Reports

Reports

The biologics marketplace is growing on an unprecedented note due to visible demand for targeted therapies in conjunction with advancements in biotechnology. Biologics are complex drugs derived from living cells that provide a high level of specificity as well as effectiveness for chronic disease treatment.

These compelling medicines are being proposed to treat a number of chronic conditions including cancer, autoimmune diseases, and rare genetic conditions, with a proven record of patient-benefit. Biopharmaceutical companies remain committed to research-based projects and continued innovation to introduce new biologics and biosimilars, including monoclonal antibodies, cell therapies, and recombinant proteins.

Furthermore, collaborations between larger pharmaceutical companies and biotech start-ups foster innovation and development timelines. The world's major biopharmaceutical companies are ramping up their biologics manufacturing capabilities, either through contracted manufacturing organizations (CMOs) or internally, in order to prepare for a future in which global demand increases.

.webp)

Approval settings are becoming increasingly more timely and providers at the regulatory level are embracing biologics and biosimilars as part of the approval package. In parallel, leading pharmaceutical manufacturers are committed and entrenched in the development of biosimilars and this support is frequently rich in investment, time, and intellectual property rights.

In other words, biosimilars are changing the norms of delivery for pharmaceuticals. Generic medicine was conceptually close to traditional drugs but the market for biosimilars has producers chasing patient loyalty in ways not seen since the market segments and patients are made aware of substantially superior clinical outcomes with biologics compared to traditional drugs. This is due to the fact that biologic drugs provide superior clinical outcomes and superior patient adherence to therapies than traditional small-molecule drugs do.

It is important that we acknowledge that biologics maintain progressive gains in clinical care, as biologics continue to grow and open up in depth of capacity in practice, patient care, hospital formularies, oncology centers and specialty clinics. Excluding supportive reimbursement from therapy providers, i.e. interim benefit and continued science, biologics are now the de-facto anchors of the future potential of medicines in the state of medicine in the changing pharmaceutical practice.

The biologics sector is growing in ways that promise strong signs of innovation, uptake, and pipeline development. The estimated number of biologics in clinical development across the globe has increased by over 35% as compared to five years ago, with monoclonal antibodies and gene therapies contributing to a significant part of the biologics category.

Not only are biologics gaining approvals in general, but nearly 70% of all drugs recently approved for oncology are biologics - illustrating the increased importance of biologics as a therapeutic modality. In fact, clinical data suggest that biologics have a higher success rate from Phase I through approval than small molecule drugs.

We are also seeing regulatory approvals of first-in-class biologics on the rise, even to the point of having in recorded history more than 40 unique biologics approved in a year across the major markets.

Additionally, hospital formulary rates for biologics, especially oncology and immunology, is on the rise as some institutions are committing over 50% of their specialty drug budget for biologics. Prescription data shows that with the biologics, refill rates are higher and discontinuation rates are lower overall by patients who use biologics - signifying improved adherence. We also see a doubling of academic publications citing biologic-based treatment models versus standard non-biologic treatment models, indicating more robust research activity around the world.

| Attribute | Detail |

|---|---|

| Biologics Market Drivers |

|

The biologics market is expanding primarily due to the increasing prevalence of chronic and autoimmune diseases. Conditions such as rheumatoid arthritis, Crohn's disease, psoriasis, or multiple sclerosis require chronic management, where biologics provide a more selective manner to treat these conditions with fewer side-effects than standard therapies.

For example, biologics that target tumor necrosis factor-alpha (TNF-α) in patients with inflammatory bowel disease have revolutionized the field while not only targeting inflammation but are also associated with the possibility of long-term damage. In a larger clinical registry, patients receiving anti-TNF biologics have had a 60% lower hospitalization rate than patients taking comparable conventional immunosuppressant medications.

Drug regimens in autoimmune diseases with biologics usually include a maintenance dosing schedule that leads to increased compliance. New entrants of biologics are using subcutaneous formulations and at-home delivery, further improving convenience in chronic disease management. The shift away from treating disease symptoms and focusing on disease-modifying therapies has placed biologics as a primary option of therapy.

The continued improvement of diagnostic tools and subsequent increase in the ability to identify conditions (early identification) is only going to continue to enlarge the eligible patient population for biologic therapies, ultimately boosting market demand. Biologics have already reached the point of being the standard of care for several chronic conditions.

Innovation in biologic manufacturing has advanced to significant levels, which facilitates production, improves cost, and improves product quality. Biomanufacturers today can incorporate engineering cell lines, single-use bioreactors, and continuous production systems to streamline the development of complex biologics.

For example, embracing single-use systems has been shown to greatly reduce the time to transition between production batches, reducing the overall manufacturing timelines by as much as 40%. Also, flexibility in single-use systems is critical during unexpected demand peaks (for example, during pandemics or spikes in solid tumor treatments).

AI and digital twins are also used to improve fermentation conditions and develop purification techniques that improve yield and manage contamination risk. These improvements not only create additional throughput but also lower manufacturing costs, which helps both to legitimize the use of biologics as compared to traditional pharmaceuticals.

In light of the increasing demand for personalized therapies, there are also new modular biomanufacturing options that are being rolled out using techniques for rapid adaption and primary manufacturing of biologics, such as antibody-drug conjugates and gene therapies.

The companies associated with making improvements in biologics manufacturing have ensured that they can provide biopharmaceuticals to those organizations with dose and commercial needs, but ensuring that appropriate QA has reviewed the product thoroughly and with enough oversight.

Ultimately, this evolution presents a platform for biopharmaceutical organizations/methods to produce a higher number of allocations at a faster pace to scale biologics manufacturing.

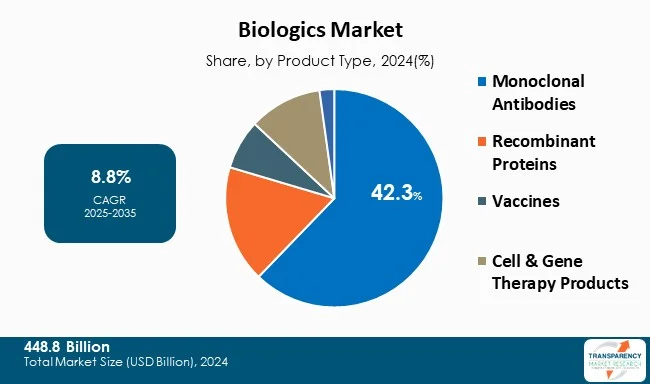

Monoclonal antibodies (mAbs) are leading the biologics market due to their specificity, known effectiveness, and vast uses in oncology, immunotherapy, and infectious disease. These molecules produced in a laboratory replicate the ability of the immune system to combat harmful pathogens and abnormal cells, allowing for a targeted therapy.

For example, anti-PD-1 and anti-PD-L1 monoclonal antibodies have changed the clinical management of cancers including melanoma, non-small cell lung cancer, and renal cell cancer in recent years. For example, a global cancer care center has stated that more than 65% of new therapeutic regimens for late-stage solid tumors include a component of monoclonal antibody therapy.

Additionally, serious autoimmune conditions such as rheumatoid arthritis and lupus have improved quality of life for patients undergoing mAb treatment. The FDA approved antibodies continue to rise with more than 100 presently approved for clinical use and an increase of biosimilars of popular monoclonal antibody products, which provide cost-effective treatment option and access for more individuals.

Antibody-drug conjugates (ADCs) are also being used to broaden therapies of mAbs and improve potency within a targeted use. Given the clinical track record for acceptable performance, high uptake rates, and continued ingenuity related to formulation and delivery, monoclonal antibodies will keep their top spot.

| Attribute | Detail |

|---|---|

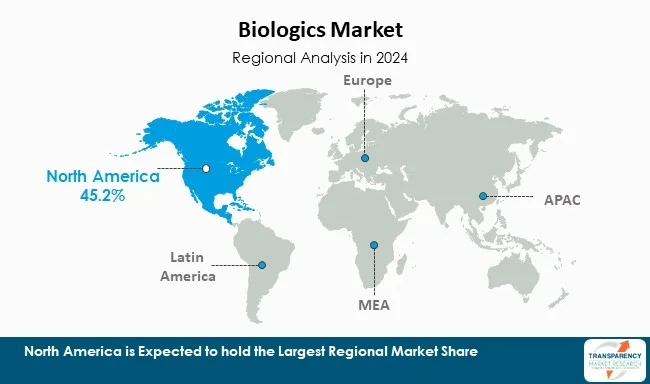

| Leading Region | North America |

North America is the most dominant region in the world for biologics, thanks to a robust biopharmaceutical industry, strong research base, and good regulatory environment. The United States is the leading sub-market in both - development and use of biologics. Boston, San Diego, and the San Francisco Bay Area - all have very high concentrations of biopharma companies, research institutes and contract manufacturing organizations, which are collectively responsible for innovation. There is also a factor of innovation with more than 60% of biologics patents across the globe from North America.

The FDA also has a supportive ecosystem for expedited approvals such as breakthrough therapy designation and fast track designation, which allows for newer biologics to be approved and commercialized. For example, in the past year, over 50% of all biologics that were developed and approved were under accelerated approval through a regulatory pathway in the United States.

North America is also a strong market due to high levels of healthcare spending and generally high levels of insurance reimbursement for high-cost biologic treatments. Access to specialty clinics and precision medicine centers allows the market to support higher levels of biologic use in markets like oncology, immunology, and rare disease. North America also has a lot of clinical trial activity taking place and private and public funds of capital. Given North America’s strong regional characteristics and investment North America is expected to keep the lead in terms of how biologics are developed, regulated, and used.

Key players operating in the biologics industry are investing through innovation, technological advancements, and strategic partnerships. They focus on enhancing imaging clarity and expanding product portfolios, ensuring sustained growth and leadership in the evolving healthcare landscape.

AbbVie, Inc., Amgen, AstraZeneca plc, Bristol-Myers Squibb Company, Eli Lilly & Company, Gilead Sciences, Inc., GSK plc, Johnson & Johnson Services, Inc., Merck & Co., Inc., Novartis AG, Pfizer, Inc., F. Hoffmann-La Roche Ltd., Regeneron Pharmaceuticals Inc. are the key players in biologics market.

Each of these players has been profiled in the biologics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 448.8 Bn |

| Forecast Value in 2035 | US$ 1,140.2 Bn |

| CAGR | 8.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biologics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The biologics market was valued at US$ 448.8 Bn in 2024.

The biologics market is projected to cross US$ 1,140.2 Bn by the end of 2035.

Increasing prevalence of chronic and autoimmune diseases and technological advancements in biologic manufacturing.

The CAGR is anticipated to be 8.8% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

AbbVie, Inc., Amgen, AstraZeneca plc, Bristol-Myers Squibb Company, Eli Lilly & Company, Gilead Sciences, Inc., GSK plc, Johnson & Johnson Services, Inc., Merck & Co., Inc., Novartis AG, Pfizer, Inc., F. Hoffmann-La Roche AG, Regeneron Pharmaceuticals Inc., and others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Biologics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Biologics Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events

5.2. Porter's Five Forces Analysis

5.3. PESTEL Analysis

5.4. Disease Prevalence & Incidence Rate

5.5. Pipeline Analysis

5.6. Regulatory Scenario by Key Countries/Regions

5.7. Reimbursement Scenario by Key Countries/Regions

5.8. Pricing Trends

5.9. Treatment Algorithm & Options

5.10. End-user Preference

6. Global Biologics Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2020 to 2035

6.3.1. Monoclonal Antibodies

6.3.2. Recombinant Proteins

6.3.3. Vaccines

6.3.4. Cell & Gene Therapy Products

6.3.5. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Biologics Market Analysis and Forecast, by Indication

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Indication, 2020 to 2035

7.3.1. Oncology

7.3.2. Autoimmune & Immunological Disorders

7.3.3. Hematological Disorders

7.3.4. Infectious Diseases

7.3.5. Others

7.4. Market Attractiveness Analysis, by Indication

8. Global Biologics Market Analysis and Forecast, by Manufacturing

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Manufacturing, 2020 to 2035

8.3.1. Outsourced

8.3.2. In-house

8.4. Market Attractiveness Analysis, by Manufacturing

9. Global Biologics Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Distribution Channel, 2020 to 2035

9.3.1. Retail Pharmacies

9.3.2. Hospital Pharmacies

9.3.3. Online Pharmacies

9.4. Market Attractiveness Analysis, by Distribution Channel

10. Global Biologics Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2020 to 2035

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Region

11. North America Biologics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2020 to 2035

11.2.1. Monoclonal Antibodies

11.2.2. Recombinant Proteins

11.2.3. Vaccines

11.2.4. Cell & Gene Therapy Products

11.2.5. Others

11.3. Market Value Forecast, by Indication, 2020 to 2035

11.3.1. Oncology

11.3.2. Autoimmune & Immunological Disorders

11.3.3. Hematological Disorders

11.3.4. Infectious Diseases

11.3.5. Others

11.4. Market Value Forecast, by Manufacturing, 2020 to 2035

11.4.1. Outsourced

11.4.2. In-house

11.5. Market Value Forecast, by Distribution Channel, 2020 to 2035

11.5.1. Retail Pharmacies

11.5.2. Hospital Pharmacies

11.5.3. Online Pharmacies

11.6. Market Value Forecast, by Country, 2020 to 2035

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Indication

11.7.3. By Manufacturing

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Biologics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2020 to 2035

12.2.1. Monoclonal Antibodies

12.2.2. Recombinant Proteins

12.2.3. Vaccines

12.2.4. Cell & Gene Therapy Products

12.2.5. Others

12.3. Market Value Forecast, by Indication, 2020 to 2035

12.3.1. Oncology

12.3.2. Autoimmune & Immunological Disorders

12.3.3. Hematological Disorders

12.3.4. Infectious Diseases

12.3.5. Others

12.4. Market Value Forecast, by Manufacturing, 2020 to 2035

12.4.1. Outsourced

12.4.2. In-house

12.5. Market Value Forecast, by Distribution Channel, 2020 to 2035

12.5.1. Retail Pharmacies

12.5.2. Hospital Pharmacies

12.5.3. Online Pharmacies

12.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Switzerland

12.6.7. The Netherlands

12.6.8. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Indication

12.7.3. By Manufacturing

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Biologics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2020 to 2035

13.2.1. Monoclonal Antibodies

13.2.2. Recombinant Proteins

13.2.3. Vaccines

13.2.4. Cell & Gene Therapy Products

13.2.5. Others

13.3. Market Value Forecast, by Indication, 2020 to 2035

13.3.1. Oncology

13.3.2. Autoimmune & Immunological Disorders

13.3.3. Hematological Disorders

13.3.4. Infectious Diseases

13.3.5. Others

13.4. Market Value Forecast, by Manufacturing, 2020 to 2035

13.4.1. Outsourced

13.4.2. In-house

13.5. Market Value Forecast, by Distribution Channel, 2020 to 2035

13.5.1. Retail Pharmacies

13.5.2. Hospital Pharmacies

13.5.3. Online Pharmacies

13.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. South Korea

13.6.5. Australia & New Zealand

13.6.6. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Indication

13.7.3. By Manufacturing

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Biologics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2020 to 2035

14.2.1. Monoclonal Antibodies

14.2.2. Recombinant Proteins

14.2.3. Vaccines

14.2.4. Cell & Gene Therapy Products

14.2.5. Others

14.3. Market Value Forecast, by Indication, 2020 to 2035

14.3.1. Oncology

14.3.2. Autoimmune & Immunological Disorders

14.3.3. Hematological Disorders

14.3.4. Infectious Diseases

14.3.5. Others

14.4. Market Value Forecast, by Manufacturing, 2020 to 2035

14.4.1. Outsourced

14.4.2. In-house

14.5. Market Value Forecast, by Distribution Channel, 2020 to 2035

14.5.1. Retail Pharmacies

14.5.2. Hospital Pharmacies

14.5.3. Online Pharmacies

14.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Argentina

14.6.4. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Indication

14.7.3. By Manufacturing

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Biologics Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product Type, 2020 to 2035

15.2.1. Monoclonal Antibodies

15.2.2. Recombinant Proteins

15.2.3. Vaccines

15.2.4. Cell & Gene Therapy Products

15.2.5. Others

15.3. Market Value Forecast, by Indication, 2020 to 2035

15.3.1. Oncology

15.3.2. Autoimmune & Immunological Disorders

15.3.3. Hematological Disorders

15.3.4. Infectious Diseases

15.3.5. Others

15.4. Market Value Forecast, by Manufacturing, 2020 to 2035

15.4.1. Outsourced

15.4.2. In-house

15.5. Market Value Forecast, by Distribution Channel, 2020 to 2035

15.5.1. Retail Pharmacies

15.5.2. Hospital Pharmacies

15.5.3. Online Pharmacies

15.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product Type

15.7.2. By Indication

15.7.3. By Manufacturing

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis, by Company (2024)

16.3. Company Profiles

16.3.1. AbbVie, Inc.

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. Amgen

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. AstraZeneca plc

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. Bristol-Myers Squibb Company

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. Eli Lilly & Company

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. Gilead Sciences, Inc.

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

16.3.7. GSK plc

16.3.7.1. Company Overview

16.3.7.2. Financial Overview

16.3.7.3. Product Portfolio

16.3.7.4. Business Strategies

16.3.7.5. Recent Developments

16.3.8. Johnson & Johnson Services, Inc.

16.3.8.1. Company Overview

16.3.8.2. Financial Overview

16.3.8.3. Product Portfolio

16.3.8.4. Business Strategies

16.3.8.5. Recent Developments

16.3.9. Merck & Co., Inc.

16.3.9.1. Company Overview

16.3.9.2. Financial Overview

16.3.9.3. Product Portfolio

16.3.9.4. Business Strategies

16.3.9.5. Recent Developments

16.3.10. Novartis AG

16.3.10.1. Company Overview

16.3.10.2. Financial Overview

16.3.10.3. Product Portfolio

16.3.10.4. Business Strategies

16.3.10.5. Recent Developments

16.3.11. Pfizer, Inc.

16.3.11.1. Company Overview

16.3.11.2. Financial Overview

16.3.11.3. Product Portfolio

16.3.11.4. Business Strategies

16.3.11.5. Recent Developments

16.3.12. F. Hoffmann-La Roche AG

16.3.12.1. Company Overview

16.3.12.2. Financial Overview

16.3.12.3. Product Portfolio

16.3.12.4. Business Strategies

16.3.12.5. Recent Developments

16.3.13. Regeneron Pharmaceuticals Inc.

16.3.13.1. Company Overview

16.3.13.2. Financial Overview

16.3.13.3. Product Portfolio

16.3.13.4. Business Strategies

16.3.13.5. Recent Developments

List of Tables

Table 01: Global Biologics Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 02: Global Biologics Market Value (US$ Mn) Forecast, By Indication, 2020 to 2035

Table 03: Global Biologics Market Value (US$ Mn) Forecast, By Manufacturing, 2020 to 2035

Table 04: Global Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Table 05: Global Biologics Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 06: North America Biologics Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 07: North America Biologics Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 08: North America Biologics Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 09: North America Biologics Market Value (US$ Mn) Forecast, By Manufacturing, 2020 to 2035

Table 10: North America Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Table 11: Europe Biologics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 12: Europe Biologics Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 13: Europe Biologics Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 14: Europe Biologics Market Value (US$ Mn) Forecast, By Manufacturing, 2020 to 2035

Table 15: Europe Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Table 16: Asia Pacific Biologics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 17: Asia Pacific Biologics Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 18: Asia Pacific Biologics Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 19: Asia Pacific Biologics Market Value (US$ Mn) Forecast, By Manufacturing, 2020 to 2035

Table 20: Asia Pacific Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Table 21: Latin America Biologics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 22: Latin America Biologics Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 23: Latin America Biologics Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 24: Latin America Biologics Market Value (US$ Mn) Forecast, By Manufacturing, 2020 to 2035

Table 25: Latin America Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Table 26: Middle East & Africa Biologics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 27: Middle East and Africa Biologics Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 28: Middle East and Africa Biologics Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 29: Middle East and Africa Biologics Market Value (US$ Mn) Forecast, By Manufacturing, 2020 to 2035

Table 30: Middle East and Africa Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

List of Figures

Figure 01: Global Biologics Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 02: Global Biologics Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 03: Global Biologics Market Revenue (US$ Mn), by Monoclonal Antibodies, 2020 to 2035

Figure 04: Global Biologics Market Revenue (US$ Mn), by Recombinant Proteins, 2020 to 2035

Figure 05: Global Biologics Market Revenue (US$ Mn), by Vaccines, 2020 to 2035

Figure 06: Global Biologics Market Revenue (US$ Mn), by Cell & Gene Therapy Products, 2020 to 2035

Figure 07: Global Biologics Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 08: Global Biologics Market Value Share Analysis, by Indication, 2024 and 2035

Figure 09: Global Biologics Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 10: Global Biologics Market Revenue (US$ Mn), by Oncology, 2020 to 2035

Figure 11: Global Biologics Market Revenue (US$ Mn), by Autoimmune & Immunological Disorders, 2020 to 2035

Figure 12: Global Biologics Market Revenue (US$ Mn), by Hematological Disorders, 2020 to 2035

Figure 13: Global Biologics Market Revenue (US$ Mn), by Infectious Diseases, 2020 to 2035

Figure 14: Global Biologics Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 15: Global Biologics Market Value Share Analysis, by Manufacturing, 2024 and 2035

Figure 16: Global Biologics Market Attractiveness Analysis, by Manufacturing, 2025 to 2035

Figure 17: Global Biologics Market Revenue (US$ Mn), by Outsourced, 2020 to 2035

Figure 18: Global Biologics Market Revenue (US$ Mn), by In-house, 2020 to 2035

Figure 19: Global Biologics Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 20: Global Biologics Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 21: Global Biologics Market Revenue (US$ Mn), by Retail Pharmacies , 2020 to 2035

Figure 22: Global Biologics Market Revenue (US$ Mn), by Hospital Pharmacies, 2020 to 2035

Figure 23: Global Biologics Market Revenue (US$ Mn), by Online Pharmacies, 2020 to 2035

Figure 24: Global Biologics Market Value Share Analysis, By Region, 2024 and 2035

Figure 25: Global Biologics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 26: North America Biologics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 27: North America Biologics Market Value Share Analysis, by Country, 2024 and 2035

Figure 28: North America Biologics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 29: North America Biologics Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 30: North America Biologics Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 31: North America Biologics Market Value Share Analysis, by Indication, 2025 to 2035

Figure 32: North America Biologics Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 33: North America Biologics Market Value Share Analysis, by Manufacturing, 2024 and 2035

Figure 34: North America Biologics Market Attractiveness Analysis, by Manufacturing, 2025 to 2035

Figure 35: North America Biologics Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 36: North America Biologics Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 37: Europe Biologics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 38: Europe Biologics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 39: Europe Biologics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 40: Europe Biologics Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 41: Europe Biologics Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 42: Europe Biologics Market Value Share Analysis, by Indication, 2025 to 2035

Figure 43: Europe Biologics Market Attractiveness Analysis, by Indication, 2024 and 2035

Figure 44: Europe Biologics Market Value Share Analysis, By Manufacturing, 2024 and 2035

Figure 45: Europe Biologics Market Attractiveness Analysis, By Manufacturing, 2025 to 2035

Figure 46: Europe Biologics Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 47: Europe Biologics Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 48: Asia Pacific Biologics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 49: Asia Pacific Biologics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 50: Asia Pacific Biologics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 51: Asia Pacific Biologics Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 52: Asia Pacific Biologics Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 53: Asia Pacific Biologics Market Value Share Analysis, by Indication, 2025 to 2035

Figure 54: Asia Pacific Biologics Market Attractiveness Analysis, by Indication, 2024 and 2035

Figure 55: Asia Pacific Biologics Market Value Share Analysis, By Manufacturing, 2024 and 2035

Figure 56: Asia Pacific Biologics Market Attractiveness Analysis, By Manufacturing, 2025 to 2035

Figure 57: Asia Pacific Biologics Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 58: Asia Pacific Biologics Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 59: Latin America Biologics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 60: Latin America Biologics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 61: Latin America Biologics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 62: Latin America Biologics Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 63: Latin America Biologics Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 64: Latin America Biologics Market Value Share Analysis, by Indication, 2025 to 2035

Figure 65: Latin America Biologics Market Attractiveness Analysis, by Indication, 2024 and 2035

Figure 66: Latin America Biologics Market Value Share Analysis, By Manufacturing, 2024 and 2035

Figure 67: Latin America Biologics Market Attractiveness Analysis, By Manufacturing, 2025 to 2035

Figure 68: Latin America Biologics Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 69: Latin America Biologics Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 70: Middle East & Africa Biologics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 71: Middle East & Africa Biologics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 72: Middle East & Africa Biologics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 73: Middle East and Africa Biologics Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 74: Middle East and Africa Biologics Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 75: Middle East and Africa Biologics Market Value Share Analysis, by Indication, 2025 to 2035

Figure 76: Middle East and Africa Biologics Market Attractiveness Analysis, by Indication, 2024 and 2035

Figure 77: Middle East and Africa Biologics Market Value Share Analysis, by Manufacturing, 2024 and 2035

Figure 78: Middle East and Africa Biologics Market Attractiveness Analysis, By Manufacturing, 2025 to 2035

Figure 79: Middle East and Africa Biologics Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 80: Middle East and Africa Biologics Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035