Reports

Reports

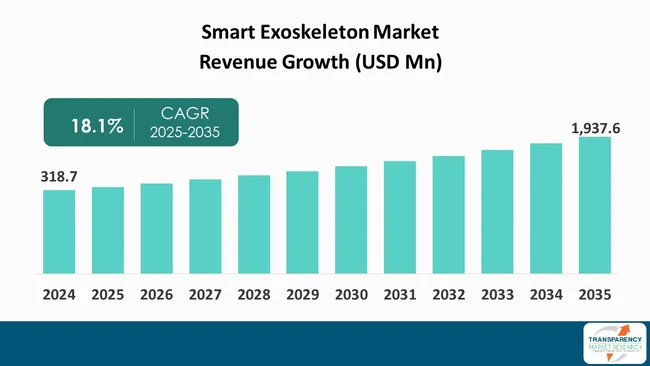

The global smart exoskeleton market size was valued at US$ 318.7 Mn in 2024 and is projected to reach US$ 1,937.6 Mn by 2035, expanding at a CAGR of 18.1% from 2025 to 2035. The market growth is driven by an increasing demand for rapid infectious disease screening and technological advancements improving sensitivity and multiplexing.

The market for smart exoskeletons is currently witnessing rapid conversion of technologies in the form of robotics, smart sensors, battery technology, and AI-powered control for providing solutions for medical rehabilitation and workplace ergonomics.

The growth of this market is mainly propelled by an increase in musculoskeletal disorders, and emphasis placed by employers on safety, which is spurring devices to prevent injury or restore mobility. The main players in this market are advancing the process of commercialization by conducting clinical research studies, entering into strategic partnerships, and developing alternative cost-effective manufacturing and distribution for enhancing adoption of their products.

Competition among specialized manufacturers and diversified OEMs are bringing about differentiation in product development categories such as active powered device systems, passive-assist suits, and hybrid products. Competition is also driving service models such as a device-as-a-service model and longer-term clinical support services.

In addition, progress in regulatory and reimbursement processes is legitimizing the clinical applications. Continuous innovation in components (lighter actuators, advanced batteries, smarter controllers) also allows for broadened use-cases and improves user acceptance.

Smart exoskeleton market is growing due to aging population, which is boosting the demand for rehabilitation devices, increasing the corporate focus on occupational health that is driving the acquisition of assistive wearables, and increased maturity of technology where weight, battery life, and user comfort - have all benefited.

The healthcare pathway is changing as clinics embed exoskeleton-assisted therapy into stroke and spinal cord injury recovery programs, thereby legitimizing their outcomes and allowing for referrals. In the workforce, manufacturing and logistics companies are incorporating ergonomic exosuits designed to reduce lost-time injuries and enhance performance in repetitive and overhead tasks.

At the same time, venture capital and strategic investments increase the scale-up of production capability and supply chains providing the opportunity for lower more aggressive pricing and pilot launches. Cross-sector collaborations — for example, automotive OEMs, robotics, and healthcare providers — are steaming up testing cycles and enabling product roadmaps to diversify in addressing risks that are specifically related to patient mobility and mobility throughput in the industry.

| Attribute | Detail |

|---|---|

| Smart Exoskeleton Market Drivers |

|

The primary driver of growth of smart exoskeletons in clinical settings is their adoption in rehabilitation settings as they provide quantifiable improvements in mobility, gait training, and neuroplastic recovery in multidisciplinary therapy models. As hospitals and rehabilitation centers are formally including exoskeleton assisted therapy in their stroke and spinal cord injury pathways to promote increased speed in function and there length of stay, clinical evidence continues to grow and clinicians become more familiar with their use.

For example, recent clinical and commercial movement around AI-enabled, self-balancing exoskeletons, and partnership announcements by manufacturers to facilitate their presence in the U.S., demonstrate the clinical interest in exoskeleton use complying with standardized therapeutic protocols for predetermined use in home care settings - both of which widen the total addressable use-cases and generate payer interest.

As early exoskeleton deployments continue in leading trauma care centers, and as regulatory approvals are established for commercial devices, conversations about reimbursement and pilot use continue, which will provide the opportunity to demonstrate value and cost-effectiveness in real patient care spaces of origin. This further promotes procurement by health systems and specialty clinics.

The growing focus on workplace safety and productivity is a compelling commercial driver for organizations to adopt exoskeletons in manufacturing, logistics, and construction, as they seek scalable solutions to mitigate musculoskeletal injuries and absenteeism. Employers are subject to regulatory and direct economic pressures to reduce injury rates, and wearable exosuits that offload weight to the back and shoulder while easily donning a viable alternative to administrative controls and costly retrofits to expensive automation systems.

Recent announcements made by dominant firms in the automotive and mobility sectors imply introduction of shoulder-assist wearable robots to pilot customer sites, highlighting the legitimization of the veracity of industrial deployments backed by OEMs. This will help validate the durability, ergonomics, and long-term costs associated with their usage, which can mitigate challenges around organizational adoption.

Furthermore, demonstrated reductions in both - muscle activity and task strain associated with the use of exoskeletons - are desirable qualities that may expand their actual use in assembly line and supply chain settings. While exoskeletons continue to improve in robustness and maintainability, growing industrial service contracts associated with commercial deployment will help to further legitimize their usage.

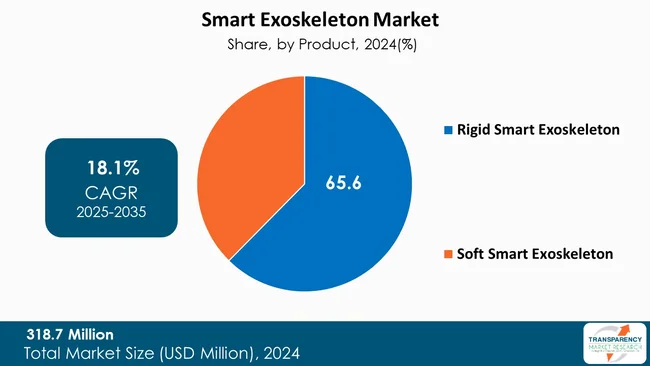

Rigid smart exoskeletons are currently receiving considerable interest, as the mechanical rigidity facilitates effective force transfer, joint cooperation, and predictability of therapeutic or ergonomics outcomes, which are important in both - clinical rehabilitation and physically-demanding environments.

Rigid frame construction, stiffness, and actuation systems provide support for higher payload, greater repeatability of gait in a clinical setting, and better alignment with orthopaedic needs; and are desirable for those needing maximum assistance, as well as in the workplace when durability is required for accommodating continuous loading. Scalable applications of engineering efforts to develop production capacity for series manufacture and commercialization of rigid exoskeletons can be seen with manufacturers increasing their industrial and medical exoskeleton product lines. Rigid designs embody reliability and life-cycle attributes that position them for an enterprise and clinical customer base. As engineering oxford is gradually developed to enable lighter and ergonomic solutions, rigid systems will increasingly be specified where consistent, high-assist, performance is needed.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America leads the smart exoskeleton market, capturing an estimated 44.5% share of global activity. It’s a position underpinned by concentrated healthcare expenditure, advanced hospital networks, established research institutions, and an active ecosystem of specialized manufacturers and startups. The United States being the largest market in the region, experiences feasible reimbursement advancements, increasing clinical trials, and large healthcare systems and industrial fleet operator procurement budgets, thereby enabling faster commercialization and market entry.

Furthermore, the U.S. suppliers and public companies are announcing product launches, regulatory developments, and quarterly updates that reflect commercialization commitments and ongoing investor attention that generate partnerships and pilot programs through health networks and manufacturing clients. For instance, the recent corporate updates and financial releases from established U.S.-based exoskeleton firms demonstrate continued activity in operations and device rollouts, all of which supports the region's position in clinical and industrial pathways.

Companies operating in the smart exoskeleton market focus on forging strategic collaborations, innovating their products, and validating the performance of their products across various clinical settings. These firms invest significantly in R&D pertaining to cutting-edge microfluidic and non-invasive techniques, broaden their distribution channels, and provide integrated service solutions to have a strong market presence and a high customer loyalty.

Ekso Bionics, ReWalk Robotics, Bionik, Inc., Cyberdyne, Inc., Rex Bionics Ltd., Hocoma AG, Wearable Robotics srl, Panasonic Corporation, Fourier Intelligence, AXOSUITS SRL, FREE Bionics Taiwan Inc., GOBIO, INNOPHYS CO., LTD., MEDEXO ROBOTICS are some of the leading players operating in the global market.

Each of these players has been profiled in the smart exoskeleton Industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 318.7 Mn |

| Forecast Value in 2035 | US$ 1,937.6 Mn |

| CAGR | 18.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn |

| Smart Exoskeleton Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global smart exoskeleton market was valued at US$ 318.7 Mn in 2024

The global smart exoskeleton industry is projected to reach more than US$ 1,937.6 Mn by the end of 2035

Clinical rehabilitation adoption and Industrial ergonomics and workforce safety

The CAGR is anticipated to be 18.1% from 2025 to 2035

Ekso Bionics, ReWalk Robotics, Bionik, Inc., Cyberdyne, Inc., Rex Bionics Ltd., Hocoma AG, Wearable Robotics srl, Panasonic Corporation, Fourier Intelligence, AXOSUITS SRL, FREE Bionics Taiwan Inc., GOBIO, INNOPHYS CO., LTD., MEDEXO ROBOTICS

Table 01: Global Smart Exoskeleton Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 02: Global Smart Exoskeleton Market Value (US$ Mn) Forecast, by Extremity, 2020 to 2035

Table 03: Global Smart Exoskeleton Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 04: Global Smart Exoskeleton Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 05: Global Smart Exoskeleton Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 06: North America Smart Exoskeleton Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 07: North America Smart Exoskeleton Market Value (US$ Mn) Forecast, by Extremity, 2020 to 2035

Table 08: North America Smart Exoskeleton Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 09: North America Smart Exoskeleton Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 10: North America Smart Exoskeleton Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 11: Europe Smart Exoskeleton Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 12: Europe Smart Exoskeleton Market Value (US$ Mn) Forecast, by Extremity, 2020 to 2035

Table 13: Europe Smart Exoskeleton Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 14: Europe Smart Exoskeleton Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 15: Europe Smart Exoskeleton Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 16: Asia Pacific Smart Exoskeleton Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 17: Asia Pacific Smart Exoskeleton Market Value (US$ Mn) Forecast, by Extremity, 2020 to 2035

Table 18: Asia Pacific Smart Exoskeleton Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 19: Asia Pacific Smart Exoskeleton Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 20: Asia Pacific Smart Exoskeleton Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 21: Latin America Smart Exoskeleton Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 22: Latin America Smart Exoskeleton Market Value (US$ Mn) Forecast, by Extremity, 2020 to 2035

Table 23: Latin America Smart Exoskeleton Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 24: Latin America Smart Exoskeleton Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 25: Latin America Smart Exoskeleton Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 26: Middle East and Africa Smart Exoskeleton Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 27: Middle East and Africa Smart Exoskeleton Market Value (US$ Mn) Forecast, by Extremity, 2020 to 2035

Table 28: Middle East and Africa Smart Exoskeleton Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 29: Middle East and Africa Smart Exoskeleton Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 30: Middle East and Africa Smart Exoskeleton Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Figure 01: Global Smart Exoskeleton Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Smart Exoskeleton Market Value Share Analysis, by Product, 2024 and 2035

Figure 03: Global Smart Exoskeleton Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 04: Global Smart Exoskeleton Market Revenue (US$ Mn), by Rigid Smart Exoskeleton, 2020 to 2035

Figure 05: Global Smart Exoskeleton Market Revenue (US$ Mn), by Soft Smart Exoskeleton, 2020 to 2035

Figure 06: Global Smart Exoskeleton Market Value Share Analysis, by Extremity, 2024 and 2035

Figure 07: Global Smart Exoskeleton Market Attractiveness Analysis, by Extremity, 2025 to 2035

Figure 08: Global Smart Exoskeleton Market Revenue (US$ Mn), by Lower Extremity, 2020 to 2035

Figure 09: Global Smart Exoskeleton Market Revenue (US$ Mn), by Upper Extremity, 2020 to 2035

Figure 10: Global Smart Exoskeleton Market Revenue (US$ Mn), by Full Body Extremity, 2020 to 2035

Figure 11: Global Smart Exoskeleton Market Value Share Analysis, by Application, 2024 and 2035

Figure 12: Global Smart Exoskeleton Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 13: Global Smart Exoskeleton Market Revenue (US$ Mn), by Rehabilitation, 2020 to 2035

Figure 14: Global Smart Exoskeleton Market Revenue (US$ Mn), by Pick & Carry, 2020 to 2035

Figure 15: Global Smart Exoskeleton Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 16: Global Smart Exoskeleton Market Value Share Analysis, by End-user, 2024 and 2035

Figure 17: Global Smart Exoskeleton Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 18: Global Smart Exoskeleton Market Revenue (US$ Mn), by Industrial, 2020 to 2035

Figure 19: Global Smart Exoskeleton Market Revenue (US$ Mn), by Healthcare, 2020 to 2035

Figure 20: Global Smart Exoskeleton Market Revenue (US$ Mn), by Military, 2020 to 2035

Figure 21: Global Smart Exoskeleton Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 22: Global Smart Exoskeleton Market Value Share Analysis, by Region, 2024 and 2035

Figure 23: Global Smart Exoskeleton Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 24: North America Smart Exoskeleton Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 25: North America Smart Exoskeleton Market Value Share Analysis, by Product, 2024 and 2035

Figure 26: North America Smart Exoskeleton Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 27: North America Smart Exoskeleton Market Value Share Analysis, by Extremity, 2024 and 2035

Figure 28: North America Smart Exoskeleton Market Attractiveness Analysis, by Extremity, 2025 to 2035

Figure 29: North America Smart Exoskeleton Market Value Share Analysis, by Application, 2024 and 2035

Figure 30: North America Smart Exoskeleton Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 31: North America Smart Exoskeleton Market Value Share Analysis, by End-user, 2024 and 2035

Figure 32: North America Smart Exoskeleton Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 33: North America Smart Exoskeleton Market Value Share Analysis, by Region, 2024 and 2035

Figure 34: North America Smart Exoskeleton Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 35: Europe Smart Exoskeleton Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 36: Europe Smart Exoskeleton Market Value Share Analysis, by Product, 2024 and 2035

Figure 37: Europe Smart Exoskeleton Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 38: Europe Smart Exoskeleton Market Value Share Analysis, by Extremity, 2024 and 2035

Figure 39: Europe Smart Exoskeleton Market Attractiveness Analysis, by Extremity, 2025 to 2035

Figure 40: Europe Smart Exoskeleton Market Value Share Analysis, by Application, 2024 and 2035

Figure 41: Europe Smart Exoskeleton Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 42: Europe Smart Exoskeleton Market Value Share Analysis, by End-user, 2024 and 2035

Figure 43: Europe Smart Exoskeleton Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 44: Europe Smart Exoskeleton Market Value Share Analysis, by Region, 2024 and 2035

Figure 45: Europe Smart Exoskeleton Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 46: Asia Pacific Smart Exoskeleton Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 47: Asia Pacific Smart Exoskeleton Market Value Share Analysis, by Product, 2024 and 2035

Figure 48: Asia Pacific Smart Exoskeleton Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 49: Asia Pacific Smart Exoskeleton Market Value Share Analysis, by Extremity, 2024 and 2035

Figure 50: Asia Pacific Smart Exoskeleton Market Attractiveness Analysis, by Extremity, 2025 to 2035

Figure 51: Asia Pacific Smart Exoskeleton Market Value Share Analysis, by Application, 2024 and 2035

Figure 52: Asia Pacific Smart Exoskeleton Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 53: Asia Pacific Smart Exoskeleton Market Value Share Analysis, by End-user, 2024 and 2035

Figure 54: Asia Pacific Smart Exoskeleton Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 55: Asia Pacific Smart Exoskeleton Market Value Share Analysis, by Region, 2024 and 2035

Figure 56: Asia Pacific Smart Exoskeleton Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 57: Latin America Smart Exoskeleton Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 58: Latin America Smart Exoskeleton Market Value Share Analysis, by Product, 2024 and 2035

Figure 59: Latin America Smart Exoskeleton Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 60: Latin America Smart Exoskeleton Market Value Share Analysis, by Extremity, 2024 and 2035

Figure 61: Latin America Smart Exoskeleton Market Attractiveness Analysis, by Extremity, 2025 to 2035

Figure 62: Latin America Smart Exoskeleton Market Value Share Analysis, by Application, 2024 and 2035

Figure 63: Latin America Smart Exoskeleton Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 64: Latin America Smart Exoskeleton Market Value Share Analysis, by End-user, 2024 and 2035

Figure 65: Latin America Smart Exoskeleton Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 66: Latin America Smart Exoskeleton Market Value Share Analysis, by Region, 2024 and 2035

Figure 67: Latin America Smart Exoskeleton Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 68: Middle East and Africa Smart Exoskeleton Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 69: Middle East and Africa Smart Exoskeleton Market Value Share Analysis, by Product, 2024 and 2035

Figure 70: Middle East and Africa Smart Exoskeleton Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 71: Middle East and Africa Smart Exoskeleton Market Value Share Analysis, by Extremity, 2024 and 2035

Figure 72: Middle East and Africa Smart Exoskeleton Market Attractiveness Analysis, by Extremity, 2025 to 2035

Figure 73: Middle East and Africa Smart Exoskeleton Market Value Share Analysis, by Application, 2024 and 2035

Figure 74: Middle East and Africa Smart Exoskeleton Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 75: Middle East and Africa Smart Exoskeleton Market Value Share Analysis, by End-user, 2024 and 2035

Figure 76: Middle East and Africa Smart Exoskeleton Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 77: Middle East and Africa Smart Exoskeleton Market Value Share Analysis, by Region, 2024 and 2035

Figure 78: Middle East and Africa Smart Exoskeleton Market Attractiveness Analysis, by Region, 2025 to 2035