Reports

Reports

Analysts’ Viewpoint on Global Commercial Refrigeration Equipment Market Scenario

Collaboration of businesses in the commercial refrigeration equipment market is a prominent strategy adopted by key players to maintain competitive advantage and increase their global reach and portfolio. Companies are focusing on achieving long-term growth through effective integration and continuous improvement & innovation in new commercial refrigeration equipment models. Rise in demand for commercial refrigeration equipment in Asia Pacific, owing to the increase in urbanization and growth in number of hypermarkets and supermarkets, is offering lucrative opportunities for market players. Hypermarkets/supermarkets in the food retail application segment are anticipated to maintain their leading position and provide substantial growth opportunities in the commercial refrigeration equipment market during the forecast period. Furthermore, the outlook for the market appears promising post the peak of COVID-19 due to the growth in trade and investment activities in developing regions.

People across the globe are spending increasingly on various household products, including refrigerators, owing to the rise in standard of living. This is boosting the global commercial refrigeration equipment market.

Companies are increasing their manufacturing capabilities in kitchen fridge & freezers and food truck commercial refrigeration equipment in order to broaden their equipment portfolio. They are providing a complete guide to commercial refrigeration to help end-users grow their business in the food service industry.

The global population is inclined toward frozen food items. Rise in preference for frozen food products among working professionals, who have less time to spend on cooking traditional meals, plays a key role in the progress of the food service refrigeration equipment market.

As per data published by the American Frozen Food Institute, a U.S-based organization that represents frozen food and beverage businesses, sale of frozen food witnessed a surge of 21% in 2020.

The non-alcoholic beverage industry has been growing significantly since the last years. This growth is boosting the usage of commercial refrigerators in various commercial places such as airports, hotels, and restaurants. The best commercial refrigerators for restaurants are compact refrigerators, reach-in refrigerators, and under-counter refrigerators. Knowledge about the types of commercial refrigerators and their usage is necessary to make efficient use of refrigeration systems.

Ice cream is a go-to dairy product for many people. Large numbers of players in the global ice cream industry are introducing a wide range of exciting flavors to cater to the increasing demand of consumers. Thus, growth of the ice cream industry is anticipated to pave the way for the expansion of the commercial refrigeration equipment market. According to the International Dairy Foods Association, a Washington D.C.-based association that deals with dairy food related developments, ice cream manufacturers in the U.S. produced more than 1 billion gallons of ice cream in 2020, a rise of 6% compared to that in 2019.

Demand for essential commodities such as food and grocery items has been rising significantly over the years. Increase in demand for essential commodities is leading to a rise in establishment of retail stores such as supermarkets, convenience stores, and departmental stores. This is anticipated to positively impact the demand for commercial food refrigeration equipment products. As per data released by the United States Census Bureau, an agency of the U.S. Federal Statistical System of Maryland, overall retail and food service sales experienced a growth of 12.9% in 2021.

Rise in trade of seafood products among countries around the world is anticipated to propel the demand for commercial refrigeration equipment, as seafood requires refrigeration to arrest staleness. A brief guide to refrigeration systems for food service is becoming an important part of end-user manuals.

In terms of application, the global commercial refrigeration equipment market has been divided into food service; food retail; food distribution; food production, and others. The hypermarkets & supermarkets sub-segment of the food retail segment is projected to be the largest application of the commercial refrigeration equipment market.

Advanced food refrigeration systems provide practical designs to capture the attention of customers. Changing food consumption trends and rise in international food trade are other factors contributing to the growth of the market. Application of refrigeration in the food industry is being extended to specialty food stores, convenience stores, and food processing industries.

The global commercial refrigeration equipment market is expected to witness high growth in developing countries of Asia Pacific. Rapid urbanization along with diversification of supermarkets, hypermarkets, and food retail chains in developing countries is anticipated to boost the demand for commercial refrigeration equipment during the forecast period. Additionally, the market in the region is fueled by growth in the manufacturing sector and increase in spending on private & public infrastructure development.

The commercial refrigeration equipment market is consolidated, with a small number of large-scale vendors controlling majority of the share. Most of the firms are investing significantly in comprehensive research and development activities. Diversification of product portfolios and mergers & acquisitions are the primary strategies adopted by key players. AB Electrolux, Daikin Industries Ltd., Dover Corporation, Emerson Electric Co., Frigoglass S.A.I.C., Fujimak Corporation, GEA Group AG, Hussmann Corporation, Johnson Controls International PLC, and United Technologies Corporation are the prominent entities operating in this market.

Each of these players has been profiled in the commercial refrigeration equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

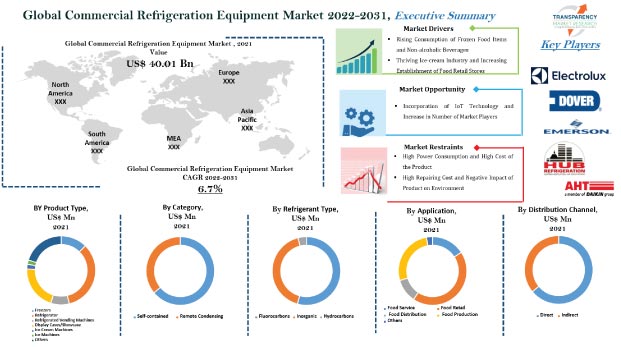

Market Size Value in 2021 |

US$ 40.01 Bn |

|

Market Forecast Value in 2031 |

US$ 75.34 Bn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 40.01 Bn in 2021

The market is estimated to expand at a CAGR of 6.7% during 2022-2031

• Rise in consumption of frozen food items and non-alcoholic beverages • Thriving ice-cream industry and increasing establishment of food retail stores

Hypermarkets/supermarkets accounted for around 46% share of the market in 2021

Asia Pacific is likely to be the most lucrative market during the forecast period

AB Electrolux, Daikin Industries Ltd., Dover Corporation, Emerson Electric Co., Frigoglass S.A.I.C., Fujimak Corporation, GEA Group AG, Hussmann Corporation, Johnson Controls International PLC, and United Technologies Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Global Commercial Refrigeration Equipment Market Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Technology Overview

5.9. COVID-19 Impact Analysis

5.10. Global Commercial Refrigeration Equipment Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Commercial Refrigeration Equipment Market Analysis and Forecast, By Product Type

6.1. Global Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

6.1.1. Freezer

6.1.1.1. Blast Freezer

6.1.1.2. Contact Freezer

6.1.2. Refrigerator

6.1.2.1. Walk-in Refrigerator

6.1.2.2. Commercial Reach-in Refrigerator

6.1.2.3. Under Counter Refrigerators

6.1.2.4. Counter Top Beverage Refrigerator

6.1.2.5. Merchandiser and Display Refrigerators

6.1.2.6. Food Prep Refrigerators

6.1.2.7. Reach-in Refrigerators & Freezers

6.1.2.8. Others (Serve Over Counter etc.)

6.1.3. Refrigerated Vending Machines

6.1.4. Display Cases/Showcase

6.1.4.1. Ice Cream Cabinets

6.1.4.2. Bakery Display Cases

6.1.4.3. Butchery Cases

6.1.4.4. Others (Seafood etc.)

6.1.5. Ice Cream Machines Ice Machines

6.1.6. Others (Transportation Refrigerators etc.)

6.2. Incremental Opportunity, By Product Type

7. Global Commercial Refrigeration Equipment Market Analysis and Forecast, By Category

7.1. Global Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Category, 2017 - 2031

7.1.1. Self-contained

7.1.2. Remote Condensing

7.2. Incremental Opportunity, By Category

8. Global Commercial Refrigeration Equipment Market Analysis and Forecast,By Refrigerant Type

8.1. Global Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Refrigerant Type, 2017 - 2031

8.1.1. Fluorocarbons

8.1.2. Inorganic

8.1.3. Hydrocarbons

8.2. Incremental Opportunity, By Refrigerant Type

9. Global Commercial Refrigeration Equipment Market Analysis and Forecast, By Application

9.1. Global Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

9.1.1. Food Service

9.1.1.1. Full Service Restaurants & Hotels

9.1.1.2. Quick Service Restaurants

9.1.1.3. Caterers

9.1.1.4. Others (Food Trucks, caterers etc.)

9.1.2. Food Retail

9.1.2.1. Hypermarkets &Supermarkets

9.1.2.2. Convenience Stores

9.1.2.3. Specialty Food Stores

9.1.2.4. Other Retail Stores

9.1.3. Food Distribution

9.1.4. Food Production

9.1.5. Others (Food Processing

9.1.6. Industry etc.)

9.2. Incremental Opportunity, By Application

10. Global Commercial Refrigeration Equipment Market Analysis and Forecast, By Distribution Channel

10.1. Global Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, By Distribution Channel

11. Global Commercial Refrigeration Equipment Market Analysis and Forecast, By Region

11.1. Global Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Commercial Refrigeration Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.2.1. Demand Side

12.2.2. Supply Side

12.3. Key Supplier Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

12.5.1. Freezer

12.5.1.1. Blast Freezer

12.5.1.2. Contact Freezer

12.5.2. Refrigerator

12.5.2.1. Walk-in refrigerator

12.5.2.2. Commercial Reach-in Refrigerator

12.5.2.3. Under Counter Refrigerators

12.5.2.4. Counter Top Beverage Refrigerator

12.5.2.5. Merchandiser and Display Refrigerators

12.5.2.6. Food Prep Refrigerators

12.5.2.7. Reach-in refrigerators & Freezers

12.5.2.8. Others (Serve Over Counter etc.)

12.5.3. Refrigerated Vending Machines

12.5.4. Display Cases/Showcase

12.5.4.1. Ice Cream Cabinets

12.5.4.2. Bakery display Cases

12.5.4.3. Butchery Cases

12.5.4.4. Others (Seafood etc.)

12.5.5. Ice Cream Machines Ice Machines

12.5.6. Others (Transportation Refrigerators etc.)

12.6. Incremental Opportunity, By Product Type

12.7. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Category, 2017 - 2031

12.7.1. Self-contained

12.7.2. Remote Condensing

12.8. Incremental Opportunity, By Category

12.9. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Refrigerant Type, 2017 - 2031

12.9.1. Fluorocarbons

12.9.2. Inorganic

12.9.3. Hydrocarbons

12.10. Incremental Opportunity, By Refrigerant Type

12.11. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

12.11.1. Food Service

12.11.1.1. Full Service Restaurants & Hotels

12.11.1.2. Quick Service Restaurants

12.11.1.3. Caterers

12.11.1.4. Others (Food Trucks, caterers etc.)

12.11.2. Food Retail

12.11.2.1. Hypermarkets &Supermarkets

12.11.2.2. Convenience Stores

12.11.2.3. Specialty Food Stores

12.11.2.4. Other Retail Stores

12.11.3. Food Distribution

12.11.4. Food Production

12.11.5. Others (Food Processing Industry etc.)

12.12. Incremental Opportunity, By Application

12.13. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.13.1. Direct Sales

12.13.2. Indirect Sales

12.14. Incremental Opportunity, By Distribution Channel

12.15. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017 - 2031

12.15.1. The U.S.

12.15.2. Canada

12.15.3. Rest of North America

12.16. Incremental Opportunity Analysis

13. Europe Commercial Refrigeration Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.2.1. Demand Side

13.2.2. Supply Side

13.3. Key Supplier Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

13.5.1. Freezer

13.5.1.1. Blast Freezer

13.5.1.2. Contact Freezer

13.5.2. Refrigerator

13.5.2.1. Walk-in refrigerator

13.5.2.2. Commercial Reach-in Refrigerator

13.5.2.3. Under Counter Refrigerators

13.5.2.4. Counter Top Beverage Refrigerator

13.5.2.5. Merchandiser and Display Refrigerators

13.5.2.6. Food Prep Refrigerators

13.5.2.7. Reach-in refrigerators & Freezers

13.5.2.8. Others (Serve Over Counter etc.)

13.5.3. Refrigerated Vending Machines

13.5.4. Display Cases/Showcase

13.5.4.1. Ice Cream Cabinets

13.5.4.2. Bakery display Cases

13.5.4.3. Butchery Cases

13.5.4.4. Others (Seafood etc.)

13.5.5. Ice Cream Machines Ice Machines

13.5.6. Others (Transportation Refrigerators etc.)

13.6. Incremental Opportunity, By Product Type

13.7. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Category, 2017 - 2031

13.7.1. Self-contained

13.7.2. Remote Condensing

13.8. Incremental Opportunity, By Category

13.9. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Refrigerant Type, 2017 - 2031

13.9.1. Fluorocarbons

13.9.2. Inorganic

13.9.3. Hydrocarbons

13.10. Incremental Opportunity, By Refrigerant Type

13.11. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

13.11.1. Food Service

13.11.1.1. Full Service Restaurants & Hotels

13.11.1.2. Quick Service Restaurants

13.11.1.3. Caterers

13.11.1.4. Others (Food Trucks, caterers etc.)

13.11.2. Food Retail

13.11.2.1. Hypermarkets &Supermarkets

13.11.2.2. Convenience Stores

13.11.2.3. Specialty Food Stores

13.11.2.4. Other Retail Stores

13.11.3. Food Distribution

13.11.4. Food Production

13.11.5. Others (Food Processing Industry etc.)

13.12. Incremental Opportunity, By Application

13.13. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.13.1. Direct Sales

13.13.2. Indirect Sales

13.14. Incremental Opportunity, By Distribution Channel

13.15. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017 - 2031

13.15.1. U.K.

13.15.2. Germany

13.15.3. France

13.15.4. Rest of Europe

13.16. Incremental Opportunity Analysis

14. Asia Pacific Commercial Refrigeration Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.2.1. Demand Side

14.2.2. Supply Side

14.3. Key Supplier Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

14.5.1. Freezer

14.5.1.1. Blast Freezer

14.5.1.2. Contact Freezer

14.5.2. Refrigerator

14.5.2.1. Walk-in refrigerator

14.5.2.2. Commercial Reach-in Refrigerator

14.5.2.3. Under Counter Refrigerators

14.5.2.4. Counter Top Beverage Refrigerator

14.5.2.5. Merchandiser and Display Refrigerators

14.5.2.6. Food Prep Refrigerators

14.5.2.7. Reach-in refrigerators & Freezers

14.5.2.8. Others (Serve Over Counter etc.)

14.5.3. Refrigerated Vending Machines

14.5.4. Display Cases/Showcase

14.5.4.1. Ice Cream Cabinets

14.5.4.2. Bakery display Cases

14.5.4.3. Butchery Cases

14.5.4.4. Others (Seafood etc.)

14.5.5. Ice Cream Machines Ice Machines

14.5.6. Others (Transportation Refrigerators etc.)

14.6. Incremental Opportunity, By Product Type

14.7. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Category, 2017 - 2031

14.7.1. Self-contained

14.7.2. Remote Condensing

14.8. Incremental Opportunity, By Category

14.9. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Refrigerant Type, 2017 - 2031

14.9.1. Fluorocarbons

14.9.2. Inorganic

14.9.3. Hydrocarbons

14.10. Incremental Opportunity, By Refrigerant Type

14.11. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

14.11.1. Food Service

14.11.1.1. Full Service Restaurants & Hotels

14.11.1.2. Quick Service Restaurants

14.11.1.3. Caterers

14.11.1.4. Others (Food Trucks, caterers etc.)

14.11.2. Food Retail

14.11.2.1. Hypermarkets &Supermarkets

14.11.2.2. Convenience Stores

14.11.2.3. Specialty Food Stores

14.11.2.4. Other Retail Stores

14.11.3. Food Distribution

14.11.4. Food Production

14.11.5. Others (Food Processing Industry etc.)

14.12. Incremental Opportunity, By Application

14.13. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.13.1. Direct Sales

14.13.2. Indirect Sales

14.14. Incremental Opportunity, By Distribution Channel

14.15. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017 - 2031

14.15.1. China

14.15.2. India

14.15.3. Japan

14.15.4. South Korea

14.15.5. Rest of Asia Pacific

14.16. Incremental Opportunity Analysis

15. Middle East & Africa Commercial Refrigeration Equipment Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trend Analysis

15.2.1. Demand Side

15.2.2. Supply Side

15.3. Key Supplier Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

15.5.1. Freezer

15.5.1.1. Blast Freezer

15.5.1.2. Contact Freezer

15.5.2. Refrigerator

15.5.2.1. Walk-in refrigerator

15.5.2.2. Commercial Reach-in Refrigerator

15.5.2.3. Under Counter Refrigerators

15.5.2.4. Counter Top Beverage Refrigerator

15.5.2.5. Merchandiser and Display Refrigerators

15.5.2.6. Food Prep Refrigerators

15.5.2.7. Reach-in refrigerators & Freezers

15.5.2.8. Others (Serve Over Counter etc.)

15.5.3. Refrigerated Vending Machines

15.5.4. Display Cases/Showcase

15.5.4.1. Ice Cream Cabinets

15.5.4.2. Bakery display Cases

15.5.4.3. Butchery Cases

15.5.4.4. Others (Seafood etc.)

15.5.5. Ice Cream Machines Ice Machines

15.5.6. Others (Transportation Refrigerators etc.)

15.6. Incremental Opportunity, By Product Type

15.7. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Category, 2017 - 2031

15.7.1. Self-contained

15.7.2. Remote Condensing

15.8. Incremental Opportunity, By Category

15.9. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Refrigerant Type, 2017 - 2031

15.9.1. Fluorocarbons

15.9.2. Inorganic

15.9.3. Hydrocarbons

15.10. Incremental Opportunity, By Refrigerant Type

15.11. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

15.11.1. Food Service

15.11.1.1. Full Service Restaurants & Hotels

15.11.1.2. Quick Service Restaurants

15.11.1.3. Caterers

15.11.1.4. Others (Food Trucks, caterers etc.)

15.11.2. Food Retail

15.11.2.1. Hypermarkets &Supermarkets

15.11.2.2. Convenience Stores

15.11.2.3. Specialty Food Stores

15.11.2.4. Other Retail Stores

15.11.3. Food Distribution

15.11.4. Food Production

15.11.5. Others (Food Processing Industry etc.)

15.12. Incremental Opportunity, By Application

15.13. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.13.1. Direct Sales

15.13.2. Indirect Sales

15.14. Incremental Opportunity, By Distribution Channel

15.15. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017 - 2031

15.15.1. GCC

15.15.2. South Africa

15.15.3. Rest of Middle East & Africa

15.16. Incremental Opportunity Analysis

16. South America Global Commercial Refrigeration Equipment Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Trend Analysis

16.2.1. Demand Side

16.2.2. Supply Side

16.3. Key Supplier Analysis

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

16.5.1. Freezer

16.5.1.1. Blast Freezer

16.5.1.2. Contact Freezer

16.5.2. Refrigerator

16.5.2.1. Walk-in refrigerator

16.5.2.2. Commercial Reach-in Refrigerator

16.5.2.3. Under Counter Refrigerators

16.5.2.4. Counter Top Beverage Refrigerator

16.5.2.5. Merchandiser and Display Refrigerators

16.5.2.6. Food Prep Refrigerators

16.5.2.7. Reach-in refrigerators & Freezers

16.5.2.8. Others (Serve Over Counter etc.)

16.5.3. Refrigerated Vending Machines

16.5.4. Display Cases/Showcase

16.5.4.1. Ice Cream Cabinets

16.5.4.2. Bakery display Cases

16.5.4.3. Butchery Cases

16.5.4.4. Others (Seafood etc.)

16.5.5. Ice Cream Machines Ice Machines

16.5.6. Others (Transportation Refrigerators etc.)

16.6. Incremental Opportunity, By Product Type

16.7. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Category, 2017 - 2031

16.7.1. Self-contained

16.7.2. Remote Condensing

16.8. Incremental Opportunity, By Category

16.9. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Refrigerant Type, 2017 - 2031

16.9.1. Fluorocarbons

16.9.2. Inorganic

16.9.3. Hydrocarbons

16.10. Incremental Opportunity, By Refrigerant Type

16.11. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

16.11.1. Food Service

16.11.1.1. Full Service Restaurants & Hotels

16.11.1.2. Quick Service Restaurants

16.11.1.3. Caterers

16.11.1.4. Others (Food Trucks, caterers etc.)

16.11.2. Food Retail

16.11.2.1. Hypermarkets &Supermarkets

16.11.2.2. Convenience Stores

16.11.2.3. Specialty Food Stores

16.11.2.4. Other Retail Stores

16.11.3. Food Distribution

16.11.4. Food Production

16.11.5. Others (Food Processing Industry etc.)

16.12. Incremental Opportunity, By Application

16.13. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.13.1. Direct Sales

16.13.2. Indirect Sales

16.14. Incremental Opportunity, By Distribution Channel

16.15. Commercial Refrigeration Equipment Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017 - 2031

16.15.1. Brazil

16.15.2. Rest of South America

16.16. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share Analysis-2021 (%)

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue (Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Product Portfolio & Pricing)

17.3.1. AB Electrolux

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Financial/Revenue (Segmental Revenue)

17.3.1.4. Strategy & Business Overview

17.3.1.5. Sales Channel Analysis

17.3.1.6. Product Portfolio & Pricing

17.3.2. Daikin Industries Ltd.

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Financial/Revenue (Segmental Revenue)

17.3.2.4. Strategy & Business Overview

17.3.2.5. Sales Channel Analysis

17.3.2.6. Product Portfolio & Pricing

17.3.3. Dover Corporation

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Financial/Revenue (Segmental Revenue)

17.3.3.4. Strategy & Business Overview

17.3.3.5. Sales Channel Analysis

17.3.3.6. Product Portfolio & Pricing

17.3.4. Emerson Electric Co.

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Financial/Revenue (Segmental Revenue)

17.3.4.4. Strategy & Business Overview

17.3.4.5. Sales Channel Analysis

17.3.4.6. Product Portfolio & Pricing

17.3.5. Frigoglass S.A.I.C.

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Financial/Revenue (Segmental Revenue)

17.3.5.4. Strategy & Business Overview

17.3.5.5. Sales Channel Analysis

17.3.5.6. Product Portfolio & Pricing

17.3.6. Fujimak Corporation

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Financial/Revenue (Segmental Revenue)

17.3.6.4. Strategy & Business Overview

17.3.6.5. Sales Channel Analysis

17.3.6.6. Product Portfolio & Pricing

17.3.7. GEA Group AG

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Financial/Revenue (Segmental Revenue)

17.3.7.4. Strategy & Business Overview

17.3.7.5. Sales Channel Analysis

17.3.7.6. Product Portfolio & Pricing

17.3.8. Hussmann Corporation

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Financial/Revenue (Segmental Revenue)

17.3.8.4. Strategy & Business Overview

17.3.8.5. Sales Channel Analysis

17.3.8.6. Product Portfolio & Pricing

17.3.9. Johnson Controls International PLC

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Financial/Revenue (Segmental Revenue)

17.3.9.4. Strategy & Business Overview

17.3.9.5. Sales Channel Analysis

17.3.9.6. Product Portfolio & Pricing

17.3.10. United Technologies Corporation

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Financial/Revenue (Segmental Revenue)

17.3.10.4. Strategy & Business Overview

17.3.10.5. Sales Channel Analysis

17.3.10.6. Product Portfolio & Pricing

17.3.11. Liebherr Group

17.3.11.1. Company Overview

17.3.11.2. Sales Area/Geographical Presence

17.3.11.3. Financial/Revenue (Segmental Revenue)

17.3.11.4. Strategy & Business Overview

17.3.11.5. Sales Channel Analysis

17.3.11.6. Product Portfolio & Pricing

17.3.12. Ali Group

17.3.12.1. Company Overview

17.3.12.2. Sales Area/Geographical Presence

17.3.12.3. Financial/Revenue (Segmental Revenue)

17.3.12.4. Strategy & Business Overview

17.3.12.5. Sales Channel Analysis

17.3.12.6. Product Portfolio & Pricing

17.3.13. ONNERA Group

17.3.13.1. Company Overview

17.3.13.2. Sales Area/Geographical Presence

17.3.13.3. Financial/Revenue (Segmental Revenue)

17.3.13.4. Strategy & Business Overview

17.3.13.5. Sales Channel Analysis

17.3.13.6. Product Portfolio & Pricing

17.3.14. AHT Cooling Systems GmbH

17.3.14.1. Company Overview

17.3.14.2. Sales Area/Geographical Presence

17.3.14.3. Financial/Revenue (Segmental Revenue)

17.3.14.4. Strategy & Business Overview

17.3.14.5. Sales Channel Analysis

17.3.14.6. Product Portfolio & Pricing

17.3.15. Epta Corporate

17.3.15.1. Company Overview

17.3.15.2. Sales Area/Geographical Presence

17.3.15.3. Financial/Revenue (Segmental Revenue)

17.3.15.4. Strategy & Business Overview

17.3.15.5. Sales Channel Analysis

17.3.15.6. Product Portfolio & Pricing

17.3.16. Ugur Sogutma Makinalari Sanayi ve Ticaret AS

17.3.16.1. Company Overview

17.3.16.2. Sales Area/Geographical Presence

17.3.16.3. Financial/Revenue (Segmental Revenue)

17.3.16.4. Strategy & Business Overview

17.3.16.5. Sales Channel Analysis

17.3.16.6. Product Portfolio & Pricing

18. Key Takeaway

18.1. Identification of Potential Market Spaces

18.1.1. Product Type

18.1.2. Category

18.1.3. Refrigerant

18.1.4. Application

18.1.5. Distribution Channel

18.1.6. Geography

18.2. Understanding the Buying Process of Customers

18.3. Prevailing Market Risks

18.4. Preferred Sales & Marketing Strategy

List of Table

Table 1: Global Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Table 2: Global Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Table 3: Global Commercial Refrigeration Equipment Market By Category Thousand Units, 2017-2031

Table 4: Global Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Table 5: Global Commercial Refrigeration Equipment Market By Refrigerant Thousand Units, 2017-2031

Table 6: Global Commercial Refrigeration Equipment Market By Refrigerant US$ Mn 2017-2031

Table 7: Global Commercial Refrigeration Equipment Market By Application Thousand Units 2017-2031

Table 8: Global Commercial Refrigeration Equipment Market By Application US$ Mn 2017-2031

Table 9: Global Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Table 10: Global Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Table 11: Global Commercial Refrigeration Equipment Market By Region Thousand Units, 2017-2031

Table 12: Global Commercial Refrigeration Equipment Market By Region US$ Mn 2017-2031

Table 13: North America Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Table 14: North America Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Table 15: North America Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Table 16: North America Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Table 17: North America Commercial Refrigeration Equipment Market By Refrigerant Thousand Units 2017-2031

Table 18: North America Commercial Refrigeration Equipment Market By Refrigerant US$ Mn 2017-2031

Table 19: North America Commercial Refrigeration Equipment Market By Application Thousand Units 2017-2031

Table 20: North America Commercial Refrigeration Equipment Market By Application US$ Mn 2017-2031

Table 21: North America Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Table 22: North America Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Table 23: North America Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Table 24: North America Commercial Refrigeration Equipment Market By Region US$ Mn 2017-2031

Table 25: Europe Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Table 26: Europe Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Table 27: Europe Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Table 28: Europe Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Table 29: Europe Commercial Refrigeration Equipment Market By Refrigerant Thousand Units 2017-2031

Table 30: Europe Commercial Refrigeration Equipment Market By Refrigerant US$ Mn 2017-2031

Table 31: Europe Commercial Refrigeration Equipment Market By Application Thousand Units 2017-2031

Table 32: Europe Commercial Refrigeration Equipment Market By Application US$ Mn 2017-2031

Table 33: Europe Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Table 34: Europe Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Table 35: Europe Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Table 36: Europe Commercial Refrigeration Equipment Market By Region US$ Mn 2017-2031

Table 37: Asia Pacific Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Table 38: Asia Pacific Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Table 39: Asia Pacific Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Table 40: Asia Pacific Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Table 41: Asia Pacific Commercial Refrigeration Equipment Market By Refrigerant Thousand Units 2017-2031

Table 42: Asia Pacific Commercial Refrigeration Equipment Market By Refrigerant US$ Mn 2017-2031

Table 43: Asia Pacific Commercial Refrigeration Equipment Market By Application Thousand Units 2017-2031

Table 44: Asia Pacific Commercial Refrigeration Equipment Market By Application US$ Mn 2017-2031

Table 45: Asia Pacific Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Table 46: Asia Pacific Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Table 47: Asia Pacific Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Table 48: Asia Pacific Commercial Refrigeration Equipment Market By Region US$ Mn 2017-2031

Table 49: Middle East & Africa Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Table 50: Middle East & Africa Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Table 51: Middle East & Africa Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Table 52: Middle East & Africa Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Table 53: Middle East & Africa Commercial Refrigeration Equipment Market By Refrigerant Thousand Units 2017-2031

Table 54: Middle East & Africa Commercial Refrigeration Equipment Market By Refrigerant US$ Mn 2017-2031

Table 55: Middle East & Africa Commercial Refrigeration Equipment Market By Application Thousand Units 2017-2031

Table 56: Middle East & Africa Commercial Refrigeration Equipment Market By Application US$ Mn 2017-2031

Table 57: Middle East & Africa Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Table 58: Middle East & Africa Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Table 59: Middle East & Africa Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Table 60: Middle East & Africa Commercial Refrigeration Equipment Market By Region US$ Mn 2017-2031

Table 61: South America Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Table 62: South America Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Table 63: South America Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Table 64: South America Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Table 65: South America Commercial Refrigeration Equipment Market By Refrigerant Thousand Units 2017-2031

Table 66: South America Commercial Refrigeration Equipment Market By Refrigerant US$ Mn 2017-2031

Table 67: South America Commercial Refrigeration Equipment Market By Application Thousand Units 2017-2031

Table 68: South America Commercial Refrigeration Equipment Market By Application US$ Mn 2017-2031

Table 69: South America Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Table 70: South America Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Table 71: South America Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Table 72: South America Commercial Refrigeration Equipment Market By Region US$ Mn 2017-2031

List of Figure

Figure 1: Global Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Figure 2: Global Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Figure 3: Global Commercial Refrigeration Equipment Market Incremental Opportunity, By Product Type 2017-2031

Figure 4: Global Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Figure 5: Global Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Figure 6: Global Commercial Refrigeration Equipment Market Incremental Opportunity, By Category Type 2017-2031

Figure 7: Global Commercial Refrigeration Equipment Market By Refrigerant Type Thousand Units 2017-2031

Figure 8: Global Commercial Refrigeration Equipment Market By Refrigerant Type US$ Mn 2017-2031

Figure 9: Global Commercial Refrigeration Equipment Market Incremental Opportunity, By refrigerant Type 2017-2031

Figure 10: Global Commercial Refrigeration Equipment Market By Application, Thousand Units 2017-2031

Figure 11: Global Commercial Refrigeration Equipment Market By Application, US$ Mn 2017-2031

Figure 12: Global Commercial Refrigeration Equipment Market Incremental Opportunity, By Application 2017-2031

Figure 13: Global Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Figure 14: Global Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Figure 15: Global Commercial Refrigeration Equipment Market Incremental Opportunity, By Distribution Channel 2017-2031

Figure 16: Global Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Figure 17: Global Commercial Refrigeration Equipment Market By Region, US$ Mn 2017-2031

Figure 18: Global Commercial Refrigeration Equipment Market Incremental Opportunity, By Region 2017-2031

Figure 19: North America Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Figure 20: North America Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Figure 21: North America Commercial Refrigeration Equipment Market Incremental Opportunity, By Product Type 2017-2031

Figure 22: North America Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2033

Figure 23: North America Commercial Refrigeration Equipment Market By Category, US$ Mn 2017-2031

Figure 24: North America Commercial Refrigeration Equipment Market Incremental Opportunity, By Category Type 2017-2031

Figure 25: North America Commercial Refrigeration Equipment Market By Refrigerant Type Thousand Units 2017-2031

Figure 26: North America Commercial Refrigeration Equipment Market By Refrigerant Type US$ Mn 2017-2031

Figure 27: North America Commercial Refrigeration Equipment Market Incremental Opportunity, By refrigerant Type 2017-2031

Figure 28: North America Commercial Refrigeration Equipment Market By Application, Thousand Units 2017-2031

Figure 29: North America Commercial Refrigeration Equipment Market By Application, US$ Mn 2017-2031

Figure 30: North America Commercial Refrigeration Equipment Market Incremental Opportunity, By Application 2017-2031

Figure 31: North America Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Figure 32: North America Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Figure 33: North America Commercial Refrigeration Equipment Market Incremental Opportunity, By Distribution Channel 2017-2031

Figure 34: North America Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Figure 35: North America Commercial Refrigeration Equipment Market By RegionUS$ Mn 2017-2031

Figure 36: North America Commercial Refrigeration Equipment Market Incremental Opportunity, By Region 2017-2031

Figure 37: Europe Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Figure 38: Europe Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Figure 39: Europe Commercial Refrigeration Equipment Market Incremental Opportunity, By Product Type 2017-2031

Figure 40: Europe Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Figure 41: Europe Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Figure 42: Europe Commercial Refrigeration Equipment Market Incremental Opportunity, By Category Type 2017-2031

Figure 43: Europe Commercial Refrigeration Equipment Market By Refrigerant Type Thousand Units 2017-2035

Figure 44: Europe Commercial Refrigeration Equipment Market By Refrigerant Type US$ Mn 2017-2031

Figure 45: Europe Commercial Refrigeration Equipment Market Incremental Opportunity, By refrigerant Type 2017-2031

Figure 46: Europe Commercial Refrigeration Equipment Market By Application, Thousand Units 2017-2031

Figure 47: Europe Commercial Refrigeration Equipment Market By Application, US$ Mn 2017-2031

Figure 48: Europe Commercial Refrigeration Equipment Market Incremental Opportunity, By Application 2017-2031

Figure 49: Europe Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Figure 50: Europe Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Figure 51: Europe Commercial Refrigeration Equipment Market Incremental Opportunity, By Distribution Channel 2017-2031

Figure 52: Europe Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Figure 53: Europe Commercial Refrigeration Equipment Market By Region, US$ Mn, 2017-2031

Figure 54: Europe Commercial Refrigeration Equipment Market Incremental Opportunity, By Region 2017-2031

Figure 55: Asia Pacific Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Figure 56: Asia Pacific Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Figure 57: Asia Pacific Commercial Refrigeration Equipment Market Incremental Opportunity, By Product Type 2017-2031

Figure 58: Asia Pacific Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Figure 59: Asia Pacific Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Figure 60: Asia Pacific Commercial Refrigeration Equipment Market Incremental Opportunity, By Category Type 2017-201

Figure 61: Asia Pacific Commercial Refrigeration Equipment Market By Refrigerant Type Thousand Units 2017-2031

Figure 62: Asia Pacific Commercial Refrigeration Equipment Market By Refrigerant Type US$ Mn 2017-2031

Figure 63: Asia Pacific Commercial Refrigeration Equipment Market Incremental Opportunity, By refrigerant Type 2017-2031

Figure 64: Asia Pacific Commercial Refrigeration Equipment Market By Application, Thousand Units 2017-2031

Figure 65: Asia Pacific Commercial Refrigeration Equipment Market By Application, US$ Mn 2017-2031

Figure 66: Asia Pacific Commercial Refrigeration Equipment Market Incremental Opportunity, By Application 2017-2031

Figure 67: Asia Pacific Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Figure 68: Asia Pacific Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Figure 69: Asia Pacific Commercial Refrigeration Equipment Market Incremental Opportunity, By Distribution Channel 2017-2031

Figure 70: Asia Pacific Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Figure 71: Asia Pacific Commercial Refrigeration Equipment Market By RegionUS$ Mn 2017-2031

Figure 72: Asia Pacific Commercial Refrigeration Equipment Market Incremental Opportunity, By Region 2017-2031

Figure 73: Middle East & Africa Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Figure 74: Middle East & Africa Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Figure 75: Middle East & Africa Commercial Refrigeration Equipment Market Incremental Opportunity, By Product Type 2017-2031

Figure 76: Middle East & Africa Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Figure 77: Middle East & Africa Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Figure 78: Middle East & Africa Commercial Refrigeration Equipment Market Incremental Opportunity, By Category Type 2017-2031

Figure 79: Middle East & Africa Commercial Refrigeration Equipment Market By Refrigerant Type Thousand Units 2017-2031

Figure 80: Middle East & Africa Commercial Refrigeration Equipment Market By Refrigerant Type US$ Mn 2017-2031

Figure 81: Middle East & Africa Commercial Refrigeration Equipment Market Incremental Opportunity, By refrigerant Type 2017-2031

Figure 82: Middle East & Africa Commercial Refrigeration Equipment Market By Application, Thousand Units 2017-2031

Figure 83: Middle East & Africa Commercial Refrigeration Equipment Market By Application, US$ Mn 2017-2031

Figure 84: Middle East & Africa Commercial Refrigeration Equipment Market Incremental Opportunity, By Application 2017-2031

Figure 85: Middle East & Africa Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Figure 86: Middle East & Africa Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Figure 87: Middle East & Africa Commercial Refrigeration Equipment Market Incremental Opportunity, By Distribution Channel 2017-2031

Figure 88: Middle East & Africa Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Figure 89: Middle East & Africa Commercial Refrigeration Equipment Market By RegionUS$ Mn 2017-2031

Figure 90: Middle East & Africa Commercial Refrigeration Equipment Market Incremental Opportunity, By Region 2017-2031

Figure 91: South America Commercial Refrigeration Equipment Market By Product Type, Thousand Units 2017-2031

Figure 92: South America Commercial Refrigeration Equipment Market By Product Type, US$ Mn 2017-2031

Figure 93: South America Commercial Refrigeration Equipment Market Incremental Opportunity, By Product Type 2017-2031

Figure 94: South America Commercial Refrigeration Equipment Market By Category Thousand Units 2017-2031

Figure 95: South America Commercial Refrigeration Equipment Market By Category US$ Mn 2017-2031

Figure 96: South America Commercial Refrigeration Equipment Market Incremental Opportunity, By Category Type 2017-2031

Figure 97: South America Commercial Refrigeration Equipment Market By Refrigerant Type Thousand Units 2017-2031

Figure 98: South America Commercial Refrigeration Equipment Market By Refrigerant Type US$ Mn 2017-2031

Figure 99: South America Commercial Refrigeration Equipment Market Incremental Opportunity, By refrigerant Type 2017-2031

Figure 100: South America Commercial Refrigeration Equipment Market By Application, Thousand Units 2017-2031

Figure 101: South America Commercial Refrigeration Equipment Market By Application, US$ Mn 2017-2031

Figure 102: South America Commercial Refrigeration Equipment Market Incremental Opportunity, By Application 2017-2031

Figure 103: South America Commercial Refrigeration Equipment Market By Distribution Channel Thousand Units 2017-2031

Figure 104: South America Commercial Refrigeration Equipment Market By Distribution Channel US$ Mn 2017-2031

Figure 105: South America Commercial Refrigeration Equipment Market Incremental Opportunity, By Distribution Channel 2017-2031

Figure 106: South America Commercial Refrigeration Equipment Market By Region Thousand Units 2017-2031

Figure 107: South America Commercial Refrigeration Equipment Market By RegionUS$ Mn 2017-2031

Figure 108: South America Commercial Refrigeration Equipment Market Incremental Opportunity, By Region 2017-2031