Reports

Reports

Analysts’ Viewpoint on Market Scenario

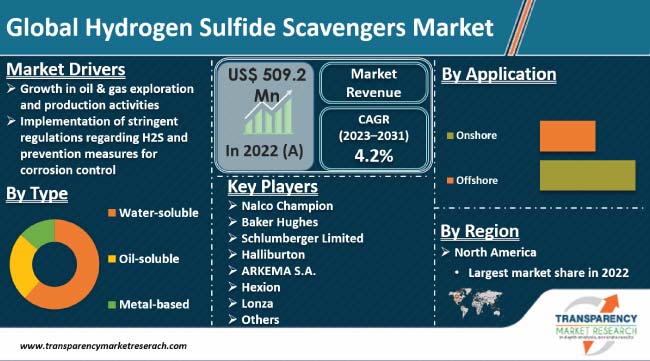

Growth in oil & gas exploration and production activities is expected to propel the global hydrogen sulfide scavengers market during the forecast period. Implementation of stringent regulations regarding H₂S and prevention measures for corrosion control are also likely to fuel market expansion in the near future.

Hydrogen sulfide gas poses significant health and safety risks to workers and can cause severe environmental damage if released into the atmosphere. Therefore, vendors in the global hydrogen sulfide scavengers industry are increasingly focusing on the development of efficient and cost-effective H₂S scavengers to meet the industry's safety and environmental standards. These innovations aim to enhance the scavenger's efficiency, reduce its environmental impact, and optimize its cost-effectiveness. Manufacturers are also focusing on the development of customized solutions to increase their hydrogen sulfide scavengers market share.

Hydrogen sulfide scavenger market refers to the industry that deals with the production and distribution of chemicals used to remove or neutralize hydrogen sulfide gas. H₂S scavengers are widely employed in various industries, including oil & gas, wastewater treatment, pulp and paper, and mining, to prevent the release of H₂S gas, which is toxic and corrosive.

Demand for H₂S scavengers is steadily growing worldwide due to expansion in various industries such as oil & gas. Advancements in chemical engineering and the development of new technologies are leading to the introduction of more efficient and specialized H₂S scavenger formulations. These advancements help improve the effectiveness of H₂S removal, reduce operating costs, and extend the lifespan of equipment used in H₂S removal processes.

Demand for effective H₂S scavengers is increasing due to expansion in exploration and production activities worldwide. Scavengers are needed to mitigate the H₂S content in crude oil, natural gas, and other hydrocarbon streams to ensure safety, protect equipment integrity, and comply with environmental regulations.

Facilities that process or store hydrocarbons containing H₂S face several operational challenges. Two such considerations are the contamination of intermediates and finished products with H₂S and the effects of H₂S -induced corrosion on terminal facilities. Contamination of hydrocarbon products with H₂S can cause products to be off-specification and cause corrosion in storage tanks. This, in turn, boosts the demand for efficient hydrogen sulfide removal, thereby fueling the hydrogen sulfide scavengers market.

Depending on specific local and national regulations, penalties and fines can result from exceeding H₂S emissions standards. Off-spec products can lead to difficulties in meeting customer commitments and in the accumulation of unsalable inventory in terms of an operational point of view. H₂S is highly corrosive and it can degrade both process and storage equipment, potentially reducing throughput and increasing the difficulty and cost. Thus, implementation of stringent regulations regarding H₂S and prevention measures for corrosion control are likely to spur the hydrogen sulfide scavengers market growth in the next few years.

According to the latest hydrogen sulfide scavengers market trends, the water-soluble type segment is expected to dominate the industry during the forecast period. H₂S scavengers that are water-soluble have an inherent advantage in aqueous systems, such as water treatment plants and wastewater treatment facilities. These scavengers can easily mix and dissolve in water, allowing for effective H₂S removal in such systems. Water-soluble scavengers can react with H₂S gas when it comes into contact with water, neutralizing it and preventing its release into the environment.

The water-soluble H₂S scavengers find extensive applications across various industries, including oil & gas, wastewater treatment, and pulp & paper. In these industries, H₂S gas is often encountered in water-based processes or systems. Water-soluble scavengers can be added directly to the water stream or incorporated into water treatment systems, making them versatile and suitable for a wide range of applications.

The hydrogen sulfide scavengers market exhibits regional variations in terms of demand, consumption, and market dynamics. North America and Europe have traditionally been significant markets for H₂S scavengers due to well-established oil & gas industry. However, emerging economies in Asia Pacific, such as China and India, are witnessing rapid industrial growth and are expected to contribute significantly to market demand.

According to the latest hydrogen sulfide scavengers market forecast, North America is expected to hold largest share from 2023 to 2031. Presence of a well-developed and mature oil & gas industry, particularly in the U.S. and Canada, is fueling market dynamics in the region. H₂S is often encountered during oil & gas exploration, production, and refining processes. Consequently, there is a significant demand for H₂S scavengers to remove or neutralize H₂S gas, ensuring worker safety and preventing environmental pollution.

North America has a robust regulatory framework that imposes strict environmental and safety regulations on industries. Regulatory bodies such as the Environmental Protection Agency (EPA) in the U.S. and the Canadian Environmental Protection Act (CEPA) in Canada enforce regulations related to H₂S emissions. This regulatory environment necessitates the use of H₂S scavengers to ensure compliance, thereby boosting market statistics in the region.

The global industry consists of several small to medium-sized vendors that compete with each other and large enterprises. Most businesses are investing significantly in research & development activities, leading to the successive early adoption of next-generation technologies and the creation of new products.

Nalco Champion, Baker Hughes, Schlumberger Limited, Halliburton, ARKEMA S.A., Hexion, Lonza, SUEZ, Dorf Ketal, Chemical Products Industries Inc., ChemTreat, Inc., NuGenTec, and Merichem Company are key entities operating in this industry.

Key players in the hydrogen sulfide scavengers market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 509.2 Mn |

|

Market Forecast Value in 2031 |

US$ 734.8 Mn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2022 |

|

Quantitative Units |

US$ Mn for Value and Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 509.2 Mn in 2022

It is projected to grow at a CAGR of 4.2% from 2023 to 2031

Growth in oil & gas exploration and production activities and stringent regulations regarding H2S and prevention measures for corrosion control

Water-soluble was the largest type segment in 2022

North America recorded the highest demand in 2022

Nalco Champion, Baker Hughes, Schlumberger Limited, Halliburton, ARKEMA S.A., Hexion, Lonza, SUEZ, Dorf Ketal, Chemical Products Industries Inc., ChemTreat, Inc., NuGenTec, and Merichem Company

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Hydrogen Sulfide Scavengers Market Analysis and Forecast, 2023-2031

2.6.1. Global Hydrogen Sulfide Scavengers Market Volume (Tons)

2.6.2. Global Hydrogen Sulfide Scavengers Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.11.1. Cost Structure Analysis

3. Economic Recovery Post COVID-19 Impact

3.1. Impact on Supply Chain of Hydrogen Sulfide Scavengers

3.2. Impact on Demand for Hydrogen Sulfide Scavengers- Pre & Post Crisis

4. Impact of Current Geopolitical Scenario

5. Production Output Analysis (Tons), by Region, 2023

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Type

6.2. Price Comparison Analysis by Region

7. Global Hydrogen Sulfide Scavengers Market Analysis and Forecast, by Type, 2023-2031

7.1. Introduction and Definitions

7.2. Global Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

7.2.1. Water-soluble

7.2.2. Oil-soluble

7.2.3. Metal-based

7.3. Global Hydrogen Sulfide Scavengers Market Attractiveness, by Type

8. Global Hydrogen Sulfide Scavengers Market Analysis and Forecast, by Process, 2023-2031

8.1. Introduction and Definitions

8.2. Global Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

8.2.1. Regenerative

8.2.1.1. Monoethanolamine (MEA)

8.2.1.2. Diethanolamine (DEA)

8.2.1.3. N-methyldiethanolamine (MDEA)

8.2.1.4. Diisopropylamine

8.2.1.5. Diglycolamine (DGA)

8.2.2. Non-regenerative

8.2.2.1. Triazine

8.2.2.2. Solid Scavengers

8.2.2.3. Oxidizing Chemicals

8.2.2.4. Aldehydes

8.2.2.5. Metal Carboxylates

8.2.2.6. Chelates

8.3. Global Hydrogen Sulfide Scavengers Market Attractiveness, by Process

9. Global Hydrogen Sulfide Scavengers Market Analysis and Forecast, by Application, 2023-2031

9.1. Introduction and Definitions

9.2. Global Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

9.2.1. Onshore

9.2.2. Offshore

9.3. Global Hydrogen Sulfide Scavengers Market Attractiveness, by Application

10. Global Hydrogen Sulfide Scavengers Market Analysis and Forecast, by Region, 2023-2031

10.1. Key Findings

10.2. Global Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2023-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. Latin America

10.3. Global Hydrogen Sulfide Scavengers Market Attractiveness, by Region

11. North America Hydrogen Sulfide Scavengers Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. North America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.3. North America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

11.4. North America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.5. North America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2023-2031

11.5.1. U.S. Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.5.2. U.S. Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

11.5.3. U.S. Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.5.4. Canada Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.5.5. Canada Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

11.5.6. Canada Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.6. North America Hydrogen Sulfide Scavengers Market Attractiveness Analysis

12. Europe Hydrogen Sulfide Scavengers Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Europe Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.3. Europe Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

12.4. Europe Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.5. Europe Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

12.5.1. Germany Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.5.2. Germany Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

12.5.3. Germany Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.5.4. France Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.5.5. France Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

12.5.6. France Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.5.7. U.K. Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.5.8. U.K. Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

12.5.9. U.K. Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.5.10. Italy Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.5.11. Italy. Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

12.5.12. Italy Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.5.13. Russia & CIS Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.5.14. Russia & CIS Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

12.5.15. Russia & CIS Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.5.16. Rest of Europe Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.5.17. Rest of Europe Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

12.5.18. Rest of Europe Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.6. Europe Hydrogen Sulfide Scavengers Market Attractiveness Analysis

13. Asia Pacific Hydrogen Sulfide Scavengers Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type

13.3. Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

13.4. Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.5. Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

13.5.1. China Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.5.2. China Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

13.5.3. China Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.5.4. Japan Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.5.5. Japan Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

13.5.6. Japan Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.5.7. India Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.5.8. India Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

13.5.9. India Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.5.10. ASEAN Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.5.11. ASEAN Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

13.5.12. ASEAN Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.5.13. Rest of Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.5.14. Rest of Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

13.5.15. Rest of Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.6. Asia Pacific Hydrogen Sulfide Scavengers Market Attractiveness Analysis

14. Latin America Hydrogen Sulfide Scavengers Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.3. Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

14.4. Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.5. Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

14.5.1. Brazil Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.5.2. Brazil Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

14.5.3. Brazil Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.5.4. Mexico Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.5.5. Mexico Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

14.5.6. Mexico Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.5.7. Rest of Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.5.8. Rest of Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

14.5.9. Rest of Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.6. Latin America Hydrogen Sulfide Scavengers Market Attractiveness Analysis

15. Middle East & Africa Hydrogen Sulfide Scavengers Market Analysis and Forecast, 2023-2031

15.1. Key Findings

15.2. Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

15.3. Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

15.4. Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

15.5. Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

15.5.1. GCC Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

15.5.2. GCC Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

15.5.3. GCC Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

15.5.4. South Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

15.5.5. South Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

15.5.6. South Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

15.5.7. Rest of Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

15.5.8. Rest of Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2023-2031

15.5.9. Rest of Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

15.6. Middle East & Africa Hydrogen Sulfide Scavengers Market Attractiveness Analysis

16. Competition Landscape

16.1. Market Players - Competition Matrix (by Tier and Size of Companies)

16.2. Market Share Analysis, 2022

16.3. Market Footprint Analysis

16.3.1. By Type

16.3.2. By Application

16.4. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

16.4.1. Nalco Champion

16.4.1.1. Company Revenue

16.4.1.2. Business Overview

16.4.1.3. Product Segments

16.4.1.4. Geographic Footprint

16.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.2. Baker Hughes

16.4.2.1. Company Revenue

16.4.2.2. Business Overview

16.4.2.3. Product Segments

16.4.2.4. Geographic Footprint

16.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.3. Schlumberger Limited

16.4.3.1. Company Revenue

16.4.3.2. Business Overview

16.4.3.3. Product Segments

16.4.3.4. Geographic Footprint

16.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.4. Halliburton

16.4.4.1. Company Revenue

16.4.4.2. Business Overview

16.4.4.3. Product Segments

16.4.4.4. Geographic Footprint

16.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.5. ARKEMA S.A.

16.4.5.1. Company Revenue

16.4.5.2. Business Overview

16.4.5.3. Product Segments

16.4.5.4. Geographic Footprint

16.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.6. Hexion

16.4.6.1. Company Revenue

16.4.6.2. Business Overview

16.4.6.3. Product Segments

16.4.6.4. Geographic Footprint

16.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.7. Lonza

16.4.7.1. Company Revenue

16.4.7.2. Business Overview

16.4.7.3. Product Segments

16.4.7.4. Geographic Footprint

16.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.8. SUEZ

16.4.8.1. Company Revenue

16.4.8.2. Business Overview

16.4.8.3. Product Segments

16.4.8.4. Geographic Footprint

16.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.9. Dorf Ketal

16.4.9.1. Company Revenue

16.4.9.2. Business Overview

16.4.9.3. Product Segments

16.4.9.4. Geographic Footprint

16.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.10. Chemical Products Industries Inc.

16.4.10.1. Company Revenue

16.4.10.2. Business Overview

16.4.10.3. Product Segments

16.4.10.4. Geographic Footprint

16.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.11. ChemTreat, Inc.

16.4.11.1. Company Revenue

16.4.11.2. Business Overview

16.4.11.3. Product Segments

16.4.11.4. Geographic Footprint

16.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.12. NuGenTec

16.4.12.1. Company Revenue

16.4.12.2. Business Overview

16.4.12.3. Product Segments

16.4.12.4. Geographic Footprint

16.4.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.13. Merichem Company

16.4.13.1. Company Revenue

16.4.13.2. Business Overview

16.4.13.3. Product Segments

16.4.13.4. Geographic Footprint

16.4.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17. Primary Research: Key Insights

18. Appendix

List of Tables

Table 1: Global Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 2: Global Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 3: Global Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 4: Global Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 5: Global Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 6: Global Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 7: Global Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Region, 2023-2031

Table 8: Global Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 9: North America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 10: North America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 11: North America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 12: North America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 13: North America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 14: North America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 15: North America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Country, 2023-2031

Table 16: North America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 17: U.S. Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 18: U.S. Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 19: U.S. Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 20: U.S. Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 21: U.S. Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 22: U.S. Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 23: Canada Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 24: Canada Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 25: Canada Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 26: Canada Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 27: Canada Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 28: Canada Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 29: Europe Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 30: Europe Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 31: Europe Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 32: Europe Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 33: Europe Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 34: Europe Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 35: Europe Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 36: Europe Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 37: Germany Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 38: Germany Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 39: Germany Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 40: Germany Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 41: Germany Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 42: Germany Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 43: France Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 44: France Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 45: France Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 46: France Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 47: France Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 48: France Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 49: U.K. Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 50: U.K. Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 51: U.K. Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 52: U.K. Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 53: U.K. Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 54: U.K. Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 55: Italy Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 56: Italy Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 57: Italy Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 58: Italy Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 59: Italy Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 60: Italy Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 61: Spain Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 62: Spain Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 63: Spain Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 64: Spain Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 65: Spain Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 66: Spain Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 67: Russia & CIS Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 68: Russia & CIS Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 69: Russia & CIS Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 70: Russia & CIS Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 71: Russia & CIS Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 72: Russia & CIS Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 73: Rest of Europe Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 74: Rest of Europe Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 75: Rest of Europe Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 76: Rest of Europe Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 77: Rest of Europe Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 78: Rest of Europe Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 79: Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 80: Asia Pacific Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 81: Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 82: Asia Pacific Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 83: Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 84: Asia Pacific Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 85: Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 86: Asia Pacific Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 87: China Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 88: China Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type 2023-2031

Table 89: China Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 90: China Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 91: China Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 92: China Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 93: Japan Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 94: Japan Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 95: Japan Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 96: Japan Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 97: Japan Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 98: Japan Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 99: India Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 100: India Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 101: India Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 102: India Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 103: India Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 104: India Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 105: India Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 106: India Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 107: ASEAN Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 108: ASEAN Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 109: ASEAN Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 110: ASEAN Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 111: ASEAN Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 112: ASEAN Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 113: Rest of Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 114: Rest of Asia Pacific Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 115: Rest of Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 116: Rest of Asia Pacific Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 117: Rest of Asia Pacific Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 118: Rest of Asia Pacific Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 119: Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 120: Latin America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 121: Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 122: Latin America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 123: Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 124: Latin America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 125: Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 126: Latin America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 127: Brazil Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 128: Brazil Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 129: Brazil Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 130: Brazil Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 131: Brazil Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 132: Brazil Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 133: Mexico Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 134: Mexico Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 135: Mexico Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 136: Mexico Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 137: Mexico Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 138: Mexico Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 139: Rest of Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 140: Rest of Latin America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 141: Rest of Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 142: Rest of Latin America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 143: Rest of Latin America Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 144: Rest of Latin America Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 145: Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 146: Middle East & Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 147: Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 148: Middle East & Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 149: Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 150: Middle East & Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 151: Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 152: Middle East & Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 153: GCC Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 154: GCC Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 155: GCC Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 156: GCC Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 157: GCC Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 158: GCC Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 159: South Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 160: South Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 161: South Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 162: South Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 163: South Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 164: South Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 165: Rest of Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 166: Rest of Middle East & Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 167: Rest of Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Process, 2023-2031

Table 168: Rest of Middle East & Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Process, 2023-2031

Table 169: Rest of Middle East & Africa Hydrogen Sulfide Scavengers Market Volume (Tons) Forecast, by Application, 2023-2031

Table 170: Rest of Middle East & Africa Hydrogen Sulfide Scavengers Market Value (US$ Mn) Forecast, by Application, 2023-2031

List of Figures

Figure 1: Global Hydrogen Sulfide Scavengers Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: Global Hydrogen Sulfide Scavengers Market Attractiveness, by Type

Figure 3: Global Hydrogen Sulfide Scavengers Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 4: Global Hydrogen Sulfide Scavengers Market Attractiveness, by Process

Figure 5: Global Hydrogen Sulfide Scavengers Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 6: Global Hydrogen Sulfide Scavengers Market Attractiveness, by Application

Figure 7: Global Hydrogen Sulfide Scavengers Market Value Share Analysis, by Region, 2022, 2027, and 2031

Figure 8: Global Hydrogen Sulfide Scavengers Market Attractiveness, by Region

Figure 9: North America Hydrogen Sulfide Scavengers Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 10: North America Hydrogen Sulfide Scavengers Market Attractiveness, by Type

Figure 11: North America Hydrogen Sulfide Scavengers Market Attractiveness, by Type

Figure 12: North America Hydrogen Sulfide Scavengers Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 13: North America Hydrogen Sulfide Scavengers Market Attractiveness, by Process

Figure 14: North America Hydrogen Sulfide Scavengers Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 15: North America Hydrogen Sulfide Scavengers Market Attractiveness, by Application

Figure 16: North America Hydrogen Sulfide Scavengers Market Attractiveness, by Country

Figure 17: Europe Hydrogen Sulfide Scavengers Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 18: Europe Hydrogen Sulfide Scavengers Market Attractiveness, by Type

Figure 19: Europe Hydrogen Sulfide Scavengers Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 20: Europe Hydrogen Sulfide Scavengers Market Attractiveness, by Process

Figure 21: Europe Hydrogen Sulfide Scavengers Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Europe Hydrogen Sulfide Scavengers Market Attractiveness, by Application

Figure 23: Europe Hydrogen Sulfide Scavengers Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Europe Hydrogen Sulfide Scavengers Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Hydrogen Sulfide Scavengers Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 26: Asia Pacific Hydrogen Sulfide Scavengers Market Attractiveness, by Type

Figure 27: Asia Pacific Hydrogen Sulfide Scavengers Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 28: Asia Pacific Hydrogen Sulfide Scavengers Market Attractiveness, by Process

Figure 29: Asia Pacific Hydrogen Sulfide Scavengers Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 30: Asia Pacific Hydrogen Sulfide Scavengers Market Attractiveness, by Application

Figure 31: Asia Pacific Hydrogen Sulfide Scavengers Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 32: Asia Pacific Hydrogen Sulfide Scavengers Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Hydrogen Sulfide Scavengers Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 34: Latin America Hydrogen Sulfide Scavengers Market Attractiveness, by Type

Figure 35: Latin America Hydrogen Sulfide Scavengers Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 36: Latin America Hydrogen Sulfide Scavengers Market Attractiveness, by Process

Figure 37: Latin America Hydrogen Sulfide Scavengers Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 38: Latin America Hydrogen Sulfide Scavengers Market Attractiveness, by Application

Figure 39: Latin America Hydrogen Sulfide Scavengers Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 40: Latin America Hydrogen Sulfide Scavengers Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Hydrogen Sulfide Scavengers Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 42: Middle East & Africa Hydrogen Sulfide Scavengers Market Attractiveness, by Type

Figure 43: Middle East & Africa Hydrogen Sulfide Scavengers Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 44: Middle East & Africa Hydrogen Sulfide Scavengers Market Attractiveness, by Process

Figure 45: Middle East & Africa Hydrogen Sulfide Scavengers Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 46: Middle East & Africa Hydrogen Sulfide Scavengers Market Attractiveness, by Application

Figure 47: Middle East & Africa Hydrogen Sulfide Scavengers Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 48: Middle East & Africa Hydrogen Sulfide Scavengers Market Attractiveness, by Country and Sub-region