Reports

Reports

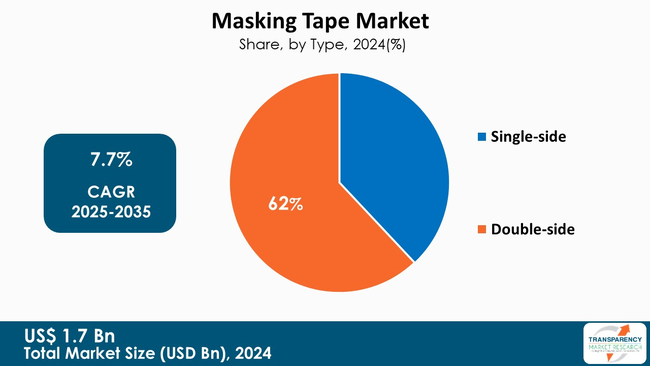

Asia Pacific masking tapes market size was valued at US$ 1.7 Bn in 2024 and is projected to reach US$ 3.9 Bn by 2035, expanding at a CAGR of 7.7% from 2025 to 2035. The market growth is driven by rising activities in construction and renovation, expanding electronics and automotive manufacturing, and stringent regulatory standards for surface protection in the industrial processes.

The Asia Pacific masking tapes market is expected to experience steadiness propelled by rising activities in construction and renovation, surging demand for packaging and e-Commerce, expanding electronics and automotive manufacturing, and stringent regulatory standards for surface protection in the industrial processes.

A masking tape, generally handled with a film or paper backing and coated with pressure-sensitive adhesive, is used masking and painting, wire harnessing, surface protection during transport and assembly, and temporary bundling in a factory.

The primary growth enablers are product innovation (low-residue, high-temp, UV-stable, and specialty crepe tapes), localized manufacturing for minimizing lead times, and increasing adoption of automated application on the production lines. Leading suppliers are investing in R&D activities in eco-friendlier backings and solvent-free adhesives, scaling local plants, and providing technical services (application trials, specification support) to OEMs and coating contractors, all of which have helped in curtailing friction to switch suppliers and widen end-use penetration.

The masking tape market in the Asia-Pacific region pertains to pressure-sensitive adhesive tapes that serve the purpose of temporarily shielding or masking surfaces during painting, coating, sealing, or assembly operations. These masking tapes are specifically designed to achieve clean paint lines, easy clean removal with no residue, and assured adhesion to metal, plastic, glass, and other surfaces. Masking tapes find applications in automotive refinishing, electronics manufacturing, construction, and various industrial applications where precision surface finishing and process efficiency are important.

The market comprises products with backings made from paper, foam, or film that have rubber, acrylic, or silicone adhesives. The growth rate of masking tapes is driven by increased industrial output, infrastructure development and demand for high performance and temperature resistant and environmental masking tapes in the Asia-Pacific region.

| Attribute | Detail |

|---|---|

| Drivers |

|

The strong growth of the manufacturing and construction industries across Asia-Pacific represents the main growth factor for the Asia Pacific masking tapes market. Intensity of investments is increasing across much of the region, especially in manufacturing nations such as China, India, Japan, South Korea, as well as the economies of Southeast Asia, in particular related to automotive, electronics, and infrastructure.

In these industries, masking tapes are vital in providing surface protection, masking off areas for coatings or painting, insulation, as well as temporary bonding during assembly. In construction fastening, masking tapes serve diverse purposes including surface finishing, sealing, and protection during any internal work.

Furthermore, the ongoing urbanization and government-supported infrastructure initiatives (including India's Smart Cities Mission and transport corridor projects in Southeast Asia) are driving the demand for long-lasting masking materials for coatings, paints, and adhesives, especially for harsh site conditions. Incremental developments in adhesive technology and automation for tape application are also promoting market penetration in industrial applications throughout the region.

The Asia-Pacific masking tapes market is experiencing alterations driven by technological advancements and sustainability that create requirements for environmentally friendly, high performance adhesive solutions. End-users are now shifting to or adopting adhesives in their tapes that are solvent-based, low-VOC, and recyclable. Key manufacturers such as 3M, Nitto Denko, and Tesa have made notable investments in R&D efforts emphasizing water-based adhesive systems and bio-based backing materials that provide the enhanced adhesion and performance required, but without harming the environment.

In addition, as the electronics and automotive sectors turn to advanced materials and lightweight substrates, the demands for masking tape include more complex performance specifications with heat-resistant performance, UV stability, and precision-engineered tapes that perform according to industry-accepted adhesion performance expectations under extreme and harsh processing conditions. Finally, the movement to smart manufacturing and the introduction of green production lines show that sustainable masking tapes are no longer simple consumables but materials enabling for production.

| Attribute | Detail |

|---|---|

| Leading Country |

|

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 1.7 Bn |

| Market Forecast Value in 2035 | US$ 3.9 Bn |

| Growth Rate (CAGR) | 7.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Square Meters for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Asia Pacific Masking Tapes Market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The Asia Pacific masking tapes market was valued at US$ 1.7 Bn in 2024

The industry is expected to grow at a CAGR of 7.7% from 2025 to 2035

Expanding manufacturing and construction activities across Asia Pacific and rising demand for sustainable and high-performance adhesive solutions

The double-side type held the largest shares respectively within the type segment and was anticipated to grow at an estimated CAGR of 5.8% during the forecast period

China was the most lucrative country in 2024

3M Company, TESA SE, Scapa Group, Nitto Denko Corporation, Henkel, LINTEC Corporation, Avery Dennison, SunTape China, Kingston India, teraoka Seisakusho Co. Ltd, and Mirka India Pvt. Ltd are the major players in the Asia Pacific masking tapes market

Table 1: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Type, 2020 to 2035

Table 2: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 3: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by: Adhesive Type, 2020 to 2035

Table 4: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by: Adhesive Type, 2020 to 2035

Table 5: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Backing Material, 2020 to 2035

Table 6: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2020 to 2035

Table 7: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by End-use, 2020 to 2035

Table 8: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 9: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by: Country, 2020 to 2035

Table 10: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by: Country, 2020 to 2035

Table 11: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Type, 2020 to 2035

Table 12: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 13: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by: Adhesive Type, 2020 to 2035

Table 14: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by: Adhesive Type, 2020 to 2035

Table 15: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Backing Material, 2020 to 2035

Table 16: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2020 to 2035

Table 17: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by End-use, 2020 to 2035

Table 18: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 19: Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by: Country: And Sub-Country, 2020 to 2035

Table 20: Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by: Country: And Sub-Country, 2020 to 2035

Table 21: China Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Type, 2020 to 2035

Table 22: China Masking Tapes Market Value (US$ Bn) Forecast, by Type 2020 to 2035

Table 23: China Masking Tapes Market Volume (Thousand Square Meters) Forecast, by: Adhesive Type, 2020 to 2035

Table 24: China Masking Tapes Market Value (US$ Bn) Forecast, by: Adhesive Type, 2020 to 2035

Table 25: China Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Backing Material, 2020 to 2035

Table 26: China Masking Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2020 to 2035

Table 27: China Masking Tapes Market Volume (Thousand Square Meters) Forecast, by End-use, 2020 to 2035

Table 28: China Masking Tapes Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 29: Japan Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Type, 2020 to 2035

Table 30: Japan Masking Tapes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 31: Japan Masking Tapes Market Volume (Thousand Square Meters) Forecast, by: Adhesive Type, 2020 to 2035

Table 32: Japan Masking Tapes Market Value (US$ Bn) Forecast, by: Adhesive Type, 2020 to 2035

Table 33: Japan Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Backing Material, 2020 to 2035

Table 34: Japan Masking Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2020 to 2035

Table 35: Japan Masking Tapes Market Volume (Thousand Square Meters) Forecast, by End-use, 2020 to 2035

Table 36: Japan Masking Tapes Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 37: India Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Type, 2020 to 2035

Table 38: India Masking Tapes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 39: India Masking Tapes Market Volume (Thousand Square Meters) Forecast, by: Adhesive Type, 2020 to 2035

Table 40: India Masking Tapes Market Value (US$ Bn) Forecast, by: Adhesive Type, 2020 to 2035

Table 41: India Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Backing Material, 2020 to 2035

Table 42: India Masking Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2020 to 2035

Table 43: India Masking Tapes Market Volume (Thousand Square Meters) Forecast, by End-use, 2020 to 2035

Table 44: India Masking Tapes Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 45: ASEAN Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Type, 2020 to 2035

Table 46: ASEAN Masking Tapes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 47: ASEAN Masking Tapes Market Volume (Thousand Square Meters) Forecast, by: Adhesive Type, 2020 to 2035

Table 48: ASEAN Masking Tapes Market Value (US$ Bn) Forecast, by: Adhesive Type, 2020 to 2035

Table 49: ASEAN Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Backing Material, 2020 to 2035

Table 50: ASEAN Masking Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2020 to 2035

Table 51: ASEAN Masking Tapes Market Volume (Thousand Square Meters) Forecast, by End-use, 2020 to 2035

Table 52: ASEAN Masking Tapes Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 53: Rest of Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Type, 2020 to 2035

Table 54: Rest of Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 55: Rest of Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by: Adhesive Type, 2020 to 2035

Table 56: Rest of Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by: Adhesive Type, 2020 to 2035

Table 57: Rest of Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by Backing Material, 2020 to 2035

Table 58: Rest of Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2020 to 2035

Table 59: Rest of Asia Pacific Masking Tapes Market Volume (Thousand Square Meters) Forecast, by End-use, 2020 to 2035

Table 60: Rest of Asia Pacific Masking Tapes Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1: Asia Pacific Masking Tapes Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2: Asia Pacific Masking Tapes Market Attractiveness, by Type

Figure 3: Asia Pacific Masking Tapes Market Volume Share Analysis, by Adhesive Type, 2024, 2028, and 2035

Figure 4: Asia Pacific Masking Tapes Market Attractiveness, by Adhesive Type

Figure 5: Asia Pacific Masking Tapes Market Volume Share Analysis, by Backing Material, 2024, 2028, and 2035

Figure 6: Asia Pacific Masking Tapes Market Attractiveness, by Backing Material

Figure 7: Asia Pacific Masking Tapes Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8: Asia Pacific Masking Tapes Market Attractiveness, by End-use

Figure 9: Asia Pacific Masking Tapes Market Volume Share Analysis, by Country, 2024, 2028, and 2035

Figure 10: Asia Pacific Masking Tapes Market Attractiveness, by Country