Reports

Reports

Analysts’ Viewpoint on Market Scenario

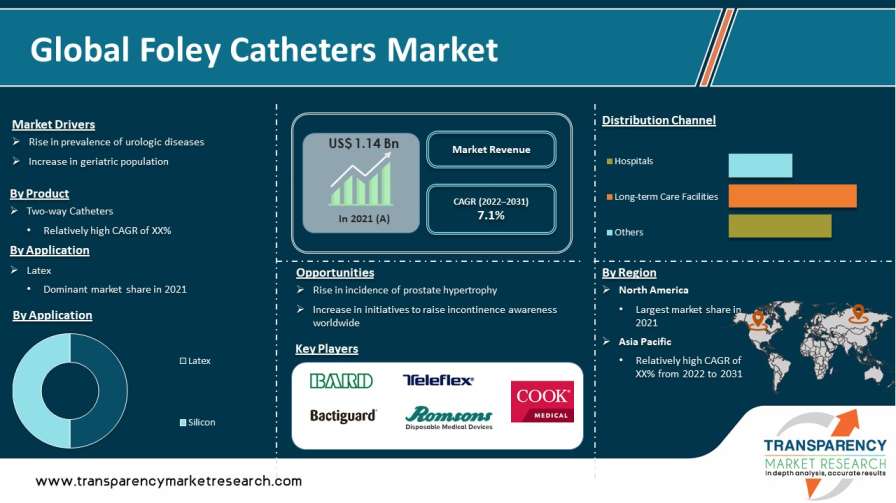

Increase in number of surgeries; rise in prevalence of diseases such as urinary incontinence, benign prostatic hyperplasia (BPH), and kidney stones; favorable reimbursement policies; and recent advancements in the production of Foley catheters are the major drivers of the global Foley catheters market. Furthermore, key players are constantly striving to develop innovative products, such as biocompatible urinary catheters, with strong focus on patient needs. Latex and silicone are the preferred materials for the manufacture of Foley catheters, which are recommended to patients susceptible to infections and allergic reactions. High prevalence of urinary incontinence is anticipated to provide lucrative opportunities to players in the global market for urinary catheters. Additionally, increase in urinary surgical procedures and number of bladder catheterization procedures in hospitals are expected to drive Foley catheter sales in emerging economies in the next few years.

A Foley catheter is a flexible tube that a urologist passes through the urethra and into the bladder to drain urine. It is a commonly used type of urinary catheter. The tube has two distinct channels or lumens that run the length of it.

An indwelling urinary catheter is inserted similarly to an intermittent catheter, but it is left in place. A water-filled balloon holds the catheter in place in the bladder, preventing it from falling out. Urine is drained through a tube connected to a collection catheter bag that can be strapped to the inside of the leg or attached to a floor stand. A valve is sometimes attached to indwelling catheters. The valve can be opened to drain urine into a toilet and closed to fill the bladder with urine until drainage is convenient. Most indwelling catheters must be changed at least once every three months.

Typically, a nurse inserts an indwelling catheter into the bladder via the urethra. Occasionally, the catheter is inserted into the bladder through a tiny hole in the abdomen. A suprapubic catheter is a type of indwelling catheter. A tiny balloon at the end of the catheter is inflated with water to keep the tube from sliding out of the body. The balloon can be deflated when the catheter needs to be removed.

The primary disadvantage of using a catheter is that it allows bacteria into the body and causes infection. According to the Centers for Disease Control and Prevention (CDC), urinary catheters are responsible for around 75% of UTIs acquired in the hospital. When using an indwelling catheter, the risk of infection is the greatest.

Urologic diseases, disorders, and conditions affect people of all ages; incur significant healthcare costs; and can result in substantial disability and reduced quality of life. Urinary tract infections, kidney stones, urinary incontinence, and benign prostatic hyperplasia are examples of non-cancerous (benign) urologic health issues (an enlarged prostate).

Urinary incontinence can be caused by weak muscles in the pelvis or around the urethra as well as nervous system disorders. Urinary retention can be caused by nervous system abnormalities, prostate enlargement, or urethral kinking. Other conditions, such as high blood pressure or diabetes (a chronic disease that affects the body's ability to use sugar for energy), can cause kidney disease.

Nerve-related bladder dysfunction caused by neurological disorders, such as multiple sclerosis, cerebral palsy, spinal trauma, and stroke, necessitates the usage of Foley catheters for urinary drainage. Thus, an increase in the number of target urinary diseases is expected to drive the demand for indwelling catheters. In turn, this is likely to augment the global Foley catheter market in the next few years.

In terms of product, the two-way catheters segment accounted for the largest global Foley catheters market share in 2021. Two-way Foley catheters are indwelling urinary catheters used to empty the bladder when a person is unable to do so independently. Two-way Foley catheters, which have two channels enclosed in a single flexible tube, are inserted through the urethra and held in place by a small balloon inflated with a sterile solution. To keep the catheter in place, the catheter is inserted into the bladder through the urethra and the balloon is inflated with sterile water. The other port is connected to either a drainage bag or a lever tap, which is opened when the bladder needs to be emptied.

Two-way Foley catheters are long-term, flexible indwelling catheters that help drain urine from one lumen and have an inflatable balloon at the other end to keep the catheter in place. The two-way catheters segment is expected to grow at a rapid pace in the next few years owing to the increase in demand for these catheters for bladder drainage in patients with urinary retention.

Based on material, the latex segment held a significant global Foley catheters market share in 2021. Pure latex catheters are not expensive. They offer improved patient safety with a lower risk of encrustation and irritation due to the presence of hydrogel, silicone, and Teflon coatings on these catheters which makes them soft, lubricious, dependable, and highly flexible. Demand for coated latex catheters is expected to rise in the near future due to their capacity to reduce bacterial adherence and encrustation.

Silicone catheter is non-allergenic and effective for people with sensitive skin. Allergies to silicone do exist, but they are much more uncommon than latex allergies. Additionally, silicone could be softer, and thus preferable for those who feel pain during clean intermittent self-catheterization. The global Foley catheter market trends indicate a rise in demand for silicon-based Foley catheters in the next few years.

In terms of end-user, the hospital segment is projected to account for a major share of the global Foley catheters market during the forecast period. The segment is anticipated to be driven by the increase in the geriatric population and the rise in the number of surgeries that result in high demand for indwelling catheters in hospitals.

According to the Centers for Disease Control and Prevention, a urinary catheter, a tube that is inserted into the bladder through the urethra to drain urine, is linked to roughly 75% of UTIs that occur in hospitals. Urinary catheters are provided to 15%–25% of hospitalized patients during their stay. The market is anticipated to grow at a rapid pace due to the high demand for Foley catheters in hospitals following urologic procedures.

North America accounted for the largest share of the global Foley catheter market in 2021. The region is projected to be a highly lucrative market during the forecast period. The market in North America is anticipated to be driven by the rise in the prevalence of urologic diseases such as urinary retention and prostate hypertrophy and an increase in the geriatric population during the forecast period. According to the American Academy of Family Physicians (AAFP), the incidence of urinary retention ranges from 4.5 to 6.8 per 1,000 men per year in the U.S. Surge in urological surgeries performed in the country has augmented the demand for Foley catheters. More than 250,000 surgical procedures for benign prostatic hyperplasia (BPH) are carried out annually in the U.S., resulting in 2 million office visits. This is likely to propel the demand for Foley catheters in the country in the next few years.

The global Foley catheter market is consolidated, with the presence of a small number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the leading players in the global Foley catheters business. Medtronic Plc, Boston Scientific Corp., BD (C.R. Bard, Inc.), Cook Medical, ConvaTec, Inc., Teleflex, Inc., Coloplast, B. Braun Melsungen AG, Medline Industries, Inc., and J and M Urinary Catheters LLC are the prominent players operating in the global market for Foley catheters.

Each of these players has been profiled in the Foley catheters market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.14 Bn |

|

Market Forecast Value in 2031 |

More than US$ 2.2 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional-level analysis. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market for Foley catheters was valued at US$ 1.14 Bn in 2021

The global market for Foley catheters is projected to reach more than US$ 2.2 Bn by 2031

The global market is anticipated to expand at a CAGR of 7.1% from 2022 to 2031

The rise in the prevalence of urologic diseases is driving the global market for Foley catheters.

North America is expected to account for a major share of the global market during the forecast period

Coloplast Corp., C.R. Bard (Becton, Dickinson & Company), Teleflex Incorporated, Bactiguard, Cardinal Health, Inc., Cook, SunMed, and Medline Industries

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Foley Catheters Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Foley Catheters Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pricing Analysis

5.2. Key Industry Events (mergers, acquisitions, collaborations, approvals, etc.)

5.3. COVID-19 Impact Analysis

5.4. Regulatory Scenario

6. Global Foley Catheters Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Two-way Catheters

6.3.2. Three-way Catheters

6.3.3. Four-way Catheters

6.4. Market Attractiveness Analysis, by Product

7. Global Foley Catheters Market Analysis and Forecast, by Material

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Material, 2017–2031

7.3.1. Latex

7.3.2. Silicone

7.4. Market Attractiveness Analysis, by Material

8. Global Foley Catheters Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Long-term Care Facilities

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Foley Catheters Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Foley Catheters Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Two-way Catheters

10.2.2. Three-way Catheters

10.2.3. Four-way Catheters

10.3. Market Value Forecast, by Material, 2017–2031

10.3.1. Latex

10.3.2. Silicone

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Long-term Care Facilities

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Material

10.6.3. By End-user

10.6.4. By Country

11. Europe Foley Catheters Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Two-way Catheters

11.2.2. Three-way Catheters

11.2.3. Four-way Catheters

11.3. Market Value Forecast, by Material, 2017–2031

11.3.1. Latex

11.3.2. Silicone

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Long-term Care Facilities

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Material

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Foley Catheters Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Two-way Catheters

12.2.2. Three-way Catheters

12.2.3. Four-way Catheters

12.3. Market Value Forecast, by Material, 2017–2031

12.3.1. Latex

12.3.2. Silicone

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Long-term Care Facilities

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Material

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Foley Catheters Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Two-way Catheters

13.2.2. Three-way Catheters

13.2.3. Four-way Catheters

13.3. Market Value Forecast, by Material, 2017–2031

13.3.1. Latex

13.3.2. Silicone

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospital

13.4.2. Long-term Care Facilities

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Material

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Foley Catheters Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Two-way Catheters

14.2.2. Three-way Catheters

14.2.3. Four-way Catheters

14.3. Market Value Forecast, by Material, 2017–2031

14.3.1. Latex

14.3.2. Silicone

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Long-term Care Facilities

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Material

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. C. R. Bard (Becton, Dickinson & Company)

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Cardinal Health, Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. B. Braun Melsungen AG

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Teleflex Incorporated

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Coloplast Corp.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Bactiguard

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Cook Medical

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Medline Industries

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. SunMed

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. J and M Urinary Catheters LLC

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. ConvaTec, Inc.

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. Medtronic PLC

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

List of Tables

Table 01: Global Foley Catheters Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Foley Catheters Market Size (US$ Mn) Forecast, by Material, 2017–2031

Table 03: Global Foley Catheters Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Foley Catheters Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Foley Catheters Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Foley Catheters Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Foley Catheters Market Size (US$ Mn) Forecast, by Material, 2017–2031

Table 08: North America Foley Catheters Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Foley Catheters Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Foley Catheters Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe Foley Catheters Market Size (US$ Mn) Forecast, by Material, 2017–2031

Table 12: Europe Foley Catheters Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Foley Catheters Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Foley Catheters Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Asia Pacific Foley Catheters Market Size (US$ Mn) Forecast, by Material, 2017–2031

Table 16: Asia Pacific Foley Catheters Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Foley Catheters Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Foley Catheters Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America Foley Catheters Market Size (US$ Mn) Forecast, by Material, 2017–2031

Table 20: Latin America Foley Catheters Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Foley Catheters Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Foley Catheters Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Middle East & Africa Foley Catheters Market Size (US$ Mn) Forecast, by Material, 2017–2031

Table 24: Middle East & Africa Foley Catheters Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Foley Catheters Market Size (US$ Mn) and Distribution (%), by Region, 2018 and 2031

Figure 02: Global Foley Catheters Market Revenue (US$ Mn), by Product, 2021

Figure 03: Global Foley Catheters Market Value Share, by Product, 2021

Figure 04: Global Foley Catheters Market Value Share, by Material, 2021

Figure 05: Global Foley Catheters Market Value Share, by End-user, 2021

Figure 06: Global Foley Catheters Market Value Share, by Region, 2021

Figure 07: Global Foley Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 08: Global Foley Catheters Market Value Share Analysis, by Product, 2017 and 2031

Figure 09: Global Foley Catheters Market Attractiveness Analysis, by Product, 2022-2031

Figure 10: Global Foley Catheters Market Value Share Analysis, by Material, 2017 and 2031

Figure 11: Global Foley Catheters Market Attractiveness Analysis, by Material, 2022-2031

Figure 12: Global Foley Catheters Market Value Share Analysis, by End-user, 2017 and 2031

Figure 13: Global Foley Catheters Market Attractiveness Analysis, by End-user, 2022-2031

Figure 14: Global Foley Catheters Market Value Share Analysis, by Region, 2017 and 2031

Figure 15: Global Foley Catheters Market Attractiveness Analysis, by Region, 2022-2031

Figure 16: North America Foley Catheters Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 17: North America Foley Catheters Market Attractiveness Analysis, by Country, 2017–2031

Figure 18: North America Foley Catheters Market Value Share Analysis, by Country, 2017 and 2031

Figure 19: North America Foley Catheters Market Value Share Analysis, by Product, 2017 and 2031

Figure 20: North America Foley Catheters Market Value Share Analysis, by Material, 2017 and 2031

Figure 21: North America Foley Catheters Market Value Share Analysis, by End-user, 2017 and 2031

Figure 22: North America Foley Catheters Market Attractiveness Analysis, by Product, 2022–2031

Figure 23: North America Foley Catheters Market Attractiveness Analysis, by Material, 2022–2031

Figure 24:North America Foley Catheters Market Attractiveness Analysis, by End-user, 2022–2031

Figure 25: Europe Foley Catheters Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 26: Europe Foley Catheters Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 27: Europe Foley Catheters Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 28: Europe Foley Catheters Market Value Share Analysis, by Product, 2017 and 2031

Figure 29: Europe Foley Catheters Market Value Share Analysis, by Material, 2017 and 2031

Figure 30: Europe Foley Catheters Market Value Share Analysis, by End-user, 2017 and 2031

Figure 31: Europe Foley Catheters Market Attractiveness Analysis, by Product, 2022–2031

Figure 32: Europe Foley Catheters Market Attractiveness Analysis, by Material, 2022–2031

Figure 33: Europe Foley Catheters Market Attractiveness Analysis, by End-user, 2022–2031

Figure 34: Asia Pacific Foley Catheters Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 35: Asia Pacific Foley Catheters Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 36: Asia Pacific Foley Catheters Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 37: Asia Pacific Foley Catheters Market Value Share Analysis, by Product, 2017 and 2031

Figure 38: Asia Pacific Foley Catheters Market Value Share Analysis, by Material, 2017 and 2031

Figure 39: Asia Pacific Foley Catheters Market Value Share Analysis, by End-user, 2017 and 2031

Figure 40: Asia Pacific Foley Catheters Market Attractiveness Analysis, by Product, 2022–2031

Figure 41: Asia Pacific Foley Catheters Market Attractiveness Analysis, by Material, 2022–2031

Figure 42: Asia Pacific Foley Catheters Market Attractiveness Analysis, by End-user, 2022–2031

Figure 43: Latin America Foley Catheters Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 44: Latin America Foley Catheters Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 45: Latin America Foley Catheters Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 46: Latin America Foley Catheters Market Value Share Analysis, by Product, 2017 and 2031

Figure 47: Latin America Foley Catheters Market Value Share Analysis, by Material, 2017 and 2031

Figure 48: Latin America Foley Catheters Market Value Share Analysis, by End-user, 2017 and 2031

Figure 49: Latin America Foley Catheters Market Attractiveness Analysis, by Product, 2022–2031

Figure 50: Latin America Foley Catheters Market Attractiveness Analysis, by Material, 2022–2031

Figure 51: Latin America Foley Catheters Market Attractiveness Analysis, by End-user, 2022–2031

Figure 52: Middle East & Africa Foley Catheters Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 53: Middle East & Africa Foley Catheters Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 54: Middle East & Africa Foley Catheters Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 55: Middle East & Africa Foley Catheters Market Value Share Analysis, by Product, 2017 and 2031

Figure 56: Middle East & Africa Foley Catheters Market Value Share Analysis, by Material, 2017 and 2031

Figure 57: Middle East & Africa Foley Catheters Market Value Share Analysis, by End-user, 2017 and 2031

Figure 58: Middle East & Africa Foley Catheters Market Attractiveness Analysis, by Product, 2022–2031

Figure 59: Middle East & Africa Foley Catheters Market Attractiveness Analysis, by Material, 2022–2031

Figure 60: Middle East & Africa Foley Catheters Market Attractiveness Analysis, by End-user, 2022–2031