Reports

Reports

Analysts’ Viewpoint

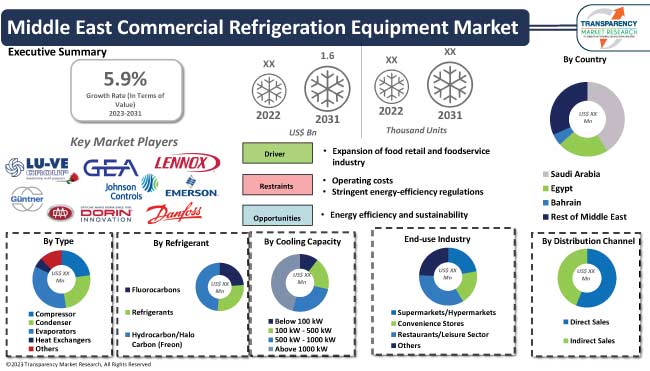

Expansion of the cold storage sector for perishable goods, and growth in food retail are key factors expected to drive the Middle East commercial refrigeration equipment industry growth. Development of smart and connected refrigeration, advanced technology, connectivity features, and increase in emphasis on energy efficiency are the important Middle East commercial refrigeration equipment market trends.

Furthermore, the revival of stalled infrastructure projects, demand for eco-friendly products, and technological innovations in commercial refrigeration equipment technology are likely to fuel market progress.

Manufacturers of commercial refrigeration equipment are allocating a major portion of their revenue to R&D activities to develop cutting-edge materials and are involved in strategic collaborations. Application of new corrosion-resistant materials in manufacturing, and use of ultra-high-speed motors, are some of the key innovations of the market.

Commercial refrigeration equipment is a type of mechanical system that uses compressors and evaporators to cool air and maintain low temperatures. The system is used in food retail and restaurants to store food and other products. The units typically come in the form of refrigerators, freezers, and chillers, and keep food, drinks, medications, and other items cold or frozen. They are necessary to prevent spoilage and wastage of goods.

Commercial refrigeration equipment are also used to maintain a consistent temperature in grocery stores, and other commercial establishments. They are designed to be energy-efficient and provide a constant temperature to extend the life of the goods stored inside. The equipment are essential for food safety and comply with food safety regulations.

Commercial refrigeration equipment are designed to be reliable and efficient, offering a long lifespan with minimal maintenance. Additionally, they are usually designed with safety features to ensure safe operations.

The food industry, including sectors such as agriculture, food processing, and retail, is a major contributor to the demand for cold storage. Growth in Middle East population, rapid urbanization, and changing dietary preferences, are driving the demand for perishable food products such as fruits, vegetables, dairy, and meat. Cold storage is essential to preserve the freshness and quality of these products during transportation and storage. Cold storage also helps to reduce the risk of foodborne illnesses, as it helps to control the growth of bacteria and food spoilage.

Furthermore, cold storage reduces the cost of food distribution by preserving food for longer periods. It requires less energy and resources to store food in cold temperatures than it would to store it at room temperature. All these factors are likely to increase the Middle East commercial refrigeration equipment market demand.

Grocery stores, restaurants, and other food-related businesses in the Middle East require refrigeration equipment to store and transport food. Moreover, the surge in demand for fresh and frozen products drives the demand for new refrigeration equipment. The food retail and food service industry relies on the storage of fresh and perishable foods, including fruits, vegetables, dairy products, meats, and seafood. Consumer preferences are shifting toward healthier and more diverse food options, leading to a greater need for refrigeration equipment to maintain the quality and safety of these products, consequently fueling the Middle East commercial refrigeration equipment market size.

Food safety regulations and standards have become increasingly stringent, with requirements for proper food storage and temperature control. Commercial refrigeration equipment plays a crucial role in ensuring that food products are stored and displayed at the right temperatures, reducing the risk of spoilage, contamination, and foodborne illnesses. Increase in demand for commercial refrigeration equipment is also attributed to the growth of food retail chains, including supermarkets, convenience stores, and specialty food shops. These businesses require a wide range of refrigeration solutions to store, display, and merchandise their products effectively, offering lucrative opportunities for market expansion.

According to the latest Middle East commercial refrigeration equipment market forecast, Saudi Arabia is anticipated to account for major share during the forecast period. Rapidly expanding food retail sector, stringent regulations regarding food safety, and a favorable policy environment for foreign investment are driving the market dynamics in the region.

The increase in number of supermarkets and hypermarkets in the country, as well as the growth in demand for frozen and chilled food products, is fueling market growth in Saudi Arabia. It has the potential to become a major market for commercial refrigerators owing to surge in consumer spending, attributed to rising disposable incomes. Furthermore, smart refrigerators come with features such as temperature control, energy efficiency, and remote monitoring. These advancements are expected to be major market catalysts in the country.

As per the commercial refrigeration equipment market report, the business model of prominent companies include R&D activities, product expansions, product development, and mergers & acquisitions. The market is highly competitive due to the presence of several Middle East and regional players.

GEA Group Aktiengesellschaft, Emerson Electric Co., Ingersoll Rand, Danfoss, Lennox, Carrier, BITZER SE, LU-VE Group, Güntner GmbH & Co. KG, Dorin S.p.A., DAIKIN INDUSTRIES, Ltd., and Frascold are the prominent entities operating in the market.

Key players have been profiled in the Middle East commercial refrigeration equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 967.9 Mn |

| Market Forecast Value in 2031 | US$ 1.6 Bn |

| Growth Rate (CAGR) | 5.9% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Mn/Bn for Value & Thousand Units for Volume |

| Market Analysis | Middle East qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format |

|

| Market Segmentation |

|

| Countries and Sub-region Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 967.9 Mn in 2022

The CAGR is projected to be 5.9% from 2023 to 2031

Surge in demand for cold storage for perishable goods, and growth in food retail & foodservice industry

Based on type, the compressor segment dominates the business

Saudi Arabia is a more attractive region for vendors

GEA Group Aktiengesellschaft, Emerson Electric Co., Ingersoll Rand, Danfoss, Lennox, Carrier, BITZER SE, LU-VE Group, Güntner GmbH & Co. KG, Dorin S.p.A., DAIKIN INDUSTRIES, Ltd., and Frascold

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Middle East Commercial Refrigeration Equipment Market Analysis and Forecast, 2023-2031

5.7.1. Market Value Projections (US$ Mn)

5.7.2. Market Volume Projections (Thousand Units)

6. Middle East Commercial Refrigeration Equipment Market Analysis and Forecast, by Type

6.1. Middle East Commercial Refrigeration Equipment Market Form (USD Mn and Thousand Units), by Type, 2023-2031

6.1.1. Compressor

6.1.1.1. Screw Compressors

6.1.1.2. Reciprocating Compressors

6.1.2. Condenser

6.1.2.1. Water Cooled and Evaporating Condenser

6.1.2.2. Air Cooled Condenser

6.1.3. Evaporators

6.1.4. Heat Exchangers

6.1.5. Others

6.2. Incremental Opportunity, by Type

7. Middle East Commercial Refrigeration Equipment Market Analysis and Forecast, By Refrigerant

7.1. Middle East Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Refrigerant, 2023-2031

7.1.1. Fluorocarbons

7.1.2. Refrigerants

7.1.3. Hydrocarbon/Halo Carbon

7.2. Incremental Opportunity, By Refrigerant

8. Middle East Commercial Refrigeration Equipment Market Analysis and Forecast, By Cooling Capacity

8.1. Middle East Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Cooling Capacity, 2023-2031

8.1.1. Below 100 kW

8.1.2. 100 kW - 500 kW

8.1.3. 500 kW - 1000 kW

8.1.4. Above 1000 kW

8.2. Incremental Opportunity, By Cooling Capacity

9. Middle East Commercial Refrigeration Equipment Market Analysis and Forecast, By End-use Industry

9.1. Middle East Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2023-2031

9.1.1. Supermarkets/Hypermarkets

9.1.2. Convenience Stores

9.1.3. Restaurants/Leisure Sector

9.1.4. Others

9.2. Incremental Opportunity, By End-use Industry

10. Middle East Commercial Refrigeration Equipment Market Analysis and Forecast, By Distribution Channel

10.1. Middle East Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2023-2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, By Distribution Channel

11. Middle East Commercial Refrigeration Equipment Market Analysis and Forecast, by Country

11.1. Middle East Commercial Refrigeration Equipment Market Form (USD Mn and Thousand Units), by Country, 2023-2031

11.1.1. Saudi Arabia

11.1.2. Egypt

11.1.3. Bahrain

11.1.4. Rest of Middle East

11.2. Incremental Opportunity, by Country

12. Saudi Arabia Commercial Refrigeration Equipment Market Analysis and Forecast

12.1. Demographic overview

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Distribution Channel Trend Analysis

12.4.1. Weighted Average Selling Distribution Channel (USD)

12.5. Commercial Refrigeration Equipment Market Form (USD Mn and Thousand Units), by Type, 2023-2031

12.5.1. Compressor

12.5.1.1. Screw Compressors

12.5.1.2. Reciprocating Compressors

12.5.2. Condenser

12.5.2.1. Water Cooled and Evaporating Condenser

12.5.2.2. Air Cooled Condenser

12.5.3. Evaporators

12.5.4. Heat Exchangers

12.5.5. Others

12.6. Incremental Opportunity, by Type

12.7. Middle East Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Refrigerant, 2023-2031

12.7.1. Fluorocarbons

12.7.2. Refrigerants

12.7.3. Hydrocarbon/Halo Carbon

12.8. Incremental Opportunity, By Refrigerant

12.9. Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Cooling Capacity, 2023-2031

12.9.1. Below 100 kW

12.9.2. 100 kW - 500 kW

12.9.3. 500 kW - 1000 kW

12.9.4. Above 1000 kW

12.10. Incremental Opportunity, By Cooling Capacity

12.11. Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2023-2031

12.11.1. Supermarkets/Hypermarkets

12.11.2. Convenience Stores

12.11.3. Restaurants/Leisure Sector

12.11.4. Others

12.12. Incremental Opportunity, By End-use Industry

12.13. Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2023-2031

12.13.1. Direct Sales

12.13.2. Indirect Sales

12.14. Incremental Opportunity, By Distribution Channel

13. Egypt Commercial Refrigeration Equipment Market Analysis and Forecast

13.1. Demographic overview

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply Side

13.3.2. Demand Side

13.4. Distribution Channel Trend Analysis

13.4.1. Weighted Average Selling Distribution Channel (USD)

13.5. Commercial Refrigeration Equipment Market Form (USD Mn and Thousand Units), by Type, 2023-2031

13.5.1. Compressor

13.5.1.1. Screw Compressors

13.5.1.2. Reciprocating Compressors

13.5.2. Condenser

13.5.2.1. Water Cooled and Evaporating Condenser

13.5.2.2. Air Cooled Condenser

13.5.3. Evaporators

13.5.4. Heat Exchangers

13.5.5. Others

13.6. Incremental Opportunity, by Type

13.7. Middle East Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Refrigerant, 2023-2031

13.7.1. Fluorocarbons

13.7.2. Refrigerants

13.7.3. Hydrocarbon/Halo Carbon

13.8. Incremental Opportunity, By Refrigerant

13.9. Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Cooling Capacity, 2023-2031

13.9.1. Below 100 kW

13.9.2. 100 kW - 500 kW

13.9.3. 500 kW - 1000 kW

13.9.4. Above 1000 kW

13.10. Incremental Opportunity, By Cooling Capacity

13.11. Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2023-2031

13.11.1. Supermarkets/Hypermarkets

13.11.2. Convenience Stores

13.11.3. Restaurants/Leisure Sector

13.11.4. Others

13.12. Incremental Opportunity, By End-use Industry

13.13. Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2023-2031

13.13.1. Direct Sales

13.13.2. Indirect Sales

13.14. Incremental Opportunity, By Distribution Channel

14. Bahrain Commercial Refrigeration Equipment Market Analysis and Forecast

14.1. Demographic overview

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply Side

14.3.2. Demand Side

14.4. Distribution Channel Trend Analysis

14.4.1. Weighted Average Selling Distribution Channel (USD)

14.5. Commercial Refrigeration Equipment Market Form (USD Mn and Thousand Units), by Type, 2023-2031

14.5.1. Compressor

14.5.1.1. Screw Compressors

14.5.1.2. Reciprocating Compressors

14.5.2. Condenser

14.5.2.1. Water Cooled and Evaporating Condenser

14.5.2.2. Air Cooled Condenser

14.5.3. Evaporators

14.5.4. Heat Exchangers

14.5.5. Others

14.6. Incremental Opportunity, by Type

14.7. Middle East Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Refrigerant, 2023-2031

14.7.1. Fluorocarbons

14.7.2. Refrigerants

14.7.3. Hydrocarbon/Halo Carbon

14.8. Incremental Opportunity, By Refrigerant

14.9. Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Cooling Capacity, 2023-2031

14.9.1. Below 100 kW

14.9.2. 100 kW - 500 kW

14.9.3. 500 kW - 1000 kW

14.9.4. Above 1000 kW

14.10. Incremental Opportunity, By Cooling Capacity

14.11. Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2023-2031

14.11.1. Supermarkets/Hypermarkets

14.11.2. Convenience Stores

14.11.3. Restaurants/Leisure Sector

14.11.4. Others

14.12. Incremental Opportunity, By End-use Industry

14.13. Commercial Refrigeration Equipment Market (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2023-2031

14.13.1. Direct Sales

14.13.2. Indirect Sales

14.14. Incremental Opportunity, By Distribution Channel

15. Competition Landscape

15.1. Competition Dashboard

15.2. Market Share Analysis % (2022)

15.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

15.3.1. GEA Group Aktiengesellschaft

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Information

15.3.1.4. (Subject to Data Availability)

15.3.1.5. Business Strategies / Recent Developments

15.3.2. Emerson Electric Co.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Information

15.3.2.4. (Subject to Data Availability)

15.3.2.5. Business Strategies / Recent Developments

15.3.3. Ingersoll Rand

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Information

15.3.3.4. (Subject to Data Availability)

15.3.3.5. Business Strategies / Recent Developments

15.3.4. Danfoss

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Information

15.3.4.4. (Subject to Data Availability)

15.3.4.5. Business Strategies / Recent Developments

15.3.5. Lennox

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Information

15.3.5.4. (Subject to Data Availability)

15.3.5.5. Business Strategies / Recent Developments

15.3.6. Carrier

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Information

15.3.6.4. (Subject to Data Availability)

15.3.6.5. Business Strategies / Recent Developments

15.3.7. BITZER SE

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Information

15.3.7.4. (Subject to Data Availability)

15.3.7.5. Business Strategies / Recent Developments

15.3.8. LU-VE Group

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Information

15.3.8.4. (Subject to Data Availability)

15.3.8.5. Business Strategies / Recent Developments

15.3.9. Güntner GmbH & Co. KG

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Information

15.3.9.4. (Subject to Data Availability)

15.3.9.5. Business Strategies / Recent Developments

15.3.10. Dorin S.p.A.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Information

15.3.10.4. (Subject to Data Availability)

15.3.10.5. Business Strategies / Recent Developments

15.3.11. DAIKIN INDUSTRIES, Ltd.

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. Financial Information

15.3.11.4. (Subject to Data Availability)

15.3.11.5. Business Strategies / Recent Developments

15.3.12. Frascold

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. Financial Information

15.3.12.4. (Subject to Data Availability)

15.3.12.5. Business Strategies / Recent Developments

15.3.13. Others Key Players

15.3.13.1. Company Overview

15.3.13.2. Product Portfolio

15.3.13.3. Financial Information

15.3.13.4. (Subject to Data Availability)

15.3.13.5. Business Strategies / Recent Developments

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.1.1. Type

16.1.2. Refrigerant

16.1.3. Cooling Capacity

16.1.4. End-use Industry

16.1.5. Distribution Channel

16.1.6. Country

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Type, 2023-2031

Table 2: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Type 2023-2031

Table 3: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Refrigerant, 2023-2031

Table 4: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Refrigerant 2023-2031

Table 5: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Cooling Capacity, 2023-2031

Table 6: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Cooling Capacity 2023-2031

Table 7: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by End-use Industry, 2023-2031

Table 8: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by End-use Industry 2023-2031

Table 9: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Distribution Channel, 2023-2031

Table 10: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Distribution Channel 2023-2031

Table 11: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Country, 2023-2031

Table 12: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Country 2023-2031

Table 13: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by Type, 2023-2031

Table 14: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by Type 2023-2031

Table 15: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by Refrigerant, 2023-2031

Table 16: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by Refrigerant 2023-2031

Table 17: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by Cooling Capacity, 2023-2031

Table 18: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by Cooling Capacity 2023-2031

Table 19: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by End-use Industry, 2023-2031

Table 20: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by End-use Industry 2023-2031

Table 21: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by Distribution Channel, 2023-2031

Table 22: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by Distribution Channel 2023-2031

Table 23: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Type, 2023-2031

Table 24: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Type 2023-2031

Table 25: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Refrigerant, 2023-2031

Table 26: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Refrigerant 2023-2031

Table 27: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Cooling Capacity, 2023-2031

Table 28: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Cooling Capacity 2023-2031

Table 29: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by End-use Industry, 2023-2031

Table 30: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by End-use Industry 2023-2031

Table 31: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Distribution Channel, 2023-2031

Table 32: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Distribution Channel 2023-2031

Table 33: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Type, 2023-2031

Table 34: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Type 2023-2031

Table 35: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Refrigerant, 2023-2031

Table 36: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Refrigerant2023-2031

Table 37: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Cooling Capacity, 2023-2031

Table 38: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Cooling Capacity 2023-2031

Table 39: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by End-use Industry, 2023-2031

Table 40: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by End-use Industry 2023-2031

Table 41: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Distribution Channel, 2023-2031

Table 42: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Distribution Channel 2023-2031

Table 43: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by Type, 2023-2031

Table 44: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by Type 2023-2031

Table 45: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by Refrigerant, 2023-2031

Table 46: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by Refrigerant 2023-2031

Table 47: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by Cooling Capacity, 2023-2031

Table 48: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by Cooling Capacity 2023-2031

Table 49: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by End-use Industry, 2023-2031

Table 50: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by End-use Industry 2023-2031

Table 51: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by Distribution Channel, 2023-2031

Table 52: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by Distribution Channel 2023-2031

List of Figures

Figure 1: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Type, 2023-2031

Figure 2: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Type 2023-2031

Figure 3: Middle East Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 4: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Refrigerant, 2023-2031

Figure 5: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Refrigerant 2023-2031

Figure 6: Middle East Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Refrigerant, 2023-2031

Figure 7: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Cooling Capacity, 2023-2031

Figure 8: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Cooling Capacity 2023-2031

Figure 9: Middle East Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Cooling Capacity, 2023-2031

Figure 10: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by End-use Industry, 2023-2031

Figure 11: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by End-use Industry 2023-2031

Figure 12: Middle East Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 13: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Distribution Channel, 2023-2031

Figure 14: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Distribution Channel 2023-2031

Figure 15: Middle East Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 16: Middle East Commercial Refrigeration Equipment Market Value (US$ Mn), by Country, 2023-2031

Figure 17: Middle East Commercial Refrigeration Equipment Market Volume (Thousand Units), by Country 2023-2031

Figure 18: Middle East Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031

Figure 19: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by Type, 2023-2031

Figure 20: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by Type 2023-2031

Figure 21: Saudi Arabia Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 22: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by Refrigerant, 2023-2031

Figure 23: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by Refrigerant2023-2031

Figure 24: Saudi Arabia Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Refrigerant, 2023-2031

Figure 25: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by Cooling Capacity, 2023-2031

Figure 26: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by Cooling Capacity 2023-2031

Figure 27: Saudi Arabia Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Cooling Capacity, 2023-2031

Figure 28: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by End-use Industry, 2023-2031

Figure 29: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by End-use Industry 2023-2031

Figure 30: Saudi Arabia Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 31: Saudi Arabia Commercial Refrigeration Equipment Market Value (US$ Mn), by Distribution Channel, 2023-2031

Figure 32: Saudi Arabia Commercial Refrigeration Equipment Market Volume (Thousand Units), by Distribution Channel 2023-2031

Figure 33: Saudi Arabia Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 34: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Type, 2023-2031

Figure 35: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Type 2023-2031

Figure 36: Egypt Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 37: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Refrigerant, 2023-2031

Figure 38: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Refrigerant2023-2031

Figure 39: Egypt Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Refrigerant, 2023-2031

Figure 40: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Product Cooling Capacity, 2023-2031

Figure 41: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Cooling Capacity 2023-2031

Figure 42: Egypt Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Cooling Capacity, 2023-2031

Figure 43: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by End-use Industry, 2023-2031

Figure 44: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by End-use Industry 2023-2031

Figure 45: Egypt Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 46: Egypt Commercial Refrigeration Equipment Market Value (US$ Mn), by Distribution Channel, 2023-2031

Figure 47: Egypt Commercial Refrigeration Equipment Market Volume (Thousand Units), by Distribution Channel 2023-2031

Figure 48: Egypt Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 49: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by Type, 2023-2031

Figure 50: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by Type 2023-2031

Figure 51: Bahrain Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 52: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by Refrigerant, 2023-2031

Figure 53: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by Refrigerant 2023-2031

Figure 54: Bahrain Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Refrigerant,2023-2031

Figure 55: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by Cooling Capacity, 2023-2031

Figure 56: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by Cooling Capacity 2023-2031

Figure 57: Bahrain Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Cooling Capacity, 2023-2031

Figure 58: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by End-use Industry, 2023-2031

Figure 59: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by End-use Industry 2023-2031

Figure 60: Bahrain Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 61: Bahrain Commercial Refrigeration Equipment Market Value (US$ Mn), by Distribution Channel, 2023-2031

Figure 62: Bahrain Commercial Refrigeration Equipment Market Volume (Thousand Units), by Distribution Channel 2023-2031

Figure 63: Bahrain Commercial Refrigeration Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031