Reports

Reports

Analysts’ Viewpoint on Market Scenario

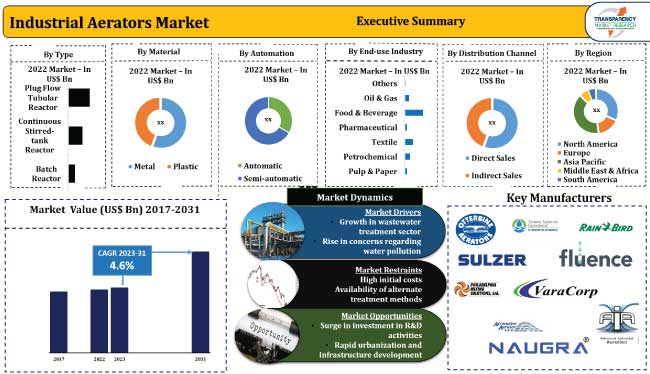

Growth in the wastewater treatment sector is expected to propel the industrial aerators market value during the forecast period. Rise in concerns regarding water pollution is also projected to boost demand for industrial aerators in the next few years.

Rapid urbanization and surge in infrastructure development are likely to offer lucrative opportunities to vendors in the global industrial aerators sector. However, high initial costs and availability of alternate treatment methods are estimated to limit the industrial aerators market growth in the near future. Thus, vendors are investing significantly in the R&D of affordable and advanced products to expand their product portfolio and increase their customer base.

Industrial aerators are used to remove particles, impurities, and dissolved gases from water. These aerators mix air (oxygen transfer) with a liquid such as water or oil to form a homogenous product. They are employed to eliminate oxidized dissolved metals such as hydrogen sulfide, volatile organic chemicals (VOCs), and iron.

Controlling the growth of bacteria in water, oxidation of manganese and iron found in well water, reduction of carbon dioxide (decarbonation), and reduction of ammonia and hydrogen sulfide (stripping) are major applications of industrial aerators. Industrial aeration provides an efficient and natural way of eliminating contaminants from wastewater. Various end-use industries are seeking alternatives to chemical treatment techniques as they can be hazardous. This, in turn, is anticipated to augment the industrial aerators market statistics during the forecast period.

A huge amount of wastewater is generated in various industries. Growth in industrial activities, rise in population, and rapid urbanization are driving demand for wastewater treatment, thereby driving the industrial aerators market revenue. The aquaculture sector, involving fish and shrimp farming, relies on aeration to improve oxygen levels. Thus, demand for industrial aerators is high in the sector.

Governments across the globe are imposing stringent regulations to protect natural water resources. These regulations involve the treatment of wastewater before discharge. Aerators play a vital role in introducing oxygen for the growth of beneficial microorganisms during wastewater treatment.

Water and wastewater management is a promising subsector in environmental technology. Rise in need for wastewater recycling and surge in emphasis on zero discharge systems are offering emerging opportunities in the industrial aerators market.

Public and private sectors are developing comprehensive water and wastewater treatment plants for effective wastewater management. The water and wastewater treatment sector in India is expected to reach US$ 2.08 Bn by 2025 from US$ 1.31 Bn in 2020. Moreover, according to the International Trade Administration, India ranks second in the water and wastewater management sector.

The U.S. is home to approximately 153,000 public drinking water systems and more than 16,000 publicly owned wastewater treatment systems. Over 80% of the U.S. population receives its potable water from these drinking water systems, as per the Cybersecurity and Infrastructure Security Agency. These stats indicate immense growth potential of the water and wastewater sector, thereby fueling the industrial aerators market expansion.

Water pollution has become a global concern. Growth in the industrial sector is fueling pollution worldwide, impacting natural water bodies. Hence, governments across the globe are implementing stringent regulations to limit water pollution. This is projected to boost demand for commercial air diffusion solutions.

The U.S. has Effluent Guidelines, which are national standards for industrial wastewater discharges to surface waters and publicly owned treatment works. Similarly, India has the Provision of Environment Act and Water Act, under which industrial units are required to install Effluent Treatment Plants (ETPs) and treat their effluents to comply with stipulated environmental standards before discharging into river and water bodies. These guidelines make industries comply with regulatory standards, which is anticipated to drive the industrial aerators market development in the near future.

According to the latest industrial aerators market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Implementation of stringent wastewater treatment regulations and growth in the water and wastewater treatment sector are fueling the market dynamics of the region.

The industry in North America is expected to grow at a steady pace during the forecast period owing to surge in investment in environmental technologies and rise in demand for water treatment in various end-use industries.

Most vendors are investing significantly in technological advancements to increase their industrial aerators market share. They are offering energy-efficient industrial aeration systems that maximize oxygen transfer while reducing energy consumption. These modifications are helping industries to reduce operational costs.

Otterbine Barebo Inc., Aeration Industries International, LLC, Rain Bird Corporation, Sulzer Ltd., Fluence Corporation Limited, Philadelphia Mixing Solutions, VaraCorp, LLC, Advanced, Industrial Aeration, Airmaster Aerator LLC, and Naugra Water Aeration System are key players in the industrial aerators market.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 1.5 Bn |

| Market Forecast Value in 2031 | US$ 2.3 Bn |

| Growth Rate (CAGR) | 4.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value & Thousand Units for Volume |

| Market Analysis | Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.5 Bn in 2022

It is estimated to be 4.6% from 2023 to 2031

It is projected to reach US$ 2.3 Bn by the end of 2031

Growth in wastewater treatment sector and rise in concerns regarding water pollution

Asia Pacific is projected to record the highest demand during the forecast period

Otterbine Barebo Inc., Aeration Industries International, LLC, Rain Bird Corporation, Sulzer Ltd., Fluence Corporation Limited, Philadelphia Mixing Solutions, VaraCorp, LLC, Advanced, Industrial Aeration, Airmaster Aerator LLC, and Naugra Water Aeration System

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Industry SWOT Analysis

5.5. Technology Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. Regulatory Framework

5.9. Global Industrial Aerators Market Analysis and Forecast

5.9.1. Market Revenue Projection (US$ Bn)

5.9.2. Market Revenue Projection (Thousand Units)

6. Global Industrial Aerators Market Analysis and Forecast, By Type

6.1. Global Industrial Aerators Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

6.1.1. Batch Reactor

6.1.2. Continuous Stirred-tank Reactor

6.1.3. Plug Flow Tubular Reactor

6.2. Incremental Opportunity, By Type

7. Global Industrial Aerators Market Analysis and Forecast, By Material

7.1. Global Industrial Aerators Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

7.1.1. Metal

7.1.2. Plastic

7.2. Incremental Opportunity, By Material

8. Global Industrial Aerators Market Analysis and Forecast, By Automation

8.1. Global Industrial Aerators Market Size (US$ Bn and Thousand Units), By Automation, 2017 - 2031

8.1.1. Automatic

8.1.2. Semi-automatic

8.2. Incremental Opportunity, By Automation

9. Global Industrial Aerators Market Analysis and Forecast, By Operation

9.1. Global Industrial Aerators Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

9.1.1. Fixed

9.1.2. Floating

9.2. Incremental Opportunity, By Operation

10. Global Industrial Aerators Market Analysis and Forecast, By End-use Industry

10.1. Global Industrial Aerators Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

10.1.1. Pulp & Paper

10.1.2. Petrochemical

10.1.3. Textile

10.1.4. Pharmaceutical

10.1.5. Food & Beverage

10.1.6. Oil & Gas

10.1.7. Others (Mining, Power, etc.)

10.2. Incremental Opportunity, By Operation

11. Global Industrial Aerators Market Analysis and Forecast, By Distribution Channel

11.1. Global Industrial Aerators Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

11.1.1. Direct Sales

11.1.2. Indirect Sales

11.2. Incremental Opportunity, By Operation

12. Global Industrial Aerators Market Analysis and Forecast, by Region

12.1. Global Industrial Aerators Market Size (US$ Bn and Thousand Units), by Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, by Region

13. North America Industrial Aerators Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Macroeconomic Analysis

13.3. Key Supplier Analysis

13.4. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

13.4.1. Batch Reactor

13.4.2. Continuous Stirred-tank Reactor

13.4.3. Plug Flow Tubular Reactor

13.5. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

13.5.1. Metal

13.5.2. Plastic

13.6. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Automation, 2017 - 2031

13.6.1. Automatic

13.6.2. Semi-automatic

13.7. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

13.7.1. Fixed

13.7.2. Floating

13.8. Industrial Aerators Market Size (US$ Bn and Thousand Units), By End-use Industry, 2017 - 2031

13.8.1. Pulp & Paper

13.8.2. Petrochemical

13.8.3. Textile

13.8.4. Pharmaceutical

13.8.5. Food & Beverage

13.8.6. Oil & Gas

13.8.7. Others (Mining, Power, etc.)

13.9. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Industrial Aerators Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

13.10.1. U.S.

13.10.2. Canada

13.10.3. Rest of North America

13.11. Incremental Opportunity Analysis

14. Europe Industrial Aerators Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Macroeconomic Analysis

14.3. Key Supplier Analysis

14.4. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

14.4.1. Batch Reactor

14.4.2. Continuous Stirred-tank Reactor

14.4.3. Plug Flow Tubular Reactor

14.5. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

14.5.1. Metal

14.5.2. Plastic

14.6. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Automation, 2017 - 2031

14.6.1. Automatic

14.6.2. Semi-automatic

14.7. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

14.7.1. Fixed

14.7.2. Floating

14.8. Industrial Aerators Market Size (US$ Bn and Thousand Units), By End-use Industry, 2017 - 2031

14.8.1. Pulp & Paper

14.8.2. Petrochemical

14.8.3. Textile

14.8.4. Pharmaceutical

14.8.5. Food & Beverage

14.8.6. Oil & Gas

14.8.7. Others (Mining, Power, etc.)

14.9. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Industrial Aerators Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

14.10.1. U.K.

14.10.2. Germany

14.10.3. France

14.10.4. Italy

14.10.5. Rest of Europe

14.11. Incremental Opportunity Analysis

15. Asia Pacific Industrial Aerators Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Macroeconomic Analysis

15.3. Key Supplier Analysis

15.4. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

15.4.1. Batch Reactor

15.4.2. Continuous Stirred-tank Reactor

15.4.3. Plug Flow Tubular Reactor

15.5. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

15.5.1. Metal

15.5.2. Plastic

15.6. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Automation, 2017 - 2031

15.6.1. Automatic

15.6.2. Semi-automatic

15.7. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

15.7.1. Fixed

15.7.2. Floating

15.8. Industrial Aerators Market Size (US$ Bn and Thousand Units), By End-use Industry, 2017 - 2031

15.8.1. Pulp & Paper

15.8.2. Petrochemical

15.8.3. Textile

15.8.4. Pharmaceutical

15.8.5. Food & Beverage

15.8.6. Oil & Gas

15.8.7. Others (Mining, Power, etc.)

15.9. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Industrial Aerators Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

15.10.1. China

15.10.2. India

15.10.3. Japan

15.10.4. Rest of Asia Pacific

15.11. Incremental Opportunity Analysis

16. Middle East & Africa Industrial Aerators Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Macroeconomic Analysis

16.3. Key Supplier Analysis

16.4. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

16.4.1. Batch Reactor

16.4.2. Continuous Stirred-tank Reactor

16.4.3. Plug Flow Tubular Reactor

16.5. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

16.5.1. Metal

16.5.2. Plastic

16.6. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Automation, 2017 - 2031

16.6.1. Automatic

16.6.2. Semi-automatic

16.7. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

16.7.1. Fixed

16.7.2. Floating

16.8. Industrial Aerators Market Size (US$ Bn and Thousand Units), By End-use Industry, 2017 - 2031

16.8.1. Pulp & Paper

16.8.2. Petrochemical

16.8.3. Textile

16.8.4. Pharmaceutical

16.8.5. Food & Beverage

16.8.6. Oil & Gas

16.8.7. Others (Mining, Power, etc.)

16.9. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

16.9.1. Direct Sales

16.9.2. Indirect Sales

16.10. Industrial Aerators Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

16.10.1. GCC

16.10.2. South Africa

16.10.3. Rest of Middle East & Africa

16.11. Incremental Opportunity Analysis

17. South America Industrial Aerators Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Macroeconomic Analysis

17.3. Key Supplier Analysis

17.4. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

17.4.1. Batch Reactor

17.4.2. Continuous Stirred-tank Reactor

17.4.3. Plug Flow Tubular Reactor

17.5. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

17.5.1. Metal

17.5.2. Plastic

17.6. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Automation, 2017 - 2031

17.6.1. Automatic

17.6.2. Semi-automatic

17.7. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

17.7.1. Fixed

17.7.2. Floating

17.8. Industrial Aerators Market Size (US$ Bn and Thousand Units), By End-use Industry, 2017 - 2031

17.8.1. Pulp & Paper

17.8.2. Petrochemical

17.8.3. Textile

17.8.4. Pharmaceutical

17.8.5. Food & Beverage

17.8.6. Oil & Gas

17.8.7. Others (Mining, Power, etc.)

17.9. Industrial Aerators Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

17.9.1. Direct Sales

17.9.2. Indirect Sales

17.10. Industrial Aerators Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017 - 2031

17.10.1. Brazil

17.10.2. Rest of South America

17.11. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Competition Dashboard

18.2. Market Share Analysis % (2022)

18.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Distribution channel overview, Business Strategies / Recent Developments]

18.3.1. Otterbine Barebo Inc.

18.3.1.1. Company Overview

18.3.1.2. Product Portfolio

18.3.1.3. Financial Information, (Subject to Data Availability)

18.3.1.4. Distribution channel overview

18.3.1.5. Business Strategies / Recent Developments

18.3.2. Aeration Industries International, LLC

18.3.2.1. Company Overview

18.3.2.2. Product Portfolio

18.3.2.3. Financial Information, (Subject to Data Availability)

18.3.2.4. Distribution channel overview

18.3.2.5. Business Strategies / Recent Developments

18.3.3. Rain Bird Corporation

18.3.3.1. Company Overview

18.3.3.2. Product Portfolio

18.3.3.3. Financial Information, (Subject to Data Availability)

18.3.3.4. Distribution channel overview

18.3.3.5. Business Strategies / Recent Developments

18.3.4. Sulzer Ltd.

18.3.4.1. Company Overview

18.3.4.2. Product Portfolio

18.3.4.3. Financial Information, (Subject to Data Availability)

18.3.4.4. Distribution channel overview

18.3.4.5. Business Strategies / Recent Developments

18.3.5. Fluence Corporation Limited

18.3.5.1. Company Overview

18.3.5.2. Product Portfolio

18.3.5.3. Financial Information, (Subject to Data Availability)

18.3.5.4. Distribution channel overview

18.3.5.5. Business Strategies / Recent Developments

18.3.6. Philadelphia Mixing Solutions

18.3.6.1. Company Overview

18.3.6.2. Product Portfolio

18.3.6.3. Financial Information, (Subject to Data Availability)

18.3.6.4. Distribution channel overview

18.3.6.5. Business Strategies / Recent Developments

18.3.7. VaraCorp, LLC

18.3.7.1. Company Overview

18.3.7.2. Product Portfolio

18.3.7.3. Financial Information, (Subject to Data Availability)

18.3.7.4. Distribution channel overview

18.3.7.5. Business Strategies / Recent Developments

18.3.8. Advanced Industrial Aeration

18.3.8.1. Company Overview

18.3.8.2. Product Portfolio

18.3.8.3. Financial Information, (Subject to Data Availability)

18.3.8.4. Distribution channel overview

18.3.8.5. Business Strategies / Recent Developments

18.3.9. Airmaster Aerator LLC

18.3.9.1. Company Overview

18.3.9.2. Product Portfolio

18.3.9.3. Financial Information, (Subject to Data Availability)

18.3.9.4. Distribution channel overview

18.3.9.5. Business Strategies / Recent Developments

18.3.10. Naugra Water Aeration System

18.3.10.1. Company Overview

18.3.10.2. Product Portfolio

18.3.10.3. Financial Information, (Subject to Data Availability)

18.3.10.4. Distribution channel overview

18.3.10.5. Business Strategies / Recent Developments

18.3.11. Other Key Players

18.3.11.1. Company Overview

18.3.11.2. Product Portfolio

18.3.11.3. Financial Information, (Subject to Data Availability)

18.3.11.4. Distribution channel overview

18.3.11.5. Business Strategies / Recent Developments

19. Go To Market Strategy

19.1. Identification of Potential Market Spaces

19.1.1. By Type

19.1.2. By Material

19.1.3. By Automation

19.1.4. By Operation

19.1.5. By End-use Industry

19.1.6. By Distribution Channel

19.1.7. By Region

19.2. Understanding Procurement Process of End-users

19.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Aerators Market Value (US$ Bn) Projection By Type 2017-2031

Table 2: Global Industrial Aerators Market Volume (Thousand Units) Projection By Type 2017-2031

Table 3: Global Industrial Aerators Market Value (US$ Bn) Projection By Material 2017-2031

Table 4: Global Industrial Aerators Market Volume (Thousand Units) Projection By Material 2017-2031

Table 5 Global Industrial Aerators Market Value (US$ Bn) Projection By Automation 2017-2031

Table 6 Global Industrial Aerators Market Volume (Thousand Units) Projection By Automation 2017-2031

Table 7: Global Industrial Aerators Market Value (US$ Bn) Projection By Operation 2017-2031

Table 8: Global Industrial Aerators Market Volume (Thousand Units) Projection By Operation 2017-2031

Table 9: Global Industrial Aerators Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 10: Global Industrial Aerators Market Volume (Thousand Units) Projection By End-use Industry 2017-2031

Table 11: Global Industrial Aerators Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 12: Global Industrial Aerators Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 13: Global Industrial Aerators Market Value (US$ Bn) Projection By Region 2017-2031

Table 14: Global Industrial Aerators Market Volume (Thousand Units) Projection By Region 2017-2031

Table 15: Global Industrial Aerators Market Value (US$ Bn) Projection By Type 2017-2031

Table 16: Global Industrial Aerators Market Volume (Thousand Units) Projection By Type 2017-2031

Table 17: North America Industrial Aerators Market Value (US$ Bn) Projection By Material 2017-2031

Table 18: North America Industrial Aerators Market Volume (Thousand Units) Projection By Material 2017-2031

Table 19: North America Industrial Aerators Market Value (US$ Bn) Projection By Automation 2017-2031

Table 20: North America Industrial Aerators Market Volume (Thousand Units) Projection By Automation 2017-2031

Table 21: North America Industrial Aerators Market Value (US$ Bn) Projection By Operation 2017-2031

Table 22: North America Industrial Aerators Market Volume (Thousand Units) Projection By Operation 2017-2031

Table 23: North America Industrial Aerators Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 24: North America Industrial Aerators Market Volume (Thousand Units) Projection By End-use Industry 2017-2031

Table 25: North America Industrial Aerators Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 26: North America Industrial Aerators Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 27: North America Industrial Aerators Market Value (US$ Bn) Projection By Country 2017-2031

Table 28: North America Industrial Aerators Market Volume (Thousand Units) Projection By Country 2017-2031

Table 29: North America Industrial Aerators Market Value (US$ Bn) Projection By Type 2017-2031

Table 30: North America Industrial Aerators Market Volume (Thousand Units) Projection By Type 2017-2031

Table 31: North America Industrial Aerators Market Value (US$ Bn) Projection By Material 2017-2031

Table 32: North America Industrial Aerators Market Volume (Thousand Units) Projection By Material 2017-2031

Table 33: Europe Industrial Aerators Market Value (US$ Bn) Projection By Automation 2017-2031

Table 34: Europe Industrial Aerators Market Volume (Thousand Units) Projection By Automation 2017-2031

Table 35: Europe Industrial Aerators Market Value (US$ Bn) Projection By Operation 2017-2031

Table 36: Europe Industrial Aerators Market Volume (Thousand Units) Projection By Operation 2017-2031

Table 37: Europe Industrial Aerators Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 38: Europe Industrial Aerators Market Volume (Thousand Units) Projection By End-use Industry 2017-2031

Table 39: Europe Industrial Aerators Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 40: Europe Industrial Aerators Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 41: Europe Industrial Aerators Market Value (US$ Bn) Projection By Country 2017-2031

Table 42: Europe Industrial Aerators Market Volume (Thousand Units) Projection By Country 2017-2031

Table 43: Europe Industrial Aerators Market Value (US$ Bn) Projection By Type 2017-2031

Table 44: Europe Industrial Aerators Market Volume (Thousand Units) Projection By Type 2017-2031

Table 45: Europe Industrial Aerators Market Value (US$ Bn) Projection By Material 2017-2031

Table 46: Europe Industrial Aerators Market Volume (Thousand Units) Projection By Material 2017-2031

Table 47: Europe Industrial Aerators Market Value (US$ Bn) Projection By Automation 2017-2031

Table 48: Europe Industrial Aerators Market Volume (Thousand Units) Projection By Automation 2017-2031

Table 49: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection By Operation 2017-2031

Table 50: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection By Operation 2017-2031

Table 51: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 52: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection By End-use Industry 2017-2031

Table 53: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 54: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 55: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection By Country 2017-2031

Table 56: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection By Country 2017-2031

Table 57: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection By Type 2017-2031

Table 58: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection By Type 2017-2031

Table 59: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection By Material 2017-2031

Table 60: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection By Material 2017-2031

Table 61: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection By Automation 2017-2031

Table 62: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection By Automation 2017-2031

Table 63: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection By Operation 2017-2031

Table 64: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection By Operation 2017-2031

Table 65: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 66: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection By End-use Industry 2017-2031

Table 67: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 68: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 69: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection By Country 2017-2031

Table 70: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection By Country 2017-2031

Table 71: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection By Type 2017-2031

Table 72: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection By Type 2017-2031

Table 73: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection By Material 2017-2031

Table 74: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection By Material 2017-2031

Table 75: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection By Automation 2017-2031

Table 76: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection By Automation 2017-2031

Table 77: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection By Operation 2017-2031

Table 78: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection By Operation 2017-2031

Table 79: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection By End-use Industry 2017-2031

Table 80: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection By End-use Industry 2017-2031

Table 81: South America Industrial Aerators Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 82: South America Industrial Aerators Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 83: South America Industrial Aerators Market Value (US$ Bn) Projection By Country 2017-2031

Table 84: South America Industrial Aerators Market Volume (Thousand Units) Projection By Country 2017-2031

Table 85: South America Industrial Aerators Market Value (US$ Bn) Projection By Application 2017-2031

Table 86: South America Industrial Aerators Market Volume (Thousand Units) Projection By Application 2017-2031

Table 87: South America Industrial Aerators Market Value (US$ Bn) Projection By End user 2017-2031

Table 88: South America Industrial Aerators Market Volume (Thousand Units) Projection By End user 2017-2031

Table 89: South America Industrial Aerators Market Value (US$ Bn) Projection By Consumer group 2017-2031

Table 90: South America Industrial Aerators Market Volume (Thousand Units) Projection By Consumer group 2017-2031

Table 91: South America Industrial Aerators Market Value (US$ Bn) Projection By Price 2017-2031

Table 92: South America Industrial Aerators Market Volume (Thousand Units) Projection By Price 2017-2031

Table 93: South America Industrial Aerators Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 94: South America Industrial Aerators Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 95: South America Industrial Aerators Market Value (US$ Bn) Projection By Country 2017-2031

Table 96: South America Industrial Aerators Market Volume (Thousand Units) Projection By Country 2017-2031

List of Figures

Figure 1: Global Industrial Aerators Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 2: Global Industrial Aerators Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 3: Global Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 4: Global Industrial Aerators Market Value (US$ Bn) Projection, By Material 2017-2031

Figure 5: Global Industrial Aerators Market Volume (Thousand Units) Projection, By Material 2017-2031

Figure 6: Global Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Material 2023-2031

Figure 7: Global Industrial Aerators Market Value (US$ Bn) Projection, By Automation 2017-2031

Figure 8: Global Industrial Aerators Market Volume (Thousand Units) Projection, By Automation 2017-2031

Figure 9: Global Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Automation 2023-2031

Figure 10: Global Industrial Aerators Market Value (US$ Bn) Projection, By Operation 2017-2031

Figure 11: Global Industrial Aerators Market Volume (Thousand Units) Projection, By Operation 2017-2031

Figure 12: Global Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Operation 2023-2031

Figure 13: Global Industrial Aerators Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 14: Global Industrial Aerators Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 15: Global Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 19: Global Industrial Aerators Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 20: Global Industrial Aerators Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 21: Global Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 22: Global Industrial Aerators Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 23: Global Industrial Aerators Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 24: Global Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2023-2031

Figure 25: North America Industrial Aerators Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 26: North America Industrial Aerators Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 27: North America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 28: North America Industrial Aerators Market Value (US$ Bn) Projection, By Material 2017-2031

Figure 29: North America Industrial Aerators Market Volume (Thousand Units) Projection, By Material 2017-2031

Figure 30: North America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Material 2023-2031

Figure 31: North America Industrial Aerators Market Value (US$ Bn) Projection, By Automation 2017-2031

Figure 32: North America Industrial Aerators Market Volume (Thousand Units) Projection, By Automation 2017-2031

Figure 33: North America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Automation 2023-2031

Figure 34: North America Industrial Aerators Market Value (US$ Bn) Projection, By Operation 2017-2031

Figure 35: North America Industrial Aerators Market Volume (Thousand Units) Projection, By Operation 2017-2031

Figure 36: North America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Operation 2023-2031

Figure 37: North America Industrial Aerators Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 38: North America Industrial Aerators Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 39: North America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 43: Global Industrial Aerators Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 44: Global Industrial Aerators Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 45: Global Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 46: North America Industrial Aerators Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 47: North America Industrial Aerators Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 48: North America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 49: Europe Industrial Aerators Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 50: Europe Industrial Aerators Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 51: Europe Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 52: Europe Industrial Aerators Market Value (US$ Bn) Projection, By Material 2017-2031

Figure 53: Europe Industrial Aerators Market Volume (Thousand Units) Projection, By Material 2017-2031

Figure 54: Europe Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Material 2023-2031

Figure 55: Europe Industrial Aerators Market Value (US$ Bn) Projection, By Automation 2017-2031

Figure 56: Europe Industrial Aerators Market Volume (Thousand Units) Projection, By Automation 2017-2031

Figure 57: Europe Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Automation 2023-2031

Figure 58: Europe Industrial Aerators Market Value (US$ Bn) Projection, By Operation 2017-2031

Figure 59: Europe Industrial Aerators Market Volume (Thousand Units) Projection, By Operation 2017-2031

Figure 60: Europe Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Operation 2023-2031

Figure 61: Europe Industrial Aerators Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 62: Europe Industrial Aerators Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 63: Europe Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 67: Europe Industrial Aerators Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 68: Europe Industrial Aerators Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 69: Europe Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 70: Europe Industrial Aerators Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 71: Europe Industrial Aerators Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 72: Europe Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 73: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 74: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 75: Asia Pacific Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 76: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection, By Material 2017-2031

Figure 77: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection, By Material 2017-2031

Figure 78: Asia Pacific Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Material 2023-2031

Figure 79: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection, By Automation 2017-2031

Figure 80: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection, By Automation 2017-2031

Figure 81: Asia Pacific Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Automation 2023-2031

Figure 82: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection, By Operation 2017-2031

Figure 83: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection, By Operation 2017-2031

Figure 84: Asia Pacific Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Operation 2023-2031

Figure 85: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 86: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 87: Asia Pacific Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 91: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 92: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 93: Asia Pacific Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 94: Asia Pacific Industrial Aerators Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 95: Asia Pacific Industrial Aerators Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 96: Asia Pacific Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 97: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 98: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 99: Middle East & Africa Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 100: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection, By Material 2017-2031

Figure 101: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection, By Material 2017-2031

Figure 102: Middle East & Africa Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Material 2023-2031

Figure 103: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection, By Automation 2017-2031

Figure 104: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection, By Automation 2017-2031

Figure 105: Middle East & Africa Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Automation 2023-2031

Figure 106: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection, By Operation 2017-2031

Figure 107: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection, By Operation 2017-2031

Figure 108: Middle East & Africa Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Operation 2023-2031

Figure 109: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 110: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 111: Middle East & Africa Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 115: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 116: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 117: Middle East & Africa Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 118: Middle East & Africa Industrial Aerators Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 119: Middle East & Africa Industrial Aerators Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 120: Middle East & Africa Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 121: South America Industrial Aerators Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 122: South America Industrial Aerators Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 123: South America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 124: South America Industrial Aerators Market Value (US$ Bn) Projection, By Material 2017-2031

Figure 125: South America Industrial Aerators Market Volume (Thousand Units) Projection, By Material 2017-2031

Figure 126: South America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Material 2023-2031

Figure 127: South America Industrial Aerators Market Value (US$ Bn) Projection, By Automation 2017-2031

Figure 128: South America Industrial Aerators Market Volume (Thousand Units) Projection, By Automation 2017-2031

Figure 129: South America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Automation 2023-2031

Figure 130: South America Industrial Aerators Market Value (US$ Bn) Projection, By Operation 2017-2031

Figure 131: South America Industrial Aerators Market Volume (Thousand Units) Projection, By Operation 2017-2031

Figure 132: South America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Operation 2023-2031

Figure 133: South America Industrial Aerators Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 134: South America Industrial Aerators Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 135: South America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2023-2031

Figure 139: South America Industrial Aerators Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 140: South America Industrial Aerators Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 141: South America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 142: South America Industrial Aerators Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 143: South America Industrial Aerators Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 144: South America Industrial Aerators Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031