Reports

Reports

Analysts’ Viewpoint on Scenario

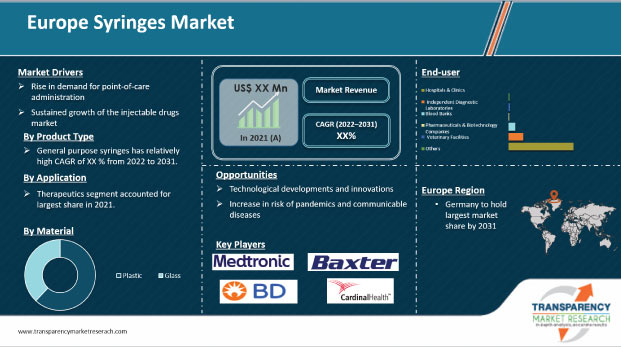

Large number of hospitals and rise in research & development activities in research labs, pharmaceutical companies, and government initiatives for different vaccination programs are expected to boost the syringes market in the Europe during the forecast period. Innovations by companies are fueling the market growth. For instance, Pharmapack introduced GxInnosafe Syringe, a fill syringe with a passive needle protection system. Companies, such as Zeon, are carrying out innovation in prefilled syringes to optimize the formulation and containment. Moreover, an increase in various chronic diseases has significantly driven the syringes market in Europe. Germany accounted for a major share of the syringes market in Europe. It has been analyzed that, in terms of usage, disposable syringes held a notable share of the market, which ultimately propels the syringes market in Europe.

A syringe is a medical equipment used to inject or withdraw fluid from the patient’s body. The various types of needles & syringes available include insulin syringes, injection syringes, disposable syringes, and prefilled syringes. Increase in geriatric population and surge in incidence of chronic diseases are projected to drive the syringes market in Europe during the forecast period.

Leading players in the syringes market in Europe are developing advanced new products and carrying out innovations through strategic collaborations, partnerships, and mergers & acquisitions. For instance, in July 2017, Gerresheimer AG entered into an exclusive license agreement with West Pharmaceutical Services, Inc. and acquired the rights to market innovative, new syringe safety solution, developed by West Pharmaceutical Services, Inc.

The well-developed healthcare system in Europe is expected to boost the syringes market in the region during the forecast period.

The number of people self-administering medication at home is increasing rapidly. Insulin dependent diabetics and people suffering from ailments are increasingly opting for reliable and safe methods to self-inject medication. The prevalence of diabetes is increasing in Europe. According to the World Health Organization (WHO), approximately 60 million people in the region have diabetes. The number of cases and prevalence of diabetes have been rising for the last few decades.

Auto injectors and pen injectors are integrated with prefilled syringes, which is an important factor driving the demand for self-administrable devices. Therefore, preference for self-administration is expected to propel the adoption of syringes over the next few years.

Increasing number of biologics and potent & complex molecules have been approved for marketing in the last few years. Key hospitals, diagnostic centers, and general practitioners are using syringes for drug delivery, as these offer ease of handling, less overfills, and better safety to patients. Most biologics are given parenterally, as oral administration leads to protein hydrolysis in the digestive tract. Moreover, usage of disposable syringes for drug delivery results in reduced costs, as these syringes reduce the overfill volume and deliver precise drug dosage. Increase in usage of injectable is likely to drive the demand for syringes.

Over 60% drugs in clinical development are biologics, indicating a robust expansion of the biologics market. This, in turn, is expected to boost the syringes market.

In terms of product type, the syringes market in Europe has been classified into general purpose syringes segment, specialized syringes (insulin syringes & others), and smart syringes. The general purpose syringe segment accounted a major share of the global market in 2021. Syringes are utilized for different conditions such as cancer, diabetes, arthritis, and multiple sclerosis. Therefore, an increase in incidence of chronic diseases drives the adoption of syringes.

In terms of material, the Europe syringes market has been bifurcated into plastic and glass. The plastic segment accounted for a major share of the market in 2021. Adoption of Polymer pre-filled (PFS) syringes is increasing, as polymer PFSs offer wider design options, while ensuring low rates of breakage. Polymer is free of heavy metals and tungsten due to its material properties and manufacturing process. It could also have low or no siliconisation options. The plastic segment is driven by ease of handling and easy transport with less breakage ratio as compared to glass-based syringes. Therefore, polymer-based syringes are extensively utilized in Europe.

Based on usage, the Europe syringes market has been divided into disposable and reusable prefilled syringes. Diagnostic centers and general practitioners use disposable syringes for drug delivery, as these offer ease of handling, reduce overfills, and provide better safety to patients. Hence, increase in usage of these syringes is likely to drive the disposable syringes segment.

In terms of application, the therapeutics segment held a notable share of the market in 2021. The segment is expected to expand at a CAGR of 5.7% from 2022 to 2031. Increase in the number of diseases and a surge in geriatric population in Europe are expected to drive the segment in the near future.

Based on end-user, the syringes market in Europe has been divided into hospitals & clinics, diagnostic laboratories, blood banks, pharmaceuticals & biotechnology companies, veterinary facilities, and others. The hospitals & clinics segment dominated the market in the region, in terms of revenue, in 2021. The trend is projected to continue during the forecast period. The growth of the segment can be ascribed to an increase in the incidence of various chronic disorders, ability of hospitals to provide optimum health care services to patients, and rise in the number of patients opting for treatment at hospitals supported by reimbursement programs such as Medicare.

In terms of country, the syringes market in Europe has been segmented into Germany, the U.K., France, Italy, Spain, Sweden, Portugal, Belgium, the Netherlands, Switzerland, Austria, Russia, Poland, the Baltics, Croatia, the Czech Republic, Hungary, Romania, Slovakia, Slovenia, Ukraine, and Rest of Europe. Germany accounted for a prominent share of the syringes market in Europe in 2021. The trend is projected to continue during the forecast period.

The market in the U.K. is estimated to expand at a rapid pace during the forecast period, owing to an increase in the number of people self-administering medication at home.

The syringes market in Europe is consolidated with a small number of large-scale vendors controlling majority of the market share. Key firms are spending significantly on comprehensive research & development, primarily to develop environment-friendly products. Expansion of product portfolios and mergers & acquisitions are major strategies adopted by key players. Some leading players analyzed in the report are Baxter International, Inc., B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Cardinal Health, Medtronic plc, etc.

Each of these players has been profiled in the Syringes Market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4 Bn |

|

Market Forecast Value in 2031 |

US$ 6.9 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at Europe as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Europe syringe market is expected to reach US$ 6.9 Bn by 2031

Europe syringe market is estimated to grow at a CAGR of 5.6 % during the forecast period

Europe syringe market is driven by rise in demand for point-of-care administration and increase in number of immunization programs by various international organizations

Therapeutics segment accounted for 52% share of Europe syringe market in 2021

Germany is more attractive for vendors in the Europe syringe market

Key players of Europe syringe market include Baxter International, Inc., B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Cardinal Health, Gerresheimer AG, Medtronic plc, Nipro Corporation, Gerresheimer AG, SCHOTT AG, ICU Medical, Inc., Terumo Corporation, Teleflex Incorporated, and Vitrex Medical A/S (CTI Group)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Europe Syringes Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Europe Syringes Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. List of Major Plastic Manufacturers

5.2. Pricing Analysis

5.3. Key Industry Events (Mergers, Acquisitions, Partnerships, etc.)

5.4. Covid-19 Impact Analysis

6. Europe Syringes Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. General Purpose Syringes

6.3.2. Specialized Syringes

6.3.2.1. Insulin

6.3.2.2. Others

6.3.3. Smart Syringes

6.4. Market Attractiveness, by Product Type

7. Europe Syringes Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals & Clinics

7.3.2. Independent Diagnostics Laboratories

7.3.3. Blood Banks

7.3.4. Pharmaceuticals & Biotechnologies Companies

7.3.5. Veterinary Facilities

7.3.6. Others

7.4. Market Attractiveness, by End-user

8. Europe Syringes Market Analysis and Forecast, by Material

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value & Volume Forecast, by Material, 2017–2031

8.3.1. Plastic

8.3.1.1. PP

8.3.1.2. LDPE

8.3.1.3. HDPE

8.3.1.4. Others

8.3.2. Glass

8.4. Market Attractiveness, by Material

9. Europe Syringes Market Analysis and Forecast, by Application

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Application, 2017–2031

9.3.1. Therapeutics

9.3.2. Diagnostics

9.3.3. Immunization

9.3.4. Others

9.4. Market Attractiveness, by Application

10. Europe Syringes Market Analysis and Forecast, by Usage

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast, by Usage , 2017–2031

10.3.1. Disposable Syringes

10.3.1.1. Conventional Syringes

10.3.1.2. Safety Syringes

10.3.2. Reusable Syringes

10.4. Market Attractiveness, by Usage

11. Europe Syringes Market Analysis and Forecast, by Country/Sub-region

11.1. Key Findings

11.2. Market Value Forecast, by Country/Sub-region, 2017–2031

11.2.1. Germany (Section-12)

11.2.2. U.K. (Section-13)

11.2.3. France (Section-14)

11.2.4. Italy (Section-15)

11.2.5. Spain (Section-16)

11.2.6. Sweden (Section-17)

11.2.7. Portugal (Section-18)

11.2.8. Belgium (Section-19)

11.2.9. Netherlands (Section-20)

11.2.10. Switzerland (Section-21)

11.2.11. Austria (Section-22)

11.2.12. Russia (Section-23)

11.2.13. Poland (Section-24)

11.2.14. Baltics (Section-25)

11.2.15. Croatia (Section-26)

11.2.16. Czech Republic (Section-27)

11.2.17. Hungary (Section-28)

11.2.18. Romania (Section-29)

11.2.19. Slovakia (Section-30)

11.2.20. Slovenia (Section-31)

11.2.21. Ukraine (Section-32)

11.2.22. Rest of Europe (Section-33)

11.3. Market Attractiveness Analysis

11.3.1. By Product Type

11.3.2. By End-user

11.3.3. By Material

11.3.4. By Application

11.3.5. By Usage

12. Competition Landscape (Section 26)

12.1. Market Player – Competition Matrix (By Tier and Size of companies)

12.2. Market Ranking Analysis By Company (2021)

12.3. Company Profiles

12.3.1. Baxter International Inc

12.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.1.2. Product Portfolio

12.3.1.3. SWOT Analysis

12.3.1.4. Strategic Overview

12.3.2. B. Braun Melsungen AG

12.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.2.2. Product Portfolio

12.3.2.3. SWOT Analysis

12.3.2.4. Strategic Overview

12.3.3. Becton, Dickinson and Company (BD)

12.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.3.2. Product Portfolio

12.3.3.3. SWOT Analysis

12.3.3.4. Strategic Overview

12.3.4. Cardinal Health

12.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.4.2. Product Portfolio

12.3.4.3. SWOT Analysis

12.3.4.4. Strategic Overview

12.3.5. Gerresheimer AG

12.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.5.2. Product Portfolio

12.3.5.3. SWOT Analysis

12.3.5.4. Strategic Overview

12.3.6. Medtronic plc

12.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.6.2. Product Portfolio

12.3.6.3. SWOT Analysis

12.3.6.4. Strategic Overview

12.3.7. Nipro Corporation

12.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.7.2. Product Portfolio

12.3.7.3. SWOT Analysis

12.3.7.4. Strategic Overview

12.3.8. Gerresheimer AG

12.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.8.2. Product Portfolio

12.3.8.3. SWOT Analysis

12.3.8.4. Strategic Overview

12.3.9. SCHOTT AG

12.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.9.2. Product Portfolio

12.3.9.3. SWOT Analysis

12.3.9.4. Strategic Overview

12.3.10. ICU Medical Inc

12.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.10.2. Product Portfolio

12.3.10.3. SWOT Analysis

12.3.10.4. Strategic Overview

12.3.11. Terumo Corporation

12.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.11.2. Product Portfolio

12.3.11.3. SWOT Analysis

12.3.11.4. Strategic Overview

12.3.12. Teleflex Incorporated

12.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.12.2. Product Portfolio

12.3.12.3. SWOT Analysis

12.3.12.4. Strategic Overview

12.3.13. Vitrex Medical A/S (CTI Group)

12.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

12.3.13.2. Product Portfolio

12.3.13.3. SWOT Analysis

12.3.13.4. Strategic Overview

List of Tables

Table 01: Europe Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Europe Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 03: Europe Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 04: Europe Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 05: Europe Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 06: Europe Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 07: Europe Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 08: Europe Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 09: Europe Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: Europe Syringes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Germany Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 12: Germany Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 13: Germany Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 14: Germany Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 15: Germany Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 16: Germany Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 17: Germany Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 18: Germany Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 19: Germany Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: U.K. Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 21: U.K. Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 22: U.K. Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 23: U.K. Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 24: U.K. Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 25: U.K. Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 26: U.K. Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 27: U.K. Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 28: U.K. Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 29: France Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 30: France Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 31: France Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 32: France Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 33: France Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 34: France Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 35: France Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 36: France Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 37: France Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 38: Italy Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 39: Italy Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 40: Italy Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 41: Italy Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 42: Italy Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 43: Italy Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 44: Italy Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 45: Italy Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 46: Italy Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 47: Spain Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 48: Spain Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 49: Spain Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 50: Spain Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 51: Spain Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 52: Spain Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 53: Spain Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 54: Spain Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 55: Spain Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 56: Sweden Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 57: Sweden Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 58: Sweden Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 59: Sweden Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 60: Sweden Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 61: Sweden Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 62: Sweden Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 63: Sweden Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 64: Sweden Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 65: Portugal Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 66: Portugal Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 67: Portugal Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 68: Portugal Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 69: Portugal Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 70: Portugal Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 71: Portugal Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 72: Portugal Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 73: Portugal Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 74: Belgium Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 75: Belgium Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 76: Belgium Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 77: Belgium Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 78: Belgium Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 79: Belgium Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 80: Belgium Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 81: Belgium Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 82: Belgium Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 83: Netherlands Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 84: Netherlands Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 85: Netherlands Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 86: Netherlands Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 87: Netherlands Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 88: Netherlands Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 89: Netherlands Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 90: Netherlands Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 91: Netherlands Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 92: Switzerland Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 93: Switzerland Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 94: Switzerland Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 95: Switzerland Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 96: Switzerland Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 97: Switzerland Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 98: Switzerland Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 99: Switzerland Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 100: Switzerland Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 101: Austria Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 102: Austria Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 103: Austria Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 104: Austria Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 105: Austria Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 106: Austria Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 107: Austria Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 108: Austria Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 109: Austria Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 110: Russia Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 111: Russia Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 112: Russia Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 113: Russia Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 114: Russia Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 115: Russia Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 116: Russia Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 117: Russia Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 118: Russia Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 119: Poland Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 120: Poland Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 121: Poland Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 122: Poland Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 123: Poland Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 124: Poland Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 125: Poland Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 126: Poland Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 127: Poland Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 128: Baltics Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 129: Baltics Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 130: Baltics Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 131: Baltics Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 132: Baltics Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 133: Baltics Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 134: Baltics Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 135: Baltics Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 136: Baltics Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 137: Croatia Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 138: Croatia Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 139: Croatia Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 140: Croatia Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 141: Croatia Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 142: Croatia Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 143: Croatia Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 144: Croatia Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 145: Croatia Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 146: Czech Republic Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 147: Czech Republic Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 148: Czech Republic Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 149: Czech Republic Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 150: Czech Republic Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 151: Czech Republic Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 152: Czech Republic Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 153: Czech Republic Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 154: Czech Republic Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 155: Hungary Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 156: Hungary Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 157: Hungary Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 158: Hungary Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 159: Hungary Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 160: Hungary Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 161: Hungary Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 162: Hungary Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 163: Hungary Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 164: Romania Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 165: Romania Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 166: Romania Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 167: Romania Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 168: Romania Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 169: Romania Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 170: Romania Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 171: Romania Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 172: Romania Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 173: Slovakia Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 174: Slovakia Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 175: Slovakia Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 176: Slovakia Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 177: Slovakia Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 178: Slovakia Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 179: Slovakia Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 180: Slovakia Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 181: Slovakia Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 182: Slovenia Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 183: Slovenia Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 185: Slovenia Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 186: Slovenia Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 187: Slovenia Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 188: Slovenia Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 189: Slovenia Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 190: Slovenia Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 191: Slovenia Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 192: Ukraine Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 193: Ukraine Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 194: Ukraine Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 195: Ukraine Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 196: Ukraine Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 197: Ukraine Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 198: Ukraine Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 199: Ukraine Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 200: Ukraine Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 201: Rest of Europe Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 202: Rest of Europe Syringes Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 203: Rest of Europe Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 204: Rest of Europe Syringes Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 205: Rest of Europe Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 206: Rest of Europe Syringes Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 207: Rest of Europe Syringes Market Volume (Tons) Forecast, by Material, 2017–2031

Table 208: Rest of Europe Syringes Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 209: Rest of Europe Syringes Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Europe Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 02: Europe Syringes Market Value Share (%), by Country/Sub-region, 2021

Figure 03: Europe Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 04: Europe Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 05: Europe Syringes Market Revenue (US$ Mn), by General Purpose Syringes, 2017–2031

Figure 06: Europe Syringes Market Revenue (US$ Mn), by Industry, 2017–2031

Figure 07: Europe Syringes Market Revenue (US$ Mn), by Smart Syringes, 2017–2031

Figure 08: Europe Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 09: Europe Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 10: Europe Syringes Market Revenue (US$ Mn), by Disposable, 2017–2031

Figure 11: Europe Syringes Market Revenue (US$ Mn), by Reusable, 2017–2031

Figure 12: Europe Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 13: Europe Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 14: Europe Syringes Market Revenue (US$ Mn), by Plastic, 2017–2031

Figure 15: Europe Syringes Market Revenue (US$ Mn), by Glass, 2017–2031

Figure 16: Europe Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 17: Europe Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 18: Europe Syringes Market Value (US$ Mn), by Therapeutics, 2017–2031

Figure 19: Europe Syringes Market Value (US$ Mn), by Diagnostics, 2017–2031

Figure 20: Europe Syringes Market Value (US$ Mn), by Immunization, 2017–2031

Figure 21: Europe Syringes Market Value (US$ Mn), by Others, 2017–2031

Figure 22: Europe Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 23: Europe Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 24: Europe Syringes Market Revenue (US$ Mn), by Hospitals & Clinics, 2017–2031

Figure 25: Europe Syringes Market Revenue (US$ Mn), by Independent Diagnostic Laboratories, 2017–2031

Figure 26: Europe Syringes Market Revenue (US$ Mn), by Blood Banks, 2017–2031

Figure 27: Europe Syringes Market Revenue (US$ Mn), by Pharmaceuticals & Biotechnology Companies, 2017–2031

Figure 28: Europe Syringes Market Revenue (US$ Mn), by Veterinary Facilities, 2017–2031

Figure 29: Europe Syringes Market Revenue (US$ Mn), by Others, 2017–2031

Figure 30: Europe Syringes Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 31: Europe Syringes Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 32: Germany Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 33: Germany Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 34: Germany Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 35: Germany Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 36: Germany Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 37: Germany Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 38: Germany Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 39: Germany Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 40: Germany Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 41: Germany Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 42: Germany Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 43: U.K. Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 44: U.K. Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 45: U.K. Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 46: U.K. Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 47: U.K. Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 48: U.K. Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 49: U.K. Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 50: U.K. Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 51: U.K. Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 52: U.K. Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 53: U.K. Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 54: France Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 55: France Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 56: France Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 57: France Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 58: France Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 59: France Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 60: France Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 61: France Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 62: France Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 63: France Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 64: France Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 65: Italy Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 66: Italy Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 67: Italy Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 68: Italy Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 69: Italy Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 70: Italy Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 71: Italy Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 72: Italy Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 73: Italy Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 74: Italy Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 75: Italy Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 76: Spain Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 77: Spain Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 78: Spain Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 79: Spain Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 80: Spain Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 81: Spain Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 82: Spain Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 83: Spain Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 84: Spain Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 85: Spain Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 86: Spain Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 87: Sweden Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 88: Sweden Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 89: Sweden Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 90: Sweden Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 91: Sweden Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 92: Sweden Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 93: Sweden Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 94: Sweden Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 95: Sweden Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 96: Sweden Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 97: Sweden Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 98: Portugal Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 99: Portugal Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 100: Portugal Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 101: Portugal Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 102: Portugal Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 103: Portugal Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 104: Portugal Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 105: Portugal Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 106: Portugal Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 107: Portugal Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 108: Portugal Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 109: Belgium Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 110: Belgium Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 111: Belgium Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 112: Belgium Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 113: Belgium Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 114: Belgium Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 115: Belgium Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 116: Belgium Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 117: Belgium Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 118: Belgium Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 119: Belgium Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 120: Netherlands Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 121: Netherlands Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 122: Netherlands Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 123: Netherlands Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 124: Netherlands Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 125: Netherlands Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 126: Netherlands Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 127: Netherlands Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 128: Netherlands Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 129: Netherlands Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 130: Netherlands Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 131: Switzerland Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 132: Switzerland Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 133: Switzerland Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 134: Switzerland Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 135: Switzerland Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 136: Switzerland Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 137: Switzerland Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 138: Switzerland Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 139: Switzerland Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 140: Switzerland Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 141: Switzerland Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 142: Austria Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 143: Austria Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 144: Austria Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 145: Austria Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 146: Austria Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 147: Austria Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 148: Austria Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 149: Austria Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 150: Austria Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 151: Austria Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 152: Austria Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 153: Russia Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 154: Russia Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 155: Russia Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 156: Russia Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 157: Russia Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 158: Russia Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 159: Russia Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 160: Russia Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 161: Russia Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 162: Russia Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 163: Russia Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 164: Poland Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 165: Poland Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 166: Poland Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 167: Poland Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 168: Poland Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 169: Poland Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 170: Poland Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 171: Poland Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 172: Poland Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 173: Poland Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 174: Poland Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 175: Baltics Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 176: Baltics Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 177: Baltics Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 178: Baltics Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 179: Baltics Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 180: Baltics Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 181: Baltics Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 182: Baltics Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 183: Baltics Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 184: Baltics Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 185: Baltics Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 186: Croatia Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 187: Croatia Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 188: Croatia Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 189: Croatia Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 190: Croatia Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 191: Croatia Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 192: Croatia Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 193: Croatia Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 194: Croatia Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 195: Croatia Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 196: Croatia Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 197: Czech Republic Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 198: Czech Republic Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 199: Czech Republic Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 200: Czech Republic Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 201: Czech Republic Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 202: Czech Republic Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 203: Czech Republic Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 204: Czech Republic Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 205: Czech Republic Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 206: Czech Republic Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 207: Czech Republic Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 208: Hungary Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 209: Hungary Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 210: Hungary Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 211: Hungary Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 212: Hungary Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 213: Hungary Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 214: Hungary Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 215: Hungary Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 216: Hungary Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 217: Hungary Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 218: Hungary Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 219: Romania Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 220: Romania Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 221: Romania Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 222: Romania Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 223: Romania Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 224: Romania Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 225: Romania Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 226: Romania Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 227: Romania Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 228: Romania Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 229: Romania Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 230: Slovakia Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 231: Slovakia Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 232: Slovakia Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 233: Slovakia Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 234: Slovakia Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 235: Slovakia Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 236: Slovakia Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 237: Slovakia Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 238: Slovakia Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 239: Slovakia Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 240: Slovakia Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 241: Slovenia Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 242: Slovenia Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 243: Slovenia Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 244: Slovenia Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 245: Slovenia Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 246: Slovenia Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 247: Slovenia Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 248: Slovenia Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 249: Slovenia Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 250: Slovenia Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 251: Slovenia Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 252: Ukraine Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 253: Ukraine Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 254: Ukraine Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 255: Ukraine Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 256: Ukraine Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 257: Ukraine Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 258: Ukraine Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 259: Ukraine Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 260: Ukraine Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 261: Ukraine Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 262: Ukraine Syringes Market Attractiveness Analysis, by End-user, 2022–2031

Figure 263: Rest of Europe Syringes Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 264: Rest of Europe Syringes Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 265: Rest of Europe Syringes Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 266: Rest of Europe Syringes Market Value Share Analysis, by Usage, 2021 and 2031

Figure 267: Rest of Europe Syringes Market Attractiveness Analysis, by Usage, 2022–2031

Figure 268: Rest of Europe Syringes Market Value Share Analysis, by Material, 2021 and 2031

Figure 269: Rest of Europe Syringes Market Attractiveness Analysis, by Material, 2022–2031

Figure 270: Rest of Europe Syringes Market Value Share Analysis, by Application, 2021 and 2031

Figure 271: Rest of Europe Syringes Market Attractiveness Analysis, by Application, 2022–2031

Figure 272: Rest of Europe Syringes Market Value Share Analysis, by End-user, 2021 and 2031

Figure 273: Rest of Europe Syringes Market Attractiveness Analysis, by End-user, 2022–2031