Reports

Reports

Analyst’s Viewpoint regarding Cancer Diagnostics Market Scenario

Drivers of the cancer diagnostics market include growing cases of cancer globally, increasing demand for early detection, technological advancements in liquid biopsy, molecular diagnostics, and AI-based imaging. Government policies, expanding applications of precision medicine and expanding awareness also contribute to market expansion.

Yet, high costs of advanced diagnostics, restrictive reimbursement policies, and regulatory hurdles are the major impediments to it, coupled with uneven access to diagnostic centers in low- and middle-income nations. In spite of these constraints, the frontiers of the fusion of AI and machine learning toward precise diagnostics, creation of non-invasive testing techniques, and biomarker-based diagnostic investigations will drive early diagnosis and tailor-made treatment techniques.

Cancer diagnosis implies the identification, detection, and confirmation of cancer within the body through the execution of different medical tests and imaging tests. It includes laboratory tests (like biopsy, blood tests, and molecular diagnostics), imaging techniques (like MRI, CT scan, PET scan, and ultrasound), and sophisticated technologies such as liquid biopsy and genetic testing to identify the type, stage, and extent of cancer. Timely and accurate diagnosis of cancer is a critical factor for treatment planning, enhancing patient outcomes, and facilitating precision medicine strategies.

| Attribute | Detail |

|---|---|

| Cancer Diagnostics Market Drivers |

|

The growth of the cancer diagnostics market is expected to be driven by technological advancements in cancer diagnostics products. Advanced technologies like next-generation sequencing (NGS), liquid biopsies, advanced imaging technologies, etc. are improving the rate of cancer detection, accuracy, and speed. Apart from high detection rates, they facilitate early diagnosis and accuracy in the process of disease identification, which is useful for effective treatment

For instance, in October 2024, Owkin, the first end-to-end AI-biotech that uses cutting-edge causal AI to unlock precision drug discovery, development, and diagnostics, announced MSIntuit CRC v21, a next-generation AI solution. Aimed at transforming the detection and treatment of colorectal cancer (CRC), MSIntuit CRC v2 will initially launch as an RUO version in the US on Roche’s navify Digital Pathology enterprise software.

Increasing awareness and early diagnosis are expected to drive the growth of cancer diagnostics Industry. With growing awareness among doctors and the general population regarding the importance of early cancer detection, people are increasingly turning to routine check-ups and diagnostic procedures. Enhanced awareness is driven by a multitude of factors such as public awareness campaigns, training programs, and sharing information via electronic and print media

Early diagnosis is required as it allows for greater scope for less invasive but more impactful treatment, which ultimately means a higher patient outcome and rate of survival. Keeping this in mind, more advanced diagnostic equipment and devices in the way of advanced imaging, i.e., high-end MRI, CT, PET/CT, next-generation sequencing (NGS), liquid biopsies, and so on, machines, and technologies are now required

These technologies not only improve the efficiency and accuracy of cancer diagnosis but also allow cancer to be diagnosed at earlier stages, when it is the most curable. The synergy between growing awareness and the availability of more advanced diagnostic equipment is fueling the market for cancer diagnostics, and it is a growth- and innovation-driven sector of the healthcare industry.

Antiplatelet medications are dominating the market owing to their essential role in treatment of the disease, which is identified with constricted arteries that hinder limb blood supply. Of the various drug types, aspirin is most widely used due to its efficacy in cardiovascular event prevention in peripheral arterial disease (PAD).

However, more effective drugs like clopidogrel and ticagrelor also are becoming popular, with improved platelet inhibition and improved patient outcomes with more extensive disease. Rising incidence of PAD, fueled by risk factors like diabetes mellitus, smoking, and aging population, has accelerated the need for potent antiplatelet therapy. Additionally, clinical trials are also in process to assess the advantages of double antiplatelet therapy in enhancing patient outcomes, which is propelling the market growth further.

Since medical professionals increasingly concentrate on integrated treatment approaches to manage symptoms and avoid complications among PAD patients, antiplatelet medications will also remain an important treatment part for managing this disease.

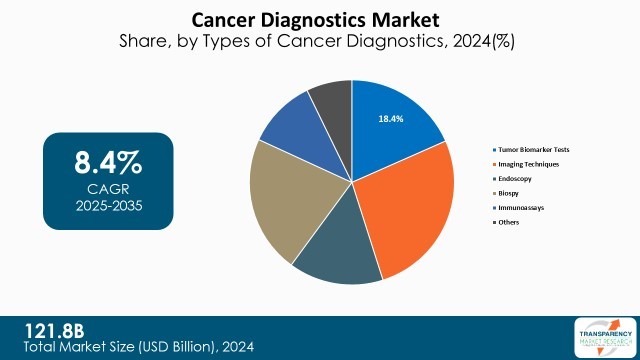

Imaging techniques lead the cancer diagnostics market, as they are non-invasive and easily available, with capability to identify tumors at any stage. Techniques including MRI, CT scan, PET scan, and ultrasound contribute to early detection of cancer and cancer staging, as well as tracking cancer therapy.

Biopsy holds the second-largest market share due to its definitive role in confirming cancer presence. Biopsy tests such as needle biopsy, liquid biopsy, and surgical biopsy yield histopathological and molecular information required for treatment tailoring.

Rising adoption of liquid biopsy, whose less invasive method for the detection of circulating tumor DNA (ctDNA) and the other biomarkers, is driving the market for this segment predominantly

| Attribute | Detail |

|---|---|

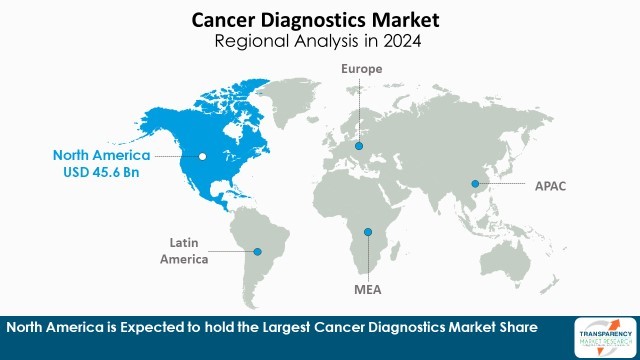

| Leading Region | North America |

North America is the leading region in the cancer diagnostics Industry due to its well-established healthcare infrastructure, high rate of adoption of advanced diagnostic technologies, and robust government programs for the early detection of cancer. The region boasts high R&D expenditure, high level of key players' concentration, and extensive availability of advanced diagnostic technologies like liquid biopsy, next-generation sequencing (NGS), and AI-driven imaging solutions

Furthermore, the region's high cancer prevalence, increasing knowledge of early detection, and favorable reimbursement policies - all contribute to strengthening the region's market leadership. With continued innovation in precision medicine and biomarker-based diagnostics, North America will most likely remain at the top of the global cancer diagnostics market

Cancer Diagnostics, Inc., Abbott, Bio-Rad Laboratories, Inc., GE HealthCare, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche AG, Quest Diagnostics Incorporated, QIAGEN, Siemens Healthineers, MedGenome, and Biodesix are some of the leading key players operating in the global cancer diagnostics market.

Each of these players have been have been profiled in the cancer diagnostics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Key Developments

| Attribute | Detail |

|---|---|

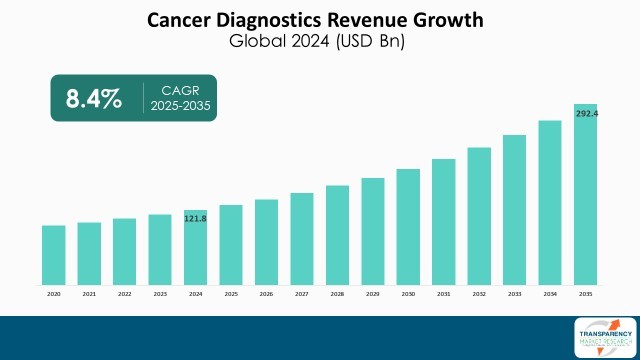

| Size in 2024 | US$ 121.8 Bn |

| Forecast Value in 2035 | More than US$ 292.4 Bn |

| CAGR | 8.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Quantitative Units | US$ Mn/Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The cancer diagnostics market was valued at US$ 121.8 Bn in 2024

The cancer diagnostics market business is projected to cross US$ 292.4 Bn by the end of 2035

Technological advancements in cancer diagnostics products, increasing awareness and early detection, and government initiatives and funding

The CAGR is anticipated to be 8.4% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Cancer Diagnostics, Inc., Abbott, Bio-Rad Laboratories, Inc., GE HealthCare, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche AG, Quest Diagnostics Incorporated, QIAGEN, Siemens Healthineers, MedGenome, and Biodesix

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cancer Diagnostics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cancer Diagnostics Market Analysis and Forecasts, 2020 - 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Global Cancer Incidence 2022

5.2. Key Industry Events

5.3. Regulatory Landscape across Key Regions / Countries

5.4. Key Purchase Metrics for End-Users

5.5. Brand Analysis

5.6. A New Artificial Intelligence Tool for Cancer

5.7. Brand Analysis

5.8. Emerging Technologies in Early Cancer Detection

6. Global Cancer Diagnostics Market Analysis and Forecasts, By Types of Cancer Diagnostics

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Types of Cancer Diagnostics, 2020 - 2035

6.3.1. Tumor Biomarker Tests

6.3.2. Imaging Techniques

6.3.3. Endoscopy

6.3.4. Biopsy

6.3.5. Immunoassays

6.3.6. Others

6.4. Market Attractiveness By Types of Cancer Diagnostics

7. Global Cancer Diagnostics Market Analysis and Forecasts, By Product Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Product Type, 2020 - 2035

7.3.1. Instruments

7.3.2. Assay Kits & Reagent

7.4. Market Attractiveness By Product Type

8. Global Cancer Diagnostics Market Analysis and Forecasts, By Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Application, 2020 - 2035

8.3.1. Lung Cancer

8.3.2. Breast Cancer

8.3.3. Colorectal Cancer

8.3.4. Prostate Cancer

8.3.5. Liver Cancer

8.3.6. Ovarian Cancer

8.3.7. Kidney Cancer

8.3.8. Pancreatic Cancer

8.3.9. Blood Cancer

8.3.10. Others

8.4. Market Attractiveness By Application

9. Global Cancer Diagnostics Market Analysis and Forecasts, By End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By End-user, 2020 - 2035

9.3.1. Hospitals

9.3.2. Diagnostics Centers

9.3.3. At Home Settings

9.3.4. Others

9.4. Market Attractiveness By End-user

10. Global Cancer Diagnostics Market Analysis and Forecasts, By Region

10.1. Key Findings

10.2. Market Value Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Cancer Diagnostics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Types of Cancer Diagnostics, 2020 - 2035

11.2.1. Tumor Biomarker Tests

11.2.2. Imaging Techniques

11.2.3. Endoscopy

11.2.4. Biopsy

11.2.5. Immunoassays

11.2.6. Others

11.3. Market Value Forecast By Product Type, 2020 - 2035

11.3.1. Instruments

11.3.2. Assay Kits & Reagent

11.4. Market Value Forecast By Application, 2020 - 2035

11.4.1. Lung Cancer

11.4.2. Breast Cancer

11.4.3. Colorectal Cancer

11.4.4. Prostate Cancer

11.4.5. Liver Cancer

11.4.6. Ovarian Cancer

11.4.7. Kidney Cancer

11.4.8. Pancreatic Cancer

11.4.9. Blood Cancer

11.4.10. Others

11.5. Market Value Forecast By End-user, 2020 - 2035

11.5.1. Hospitals

11.5.2. Diagnostics Centers

11.5.3. At Home Settings

11.5.4. Others

11.6. Market Value Forecast By Country, 2020 - 2035

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Types of Cancer Diagnostics

11.7.2. By Product Type

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Cancer Diagnostics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Types of Cancer Diagnostics, 2020 - 2035

12.2.1. Tumor Biomarker Tests

12.2.2. Imaging Techniques

12.2.3. Endoscopy

12.2.4. Biopsy

12.2.5. Immunoassays

12.2.6. Others

12.3. Market Value Forecast By Product Type, 2020 - 2035

12.3.1. Instruments

12.3.2. Assay Kits & Reagent

12.4. Market Value Forecast By Application, 2020 - 2035

12.4.1. Lung Cancer

12.4.2. Breast Cancer

12.4.3. Colorectal Cancer

12.4.4. Prostate Cancer

12.4.5. Liver Cancer

12.4.6. Ovarian Cancer

12.4.7. Kidney Cancer

12.4.8. Pancreatic Cancer

12.4.9. Blood Cancer

12.4.10. Others

12.5. Market Value Forecast By End-user, 2020 - 2035

12.5.1. Hospitals

12.5.2. Diagnostics Centers

12.5.3. At Home Settings

12.5.4. Others

12.6. Market Value Forecast By Country/Sub-region, 2020 - 2035

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Types of Cancer Diagnostics

12.7.2. By Product Type

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Cancer Diagnostics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Types of Cancer Diagnostics, 2020 - 2035

13.2.1. Tumor Biomarker Tests

13.2.2. Imaging Techniques

13.2.3. Endoscopy

13.2.4. Biopsy

13.2.5. Immunoassays

13.2.6. Others

13.3. Market Value Forecast By Product Type, 2020 - 2035

13.3.1. Instruments

13.3.2. Assay Kits & Reagent

13.4. Market Value Forecast By Application, 2020 - 2035

13.4.1. Lung Cancer

13.4.2. Breast Cancer

13.4.3. Colorectal Cancer

13.4.4. Prostate Cancer

13.4.5. Liver Cancer

13.4.6. Ovarian Cancer

13.4.7. Kidney Cancer

13.4.8. Pancreatic Cancer

13.4.9. Blood Cancer

13.4.10. Others

13.5. Market Value Forecast By End-user, 2020 - 2035

13.5.1. Hospitals

13.5.2. Diagnostics Centers

13.5.3. At Home Settings

13.5.4. Others

13.6. Market Value Forecast By Country/Sub-region, 2020 - 2035

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Types of Cancer Diagnostics

13.7.2. By Product Type

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Cancer Diagnostics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Types of Cancer Diagnostics, 2020 - 2035

14.2.1. Tumor Biomarker Tests

14.2.2. Imaging Techniques

14.2.3. Endoscopy

14.2.4. Biopsy

14.2.5. Immunoassays

14.2.6. Others

14.3. Market Value Forecast By Product Type, 2020 - 2035

14.3.1. Instruments

14.3.2. Assay Kits & Reagent

14.4. Market Value Forecast By Application, 2020 - 2035

14.4.1. Lung Cancer

14.4.2. Breast Cancer

14.4.3. Colorectal Cancer

14.4.4. Prostate Cancer

14.4.5. Liver Cancer

14.4.6. Ovarian Cancer

14.4.7. Kidney Cancer

14.4.8. Pancreatic Cancer

14.4.9. Blood Cancer

14.4.10. Others

14.5. Market Value Forecast By End-user, 2020 - 2035

14.5.1. Hospitals

14.5.2. Diagnostics Centers

14.5.3. At Home Settings

14.5.4. Others

14.6. Market Value Forecast By Country/Sub-region, 2020 - 2035

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Types of Cancer Diagnostics

14.7.2. By Product Type

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Cancer Diagnostics Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Types of Cancer Diagnostics, 2020 - 2035

15.2.1. Tumor Biomarker Tests

15.2.2. Imaging Techniques

15.2.3. Endoscopy

15.2.4. Biopsy

15.2.5. Immunoassays

15.2.6. Others

15.3. Market Value Forecast By Product Type, 2020 - 2035

15.3.1. Instruments

15.3.2. Assay Kits & Reagent

15.4. Market Value Forecast By Application, 2020 - 2035

15.4.1. Lung Cancer

15.4.2. Breast Cancer

15.4.3. Colorectal Cancer

15.4.4. Prostate Cancer

15.4.5. Liver Cancer

15.4.6. Ovarian Cancer

15.4.7. Kidney Cancer

15.4.8. Pancreatic Cancer

15.4.9. Blood Cancer

15.4.10. Others

15.5. Market Value Forecast By End-user, 2020 - 2035

15.5.1. Hospitals

15.5.2. Diagnostics Centers

15.5.3. At Home Settings

15.5.4. Others

15.6. Market Value Forecast By Country/Sub-region, 2020 - 2035

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Types of Cancer Diagnostics

15.7.2. By Product Type

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis By Company (2024)

16.3. Company Profiles

16.3.1. Cancer Diagnostics, Inc.

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. Abbott

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. Bio-Rad Laboratories, Inc.

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. GE HealthCare

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. Thermo Fisher Scientific, Inc.

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. F. Hoffmann-La Roche AG

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

16.3.7. Quest Diagnostics Incorporated

16.3.7.1. Company Overview

16.3.7.2. Financial Overview

16.3.7.3. Product Portfolio

16.3.7.4. Business Strategies

16.3.7.5. Recent Developments

16.3.8. QIAGEN

16.3.8.1. Company Overview

16.3.8.2. Financial Overview

16.3.8.3. Product Portfolio

16.3.8.4. Business Strategies

16.3.8.5. Recent Developments

16.3.9. Siemens Healthineers

16.3.9.1. Company Overview

16.3.9.2. Financial Overview

16.3.9.3. Product Portfolio

16.3.9.4. Business Strategies

16.3.9.5. Recent Developments

16.3.10. MedGenome

16.3.10.1. Company Overview

16.3.10.2. Financial Overview

16.3.10.3. Product Portfolio

16.3.10.4. Business Strategies

16.3.10.5. Recent Developments

16.3.11. Biodesix

16.3.11.1. Company Overview

16.3.11.2. Financial Overview

16.3.11.3. Product Portfolio

16.3.11.4. Business Strategies

16.3.11.5. Recent Developments

List of Tables

Table 01: Global Cancer Diagnostics Market Value (US$ Bn) Forecast, By Type of Cancer Diagnostics, 2020-2035

Table 02: Global Cancer Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 03: Global Cancer Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 04: Global Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 05: Global Cancer Diagnostics Market Value (US$ Bn) Forecast, By Region, 2020-2035

Table 06: North America - Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Type of Cancer Diagnostics, 2020-2035

Table 08: North America - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 09: North America - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 10: North America - Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 11: Europe - Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 12: Europe - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Type of Cancer Diagnostics, 2020-2035

Table 13: Europe - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 14: Europe - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 15: Europe - Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 16: Asia Pacific - Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 17: Asia Pacific - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Type of Cancer Diagnostics, 2020-2035

Table 18: Asia Pacific - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 19: Asia Pacific - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 20: Asia Pacific - Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 21: Latin America - Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Latin America - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Type of Cancer Diagnostics, 2020-2035

Table 23: Latin America - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 24: Latin America - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 25: Latin America - Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 26: Middle East & Africa - Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 27: Middle East & Africa - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Type of Cancer Diagnostics, 2020-2035

Table 28: Middle East & Africa - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020-2035

Table 29: Middle East & Africa - Cancer Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 30: Middle East & Africa - Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020-2035

List of Figures

Figure 01: Global Cancer Diagnostics Market Value Share Analysis, By Type of Cancer Diagnostics, 2024 and 2035

Figure 02: Global Cancer Diagnostics Market Attractiveness Analysis, By Type of Cancer Diagnostics, 2025-2035

Figure 03: Global Cancer Diagnostics Market Revenue (US$ Bn), by Tumor Biomarker Tests, 2020-2035

Figure 04: Global Cancer Diagnostics Market Revenue (US$ Bn), by Imaging Techniques, 2020-2035

Figure 05: Global Cancer Diagnostics Market Revenue (US$ Bn), by Endoscopy, 2020-2035

Figure 06: Global Cancer Diagnostics Market Revenue (US$ Bn), by Biopsy, 2020-2035

Figure 07: Global Cancer Diagnostics Market Revenue (US$ Bn), by Immunoassays, 2020-2035

Figure 08: Global Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020-2035

Figure 09: Global Cancer Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 10: Global Cancer Diagnostics Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 11: Global Cancer Diagnostics Market Revenue (US$ Bn), by Instruments, 2020-2035

Figure 12: Global Cancer Diagnostics Market Revenue (US$ Bn), by Assay Kits & Reagent, 2020-2035

Figure 13: Global Cancer Diagnostics Market Value Share Analysis, By Application, 2024 and 2035

Figure 14: Global Cancer Diagnostics Market Attractiveness Analysis, By Application, 2025-2035

Figure 15: Global Cancer Diagnostics Market Revenue (US$ Bn), by Lung Cancer, 2020-2035

Figure 16: Global Cancer Diagnostics Market Revenue (US$ Bn), by Breast Cancer, 2020-2035

Figure 17: Global Cancer Diagnostics Market Revenue (US$ Bn), by Colorectal Cancer, 2020-2035

Figure 18: Global Cancer Diagnostics Market Revenue (US$ Bn), by Prostate Cancer, 2020-2035

Figure 19: Global Cancer Diagnostics Market Revenue (US$ Bn), by Liver Cancer, 2020-2035

Figure 20: Global Cancer Diagnostics Market Revenue (US$ Bn), by Ovarian Cancer, 2020-2035

Figure 21: Global Cancer Diagnostics Market Revenue (US$ Bn), by Kidney Cancer, 2020-2035

Figure 22: Global Cancer Diagnostics Market Revenue (US$ Bn), by Pancreatic Cancer, 2020-2035

Figure 23: Global Cancer Diagnostics Market Revenue (US$ Bn), by Blood Cancer, 2020-2035

Figure 24: Global Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020-2035

Figure 25: Global Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 26: Global Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025-2035

Figure 27: Global Cancer Diagnostics Market Revenue (US$ Bn), by Hospitals, 2020-2035

Figure 28: Global Cancer Diagnostics Market Revenue (US$ Bn), by Diagnostic Centers, 2020-2035

Figure 29: Global Cancer Diagnostics Market Revenue (US$ Bn), by At-Home Settings, 2020-2035

Figure 30: Global Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020-2035

Figure 31: Global Cancer Diagnostics Market Value Share Analysis, By Region, 2024 and 2035

Figure 32: Global Cancer Diagnostics Market Attractiveness Analysis, By Region, 2025-2035

Figure 33: North America - Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020-2035

Figure 34: North America - Cancer Diagnostics Market Value Share Analysis, by Country, 2024 and 2035

Figure 35: North America - Cancer Diagnostics Market Attractiveness Analysis, by Country, 2025-2035

Figure 36: North America - Cancer Diagnostics Market Value Share Analysis, By Type of Cancer Diagnostics, 2024 and 2035

Figure 37: North America - Cancer Diagnostics Market Attractiveness Analysis, By Type of Cancer Diagnostics, 2025-2035

Figure 38: North America - Cancer Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 39: North America - Cancer Diagnostics Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 40: North America - Cancer Diagnostics Market Value Share Analysis, By Application, 2024 and 2035

Figure 41: North America - Cancer Diagnostics Market Attractiveness Analysis, By Application, 2025-2035

Figure 42: North America - Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: North America - Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025-2035

Figure 44: Europe - Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020-2035

Figure 45: Europe - Cancer Diagnostics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 46: Europe - Cancer Diagnostics Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 47: Europe - Cancer Diagnostics Market Value Share Analysis, By Type of Cancer Diagnostics, 2024 and 2035

Figure 48: Europe - Cancer Diagnostics Market Attractiveness Analysis, By Type of Cancer Diagnostics, 2025-2035

Figure 49: Europe - Cancer Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 50: Europe - Cancer Diagnostics Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 51: Europe - Cancer Diagnostics Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Europe - Cancer Diagnostics Market Attractiveness Analysis, By Application, 2025-2035

Figure 53: Europe - Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 54: Europe - Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025-2035

Figure 55: Asia Pacific - Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020-2035

Figure 56: Asia Pacific - Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 57: Asia Pacific - Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 58: Asia Pacific - Cancer Diagnostics Market Value Share Analysis, By Type of Cancer Diagnostics, 2024 and 2035

Figure 59: Asia Pacific - Cancer Diagnostics Market Attractiveness Analysis, By Type of Cancer Diagnostics, 2025-2035

Figure 60: Asia Pacific - Cancer Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 61: Asia Pacific - Cancer Diagnostics Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 62: Asia Pacific - Cancer Diagnostics Market Value Share Analysis, By Application, 2024 and 2035

Figure 63: Asia Pacific - Cancer Diagnostics Market Attractiveness Analysis, By Application, 2025-2035

Figure 64: Asia Pacific - Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Asia Pacific - Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025-2035

Figure 66: Latin America - Cancer Diagnostics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 67: Latin America - Cancer Diagnostics Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 68: Latin America - Cancer Diagnostics Market Value Share Analysis, By Type of Cancer Diagnostics, 2024 and 2035

Figure 69: Latin America - Cancer Diagnostics Market Attractiveness Analysis, By Type of Cancer Diagnostics, 2025-2035

Figure 70: Latin America - Cancer Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 71: Latin America - Cancer Diagnostics Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 72: Latin America - Cancer Diagnostics Market Value Share Analysis, By Application, 2024 and 2035

Figure 73: Latin America - Cancer Diagnostics Market Attractiveness Analysis, By Application, 2025-2035

Figure 74: Latin America - Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 75: Latin America - Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025-2035

Figure 76: Middle East & Africa - Cancer Diagnostics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 77: Middle East & Africa - Cancer Diagnostics Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 78: Middle East & Africa - Cancer Diagnostics Market Value Share Analysis, By Type of Cancer Diagnostics, 2024 and 2035

Figure 79: Middle East & Africa - Cancer Diagnostics Market Attractiveness Analysis, By Type of Cancer Diagnostics, 2025-2035

Figure 80: Middle East & Africa - Cancer Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 81: Middle East & Africa - Cancer Diagnostics Market Attractiveness Analysis, By Product Type, 2025-2035

Figure 82: Middle East & Africa - Cancer Diagnostics Market Value Share Analysis, By Application, 2024 and 2035

Figure 83: Middle East & Africa - Cancer Diagnostics Market Attractiveness Analysis, By Application, 2025-2035

Figure 84: Middle East & Africa - Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 85: Middle East & Africa - Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025-2035