Reports

Reports

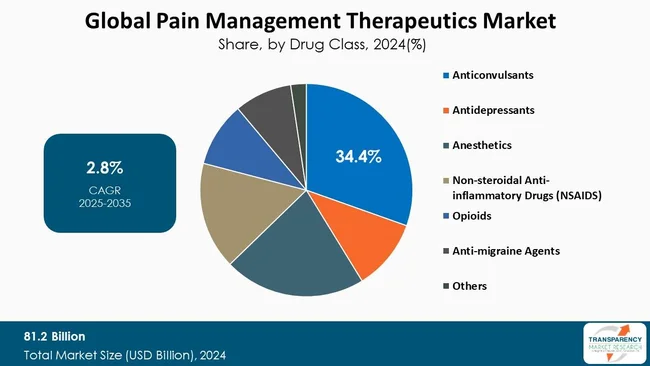

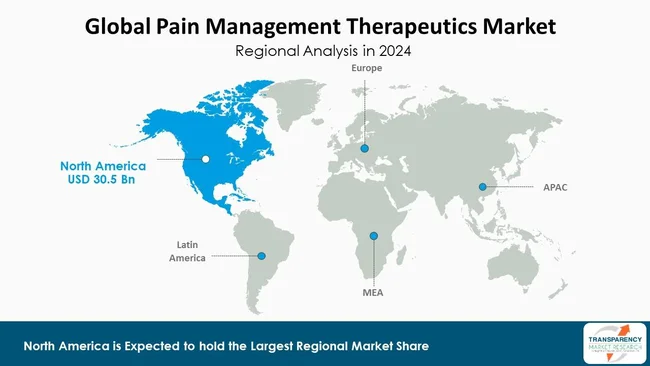

The pain management therapeutics market is poised for steady growth, owing to increasing prevalence of chronic pain conditions including arthritis, neuropathic pain, and pain related to cancer – particularly in aging population. North America has the most advanced market due to it being home to established healthcare delivery systems and significant chronic pain burden on the healthcare system.

.webp)

Meanwhile, emerging markets in Asia-Pacific, Latin America, and Africa have a great growth opportunity with improvement in access to healthcare and awareness regarding the same. Some of the key factors driving the growth of the market include, but are not limited to increasing incidence of chronic pain, development of drug delivery systems such as transdermal patches, sustained-release drug formulations, and that the geriatric population is growing causing the need for solutions for age-related chronic pain.

The market is not without restraints, including the existing opioid crisis resulting from strict regulatory requirements limiting the opioid-based therapies, potential side-effects of medications including adhesive/pain relief patches, non-steroidal anti-inflammatory drugs (NSAIDs) or gabapentinoids, and the cost of advanced treatments noting that in less-developed regions, neuromodulation and biologics have typically high costs that restrict the market.

Opportunities include understanding and exploring personalized medicine where a biomarker directs treatment course, growth of emerging markets when healthcare systems develop, increase in the utilization of new biologic treatments, anticonvulsants, and new technologies including wearable devices, nerve stimulation devices, and nanoparticle-based treatments as alternatives to opioids while also increasing innovation in the market on the whole.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing incidences of chronic pain will be a significant contributor to the pain management therapeutics market. Frequency of chronic pain conditions such as arthritis, fibromyalgia, lower back, neuropathic pain and cancer pain is increasing all over the world. Many reasons are contributing to the rise of chronic pain, particularly aging of population, inactivity, and rising incidence of disease such as obesity and diabetes.

According to data published by Centers for Disease Control and Prevention in April 2023, during 2021, an estimated 20.9% of U.S. adults (51.6 million persons) experienced chronic pain, and 6.9% (17.1 million persons) experienced high-impact chronic pain (i.e., chronic pain that results in substantial restriction to daily activities) with a higher prevalence among non-Hispanic American Indian or Alaska Native adults. The increase in population suffering from chronic pain is stimulating additional demand for pharmacologic and non-pharmacologic samples of pain relief.

New approaches to drug formulation and delivery are likely to dramatically enhance the pain management therapeutics market due to improved efficacy, compliance, and safety. Innovations such as sustained-release formulations, transdermal patches, liposomal drug delivery, and targeted release drug delivery allow for more stable pain control, with less side-effects and low burden of dependency (the latter is particularly critical regarding opioids).

Also, innovations in non-opioid analgesics, especially combinations of drugs, are evolving to meet the need for safer options for long-term pain management. Most importantly, developments with injectable biologics, or gene therapy for conditions such as neuropathic and inflammatory pain are gaining momentum, allowing for personalized and longer-acting pain relief. These advances not only support the delivery of better patient outcomes, but also have the potential to increase revenue for pharmaceutical companies by differentiation to competitive drugs.

As more number of health practitioners, look for alternatives to oral opioids, delivery of pain medications through alternative methods has become a key strategic opportunity in the evolution of the modern pain management process and will be a significant contributor to growth in the pain management therapeutics market.

Opioids represent is dominating the pain management therapeutics market due to their established role in moderate to severe pain management. Opioids are the most widely utilized treatment for surgeries, cancer, injury, and chronic pain syndromes, including several debilitating conditions like arthritis and neuropathy. Opioids are the favored choice of healthcare providers due to the strong analgesia as compared to the other treatment options when they are ineffective.

While there is a growing concern and regulatory effort around addiction and misuse, opioids have become a mainstay of pain management protocols, especially for acute care. Improvements to formulations such as extended-release and abuse deterrent features have been developed to target safety concerns for more controlled or longer use of the medication.

Furthermore, the increase in surgical procedures and the rising chronic disease burden create demand for opioid-based therapies. As emerging markets have greater access to the latest advanced healthcare, opioid use is expected to widen and continue to reinforce the importance of opioids for longer-lasting pain management globally.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is leading the pain management therapeutics market as a result of its sophisticated healthcare infrastructure, high incidence of chronic pain disorders, and high rates of implementation of new therapies. There is a sizable patient population with arthritis, cancer, back pain, or neuropathic disorders in North America, placing long-term pain management at a high priority level.

With considerable insurance coverage, good reimbursement policies, and access to specialists and hospitals, the United States allows for widespread use of pharmacological and non-pharmacological therapies to treat multiple chronic pain conditions. North America also houses many of the most comprehensive and advanced pharmaceutical and biotech organizations, with a focus on developing new pain medications and therapeutics including new non-opioid drugs and formulating new delivery systems.

R&D support, increasing awareness of all pain management therapies, and trends toward personalized, digital opportunities is only improving North America's position as the leader in the pain management therapeutics market. As highlighted in the report, opioid dependency has created obstacles for many organizations, but North America remains the leader in both - innovation and consumption in the pain therapeutics space.

Pfizer Inc., Eli Lilly and Company, GSK plc, Merck & Co., Inc., Novartis AG, Johnson & Johnson Services, Inc., Abbott, Teva Pharmaceutical Industries Ltd., Mallinckrodt Pharmaceuticals, AstraZeneca, Endo, Inc., Bayer AG, Sanofi, Viatris Inc., Haleon plc, Impax Laboratories, Inc., Lupin Limited, and other prominent players are operating in the global Market.

Each of these players has been profiled in the pain management therapeutics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 81.2 Bn |

| Forecast Value in 2035 | US$ 110.0 Bn |

| CAGR | 2.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 81.2 Bn in 2024.

It is projected to cross US$ 110.0 Bn by the end of 2035.

Rising prevalence of chronic pain conditions, innovations in drug formulations and delivery methods and paradigm shift towards multimodal pain management.

It is anticipated to grow at a CAGR of 2.8% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Pfizer Inc., Eli Lilly and Company, GSK plc, Merck & Co., Inc., Novartis AG, Johnson & Johnson Services, Inc., Abbott, Teva Pharmaceutical Industries Ltd., Mallinckrodt Pharmaceuticals, AstraZeneca, Endo, Inc., Bayer AG, Sanofi, Viatris Inc., Haleon plc, Impax Laboratories, Inc., Lupin Limited, and other prominent players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Pain Management Therapeutics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Pain Management Therapeutics Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Regulatory Landscape across Key Regions/Countries

5.2. Market Trends

5.3. PORTER’s Five Forces Analysis

5.4. PESTEL Analysis

5.5. Key Purchase Metrics for End-users

5.6. Brand and Pricing Analysis

5.7. Pipeline Analysis

5.8. Epidemiology of Major Diseases

6. Global Pain Management Therapeutics Market Analysis and Forecasts, By Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Drug Class, 2020 to 2035

6.3.1. Anticonvulsants

6.3.2. Antidepressants

6.3.3. Anaesthetics

6.3.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

6.3.5. Opioids

6.3.6. Anti-migraine Agents

6.3.7. Other

6.4. Market Attractiveness By Drug Class

7. Global Pain Management Therapeutics Market Analysis and Forecasts, By Drug Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Drug Type, 2020 to 2035

7.3.1. Over-the-Counter (OTC) Drugs

7.3.2. Prescription Drugs

7.4. Market Attractiveness By Drug Type

8. Global Pain Management Therapeutics Market Analysis and Forecasts, By Pain Type

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Pain Type, 2020 to 2035

8.3.1. Acute Pain

8.3.2. Chronic Pain

8.4. Market Attractiveness By Pain Type

9. Global Pain Management Therapeutics Market Analysis and Forecasts, By Route of Administration

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Route of Administration, 2020 to 2035

9.3.1. Oral

9.3.2. Parenteral

9.3.3. Topical

9.3.4. Others

9.4. Market Attractiveness By Route of Administration

10. Global Pain Management Therapeutics Market Analysis and Forecasts, By Indication

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast By Indication, 2020 to 2035

10.3.1. Arthritic Pain

10.3.2. Bone Facture

10.3.3. Cancer Pain

10.3.4. Chronic Back Pain

10.3.5. Fibromyalgia

10.3.6. Migraine

10.3.7. Muscle Sprain/Strain

10.3.8. Neuropathic Pain

10.3.9. Post-Operative Pain

10.3.10. Others

10.4. Market Attractiveness By Indication

11. Global Pain Management Therapeutics Market Analysis and Forecasts, By Distribution Channel

11.1. Introduction & Definition

11.2. Key Findings / Developments

11.3. Market Value Forecast By Distribution Channel, 2020 to 2035

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Online Pharmacies

11.4. Market Attractiveness By Distribution Channel

12. Global Pain Management Therapeutics Market Analysis and Forecasts, By Region

12.1. Key Findings

12.2. Market Value Forecast By Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Latin America

12.2.5. Middle East & Africa

12.3. Market Attractiveness By Region

13. North America Pain Management Therapeutics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Drug Class, 2020 to 2035

13.2.1. Anticonvulsants

13.2.2. Antidepressants

13.2.3. Anaesthetics

13.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

13.2.5. Opioids

13.2.6. Anti-migraine Agents

13.2.7. Other

13.3. Market Value Forecast By Drug Type, 2020 to 2035

13.3.1. Over-the-Counter (OTC) Drugs

13.3.2. Prescription Drugs

13.4. Market Value Forecast By Pain Type, 2020 to 2035

13.4.1. Acute Pain

13.4.2. Chronic Pain

13.5. Market Value Forecast By Route of Administration, 2020 to 2035

13.5.1. Oral

13.5.2. Parenteral

13.5.3. Topical

13.5.4. Others

13.6. Market Value Forecast By Indication, 2020 to 2035

13.6.1. Arthritic Pain

13.6.2. Bone Facture

13.6.3. Cancer Pain

13.6.4. Chronic Back Pain

13.6.5. Fibromyalgia

13.6.6. Migraine

13.6.7. Muscle Sprain/Strain

13.6.8. Neuropathic Pain

13.6.9. Post-Operative Pain

13.6.10. Others

13.7. Market Value Forecast By Distribution Channel, 2020 to 2035

13.7.1. Hospital Pharmacies

13.7.2. Retail Pharmacies

13.7.3. Online Pharmacies

13.8. Market Value Forecast By Country, 2020 to 2035

13.8.1. U.S.

13.8.2. Canada

13.9. Market Attractiveness Analysis

13.9.1. By Drug Class

13.9.2. By Drug Type

13.9.3. By Pain Type

13.9.4. By Route of Administration

13.9.5. By Indication

13.9.6. By Distribution Channel

13.9.7. By Country

14. Europe Pain Management Therapeutics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Drug Class, 2020 to 2035

14.2.1. Anticonvulsants

14.2.2. Antidepressants

14.2.3. Anaesthetics

14.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

14.2.5. Opioids

14.2.6. Anti-migraine Agents

14.2.7. Other

14.3. Market Value Forecast By Drug Type, 2020 to 2035

14.3.1. Over-the-Counter (OTC) Drugs

14.3.2. Prescription Drugs

14.4. Market Value Forecast By Pain Type, 2020 to 2035

14.4.1. Acute Pain

14.4.2. Chronic Pain

14.5. Market Value Forecast By Route of Administration, 2020 to 2035

14.5.1. Oral

14.5.2. Parenteral

14.5.3. Topical

14.5.4. Others

14.6. Market Value Forecast By Indication, 2020 to 2035

14.6.1. Arthritic Pain

14.6.2. Bone Facture

14.6.3. Cancer Pain

14.6.4. Chronic Back Pain

14.6.5. Fibromyalgia

14.6.6. Migraine

14.6.7. Muscle Sprain/Strain

14.6.8. Neuropathic Pain

14.6.9. Post-Operative Pain

14.6.10. Others

14.7. Market Value Forecast By Distribution Channel, 2020 to 2035

14.7.1. Hospital Pharmacies

14.7.2. Retail Pharmacies

14.7.3. Online Pharmacies

14.8. Market Value Forecast By Country/Sub-region, 2020 to 2035

14.8.1. Germany

14.8.2. U.K.

14.8.3. France

14.8.4. Italy

14.8.5. Spain

14.8.6. Switzerland

14.8.7. The Netherlands

14.8.8. Rest of Europe

14.9. Market Attractiveness Analysis

14.9.1. By Drug Class

14.9.2. By Drug Type

14.9.3. By Pain Type

14.9.4. By Route of Administration

14.9.5. By Indication

14.9.6. By Distribution Channel

14.9.7. By Country/Sub-region

15. Asia Pacific Pain Management Therapeutics Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Drug Class, 2020 to 2035

15.2.1. Anticonvulsants

15.2.2. Antidepressants

15.2.3. Anaesthetics

15.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

15.2.5. Opioids

15.2.6. Anti-migraine Agents

15.2.7. Other

15.3. Market Value Forecast By Drug Type, 2020 to 2035

15.3.1. Over-the-Counter (OTC) Drugs

15.3.2. Prescription Drugs

15.4. Market Value Forecast By Pain Type, 2020 to 2035

15.4.1. Acute Pain

15.4.2. Chronic Pain

15.5. Market Value Forecast By Route of Administration, 2020 to 2035

15.5.1. Oral

15.5.2. Parenteral

15.5.3. Topical

15.5.4. Others

15.6. Market Value Forecast By Indication, 2020 to 2035

15.6.1. Arthritic Pain

15.6.2. Bone Facture

15.6.3. Cancer Pain

15.6.4. Chronic Back Pain

15.6.5. Fibromyalgia

15.6.6. Migraine

15.6.7. Muscle Sprain/Strain

15.6.8. Neuropathic Pain

15.6.9. Post-Operative Pain

15.6.10. Others

15.7. Market Value Forecast By Distribution Channel, 2020 to 2035

15.7.1. Hospital Pharmacies

15.7.2. Retail Pharmacies

15.7.3. Online Pharmacies

15.8. Market Value Forecast By Country/Sub-region, 2020 to 2035

15.8.1. China

15.8.2. Japan

15.8.3. India

15.8.4. Australia & New Zealand

15.8.5. South Korea

15.8.6. Rest of Asia Pacific

15.9. Market Attractiveness Analysis

15.9.1. By Drug Class

15.9.2. By Drug Type

15.9.3. By Pain Type

15.9.4. By Route of Administration

15.9.5. By Indication

15.9.6. By Distribution Channel

15.9.7. By Country/Sub-region

16. Latin America Pain Management Therapeutics Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast By Drug Class, 2020 to 2035

16.2.1. Anticonvulsants

16.2.2. Antidepressants

16.2.3. Anaesthetics

16.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

16.2.5. Opioids

16.2.6. Anti-migraine Agents

16.2.7. Other

16.3. Market Value Forecast By Drug Type, 2020 to 2035

16.3.1. Over-the-Counter (OTC) Drugs

16.3.2. Prescription Drugs

16.4. Market Value Forecast By Pain Type, 2020 to 2035

16.4.1. Acute Pain

16.4.2. Chronic Pain

16.5. Market Value Forecast By Route of Administration, 2020 to 2035

16.5.1. Oral

16.5.2. Parenteral

16.5.3. Topical

16.5.4. Others

16.6. Market Value Forecast By Indication, 2020 to 2035

16.6.1. Arthritic Pain

16.6.2. Bone Facture

16.6.3. Cancer Pain

16.6.4. Chronic Back Pain

16.6.5. Fibromyalgia

16.6.6. Migraine

16.6.7. Muscle Sprain/Strain

16.6.8. Neuropathic Pain

16.6.9. Post-Operative Pain

16.6.10. Others

16.7. Market Value Forecast By Distribution Channel, 2020 to 2035

16.7.1. Hospital Pharmacies

16.7.2. Retail Pharmacies

16.7.3. Online Pharmacies

16.8. Market Value Forecast By Country/Sub-region, 2020 to 2035

16.8.1. Brazil

16.8.2. Mexico

16.8.3. Argentina

16.8.4. Rest of Latin America

16.9. Market Attractiveness Analysis

16.9.1. By Drug Class

16.9.2. By Drug Type

16.9.3. By Pain Type

16.9.4. By Route of Administration

16.9.5. By Indication

16.9.6. By Distribution Channel

16.9.7. By Country/Sub-region

17. Middle East & Africa Pain Management Therapeutics Market Analysis and Forecast

17.1. Introduction

17.1.1. Key Findings

17.2. Market Value Forecast By Drug Class, 2020 to 2035

17.2.1. Anticonvulsants

17.2.2. Antidepressants

17.2.3. Anaesthetics

17.2.4. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

17.2.5. Opioids

17.2.6. Anti-migraine Agents

17.2.7. Other

17.3. Market Value Forecast By Drug Type, 2020 to 2035

17.3.1. Over-the-Counter (OTC) Drugs

17.3.2. Prescription Drugs

17.4. Market Value Forecast By Pain Type, 2020 to 2035

17.4.1. Acute Pain

17.4.2. Chronic Pain

17.5. Market Value Forecast By Route of Administration, 2020 to 2035

17.5.1. Oral

17.5.2. Parenteral

17.5.3. Topical

17.5.4. Others

17.6. Market Value Forecast By Indication, 2020 to 2035

17.6.1. Arthritic Pain

17.6.2. Bone Facture

17.6.3. Cancer Pain

17.6.4. Chronic Back Pain

17.6.5. Fibromyalgia

17.6.6. Migraine

17.6.7. Muscle Sprain/Strain

17.6.8. Neuropathic Pain

17.6.9. Post-Operative Pain

17.6.10. Others

17.7. Market Value Forecast By Distribution Channel, 2020 to 2035

17.7.1. Hospital Pharmacies

17.7.2. Retail Pharmacies

17.7.3. Online Pharmacies

17.8. Market Value Forecast By Country/Sub-region, 2020 to 2035

17.8.1. GCC Countries

17.8.2. South Africa

17.8.3. Rest of Middle East & Africa

17.9. Market Attractiveness Analysis

17.9.1. By Drug Class

17.9.2. By Drug Type

17.9.3. By Pain Type

17.9.4. By Route of Administration

17.9.5. By Indication

17.9.6. By Distribution Channel

17.9.7. By Country/Sub-region

18. Competition Landscape

18.1. Market Player – Competition Matrix (By Tier and Size of companies)

18.2. Market Share Analysis By Company (2024)

18.3. Company Profiles

18.3.1. Pfizer Inc.

18.3.1.1. Company Overview

18.3.1.2. Financial Overview

18.3.1.3. Product Portfolio

18.3.1.4. Business Strategies

18.3.1.5. Recent Developments

18.3.2. Eli Lilly and Company

18.3.2.1. Company Overview

18.3.2.2. Financial Overview

18.3.2.3. Product Portfolio

18.3.2.4. Business Strategies

18.3.2.5. Recent Developments

18.3.3. GSK plc

18.3.3.1. Company Overview

18.3.3.2. Financial Overview

18.3.3.3. Product Portfolio

18.3.3.4. Business Strategies

18.3.3.5. Recent Developments

18.3.4. Merck & Co., Inc.

18.3.4.1. Company Overview

18.3.4.2. Financial Overview

18.3.4.3. Product Portfolio

18.3.4.4. Business Strategies

18.3.4.5. Recent Developments

18.3.5. Novartis AG

18.3.5.1. Company Overview

18.3.5.2. Financial Overview

18.3.5.3. Product Portfolio

18.3.5.4. Business Strategies

18.3.5.5. Recent Developments

18.3.6. Johnson & Johnson Services, Inc.

18.3.6.1. Company Overview

18.3.6.2. Financial Overview

18.3.6.3. Product Portfolio

18.3.6.4. Business Strategies

18.3.6.5. Recent Developments

18.3.7. Abbott

18.3.7.1. Company Overview

18.3.7.2. Financial Overview

18.3.7.3. Product Portfolio

18.3.7.4. Business Strategies

18.3.7.5. Recent Developments

18.3.8. Teva Pharmaceutical Industries Ltd.

18.3.8.1. Company Overview

18.3.8.2. Financial Overview

18.3.8.3. Product Portfolio

18.3.8.4. Business Strategies

18.3.8.5. Recent Developments

18.3.9. Mallinckrodt Pharmaceuticals

18.3.9.1. Company Overview

18.3.9.2. Financial Overview

18.3.9.3. Product Portfolio

18.3.9.4. Business Strategies

18.3.9.5. Recent Developments

18.3.10. AstraZeneca

18.3.10.1. Company Overview

18.3.10.2. Financial Overview

18.3.10.3. Product Portfolio

18.3.10.4. Business Strategies

18.3.10.5. Recent Developments

18.3.11. Endo, Inc.

18.3.11.1. Company Overview

18.3.11.2. Financial Overview

18.3.11.3. Product Portfolio

18.3.11.4. Business Strategies

18.3.11.5. Recent Developments

18.3.12. Bayer AG

18.3.12.1. Company Overview

18.3.12.2. Financial Overview

18.3.12.3. Product Portfolio

18.3.12.4. Business Strategies

18.3.12.5. Recent Developments

18.3.13. Sanofi

18.3.13.1. Company Overview

18.3.13.2. Financial Overview

18.3.13.3. Product Portfolio

18.3.13.4. Business Strategies

18.3.13.5. Recent Developments

18.3.14. Viatris Inc

18.3.14.1. Company Overview

18.3.14.2. Financial Overview

18.3.14.3. Product Portfolio

18.3.14.4. Business Strategies

18.3.14.5. Recent Developments

18.3.15. Haleon plc

18.3.15.1. Company Overview

18.3.15.2. Financial Overview

18.3.15.3. Product Portfolio

18.3.15.4. Business Strategies

18.3.15.5. Recent Developments

18.3.16. Impax Laboratories, Inc.

18.3.16.1. Company Overview

18.3.16.2. Financial Overview

18.3.16.3. Product Portfolio

18.3.16.4. Business Strategies

18.3.16.5. Recent Developments

18.3.17. Lupin Limited

18.3.17.1. Company Overview

18.3.17.2. Financial Overview

18.3.17.3. Product Portfolio

18.3.17.4. Business Strategies

18.3.17.5. Recent Developments

List of Tables

Table 01: Global Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 02: Global Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 03: Global Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Pain Type, 2020 to 2035

Table 04: Global Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 05: Global Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 06: Global Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 07: Global Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 09: North America Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 10: North America Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 11: North America Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Pain Type, 2020 to 2035

Table 12: North America Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 13: North America Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 14: North America Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 15: Europe Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 16: Europe Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 17: Europe Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 18: Europe Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Pain Type, 2020 to 2035

Table 19: Europe Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 20: Europe Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 21: Europe Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 22: Asia Pacific Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 23: Asia Pacific Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 24: Asia Pacific Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 25: Asia Pacific Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Pain Type, 2020 to 2035

Table 26: Asia Pacific Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 27: Asia Pacific Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 28: Asia Pacific Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 29: Latin America Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 30: Latin America Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 31: Latin America Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 32: Latin America Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Pain Type, 2020 to 2035

Table 33: Latin America Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 34: Latin America Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 35: Latin America Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 36: Middle East & Africa Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 37: Middle East & Africa Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 38: Middle East & Africa Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 39: Middle East & Africa Pain Management Therapeutics Market Value (US$ Bn) Forecast, by Pain Type, 2020 to 2035

Table 40: Middle East & Africa Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 41: Middle East & Africa Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 42: Middle East & Africa Pain Management Therapeutics Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

List of Figures

Figure 01: Global Pain Management Therapeutics Market Value Share Analysis, by Drug Class, 2024 and 2035

Figure 02: Global Pain Management Therapeutics Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 03: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Anticonvulsants, 2020 to 2035

Figure 04: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Antidepressants, 2020 to 2035

Figure 05: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Anaesthetics, 2020 to 2035

Figure 06: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Non-steroidal Anti-inflammatory Drugs (NSAIDS), 2020 to 2035

Figure 07: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Opioids, 2020 to 2035

Figure 08: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Anti-migraine Agents, 2020 to 2035

Figure 09: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Pain Management Therapeutics Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 11: Global Pain Management Therapeutics Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 12: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Over-the-Counter (OTC), 2020 to 2035

Figure 13: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Prescription Drugs, 2020 to 2035

Figure 14: Global Pain Management Therapeutics Market Value Share Analysis, By Pain Type, 2024 and 2035

Figure 15: Global Pain Management Therapeutics Market Attractiveness Analysis, By Pain Type, 2025 to 2035

Figure 16: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Acute Pain, 2020 to 2035

Figure 17: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Chronic Pain, 2020 to 2035

Figure 18: Global Pain Management Therapeutics Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 19: Global Pain Management Therapeutics Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 20: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Oral, 2020 to 2035

Figure 21: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Parenteral, 2020 to 2035

Figure 22: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Topical, 2020 to 2035

Figure 23: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 24: Global Pain Management Therapeutics Market Value Share Analysis, By Indication, 2024 and 2035

Figure 25: Global Pain Management Therapeutics Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 26: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Arthritic Pain, 2020 to 2035

Figure 27: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Bone Fracture, 2020 to 2035

Figure 28: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Cancer Pain, 2020 to 2035

Figure 29: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Chronic Back Pain, 2020 to 2035

Figure 30: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Fibromyalgia, 2020 to 2035

Figure 31: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Migraine, 2020 to 2035

Figure 32: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Muscle Sprain/Strain, 2020 to 2035

Figure 33: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Neuropathic Pain, 2020 to 2035

Figure 34: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Post-operative Pain, 2020 to 2035

Figure 35: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 36: Global Pain Management Therapeutics Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 37: Global Pain Management Therapeutics Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 38: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 39: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 40: Global Pain Management Therapeutics Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 41: Global Pain Management Therapeutics Market Value Share Analysis, By Region, 2024 and 2035

Figure 42: Global Pain Management Therapeutics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 43: North America Pain Management Therapeutics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: North America Pain Management Therapeutics Market Value Share Analysis, by Country, 2024 and 2035

Figure 45: North America Pain Management Therapeutics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 46: North America Pain Management Therapeutics Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 47: North America Pain Management Therapeutics Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 48: North America Pain Management Therapeutics Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 49: North America Pain Management Therapeutics Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 50: North America Pain Management Therapeutics Market Value Share Analysis, By Pain Type, 2024 and 2035

Figure 51: North America Pain Management Therapeutics Market Attractiveness Analysis, By Pain Type, 2025 to 2035

Figure 52: North America Pain Management Therapeutics Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 53: North America Pain Management Therapeutics Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 54: North America Pain Management Therapeutics Market Value Share Analysis, By Indication, 2024 and 2035

Figure 55: North America Pain Management Therapeutics Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 56: North America Pain Management Therapeutics Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 57: North America Pain Management Therapeutics Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 58: Europe Pain Management Therapeutics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Europe Pain Management Therapeutics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 60: Europe Pain Management Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 61: Europe Pain Management Therapeutics Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 62: Europe Pain Management Therapeutics Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 63: Europe Pain Management Therapeutics Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 64: Europe Pain Management Therapeutics Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 65: Europe Pain Management Therapeutics Market Value Share Analysis, By Pain Type, 2024 and 2035

Figure 66: Europe Pain Management Therapeutics Market Attractiveness Analysis, By Pain Type, 2025 to 2035

Figure 67: Europe Pain Management Therapeutics Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 68: Europe Pain Management Therapeutics Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 69: Europe Pain Management Therapeutics Market Value Share Analysis, By Indication, 2024 and 2035

Figure 70: Europe Pain Management Therapeutics Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 71: Europe Pain Management Therapeutics Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 72: Europe Pain Management Therapeutics Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 73: Asia Pacific Pain Management Therapeutics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 74: Asia Pacific Pain Management Therapeutics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 75: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 76: Asia Pacific Pain Management Therapeutics Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 77: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 78: Asia Pacific Pain Management Therapeutics Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 79: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 80: Asia Pacific Pain Management Therapeutics Market Value Share Analysis, By Pain Type, 2024 and 2035

Figure 81: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, By Pain Type, 2025 to 2035

Figure 82: Asia Pacific Pain Management Therapeutics Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 83: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 84: Asia Pacific Pain Management Therapeutics Market Value Share Analysis, By Indication, 2024 and 2035

Figure 85: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 86: Asia Pacific Pain Management Therapeutics Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 87: Asia Pacific Pain Management Therapeutics Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 88: Latin America Pain Management Therapeutics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 89: Latin America Pain Management Therapeutics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 90: Latin America Pain Management Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 91: Latin America Pain Management Therapeutics Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 92: Latin America Pain Management Therapeutics Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 93: Latin America Pain Management Therapeutics Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 94: Latin America Pain Management Therapeutics Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 95: Latin America Pain Management Therapeutics Market Value Share Analysis, By Pain Type, 2024 and 2035

Figure 96: Latin America Pain Management Therapeutics Market Attractiveness Analysis, By Pain Type, 2025 to 2035

Figure 97: Latin America Pain Management Therapeutics Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 98: Latin America Pain Management Therapeutics Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 99: Latin America Pain Management Therapeutics Market Value Share Analysis, By Indication, 2024 and 2035

Figure 100: Latin America Pain Management Therapeutics Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 101: Latin America Pain Management Therapeutics Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 102: Latin America Pain Management Therapeutics Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 103: Middle East & Africa Pain Management Therapeutics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 104: Middle East & Africa Pain Management Therapeutics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 105: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 106: Middle East & Africa Pain Management Therapeutics Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 107: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 108: Middle East & Africa Pain Management Therapeutics Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 109: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 110: Middle East & Africa Pain Management Therapeutics Market Value Share Analysis, By Pain Type, 2024 and 2035

Figure 111: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, By Pain Type, 2025 to 2035

Figure 112: Middle East & Africa Pain Management Therapeutics Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 113: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 114: Middle East & Africa Pain Management Therapeutics Market Value Share Analysis, By Indication, 2024 and 2035

Figure 115: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 116: Middle East & Africa Pain Management Therapeutics Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 117: Middle East & Africa Pain Management Therapeutics Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035