultrasound images.

Significant U.S. companies such as GE HealthCare and Hologic are located in the region, resulting in fast-paced technology adoption and a very strong competitive environment.

In the U.S., diagnostic imaging has a systemic role in the delivery of care, as the Centers for Medicare & Medicaid Services (CMS) report that imaging/post-procedure services hold a significant portion of hospital outpatient spending costs.

As per the American Hospital Association (2023), there are more than 6,000 hospitals in the United States, most of which have access to MRI and CT imaging facilities, indicating the immense capacity for diagnostic imaging in the country. Moreover, the prevalence of chronic disease in the U.S. (e.g., an estimated 695,000 heart related deaths per year or 20% of deaths from CDC, 2023) necessitates the need for continued increases in the uptake of imaging technologies to facilitate early treatments followed by interventions.

With continued investment in R&D, supportive regulatory environments, and growing volumes in imaging procedures, North America will continue to dominate the diagnostic imaging landscape.

Key players operating in the diagnostic imaging industry are investing in innovation, strategic partnerships, and technological advancements. They focus on enhancing imaging clarity and expanding product portfolios, ensuring sustained growth and leadership in the evolving healthcare landscape.

GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems, Hitachi Healthcare, Hologic Inc., Bruker Corporation, Esaote SPA, Fujifilm Holdings Corporation, Shimadzu Corporation, Aurora Imaging Technologies, Inc., Shenzhen Mindray, Bio-Medical Electronics Co., Ltd., Neusoft Medical Systems Co., Ltd., Toshiba Medical Systems Corporation are the key players in market.

Each of these players has been profiled in the diagnostic imaging market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

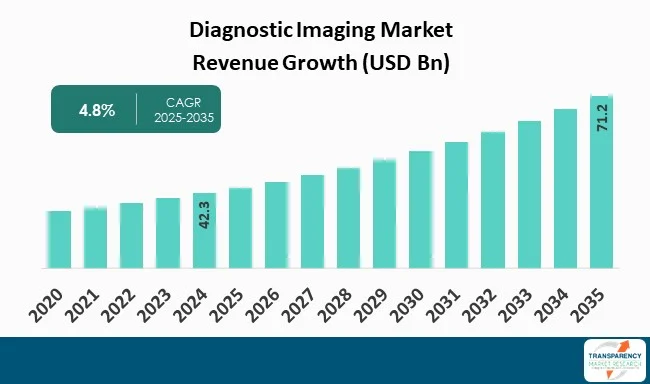

| Size in 2024 | US$ 42.3 Bn |

| Forecast Value in 2035 | US$ 71.2 Bn |

| CAGR | 4.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Diagnostic Imaging Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The diagnostic imaging market was valued at US$ 42.3 Bn in 2024

The diagnostic imaging market is projected to cross US$ 71.2 Bn by the end of 2035

Rising prevalence of chronic diseases and technological advancements in imaging modalities

The CAGR is anticipated to be 4.8% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems, Hitachi Healthcare, Hologic Inc., Bruker Corporation, Esaote SPA, Fujifilm Holdings Corporation, Shimadzu Corporation, Aurora Imaging Technologies, Inc., Shenzhen Mindray, Bio-Medical Electronics Co., Ltd., Neusoft Medical Systems Co., Ltd., Toshiba Medical Systems Corporation, and others

Table 01: Global Diagnostic Imaging Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 02: Global Diagnostic Imaging Market Value (US$ Bn) Forecast, by X-Ray, 2020 to 2035

Table 03: Global Diagnostic Imaging Market Value (US$ Bn) Forecast, by Magnetic Resonance Imaging (MRI), 2020 to 2035

Table 04: Global Diagnostic Imaging Market Value (US$ Bn) Forecast, by Computed Tomography (CT), 2020 to 2035

Table 05: Global Diagnostic Imaging Market Value (US$ Bn) Forecast, by Ultrasound, 2020 to 2035

Table 06: Global Diagnostic Imaging Market Value (US$ Bn) Forecast, by Nuclear Imaging, 2020 to 2035

Table 07: Global Diagnostic Imaging Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: Global Diagnostic Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 09: Global Diagnostic Imaging Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 10: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 11: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 12: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, by X-Ray, 2020 to 2035

Table 13: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Magnetic Resonance Imaging (MRI), 2020 to 2035

Table 14: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Computed Tomography (CT), 2020 to 2035

Table 15: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Ultrasound, 2020 to 2035

Table 16: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Nuclear Imaging, 2020 to 2035

Table 17: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 19: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 21: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, by X-Ray, 2020 to 2035

Table 22: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, by Magnetic Resonance Imaging (MRI), 2020 to 2035

Table 23: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, by Computed Tomography (CT), 2020 to 2035

Table 24: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, by Ultrasound, 2020 to 2035

Table 25: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, by Nuclear Imaging, 2020 to 2035

Table 26: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 27: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 28: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 29: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 30: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, by X-Ray, 2020 to 2035

Table 31: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, by Magnetic Resonance Imaging (MRI), 2020 to 2035

Table 32: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, by Computed Tomography (CT), 2020 to 2035

Table 33: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, by Ultrasound, 2020 to 2035

Table 34: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, by Nuclear Imaging, 2020 to 2035

Table 35: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 37: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 38: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 39: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, by X-Ray, 2020 to 2035

Table 40: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Magnetic Resonance Imaging (MRI), 2020 to 2035

Table 41: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Computed Tomography (CT), 2020 to 2035

Table 42: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Ultrasound, 2020 to 2035

Table 43: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, by Nuclear Imaging, 2020 to 2035

Table 44: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 45: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 46: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 47: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 48: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, by X-Ray, 2020 to 2035

Table 49: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, by Magnetic Resonance Imaging (MRI), 2020 to 2035

Table 50: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, by Computed Tomography (CT), 2020 to 2035

Table 51: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, by Ultrasound, 2020 to 2035

Table 52: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, by Nuclear Imaging, 2020 to 2035

Table 53: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 54: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Diagnostic Imaging Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 02: Global Diagnostic Imaging Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 03: Global Diagnostic Imaging Market Revenue (US$ Bn), by X-Ray, 2020 to 2035

Figure 04: Global Diagnostic Imaging Market Revenue (US$ Bn), by Magnetic Resonance Imaging (MRI), 2020 to 2035

Figure 05: Global Diagnostic Imaging Market Revenue (US$ Bn), by Computed Tomography (CT), 2020 to 2035

Figure 06: Global Diagnostic Imaging Market Revenue (US$ Bn), by Ultrasound, 2020 to 2035

Figure 07: Global Diagnostic Imaging Market Revenue (US$ Bn), by Nuclear Imaging, 2020 to 2035

Figure 08: Global Diagnostic Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 09: Global Diagnostic Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 10: Global Diagnostic Imaging Market Revenue (US$ Bn), by Cardiology, 2020 to 2035

Figure 11: Global Diagnostic Imaging Market Revenue (US$ Bn), by Gynecology/ Obstetrics, 2020 to 2035

Figure 12: Global Diagnostic Imaging Market Revenue (US$ Bn), by Orthopedics & Musculoskeletal, 2020 to 2035

Figure 13: Global Diagnostic Imaging Market Revenue (US$ Bn), by Radiology, 2020 to 2035

Figure 14: Global Diagnostic Imaging Market Revenue (US$ Bn), by Neurology & Spine, 2020 to 2035

Figure 15: Global Diagnostic Imaging Market Revenue (US$ Bn), by General Imaging, 2020 to 2035

Figure 16: Global Diagnostic Imaging Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Diagnostic Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 18: Global Diagnostic Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 19: Global Diagnostic Imaging Market Revenue (US$ Bn), by Hospitals , 2020 to 2035

Figure 20: Global Diagnostic Imaging Market Revenue (US$ Bn), by Diagnostic Centers , 2020 to 2035

Figure 21: Global Diagnostic Imaging Market Revenue (US$ Bn), by Specialty Clinics, 2020 to 2035

Figure 22: Global Diagnostic Imaging Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 23: Global Diagnostic Imaging Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Diagnostic Imaging Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America Diagnostic Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America Diagnostic Imaging Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America Diagnostic Imaging Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Diagnostic Imaging Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 29: North America Diagnostic Imaging Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 30: North America Diagnostic Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 31: North America Diagnostic Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 32: North America Diagnostic Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 33: North America Diagnostic Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 34: Europe Diagnostic Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Europe Diagnostic Imaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: Europe Diagnostic Imaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: Europe Diagnostic Imaging Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 38: Europe Diagnostic Imaging Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 39: Europe Diagnostic Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 40: Europe Diagnostic Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 41: Europe Diagnostic Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 42: Europe Diagnostic Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 43: Asia Pacific Diagnostic Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Asia Pacific Diagnostic Imaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 45: Asia Pacific Diagnostic Imaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 46: Asia Pacific Diagnostic Imaging Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 47: Asia Pacific Diagnostic Imaging Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 48: Asia Pacific Diagnostic Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 49: Asia Pacific Diagnostic Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 50: Asia Pacific Diagnostic Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 51: Asia Pacific Diagnostic Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 52: Latin America Diagnostic Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 53: Latin America Diagnostic Imaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 54: Latin America Diagnostic Imaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 55: Latin America Diagnostic Imaging Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 56: Latin America Diagnostic Imaging Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 57: Latin America Diagnostic Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 58: Latin America Diagnostic Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 59: Latin America Diagnostic Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 60: Latin America Diagnostic Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 61: Middle East and Africa Diagnostic Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Middle East and Africa Diagnostic Imaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 63: Middle East and Africa Diagnostic Imaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 64: Middle East and Africa Diagnostic Imaging Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 65: Middle East and Africa Diagnostic Imaging Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 66: Middle East and Africa Diagnostic Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 67: Middle East and Africa Diagnostic Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 68: Middle East and Africa Diagnostic Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 69: Middle East and Africa Diagnostic Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035