Reports

Reports

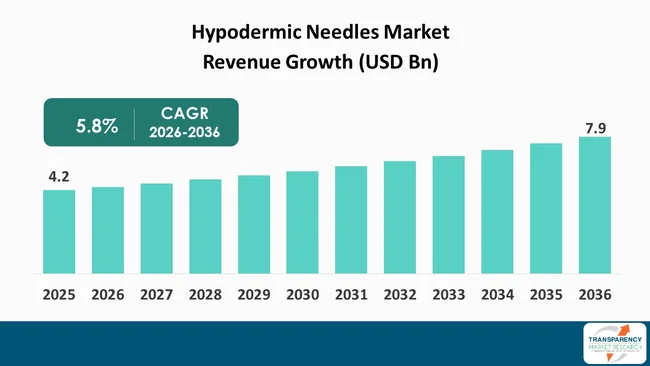

The global hypodermic needles market size was valued at US$ 4.2 Bn in 2025 and is projected to reach US$ 7.9 Bn by 2036, expanding at a CAGR of 5.8% from 2026 to 2036. The market growth is driven by an increasing demand for rapid infectious disease screening and technological advancements improving sensitivity and multiplexing.

The hypodermic needles industry is fueled by the continuous need for needles and needle disposables, due to increased injection-based therapies and vaccination efforts across hospitals, clinics, and homecare. Due to the increased rates of chronic illnesses and the movement to outpatient and home delivered medications, the units of needles and the other expendable product usage continues to grow. The large players in this market have the ability to influence their markets through the development and innovation of products that comply with regulatory guidelines and support higher volume manufacturing, thus reducing the cost per unit and improving the adoption of Safety Engineered designs. Due to the efforts to support safe injection practices through public health initiatives and procurement policies, the market continues to develop new products.

The consistent pricing of these products from large global manufacturers ensure that they are available in both - developed and emerging markets. The rate of adoption of safety innovations for replacement of traditional products will be based on government and institutional purchasing behavior, therefore developing strategic partnerships and effective clinical education programs will be critical for the growth and profitability of Leadership Companies within the Hypodermic Needle Industry.

Market demand is supported by various persistent drivers that do not depend on transitory pricing or single-country dynamics. Cyclic consumption of single-use needles will be bolstered through the continued expansion of vaccination and immunization efforts. As the population ages and the incidence of chronic diseases increases, the long-term demand for injectable treatments, including biologics administered via subcutaneous routes, will grow. The growth of outpatient and at-home healthcare services means there is now a greater demand for simpler-to-use pre-filled, ready-to-go, needle-syringe kits.

Safety engineering and the other regulations mandating methods to eliminate the risk of needle-stick injuries incentivize the purchase of safety-engineered devices. With improvements in the medical infrastructure of middle-income countries, new channels for purchasing have emerged, while contracts through distribution partnerships and tender purchasing with governmental health organizations help eliminate market volatility. These benefits will allow the market to continue expanding without relying on fluctuations in demand to generate additional growth opportunities.

| Attribute | Detail |

|---|---|

| Hypodermic Needles Market Drivers |

|

The heightened interest in regulating and preventing occupational exposure through policies and regulations has significantly increased the amount of safety hypodermic needles used in healthcare. The direct and indirect costs associated with treating needle stick injuries for healthcare institutions create a strong incentive for purchasing departments to support the use of engineered safety devices. Additionally, the global community, as well as national organizations and health agencies have promoted or mandated the use of safer injection products, leading to an expedited shift from older product lines.

For example, World Health Organization's promotion of the use of smart or auto-disable syringes and the development of policies to discourage the reuse of syringes worldwide, which prompts the public and nonprofit immunization programs to create demand for procurement of these types of products.

A combination of external compliance requirements, quantifiable monetary losses associated with needle injuries, and the access to validated safety-engineered needle products creates a long-term dedicated source of demand for needle manufacturers who invest in engineering compliance products.

Increased use of outpatient services and increased promotion of homecare services have changed the purchasing habits of hypodermic syringes. As more treatments are done on an outpatient basis, hypodermic syringes will be purchased by a much larger group of consumers than just hospitals (i.e. clinics, long-term care facilities, and consumers). For example, due to the rise of self-injectable biologics and subcutaneous therapies, many suppliers have created commercial programs for their drug-device combination to provide prefilled syringes with matching needles for these products to make them easier to dose and provide patients with more compliance.

The need for these prefilled syringes is also increasing with the aging population and the shift toward managing chronic illnesses through home therapy to limit the need for hospitalization. Consequently, manufacturers will be required to develop new product lines or SKUs for these convenience oriented products, and they will need to develop new distribution channels to reach retailers or community pharmacies. All of these changes to the healthcare delivery system are making the outpatient and homecare markets long-term growth opportunities for the hypodermic syringes market that also create new product opportunities in the areas of packaging, ergonomics and compatibility with drug delivery systems.

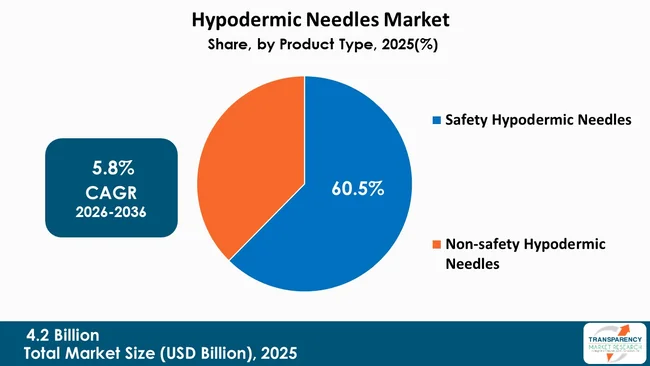

Currently, safety hypodermic needles are the most common product type in the market as they address clinical and occupational needs while not requiring changes to clinical workflows. Safety hypodermic needles operate by integrating a mechanism that either shields or retracts the sharp immediately after the needle has been used, thus reducing the chance of unintentional needle stick injuries and blood borne pathogen transmissions.

The impetus for manufacturers to produce safety hypodermic needles is the purchasing practices of hospitals and health care systems, regulatory compliance and guidelines, and the existence of large-scale public health initiatives such as immunization campaigns and large public health tenders, which specify that a safety-engineered device is required. For example, the existence of national and international initiatives to reduce unsafe injection practices and to reduce needlestick injuries has created a preference for safety hypodermic needles in terms of purchasing.

A well-known initiative attempted to support the adoption of "smart" or auto-disable syringes in order to prevent reuse and protect both the patient and the health care provider.

Purchasing personnel in hospitals prefer devices that can maximize safety and minimize costs and are likely to award contracts or tenders to manufacturers who provide validated safety designs. Recent reports from occupational safety and health reporting systems and occupational health surveillance programs report that sharps injuries are frequent and costly, leading many hospital risk managers and public health programs to include safety-engineered devices as a priority when purchasing supplies. Therefore, safety hypodermic needles are at the confluence of government purchasing policies, clinical risk reduction activities, and the capabilities of suppliers to provide these products.

| Attribute | Detail |

|---|---|

| Leading Region |

|

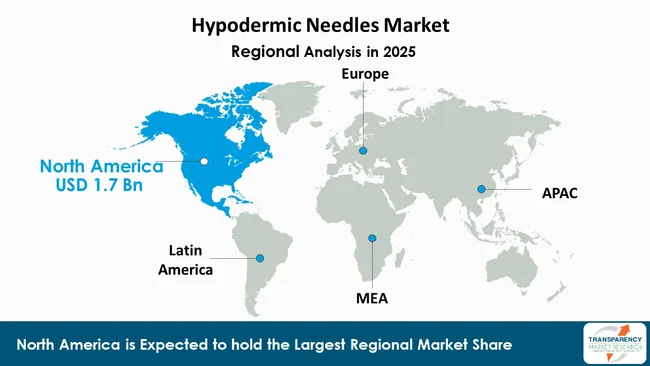

North America has the highest concentration of market leadership currently with the greatest amount of investment into the health care system through increased investment per capita to improve access to care. In the U.S., in particular, North America has very well-developed integrated hospital systems; numerous outpatient and/or homecare services; and established mechanisms to procure medically approved medical devices by hospitals.

The combination of institutional purchasing; occupational safety standards; and comprehensive reporting of needles used in occupational settings creates a predictable demand for improving upon current needle technologies.

For example, records from Public Health and Occupational Safety in the U.S. show that thousands of needle stick injuries occur to employees within the health care system every year, thus directing the purchasing of safety engineered needles for hospitals and other clinics throughout the country. The reimbursement from payers for outpatient injectable therapies and the organization of robust vaccination campaigns will support continuing purchasing activity as well. The combination of regulatory incentives; clinical risk management emphasis; and established supply chain infrastructures place the North American market as the leading market for new product introductions and premium-enabled product utilization.

Companies operating in the hypodermic needles market focus on forging strategic collaborations, innovating their products, and validating the performance of their products across various clinical settings. These firms invest significantly in R&D related to cutting-edge microfluidic and non-invasive techniques, widen their distribution channels, and provide integrated service solutions for having a strong market presence and a high customer loyalty.

Hitech Syringes, Retractable Technologies Inc., Cardinal Health Inc., Becton Dickinson and Company, B. Braun Melsungen AG, Nipro Corporation, Connecticut Hypodermics Inc., Exelint International Co., Terumo Medical Corporation, McKesson Corporation, Medtronic, Smiths Medical, Novo Nordisk, Medline Industries Inc. are some of the leading players operating in the global hypodermic needles market.

Each of these players has been profiled in the hypodermic needles market research report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 4.2 Bn |

| Forecast Value in 2036 | US$ 7.9 Bn |

| CAGR | 5.8% |

| Forecast Period | 2025-2036 |

| Historical Data Available for | 2021-2024 |

| Quantitative Units | US$ Bn |

| Hypodermic Needles Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global hypodermic needles market was valued at US$ 4.2 Bn in 2025

The global hypodermic needles industry is projected to reach more than US$ 7.9 Bn by the end of 2036

Increased focus on safety and regulations and growth of outpatient and home healthcare delivery

The CAGR is anticipated to be 5.8% from 2026 to 2036

Hitech Syringes, Retractable Technologies Inc., Cardinal Health Inc., Becton Dickinson and Company, B. Braun Melsungen AG, Nipro Corporation, Connecticut Hypodermics Inc., Exelint International Co., Terumo Medical Corporation, McKesson Corporation, Medtronic, Smiths Medical, Novo Nordisk, Medline Industries Inc., and others

Table 01: Global Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 02: Global Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 03: Global Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 04: Global Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 05: Global Hypodermic Needles Market Value (US$ Bn) Forecast, by Region, 2021 to 2036

Table 06: North America Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 07: North America Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 08: North America Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 09: North America Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 10: North America Hypodermic Needles Market Value (US$ Bn) Forecast, by Country, 2021 to 2036

Table 11: U.S. Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 12: U.S. Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 13: U.S. Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 14: U.S. Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 15: Canada Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 16: Canada Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 17: Canada Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 18: Canada Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 19: Europe Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 20: Europe Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 21: Europe Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 22: Europe Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 23: Europe Hypodermic Needles Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 24: Germany Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 25: Germany Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 26: Germany Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 27: Germany Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 28: U.K. Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 29: U.K. Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 30: U.K. Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 31: U.K. Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 32: France Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 33: France Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 34: France Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 35: France Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 36: Italy Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 37: Italy Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 38: Italy Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 39: Italy Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 40: Spain Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 41: Spain Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 42: Spain Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 43: Spain Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 44: The Netherlands Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 45: The Netherlands Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 46: The Netherlands Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 47: The Netherlands Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 48: Rest of Europe Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 49: Rest of Europe Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 50: Rest of Europe Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 51: Rest of Europe Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 52: Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 53: Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 54: Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 55: Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 56: Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 57: China Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 58: China Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 59: China Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 60: China Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 61: Japan Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 62: Japan Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 63: Japan Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 64: Japan Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 65: India Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 66: India Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 67: India Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 68: India Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 69: South Korea Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 70: South Korea Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 71: South Korea Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 72: South Korea Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 73: ASEAN Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 74: ASEAN Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 75: ASEAN Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 76: ASEAN Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 77: Australia Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 78: Australia Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 79: Australia Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 80: Australia Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 81: Rest of Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 82: Rest of Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 83: Rest of Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 84: Rest of Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 85: Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 86: Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 87: Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 88: Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 89: Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 90: Brazil Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 91: Brazil Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 92: Brazil Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 93: Brazil Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 94: Mexico Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 95: Mexico Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 96: Mexico Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 97: Mexico Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 98: Argentina Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 99: Argentina Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 100: Argentina Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 101: Argentina Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 102: Rest of Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 103: Rest of Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 104: Rest of Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 105: Rest of Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 106: Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 107: Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 108: Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 109: Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 110: Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 111: GCC Countries Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 112: GCC Countries Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 113: GCC Countries Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 114: GCC Countries Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 115: South Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 116: South Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 117: South Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 118: South Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 119: Rest of Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 120: Rest of Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Safety Hypodermic Needles, 2021 to 2036

Table 121: Rest of Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 122: Rest of Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Figure 01: Global Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 03: Global Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 04: Global Hypodermic Needles Market Revenue (US$ Bn), by Safety Hypodermic Needles, 2021 to 2036

Figure 05: Global Hypodermic Needles Market Revenue (US$ Bn), by Non-safety Hypodermic Needles, 2021 to 2036

Figure 06: Global Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 07: Global Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 08: Global Hypodermic Needles Market Revenue (US$ Bn), by Drug Delivery, 2021 to 2036

Figure 09: Global Hypodermic Needles Market Revenue (US$ Bn), by Vaccination, 2021 to 2036

Figure 10: Global Hypodermic Needles Market Revenue (US$ Bn), by Blood Specimen Collection, 2021 to 2036

Figure 11: Global Hypodermic Needles Market Revenue (US$ Bn), by Others (Anesthesia & Spinal Procedures, etc.), 2021 to 2036

Figure 12: Global Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 13: Global Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 14: Global Hypodermic Needles Market Revenue (US$ Bn), by Hospitals and Clinics, 2021 to 2036

Figure 15: Global Hypodermic Needles Market Revenue (US$ Bn), by Cancer Treatments Centers, 2021 to 2036

Figure 16: Global Hypodermic Needles Market Revenue (US$ Bn), by Dermatology Clinics, 2021 to 2036

Figure 17: Global Hypodermic Needles Market Revenue (US$ Bn), by Others (Ambulatory Surgical Centers, etc.), 2021 to 2036

Figure 18: Global Hypodermic Needles Market Value Share Analysis, by Region, 2025 and 2036

Figure 19: Global Hypodermic Needles Market Attractiveness Analysis, by Region, 2025 to 2036

Figure 20: North America Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 21: North America Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 22: North America Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 23: North America Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 24: North America Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 25: North America Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 26: North America Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 27: North America Hypodermic Needles Market Value Share Analysis, by Country, 2025 and 2036

Figure 28: North America Hypodermic Needles Market Attractiveness Analysis, by Country, 2025 to 2036

Figure 29: U.S. Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 30: U.S. Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 31: U.S. Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 32: U.S. Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 33: U.S. Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 34: U.S. Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 35: U.S. Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 36: Canada Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 37: Canada Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 38: Canada Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 39: Canada Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 40: Canada Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 41: Canada Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 42: Canada Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 43: Europe Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 44: Europe Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 45: Europe Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 46: Europe Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 47: Europe Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 48: Europe Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 49: Europe Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 50: Europe Hypodermic Needles Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 51: Europe Hypodermic Needles Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2036

Figure 52: Germany Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 53: Germany Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 54: Germany Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 55: Germany Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 56: Germany Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 57: Germany Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 58: Germany Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 59: U.K. Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 60: U.K. Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 61: U.K. Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 62: U.K. Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 63: U.K. Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 64: U.K. Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 65: U.K. Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 66: France Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 67: France Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 68: France Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 69: France Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 70: France Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 71: France Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 72: France Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 73: Italy Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 74: Italy Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 75: Italy Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 76: Italy Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 77: Italy Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 78: Italy Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 79: Italy Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 80: Spain Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 81: Spain Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 82: Spain Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 83: Spain Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 84: Spain Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 85: Spain Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 86: Spain Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 87: The Netherlands Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 88: The Netherlands Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 89: The Netherlands Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 90: The Netherlands Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 91: The Netherlands Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 92: The Netherlands Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 93: The Netherlands Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 94: Rest of Europe Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 95: Rest of Europe Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 96: Rest of Europe Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 97: Rest of Europe Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 98: Rest of Europe Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 99: Rest of Europe Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 100: Rest of Europe Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 101: Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 102: Asia Pacific Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 103: Asia Pacific Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 104: Asia Pacific Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 105: Asia Pacific Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 106: Asia Pacific Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 107: Asia Pacific Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 108: Asia Pacific Hypodermic Needles Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 109: Asia Pacific Hypodermic Needles Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2036

Figure 110: China Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 111: China Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 112: China Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 113: China Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 114: China Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 115: China Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 116: China Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 117: Japan Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 118: Japan Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 119: Japan Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 120: Japan Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 121: Japan Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 122: Japan Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 123: Japan Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 124: India Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 125: India Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 126: India Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 127: India Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 128: India Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 129: India Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 130: India Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 131: South Korea Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 132: South Korea Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 133: South Korea Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 134: South Korea Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 135: South Korea Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 136: South Korea Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 137: South Korea Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 138: ASEAN Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 139: ASEAN Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 140: ASEAN Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 141: ASEAN Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 142: ASEAN Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 143: ASEAN Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 144: ASEAN Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 145: Australia Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 146: Australia Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 147: Australia Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 148: Australia Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 149: Australia Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 150: Australia Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 151: Australia Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 152: Rest of Asia Pacific Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 153: Rest of Asia Pacific Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 154: Rest of Asia Pacific Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 155: Rest of Asia Pacific Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 156: Rest of Asia Pacific Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 157: Rest of Asia Pacific Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 158: Rest of Asia Pacific Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 159: Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 160: Latin America Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 161: Latin America Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 162: Latin America Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 163: Latin America Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 164: Latin America Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 165: Latin America Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 166: Latin America Hypodermic Needles Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 167: Latin America Hypodermic Needles Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2036

Figure 168: Brazil Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 169: Brazil Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 170: Brazil Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 171: Brazil Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 172: Brazil Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 173: Brazil Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 174: Brazil Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 175: Mexico Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 176: Mexico Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 177: Mexico Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 178: Mexico Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 179: Mexico Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 180: Mexico Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 181: Mexico Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 182: Argentina Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 183: Argentina Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 184: Argentina Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 185: Argentina Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 186: Argentina Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 187: Argentina Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 188: Argentina Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 189: Rest of Latin America Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 190: Rest of Latin America Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 191: Rest of Latin America Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 192: Rest of Latin America Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 193: Rest of Latin America Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 194: Rest of Latin America Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 195: Rest of Latin America Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 196: Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 197: Middle East and Africa Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 198: Middle East and Africa Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 199: Middle East and Africa Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 200: Middle East and Africa Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 201: Middle East and Africa Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 202: Middle East and Africa Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 203: Middle East and Africa Hypodermic Needles Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 204: Middle East and Africa Hypodermic Needles Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2036

Figure 205: GCC Countries Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 206: GCC Countries Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 207: GCC Countries Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 208: GCC Countries Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 209: GCC Countries Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 210: GCC Countries Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 211: GCC Countries Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 212: South Africa Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 213: South Africa Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 214: South Africa Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 215: South Africa Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 216: South Africa Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 217: South Africa Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 218: South Africa Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036

Figure 219: Rest of Middle East and Africa Hypodermic Needles Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 220: Rest of Middle East and Africa Hypodermic Needles Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 221: Rest of Middle East and Africa Hypodermic Needles Market Attractiveness Analysis, by Product Type, 2025 to 2036

Figure 222: Rest of Middle East and Africa Hypodermic Needles Market Value Share Analysis, by Application, 2025 and 2036

Figure 223: Rest of Middle East and Africa Hypodermic Needles Market Attractiveness Analysis, by Application, 2025 to 2036

Figure 224: Rest of Middle East and Africa Hypodermic Needles Market Value Share Analysis, by End-user, 2025 and 2036

Figure 225: Rest of Middle East and Africa Hypodermic Needles Market Attractiveness Analysis, by End-user, 2025 to 2036