Reports

Reports

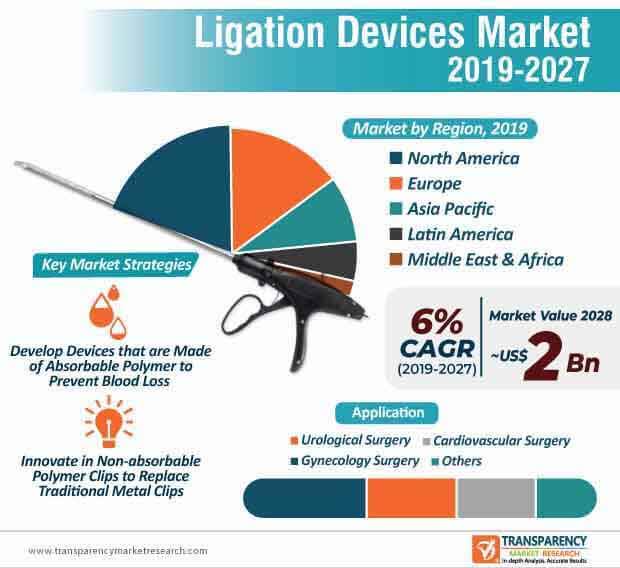

Helping healthcare practitioners achieve good tissue grip during surgeries and minimally invasive placement of ligation devices is becoming the key focus point for companies in the market landscape. Hence, companies in the ligation devices market are fine-tuning their engineering and technical expertise to improve medical outcomes. For instance, Micro Stamping Corporation— one of the pioneers in the manufacturing of ligation clips, are continually contributing to the growth of the ligation devices market, which is projected to advance at a CAGR of 6% during the forecast period.

Full-service contract manufacturers specializing in precision medical devices are relying on innovations as a hallmark for exponential growth of the business. They are reinvesting in technologies, equipment, and offering training to practitioners that help to improve patient quality of life. Manufacturers are producing ligation devices that are being increasingly used in endoscopic procedures.

Apart from gynecological and urological surgeries, manufacturers in the ligation devices market are capitalizing on the demand arising from the varicose veins treatment. They are generating revenue streams by increasing production capabilities to develop self-ligating orthodontic brackets. On the other hand, precision ablation using vessel ligation devices is one of the key drivers contributing toward market growth. These novel devices help practitioners, especially in hospitals and clinics to conduct precision ablation using ultrasound waves. For instance, Novuson— one of the pioneers in direct therapeutic ultrasound technology, is focused on the development of their vessel ligation device capable of rapid and precise ablation with the help of ultrasound waves for improved hemostatic control.

The ligation devices market is witnessing a transformation with the introduction of substantive innovations using advanced ligation devices targeted for vessel sealing and hemostasis. As such, the revenue of cardiovascular surgeries is estimated to reach the third-highest revenue amongst all applications in the market landscape.

Permanent surgical sutures and other non-absorbable devices such as clips, cable ties, and staples are extensively used in various ligation applications. However, these devices may lead to issues such as negative tissue responses, resulting in infection, inflammation, and scar tissue formation. Hence, companies in the ligation devices market are innovating in devices made from absorbable polymers. For instance, Poly-Med Inc.— a biotechnology company in South Carolina, joined forces with Resorbable Devices AB, a specialist in surgical implants and resorbable polymers to develop LigaTie®, a device made from absorbable polymer and used in surgical procedures. As such, the revenue of minimally invasive surgical procedures is higher than that of open surgeries.

The ligation devices market is anticipated to reach a value of ~US$ 1.5 Bn by the end of 2028. This is evident since healthcare companies are advancing in R&D activities to innovate in ligation devices that prevent air leaks and blood loss when used for surgical procedures associated with lungs or airways.

Companies in the ligation devices market are increasing their production capabilities to develop devices made from implantable and non-absorbable polymers for tissue/vessel ligation. For instance, the U.K.-based medical device innovation company has an extensive portfolio in vascular products involving their VascuLok ligating polymer clip, which embodies non-erosive attributes for delicate tissue ligations. As such, the revenue of gynecological surgeries is estimated to reach the highest amongst all applications in the ligation devices market.

Novel non-absorbable polymer clips are pervasively replacing traditional thin metal clips that result in issues such as tissue damage and significant MRI/CT artefacts in scanning procedures for cancer surgery or neurosurgery. Advantages of ligation devices made with non-absorbable polymer clips are benefitting healthcare providers that help to secure fastening through integrated locking system. Companies in the market for ligation devices are increasing their production capacities to manufacture non-metallic clips that reduce incidence of MRI/CT artefacts and results in better brain scanning and tumor monitoring.

Analysts’ Viewpoint

Advanced left atrial appendage (LAA) closure devices are acquiring global recognition and play an instrumental role in surgical methods involving amputation of the appendage and ligation of the appendage from the epicardial side. Companies in the ligation devices market are increasing their research efforts to develop LAA closure devices to prevent clot formation during surgeries.

Current hemostatic and vessel ligation devices help to perform mechanical ligation and utilize high frequency electric currents to conduct surgical operations. However, conventional vessel ligation devices are challenged with limitations of tissue damage and can only be used in a limited range of applications. Hence, companies should develop technologically sound vessel ligation devices that deploy direct therapeutic ultrasound in order to carry out precision ablation for coagulation and hemostatic control.

Ligation devices market to reach valuation of ~US$ 1.5 Bn by 2028

Ligation devices market is projected to expand at a CAGR of 6% from 2020 to 2028

Ligation devices market is driven by increase in the number of minimally invasive surgical procedures performed

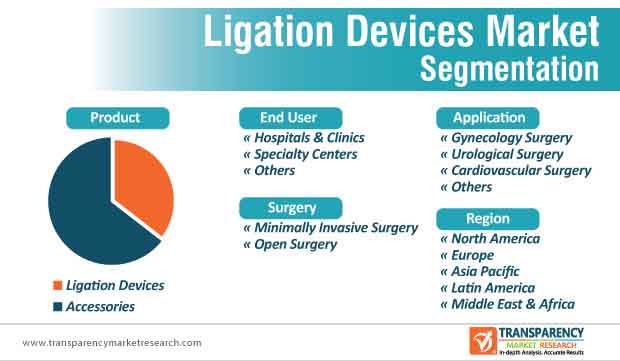

The accessories segment dominated the global ligation devices market and the trend is projected to continue during the forecast period

Key players in the global ligation devices market include Ethicon (Johnson & Johnson), Medtronic Plc, B. Braun Melsungen AG, CONMED Corporation, Teleflex Incorporated

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Ligation Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ligation Devices Market Analysis and Forecast, 2018–2028

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Value Chain Analysis of Key Vendors & Distributors

5.2. Winning Imperatives: Top Companies

5.3. Regulatory Scenario

6. Global Ligation Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2018–2028

6.3.1. Ligation Devices

6.3.2. Accessories

6.4. Market Attractiveness, by Product

7. Global Ligation Devices Market Analysis and Forecast, by Surgery

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Surgery, 2018–2028

7.3.1. Minimally Invasive Surgery

7.3.2. Open Surgery

7.4. Market Attractiveness, by Surgery

8. Global Ligation Devices Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2018–2028

8.3.1. Gynecology Surgery

8.3.2. Urological Surgery

8.3.3. Cardiovascular Surgery

8.3.4. Others

8.4. Market Attractiveness, by Application

9. Global Ligation Devices Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2018–2028

9.3.1. Hospitals & Clinics

9.3.2. Specialty Centers

9.3.3. Others

9.4. Market Attractiveness, by End-user

10. Global Ligation Devices Market Analysis and Forecast, by Region

10.1. 10.1. Key Findings

10.2. 10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness, by Country/Region

11. North America Ligation Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2018–2028

11.2.1. Ligation Devices

11.2.2. Accessories

11.3. Market Value Forecast, by Surgery, 2018–2028

11.3.1. Minimally Invasive Surgery

11.3.2. Open Surgery

11.4. 11.4.Market Value Forecast, by Application, 2018–2028

11.4.1. Gynecology Surgery

11.4.2. Urological Surgery

11.4.3. Cardiovascular Surgery

11.4.4. Others

11.5. Market Value Forecast, by End-user, 2018–2028

11.5.1. Hospitals & Clinics

11.5.2. Specialty Centers

11.5.3. Others

11.6. Market Value Forecast, by Country, 2018–2028

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Surgery

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Ligation Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. 12.1.1. Key Findings

12.1.2. 12.2.Market Value Forecast, by Product, 2018–2028

12.1.3. 12.2.1. Ligation Devices

12.1.4. 12.2.2. Accessories

12.1.5. 12.3.Market Value Forecast, by Surgery, 2018–2028

12.1.6. 12.3.1. Minimally Invasive Surgery

12.1.7. 12.3.2. Open Surgery

12.1.8. 12.4.Market Value Forecast, by Application, 2018–2028

12.1.9. Gynecology Surgery

12.1.10. Urological Surgery

12.1.11. Cardiovascular Surgery

12.1.12. Others

12.2. Market Value Forecast, by End-user, 2018–2028

12.2.1. Hospitals & Clinics

12.2.2. Specialty Centers

12.2.3. Others

12.3. Market Value Forecast, by Country/Sub-region, 2018–2028

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Spain

12.3.5. Italy

12.3.6. Rest of Europe

12.4. Market Attractiveness Analysis

12.4.1. By Product

12.4.2. By Surgery

12.4.3. By Application

12.4.4. By End-user

12.4.5. By Country/Sub-region

13. Asia Pacific Ligation Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2018–2028

13.2.1. Ligation Devices

13.2.2. Accessories

13.3. Market Value Forecast, by Surgery, 2018–2028

13.3.1. Minimally Invasive Surgery

13.3.2. Open Surgery

13.4. Market Value Forecast, by Application, 2018–2028

13.4.1. Gynecology Surgery

13.4.2. Urological Surgery

13.4.3. Cardiovascular Surgery

13.4.4. Others

13.5. Market Value Forecast, by End-user, 2018–2028

13.5.1. Hospitals & Clinics

13.5.2. Specialty Centers

13.5.3. Others

13.6. Market Value Forecast, by Country/Sub-region, 2018–2028

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Surgery

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Ligation Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2018–2028

14.2.1. Ligation Devices

14.2.2. Accessories

14.3. Market Value Forecast, by Surgery, 2018–2028

14.3.1. Minimally Invasive Surgery

14.3.2. Open Surgery

14.4. Market Value Forecast, by Application, 2018–2028

14.4.1. Gynecology Surgery

14.4.2. Urological Surgery

14.4.3. Cardiovascular Surgery

14.4.4. Others

14.5. Market Value Forecast, by End-user, 2018–2028

14.5.1. Hospitals & Clinics

14.5.2. Specialty Centers

14.5.3. Others

14.6. Market Value Forecast, by Country/Sub-region, 2018–2028

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Surgery

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Ligation Devices Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2018–2028

15.2.1. Ligation Devices

15.2.2. Accessories

15.3. Market Value Forecast, by Surgery, 2018–2028

15.3.1. Minimally Invasive Surgery

15.3.2. Open Surgery

15.4. 15.4.Market Value Forecast, by Application, 2018–2028

15.4.1. Gynecology Surgery

15.4.2. Urological Surgery

15.4.3. Cardiovascular Surgery

15.4.4. Others

15.5. Market Value Forecast, by End-user, 2018–2028

15.5.1. Hospitals & Clinics

15.5.2. Specialty Centers

15.5.3. Others

15.6. Market Value Forecast, by Country/Sub-region, 2018–2028

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Surgery

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis, by Company (2018)

16.3. Company Profiles

16.3.1. Ethicon (Johnson & Johnson)

16.3.1.1. Company Overview

16.3.1.2. Company Financials

16.3.1.3. Growth Strategies

16.3.1.4. SWOT Analysis

16.3.2. Medtronic Plc

16.3.2.1. Company Overview

16.3.2.2. Company Financials

16.3.2.3. Growth Strategies

16.3.2.4. SWOT Analysis

16.3.3. B. Braun Melsungen AG

16.3.3.1. Company Overview

16.3.3.2. Company Financials

16.3.3.3. Growth Strategies

16.3.3.4. SWOT Analysis

16.3.4. CONMED Corporation

16.3.4.1. Company Overview

16.3.4.2. Company Financials

16.3.4.3. Growth Strategies

16.3.4.4. SWOT Analysis

16.3.5. Teleflex Incorporated

16.3.5.1. Company Overview

16.3.5.2. Company Financials

16.3.5.3. Growth Strategies

16.3.5.4. SWOT Analysis

16.3.6. Olympus Corporation

16.3.6.1. Company Overview

16.3.6.2. Company Financials

16.3.6.3. Growth Strategies

16.3.6.4. SWOT Analysis

16.3.7. Applied Medical

16.3.7.1. Company Overview

16.3.7.2. Company Financials

16.3.7.3. Growth Strategies

16.3.7.4. SWOT Analysis

16.3.8. Genicon, Inc.

16.3.8.1. Company Overview

16.3.8.2. Company Financials

16.3.8.3. Growth Strategies

16.3.8.4. SWOT Analysis

16.3.9. Grena Think Medical

16.3.9.1. Company Overview

16.3.9.2. Company Financials

16.3.9.3. Growth Strategies

16.3.9.4. SWOT Analysis

16.3.10. Stryker

16.3.10.1. Company Overview

16.3.10.2. Company Financials

16.3.10.3. Growth Strategies

16.3.10.4. SWOT Analysis

16.3.11. Other Prominent Key Players

List of Tables

Table: 1 Global Ligation Devices Market Size (US$ Mn) Forecast, by Product, 2018–2028

Table: 2 Global Ligation Devices Market Size (US$ Mn) Forecast, by Surgery, 2018–2028

Table: 3 Global Ligation Devices Market Size (US$ Mn) Forecast, by Application, 2018–2028

Table: 4 Global Ligation Devices Market Size (US$ Mn) Forecast, by End-user, 2018–2028

Table: 5 Global Ligation Devices Market Value (US$ Mn) Forecast, by Region, 2018–2028

Table: 6 North America Ligation Devices Market Size (US$ Mn) Forecast, by Product, 2018–2028

Table: 7 North America Ligation Devices Market Size (US$ Mn) Forecast, by Surgery, 2018–2028

Table: 8 North America Ligation Devices Market Size (US$ Mn) Forecast, by Application, 2018–2028

Table: 9 North America Ligation Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table: 10 North America Ligation Devices Market Value (US$ Mn) Forecast, by Country, 2018–2028

Table: 11 Europe Ligation Devices Market Size (US$ Mn) Forecast, by Product, 2018–2028

Table: 12 Europe Ligation Devices Market Size (US$ Mn) Forecast, by Surgery, 2018–2028

Table: 13 Europe Ligation Devices Market Size (US$ Mn) Forecast, by Application, 2018–2028

Table: 14 Europe Ligation Devices Market Revenue (US$ Mn) Forecast, by End-user, 2018–2028

Table: 15 Europe Ligation Devices Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table: 16 Asia Pacific Ligation Devices Market Size (US$ Mn) Forecast, by Product, 2018–2028

Table: 17 Asia Pacific Ligation Devices Market Size (US$ Mn) Forecast, by Surgery, 2018–2028

Table: 18 Asia Pacific Ligation Devices Market Size (US$ Mn) Forecast, by Application, 2018–2028

Table: 19 Asia Pacific Ligation Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table: 20 Asia Pacific Ligation Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table: 21 Latin America Ligation Devices Market Size (US$ Mn) Forecast, by Product, 2018–2028

Table: 22 Latin America Ligation Devices Market Size (US$ Mn) Forecast, by Surgery, 2018–2028

Table: 23 Latin America Ligation Devices Market Size (US$ Mn) Forecast, by Application, 2018–2028

Table: 24 Latin America Ligation Devices Market Size (US$ Mn) Forecast, by End-user, 2018–2028

Table: 25 Latin America Ligation Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table: 26 Middle East & Africa Ligation Devices Market Size (US$ Mn) Forecast, by Product, 2018–2028

Table: 27 Middle East & Africa Ligation Devices Market Size (US$ Mn) Forecast, by Surgery, 2018–2028

Table: 28 Middle East & Africa Ligation Devices Market Size (US$ Mn) Forecast, by Application, 2018–2028

Table: 29 Middle East & Africa Ligation Devices Market Value (US$ Mn) Forecast, by End-user, 2018–2028

Table: 30 Middle East & Africa Ligation Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

List of Figures

Figure: 1 Market Value, by Product (US$ Mn), 2019

Figure: 2 Market Share, Top Trends by Product (2019)

Figure: 3 Market Share by Region, 2019

Figure: 4 Market Share Analysis, by Region

Figure: 5 Porter’s Five Forces Analysis

Figure: 6 Global Ligation Devices Market Value (US$ Mn) and Forecast, 2018–2028

Figure: 7 Global Market Value Share, by Product (2019)

Figure: 8 Global Market Value Share, by Surgery (2019)

Figure: 9 Global Market Value Share, by Application (2019)

Figure: 10 Global Market Value Share, by End-user (2019)

Figure: 11 Global Ligation Devices Market Value Share Analysis, by Product, 2018 and 2028

Figure: 12 Global Ligation Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ligation Devices, 2018–2028

Figure: 13 Global Ligation Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Accessories, 2018–2028

Figure: 14 Global Ligation Devices Market Attractiveness Analysis, by Product, 2018–2028

Figure: 15 Global Ligation Devices Market Value Share Analysis, by Surgery, 2018 and 2028

Figure: 16 Global Ligation Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Minimally Invasive Surgery, 2018–2028

Figure: 17 Global Ligation Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Open Surgery, 2018–2028

Figure: 18 Global Ligation Devices Market Attractiveness Analysis, by Surgery, 2018–2028

Figure: 19 Global Ligation Devices Market Value Share Analysis, by Region, 2018 and 2028

Figure: 20 Global Ligation Devices Market Attractiveness Analysis, by Region, 2018–2028

Figure: 21 North America Ligation Devices Market Value (US$ Mn) Forecast, 2018–2028

Figure: 22 North America Ligation Devices Market Attractiveness Analysis, by Country, 2018–2028

Figure: 23 North America Ligation Devices Market Value Share Analysis, by Product, 2018 and 2028

Figure: 24 North America Ligation Devices Market Value Share Analysis, by Surgery, 2018 and 2028

Figure: 25 North America Ligation Devices Market Value Share Analysis, by Application, 2018 and 2028

Figure: 26 North America Ligation Devices Market Value Share Analysis, by End-user, 2018 and 2028

Figure: 27 North America Ligation Devices Market Value Share Analysis, by Country, 2018 and 2028

Figure: 28 North America Ligation Devices Market Attractiveness Analysis, by Product, 2018–2028

Figure: 29 North America Ligation Devices Market Attractiveness Analysis, by Surgery, 2018–2028

Figure: 30 North America Ligation Devices Market Attractiveness Analysis, by Application, 2018–2028

Figure: 31 North America Ligation Devices Market Attractiveness Analysis, by End-user, 2018–2028

Figure: 32 Europe Ligation Devices Market Value (US$ Mn) Forecast, 2018–2028

Figure: 33 Europe Ligation Devices Market Attractiveness Analysis, by Country/Sub-region, 2018–2028

Figure: 34 Europe Ligation Devices Market Value Share Analysis, by Product, 2018 and 2028

Figure: 35 Europe Ligation Devices Market Value Share Analysis, by Surgery, 2018 and 2028

Figure: 36 Europe Ligation Devices Market Value Share Analysis, by Application, 2018 and 2028

Figure: 37 Europe Ligation Devices Market Value Share Analysis, by End-user, 2018 and 2028

Figure: 38 Europe Ligation Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2028

Figure: 39 Europe Ligation Devices Market Attractiveness Analysis, by Product, 2018–2028

Figure: 40 Europe Ligation Devices Market Attractiveness Analysis, by Surgery, 2018–2028

Figure: 41 Europe Ligation Devices Market Attractiveness Analysis, by Application, 2018–2028

Figure: 42 Europe Ligation Devices Market Attractiveness Analysis, by End-user, 2018–2028

Figure: 43 Asia Pacific Ligation Devices Market Value (US$ Mn) Forecast, 2018–2028

Figure: 44 Asia Pacific Ligation Devices Market Attractiveness Analysis, by Country/Sub-region, 2018–2028

Figure: 45 Asia Pacific Ligation Devices Market Value Share Analysis, by Product, 2018 and 2028

Figure: 46 Asia Pacific Ligation Devices Market Value Share Analysis, by Surgery, 2018 and 2028

Figure: 47 Asia Pacific Ligation Devices Market Value Share Analysis, by Application, 2018 and 2028

Figure: 48 Asia Pacific Ligation Devices Market Value Share Analysis, by End-user, 2018 and 2028

Figure: 49 Asia Pacific Ligation Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2028

Figure: 50 Asia Pacific Ligation Devices Market Attractiveness Analysis, byproduct, 2018–2028

Figure: 51 Asia Pacific Ligation Devices Market Attractiveness Analysis, by Surgery, 2018–2028

Figure: 52 Asia Pacific Ligation Devices Market Attractiveness Analysis, by Application, 2018–2028

Figure: 53 Asia Pacific Ligation Devices Market Attractiveness Analysis, by End-user, 2018–2028

Figure: 54 Latin America Ligation Devices Market Value (US$ Mn) Forecast, 2018–2028

Figure: 55 Latin America Ligation Devices Market Attractiveness Analysis, by Country/Sub-region, 2018–2028

Figure: 56 Latin America Ligation Devices Market Value Share Analysis, by Product, 2018 and 2028

Figure: 57 Latin America Ligation Devices Market Value Share Analysis, by Surgery, 2018 and 2028

Figure: 58 Latin America Ligation Devices Market Value Share Analysis, by Application, 2018 and 2028

Figure: 59 Latin America Ligation Devices Market Value Share Analysis, by End-user, 2018 and 2028

Figure: 60 Latin America Ligation Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2028

Figure: 61 Latin America Ligation Devices Market Attractiveness Analysis, by Product, 2018–2028

Figure: 62 Latin America Ligation Devices Market Attractiveness Analysis, by Surgery, 2018–2028

Figure: 63 Latin America Ligation Devices Market Attractiveness Analysis, by Application, 2018–2028

Figure: 64 Latin America Ligation Devices Market Attractiveness Analysis, by End-user, 2018–2028

Figure: 65 Middle East & Africa Ligation Devices Market Value (US$ Mn) Forecast, 2018–2028

Figure: 66 Middle East & Africa Ligation Devices Market Attractiveness Analysis, by Country/Sub-region, 2018–2028

Figure: 67 Middle East & Africa Ligation Devices Market Value Share Analysis, by Product, 2018 and 2028

Figure: 68 Middle East & Africa Ligation Devices Market Value Share Analysis, by Surgery, 2018 and 2028

Figure: 69 Middle East & Africa Ligation Devices Market Value Share Analysis, by Application, 2018 and 2028

Figure: 70 Middle East & Africa Ligation Devices Market Value Share Analysis, by End-user, 2018 and 2028

Figure: 71 Middle East & Africa Ligation Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2028

Figure: 72 Middle East & Africa Ligation Devices Market Attractiveness Analysis, by Product, 2018–2028

Figure: 73 Middle East & Africa Ligation Devices Market Attractiveness Analysis, by Surgery, 2018–2028

Figure: 74 Middle East & Africa Ligation Devices Market Attractiveness Analysis, by Application, 2018–2028

Figure: 75 Middle East & Africa Ligation Devices Market Attractiveness Analysis, by End-user, 2018–2028

Figure: 76 Ethicon (Johnson & Johnson) Revenue (US$ Bn) and Y-o-Y Growth (%), 2013–2017

Figure: 77 Ethicon (Johnson & Johnson) Research & Development Expenses (2017)

Figure: 78 Ethicon (Johnson & Johnson) Breakdown of Net Sales (% Share), by Business Segment (2017)

Figure: 79 Ethicon (Johnson & Johnson) Breakdown of Net Sales (% Share), by Region (2017)

Figure: 80 Medtronic Plc Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2019

Figure: 81 Medtronic Plc Research and Development Expenses, 2014-2019

Figure: 82 Medtronic Plc Breakdown of Net Sales (% Share), by Region (2017–2019)

Figure: 83 B. Braun Melsungen AG Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2017

Figure: 84 B. Braun Melsungen AG Research and Development Expenses, 2013-2017

Figure: 85 B. Braun Melsungen AG Breakdown of Net Sales (% Share), by Business Segment (2017)

Figure: 86 B. Braun Melsungen AG Breakdown of Net Sales (% Share), by Region (2017)

Figure: 87 CONMED Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2017

Figure: 88 CONMED Corporation Research and Development Expenses, 2013-2017

Figure: 89 CONMED Corporation Breakdown of Net Sales (% Share), by Business Segment (2017)

Figure: 90 CONMED Corporation Breakdown of Net Sales (% Share), by Region (2017)

Figure: 91 Teleflex Incorporated Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2017

Figure: 92 Teleflex Incorporated Research and Development Expenses, 2013–2017

Figure: 93 Olympus Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017

Figure: 94 Olympus Corporation Breakdown of Net Sales, by Business Segment, 2017

Figure: 95 Olympus Corporation Research & Development Cost, 2015–2017 (US$ Mn)

Figure: 96 Applied Medical Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017

Figure: 97 Applied Medical Breakdown of Net Sales, by Country, 2017

Figure: 98 Applied Medical Breakdown of Net Sales, by business segment, 2017 (US$ Mn)

Figure: 99 Genicon, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure: 100 Genicon, Inc. Research & Development Expenses, 2016 and 2017

Figure: 101 Genicon, Inc. Breakdown of Net Sales (% Share), by Business Segment (2017)

Figure: 102 Genicon, Inc. Breakdown of Net Sales (% Share), by Region (2017)

Figure: 103 Grena Think Medical Revenue (US$ Mn) & Y-o-Y Growth (%), 2013–2016

Figure: 104 Grena Think Medical Breakdown of Net Sales, by Region, 2016

Figure: 105 Grena Think Medical Breakdown of Net Sales, by Business Segment, 2016