Reports

Reports

Continuous Glucose Monitoring (CGM) Market is expanding at a very high rate with the fast-rising prevalence of diabetes and demand for efficient management systems. CGM systems provide accurate, real-time information on blood glucose level so that the patient can take proper action on diet, exercise, and insulin therapy. This not only enhances glycemic control but also reduces the risk of complications of diabetes, hence making it a useful tool for both patients and medical practitioners.

.jpg)

The expansion is further fueled by technology breakthroughs like interoperability between smartphone technology and CGM devices and wearable technology. With such alignment, the tracking of glucose is easy for the users, and data transfer to healthcare providers is made easy, paving the way for remote monitoring and customized treatment programs. More emphasis on preventive care and patient empowerment further drive more users to the use of CGM systems.

In addition, clearance of other CGM technologies by the regulatory bodies is providing market opportunities for entry and introducing competition among manufacturers, which will result in innovation and cost reduction. As more people are aware of the benefits of continuous monitoring and increased improvements in device accuracy and ease of use, the market for CGM will expand tremendously, enhancing diabetes control and patient health.

Continuous glucose monitoring (CGM) is a technology that monitors glucose levels continuously during the day and at night. It is a small sensor inserted under the skin, typically on the abdomen or arm, which monitors glucose levels in the interstitial fluid. Data is transferred wirelessly to a receiver or a smartphone application, giving users constant feedback on their glucose trends. These glucose monitoring allows people with diabetes to better control their diabetes by giving them information on how diet, exercise, medications, and other factors affect their glucose levels.

Compared to the traditional finger stick test, continuous glucose monitoring gives a more comprehensive and dynamic view of glucose levels, enabling immediate adjustments in treatment and reducing the potential for hypoglycemia or hyperglycemia. Modern continuous glucose monitoring systems often include user-programmable alarms, which make them valuable tools for improving glucose control and diabetes care in general.

| Attribute | Detail |

|---|---|

| Continuous Glucose Monitoring Market Drivers |

|

The remote patient monitoring and telemedicine markets have influenced the growth of the Continuous Glucose Monitoring (CGM) market in a big way. As healthcare systems gravitate toward more efficient and convenient healthcare, CGM technology provides real-time glucose monitoring, enabling diabetes patients to take care of their condition at home while still being connected to healthcare professionals.

Telemedicine has also accelerated the uptake of CGM, since these devices are readily integrated into telehealth platforms. Clinicians can remotely monitor glucose levels and provide timely intervention and personalized guidance without physical consultation. This improves patient engagement, enhances treatment adherence, and lowers healthcare costs by enabling better outcomes. The pandemic of COVID-19 also hastened demand for remote care, pushing both providers and patients toward virtual solutions.

CGMs provide real-time glucose data that can be examined within the framework of telehealth visits to enable timely planning of care. As technology evolves, CGMs are also becoming less costly and simpler to use, which makes them more accessible. This convergence of remote monitoring and digital health is revolutionizing diabetes care and driving sustained demand in the continuous glucose monitoring industry.

The Continuous Glucose Monitoring (CGM) market is experiencing rapid growth, largely driven by significant technological advancements. Innovations in sensor technology, data analytics, and connectivity are enhancing the accuracy, responsiveness, and usability of CGM systems. Second-generation CGMs now offer more precise readings, faster response times, and longer-lasting sensors, contributing to improved glucose control and patient outcomes.

Modern CGMs also feature real-time data sharing, integration with wearables and smartphones, and customizable alerts for abnormal readings-empowering users to take immediate action. As artificial intelligence and machine learning evolve, CGM platforms can now offer deeper data insights, enabling better trend analysis and more informed decision-making by both patients and clinicians. The shift toward minimally invasive and user-friendly devices has broadened CGM accessibility and appeal.

Continued innovation is expected to introduce predictive capabilities that forecast glucose fluctuations, allowing for proactive diabetes management.As technology improves, CGMs are becoming more affordable and are increasingly integrated into comprehensive diabetes care solutions-solidifying their role in the future of personalized, digital healthcare.

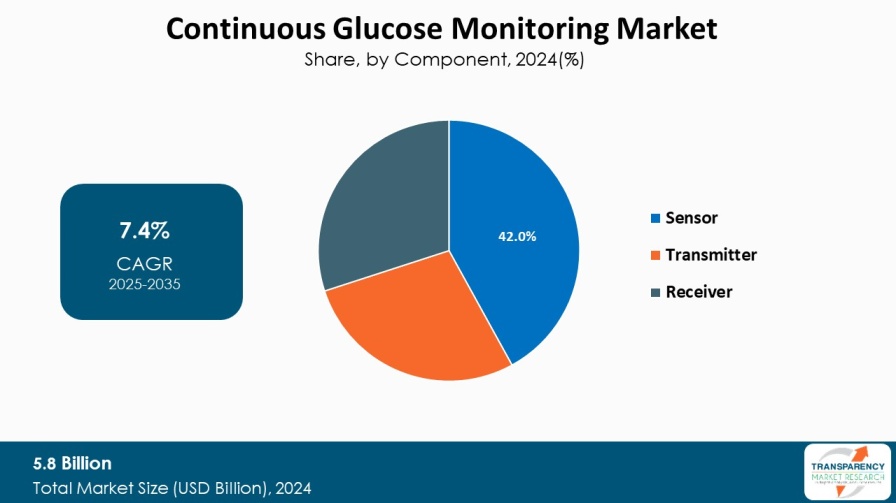

Sensor devices are the core technology driving the Continuous Glucose Monitoring (CGM) market, primarily due to their ability to deliver accurate and timely glucose readings. These sensors enable continuous monitoring with minimal discomfort, making them both effective and user-friendly. Ongoing advancements have improved sensor accuracy, sensitivity, and stability-critical factors in building user trust and enhancing patient experience.

As the demand for better diabetes management grows, so does the need for high-performance sensors. Their ability to provide rapid glucose readings plays a vital role in preventing hypoglycemic and hyperglycemic episodes. The emergence of minimally invasive and implantable sensors has further propelled market growth by offering more comfortable, long-term monitoring options.

Enhanced by sophisticated algorithms and seamless connectivity features, sensors now support real-time data sharing and advanced glucose trend analysis. As a result, the sensor segment remains the dominant force in the CGM market, significantly improving patient outcomes and reinforcing its central role in diabetes care.

| Attribute | Detail |

|---|---|

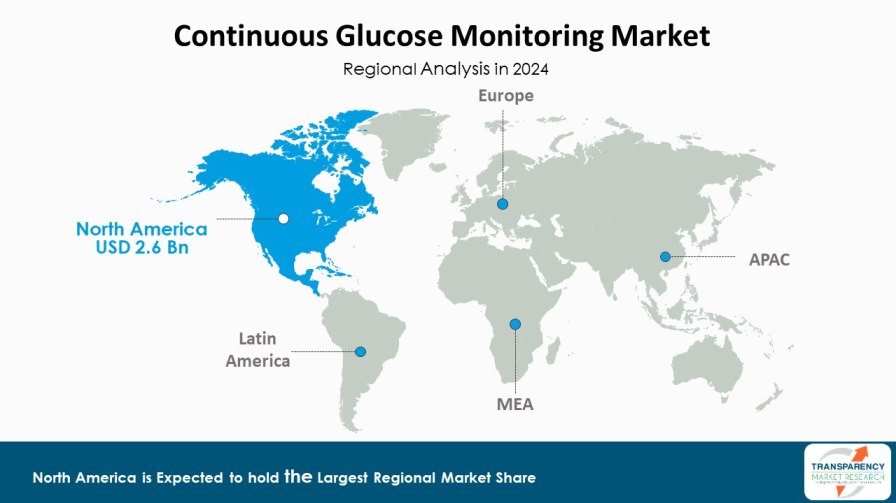

| Leading Region | North America |

According to the latest continuous glucose monitoring market analysis North America is anticipated to lead the industry because of several reasons. The region is highly impacted by diabetes and has millions of patients requiring tight control. This creates enormous demand for CGM technology, which provides tighter control and less complication for the patient.

A, North America is home to pharma and tech giants that invest heavily in R&D. These companies are driving innovation in CGM systems through continuous innovation in device accuracy, connectivity, and usability. Healthcare infrastructure is also robust in the region along with advanced regulatory systems that facilitate development of the region's market for CGM.

Other than this, growing awareness of the importance of diabetes management and benefits of round-the-clock monitoring of patients as well as caregivers encourages adoption. With such immense focus on patient care and integration with telehealth, North America is going to dominate the CGM market with constant growth and development of diabetes management solutions.

Key players are making efforts to obtain regulatory approvals for new stent technologies. Companies are actively working on getting their products approved by major regulatory bodies like the FDA and EMA, ensuring that their stents meet safety and efficacy standards.

Dexcom, Inc., Abbott, Medtronic, Ypsomed AG, Senseonics Holdings, Inc., A. Menarini Diagnostics S.r.l., Signos, Inc., F. Hoffmann-La Roche Ltd, Nemaura, Bionime Corporation, Intelligo BV. are some of the leading players operating in the Continuous Glucose Monitoring Market industry.

Each of these players has been have been profiled in the Continuous Glucose Monitoring Market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 5.8 Bn |

| Forecast Value in 2035 | US$ 12.6 Bn |

| CAGR | 7.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Continuous Glucose Monitoring Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global continuous glucose monitoring market was valued at US$ 5.8 Bn in 2024.

The global continuous glucose monitoring market is projected to cross US$ 12.6 Bn by the end of 2035.

Growing demand for remote patient monitoring and telemedicine and technological advancements in CGM devices.

The CAGR is anticipated to be 7.4% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Dexcom, Inc., Abbott, Medtronic, Ypsomed AG, Senseonics Holdings, Inc., A. Menarini Diagnostics S.r.l., Signos, Inc., F. Hoffmann-La Roche Ltd, Nemaura, Bionime Corporation, Intelligo BV. And Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Continuous Glucose Monitoring Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Continuous Glucose Monitoring Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with key countries

5.2. Key Industry Events (Mergers, Acquisitions, Partnerships, Collaborations, etc.)

5.3. Technological Advancements

5.4. PORTER’s Five Forces Analysis

5.5. PESTEL Analysis

5.6. Value Chain Analysis

5.7. Pricing Analysis (Brand pricing, Average Selling Price by Region/Country)

5.8. Regulatory Scenario by Key Country/Region

5.9. Research and Development Trends

5.10. Go-to-Market Strategy for New Market Entrants

6. Global Continuous Glucose Monitoring Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2020 to 2035

6.3.1. Real-Time CGM

6.3.2. Intermittently Scanned CGM

6.4. Market Attractiveness Analysis, by Type

7. Global Continuous Glucose Monitoring Market Analysis and Forecast, by Component

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Component, 2020 to 2035

7.3.1. Sensor

7.3.2. Transmitter

7.3.3. Receiver

7.4. Market Attractiveness Analysis, by Component

8. Global Continuous Glucose Monitoring Market Analysis and Forecast, by Age Group

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Age Group, 2020 to 2035

8.3.1. Children

8.3.2. Adults

8.4. Market Attractiveness Analysis, by Age Group

9. Global Continuous Glucose Monitoring Market Analysis and Forecast, by Indication

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Indication, 2020 to 2035

9.3.1. Type 1 Diabetes

9.3.2. Type 2 Diabetes

9.3.3. Others

9.4. Market Attractiveness Analysis, by Indication

10. Global Continuous Glucose Monitoring Market Analysis and Forecast, by End-user

10.1. Introduction & Definition

10.2. Key Findings/Developments

10.3. Market Value Forecast, by End-user, 2020 to 2035

10.3.1. Hospitals & Clinics

10.3.2. Homecare Settings

10.3.3. Others

10.4. Market Attractiveness Analysis, by End-user

11. Global Continuous Glucose Monitoring Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region, 2020 to 2035

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, by Region

12. North America Continuous Glucose Monitoring Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2020 to 2035

12.2.1. Real-Time CGM

12.2.2. Intermittently Scanned CGM

12.3. Market Value Forecast, by Component, 2020 to 2035

12.3.1. Sensor

12.3.2. Transmitter

12.3.3. Receiver

12.4. Market Value Forecast, by Age Group, 2020 to 2035

12.4.1. Children

12.4.2. Adults

12.5. Market Value Forecast, by Indication, 2020 to 2035

12.5.1. Type 1 Diabetes

12.5.2. Type 2 Diabetes

12.5.3. Others

12.6. Market Value Forecast, by End-user, 2020 to 2035

12.6.1. Hospitals & Clinics

12.6.2. Homecare Settings

12.6.3. Others

12.7. Market Value Forecast, by Country, 2020 to 2035

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Component

12.8.3. By Age Group

12.8.4. By Indication

12.8.5. By End-user

12.8.6. By Country

13. Europe Continuous Glucose Monitoring Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2020 to 2035

13.2.1. Real-Time CGM

13.2.2. Intermittently Scanned CGM

13.3. Market Value Forecast, by Component, 2020 to 2035

13.3.1. Sensor

13.3.2. Transmitter

13.3.3. Receiver

13.4. Market Value Forecast, by Age Group, 2020 to 2035

13.4.1. Children

13.4.2. Adults

13.5. Market Value Forecast, by Indication, 2020 to 2035

13.5.1. Type 1 Diabetes

13.5.2. Type 2 Diabetes

13.5.3. Others

13.6. Market Value Forecast, by End-user, 2020 to 2035

13.6.1. Hospitals & Clinics

13.6.2. Homecare Settings

13.6.3. Others

13.7. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.7.1. Germany

13.7.2. UK

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. The Netherlands

13.7.7. Switzerland

13.7.8. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Component

13.8.3. By Age Group

13.8.4. By Indication

13.8.5. By End-user

13.8.6. By Country/Sub-region

14. Asia Pacific Continuous Glucose Monitoring Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2020 to 2035

14.2.1. Real-Time CGM

14.2.2. Intermittently Scanned CGM

14.3. Market Value Forecast, by Component, 2020 to 2035

14.3.1. Sensor

14.3.2. Transmitter

14.3.3. Receiver

14.4. Market Value Forecast, by Age Group, 2020 to 2035

14.4.1. Children

14.4.2. Adults

14.5. Market Value Forecast, by Indication, 2020 to 2035

14.5.1. Type 1 Diabetes

14.5.2. Type 2 Diabetes

14.5.3. Others

14.6. Market Value Forecast, by End-user, 2020 to 2035

14.6.1. Hospitals & Clinics

14.6.2. Homecare Settings

14.6.3. Others

14.7. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. South Korea

14.7.6. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Component

14.8.3. By Age Group

14.8.4. By Indication

14.8.5. By End-user

14.8.6. By Country/Sub-region

15. Latin America Continuous Glucose Monitoring Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Type, 2020 to 2035

15.2.1. Real-Time CGM

15.2.2. Intermittently Scanned CGM

15.3. Market Value Forecast, by Component, 2020 to 2035

15.3.1. Sensor

15.3.2. Transmitter

15.3.3. Receiver

15.4. Market Value Forecast, by Age Group, 2020 to 2035

15.4.1. Children

15.4.2. Adults

15.5. Market Value Forecast, by Indication, 2020 to 2035

15.5.1. Type 1 Diabetes

15.5.2. Type 2 Diabetes

15.5.3. Others

15.6. Market Value Forecast, by End-user, 2020 to 2035

15.6.1. Hospitals & Clinics

15.6.2. Homecare Settings

15.6.3. Others

15.7. Market Value Forecast, by Country/Sub-region, 2020 to 2035

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Argentina

15.7.4. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Type

15.8.2. By Component

15.8.3. By Age Group

15.8.4. By Indication

15.8.5. By End-user

15.8.6. By Country/Sub-region

16. Middle East & Africa Continuous Glucose Monitoring Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Type, 2020 to 2035

16.2.1. Real-Time CGM

16.2.2. Intermittently Scanned CGM

16.3. Market Value Forecast, by Component, 2020 to 2035

16.3.1. Sensor

16.3.2. Transmitter

16.3.3. Receiver

16.4. Market Value Forecast, by Age Group, 2020 to 2035

16.4.1. Children

16.4.2. Adults

16.5. Market Value Forecast, by Indication, 2020 to 2035

16.5.1. Type 1 Diabetes

16.5.2. Type 2 Diabetes

16.5.3. Others

16.6. Market Value Forecast, by End-user, 2020 to 2035

16.6.1. Hospitals & Clinics

16.6.2. Homecare Settings

16.6.3. Others

16.7. Market Value Forecast, by Country/Sub-region, 2020 to 2035

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Type

16.8.2. By Component

16.8.3. By Age Group

16.8.4. By Indication

16.8.5. By End-user

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (By Tier and Size of Companies)

17.2. Market Share Analysis, by Company (2024)

17.3. Company Profiles

17.3.1. Dexcom, Inc.

17.3.1.1. Company Overview

17.3.1.2. Financial Overview

17.3.1.3. Product Portfolio

17.3.1.4. Business Strategies

17.3.1.5. Recent Developments

17.3.2. Abbott

17.3.2.1. Company Overview

17.3.2.2. Financial Overview

17.3.2.3. Product Portfolio

17.3.2.4. Business Strategies

17.3.2.5. Recent Developments

17.3.3. Medtronic

17.3.3.1. Company Overview

17.3.3.2. Financial Overview

17.3.3.3. Product Portfolio

17.3.3.4. Business Strategies

17.3.3.5. Recent Developments

17.3.4. Ypsomed AG

17.3.4.1. Company Overview

17.3.4.2. Financial Overview

17.3.4.3. Product Portfolio

17.3.4.4. Business Strategies

17.3.4.5. Recent Developments

17.3.5. Senseonics Holdings, Inc.

17.3.5.1. Company Overview

17.3.5.2. Financial Overview

17.3.5.3. Product Portfolio

17.3.5.4. Business Strategies

17.3.5.5. Recent Developments

17.3.6. A. Menarini Diagnostics S.r.l.

17.3.6.1. Company Overview

17.3.6.2. Financial Overview

17.3.6.3. Product Portfolio

17.3.6.4. Business Strategies

17.3.6.5. Recent Developments

17.3.7. Signos, Inc.

17.3.7.1. Company Overview

17.3.7.2. Financial Overview

17.3.7.3. Product Portfolio

17.3.7.4. Business Strategies

17.3.7.5. Recent Developments

17.3.8. F. Hoffmann-La Roche Ltd

17.3.8.1. Company Overview

17.3.8.2. Financial Overview

17.3.8.3. Product Portfolio

17.3.8.4. Business Strategies

17.3.8.5. Recent Developments

17.3.9. Nemaura

17.3.9.1. Company Overview

17.3.9.2. Financial Overview

17.3.9.3. Product Portfolio

17.3.9.4. Business Strategies

17.3.9.5. Recent Developments

17.3.10. Bionime Corporation

17.3.10.1. Company Overview

17.3.10.2. Financial Overview

17.3.10.3. Product Portfolio

17.3.10.4. Business Strategies

17.3.10.5. Recent Developments

17.3.11. Intelligo BV.

17.3.11.1. Company Overview

17.3.11.2. Financial Overview

17.3.11.3. Product Portfolio

17.3.11.4. Business Strategies

17.3.11.5. Recent Developments

List of Tables

Table 01: Global Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 02: Global Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 03: Global Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 04: Global Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 05: Global Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 08: North America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 09: North America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 10: North America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 11: North America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 12: North America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 14: Europe Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 15: Europe Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 16: Europe Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 17: Europe Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 18: Europe Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 20: Asia Pacific Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 21: Asia Pacific Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 22: Asia Pacific Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 23: Asia Pacific Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 24: Asia Pacific Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 26: Latin America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 27: Latin America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 28: Latin America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 29: Latin America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 30: Latin America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 32: Middle East & Africa Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 33: Middle East & Africa Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 34: Middle East & Africa Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 35: Middle East & Africa Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 36: Middle East & Africa Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Continuous Glucose Monitoring Market Value Share Analysis, By Type, 2024 and 2035

Figure 02: Global Continuous Glucose Monitoring Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 03: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Real-Time CGM, 2020 to 2035

Figure 04: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Intermittently Scanned CGM, 2020 to 2035

Figure 05: Global Continuous Glucose Monitoring Market Value Share Analysis, By Component, 2024 and 2035

Figure 06: Global Continuous Glucose Monitoring Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 07: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Sensor, 2020 to 2035

Figure 08: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Transmitter, 2020 to 2035

Figure 09: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Receiver, 2020 to 2035

Figure 10: Global Continuous Glucose Monitoring Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 11: Global Continuous Glucose Monitoring Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 12: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Children, 2020 to 2035

Figure 13: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Adults, 2020 to 2035

Figure 14: Global Continuous Glucose Monitoring Market Value Share Analysis, By Indication, 2024 and 2035

Figure 15: Global Continuous Glucose Monitoring Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 16: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Type 1 Diabetes, 2020 to 2035

Figure 17: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Type 2 Diabetes, 2020 to 2035

Figure 18: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global Continuous Glucose Monitoring Market Value Share Analysis, By End-user, 2024 and 2035

Figure 20: Global Continuous Glucose Monitoring Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 21: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Hospitals & Clinics, 2020 to 2035

Figure 22: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Homecare Settings, 2020 to 2035

Figure 23: Global Continuous Glucose Monitoring Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 24: Global Continuous Glucose Monitoring Market Value Share Analysis, By Region, 2024 and 2035

Figure 25: Global Continuous Glucose Monitoring Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 26: North America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: North America Continuous Glucose Monitoring Market Value Share Analysis, by Country, 2024 and 2035

Figure 28: North America Continuous Glucose Monitoring Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 29: North America Continuous Glucose Monitoring Market Value Share Analysis, By Type, 2024 and 2035

Figure 30: North America Continuous Glucose Monitoring Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 31: North America Continuous Glucose Monitoring Market Value Share Analysis, By Component, 2024 and 2035

Figure 32: North America Continuous Glucose Monitoring Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 33: North America Continuous Glucose Monitoring Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 34: North America Continuous Glucose Monitoring Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 35: North America Continuous Glucose Monitoring Market Value Share Analysis, By Indication, 2024 and 2035

Figure 36: North America Continuous Glucose Monitoring Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 37: North America Continuous Glucose Monitoring Market Value Share Analysis, By End-user, 2024 and 2035

Figure 38: North America Continuous Glucose Monitoring Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 39: Europe Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Europe Continuous Glucose Monitoring Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 41: Europe Continuous Glucose Monitoring Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 42: Europe Continuous Glucose Monitoring Market Value Share Analysis, By Type, 2024 and 2035

Figure 43: Europe Continuous Glucose Monitoring Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 44: Europe Continuous Glucose Monitoring Market Value Share Analysis, By Component, 2024 and 2035

Figure 45: Europe Continuous Glucose Monitoring Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 46: Europe Continuous Glucose Monitoring Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 47: Europe Continuous Glucose Monitoring Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 48: Europe Continuous Glucose Monitoring Market Value Share Analysis, By Indication, 2024 and 2035

Figure 49: Europe Continuous Glucose Monitoring Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 50: Europe Continuous Glucose Monitoring Market Value Share Analysis, By End-user, 2024 and 2035

Figure 51: Europe Continuous Glucose Monitoring Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 52: Asia Pacific Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 53: Asia Pacific Continuous Glucose Monitoring Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 54: Asia Pacific Continuous Glucose Monitoring Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 55: Asia Pacific Continuous Glucose Monitoring Market Value Share Analysis, By Type, 2024 and 2035

Figure 56: Asia Pacific Continuous Glucose Monitoring Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 57: Asia Pacific Continuous Glucose Monitoring Market Value Share Analysis, By Component, 2024 and 2035

Figure 58: Asia Pacific Continuous Glucose Monitoring Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 59: Asia Pacific Continuous Glucose Monitoring Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 60: Asia Pacific Continuous Glucose Monitoring Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 61: Asia Pacific Continuous Glucose Monitoring Market Value Share Analysis, By Indication, 2024 and 2035

Figure 62: Asia Pacific Continuous Glucose Monitoring Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 63: Asia Pacific Continuous Glucose Monitoring Market Value Share Analysis, By End-user, 2024 and 2035

Figure 64: Asia Pacific Continuous Glucose Monitoring Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 65: Latin America Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 66: Latin America Continuous Glucose Monitoring Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 67: Latin America Continuous Glucose Monitoring Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 68: Latin America Continuous Glucose Monitoring Market Value Share Analysis, By Type, 2024 and 2035

Figure 69: Latin America Continuous Glucose Monitoring Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 70: Latin America Continuous Glucose Monitoring Market Value Share Analysis, By Component, 2024 and 2035

Figure 71: Latin America Continuous Glucose Monitoring Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 72: Latin America Continuous Glucose Monitoring Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 73: Latin America Continuous Glucose Monitoring Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 74: Latin America Continuous Glucose Monitoring Market Value Share Analysis, By Indication, 2024 and 2035

Figure 75: Latin America Continuous Glucose Monitoring Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 76: Latin America Continuous Glucose Monitoring Market Value Share Analysis, By End-user, 2024 and 2035

Figure 77: Latin America Continuous Glucose Monitoring Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 78: Middle East & Africa Continuous Glucose Monitoring Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 79: Middle East & Africa Continuous Glucose Monitoring Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 80: Middle East & Africa Continuous Glucose Monitoring Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 81: Middle East & Africa Continuous Glucose Monitoring Market Value Share Analysis, By Type, 2024 and 2035

Figure 82: Middle East & Africa Continuous Glucose Monitoring Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 83: Middle East & Africa Continuous Glucose Monitoring Market Value Share Analysis, By Component, 2024 and 2035

Figure 84: Middle East & Africa Continuous Glucose Monitoring Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 85: Middle East & Africa Continuous Glucose Monitoring Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 86: Middle East & Africa Continuous Glucose Monitoring Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 87: Middle East & Africa Continuous Glucose Monitoring Market Value Share Analysis, By Indication, 2024 and 2035

Figure 88: Middle East & Africa Continuous Glucose Monitoring Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 89: Middle East & Africa Continuous Glucose Monitoring Market Value Share Analysis, By End-user, 2024 and 2035

Figure 90: Middle East & Africa Continuous Glucose Monitoring Market Attractiveness Analysis, By End-user, 2025 to 2035