Reports

Reports

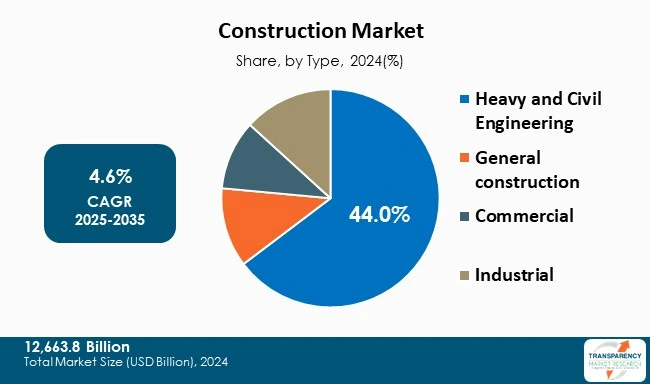

The global construction market is amongst the most important sectors of economic development that involve diversity of activities including heavy and civil engineering constructions, residential, commercial and industrial developments. The industry is mainly dominated by heavy and civil engineering as works including roads, bridges, rails, and airports are essential as they provide the foundation of intercountry connections and trade. Whereas general, residential, commercial, and institutaional construction, including houses, apartments, offices, hotels, hospitals, and malls, also have a stable demand all over the world. The need to have modern living spaces, commercial establishments and public facilities supports this demand. There is also commercial and industrial construction which further contributes a lot in providing spaces to businesses, health, education and manufacturing.

Asia-Pacific has the largest market regionally; the region is reinforced by huge investments in infrastructure, smart urban development, and growing urban population. Europe and North America also have significant shares due to modernization, green building practices and sustainable infrastructure. The major industry players including multinational construction companies as well as regional players are ever investing in newer technologies, effective construction practices and joint ventures to augment their position in the market. Overall, the construction industry is becoming more sustainable, technologically advancing, and investment-friendly, which is why it is in the center of the economies and society development all over the world.

The construction market is dedicated to planning, designing, construction, and maintenance of buildings, residential complexes, business buildings, industrial facilities, and other large-scale infrastructure projects. It involves an extensive scope of operations such as site preparation, material procurement, architectural and engineering design, project performance and long-term maintenance. The industry is an interdependent ecosystem, with the contribution of governments, private developers, contractors, engineers, and technology providers that promotes economic growth and development within the society.

The division of the market broadly is into four major groups: residential construction, including housing, apartments and townships; commercial construction, including offices, retail space, hospitals, and schools; industrial construction, including factories, warehouses, and power plants; and infrastructure construction, including roads, bridges, railways, airports and ports, and water systems. All these categories have their own functions but it is all meant to promote urbanization, industrialization and better connectivity to meet the growing demand of living and working space.

The uses of the construction industry are not limited to the purposes of shelter and business premises but it is at the center of cities shaping, trade facilitating and economic driving. The market is changing, developing innovations in digital tools, sustainable construction techniques, and environmentally friendly materials, which sets it not only as a growth engine but a main contributor to the sustainable and intelligent urban development.

| Attribute | Detail |

|---|---|

| Construction Market Drivers |

|

One of the key driving force of the construction market are the government infrastructure spending that preconditions the economic growth, social development, and industrial competitiveness. The increased allocation of budget by governments to infrastructure boosts the demand of big construction projects in terms of transportation systems and houses as well as energy plants and urbanization. Such projects not only increase national productivity, but also generate jobs and induce demand in related industries (steel, cement, glass and machinery) that have substantial multiplier effects throughout the economy.

Such investments are seen both in the developed and developing regions globally. As an example, the Union Budget 2025-26 of India included spending of Rs. 11.21 lakh crore (US$ 128.64 billion) on infrastructure, which is 3.1% of GDP and shows the high push towards highways, railways and airports modernization (IBEF, 2025). Likewise, The Vision 2030 (a government program launched by Saudi Arabia) of Saudi Arabia in the Middle East pays much attention to major infrastructure projects and smart cities such as NEOM. Such examples demonstrate a universal role of government-driven development of infrastructure, which gives their stable demand to construction services and strengthens the long-term growth curves in regions.

Green building and sustainability have emerged as one of the main drivers of the construction industry globally as they respond to the increased demand to be energy efficient, reduce carbon, and ensure climate resiliency. Government, businesses, and consumers are raising concerns over environmentally friendly infrastructures, so there are now regulations and incentives that push the industry towards environmental friendliness. An example is the 2025 Renew America’s Schools Prize by the U.S. Department of Energy offering 90 million dollars to enhance energy efficiency in public K-12 schools (and other projects), which illustrates how the sustainability approach to construction is transforming the nature of buildings by driving the need toward high-performance insulation, integration of renewable energy sources, and green building materials. These attempts underscore the fact that green building is not a choice anymore, but a key requirement in contemporary infrastructure.

In addition to regulatory compliance, the sustainability programs can also offer a high economic and social value to the firms. Eco-friendly designs reduce operation, increase building lifespan and comply with global climate action plans, thus, drawing investors, purchasers, and stakeholders concerned with environmental responsibility. The increased utilization of technologies such as smart energy systems, as well as low-carbon cement, prove that green initiatives are introducing innovations in the industry. Sustainability has turned out to be a revolutionary element that can change the market demand and the construction practices in the world by establishing new standards of efficiency and resilience.

In the construction sector, the industry is dominated by heavy and civil engineering rather than general and industrial construction. The segment also includes large-scale infrastructure, which forms the back bone of national development and urbanization like bridges, roads, railways, airports and sewage systems. For instance, the increasing road and railroad developments in Asia-Pacific and North America which are heavily financed by the government and contribute a huge portion of the overall construction projects. These projects need increased investments as well as long project timelines and scopes, making them the most prevalent category in terms of market value.

Although general construction (residential and commercial) also has a significant portion because of the increasing urban housing demand and commercial infrastructural construction, smaller but fragmented projects are usually found in general construction than in heavy and civil engineering. Industrial construction is necessary, but has a comparatively lesser contribution since it is more specialized and less cyclical, i.e. manufacturing, oil and gas, logistics. Heavy and civil engineering is therefore the prevailing sector in the world construction industry with respect to scale, government funding and the key contribution to connectivity and economic grow

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific |

Asia-Pacific (APAC) region dominates the global construction market as a result of a set of factors that includes the population growth, infrastructure development, which is led by governments, and stable flows of foreign investments. The economies of China, India, Japan, South Korea and Australia continue to propel mass housing, industrial and infrastructure projects. One of the reflections of this scale is the Belt and Road Initiative (BRI) of China, which billed USD 66.2 billion in construction contracts and USD 57.1 billion in investments in the first half of 2025 alone, almost twice as much as the same figure did in the prior year (Green Finance and Development Center, 2025). Such involvement is a demonstration of the ability of the region to invest capital and to undertake infrastructure on both local and global levels.

Along with outbound projects in China, there has been internal investment and foreign direct investment (FDI) which contributes to construction in APAC. India can be cited as an example of this kind of inflow of FDI at the construction sector which experienced the inflow of up to Rs. 1,35,824 crores (US$ 15.79 billion) of FDI in construction development projects and Rs. 2,58,516 crores (US$ 30.05 billion) in construction infrastructure activity during the period between April 2000 and March 2025 (IBEF, 2025). These figures are an example of how government programs, housing demand in the cities, and confidence of the world investors all come together to enhance the construction ecosystem within the region. A combination of these drivers, reinforced by large-scale programs, increasing urban demands, and stable inflows of capital, underpin the reasons why APAC takes up majority of the construction market in the world.

The majority of companies are spending significant amounts on comprehensive R&D activities, primarily to develop innovative products. Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by Construction market manufacturers and brands of the global market forecast.

Balfour Beatty Plc, Lennar Corporation, Adani Group, Bechtel Corporation, Bouygues, China Communications Construction Company, Larsen and Toubro, Power Construction Corporation of China, Skanska AB, STRABAG SE, and VINCI Construction and other key players

Each of these players has been profiled in the Construction market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 12,663.8 Bn |

| Forecast Value in 2035 | US$ 20,665.5 Bn |

| CAGR | 4.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Construction Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The construction market was valued at US$ 12,663.8 Bn in 2024

The construction industry is projected to reach at US$ 20,665.5 Bn by the end of 2035

Investments in infrastructure by the government, and initiatives for green building and sustainability are some of the factors driving the expansion of construction market.

The CAGR is anticipated to be 4.6% from 2025 to 2035

Balfour Beatty Plc, Lennar Corporation, Adani Group, Bechtel Corporation, Bouygues, China Communications Construction Company, Larsen and Toubro, Power Construction Corporation of China, Skanska AB, STRABAG SE, and VINCI Construction and other key players

Table 1: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 2: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 3: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 4: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 5: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Region

Table 6: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 7: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 8: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 9: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 10: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 11: U.S. Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 12: U.S. Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 13: U.S. Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 14: U.S. Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 15: Canada Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 16: Canada Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 17: Canada Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 18: Canada Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 19: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 20: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 21: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 22: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 23: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 24: U.K. Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 25: U.K. Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 26: U.K. Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 27: U.K. Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 28: Germany Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 29: Germany Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 30: Germany Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 31: Germany Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 32: France Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 33: France Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 34: France Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 35: France Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 36: Italy Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 37: Italy Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 38: Italy Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 39: Italy Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 40: Spain Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 41: Spain Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 42: Spain Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 43: Spain Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 44: The Netherlands Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 45: The Netherlands Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 46: The Netherlands Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 47: The Netherlands Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 48: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 49: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 50: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 51: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 52: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 53: China Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 54: China Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 55: China Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 56: China Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 57: India Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 58: India Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 59: India Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 60: India Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 61: Japan Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 62: Japan Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 63: Japan Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 64: Japan Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 65: Australia Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 66: Australia Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 67: Australia Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 68: Australia Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 69: South Korea Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 70: South Korea Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 71: South Korea Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 72: South Korea Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 73: ASEAN Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 74: ASEAN Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 75: ASEAN Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 76: ASEAN Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 77: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 78: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 79: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 80: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 81: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 82: GCC Countries Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 83: GCC Countries Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 84: GCC Countries Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 85: GCC Countries Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 86: South Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 87: South Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 88: South Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 89: South Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 90: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 91: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 92: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 93: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 94: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 95: Brazil Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 96: Brazil Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 97: Brazil Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 98: Brazil Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 99: Argentina Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 100: Argentina Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 101: Argentina Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 102: Argentina Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Table 103: Mexico Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 104: Mexico Market Value (US$ Bn) Projection, 2020 to 2035 By Entity

Table 105: Mexico Market Value (US$ Bn) Projection, 2020 to 2035 By Category

Table 106: Mexico Market Value (US$ Bn) Projection, 2020 to 2035 By Location

Figure 1: Global Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 2: Global Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 3: Global Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 4: Global Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 5: Global Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 6: Global Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 7: Global Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 8: Global Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 9: Global Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 10: Global Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 11: North America Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 12: North America Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 13: North America Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 14: North America Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 15: North America Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 16: North America Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 17: North America Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 18: North America Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 19: North America Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 20: North America Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 21: U.S. Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 22: U.S. Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 23: U.S. Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 24: U.S. Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 25: U.S. Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 26: U.S. Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 27: U.S. Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 28: U.S. Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 29: Canada Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 30: Canada Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 31: Canada Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 32: Canada Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 33: Canada Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 34: Canada Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 35: Canada Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 36: Canada Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 37: Europe Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 38: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 39: Europe Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 40: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 41: Europe Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 42: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 43: Europe Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 44: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 45: Europe Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 46: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 47: U.K. Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 48: U.K. Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 49: U.K. Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 50: U.K. Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 51: U.K. Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 52: U.K. Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 53: U.K. Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 54: U.K. Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 55: Germany Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 56: Germany Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 57: Germany Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 58: Germany Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 59: Germany Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 60: Germany Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 61: Germany Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 62: Germany Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 63: France Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 64: France Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 65: France Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 66: France Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 67: France Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 68: France Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 69: France Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 70: France Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 71: Italy Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 72: Italy Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 73: Italy Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 74: Italy Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 75: Italy Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 76: Italy Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 77: Italy Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 78: Italy Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 79: Spain Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 80: Spain Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 81: Spain Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 82: Spain Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 83: Spain Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 84: Spain Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 85: Spain Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 86: Spain Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 87: The Netherlands Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 88: The Netherlands Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 89: The Netherlands Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 90: The Netherlands Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 91: The Netherlands Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 92: The Netherlands Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 93: The Netherlands Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 94: The Netherlands Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 95: Asia Pacific Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 96: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 97: Asia Pacific Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 98: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 99: Asia Pacific Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 100: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 101: Asia Pacific Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 102: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 103: Asia Pacific Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 104: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 105: China Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 106: China Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 107: China Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 108: China Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 109: China Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 110: China Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 111: China Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 112: China Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 113: India Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 114: India Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 115: India Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 116: India Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 117: India Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 118: India Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 119: India Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 120: India Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 121: Japan Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 122: Japan Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 123: Japan Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 124: Japan Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 125: Japan Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 126: Japan Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 127: Japan Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 128: Japan Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 129: Australia Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 130: Australia Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 131: Australia Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 132: Australia Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 133: Australia Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 134: Australia Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 135: Australia Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 136: Australia Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 137: South Korea Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 138: South Korea Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 139: South Korea Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 140: South Korea Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 141: South Korea Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 142: South Korea Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 143: South Korea Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 144: South Korea Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 145: ASEAN Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 146: ASEAN Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 147: ASEAN Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 148: ASEAN Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 149: ASEAN Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 150: ASEAN Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 151: ASEAN Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 152: ASEAN Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 153: Middle East & Africa Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 154: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 155: Middle East & Africa Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 156: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 157: Middle East & Africa Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 158: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 159: Middle East & Africa Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 160: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 161: Middle East & Africa Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 162: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 163: GCC Countries Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 164: GCC Countries Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 165: GCC Countries Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 166: GCC Countries Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 167: GCC Countries Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 168: GCC Countries Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 169: GCC Countries Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 170: GCC Countries Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 171: South Africa Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 172: South Africa Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 173: South Africa Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 174: South Africa Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 175: South Africa Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 176: South Africa Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 177: South Africa Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 178: South Africa Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 179: Latin America Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 180: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 181: Latin America Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 182: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 183: Latin America Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 184: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 185: Latin America Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 186: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 187: Latin America Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 188: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 189: Brazil Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 190: Brazil Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 191: Brazil Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 192: Brazil Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 193: Brazil Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 194: Brazil Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 195: Brazil Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 196: Brazil Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 197: Argentina Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 198: Argentina Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 199: Argentina Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 200: Argentina Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 201: Argentina Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 202: Argentina Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 203: Argentina Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 204: Argentina Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035

Figure 205: Mexico Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 206: Mexico Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 207: Mexico Market Value (US$ Bn) Projection, By Entity 2020 to 2035

Figure 208: Mexico Market Incremental Opportunities (US$ Bn) Forecast, By Entity 2025 to 2035

Figure 209: Mexico Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 210: Mexico Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 211: Mexico Market Value (US$ Bn) Projection, By Location 2020 to 2035

Figure 212: Mexico Market Incremental Opportunities (US$ Bn) Forecast, By Location 2025 to 2035