Reports

Reports

Among several potential transmission sources in the spreading of coronavirus, dental services have received a high volume of attention. Such trends are influencing growth in the North America dental equipment and maintenance market. Equipment maintenance recommendations are being publicized among dentists. Providers of complete solutions for dental interiors, equipment, and maintenance are offering COVID-19 equipment maintenance recommendations to prepare dental practices for reopening with improved cross-infection measures & servicing equipment.

Service providers in the North America dental equipment and maintenance market are focusing on essential works to enable their customers to provide emergency treatments. They are increasing efforts to help remotely via phone or by video meeting and only make a visit if the service providers are unable to help remotely.

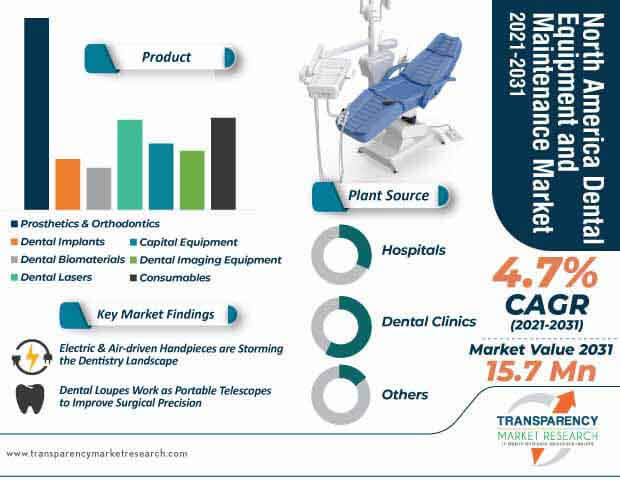

The North America dental equipment and maintenance market is expected to surpass the valuation of US$ 15.7 Bn by 2031. However, there is a need for regular and proper maintenance of dental equipment in the most effective way to reduce injury risk from equipment failure. Potential injuries include nerve damage, trauma to the patient’s mouth, and serious infections. Hence, service providers should increase efforts to offer maintenance services that involves performing equipment audits regularly by strictly adhering to maintenance guidelines given by the manufacturer.

Since dentists are required to use high-quality products, equipment manufacturers are developing tools according to the set health and safety standards.

Innovations in dental handpieces are creating revenue opportunities for stakeholders in the North America dental equipment and maintenance market. Electric and air driven handpieces are storming the dentistry landscape. These handpieces are one of the most utilized equipment and thus, it is necessary to offer improved efficiency in these tools.

The Aeras 500 lite from DENTALEZ is being publicized for its robust cutting power and RFID (Radio Frequency Identification) technology. Maintenance and repair of such new technologies are creating incremental opportunities for companies in the North America dental equipment and maintenance market. Lightweight designs in handpieces help reduce hand fatigue. The RFID technology, on the other hand, helps dentists track important data such as usage and sterility.

Dental loupes and dental photography applications are generating revenue streams for companies in the North America dental equipment and maintenance market. Dental loupes are extensively used by practitioners to examine a patient’s teeth precisely and accurately. These are magnifying glasses that facilitate a detailed and comprehensive view over people’s oral condition, pinpoint their issue, and provide treatment for the same. This helps dental therapists to perform proper rectification of the patient’s dental problems.

Dental loupes work as portable dental telescopes to improve surgical precision. Such applications are creating value-grab opportunities for companies in the North America dental equipment and maintenance market.

Dental photography is another important application in dentistry, which deals in analyzing shades pertaining to the cosmetic dentistry. Dentists are often challenged with annoying reflection of light that occurs from the teeth. As a result, the details of the composite and porcelain color are hidden. The growing awareness about fundamental know-how of photography and appropriate products for dental photography are helping to improve medical outcomes. Thus, maintenance of such photography equipment is creating revenue opportunities for companies in the North America dental equipment and maintenance market.

Dental photography tools such as contractors, retractors, lenses, and mirrors are triggering the demand for repair services in the North America dental equipment and maintenance market. Retractors make it easier for to access the oral cavity by lifting up the lips. Contactors, on the other hand, hide those oral tissues that cause inconvenience by distraction.

Analysts’ Viewpoint

COVID-19 maintenance recommendations such as constant flushing of suction pumps and improved cross-infection measures are gaining importance to ensure the safety of dentists and patients. The North America dental equipment and maintenance market is slated to clock a CAGR of 4.7% during the forecast period. This is evident since there is a need for proper and regular maintenance of dental equipment to reduce the incidences of injury due to equipment failure. Thus, to boost credibility credentials, service providers should educate dentists to buy dental equipment that are compatible with existing equipment. Dentists should compare different models of the same equipment from different manufacturers before making a purchase decision.

North America Dental Equipment and Maintenance Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 9.66 Bn |

|

Market Forecast Value in 2031 |

US$ 15.7 Bn |

|

Growth Rate (CAGR) |

4.7 % |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, supply chain analysis, and parent industry overview. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Dental equipment and maintenance market in north america is expected to surpass the valuation of US$ 15.7 Bn by 2031

Dental equipment and maintenance market in north america to expand at a CAGR of 4.7% during 2021-2031

Dental equipment and maintenance market in north america is driven by increase adoption of diagnostic imaging technologies in wider applications

Key players in the dental equipment and maintenance market in north america are Institut Straumann AG (Straumann Group), DENTSPLY SIRONA, Inc., A-dec, Inc., Renew Digital, LLC., Envista Holdings Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: North America Dental Equipment and Maintenance Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. North America Dental Equipment and Maintenance Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

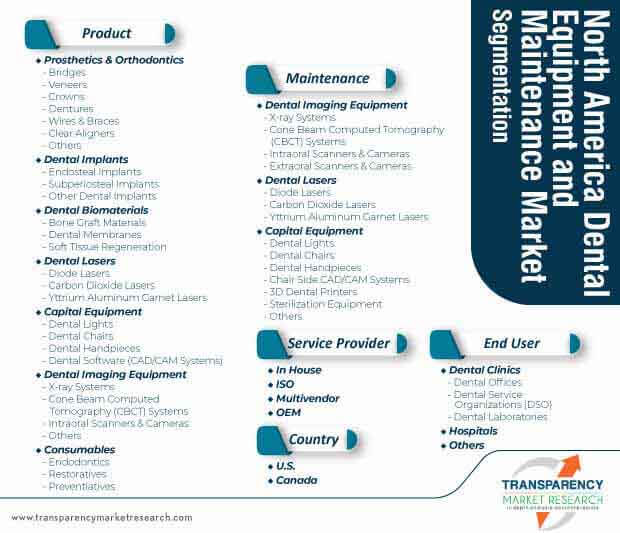

5. North America Dental Equipment and Maintenance Market Analysis and Forecast, By Product

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Market ValueForecast, by Product, 2017–2031

5.3.1. Prosthetics & Orthodontics

5.3.1.1. Bridges

5.3.1.2. Veneers

5.3.1.3. Crowns

5.3.1.4. Dentures

5.3.1.5. Wires & Braces

5.3.1.6. Clear Aligners

5.3.1.7. Others

5.3.2. Dental Implants

5.3.2.1. Endosteal Implants

5.3.2.2. Subperiosteal Implants

5.3.2.3. Other Dental Implants

5.3.3. Dental Biomaterials

5.3.3.1. Bone Graft Materials

5.3.3.2. Dental Membranes

5.3.3.3. Soft Tissue Regeneration

5.3.4. Dental Lasers

5.3.4.1. Diode Lasers

5.3.4.2. Carbon Dioxide Lasers

5.3.4.3. Yttrium Aluminum Garnet Lasers

5.3.5. Capital Equipment

5.3.5.1. Dental Lights

5.3.5.2. Dental Chairs

5.3.5.3. Dental Handpieces

5.3.5.4. Dental Software (CAD/CAM Systems)

5.3.6. Dental Imaging Equipment

5.3.6.1. X-ray Systems

5.3.6.2. Cone Beam Computed Tomography (CBCT) Systems

5.3.6.3. Intraoral Scanners & Cameras

5.3.6.4. Others

5.3.7. Consumables

5.3.7.1. Endodontics

5.3.7.2. Restoratives

5.3.7.3. Preventiatives

5.4. Market Attractiveness Analysis, by Product

6. North America Dental Equipment and Maintenance Market Analysis and Forecast, by End-user

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market ValueForecast, by End-user, 2017–2031

6.3.1. Dental Clinics

6.3.1.1. Dental Offices

6.3.1.2. Dental Service Organizations (DSO)

6.3.1.3. Dental Laboratories

6.3.2. Hospitals

6.3.3. Others

6.4. Market Attractiveness Analysis, by End-user

7. North America Dental Equipment and Maintenance Market Analysis and Forecast, by Maintenance

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Maintenance, 2017–2031

7.3.1. Dental Imaging Equipment

7.3.1.1. X-ray Systems

7.3.1.2. Cone Beam Computed Tomography (CBCT) Systems

7.3.1.3. Intraoral Scanners & Cameras

7.3.1.4. Extraoral Scanners & Cameras

7.3.2. Dental Lasers

7.3.2.1. Diode Lasers

7.3.2.2. Carbon Dioxide Lasers

7.3.2.3. Yttrium Aluminum Garnet Lasers

7.3.3. Capital Equipment

7.3.3.1. Dental Lights

7.3.3.2. Dental Chairs

7.3.3.3. Dental Handpieces

7.3.3.4. Chair Side CAD/CAM Systems

7.3.3.5. 3D Dental Printers

7.3.3.6. Sterilization Equipment

7.3.3.7. Others

7.4. Market Attractiveness Analysis, by Maintenance

8. North America Dental Equipment and Maintenance Market Analysis and Forecast, by Service Providers

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market ValueForecast, by Maintenance, 2017–2031

8.3.1. In House

8.3.2. ISO

8.3.3. Multivendor

8.3.4. OEM

8.4. Market Attractiveness Analysis, by Service Providers

9. North America Dental Equipment and Maintenance Market Analysis and Forecast, by Country

9.1. Key Findings

9.2. Market ValueForecast, by Country

9.2.1. U.S.

9.2.2. Canada

9.3. Market Attractiveness Analysis, by Country

10. Competition Landscape

10.1. Company Share Analysis

10.2. Company Profiles

10.2.1. Institut Straumann AG (Straumann Group)

10.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.1.2. Company Financials

10.2.1.3. Growth Strategies

10.2.1.4. SWOT Analysis

10.2.2. DENTSPLY SIRONA, Inc.

10.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.2.2. Company Financials

10.2.2.3. Growth Strategies

10.2.2.4. SWOT Analysis

10.2.3. A-dec, Inc.

10.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.3.2. Company Financials

10.2.3.3. Growth Strategies

10.2.3.4. SWOT Analysis

10.2.4. Renew Digital, LLC.

10.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.4.2. Company Financials

10.2.4.3. Growth Strategies

10.2.4.4. SWOT Analysis

10.2.5. Envista Holdings Corporation

10.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.5.2. Company Financials

10.2.5.3. Growth Strategies

10.2.5.4. SWOT Analysis

10.2.6. Henry Schein, Inc.

10.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.6.2. Company Financials

10.2.6.3. Growth Strategies

10.2.6.4. SWOT Analysis

10.2.7. BioHorizons, Inc.

10.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.7.2. Company Financials

10.2.7.3. Growth Strategies

10.2.7.4. SWOT Analysis

10.2.8. BIOLASE, Inc.

10.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.8.2. Company Financials

10.2.8.3. Growth Strategies

10.2.8.4. SWOT Analysis

10.2.9. Cortex Dental Implants Industries Ltd.

10.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.9.2. Company Financials

10.2.9.3. Growth Strategies

10.2.9.4. SWOT Analysis

10.2.10. DENTALEZ, Inc.

10.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.10.2. Company Financials

10.2.10.3. Growth Strategies

10.2.10.4. SWOT Analysis

10.2.11. Ultradent Products, Inc.

10.2.11.1. Company Overview (HQ, Business Segments,Employee Strength)

10.2.11.2. Company Financials

10.2.11.3. Growth Strategies

10.2.11.4. SWOT Analysis

10.2.12. 3M

10.2.12.1. Company Overview (HQ, Business Segments,Employee Strength)

10.2.12.2. Company Financials

10.2.12.3. Growth Strategies

10.2.12.4. SWOT Analysis

10.2.13. Ivoclar Vivadent AG

10.2.13.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.13.2. Company Financials

10.2.13.3. Growth Strategies

10.2.13.4. SWOT Analysis

10.2.14. Carestream Health, Inc.

10.2.14.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.14.2. Company Financials

10.2.14.3. Growth Strategies

10.2.14.4. SWOT Analysis

10.2.15. TriMedx Holdings, LLC

10.2.15.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.15.2. Company Financials

10.2.15.3. Growth Strategies

10.2.15.4. SWOT Analysis

10.2.16. AlphaSource Group

10.2.16.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.16.2. Company Financials

10.2.16.3. Growth Strategies

10.2.16.4. SWOT Analysis

10.2.17. Midmark Corporation

10.2.17.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.17.2. Company Financials

10.2.17.3. Growth Strategies

10.2.17.4. SWOT Analysis

10.2.18. Owandy Radiology

10.2.18.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.18.2. Company Financials

10.2.18.3. Growth Strategies

10.2.18.4. SWOT Analysis

10.2.19. PLANMECA OY

10.2.19.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.19.2. Company Financials

10.2.19.3. Growth Strategies

10.2.19.4. SWOT Analysis

10.2.20. Zimmer Biomet Holdings, Inc.

10.2.20.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.20.2. Company Financials

10.2.20.3. Growth Strategies

10.2.20.4. SWOT Analysis

10.2.21. Neobiotech Co., Ltd.

10.2.21.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.21.2. Company Financials

10.2.21.3. Growth Strategies

10.2.21.4. SWOT Analysis

10.2.22. Capital Dental Equipment

10.2.22.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.22.2. Company Financials

10.2.22.3. Growth Strategies

10.2.22.4. SWOT Analysis

10.2.23. North America Imaging Resources

10.2.23.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.23.2. Company Financials

10.2.23.3. Growth Strategies

10.2.23.4. SWOT Analysis

10.2.24. Dental Planet, LLC

10.2.24.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.24.2. Company Financials

10.2.24.3. Growth Strategies

10.2.24.4. SWOT Analysis

10.2.25. Collins Dental Equipment Co., Inc.

10.2.25.1. Company Overview (HQ, Business Segments, Employee Strength)

10.2.25.2. Company Financials

10.2.25.3. Growth Strategies

10.2.25.4. SWOT Analysis

List of Tables

Table 01: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 02: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Prosthetics & Orthodontics, 2017‒2031

Table 03: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Dental Implant, 2017‒2031

Table 04: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Dental Biomaterials, 2017‒2031

Table 05: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Dental Lasers, 2017‒2031

Table 06: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Capital Equipment, 2017‒2031

Table 07: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Dental Imaging Equipment, 2017‒2031

Table 08: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Consumables, 2017‒2031

Table 09: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 10: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Dental Clinics, 2017‒2031

Table 11: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 12: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Maintenance, 2017‒2031

Table 13: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Dental Imaging Equipment, 2017‒2031

Table 14: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Capital Equipment, 2017‒2031

Table 15: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Dental Laser, 2017‒2031

List of Figures

Figure 01: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, by Equipment 2017–2031

Figure 02: North America Dental Equipment and Maintenance Market Value Share, by Product, 2020

Figure 03: North America Dental Equipment and Maintenance Market Value Share, by End-user, 2020

Figure 04: North America Dental Equipment and Maintenance Market Value Share, by Country, 2020

Figure 05: North America Dental Equipment and Maintenance Market Value Share, by Dental Clinics, 2020

Figure 06: North America Dental Equipment and Maintenance Market Value (US$ Mn) Forecast, 2017–2031

Figure 07: North America Dental Equipment and Maintenance Market Value Share, by Product, 2020

Figure 08: North America Dental Equipment and Maintenance Market Value Share, by Service Provider, 2020

Figure 09: North America Dental Equipment and Maintenance Market Value Share, by Country, 2020

Figure 10: North America Dental Equipment and Maintenance Market Value Share Analysis, by Product, 2020 and 2031

Figure 11: North America Dental Equipment and Maintenance Market Attractiveness Analysis, by Product, 2021–2031

Figure 12: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Prosthetics & Orthodontics, 2017‒2031

Figure 13: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Dental Implants, 2017‒2031

Figure 14: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Dental Biomaterials, 2017‒2031

Figure 15: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Dental Lasers, 2017‒2031

Figure 16: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Capital Equipment, 2017‒2031

Figure 17: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Dental Imaging Equipment, 2017‒2031

Figure 18: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Consumables, 2017-2031

Figure 19: North America Dental Equipment and Maintenance Market Value Share Analysis, by End-user, 2020 and 2031

Figure 20: North America Dental Equipment and Maintenance Market Attractiveness Analysis, by End-user, 2021–2031

Figure 21: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Hospitals, 2017‒2031

Figure 22: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Dental Clinics, 2017‒2031

Figure 23: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Others, 2017-2031

Figure 24: North America Dental Equipment and Maintenance Market Value Share Analysis, by Country, 2020 and 2031

Figure 25: North America Dental Equipment and Maintenance Market Attractiveness Analysis, by Country, 2021–2031

Figure 26: North America Dental Equipment and Maintenance Market Value Share Analysis, by Maintenance, 2020 and 2031

Figure 27: North America Dental Equipment and Maintenance Market Attractiveness Analysis, by Maintenance, 2021–2031

Figure 28: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Dental imaging Equipment, 2017‒2031

Figure 29: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Capital Equipment, 2017‒2031

Figure 30: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Dental Laser, 2017-2031

Figure 31: North America Dental Equipment and Maintenance Market Value Share Analysis, by Service Provider, 2020 and 2031

Figure 32: North America Dental Equipment and Maintenance Market Value (US$ Mn), by In-house, 2017‒2031

Figure 33: North America Dental Equipment and Maintenance Market Value (US$ Mn), by ISO, 2017‒2031

Figure 34: North America Dental Equipment and Maintenance Market Value (US$ Mn), by Multivendor, 2017‒2031

Figure 35: North America Dental Equipment and Maintenance Market Value (US$ Mn), by OEM, 2017‒2031

Figure 36: North America Dental Equipment and Maintenance Market Attractiveness Analysis, by Provider, 2021–2031

Figure 37: North America Dental Equipment and Maintenance Market Value Share Analysis, by Country-Maintenance, 2020 and 2031

Figure 38: North America Dental Equipment and Maintenance Market Attractiveness Analysis, by Country-Maintenance, 2021–2031