Reports

Reports

Analysts’ Viewpoint

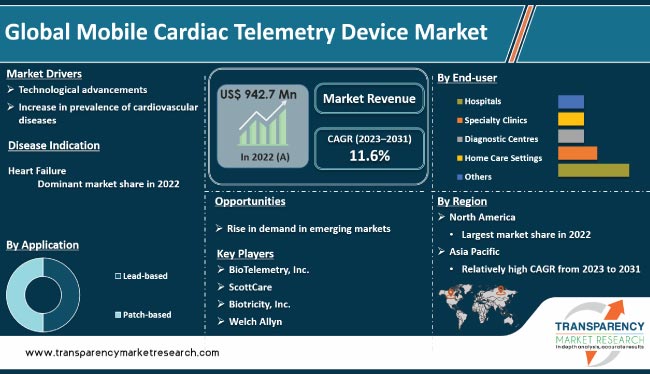

The global mobile cardiac telemetry device market is expected to witness significant growth in the next few years due to increase in prevalence of cardiovascular diseases, technological advancements, and surge in demand for mobile cardiac telemetry monitors. Rise in the geriatric population and increase in disposable income are driving global mobile cardiac telemetry device market growth. Furthermore, surge in awareness about preventive healthcare and rise in adoption of mHealth solutions are fueling market expansion.

However, high cost associated with these devices, data security concerns, and lack of skilled professionals in developing countries are likely to hamper market development. Untapped markets such as Africa and South Asia offer lucrative opportunities for players in the industry. Leading manufacturers are focusing on partnering with telecom operators and healthcare providers to create novel and low cost devices to increase market share.

Mobile cardiac telemetry (MCT) is a medical device used to monitor the heart rate and rhythm of patients. It is a non-invasive device that is worn on the patient's chest and transmits data to a monitoring station. The device is used to detect and diagnose cardiac arrhythmias, or abnormal heart rhythms, and to monitor the patient's heart rate and rhythm over time. MCT devices are typically composed of a transmitter, a receiver, and a monitor. The transmitter is worn on the patient's chest and is connected to electrodes that measure the electrical activity of the heart. The transmitter then sends the data to the receiver, which is connected to a monitor. The monitor displays the data in real time, allowing the physician to monitor the patient's heart rate and rhythm.

MCT devices offer several advantages over traditional cardiac monitoring methods. These are non-invasive i.e., these do not require surgery or other invasive procedures. These devices are also portable, allowing the patient to move around while being monitored. Additionally, MCT devices are able to detect and diagnose arrhythmias more quickly and accurately than traditional methods. However, MCT devices are expensive and require frequent maintenance and calibration.

Improvements in mobile cardiac telemetry devices have enabled the development of more sophisticated and accurate devices that can monitor a patient's heart rate and rhythm. For example, in April 2020, Abbott Laboratories launched the Confirm Rx Insertable Cardiac Monitor, a device that can detect and monitor cardiac arrhythmias. This device is the first of its kind to be approved by the U.S. Food and Drug Administration (FDA) and is expected to revolutionize the way cardiac arrhythmias are monitored and treated.

Developments in mobile cardiac telemetry device market, such as cloud-based platforms and mobile applications, have enabled remote monitoring of patients, allowing healthcare providers to monitor patients' heart rate and rhythm from anywhere. This has enabled healthcare providers to offer better care to patients and has also increased demand for mobile cardiac telemetry devices.

Increase in prevalence of cardiovascular diseases is another key driver of the global mobile cardiac telemetry device market. According to the World Health Organization, cardiovascular diseases are the leading cause of death globally, accounting for 17.9 million deaths in 2016. This has led to increase in demand for cardiac monitoring devices, as these can help healthcare providers detect and monitor cardiac arrhythmias and other cardiac conditions. Furthermore, rise in prevalence of cardiovascular diseases has led to increase in demand for remote monitoring devices, as these can help healthcare providers monitor their patients' heart rate and rhythm from anywhere.

In terms of application, the lead-based segment accounted for the largest share of the global mobile cardiac telemetry device market in 2022. This is ascribed to their ability to provide accurate and reliable data for the diagnosis and monitoring of cardiac arrhythmias. The lead-based segment has been split into single leads, dual leads, three leads, four leads, five leads, and six or more leads.

The surge in demand for advanced technology in healthcare has led to an increase in the adoption of mobile cardiac telemetry devices with multiple leads. For instance, in March 2019, Abbott Laboratories launched a new mobile cardiac telemetry device called Confirm Rx Insertable Cardiac Monitor (ICM), which features a five-lead system that provides physicians with more comprehensive data about their patients’ heart rhythms than traditional two or three lead systems. This device helps physicians detect arrhythmias earlier and more accurately than ever before. Thus, technological advancements are expected to drive the lead-based segment during the forecast period.

In terms of disease indication, the heart failure segment dominated the global market in 2022. This is ascribed to the rise in the prevalence of cardiovascular diseases across all age groups globally. According to the World Health Organization (WHO), 17 million people succumbed to cardiovascular diseases in 2016, which accounted for 31% of all global deaths that year. Moreover, WHO reported that around 85 million people worldwide were suffering from heart failure as of 2019, which is expected to increase significantly over time due to lifestyle changes such as unhealthy diets and lack of physical activity. This has resulted in increase in demand for advanced medical devices, such as mobile cardiac telemetry devices for diagnosis and monitoring purposes, which is likely to augment the segment during the forecast period.

Based on end-user, the hospitals segment held the largest share of the global mobile cardiac telemetry device market in 2022. Surge in prevalence of cardiovascular diseases is one of the major factors driving the segment. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally. This has led to increase in demand for cardiac monitoring devices, which, in turn, is propelling the hospitals segment. Surge in number of government initiatives to promote the adoption of cardiac monitoring devices is fueling the hospitals segment. For instance, in April 2020, the Government of India launched the Pradhan Mantri Jan Arogya Yojana (PMJAY) to provide free healthcare services to the poor. This scheme includes the provision of cardiac monitoring devices, which is expected to propel the hospitals segment.

Increase in number of strategic collaborations between hospitals and device manufacturers is bolstering the hospitals segment. For instance, in April 2021, Philips and the University of Michigan Health System announced a strategic collaboration to develop and deploy advanced cardiac monitoring solutions.

North America dominated the global market in 2022. The region is projected to account for the largest share of the market due to rise in prevalence of cardiac diseases and well-developed healthcare infrastructure. Moreover, increase in adoption of mobile cardiac telemetry devices, such as Holter monitors, event recorders, and telemetry systems, is driving the market in North America. In April 2021, Abbott Laboratories launched a Holter monitor, the Confirm Rx ICM, which is an insertable cardiac monitor that can detect cardiac arrhythmias.

Asia Pacific is the fastest-growing region in the mobile cardiac telemetry device market. The increase in prevalence of cardiac diseases, rise in awareness about cardiac health, and surge in investments by global players in this region are driving the growth of the market.

The mobile cardiac telemetry device industry report includes vital information about the mobile cardiac telemetry device market's top players. Companies focus on strategies such as product launches, divestitures, mergers & acquisitions (M&A), and partnerships to strengthen their position in the market. BioTelemetry, Inc., ScottCare, Biotricity, Inc., Welch Allyn, Applied Cardiac Systems, Inc., Medicomp, Inc., Preventice Solutions, Telerhythmics LLC, Zoll Medical Corporation and iRhythm Technologies, Inc. are prominent players in the global market.

Each of these players in the market has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 942.7 Mn |

|

Market Forecast Value in 2031 |

More than US$ 2.5 Bn |

|

Compound Annual Growth Rate (CAGR) |

11.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 942.7 Mn in 2022.

It is projected to reach more than US$ 2.5 Bn by 2031.

The CAGR is anticipated to be 11.6% from 2023 to 2031.

Technological advancements and increase in prevalence of cardiovascular diseases are driving the market.

The lead-based segment held the largest share in 2022.

North America is expected to account for significant market share during the forecast period.

BioTelemetry, Inc., ScottCare, Biotricity, Inc., Welch Allyn, Applied Cardiac Systems, Inc., Medicomp, Inc., Preventice Solutions, Telerhythmics LLC, Zoll Medical Corporation, and iRhythm Technologies, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Mobile Cardiac Telemetry Device Market

4. Market Overview

4.1. Introduction

4.1.1. Disease Indication Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Mobile Cardiac Telemetry Device Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancement

5.2. Regulatory Analysis

5.3. Disease Incidence and Prevalence

5.4. COVID-19 Impact Analysis

6. Global Mobile Cardiac Telemetry Device Market Analysis and Forecast, by Application

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Application, 2017 – 2031

6.3.1. Lead-based

6.3.2. Patch-based

6.4. Market Attractiveness Analysis, by Application

7. Global Mobile Cardiac Telemetry Device Market Analysis and Forecast, by Disease Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Disease Indication, 2017–2031

7.3.1. Angina Pectoris

7.3.2. Atherosclerosis

7.3.3. Heart Failure

7.3.4. Others

7.4. Market Attractiveness, by Disease Indication

8. Global Mobile Cardiac Telemetry Device Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Specialty Clinics

8.3.3. Diagnostic Centers

8.3.4. Home Care Settings

8.3.5. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Mobile Cardiac Telemetry Device Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Mobile Cardiac Telemetry Device Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Application, 2017–2031

10.2.1. Lead-based

10.2.2. Patch-based

10.3. Market Value Forecast, by Disease Indication, 2017–2031

10.3.1. Angina Pectoris

10.3.2. Atherosclerosis

10.3.3. Heart Failure

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Specialty Clinics

10.4.3. Diagnostic Centers

10.4.4. Home Care Settings

10.4.5. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Application

10.6.2. By Disease Indication

10.6.3. By End-user

10.6.4. By Country

11. Europe Mobile Cardiac Telemetry Device Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Application, 2017–2031

11.2.1. Lead-based

11.2.2. Patch-based

11.3. Market Value Forecast, by Disease Indication, 2017–2031

11.3.1. Angina Pectoris

11.3.2. Atherosclerosis

11.3.3. Heart Failure

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Specialty Clinics

11.4.3. Diagnostic Centers

11.4.4. Home Care Settings

11.4.5. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Application

11.6.2. By Disease Indication

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Mobile Cardiac Telemetry Device Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Application, 2017–2031

12.2.1. Lead-based

12.2.2. Patch-based

12.3. Market Value Forecast, by Disease Indication, 2017–2031

12.3.1. Angina Pectoris

12.3.2. Atherosclerosis

12.3.3. Heart Failure

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Specialty Clinics

12.4.3. Diagnostic Centers

12.4.4. Home Care Settings

12.4.5. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Application

12.6.2. By Disease Indication

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Mobile Cardiac Telemetry Device Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Application, 2017–2031

13.2.1. Lead-based

13.2.2. Patch-based

13.3. Market Value Forecast, by Disease Indication, 2017–2031

13.3.1. Angina Pectoris

13.3.2. Atherosclerosis

13.3.3. Heart Failure

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Specialty Clinics

13.4.3. Diagnostic Centers

13.4.4. Home Care Settings

13.4.5. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Application

13.6.2. By Disease Indication

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Mobile Cardiac Telemetry Device Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Application, 2017–2031

14.2.1. Lead-based

14.2.2. Patch-based

14.3. Market Value Forecast, by Disease Indication, 2017–2031

14.3.1. Angina Pectoris

14.3.2. Atherosclerosis

14.3.3. Heart Failure

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Specialty Clinics

14.4.3. Diagnostic Centers

14.4.4. Home Care Settings

14.4.5. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. Brazil

14.5.2. Mexico

14.5.3. Rest of Latin America

14.6. Market Attractiveness Analysis

14.6.1. By Application

14.6.2. By Disease Indication

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. BioTelemetry, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Test Application Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. ScottCare

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Test Application Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Biotricity Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Test Application Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Welch Allyn

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Test Application Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Applied Cardiac Systems, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Test Application Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Medicomp, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Test Application Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Preventice Solutions

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Test Application Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Telerhythmics LLC

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Test Application Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Zoll Medical Corporation

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Test Application Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. iRhythm Technologies, Inc.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Test Application Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 1: Global overview of Surgical Mobile Cardiac Telemetry Device

Table 2: Regional overview of Surgical Mobile Cardiac Telemetry Device

Table 4: North America Overview of Surgical Mobile Cardiac Telemetry Device

Table 4: Asia Pacific overview of Surgical Mobile Cardiac Telemetry Device

Table 5: Global Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Application, 2023–2031

Table 6: Global Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Disease Indication, 2023–2031

Table 7: Global Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 8: Global Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Region, 2023–2031

Table 9: North America Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Country, 2023–2031

Table 10: North America Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Application, 2023–2031

Table 11: North America Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Disease Indication, 2023–2031

Table 12: North America Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 13: Europe Surgical Mobile Cardiac Telemetry Device Revenue (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 14: Europe Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Application, 2023–2031

Table 15: Europe Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Disease Indication, 2023–2031

Table 16: Europe Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 17: Asia Pacific Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 18: Asia Pacific Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Application, 2023–2031

Table 19: Asia Pacific Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Disease Indication, 2023–2031

Table 20: Asia Pacific Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 21: Latin America Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 22: Latin America Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Application, 2023–2031

Table 23: Latin America Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Disease Indication, 2023–2031

Table 24: Latin America Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 25: Middle East & Africa Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 26: Middle East & Africa Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Application, 2023–2031

Table 27: Middle East & Africa Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by Disease Indication, 2023–2031

Table 28: Middle East & Africa Surgical Mobile Cardiac Telemetry Device Value (US$ Mn) Forecast, by End-user, 2023–2031

List of Figures

Figure 01: Global Mobile Cardiac Telemetry Device Market

Figure 02: Global Mobile Cardiac Telemetry Device Market Size (US$ Mn) Forecast, 2017–2031

Figure 03: Global Mobile Cardiac Telemetry Device Market Value Share, by Disease Indication (2022)

Figure 04: Global Mobile Cardiac Telemetry Device Market Value Share, by Application (2022)

Figure 05: Global Mobile Cardiac Telemetry Device Market Value Share, by End-user (2022)

Figure 06: Global Mobile Cardiac Telemetry Device Market Value Share, by Region (2022)

Figure 07: Global Mobile Cardiac Telemetry Device Market Value Share, by Application, 2022 and 2031

Figure 08: Global Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Application, 2023–2031

Figure 09: Global Mobile Cardiac Telemetry Device Market Value Share, by Disease Indication, 2022 and 2031

Figure 10: Global Mobile Cardiac Telemetry Device Market Attractiveness, by Disease Indication, 2023–2031

Figure 11: Global Mobile Cardiac Telemetry Device Market Value Share, by End-user, 2022 and 2031

Figure 12: Global Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by End-user, 2023–2031

Figure 13: Global Mobile Cardiac Telemetry Device Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 14: Global Mobile Cardiac Telemetry Device Market Value Share, by Region, 2023–2031

Figure 15: Global Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Region, 2023–2031

Figure 16: North America Mobile Cardiac Telemetry Device Market Value Share, by Application, 2022 and 2031

Figure 17: North America Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Application, 2023–2031

Figure 18: North America Mobile Cardiac Telemetry Device Market Value Share, by Disease Indication, 2022 and 2031

Figure 19: North America Mobile Cardiac Telemetry Device Market Attractiveness, by Disease Indication, 2023–2031

Figure 20: North America Mobile Cardiac Telemetry Device Market Value Share, by End-user, 2022 and 2031

Figure 21: North America Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by End-user, 2023–2031

Figure 22: North America Mobile Cardiac Telemetry Device Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 23: North America Mobile Cardiac Telemetry Device Market Value Share, by Country, 2023–2031

Figure 24: North America Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Country, 2023–2031

Figure 25: Europe Mobile Cardiac Telemetry Device Market Value Share, by Application, 2022 and 2031

Figure 26: Europe Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Application, 2023–2031

Figure 27: Europe Mobile Cardiac Telemetry Device Market Value Share, by Disease Indication, 2022 and 2031

Figure 28: Europe Mobile Cardiac Telemetry Device Market Attractiveness, by Disease Indication, 2023–2031

Figure 29: Europe Mobile Cardiac Telemetry Device Market Value Share, by End-user, 2022 and 2031

Figure 30: Europe Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by End-user, 2023–2031

Figure 31: Europe Mobile Cardiac Telemetry Device Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 32: Europe Mobile Cardiac Telemetry Device Market Value Share, by Country/Sub-region, 2022–2031

Figure 33: Europe Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Asia Pacific Mobile Cardiac Telemetry Device Market Value Share, by Application, 2022 and 2031

Figure 35: Asia Pacific Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Application, 2023–2031

Figure 36: Asia Pacific Mobile Cardiac Telemetry Device Market Value Share, by Disease Indication, 2022 and 2031

Figure 37: Asia Pacific Mobile Cardiac Telemetry Device Market Attractiveness, by Disease Indication, 2023–2031

Figure 38: Asia Pacific Mobile Cardiac Telemetry Device Market Value Share, by End-user, 2022 and 2031

Figure 39: Asia Pacific Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by End-user, 2023–2031

Figure 40: Asia Pacific Mobile Cardiac Telemetry Device Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 41: Asia Pacific Mobile Cardiac Telemetry Device Market Value Share, by Country/Sub-region, 2022–2031

Figure 42: Asia Pacific Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Latin America Mobile Cardiac Telemetry Device Market Value Share, by Application, 2022 and 2031

Figure 44: Latin America Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Application, 2023–2031

Figure 45: Latin America Mobile Cardiac Telemetry Device Market Value Share, by Disease Indication, 2022 and 2031

Figure 46: Latin America Mobile Cardiac Telemetry Device Market Attractiveness, by Disease Indication, 2023–2031

Figure 47: Latin America Mobile Cardiac Telemetry Device Market Value Share, by End-user, 2022 and 2031

Figure 48: Latin America Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by End-user, 2023–2031

Figure 49: Latin America Mobile Cardiac Telemetry Device Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 50: Latin America Mobile Cardiac Telemetry Device Market Value Share, by Country/Sub-region, 2022–2031

Figure 51: Latin America Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 52: Middle East & Africa Mobile Cardiac Telemetry Device Market Value Share, by Application, 2022 and 2031

Figure 53: Middle East & Africa Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Application, 2023–2031

Figure 54: Middle East & Africa Mobile Cardiac Telemetry Device Market Value Share, by Disease Indication, 2022 and 2031

Figure 55: Middle East & Africa Mobile Cardiac Telemetry Device Market Attractiveness, by Disease Indication, 2023–2031

Figure 56: Middle East & Africa Mobile Cardiac Telemetry Device Market Value Share, by End-user, 2022 and 2031

Figure 57: Middle East & Africa Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by End-user, 2023–2031

Figure 58: Middle East & Africa Mobile Cardiac Telemetry Device Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 59: Middle East & Africa Mobile Cardiac Telemetry Device Market Value Share, by Country/Sub-region, 2022–2031

Figure 60: Middle East & Africa Mobile Cardiac Telemetry Device Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 61: Global Mobile Cardiac Telemetry Device Market Share Analysis, by Company, 2022 (Estimated)

Figure 62: Global Mobile Cardiac Telemetry Device Market Performance, by Company, 2022

Figure 63: Competition Matrix