Reports

Reports

Analysts’ Viewpoint on Market Scenario

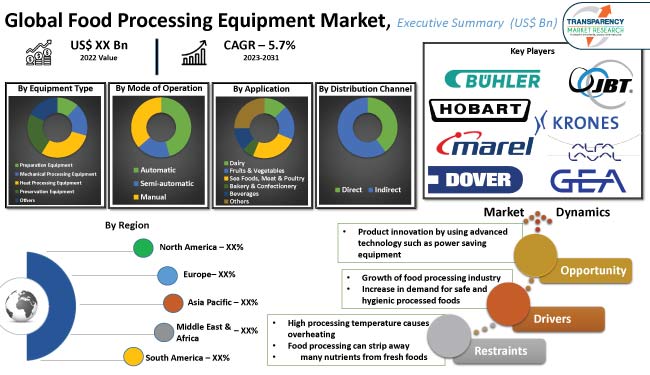

Expansion of the food processing industry and the rise in demand for processed foods that are safe and hygienic are driving the food processing equipment market growth.

Consumers' attention to their food choices has increased in recent years in response to shifting trends. New products are continuously determined by customer interest and economic situations.

Manufacturers in the global food processing equipment market are choosing to switch to a just-in-case model, which has helped them control costs and reduce waste. Companies in the global food processing equipment industry that have trouble predicting demand typically use this model. Additionally, robots and other food automation equipment are revolutionizing commercial kitchens at an unprecedented rate, assisting food establishments in providing better support for their employees and customer service.

The parts, handling machines, and frameworks that are used to plan, cook, store, and bundle food and food items together are known as food processing equipment.

Separating, baking, mixing, freezing, washing, and sealing are a few of the unit operations that can be performed with a wide range of food processing tools during a full production cycle. A few pieces of this equipment also perform auxiliary or main functions such as preparation, handling, and packaging. The primary goal of this equipment is consumability, preservation, and palatability.

Food processing equipment is used to make bakery goods, beverages, dairy, and other food products. Depending on the needs of the operation, food processing machines can be designed to handle liquid, semi-solid, and solid products continuously or in batches. The ideal plan and development of the food handling hardware relies upon the details and necessities of the specific food handling application.

Food safety, clean labels, functional foods and ingredients, global flavors and novel combinations, plant-based alternatives, grain-free flours, and sustainability are some of the latest food processing equipment market trends.

Global expansion of the food industry is anticipated to boost the food processing equipment industry growth during the forecast period. Crushers, mills, extruders, blenders, meat mixers and meat grinders, and bowl cutters, are the most widely used equipment in the food industry due to several advantages such as better mixing capability, and process flexibility.

Food retailing and food service industries supplied approximately US$ 2.1 Trn worth of food in 2021, according to the USDA (U.S. Department of Agriculture). One of Europe's largest manufacturing sectors is the food industry.

India's food ecosystem represents a significant investment opportunity in Asia Pacific owing to favorable economic policies, appealing fiscal incentives, and the expansion of the food processing sector. India's agricultural and processed food product exports increased 13% to US$ 19.69 Bn in 2022.

The total value of all food products produced in China in the first half of 2022 was US$ 130.0 Bn, an increase of 9.9% year-over-year, according to data from the National Bureau of Statistics of China.

Urbanization and changes in buyer habits have increased the number of people purchasing and eating food arranged out in open places. Globalization has triggered consumer demand for a more extensive assortment of food sources, which is likely to increase food processing equipment market demand in the near future.

As per the WHO fact sheet, an expected 600 million, right around 1 out of 10 individuals in the world become sick in the wake of eating contaminated food, and 420,000 die every year, bringing about the loss of 33 million healthy life years. The key to maintaining good health is having access to sufficient nutritious and safe food. Flavor, portability, and affordability would always be crucial factors. More than 200 diseases, from diarrhea to cancer, are caused by unsafe food items that contain harmful bacteria, viruses, parasites, or chemicals.

Asia Pacific is anticipated to hold the largest food processing equipment market share during the forecast period. Government drives, for example, Mega Food Park Projects and Agro Processing Cluster Projects are leading to food processing equipment market development in the region. Additionally, the developing interest for frozen food in China and Australia is driving market development in Asia Pacific.

The food processing equipment market size in Europe is anticipated to grow at a steady rate, ascribed to the rise in demand for ready-to-eat and convenience foods in France, the U.K., and Germany. Food processing equipment manufacturers in this market are expected to benefit from the expanding number of food processing facilities in the region.

The business model of prominent manufacturers includes investments in R&D, product expansions, and mergers & acquisitions as prominent strategies. Market analysis suggests product development as a major food processing equipment marketing strategy adopted by top players.

The market is highly competitive, with the presence of various global and regional players. Alfa Laval AB, BAADER, Buhler AG, Dover Corporation, GEA Group AG, Hobart, JBT, Krones AG, Marel, and Tetra Laval International S.A. are the prominent entities profiled in the food processing equipment market research.

Each of these players has been profiled in the food processing equipment market report based on parameters such as company overview, business strategies, product portfolio, financial overview, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 47.8 Bn |

|

Market Forecast Value in 2031 |

US$ 69.2 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 47.8 Bn in 2022

It is projected to expand at a CAGR of 5.7% from 2023 to 2031

Growth of the food processing industry and increase in demand for safe and hygienic processed foods

Automatic was the major segment in terms of mode of operation in 2022

Asia Pacific is a dominating region globally

Alfa Laval AB, BAADER, Buhler AG, Dover Corporation, GEA Group AG, Hobart, JBT, Krones AG, Marel, and Tetra Laval International S.A.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Food Processing Equipment Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Food Processing Equipment Market Analysis and Forecast, By Equipment Type

6.1. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Equipment Type, 2017 - 2031

6.1.1. Preparation Equipment

6.1.2. Mechanical Processing Equipment

6.1.3. Heat Processing Equipment

6.1.4. Preservation Equipment

6.1.5. Others

6.2. Incremental Opportunity, By Equipment Type

7. Global Food Processing Equipment Market Analysis and Forecast, By Mode of Operation

7.1. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Mode of Operation, 2017 - 2031

7.1.1. Automatic

7.1.2. Semi-automatic

7.1.3. Manual

7.2. Incremental Opportunity, By Mode of Operation

8. Global Food Processing Equipment Market Analysis and Forecast, By Application

8.1. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

8.1.1. Dairy

8.1.2. Fruits & Vegetables

8.1.3. Sea Foods, Meat & Poultry

8.1.4. Bakery & Confectionery

8.1.5. Beverages

8.1.6. Others

8.2. Incremental Opportunity, By Application

9. Global Food Processing Equipment Market Analysis and Forecast, By Distribution Channel

9.1. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, By Distribution Channel

10. Global Food Processing Equipment Market Analysis and Forecast, By Region

10.1. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Food Processing Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Equipment Type, 2017 - 2031

11.5.1. Preparation Equipment

11.5.2. Mechanical Processing Equipment

11.5.3. Heat Processing Equipment

11.5.4. Preservation Equipment

11.5.5. Others

11.6. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Mode of Operation, 2017 - 2031

11.6.1. Automatic

11.6.2. Semi-automatic

11.6.3. Manual

11.7. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

11.7.1. Dairy

11.7.2. Fruits & Vegetables

11.7.3. Sea Foods, Meat & Poultry

11.7.4. Bakery & Confectionery

11.7.5. Beverages

11.7.6. Others

11.8. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.8.1. Direct

11.8.2. Indirect

11.9. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Food Processing Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Equipment Type, 2017 - 2031

12.5.1. Preparation Equipment

12.5.2. Mechanical Processing Equipment

12.5.3. Heat Processing Equipment

12.5.4. Preservation Equipment

12.5.5. Others

12.6. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Mode of Operation, 2017 - 2031

12.6.1. Automatic

12.6.2. Semi-automatic

12.6.3. Manual

12.7. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

12.7.1. Dairy

12.7.2. Fruits & Vegetables

12.7.3. Sea Foods, Meat & Poultry

12.7.4. Bakery & Confectionery

12.7.5. Beverages

12.7.6. Others

12.8. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.8.1. Direct

12.8.2. Indirect

12.9. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Food Processing Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Key Trends Analysis

13.3.1. Demand Side

13.3.2. Supplier Side

13.4. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Equipment Type, 2017 - 2031

13.4.1. Preparation Equipment

13.4.2. Mechanical Processing Equipment

13.4.3. Heat Processing Equipment

13.4.4. Preservation Equipment

13.4.5. Others

13.5. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Mode of Operation, 2017 - 2031

13.5.1. Automatic

13.5.2. Semi-automatic

13.5.3. Manual

13.6. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.6.1. Dairy

13.6.2. Fruits & Vegetables

13.6.3. Sea Foods, Meat & Poultry

13.6.4. Bakery & Confectionery

13.6.5. Beverages

13.6.6. Others

13.7. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.7.1. Direct

13.7.2. Indirect

13.8. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

13.8.1. India

13.8.2. China

13.8.3. Japan

13.8.4. Rest of Asia Pacific

13.9. Incremental Opportunity Analysis

14. Middle East & South Africa Food Processing Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Equipment Type, 2017 - 2031

14.5.1. Preparation Equipment

14.5.2. Mechanical Processing Equipment

14.5.3. Heat Processing Equipment

14.5.4. Preservation Equipment

14.5.5. Others

14.6. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Mode of Operation, 2017 - 2031

14.6.1. Automatic

14.6.2. Semi-automatic

14.6.3. Manual

14.7. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

14.7.1. Dairy

14.7.2. Fruits & Vegetables

14.7.3. Sea Foods, Meat & Poultry

14.7.4. Bakery & Confectionery

14.7.5. Beverages

14.7.6. Others

14.8. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.8.1. Direct

14.8.2. Indirect

14.9. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

14.9.1. GCC

14.9.2. Rest of MEA

14.10. Incremental Opportunity Analysis

15. South America Food Processing Equipment Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Equipment Type, 2017 - 2031

15.5.1. Preparation Equipment

15.5.2. Mechanical Processing Equipment

15.5.3. Heat Processing Equipment

15.5.4. Preservation Equipment

15.5.5. Others

15.6. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Mode of Operation, 2017 - 2031

15.6.1. Automatic

15.6.2. Semi-automatic

15.6.3. Manual

15.7. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

15.7.1. Dairy

15.7.2. Fruits & Vegetables

15.7.3. Sea Foods, Meat & Poultry

15.7.4. Bakery & Confectionery

15.7.5. Beverages

15.7.6. Others

15.8. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.8.1. Direct

15.8.2. Indirect

15.9. Food Processing Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis (%), by Company, (2022)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Alfa Laval AB

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Buhler AG

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Dover Corporation

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. GEA Group AG

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Hobart

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. JBT

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Krones AG

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Marel

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. BAADER

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Tetra Laval International S.A.

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Revenue

16.3.11.4. Strategy & Business Overview

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.1.1. By Equipment Type

17.1.2. By Mode of Operation

17.1.3. By Application

17.1.4. By Distribution Channel

17.1.5. By Region

17.2. Prevailing Market Risks

17.3. Understanding the Buying Process of Customers

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Table 4: Global Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Table 5: Global Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Table 6: Global Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Table 7: Global Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 8: Global Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 9: Global Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Table 10: Global Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Table 11: North America Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Table 12: North America Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Table 13: North America Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Table 14: North America Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Table 15: North America Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Table 16: North America Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Table 17: North America Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 18: North America Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 19: North America Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Table 20: North America Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Table 21: Europe Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Table 22: Europe Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Table 23: Europe Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Table 24: Europe Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Table 25: Europe Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Table 26: Europe Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Table 27: Europe Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 28: Europe Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 29: Europe Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Table 30: Europe Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Table 31: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Table 32: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Table 33: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Table 34: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Table 35: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Table 36: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Table 37: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Table 40: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Table 41: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Table 42: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Table 43: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Table 44: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Table 45: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Table 46: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Table 47: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 48: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 49: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Table 50: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Table 51: South America Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Table 52: South America Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Table 53: South America Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Table 54: South America Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Table 55: South America Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Table 56: South America Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Table 57: South America Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 58: South America Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 59: South America Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Table 60: South America Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Figure 5: Global Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Figure 6: Global Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Mode of Operation, 2023-2031

Figure 7: Global Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Figure 8: Global Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Figure 9: Global Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 10: Global Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 11: Global Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 12: Global Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Figure 14: Global Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Figure 15: Global Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 16: North America Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Figure 17: North America Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Figure 18: North America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 19: North America Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Figure 20: North America Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Figure 21: North America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Mode of Operation, 2023-2031

Figure 22: North America Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Figure 23: North America Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Figure 24: North America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 25: North America Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 26: North America Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 27: North America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 28: North America Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Figure 29: North America Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Figure 30: North America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 31: Europe Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Figure 32: Europe Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Figure 33: Europe Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 34: Europe Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Figure 35: Europe Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Figure 36: Europe Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Mode of Operation, 2023-2031

Figure 37: Europe Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Figure 38: Europe Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Figure 39: Europe Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 40: Europe Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 41: Europe Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 42: Europe Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Europe Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Europe Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Figure 45: Europe Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Figure 47: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Figure 48: Asia Pacific Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 49: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Figure 50: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Figure 51: Asia Pacific Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Mode of Operation, 2023-2031

Figure 52: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Figure 53: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Figure 54: Asia Pacific Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 55: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Asia Pacific Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Asia Pacific Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Asia Pacific Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Figure 60: Asia Pacific Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Figure 62: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Figure 63: Middle East & Africa Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 64: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Figure 65: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Figure 66: Middle East & Africa Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Mode of Operation,2023-2031

Figure 67: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Figure 68: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Figure 69: Middle East & Africa Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2017-2031

Figure 70: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 71: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 72: Middle East & Africa Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 73: Middle East & Africa Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Figure 74: Middle East & Africa Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Figure 75: Middle East & Africa Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 76: South America Food Processing Equipment Market Value (US$ Bn), by Type, 2017-2031

Figure 77: South America Food Processing Equipment Market Volume (Thousand Units), by Type 2017-2031

Figure 78: South America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 79: South America Food Processing Equipment Market Value (US$ Bn), by Mode of Operation, 2017-2031

Figure 80: South America Food Processing Equipment Market Volume (Thousand Units), by Mode of Operation 2017-2031

Figure 81: South America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Mode of Operation, 2023-2031

Figure 82: South America Food Processing Equipment Market Value (US$ Bn), by Application, 2017-2031

Figure 83: South America Food Processing Equipment Market Volume (Thousand Units), by Application 2017-2031

Figure 84: South America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 85: South America Food Processing Equipment Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 86: South America Food Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 87: South America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 88: South America Food Processing Equipment Market Value (US$ Bn), by Region, 2017-2031

Figure 89: South America Food Processing Equipment Market Volume (Thousand Units), by Region 2017-2031

Figure 90: South America Food Processing Equipment Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031