Reports

Reports

Analyst Viewpoint

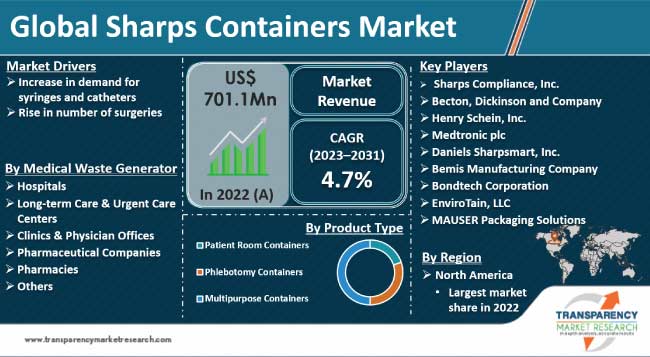

Increase in demand for syringes and catheters is driving the global sharps containers market. Ongoing developments in medical infrastructure and rise in awareness about vaccinations are spurring the need for syringes and catheters in hospitals, clinics, and laboratories. Increase in the adoption of such equipment generates large amounts of medical waste which requires safe disposal solutions. Furthermore, increase in number of surgeries is expected to bolster the global sharps containers industry size during the forecast period.

Advancements in medical technology and surge in cases of chronic illnesses offer lucrative opportunities to market players. Manufacturers are investing significantly in the development of locking mechanism for sharps containers and in pediatric sharps disposal solutions in order to increase market share.

Sharp containers are heavy plastic vessels used to safely dispose medical wastes such as hypodermic needles, IV catheters, and disposal scalpels. These containers are designed to be leak-proof and puncture-resistant, making secure disposal easy and accessible even to non-medical practitioners.

Rise in chronic diseases that require surgical procedures is propelling the sharps containers market dynamics. Consequences of improper medical waste disposal both toxic and non-toxic include the risk of spread of diseases, contamination of water supply, and deterioration of environment. Sharps containers are available easily in conventional pharmacies, medical suppliers, and healthcare providers.

Ongoing developments in medical infrastructure and rise in awareness about vaccinations post-pandemic are driving demand for syringes, catheters, saline needles, and reagents in hospitals, clinics, and laboratories. Increase in adoption of such equipment generates large amounts of medical waste, which requires safe disposal solutions.

According to World Health Organization (WHO), global COVID-19 vaccination programs generated an additional 144,000 tons of waste in the form of syringes, needles, and safety boxes.

According to a report by All Points Medical Waste, the U.K. produces an estimated 538,600 tons of medical waste every year, compared to 5.9 million tons generated by the U.S. Thus, increase in demand for syringes and catheters is projected to propel the global sharps containers market in the next few years.

Surge in incidence of chronic diseases increases the number of surgeries and advanced medical treatments. This in turn drives demand for sharps containers. Innovation in medical products has led to development of advanced medical devices and techniques which can involve technologies ranging from radiation to nano-medicine.

According to a study conducted by the World Journal of Surgery, around 3,646 surgeries are required per 100,000 people living in India every year. The global estimate for a similar study is tracked at 5,000 surgeries per 100,000 people. Thus, rise in number for surgeries is increasing the volume of medical waste, which, in turn, is bolstering the sharps containers market during the forecast period.

North America accounted for the largest global sharps containers market share in 2022. Presence of well-developed healthcare sector and rise in awareness about biological waste are augmenting the market dynamics of the region.

As per data made publicly available by the Government of Canada, over 104 million COVID-19 vaccine dosages were administered in the country. This surge in vaccination increased the need for sharps containers for bio-waste disposal.

According to the sharps containers market analysis, Europe is a lucrative region for manufacturers due to availability of public healthcare and implementation of strict government laws regarding disposal of hazardous bio-waste.

Increase in adoption of metal sharps due to rise in number of surgical practices and expansion of medical tourism augments the market in Asia Pacific.

According to recent sharps containers market trends, prominent manufacturers are investing significantly in the development of biohazard sharps disposal solutions. They are developing cost-effective sharps containers for diabetic needles and infectious waste bins for medical waste disposals used by hospitals and clinics.

Sharps Compliance, Inc., Becton, Dickinson and Company, Henry Schein, Inc., Medtronic plc, Daniels Sharpsmart, Inc., Bemis Manufacturing Company, Bondtech Corporation, EnviroTain, LLC, and MAUSER Packaging Solutions are the prominent players in the global market.

Leading companies have been profiled in the sharps containers market report based on parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 (Base Year) | US$ 701.1 Mn |

| Forecast (Value) in 2031 | US$ 1.0 Bn |

| Growth Rate (CAGR) | 4.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn/Mn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 701.1 Mn in 2022

It is projected to grow at a CAGR of 4.7% from 2023 to 2031

Increase in demand for syringes & catheters and surge in number of surgeries

The multipurpose containers segment accounted for the largest share in 2022

North America was the most lucrative region in 2022

Sharps Compliance, Inc., Becton, Dickinson and Company, Henry Schein, Inc., Medtronic plc, Daniels Sharpsmart, Inc., Bemis Manufacturing Company, Bondtech Corporation, EnviroTain, LLC, and MAUSER Packaging Solutions

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Sharps Containers Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Sharps Containers Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product Type/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Sharps Containers Market Analysis and Forecast, by Product Type

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Patient Room Containers

6.3.2. Phlebotomy Containers

6.3.3. Multipurpose Containers

6.4. Market Attractiveness Analysis, by Product Type

7. Global Sharps Containers Market Analysis and Forecast, by Waste Type

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Waste Type, 2017–2031

7.3.1. Infectious & Pathological Waste

7.3.2. Sharps Waste

7.3.3. Pharmaceutical Waste

7.3.4. Non-infectious & Other Waste

7.4. 7.4 Market Attractiveness Analysis, by Waste Type

8. Global Sharps Containers Market Analysis and Forecast, by Medical Waste Generator

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Medical Waste Generator, 2017–2031

8.3.1. Hospitals

8.3.2. Long-term Care & Urgent Care Centers

8.3.3. Clinics & Physician Offices

8.3.4. Pharmaceutical Companies

8.3.5. Pharmacies

8.3.6. Others

8.4. Market Attractiveness Analysis, by Medical Waste Generator

9. Global Sharps Containers Market Analysis and Forecast, by Usage Type

9.1. Introduction and Definitions

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Usage Type, 2017–2031

9.3.1. Disposable Containers

9.3.2. Reusable Containers

9.4. Market Attractiveness Analysis, by Usage Type

10. Global Sharps Containers Market Analysis and Forecast, by Distribution Channel

10.1. Introduction and Definitions

10.2. Key Findings/Developments

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Direct Sale

10.3.2. Online Sale

10.3.3. Retail Sale

10.4. Market Attractiveness Analysis, by Distribution Channel

11. Global Sharps Containers Market Analysis and Forecast, by Container Size

11.1. Introduction and Definitions

11.2. Key Findings/Developments

11.3. Market Value Forecast, by Container Size, 2017–2031

11.3.1. 1 – 2 Gallons

11.3.2. 2 – 4 Gallons

11.3.3. 4 – 8 Gallons

11.3.4. Others

11.4. Market Attractiveness Analysis, by Container Size

12. Global Sharps Containers Market Analysis and Forecast, by Region

12.1. Key Findings

12.2. Market Value Forecast, by Region, 2017–2031

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Latin America

12.2.5. Middle East & Africa

12.3. Market Attractiveness Analysis, by Region

13. North America Sharps Containers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Patient Room Containers

13.2.2. Phlebotomy Containers

13.2.3. Multipurpose Containers

13.3. Market Attractiveness Analysis, by Product Type

13.4. Market Value Forecast, by Waste Type, 2017–2031

13.4.1. Infectious & Pathological Waste

13.4.2. Sharps Waste

13.4.3. Pharmaceutical Waste

13.4.4. Non-infectious & Other Waste

13.5. Market Attractiveness Analysis, by Waste Type

13.6. Market Value Forecast, by Medical Waste Generator, 2017–2031

13.6.1. Hospitals

13.6.2. Long-term Care & Urgent Care Centers

13.6.3. Clinics & Physician Offices

13.6.4. Pharmaceutical Companies

13.6.5. Pharmacies

13.6.6. Others

13.7. Market Attractiveness Analysis, by Medical Waste Generator

13.8. Market Value Forecast, by Usage Type, 2017–2031

13.8.1. Disposable Containers

13.8.2. Reusable Containers

13.9. Market Attractiveness Analysis, by Usage Type

13.10. Market Value Forecast, by Distribution Channel, 2017–2031

13.10.1. Direct Sale

13.10.2. Online Sale

13.10.3. Retail Sale

13.11. Market Attractiveness Analysis, by Distribution Channel

13.12. Market Value Forecast, by Container Size

13.12.1. 1 – 2 Gallons

13.12.2. 2 – 4 Gallons

13.12.3. 4 – 8 Gallons

13.12.4. Others

13.13. Market Attractiveness Analysis, by Container Size

13.14. Market Value Forecast, by Country/Sub-region, 2017–2031

13.14.1. U.S.

13.14.2. Canada

13.15. Market Attractiveness Analysis

13.15.1. By Product Type

13.15.2. By Waste Type

13.15.3. By Medical Waste Generator

13.15.4. By Usage Type

13.15.5. By Distribution Channel

13.15.6. By Container Size

13.15.7. By Country

14. Europe Sharps Containers Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Patient Room Containers

14.2.2. Phlebotomy Containers

14.2.3. Multipurpose Containers

14.3. Market Attractiveness Analysis, by Product Type

14.4. Market Value Forecast, by Waste Type, 2017–2031

14.4.1. Infectious & Pathological Waste

14.4.2. Sharps Waste

14.4.3. Pharmaceutical Waste

14.4.4. Non-infectious & Other Waste

14.5. Market Attractiveness Analysis, by Waste Type

14.6. Market Value Forecast, by Medical Waste Generator, 2017–2031

14.6.1. Hospitals

14.6.2. Long-term Care & Urgent Care Centers

14.6.3. Clinics & Physician Offices

14.6.4. Pharmaceutical Companies

14.6.5. Pharmacies

14.6.6. Others

14.7. Market Attractiveness Analysis, by Medical Waste Generator

14.8. Market Value Forecast, by Usage Type, 2017–2031

14.8.1. Disposable Containers

14.8.2. Reusable Containers

14.9. Market Attractiveness Analysis, by Usage Type

14.10. Market Value Forecast, by Distribution Channel, 2017–2031

14.10.1. Direct Sale

14.10.2. Online Sale

14.10.3. Retail Sale

14.11. Market Attractiveness Analysis, by Distribution Channel

14.12. Market Value Forecast, by Container Size, 2017–2031

14.12.1. 1 – 2 Gallons

14.12.2. 2 – 4 Gallons

14.12.3. 4 – 8 Gallons

14.12.4. Others

14.13. Market Attractiveness Analysis, by Container Size

14.14. Market Value Forecast, by Country/Sub-region, 2017–2031

14.14.1. Germany

14.14.2. U.K.

14.14.3. France

14.14.4. Italy

14.14.5. Spain

14.14.6. Rest of Europe

14.15. Market Attractiveness Analysis

14.15.1. By Product Type

14.15.2. By Waste Type

14.15.3. By Medical Waste Generator

14.15.4. By Usage Type

14.15.5. By Distribution Channel

14.15.6. By Container Size

14.15.7. By Country/Sub-region

15. Asia Pacific Sharps Containers Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product Type, 2017–2031

15.2.1. Patient Room Containers

15.2.2. Phlebotomy Containers

15.2.3. Multipurpose Containers

15.3. Market Attractiveness Analysis, by Product Type

15.4. Market Value Forecast, by Waste Type, 2017–2031

15.4.1. Infectious & Pathological Waste

15.4.2. Sharps Waste

15.4.3. Pharmaceutical Waste

15.4.4. Non-infectious & Other Waste

15.5. Market Attractiveness Analysis, by Waste Type

15.6. Market Value Forecast, by Medical Waste Generator, 2017–2031

15.6.1. Hospitals

15.6.2. Long-term Care & Urgent Care Centers

15.6.3. Clinics & Physician Offices

15.6.4. Pharmaceutical Companies

15.6.5. Pharmacies

15.6.6. Others

15.7. Market Attractiveness Analysis, by Medical Waste Generator

15.8. Market Value Forecast, by Usage Type, 2017–2031

15.8.1. Disposable Containers

15.8.2. Reusable Containers

15.9. Market Attractiveness Analysis, by Usage Type

15.10. Market Value Forecast, by Distribution Channel, 2017–2031

15.10.1. Direct Sale

15.10.2. Online Sale

15.10.3. Retail Sale

15.11. Market Attractiveness Analysis, by Distribution Channel

15.12. Market Value Forecast, by Container Size, 2017–2031

15.12.1. 1 – 2 Gallons

15.12.2. 2 – 4 Gallons

15.12.3. 4 – 8 Gallons

15.12.4. Others

15.13. Market Attractiveness Analysis, by Container Size

15.14. Market Value Forecast, by Country/Sub-region, 2017–2031

15.14.1. China

15.14.2. Japan

15.14.3. India

15.14.4. Australia & New Zealand

15.14.5. Rest of Asia Pacific

15.15. Market Attractiveness Analysis

15.15.1. By Product Type

15.15.2. By Waste Type

15.15.3. By Medical Waste Generator

15.15.4. By Usage Type

15.15.5. By Distribution Channel

15.15.6. By Container Size

15.15.7. By Country/Sub-region

16. Latin America Sharps Containers Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Product Type, 2017–2031

16.2.1. Patient Room Containers

16.2.2. Phlebotomy Containers

16.2.3. Multipurpose Containers

16.3. Market Attractiveness Analysis, by Product Type

16.4. Market Value Forecast, by Waste Type, 2017–2031

16.4.1. Infectious & Pathological Waste

16.4.2. Sharps Waste

16.4.3. Pharmaceutical Waste

16.4.4. Non-infectious & Other Waste

16.5. Market Attractiveness Analysis, by Waste Type

16.6. Market Value Forecast, by Medical Waste Generator, 2017–2031

16.6.1. Hospitals

16.6.2. Long-term Care & Urgent Care Centers

16.6.3. Clinics & Physician Offices

16.6.4. Pharmaceutical Companies

16.6.5. Pharmacies

16.6.6. Others

16.7. Market Attractiveness Analysis, by Medical Waste Generator

16.8. Market Value Forecast, by Usage Type, 2017–2031

16.8.1. Disposable Containers

16.8.2. Reusable Containers

16.9. Market Attractiveness Analysis, by Usage Type

16.10. Market Value Forecast, by Distribution Channel, 2017–2031

16.10.1. Direct Sale

16.10.2. Online Sale

16.10.3. Retail Sale

16.11. Market Attractiveness Analysis, by Distribution Channel

16.12. Market Value Forecast, by Container Size, 2017–2031

16.12.1. 1 – 2 Gallons

16.12.2. 2 – 4 Gallons

16.12.3. 4 – 8 Gallons

16.12.4. Others

16.13. Market Attractiveness Analysis, by Container Size

16.14. Market Value Forecast, by Country/Sub-region, 2017–2031

16.14.1. Brazil

16.14.2. Mexico

16.14.3. Rest of Latin America

16.15. Market Attractiveness Analysis

16.15.1. By Product Type

16.15.2. By Waste Type

16.15.3. By Medical Waste Generator

16.15.4. By Usage Type

16.15.5. By Distribution Channel

16.15.6. By Container Size

16.15.7. By Country/Sub-region

17. Middle East & Africa Sharps Containers Market Analysis and Forecast

17.1. Introduction

17.1.1. Key Findings

17.2. Market Value Forecast, by Product Type, 2017–2031

17.2.1. Patient Room Containers

17.2.2. Phlebotomy Containers

17.2.3. Multipurpose Containers

17.3. Market Attractiveness Analysis, by Product Type

17.4. Market Value Forecast, by Waste Type, 2017–2031

17.4.1. Infectious & Pathological Waste

17.4.2. Sharps Waste

17.4.3. Pharmaceutical Waste

17.4.4. Non-infectious & Other Waste

17.5. Market Attractiveness Analysis, by Waste Type

17.6. Market Value Forecast, by Medical Waste Generator, 2017–2031

17.6.1. Hospitals

17.6.2. Long-term Care & Urgent Care Centers

17.6.3. Clinics & Physician Offices

17.6.4. Pharmaceutical Companies

17.6.5. Pharmacies

17.6.6. Others

17.7. Market Attractiveness Analysis, by Medical Waste Generator

17.8. Market Value Forecast, by Usage Type, 2017–2031

17.8.1. Disposable Containers

17.8.2. Reusable Containers

17.9. Market Attractiveness Analysis, by Usage Type

17.10. Market Value Forecast, by Distribution Channel, 2017–2031

17.10.1. Direct Sale

17.10.2. Online Sale

17.10.3. Retail Sale

17.11. Market Attractiveness Analysis, by Distribution Channel

17.12. Market Value Forecast, by Container Size, 2017–2031

17.12.1. 1 – 2 Gallons

17.12.2. 2 – 4 Gallons

17.12.3. 4 – 8 Gallons

17.12.4. Others

17.13. Market Attractiveness Analysis, by Container Size

17.14. Market Value Forecast, by Country/Sub-region, 2017–2031

17.14.1. GCC Countries

17.14.2. South Africa

17.14.3. Rest of Middle East & Africa

17.15. Market Attractiveness Analysis

17.15.1. By Product Type

17.15.2. By Waste Type

17.15.3. By Medical Waste Generator

17.15.4. By Usage Type

17.15.5. By Distribution Channel

17.15.6. By Container Size

17.15.7. By Country/Sub-region

18. Competition Landscape

18.1. Market Player – Competition Matrix (by tier and size of companies)

18.2. Market Share Analysis, by Company (2022)

18.3. Company Profiles

18.3.1. Sharps Compliance, Inc.

18.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.1.2. Product Type Portfolio

18.3.1.3. Financial Overview

18.3.1.4. SWOT Analysis

18.3.1.5. Strategic Overview

18.3.2. Becton, Dickinson and Company

18.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.2.2. Product Type Portfolio

18.3.2.3. Financial Overview

18.3.2.4. SWOT Analysis

18.3.2.5. Strategic Overview

18.3.3. Henry Schein, Inc.

18.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.3.2. Product Type Portfolio

18.3.3.3. Financial Overview

18.3.3.4. SWOT Analysis

18.3.3.5. Strategic Overview

18.3.4. Medtronic plc

18.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.4.2. Product Type Portfolio

18.3.4.3. Financial Overview

18.3.4.4. SWOT Analysis

18.3.4.5. Strategic Overview

18.3.5. Daniels Sharpsmart, Inc.

18.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.5.2. Product Type Portfolio

18.3.5.3. Financial Overview

18.3.5.4. SWOT Analysis

18.3.5.5. Strategic Overview

18.3.6. Bemis Manufacturing Company

18.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.6.2. Product Type Portfolio

18.3.6.3. Financial Overview

18.3.6.4. SWOT Analysis

18.3.6.5. Strategic Overview

18.3.7. Bondtech Corporation

18.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.7.2. Product Type Portfolio

18.3.7.3. Financial Overview

18.3.7.4. SWOT Analysis

18.3.7.5. Strategic Overview

18.3.8. EnviroTain, LLC

18.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.8.2. Product Type Portfolio

18.3.8.3. Financial Overview

18.3.8.4. SWOT Analysis

18.3.8.5. Strategic Overview

18.3.9. MAUSER Packaging Solutions

18.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.9.2. Product Type Portfolio

18.3.9.3. Financial Overview

18.3.9.4. SWOT Analysis

18.3.9.5. Strategic Overview

List of Tables

Table 01: Global Sharps Containers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Sharps Containers Market Size (US$ Mn) Forecast, by Waste Type, 2017–2031

Table 03: Global Sharps Containers Market Size (US$ Mn) Forecast, by Usage Type, 2017–2031

Table 04: Global Sharps Containers Market Size (US$ Mn) Forecast, by Medical Waste Generator, 2017–2031

Table 05: Global Sharps Containers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: Global Sharps Containers Market Size (US$ Mn) Forecast, by Container Size, 2017–2031

Table 07: Global Sharps Containers Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 08: North America Sharps Containers Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 09: North America Sharps Containers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 10: North America Sharps Containers Market Size (US$ Mn) Forecast, by Waste Type, 2017–2031

Table 11: North America Sharps Containers Market Size (US$ Mn) Forecast, by Medical Waste Generator, 2017–2031

Table 12: North America Sharps Containers Market Size (US$ Mn) Forecast, by Usage Type, 2017–2031

Table 13: North America Sharps Containers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 14: North America Sharps Containers Market Size (US$ Mn) Forecast, by Container Size, 2017–2031

Table 15: Europe Sharps Containers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Europe Sharps Containers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 17: Europe Sharps Containers Market Size (US$ Mn) Forecast, by Waste Type, 2017–2031

Table 18: Europe Sharps Containers Market Size (US$ Mn) Forecast, by Medical Waste Generator, 2017–2031

Table 19: Europe Sharps Containers Market Size (US$ Mn) Forecast, by Usage Type, 2017–2031

Table 20: Europe Sharps Containers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Europe Sharps Containers Market Size (US$ Mn) Forecast, by Container Size, 2017–2031

Table 22: Asia Pacific Sharps Containers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 23: Asia Pacific Sharps Containers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 24: Asia Pacific Sharps Containers Market Size (US$ Mn) Forecast, by Waste Type, 2017–2031

Table 25: Asia Pacific Sharps Containers Market Size (US$ Mn) Forecast, by Medical Waste Generator, 2017–2031

Table 26: Asia Pacific Sharps Containers Market Size (US$ Mn) Forecast, by Usage Type, 2017–2031

Table 27: Asia Pacific Sharps Containers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 28: Asia Pacific Sharps Containers Market Size (US$ Mn) Forecast, by Container Size, 2017–2031

Table 29: Latin America Sharps Containers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 30: Latin America Sharps Containers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 31: Latin America Sharps Containers Market Size (US$ Mn) Forecast, by Waste Type, 2017–2031

Table 32: Latin America Sharps Containers Market Size (US$ Mn) Forecast, by Medical Waste Generator, 2017–2031

Table 33: Latin America Sharps Containers Market Size (US$ Mn) Forecast, by Usage Type, 2017–2031

Table 34: Latin America Sharps Containers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 35: Latin America Sharps Containers Market Size (US$ Mn) Forecast, by Container Size, 2017–2031

Table 36: Middle East & Africa Sharps Containers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 37: Middle East & Africa Sharps Containers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 38: Middle East & Africa Sharps Containers Market Size (US$ Mn) Forecast, by Waste Type, 2017–2031

Table 39: Middle East & Africa Sharps Containers Market Size (US$ Mn) Forecast, by Medical Waste Generator, 2017–2031

Table 40: Middle East & Africa Sharps Containers Market Size (US$ Mn) Forecast, by Usage Type, 2017–2031

Table 41: Middle East & Africa Sharps Containers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 42: Middle East & Africa Sharps Containers Market Size (US$ Mn) Forecast, by Container Size, 2017–2031

List of Figures

Figure 01: Global Sharps Containers Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Sharps Containers Market Revenue (US$ Mn), by Product Type, 2022

Figure 03: Global Sharps Containers Market Value Share, by Product Type, 2022

Figure 04: Global Sharps Containers Market Revenue (US$ Mn), by Waste Type, 2022

Figure 05: Global Sharps Containers Market Value Share, by Waste Type, 2022

Figure 06: Global Sharps Containers Market Revenue (US$ Mn), by Medical Waste Generator, 2022

Figure 07: Global Sharps Containers Market Value Share, by Medical Waste Generator, 2022

Figure 08: Global Sharps Containers Market Revenue (US$ Mn), by Usage Type, 2022

Figure 09: Global Sharps Containers Market Value Share, by Usage Type, 2022

Figure 10: Global Sharps Containers Market Revenue (US$ Mn), by Distribution Channel, 2022

Figure 11: Global Sharps Containers Market Value Share, by Distribution Channel, 2022

Figure 12: Global Sharps Containers Market Value Share, by Container Size, 2022

Figure 13: Global Sharps Containers Market Value Share, by Container Size, 2022

Figure 14: Global Sharps Containers Market Value Share, by Region, 2022

Figure 15: Global Sharps Containers Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Global Sharps Containers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 17: Global Sharps Containers Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 18: Global Sharps Containers Market Value Share Analysis, by Waste Type, 2022 and 2031

Figure 19: Global Sharps Containers Market Attractiveness Analysis, by Waste Type, 2023-2031

Figure 20: Global Sharps Containers Market Value Share Analysis, by Medical Waste Generator, 2022 and 2031

Figure 21: Global Sharps Containers Market Attractiveness Analysis, by Medical Waste Generator, 2023-2031

Figure 22: Global Sharps Containers Market Revenue (US$ Mn), by Usage Type, 2022

Figure 23: Global Sharps Containers Market Value Share, by Usage Type, 2022

Figure 24: Global Sharps Containers Market Revenue (US$ Mn), by Distribution Channel, 2022

Figure 25: Global Sharps Containers Market Value Share, by Distribution Channel, 2022

Figure 26: Global Sharps Containers Market Revenue (US$ Mn), by Container Size, 2022

Figure 27: Global Sharps Containers Market Value Share, by Container Size, 2022

Figure 28: Global Sharps Containers Market Value Share Analysis, by Region, 2022 and 2031

Figure 29: Global Sharps Containers Market Attractiveness Analysis, by Region, 2023-2031

Figure 30: North America Sharps Containers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 31: North America Sharps Containers Market Attractiveness Analysis, by Country, 2023–2031

Figure 32: North America Sharps Containers Market Value Share Analysis, by Country, 2022 and 2031

Figure 33: North America Sharps Containers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 34: North America Sharps Containers Market Value Share Analysis, by Waste Type, 2022 and 2031

Figure 35: North America Sharps Containers Market Value Share Analysis, by Medical Waste Generator, 2022 and 2031

Figure 36: North America Sharps Containers Market Value Share Analysis, by Usage Type, 2022 and 2031

Figure 37: North America Sharps Containers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 38: North America Sharps Containers Market Value Share Analysis, by Container Size, 2022 and 2031

Figure 39: North America Sharps Containers Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 40: North America Sharps Containers Market Attractiveness Analysis, by Waste Type, 2023–2031

Figure 41: North America Sharps Containers Market Attractiveness Analysis, by Medical Waste Generator, 2023–2031

Figure 42: North America Sharps Containers Market Attractiveness Analysis, by Usage Type, 2023–2031

Figure 43: North America Sharps Containers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 44: North America Sharps Containers Market Attractiveness Analysis, by Container Size, 2023–2031

Figure 45: Europe Sharps Containers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Europe Sharps Containers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Europe Sharps Containers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Europe Sharps Containers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 49: Europe Sharps Containers Market Value Share Analysis, by Waste Type, 2022 and 2031

Figure 50: Europe Sharps Containers Market Value Share Analysis, by Medical Waste Generator, 2022 and 2031

Figure 51: Europe Sharps Containers Market Value Share Analysis, by Usage Type, 2022 and 2031

Figure 52: Europe Sharps Containers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 53: Europe Sharps Containers Market Value Share Analysis, by Container Size, 2022 and 2031

Figure 54: Europe Sharps Containers Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 55: Europe Sharps Containers Market Attractiveness Analysis, by Waste Type, 2023–2031

Figure 56: Europe Sharps Containers Market Attractiveness Analysis, by Medical Waste Generator, 2023–2031

Figure 57: Europe Sharps Containers Market Attractiveness Analysis, by Usage Type, 2023–2031

Figure 58: Europe Sharps Containers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 59: Europe Sharps Containers Market Attractiveness Analysis, by Container Size, 2023–2031

Figure 60: Asia Pacific Sharps Containers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 61: Asia Pacific Sharps Containers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 62: Asia Pacific Sharps Containers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 63: Asia Pacific Sharps Containers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 64: Asia Pacific Sharps Containers Market Value Share Analysis, by Waste Type, 2022 and 2031

Figure 65: Asia Pacific Sharps Containers Market Value Share Analysis, by Medical Waste Generator, 2022 and 2031

Figure 66: Asia Pacific Sharps Containers Market Value Share Analysis, by Usage Type, 2022 and 2031

Figure 67: Asia Pacific Sharps Containers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 68: Asia Pacific Sharps Containers Market Value Share Analysis, by Container Size, 2022 and 2032

Figure 69: Asia Pacific Sharps Containers Market Attractiveness Analysis, by Product Type, 2017–2031

Figure 70: Asia Pacific Sharps Containers Market Attractiveness Analysis, by Waste Type, 2023–2031

Figure 71: Asia Pacific Sharps Containers Market Attractiveness Analysis, by Medical Waste Generator, 2023–2031

Figure 72: Asia Pacific Sharps Containers Market Attractiveness Analysis, by Usage Type, 2023–2031

Figure 73: Asia Pacific Sharps Containers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 74: Asia Pacific Sharps Containers Market Attractiveness Analysis, by Container Size, 2023–2032

Figure 75: Latin America Sharps Containers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 76: Latin America Sharps Containers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 77: Latin America Sharps Containers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 78: Latin America Sharps Containers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 79: Latin America Sharps Containers Market Value Share Analysis, by Waste Type, 2022 and 2031

Figure 80: Latin America Sharps Containers Market Value Share Analysis, by Medical Waste Generator, 2022 and 2031

Figure 81: Latin America Sharps Containers Market Value Share Analysis, by Usage Type, 2022 and 2031

Figure 82: Latin America Sharps Containers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 83: Latin America Sharps Containers Market Value Share Analysis, by Container Size, 2022 and 2032

Figure 84: Latin America Sharps Containers Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 85: Latin America Sharps Containers Market Attractiveness Analysis, by Waste Type, 2023–2031

Figure 86: Latin America Sharps Containers Market Attractiveness Analysis, by Medical Waste Generator, 2023–2031

Figure 87: Latin America Sharps Containers Market Attractiveness Analysis, by Usage Type, 2023–2031

Figure 88: Latin America Sharps Containers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 89: Latin America Sharps Containers Market Attractiveness Analysis, by Container Size, 2023–2031

Figure 90: Middle East & Africa Sharps Containers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 91: Middle East & Africa Sharps Containers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 92: Middle East & Africa Sharps Containers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 93: Middle East & Africa Sharps Containers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 94: Middle East & Africa Sharps Containers Market Value Share Analysis, by Waste Type, 2022 and 2031

Figure 95: Middle East & Africa Sharps Containers Market Value Share Analysis, by Medical Waste Generator, 2022 and 2031

Figure 96: Middle East & Africa Sharps Containers Market Value Share Analysis, by Usage Type, 2022 and 2031

Figure 97: Middle East & Africa Sharps Containers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 98: Middle East & Africa Sharps Containers Market Value Share Analysis, by Container Size, 2022 and 2032

Figure 99: Middle East & Africa Sharps Containers Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 100: Middle East & Africa Sharps Containers Market Attractiveness Analysis, by Waste Type, 2023–2031

Figure 101: Middle East & Africa Sharps Containers Market Attractiveness Analysis, by Medical Waste Generator, 2023–2031

Figure 102: Middle East & Africa Sharps Containers Market Attractiveness Analysis, by Usage Type, 2023–2031

Figure 103: Middle East & Africa Sharps Containers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 104: Middle East & Africa Sharps Containers Market Attractiveness Analysis, by Container Size, 2023–2031