Reports

Reports

Within the healthcare sector, reprocessing of ‘single-use’ devices has become mainstream across hospitals and clinics as a measure to reduce costs. However, while reprocessing enables healthcare providers to reduce costs, there is a downside to it– the risk of cross-contamination and pathogen infection. The number of hospital-acquired infections (HAI) has increased at a steady pace across the global healthcare sector and thus, medical device cleaning processes have garnered significant attention from regulatory bodies. At present, medical device manufacturers are increasingly focusing on providing robust guidelines and manuals that offer insights regarding sterilization, disinfection, and cleaning of ‘single-use’ medical devices.

Thus, medical device cleaning validations have become an integral part of the reprocessing validation cycle. Moreover, it also assures that medical devices can be cleaned and sterilized by adhering to the medical device manufacturer’s instruction for use (IFU).

While the prevalence of hospital acquired infections continues to grow across ambulatory clinics, surgical centers, hospitals, etc., the medical device cleaning market has also gained notable momentum. In the current scenario, in the U.S., guidelines provided by The American Society of Testing and Materials (ASTM) related to medical device cleaning are applicable, which predominantly focus on equipment design, documentation, sampling, analytical techniques, procedures, etc. Owing to these developments in the healthcare sector concerning medical device cleaning, the medical device cleaning market is projected to reach a value of ~US$ 3.2 Bn by the end of 2020.

Scientific advancements in therapeutic and diagnostic medicine have triggered the production of cutting-edge reusable medical devices. However, due to the risk of cross-contamination and a range of other infections, medical device manufacturers have the responsibility to validate their product label claims as far as reusability is concerned. Label guidelines require approval from the Food and Drug Association (FDA) to ensure the overall efficacy and safety of the provided guidelines. The efficacy of the guidelines primarily depends on the markers utilized to soil the devices prior to cleaning. Some of the most commonly used markers include hemoglobin and protein.

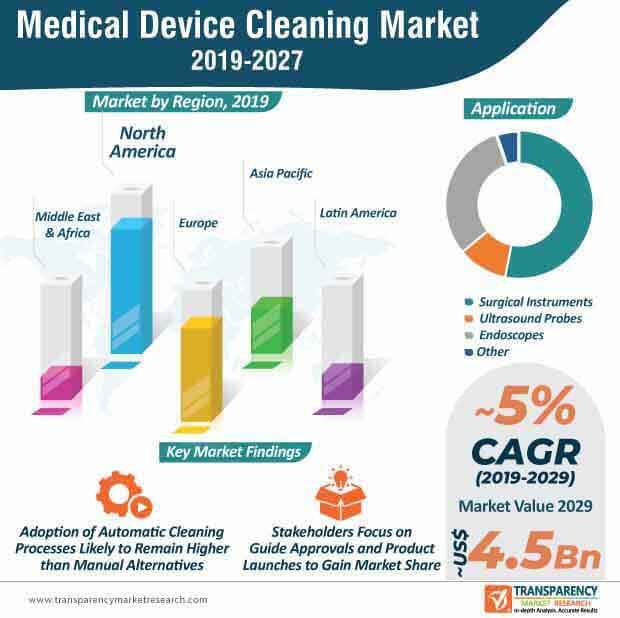

Medical device cleaning techniques have evolved over the years and are one of the most critical stages in the reprocessing of reusable medical devices. Cleaning techniques are primarily segregated into manual and automatic processes. Manual medical device cleaning processes are largely deployed to clean highly complex and delicate medical devices, such as lensed instruments, microsurgical devices, and flexible endoscopes among others. Automated cleaning techniques are predominantly used when other cleaning techniques prove to be ineffective, to prevent soiling of crevices, joints, lumens, and other parts of a medical device. Within the medical device cleaning market, the automatic cleaning process segment is estimated to reach a value of ~US$ 2 Bn and account for ~63% share of the medical device cleaning market by the end of 2020. The automatic cleaning process segment is also projected to expand at a higher CAGR than manual cleaning process segment during the forecast period (2019-2027).

The American Society of Testing and Material is an important regulatory body that is responsible for the approval of new standards for medical device cleaning. Testing laboratories, regulatory agencies, and medical device manufacturers are required to comply with these standards. In the medical device cleaning market, attaining approval from the ASTM for new standards has gained significant momentum in recent times.

For instance, in November 2019, the ASTM approved a list of new standards wherein the effectiveness of new medical device cleaning procedures is thoroughly evaluated. Additionally, the newly curated guide will largely focus on the extraction process of test soils to verify new cleaning methods. According to a member of the ATSM, approval of new standards is a crucial step in the overall process of validating cleaning instructions.

Stakeholders in the medical device cleaning market are also focusing their efforts on the launch of new medical device cleaning products. For instance, in April 2019, DuPont launched a medical device cleaning bio-based enzyme – OPTIMASE. The product, which is part of the company’s new product range is primarily developed to provide optimum cleaning efficiency in medical devices.

Analysts’ Viewpoint

The medical device cleaning market is estimated to grow at a CAGR of 5.2% during the forecast period. A significant rise in the number of hospital-acquired infections is a leading factor that has increased brought medical device cleaning at the forefront in the past couple of decades. Moreover, as medical device manufacturers are required to provide guidelines and standards for cleaning, sterilization, etc., the market for medical device cleaning is expected to witness significant growth in the coming years. Automatic cleaning processes will remain popular during the forecast period despite steady adoption of manual cleaning processes. Product launches and mergers & acquisitions are likely to become common in the medical device cleaning market landscape.

Medical device cleaning market to reach A valuation of US$ 4.53 Bn by 2027

Medical device cleaning market is expected to expand at a CAGR of 5.2% from 2019 to 2027

Medical device cleaning market is driven by increase in the number of surgeries and rise in the demand for endoscopic procedures in emerging economies across the globe

Asia Pacific accounted for a major share of the global medical device cleaning market , owing to a large number of patients with chronic burn injuries and cancer

Key players operating in the global medical device cleaning market include 3M Company, Getinge AB, Cantel Medical Corp., STERIS plc., Fortive Corporation, Oro Clean Chemie AG

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Global Medical Device Cleaning Market: Market Snapshot

4. Market Overview

4.1. Global Medical Device Cleaning Market: Type Overview

4.2. Global Medical Device Cleaning Market: Key Industry Developments

4.3. Market Dynamics

4.4. Drivers and Restraints Snapshot Analysis

4.5. Drivers

4.5.1. Surge in number of surgeries

4.5.2. Aging global population

4.6. Restraints

4.6.1. Shift in trend toward utilization of disposable medical devices

4.7. Opportunities

4.8. Global Medical Device Cleaning Market Revenue Projections (US$ Mn), 2017–2027

5. Key Insights

5.1. Key Mergers & Acquisitions

5.2. Guidelines for Disinfection and Sterilization in Healthcare

5.3. Top 3 players operating in the market

6. Global Medical Device Cleaning Market Analysis, by Product

6.1. Introduction

6.2. Global Medical Device Cleaning Market Value and Forecast, by Product

6.2.1. Chemicals

6.2.1.1. Aldehydes

6.2.1.2. Hydrogen Peroxide

6.2.1.3. Alcohol

6.2.1.4. Chlorine based Disinfectant

6.2.1.5. Peracetic Acid

6.2.1.6. Quaternary Ammonium Compounds

6.2.1.7. Others

6.2.2. Detergents

6.3. Global Medical Device Cleaning Market Analysis, by Product

6.4. Global Medical Device Cleaning Market Attractiveness Analysis, by Product

7. Global Medical Device Cleaning Market Analysis, by Process

7.1. Introduction

7.2. Global Medical Device Cleaning Market Value and Forecast, by Process

7.2.1. Manual Cleaning

7.2.2. Automatic Cleaning

7.3. Global Medical Device Cleaning Market Analysis, by Process

7.4. Global Medical Device Cleaning Market Attractiveness Analysis, by Process

8. Global Medical Device Cleaning Market Analysis, by Application

8.1. Introduction

8.2. Global Medical Device Cleaning Market Value and Forecast, by Application

8.2.1. Surgical Instruments

8.2.2. Ultrasound Probes

8.2.3. Endoscopes

8.2.4. Others

8.3. Global Medical Device Cleaning Market Analysis, by Application

8.4. Global Medical Device Cleaning Market Attractiveness Analysis, by Application

9. Global Medical Device Cleaning Market Analysis, by Region

9.1. Global Medical Device Cleaning Market Value and Forecast, by Region, 2017–2027

9.1.1. North America

9.1.2. Europe

9.1.3. Japan

9.1.4. Rest of the World

9.2. Global Medical Device Cleaning Market Analysis, by Region

9.3. Global Medical Device Cleaning Market Attractiveness Analysis, by Region

10. North America Medical Device Cleaning Market Analysis

10.1. North America Medical Device Cleaning Market

10.2. North America Medical Device Cleaning Market Overview

10.3. North America Medical Device Cleaning Market Value and Forecast, by Product

10.3.1. Chemicals

10.3.1.1. Aldehydes

10.3.1.2. Hydrogen Peroxide

10.3.1.3. Alcohol

10.3.1.4. Chlorine based Disinfectant

10.3.1.5. Peracetic Acid

10.3.1.6. Quaternary Ammonium Compounds

10.3.1.7. Others

10.3.2. Detergents

10.4. North America Medical Device Cleaning Market Value and Forecast, by Process

10.4.1. Manual Cleaning

10.4.2. Automatic Cleaning

10.5. North America Medical Device Cleaning Market Value and Forecast, by Application

10.5.1. Surgical Instruments

10.5.2. Ultrasound Probes

10.5.3. Endoscopes

10.5.4. Others

10.6. North America Medical Device Cleaning Market Forecast, by Country

10.6.1. U.S.

10.6.2. Canada

10.7. North America Medical Device Cleaning Market Attractiveness Analysis

10.7.1. By Product

10.7.2. By Process

10.7.3. By Application

10.7.4. By Country

11. Europe Medical Device Cleaning Market Analysis

11.1. Europe Medical Device Cleaning Market

11.2. Europe Medical Device Cleaning Market Overview

11.3. Europe Medical Device Cleaning Market Value and Forecast, by Product

11.3.1. Chemicals

11.3.1.1. Aldehydes

11.3.1.2. Hydrogen Peroxide

11.3.1.3. Alcohol

11.3.1.4. Chlorine based Disinfectant

11.3.1.5. Peracetic Acid

11.3.1.6. Quaternary Ammonium Compounds

11.3.1.7. Others

11.3.2. Detergents

11.4. Europe Medical Device Cleaning Market Value and Forecast, by Process

11.4.1. Manual Cleaning

11.4.2. Automatic Cleaning

11.5. Europe Medical Device Cleaning Market Value and Forecast, by Application

11.5.1. Surgical Instruments

11.5.2. Ultrasound Probes

11.5.3. Endoscopes

11.5.4. Others

11.6. Europe Medical Device Cleaning Market Forecast, by Country/Sub-region

11.6.1. U.K.

11.6.2. France

11.6.3. Germany

11.6.4. Spain

11.6.5. Italy

11.6.6. Rest of Europe

11.7. Europe Medical Device Cleaning Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Process

11.7.3. By Application

11.7.4. By Country/Sub-region

12. Asia Pacific Medical Device Cleaning Market Analysis

12.1. Asia Pacific Medical Device Cleaning Market

12.2. Asia Pacific Medical Device Cleaning Market Overview

12.3. Asia Pacific Medical Device Cleaning Market Value and Forecast, by Product

12.3.1. Chemicals

12.3.1.1. Aldehydes

12.3.1.2. Hydrogen Peroxide

12.3.1.3. Alcohol

12.3.1.4. Chlorine based Disinfectant

12.3.1.5. Peracetic Acid

12.3.1.6. Quaternary Ammonium Compounds

12.3.1.7. Others

12.3.2. Detergents

12.4. Asia Pacific Medical Device Cleaning Market Value and Forecast, by Process

12.4.1. Manual Cleaning

12.4.2. Automatic Cleaning

12.5. Asia Pacific Medical Device Cleaning Market Value and Forecast, by Application

12.5.1. Surgical Instruments

12.5.2. Ultrasound Probes

12.5.3. Endoscopes

12.5.4. Others

12.6. Asia Pacific Medical Device Cleaning Market Forecast, by Country/Sub-region

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Asia Pacific Medical Device Cleaning Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Process

12.7.3. By Application

12.7.4. By Country/Sub-region

13. Latin America Medical Device Cleaning Market Analysis

13.1. Latin America Medical Device Cleaning Market

13.2. Latin America Medical Device Cleaning Market Overview

13.3. Latin America Medical Device Cleaning Market Value and Forecast, by Product

13.3.1. Chemicals

13.3.1.1. Aldehydes

13.3.1.2. Hydrogen Peroxide

13.3.1.3. Alcohol

13.3.1.4. Chlorine based Disinfectant

13.3.1.5. Peracetic Acid

13.3.1.6. Quaternary Ammonium Compounds

13.3.1.7. Others

13.3.2. Detergents

13.4. Latin America Medical Device Cleaning Market Value and Forecast, by Process

13.4.1. Manual Cleaning

13.4.2. Automatic Cleaning

13.5. Latin America Medical Device Cleaning Market Value and Forecast, by Application

13.5.1. Surgical Instruments

13.5.2. Ultrasound Probes

13.5.3. Endoscopes

13.5.4. Others

13.6. Latin America Medical Device Cleaning Market Forecast, by Country/Sub-region

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Latin America Medical Device Cleaning Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Process

13.7.3. By Application

13.7.4. By Country/Sub-region

14. Middle East & Africa Medical Device Cleaning Market Analysis

14.1. Middle East & Africa Medical Device Cleaning Market

14.2. Middle East & Africa Medical Device Cleaning Market Overview

14.3. Middle East & Africa Medical Device Cleaning Market Value and Forecast, by Product

14.3.1. Chemicals

14.3.1.1. Aldehydes

14.3.1.2. Hydrogen Peroxide

14.3.1.3. Alcohol

14.3.1.4. Chlorine based Disinfectant

14.3.1.5. Peracetic Acid

14.3.1.6. Quaternary Ammonium Compounds

14.3.1.7. Others

14.3.2. Detergents

14.4. Middle East & Africa Medical Device Cleaning Market Value and Forecast, by Process

14.4.1. Manual Cleaning

14.4.2. Automatic Cleaning

14.5. Middle East & Africa Medical Device Cleaning Market Value and Forecast, by Application

14.5.1. Surgical Instruments

14.5.2. Ultrasound Probes

14.5.3. Endoscopes

14.5.4. Others

14.6. Middle East & Africa Medical Device Cleaning Market Forecast, by Country/Sub-region

14.6.1. GCC countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Middle East & Africa Medical Device Cleaning Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Process

14.7.3. By Application

14.7.4. By Country/Sub-region

15. Competitive Landscape

15.1. Company Profiles

15.1.1. 3M

15.1.1.1. Overview (HQ, Employee Strength, Business Segments)

15.1.1.2. Financials

15.1.1.3. Recent Developments

15.1.1.4. Strategy

15.1.2. Getinge AB

15.1.2.1. Overview (HQ, Employee Strength, Business Segments)

15.1.2.2. Financials

15.1.2.3. Recent Developments

15.1.2.4. Strategy

15.1.3. Cantel Medical Corp

15.1.3.1. Overview (HQ, Employee Strength, Business Segments)

15.1.3.2. Financials

15.1.3.3. Recent Developments

15.1.3.4. Strategy

15.1.4. STERIS plc.

15.1.4.1. Overview (HQ, Employee Strength, Business Segments)

15.1.4.2. Financials

15.1.4.3. Recent Developments

15.1.4.4. Strategy

15.1.5. Fortive Corporation

15.1.5.1. Overview (HQ, Employee Strength, Business Segments)

15.1.5.2. Financials

15.1.5.3. Recent Developments

15.1.5.4. Strategy

15.1.6. Oro Clean Chemie AG

15.1.6.1. Overview (HQ, Employee Strength, Business Segments)

15.1.6.2. Recent Developments

15.1.6.3. Strategy

15.1.7. Ruhof Corporation

15.1.7.1. Overview (HQ, Employee Strength, Business Segments)

15.1.7.2. Recent Developments

15.1.7.3. Strategy

15.1.8. Ecolab Inc

15.1.8.1. Overview (HQ, Employee Strength, Business Segments)

15.1.8.2. Financials

15.1.8.3. Recent Developments

15.1.8.4. Strategy

15.1.9. Dr. Weigert

15.1.9.1. Overview (HQ, Employee Strength, Business Segments)

15.1.9.2. Recent Developments

15.1.9.3. Strategy

List of Tables

TABLE 1 Global Medical Devices Cleaning Market Value (US$ Mn) Forecast, by Product, 2017–2027

TABLE 2 Global Medical Devices Cleaning Market Value (US$ Mn) Forecast, by Chemicals, 2017–2027

TABLE 3 Global Medical Devices Cleaning Market Value (US$ Mn) Forecast, by Process, 2017–2027

TABLE 4 Global Medical Devices Cleaning Market Value (US$ Mn) Forecast, by Application, 2017–2027

TABLE 5 Global Medical Devices Cleaning Market Value (US$ Mn) Forecast, by Region, 2017–2027

TABLE 6 North America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Country, 2017–2027

TABLE 7 North America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Product, 2017–2027

TABLE 8 North America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Chemicals, 2017–2027

TABLE 9 North America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Process, 2017–2027

TABLE 10 North America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Application, 2017–2027

TABLE 11 Europe Medical Device Cleaning Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

TABLE 12 Europe Medical Device Cleaning Market Value (US$ Mn) Forecast, by Product, 2017–2027

TABLE 13 Europe Medical Device Cleaning Market Value (US$ Mn) Forecast, by Chemicals, 2017–2027

TABLE 14 Europe Medical Device Cleaning Market Value (US$ Mn) Forecast, by Process, 2017–2027

TABLE 15 Europe Medical Device Cleaning Market Value (US$ Mn) Forecast, by Application, 2017–2027

TABLE 16 Asia Pacific Medical Device Cleaning Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

TABLE 17 Asia Pacific Medical Device Cleaning Market Value (US$ Mn) Forecast, by Product, 2017–2027

TABLE 18 Asia Pacific Medical Device Cleaning Market Value (US$ Mn) Forecast, by Chemicals, 2017–2027

TABLE 19 Asia Pacific Medical Device Cleaning Market Value (US$ Mn) Forecast, by Process, 2017–2027

TABLE 20 Asia Pacific Medical Device Cleaning Market Value (US$ Mn) Forecast, by Application, 2017–2027

TABLE 21 Latin America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

TABLE 22 Latin America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Product, 2017–2027

TABLE 23 Latin America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Chemicals, 2017–2027

TABLE 24 Latin America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Process, 2017–2027

TABLE 25 Latin America Medical Device Cleaning Market Value (US$ Mn) Forecast, by Application, 2017–2027

TABLE 26 Middle East & Africa Medical Device Cleaning Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

TABLE 27 Middle East & Africa Medical Device Cleaning Market Value (US$ Mn) Forecast, by Product, 2017–2027

TABLE 28 Middle East & Africa Medical Device Cleaning Market Value (US$ Mn) Forecast, by Chemicals, 2017–2027

TABLE 29 Middle East & Africa Medical Device Cleaning Market Value (US$ Mn) Forecast, by Process, 2017–2027

TABLE 30 Middle East & Africa Medical Device Cleaning Market Value (US$ Mn) Forecast, by Application, 2017–2027

List of Figures

Figure 1: Global Medical Devices Cleaning Market Value (US$ Mn) Forecast, 2019–2027

Figure 2: Global Medical Devices Cleaning Market Value Share, Process, 2018

Figure 3: Global Medical Devices Cleaning Market Value Share, Application, 2018

Figure 4: Global Medical Devices Cleaning Market Value Share, by Product, 2018

Figure 5: Global Medical Devices Cleaning Market Value Share, by Region, 2018

Figure 6: Global Medical Devices Cleaning Market Value Share (%), by Product, 2018 and 2027

Figure 7: Global Medical Devices Cleaning Market Attractiveness, by Product, 2019–2027

Figure 8: Global Medical Devices Cleaning Market Value (US$ Mn) and Y-o-Y Growth, by Detergents, 2017–2027

Figure 9: Global Medical Devices Cleaning Market Value (US$ Mn) and Y-o-Y Growth, by Chemicals, 2017–2027

Figure 10: Global Medical Devices Cleaning Market Value Share (%), by Chemicals, 2018 and 2027

Figure 11: Global Medical Devices Cleaning Market Value Share (%), by Process, 2018 and 2027

Figure 12: Global Medical Devices Cleaning Market Attractiveness, by Process, 2019–2027

Figure 13: Global Medical Devices Cleaning Market Value (US$ Mn) and Y-o-Y Growth, by Manual Cleaning, 2017–2027

Figure 14: Global Medical Devices Cleaning Market Value (US$ Mn) and Y-o-Y Growth, by Automatic Cleaning,

Figure 15: Global Medical Devices Cleaning Market Value Share Analysis, by Application, 2018 and 2027

Figure 16: Global Medical Devices Cleaning Market Attractiveness, by Application, 2019–2027

Figure 17: Global Medical Devices Cleaning Market Value (US$ Mn) and Y-o-Y Growth, by Surgical Instruments, 2017–2027

Figure 18: Global Medical Devices Cleaning Market Value (US$ Mn) and Y-o-Y Growth, by Ultrasound Probes, 2017–2027

Figure 19: Global Medical Devices Cleaning Market Value (US$ Mn) and Y-o-Y Growth, by Endoscopes, 2017–2027

Figure 20: Global Medical Devices Cleaning Market Value (US$ Mn) and Y-o-Y Growth, by Others, 2017–2027

Figure 21: Global Medical Devices Cleaning Market Value Share Analysis, by Region, 2018 and 2027

Figure 22: Global Medical Devices Cleaning Market Attractiveness Analysis, by Region, 2019–2027

Figure 23: North America Medical Device Cleaning Market Value (US$ Mn) Forecast, 2017–2027

Figure 24: North America Medical Device Cleaning Market Value Share Analysis, by Country, 2018 and 2027

Figure 25: North America Medical Device Cleaning Market Attractiveness Analysis, by Country, 2019-2027

Figure 26: North America Medical Device Cleaning Market

Figure 27: North America Medical Device Cleaning Market

Figure 28: North America Medical Device Cleaning Market Value Share Analysis, by Process, 2018 and 2027

Figure 29: North America Medical Device Cleaning Market Attractiveness Analysis, by Process, 2019–2027

Figure 30: North America Medical Device Cleaning Market Value Share Analysis, by Application, 2018 and 2027

Figure 31: North America Medical Device Cleaning Market Attractiveness Analysis, by Application, 2019–2027

Figure 32: Europe Medical Device Cleaning Market Value (US$ Mn) Forecast, 2017–2027

Figure 33: Europe Medical Device Cleaning Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 34: Europe Medical Device Cleaning Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 35: Europe Medical Device Cleaning Market Value Share Analysis, by Product, 2018 and 2027

Figure 36: Europe Medical Device Cleaning Market Attractiveness Analysis, by Product, 2019–2027

Figure 37: Europe Medical Device Cleaning Market Value Share Analysis, by Process, 2018 and 2027

Figure 38: Europe Medical Device Cleaning Market Attractiveness Analysis, by Process, 2019–2027

Figure 39: Europe Medical Device Cleaning Market Value Share Analysis, by Application, 2018 and 2027

Figure 40: Europe Medical Device Cleaning Market Attractiveness Analysis, by Application, 2019–2027

Figure 41: Asia Pacific Medical Device Cleaning Market Value (US$ Mn) Forecast, 2017–2027

Figure 42: Asia Pacific Medical Device Cleaning Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 43: Asia Pacific Medical Device Cleaning Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 44: Asia Pacific Medical Device Cleaning Market Value Share Analysis, by Product, 2018 and 2027

Figure 45: Asia Pacific Medical Device Cleaning Market Attractiveness Analysis, by Product, 2019–2027

Figure 46: Asia Pacific Medical Device Cleaning Market Value Share Analysis, by Process, 2018 and 2027

Figure 47: Asia Pacific Medical Device Cleaning Market Attractiveness Analysis, by Process, 2019–2027

Figure 48: Asia Pacific Medical Device Cleaning Market Value Share Analysis, by Application, 2018 and 2027

Figure 49: Asia Pacific Medical Device Cleaning Market Attractiveness Analysis, by Application, 2019–2027

Figure 50: Latin America Medical Device Cleaning Market Value (US$ Mn) Forecast, 2017–2027

Figure 51: Latin America Medical Device Cleaning Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 52: Latin America Medical Device Cleaning Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 53: Latin America Medical Device Cleaning Market Value Share Analysis, by Product, 2018 and 2027

Figure 54: Latin America Medical Device Cleaning Market Attractiveness Analysis, by Product, 2019–2027

Figure 55: Latin America Medical Device Cleaning Market Value Share Analysis, by Process, 2018 and 2027

Figure 56: Latin America Medical Device Cleaning Market Attractiveness Analysis, by Process, 2019–2027

Figure 57: Latin America Medical Device Cleaning Market Value Share Analysis, by Application, 2018 and 2027

Figure 58: Latin America Medical Device Cleaning Market Attractiveness Analysis, by Application, 2019–2027

Figure 59: Middle East & Africa Medical Device Cleaning Market Value (US$ Mn) Forecast, 2017–2027

Figure 60: Middle East & Africa Medical Device Cleaning Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 61: Middle East & Africa Medical Device Cleaning Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 62: Middle East & Africa Medical Device Cleaning Market Value Share Analysis, by Product, 2018 and 2027

Figure 63: Middle East & Africa Medical Device Cleaning Market Attractiveness Analysis, by Product, 2019–2027

Figure 64: Middle East & Africa Medical Device Cleaning Market Value Share Analysis, by Process, 2018 and 2027

Figure 65: Middle East & Africa Medical Device Cleaning Market Attractiveness Analysis, by Process, 2019–2027

Figure 66: Middle East & Africa Medical Device Cleaning Market Value Share Analysis, by Application, 2018 and 2027

Figure 67: Middle East & Africa Medical Device Cleaning Market Attractiveness Analysis, by Application, 2019–2027