Reports

Reports

The global psoriasis treatment market is witnessing steadiness, driven primarily by the increase in prevalence of psoriasis, rising awareness and advancements in biologic and targeted therapies. More number of patients are being diagnosed with psoriasis due to the overall increase in healthcare access and improved awareness, which increases the demand for effective treatment that offers long-term control of symptoms.

Biologic therapies, especially the IL-17 and IL-23 inhibitors, are currently offering highly effective treatment options are accepted by patients and care providers. However, there are key restraints including the high price of these new therapies that are limiting access in low and middle-income areas.

.webp)

The major opportunities are available particularly in emerging markets as the healthcare infrastructure improves, as well as the emergence of biosimilars in conjunction with more customized forms of treatments with facilitating technology including digital health monitoring and AI diagnostics that can help identify treatment patterns simplifying affordability, access, and effectiveness of therapy. These changes are a fast-moving landscape offering an opportunity for pharmaceutical companies in gaining new ground and ultimately helping patients.

Psoriasis is an autoimmune condition that causes inflammation in skin. Symptoms of psoriasis include thick areas of discolored skin covered with scales. These thick, scaly areas are called plaques. Psoriasis is a chronic skin condition, which means it can flare up unexpectedly and there’s no cure. Psoriasis treatment market aim to stop skin cells from growing so quickly and to remove scales. Options include creams and ointments (topical therapy), light therapy (phototherapy), and oral or injected medications.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing incidence of psoriasis is a significant driver to the growth of the psoriasis treatment market around the world. For instance, according to data published by National Center for Biotechnology Information in 2022, Psoriasis is a common chronic inflammatory disease with prevalence of 0.33%-0.6% in different races and affects around 125 million people worldwide. This growing patient pool of psoriasis, their need for more innovative treatments to manage symptoms of inflammation, red lesions, and plaques, the pressure for drugs geared toward symptom relief is increasing along with the size of the patient pool.

The increasing incidence of comorbidities including psoriatic arthritis (which occurs in 30 to 40% of psoriasis patients) will only serve to increase the need for potential therapies. Along with increased disease awareness, diagnosis, and access, the residual population seeking treatment is well defined and follow-up consultation will continue to grow.

The increasing regulatory approvals is a key driver to the psoriasis treatment industry growth as they are allowing for more advanced innovative therapies, specifically biologics and new small molecules, to be developed to provide better efficacy and safety for patients. With more innovative products such as newer interleukin inhibitors and topical products approved by regulatory agencies, patients will have a greater range of effective treatment options to treat their unmet medical needs to manage their disease.

For instance, in May 2025, Arcutis Biotherapeutics, Inc. announced the U.S. Food and Drug Administration (FDA) has approved the supplemental New Drug Application (sNDA) for ZORYVE (roflumilast) topical foam 0.3% for the treatment of plaque psoriasis of the scalp and body in adult and pediatric patients 12 years of age and older. ZORYVE foam is a once-daily, steroid-free topical and is now widely available as a treatment for plaque psoriasis

Furthermore, with the approval of these new therapies, there will be more new products for competition, continued development and research, and biopharmaceutical industry investment, all contributing to strong growth in the market over the forecast period.

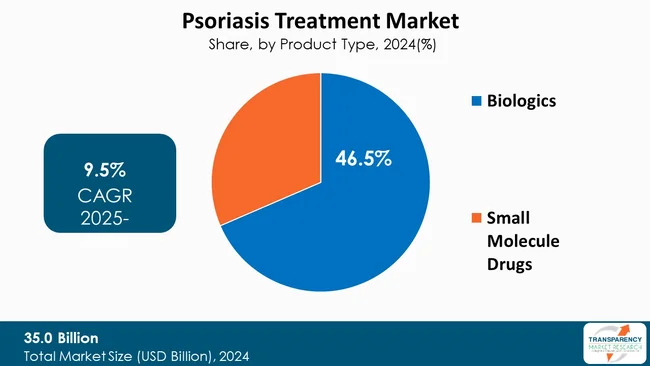

Based on drug type, biologics is expected to be the dominating segment in psoriasis treatment market. This is due to biologics providing superior efficacy, prolonged duration/high sustained response rates, and ability to target the components of the immune system related to the inflammation processes associated with psoriasis. Evidence indicates that biologics, particularly interleukin inhibitors (IL-17 and IL-23 inhibitors), lead to improvements in skin clearance and quality of life for moderate to severe forms of psoriasis compared to systemic therapies.

The targeted mechanism of action of biologics produces fewer systemic side-effects and improved adherence to therapy. Biologics are further gaining traction in psoriasis treatment through clinical trials, regulatory approvals, as well as awareness of biologics among healthcare providers and patients. With this momentum, biologics will continue to represent the largest portion of growth in this market over the next few years.

| Attribute | Detail |

|---|---|

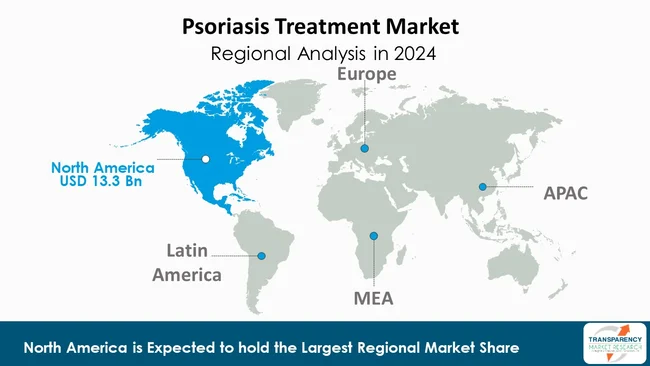

| Leading Region | North America |

North America has a strong hold on the market due to its better healthcare facilities, higher prevalence of psoriasis, and emphasis on novel therapies. The U. S., in particular, dominates the North American market, accounting for a large population who have points of plaque psoriasis and psoriatic arthritis, and thus increased demand for newer advance psoriasis treatment market options.

The primary form of biologics treatment are TNF inhibitors and interleukin inhibitors, and there is also an increasing accessibility to new drugs as more are approved. Challenges exist in terms of reimbursement, regulatory processes, and competition, but overall, North America and its non-problematic advanced technologies, coupled with the many acclaims from sponsors and overall supportive research and development from the leading pharmaceutical companies solidifies North America's lead in the market.

There are also awareness initiatives, such as Psoriasis Awareness Month, which educate patients about their disease and increase treatment uptake. All these trends are creating new opportunities for patient stratification - specifically around biologics - despite the product pricing being higher and impacting patient accessibility overall. The continued development of, and access to, innovative medicines coupled with the growing focus on medical innovation would likely mitigate low product performance.

AbbVie Inc, Amgen Inc, AstraZeneca, Eli Lilly and Company, Johnson & Johnson Services, Inc., LEO Pharma A/S, Merck & Co., Inc., Novartis AG, Boehringer Ingelheim Pharmaceuticals, Inc., Arcutis Biotherapeutics, Inc., Dermavant Sciences, Inc., TIEFENBACHER GROUP, UCB S.A., Bausch Health, Sun Pharmaceutical Industries Limited, Akeso Biopharma Co., Ltd are some of the leading players operating in the global psoriasis treatment market.

Each of these players has been profiled in the psoriasis treatment market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 35.0 Bn |

| Forecast Value in 2035 | US$ 87.6 Bn |

| CAGR | 9.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 35.0 Bn in 2024.

It is projected to reach US$ 87.6 Bn by the end of 2035.

Rising Prevalence of Psoriasis and Increasing regulatory approvals.

It is anticipated to grow at a CAGR of 9.5% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

AbbVie Inc, Amgen Inc, AstraZeneca, Eli Lilly and Company, Johnson & Johnson Services, Inc., LEO Pharma A/S, Merck & Co., Inc., Novartis AG, Boehringer Ingelheim Pharmaceuticals, Inc., Arcutis Biotherapeutics, Inc., Dermavant Sciences, Inc., TIEFENBACHER GROUP, UCB S.A., Bausch Health, Sun Pharmaceutical Industries Limited, Akeso Biopharma Co., and Other prominent players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Psoriasis Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Psoriasis Treatment Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Regulatory Landscape across Key Regions / Countries

5.2. Psoriasis Treatment Market Trends

5.3. PORTER’s Five Forces Analysis

5.4. PESTEL Analysis

5.5. Key Purchase Metrics for End-users

5.6. Brand and Pricing Analysis

5.7. Treatment Algorithm

5.8. Distributors Landscape

6. Global Psoriasis Treatment Market Analysis and Forecasts, By Drug Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Drug Type, 2020 to 2035

6.3.1. Biologics

6.3.1.1. TNF Inhibitors

6.3.1.2. Interleukin Inhibitors

6.3.1.2.1. IL-17 Inhibitors

6.3.1.2.2. IL-23 Inhibitors

6.3.1.2.3. Others

6.3.2. Small Molecule Drugs

6.3.2.1. Tyrosine kinase 2 (TYK2) inhibitors

6.3.2.2. Phosphodiesterase 4 (PDE4) inhibitor

6.3.2.3. Corticosteroids

6.3.2.4. Retinoids

6.3.2.5. Calcineurin inhibitors

6.3.2.6. Others

6.4. Market Attractiveness By Drug Type

7. Global Psoriasis Treatment Market Analysis and Forecasts, By Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Type, 2020 to 2035

7.3.1. Branded

7.3.2. Generic

7.4. Market Attractiveness By Type

8. Global Psoriasis Treatment Market Analysis and Forecasts, By Types of Psoriasis

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Types of Psoriasis, 2020 to 2035

8.3.1. Plaque Psoriasis

8.3.2. Inverse Psoriasis

8.3.3. Guttate Psoriasis

8.3.4. Pustular Psoriasis

8.3.5. Others

8.4. Market Attractiveness By Types of Psoriasis

9. Global Psoriasis Treatment Market Analysis and Forecasts, By Route of Administration

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Route of Administration, 2020 to 2035

9.3.1. Oral

9.3.2. Topical

9.3.3. Parenteral

9.4. Market Attractiveness By Route of Administration

10. Global Psoriasis Treatment Market Analysis and Forecasts, By Distribution Channel

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast By Distribution Channel, 2020 to 2035

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Attractiveness By Distribution Channel

11. Global Psoriasis Treatment Market Analysis and Forecasts, By Region

11.1. Key Findings

11.2. Market Value Forecast By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness By Region

12. North America Psoriasis Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Drug Type, 2020 to 2035

12.2.1. Biologics

12.2.1.1. TNF Inhibitors

12.2.1.2. Interleukin Inhibitors

12.2.1.2.1. IL-17 Inhibitors

12.2.1.2.2. IL-23 Inhibitors

12.2.1.2.3. Others

12.2.2. Small Molecule Drugs

12.2.2.1. Tyrosine kinase 2 (TYK2) inhibitors

12.2.2.2. Phosphodiesterase 4 (PDE4) inhibitor

12.2.2.3. Corticosteroids

12.2.2.4. Retinoids

12.2.2.5. Calcineurin inhibitors

12.2.2.6. Others

12.3. Market Value Forecast By Type, 2020 to 2035

12.3.1. Branded

12.3.2. Generic

12.4. Market Value Forecast By Types of Psoriasis, 2020 to 2035

12.4.1. Plaque Psoriasis

12.4.2. Inverse Psoriasis

12.4.3. Guttate Psoriasis

12.4.4. Pustular Psoriasis

12.4.5. Others

12.5. Market Value Forecast By Route of Administration, 2020 to 2035

12.5.1. Oral

12.5.2. Topical

12.5.3. Topical

12.6. Market Value Forecast By Distribution Channel, 2020 to 2035

12.6.1. Hospital Pharmacies

12.6.2. Retail Pharmacies

12.6.3. Online Pharmacies

12.7. Market Value Forecast By Country, 2020 to 2035

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Drug Type

12.8.2. By Type

12.8.3. By Types of Psoriasis

12.8.4. By Route of Administration

12.8.5. By Distribution Channel

12.8.6. By Country

13. Europe Psoriasis Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Drug Type, 2020 to 2035

13.2.1. Biologics

13.2.1.1. TNF Inhibitors

13.2.1.2. Interleukin Inhibitors

13.2.1.2.1. IL-17 Inhibitors

13.2.1.2.2. IL-23 Inhibitors

13.2.1.2.3. Others

13.2.2. Small Molecule Drugs

13.2.2.1. Tyrosine kinase 2 (TYK2) inhibitors

13.2.2.2. Phosphodiesterase 4 (PDE4) inhibitor

13.2.2.3. Corticosteroids

13.2.2.4. Retinoids

13.2.2.5. Calcineurin inhibitors

13.2.2.6. Others

13.3. Market Value Forecast By Type, 2020 to 2035

13.3.1. Branded

13.3.2. Generic

13.4. Market Value Forecast By Types of Psoriasis, 2020 to 2035

13.4.1. Plaque Psoriasis

13.4.2. Inverse Psoriasis

13.4.3. Guttate Psoriasis

13.4.4. Pustular Psoriasis

13.4.5. Others

13.5. Market Value Forecast By Route of Administration, 2020 to 2035

13.5.1. Oral

13.5.2. Topical

13.5.3. Topical

13.6. Market Value Forecast By Distribution Channel, 2020 to 2035

13.6.1. Hospital Pharmacies

13.6.2. Retail Pharmacies

13.6.3. Online Pharmacies

13.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Switzerland

13.7.7. The Netherlands

13.7.8. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Drug Type

13.8.2. By Type

13.8.3. By Types of Psoriasis

13.8.4. By Route of Administration

13.8.5. By Distribution Channel

13.8.6. By Country/Sub-region

14. Asia Pacific Psoriasis Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Drug Type, 2020 to 2035

14.2.1. Biologics

14.2.1.1. TNF Inhibitors

14.2.1.2. Interleukin Inhibitors

14.2.1.2.1. IL-17 Inhibitors

14.2.1.2.2. IL-23 Inhibitors

14.2.1.2.3. Others

14.2.2. Small Molecule Drugs

14.2.2.1. Tyrosine kinase 2 (TYK2) inhibitors

14.2.2.2. Phosphodiesterase 4 (PDE4) inhibitor

14.2.2.3. Corticosteroids

14.2.2.4. Retinoids

14.2.2.5. Calcineurin inhibitors

14.2.2.6. Others

14.3. Market Value Forecast By Type, 2020 to 2035

14.3.1. Branded

14.3.2. Generic

14.4. Market Value Forecast By Types of Psoriasis, 2020 to 2035

14.4.1. Plaque Psoriasis

14.4.2. Inverse Psoriasis

14.4.3. Guttate Psoriasis

14.4.4. Pustular Psoriasis

14.4.5. Others

14.5. Market Value Forecast By Route of Administration, 2020 to 2035

14.5.1. Oral

14.5.2. Topical

14.5.3. Topical

14.6. Market Value Forecast By Distribution Channel, 2020 to 2035

14.6.1. Hospital Pharmacies

14.6.2. Retail Pharmacies

14.6.3. Online Pharmacies

14.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. South Korea

14.7.6. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Drug Type

14.8.2. By Type

14.8.3. By Types of Psoriasis

14.8.4. By Route of Administration

14.8.5. By Distribution Channel

14.8.6. By Country/Sub-region

15. Latin America Psoriasis Treatment Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Drug Type, 2020 to 2035

15.2.1. Biologics

15.2.1.1. TNF Inhibitors

15.2.1.2. Interleukin Inhibitors

15.2.1.2.1. IL-17 Inhibitors

15.2.1.2.2. IL-23 Inhibitors

15.2.1.2.3. Others

15.2.2. Small Molecule Drugs

15.2.2.1. Tyrosine kinase 2 (TYK2) inhibitors

15.2.2.2. Phosphodiesterase 4 (PDE4) inhibitor

15.2.2.3. Corticosteroids

15.2.2.4. Retinoids

15.2.2.5. Calcineurin inhibitors

15.2.2.6. Others

15.3. Market Value Forecast By Type, 2020 to 2035

15.3.1. Branded

15.3.2. Generic

15.4. Market Value Forecast By Types of Psoriasis, 2020 to 2035

15.4.1. Plaque Psoriasis

15.4.2. Inverse Psoriasis

15.4.3. Guttate Psoriasis

15.4.4. Pustular Psoriasis

15.4.5. Others

15.5. Market Value Forecast By Route of Administration, 2020 to 2035

15.5.1. Oral

15.5.2. Topical

15.5.3. Topical

15.6. Market Value Forecast By Distribution Channel, 2020 to 2035

15.6.1. Hospital Pharmacies

15.6.2. Retail Pharmacies

15.6.3. Online Pharmacies

15.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Argentina

15.7.4. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Drug Type

15.8.2. By Type

15.8.3. By Types of Psoriasis

15.8.4. By Route of Administration

15.8.5. By Distribution Channel

15.8.6. By Country/Sub-region

16. Middle East & Africa Psoriasis Treatment Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast By Drug Type, 2020 to 2035

16.2.1. Biologics

16.2.1.1. TNF Inhibitors

16.2.1.2. Interleukin Inhibitors

16.2.1.2.1. IL-17 Inhibitors

16.2.1.2.2. IL-23 Inhibitors

16.2.1.2.3. Others

16.2.2. Small Molecule Drugs

16.2.2.1. Tyrosine kinase 2 (TYK2) inhibitors

16.2.2.2. Phosphodiesterase 4 (PDE4) inhibitor

16.2.2.3. Corticosteroids

16.2.2.4. Retinoids

16.2.2.5. Calcineurin inhibitors

16.2.2.6. Others

16.3. Market Value Forecast By Type, 2020 to 2035

16.3.1. Branded

16.3.2. Generic

16.4. Market Value Forecast By Types of Psoriasis, 2020 to 2035

16.4.1. Plaque Psoriasis

16.4.2. Inverse Psoriasis

16.4.3. Guttate Psoriasis

16.4.4. Pustular Psoriasis

16.4.5. Others

16.5. Market Value Forecast By Route of Administration, 2020 to 2035

16.5.1. Oral

16.5.2. Topical

16.5.3. Topical

16.6. Market Value Forecast By Distribution Channel, 2020 to 2035

16.6.1. Hospital Pharmacies

16.6.2. Retail Pharmacies

16.6.3. Online Pharmacies

16.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Drug Type

16.8.2. By Type

16.8.3. By Types of Psoriasis

16.8.4. By Route of Administration

16.8.5. By Distribution Channel

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (By Tier and Size of companies)

17.2. Market Share Analysis By Company (2024)

17.3. Company Profiles

17.3.1. Bristol-Myers Squibb Company

17.3.1.1. Company Overview

17.3.1.2. Financial Overview

17.3.1.3. Product Portfolio

17.3.1.4. Business Strategies

17.3.1.5. Recent Developments

17.3.2. AbbVie Inc

17.3.2.1. Company Overview

17.3.2.2. Financial Overview

17.3.2.3. Product Portfolio

17.3.2.4. Business Strategies

17.3.2.5. Recent Developments

17.3.3. Amgen Inc

17.3.3.1. Company Overview

17.3.3.2. Financial Overview

17.3.3.3. Product Portfolio

17.3.3.4. Business Strategies

17.3.3.5. Recent Developments

17.3.4. AstraZeneca

17.3.4.1. Company Overview

17.3.4.2. Financial Overview

17.3.4.3. Product Portfolio

17.3.4.4. Business Strategies

17.3.4.5. Recent Developments

17.3.5. Eli Lilly and Company

17.3.5.1. Company Overview

17.3.5.2. Financial Overview

17.3.5.3. Product Portfolio

17.3.5.4. Business Strategies

17.3.5.5. Recent Developments

17.3.6. Johnson & Johnson Services, Inc.

17.3.6.1. Company Overview

17.3.6.2. Financial Overview

17.3.6.3. Product Portfolio

17.3.6.4. Business Strategies

17.3.6.5. Recent Developments

17.3.7. LEO Pharma A/S

17.3.7.1. Company Overview

17.3.7.2. Financial Overview

17.3.7.3. Product Portfolio

17.3.7.4. Business Strategies

17.3.7.5. Recent Developments

17.3.8. Merck & Co., Inc.,

17.3.8.1. Company Overview

17.3.8.2. Financial Overview

17.3.8.3. Product Portfolio

17.3.8.4. Business Strategies

17.3.8.5. Recent Developments

17.3.9. Novartis AG

17.3.9.1. Company Overview

17.3.9.2. Financial Overview

17.3.9.3. Product Portfolio

17.3.9.4. Business Strategies

17.3.9.5. Recent Developments

17.3.10. Boehringer Ingelheim Pharmaceuticals, Inc.

17.3.10.1. Company Overview

17.3.10.2. Financial Overview

17.3.10.3. Product Portfolio

17.3.10.4. Business Strategies

17.3.10.5. Recent Developments

17.3.11. Arcutis Biotherapeutics, Inc

17.3.11.1. Company Overview

17.3.11.2. Financial Overview

17.3.11.3. Product Portfolio

17.3.11.4. Business Strategies

17.3.11.5. Recent Developments

17.3.12. Dermavant Sciences, Inc.

17.3.12.1. Company Overview

17.3.12.2. Financial Overview

17.3.12.3. Product Portfolio

17.3.12.4. Business Strategies

17.3.12.5. Recent Developments

17.3.13. TIEFENBACHER GROUP

17.3.13.1. Company Overview

17.3.13.2. Financial Overview

17.3.13.3. Product Portfolio

17.3.13.4. Business Strategies

17.3.13.5. Recent Developments

17.3.14. UCB S.A.

17.3.14.1. Company Overview

17.3.14.2. Financial Overview

17.3.14.3. Product Portfolio

17.3.14.4. Business Strategies

17.3.14.5. Recent Developments

17.3.15. Bausch Health

17.3.15.1. Company Overview

17.3.15.2. Financial Overview

17.3.15.3. Product Portfolio

17.3.15.4. Business Strategies

17.3.15.5. Recent Developments

17.3.16. Sun Pharmaceutical Industries Limited

17.3.16.1. Company Overview

17.3.16.2. Financial Overview

17.3.16.3. Product Portfolio

17.3.16.4. Business Strategies

17.3.16.5. Recent Developments

17.3.17. Akeso Biopharma Co., Ltd.

17.3.17.1. Company Overview

17.3.17.2. Financial Overview

17.3.17.3. Product Portfolio

17.3.17.4. Business Strategies

17.3.17.5. Recent Developments

List of Tables

Table 01: Global Psoriasis Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 02: Global Psoriasis Treatment Market Value (US$ Bn) Forecast, By Biologics, 2020 to 2035

Table 03: Global Psoriasis Treatment Market Value (US$ Bn) Forecast, By Small Molecule Drugs, 2020 to 2035

Table 04: Global Psoriasis Treatment Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 05: Global Psoriasis Treatment Market Value (US$ Bn) Forecast, By Types of Psoriasis, 2020 to 2035

Table 06: Global Psoriasis Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 07: Global Psoriasis Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 08: Global Psoriasis Treatment Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America Psoriasis Treatment Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 10: North America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 11: North America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Biologics, 2020 to 2035

Table 12: North America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Small Molecule Drugs, 2020 to 2035

Table 13: North America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 14: North America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Types of Psoriasis, 2020 to 2035

Table 15: North America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 16: North America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 17: Europe Psoriasis Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 18: Europe Psoriasis Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 19: Europe Psoriasis Treatment Market Value (US$ Bn) Forecast, By Biologics, 2020 to 2035

Table 20: Europe Psoriasis Treatment Market Value (US$ Bn) Forecast, By Small Molecule Drugs, 2020 to 2035

Table 21: Europe Psoriasis Treatment Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 22: Europe Psoriasis Treatment Market Value (US$ Bn) Forecast, By Types of Psoriasis, 2020 to 2035

Table 23: Europe Psoriasis Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 24: Europe Psoriasis Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 25: Asia Pacific Psoriasis Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 26: Asia Pacific Psoriasis Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 27: Asia Pacific Psoriasis Treatment Market Value (US$ Bn) Forecast, By Biologics, 2020 to 2035

Table 28: Asia Pacific Psoriasis Treatment Market Value (US$ Bn) Forecast, By Small Molecule Drugs, 2020 to 2035

Table 29: Asia Pacific Psoriasis Treatment Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 30: Asia Pacific Psoriasis Treatment Market Value (US$ Bn) Forecast, By Types of Psoriasis, 2020 to 2035

Table 31: Asia Pacific Psoriasis Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 32: Asia Pacific Psoriasis Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 33: Latin America Psoriasis Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 34: Latin America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 35: Latin America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Biologics, 2020 to 2035

Table 36: Latin America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Small Molecule Drugs, 2020 to 2035

Table 37: Latin America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 38: Latin America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Types of Psoriasis, 2020 to 2035

Table 39: Latin America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 40: Latin America Psoriasis Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 41: Middle East & Africa Psoriasis Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 42: Middle East & Africa Psoriasis Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 43: Middle East & Africa Psoriasis Treatment Market Value (US$ Bn) Forecast, By Biologics, 2020 to 2035

Table 44: Middle East & Africa Psoriasis Treatment Market Value (US$ Bn) Forecast, By Small Molecule Drugs, 2020 to 2035

Table 45: Middle East & Africa Psoriasis Treatment Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 46: Middle East & Africa Psoriasis Treatment Market Value (US$ Bn) Forecast, By Types of Psoriasis, 2020 to 2035

Table 47: Middle East & Africa Psoriasis Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 48: Middle East & Africa Psoriasis Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

List of Figures

Figure 01: Global Psoriasis Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 02: Global Psoriasis Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 03: Global Psoriasis Treatment Market Revenue (US$ Bn), by Biologics, 2020 to 2035

Figure 04: Global Psoriasis Treatment Market Revenue (US$ Bn), by Small Molecule Drugs, 2020 to 2035

Figure 05: Global Psoriasis Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 06: Global Psoriasis Treatment Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 07: Global Psoriasis Treatment Market Revenue (US$ Bn), by Branded, 2020 to 2035

Figure 08: Global Psoriasis Treatment Market Revenue (US$ Bn), by Generics, 2020 to 2035

Figure 09: Global Psoriasis Treatment Market Value Share Analysis, By Types of Psoriasis, 2024 and 2035

Figure 10: Global Psoriasis Treatment Market Attractiveness Analysis, By Types of Psoriasis, 2025 to 2035

Figure 11: Global Psoriasis Treatment Market Revenue (US$ Bn), by Plaque Psoriasis, 2020 to 2035

Figure 12: Global Psoriasis Treatment Market Revenue (US$ Bn), by Inverse Psoriasis, 2020 to 2035

Figure 13: Global Psoriasis Treatment Market Revenue (US$ Bn), by Guttate Psoriasis, 2020 to 2035

Figure 14: Global Psoriasis Treatment Market Revenue (US$ Bn), by Pustular Psoriasis, 2020 to 2035

Figure 15: Global Psoriasis Treatment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Psoriasis Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 17: Global Psoriasis Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 18: Global Psoriasis Treatment Market Revenue (US$ Bn), by Oral, 2020 to 2035

Figure 19: Global Psoriasis Treatment Market Revenue (US$ Bn), by Topical, 2020 to 2035

Figure 20: Global Psoriasis Treatment Market Revenue (US$ Bn), by Parenteral, 2020 to 2035

Figure 21: Global Psoriasis Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 22: Global Psoriasis Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 23: Global Psoriasis Treatment Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 24: Global Psoriasis Treatment Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 25: Global Psoriasis Treatment Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 26: Global Psoriasis Treatment Market Value Share Analysis, By Region, 2024 and 2035

Figure 27: Global Psoriasis Treatment Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 28: North America Psoriasis Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: North America Psoriasis Treatment Market Value Share Analysis, by Country, 2024 and 2035

Figure 30: North America Psoriasis Treatment Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 31: North America Psoriasis Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 32: North America Psoriasis Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 33: North America Psoriasis Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 34: North America Psoriasis Treatment Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 35: North America Psoriasis Treatment Market Value Share Analysis, By Types of Psoriasis, 2024 and 2035

Figure 36: North America Psoriasis Treatment Market Attractiveness Analysis, By Types of Psoriasis, 2025 to 2035

Figure 37: North America Psoriasis Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 38: North America Psoriasis Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 39: North America Psoriasis Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 40: North America Psoriasis Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 41: Europe Psoriasis Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 42: Europe Psoriasis Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 43: Europe Psoriasis Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 44: Europe Psoriasis Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 45: Europe Psoriasis Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 46: Europe Psoriasis Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 47: Europe Psoriasis Treatment Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 48: Europe Psoriasis Treatment Market Value Share Analysis, By Types of Psoriasis, 2024 and 2035

Figure 49: Europe Psoriasis Treatment Market Attractiveness Analysis, By Types of Psoriasis, 2025 to 2035

Figure 50: Europe Psoriasis Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 51: Europe Psoriasis Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 52: Europe Psoriasis Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 53: Europe Psoriasis Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 54: Asia Pacific Psoriasis Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Asia Pacific Psoriasis Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 56: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 57: Asia Pacific Psoriasis Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 58: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 59: Asia Pacific Psoriasis Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 60: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 61: Asia Pacific Psoriasis Treatment Market Value Share Analysis, By Types of Psoriasis, 2024 and 2035

Figure 62: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, By Types of Psoriasis, 2025 to 2035

Figure 63: Asia Pacific Psoriasis Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 64: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 65: Asia Pacific Psoriasis Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 66: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 67: Latin America Psoriasis Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Latin America Psoriasis Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 69: Latin America Psoriasis Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 70: Latin America Psoriasis Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 71: Latin America Psoriasis Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 72: Latin America Psoriasis Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 73: Latin America Psoriasis Treatment Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 74: Latin America Psoriasis Treatment Market Value Share Analysis, By Types of Psoriasis, 2024 and 2035

Figure 75: Latin America Psoriasis Treatment Market Attractiveness Analysis, By Types of Psoriasis, 2025 to 2035

Figure 76: Latin America Psoriasis Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 77: Latin America Psoriasis Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 78: Latin America Psoriasis Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 79: Latin America Psoriasis Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 80: Middle East & Africa Psoriasis Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 81: Middle East & Africa Psoriasis Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 82: Middle East & Africa Psoriasis Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 83: Middle East & Africa Psoriasis Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 84: Middle East & Africa Psoriasis Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 85: Middle East & Africa Psoriasis Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 86: Middle East & Africa Psoriasis Treatment Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 87: Middle East & Africa Psoriasis Treatment Market Value Share Analysis, By Types of Psoriasis, 2024 and 2035

Figure 88: Middle East & Africa Psoriasis Treatment Market Attractiveness Analysis, By Types of Psoriasis, 2025 to 2035

Figure 89: Middle East & Africa Psoriasis Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 90: Middle East & Africa Psoriasis Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 91: Middle East & Africa Psoriasis Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 92: Middle East & Africa Psoriasis Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035