Reports

Reports

Analyst’s Viewpoint

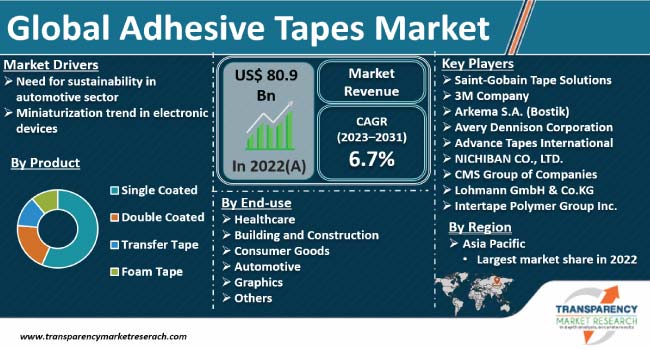

Miniaturization trend in electronic devices and need for sustainability in various industries, especially in automotive, are key factors driving the adhesive tapes market value. Various sectors rely on these tapes for thermal management, electrical insulation, and performance bonding applications. For instance, the electronics sector uses adhesive tapes for circuit packaging, display manufacturing, and a plethora of similar purposes.

The adhesive tapes market size is projected to grow at a steady pace in the near future owing to the rise in demand for these tapes in packaging, healthcare, automotive, and aerospace industries. Adhesive tapes market demand is also being driven by the growth in usage of double-sided, especially sustainable adhesive tapes. The trend toward eco-friendliness has also percolated down to the adhesive tapes business, with consumers and companies striving to minimize their carbon footprint. This has also marked a shift from plastic and other traditional non-biodegradable adhesive tape materials to sustainable and eco-friendly tapes made from recycled materials.

Adhesive tapes are specially designed materials, which comprise a foundational material with a layer of adhesive applied to one side. The packaging sector is the single largest end-user of adhesive tapes. Adhesive tapes are also widely used in healthcare, building and construction, aerospace, and other sectors.

Key adhesive tapes market players are carrying out technological advancements to improve functionality and performance of these tapes in terms of bonding strength, temperature resistance, and durability. This broadens the scope of application of these tapes among industries.

Widespread research and development activities have led to advanced capabilities for adhesive tapes. The automotive sector has emerged as one such key beneficiary of these advancements.

Rise in trend of substituting bolts, screws, rivets, and other attaching or fastening techniques with adhesives has led to sizeable demand for these tapes on a global scale. Stricter emission norms have also spurred the demand for lightweight vehicles. This involves replacement of mechanical fasteners with adhesive tapes to generate higher fuel efficiency.

Emergence of novel, durable, and recyclable materials is further augmenting adhesive tapes market dynamics.

The electronics sector employs pressure sensitive tapes and adhesives to install parts directly in devices without the use of additional fasteners. The trend toward miniaturization of electronic devices, especially cell phones, portable personal computers, and tablets, is a key factor driving the adhesive tapes market development.

Rise in disposable income has led to an improvement in lifestyle of consumers. It has also increased the dependence on electronic devices. Asia Pacific generates extensive demand for consumer electronics. This, in turn, is augmenting the sales of double-sided adhesive tapes.

Double-sided adhesive tapes are also extensively employed in several automotive applications such as wire harnessing, automotive body repairs, and surface protection. These tapes provide better resistance and adhesion to automotive interior parts.

Demand for adhesive tapes has been rising in the global packaging sector. These tapes are used in carton sealing, bundling, unitizing, pelletizing, and general packaging.

Double coated tapes are anticipated to replace traditional sealing and adhesion techniques. Popularity of these tapes is driven by durability, good surface adhesion, and high shear strength. Strong production base and rapidly growing usage in the automotive sector are expected to remain key market catalysts.

Replacement of traditional fasteners, screws, bolts, and rivets with these tapes across automotive and aerospace applications is estimated to fuel market expansion.

The single coated segment accounted for significant adhesive tapes market share in 2022. Adhesive is usually composed of natural rubber, silicone, or acrylic, while the backing material could be polymeric film, paper, foil, or high thread count woven cloth.

Demand for adhesive tapes, which include masking, medical, electrical, carton sealing, and BOPP adhesives tapes, is high across the globe. This is due to their ability to facilitate the bonding of a material with a surface as well as the linking of two adjacent or overlapping materials.

According to the global adhesive tapes market analysis, Asia Pacific dominated the global industry in 2022. The region is expected to speed up market statistics, owing to its position as a major manufacturing hub and innovation center. Furthermore, easy availability of raw materials and skilled labor is expected to solidify the region’s position as a key center for the adhesive tapes business in the near future.

North America and Europe are mature markets for adhesive tapes, with the presence of various small scale players and local manufacturing facilities. The U.S. and Italy are among the key producers of adhesive tapes in these regions.

Leading players in the market are focusing on manufacturing innovative adhesive tapes to expand their customer base. They are also adopting newer techniques to enhance their production capacity.

Prominent vendors in the adhesive tapes landscape are also focusing on mergers and acquisitions to extend their global footprint. High prices of raw materials make it difficult for new players to enter the market. However, established manufacturers use this as an opportunity to increase their market share.

Advance Tapes International, NICHIBAN CO., LTD., CMS Group of Companies, Saint-Gobain Tape Solutions, Avery Dennison Corporation, Lohmann GmbH & Co.KG., Intertape Polymer Group, and Surface Shields are some of the key market players.

These companies have been profiled in the adhesive tapes market report based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 80.9 Bn |

| Market Forecast Value in 2031 | US$ 143.5 Bn |

| Growth Rate (CAGR) | 6.7% |

| Forecast Period | 2023 to 2031 |

| Quantitative Units | US$ Bn for Value and Million Square Meters for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 80.9 Bn in 2022

It is likely to grow at a CAGR of 6.7% from 2023 to 2031

Miniaturization trend in electronic devices and need for sustainability in various industries, especially in automotive

The single coated segment held the largest share in 2022

Asia Pacific was the most lucrative region in 2022

Advance Tapes International, NICHIBAN CO., LTD., CMS Group of Companies, Saint-Gobain Tape Solutions, Avery Dennison Corporation, Lohmann GmbH & Co.KG., Intertape Polymer Group, and Surface Shields

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Adhesive Tapes Market Analysis and Forecast, 2023-2031

2.6.1. Global Adhesive Tapes Market Volume (Million Square Meters)

2.6.2. Global Adhesive Tapes Market Value (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Manufacturers

2.9.2. List of Dealer/Distributors

2.9.3. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Adhesive Tapes

3.2. Impact on the Demand for Adhesive Tapes – Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Million Square Meters)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis, by Product

6.2. Price Comparison Analysis, by Region

7. Global Adhesive Tapes Market Analysis and Forecast, by Product, 2023–2031

7.1. Introduction and Definitions

7.2. Global Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

7.2.1. Single Coated

7.2.2. Double Coated

7.2.3. Transfer Tape

7.2.4. Foam Tape

7.3. Global Adhesive Tapes Market Attractiveness, by Product

8. Global Adhesive Tapes Market Analysis and Forecast, by Composition, 2023–2031

8.1. Introduction and Definitions

8.2. Global Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

8.2.1. Acrylic

8.2.2. Rubber

8.2.3. Silicone

8.2.4. Others

8.3. Global Adhesive Tapes Market Attractiveness, by Composition

9. Global Adhesive Tapes Market Analysis and Forecast, Backing Material, 2023–2031

9.1. Introduction and Definitions

9.2. Global Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

9.2.1. Polypropylene

9.2.2. Paper

9.2.3. Polyvinyl Chloride

9.2.4. Others

9.3. Global Adhesive Tapes Market Attractiveness, by Backing Material

10. Global Adhesive Tapes Market Analysis and Forecast, End-use, 2023–2031

10.1. Introduction and Definitions

10.2. Global Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by End-use, 2023–2031

10.2.1. Healthcare

10.2.2. Building & Construction

10.2.3. Consumer Goods

10.2.4. Automotive

10.2.5. Graphics

10.2.6. Others

10.3. Global Adhesive Tapes Market Attractiveness, by End-use

11. Global Adhesive Tapes Market Analysis and Forecast, by Region, 2023–2031

11.1. Key Findings

11.2. Global Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Region, 2023–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Global Adhesive Tapes Market Attractiveness, by Region

12. North America Adhesive Tapes Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. North America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.3. North America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

12.4. North America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

12.5. North America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.6. North America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Country, 2023–2031

12.6.1. U.S. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.6.2. U.S. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

12.6.3. U.S. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

12.6.4. U.S. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

12.6.5. Canada Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product Composition, 2023–2031

12.6.6. Canada Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

12.6.7. Canada Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

12.6.8. Canada Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

12.7. North America Adhesive Tapes Market Attractiveness Analysis

13. Europe Adhesive Tapes Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Europe Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.3. Europe Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

13.4. Europe Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

13.5. Europe Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.6. Europe Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

13.6.1. Germany Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.6.2. Germany Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

13.6.3. Germany Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

13.6.4. Germany. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

13.6.5. France Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.6.6. France Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

13.6.7. France Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

13.6.8. France. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

13.6.9. U.K. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.6.10. U.K. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

13.6.11. U.K. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

13.6.12. U.K. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

13.6.13. Italy Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.6.14. Italy. Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

13.6.15. Italy Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

13.6.16. Italy Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

13.6.17. Russia & CIS Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.6.18. Russia & CIS Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

13.6.19. Russia & CIS Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

13.6.20. Russia & CIS Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

13.6.21. Rest of Europe Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.6.22. Rest of Europe Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

13.6.23. Rest of Europe Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

13.6.24. Rest of Europe Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

13.7. Europe Adhesive Tapes Market Attractiveness Analysis

14. Asia Pacific Adhesive Tapes Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product

14.3. Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

14.4. Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

14.5. Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.6. Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.6.1. China Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

14.6.2. China Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

14.6.3. China Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

14.6.4. China Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

14.6.5. Japan Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

14.6.6. Japan Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

14.6.7. Japan Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

14.6.8. Japan Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

14.6.9. India Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

14.6.10. India Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

14.6.11. India Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

14.6.12. India Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

14.6.13. ASEAN Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

14.6.14. ASEAN Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

14.6.15. ASEAN Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

14.6.16. ASEAN Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

14.6.17. Rest of Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

14.6.18. Rest of Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

14.6.19. Rest of Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

14.6.20. Rest of Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

14.7. Asia Pacific Adhesive Tapes Market Attractiveness Analysis

15. Latin America Adhesive Tapes Market Analysis and Forecast, 2023–2031

15.1. Key Findings

15.2. Latin America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product Composition, 2023–2031

15.3. Latin America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

15.4. Latin America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

15.5. Latin America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by End-use, 2023–2031

15.6. Latin America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

15.6.1. Brazil Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

15.6.2. Brazil Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

15.6.3. Brazil Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

15.6.4. Brazil Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

15.6.5. Mexico Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

15.6.6. Mexico Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

15.6.7. Mexico Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

15.6.8. Mexico Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

15.6.9. Rest of Latin America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

15.6.10. Rest of Latin America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

15.6.11. Rest of Latin America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

15.6.12. Rest of Latin America Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

15.7. Latin America Adhesive Tapes Market Attractiveness Analysis

16. Middle East & Africa Adhesive Tapes Market Analysis and Forecast, 2023–2031

16.1. Key Findings

16.2. Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

16.3. Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

16.4. Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

16.5. Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by End-use, 2023–2031

16.6. Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

16.6.1. GCC Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

16.6.2. GCC Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

16.6.3. GCC Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

16.6.4. GCC Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

16.6.5. South Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

16.6.6. South Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

16.6.7. South Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

16.6.8. South Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

16.6.9. Rest of Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Product, 2023–2031

16.6.10. Rest of Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Composition, 2023–2031

16.6.11. Rest of Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, by Backing Material, 2023–2031

16.6.12. Rest of Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) and Value (US$ Bn) Forecast, End-use, 2023–2031

16.7. Middle East & Africa Adhesive Tapes Market Attractiveness Analysis

17. Competition Landscape

17.1. Market Players - Competition Matrix (by Tier and Size of Companies)

17.2. Market Share Analysis, 2021

17.3. Market Footprint Analysis

17.3.1. By Product

17.3.2. By End-use

17.4. Company Profiles

17.4.1. Saint-Gobain Tape Solutions

17.4.1.1. Company Revenue

17.4.1.2. Business Overview

17.4.1.3. Product Segments

17.4.1.4. Geographic Footprint

17.4.1.5. Production Composition/Plant Details, etc. (*As Applicable)

17.4.1.6. Strategic Partnership, Composition Expansion, New Product Innovation, etc.

17.4.2. Intertape Polymer Group Inc.

17.4.2.1. Company Revenue

17.4.2.2. Business Overview

17.4.2.3. Product Segments

17.4.2.4. Geographic Footprint

17.4.2.5. Production Composition/Plant Details, etc. (*As Applicable)

17.4.2.6. Strategic Partnership, Composition Expansion, New Product Innovation, etc.

17.4.3. Avery Dennison Corporation

17.4.3.1. Company Revenue

17.4.3.2. Business Overview

17.4.3.3. Product Segments

17.4.3.4. Geographic Footprint

17.4.3.5. Production Composition/Plant Details, etc. (*As Applicable)

17.4.3.6. Strategic Partnership, Composition Expansion, New Product Innovation etc.

17.4.4. Advance Tapes International

17.4.4.1. Company Revenue

17.4.4.2. Business Overview

17.4.4.3. Product Segments

17.4.4.4. Geographic Footprint

17.4.4.5. Production Composition/Plant Details, etc. (*As Applicable)

17.4.4.6. Strategic Partnership, Composition Expansion, New Product Innovation, etc.

17.4.5. NICHIBAN Co., Ltd.

17.4.5.1. Company Revenue

17.4.5.2. Business Overview

17.4.5.3. Product Segments

17.4.5.4. Geographic Footprint

17.4.5.5. Production Composition/Plant Details, etc. (*As Applicable)

17.4.5.6. Strategic Partnership, Composition Expansion, New Product Innovation, etc.

17.4.6. CMS Group of Companies

17.4.6.1. Company Revenue

17.4.6.2. Business Overview

17.4.6.3. Product Segments

17.4.6.4. Geographic Footprint

17.4.6.5. Production Composition/Plant Details, etc. (*As Applicable)

17.4.6.6. Strategic Partnership, Composition Expansion, New Product Innovation, etc.

17.4.7. Lohmann GmbH & Co.KG

17.4.7.1. Company Revenue

17.4.7.2. Business Overview

17.4.7.3. Product Segments

17.4.7.4. Geographic Footprint

17.4.7.5. Production Composition/Plant Details, etc. (*As Applicable)

17.4.7.6. Strategic Partnership, Composition Expansion, New Product Innovation, etc.

17.4.8. Surface Shields

17.4.8.1. Company Revenue

17.4.8.2. Business Overview

17.4.8.3. Product Segments

17.4.8.4. Geographic Footprint

17.4.8.5. Production Composition/Plant Details, etc. (*As Applicable)

17.4.8.6. Strategic Partnership, Composition Expansion, New Product Innovation, etc.

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 1: Global Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 2: Global Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 3: Global Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 4: Global Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 5: Global Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 6: Global Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 7: Global Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 8: Global Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 9: Global Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Region, 2023–2031

Table 10: Global Adhesive Tapes Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 11: North America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 12: North America Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 13: North America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 14: North America Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 15: North America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 16: North America Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 17: North America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 18: North America Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 19: North America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Country, 2023–2031

Table 20: North America Adhesive Tapes Market Value (US$ Bn) Forecast, by Country, 2023–2031

Table 21: U.S. Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 22: U.S. Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 23: U.S. Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 24: U.S. Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 25: U.S. Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 26: U.S. Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 27: U.S. Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 28: U.S. Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 29: Canada Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 30: Canada Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 31: Canada Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 32: Canada Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 33: Canada Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 34: Canada Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 35: Canada Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 36: Canada Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 37: Europe Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 38: Europe Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 39: Europe Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 40: Europe Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 41: Europe Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 42: Europe Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 43: Europe Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 44: Europe Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 45: Europe Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Country and Sub-region, 2023–2031

Table 46: Europe Adhesive Tapes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 47: Germany Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 48: Germany Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 49: Germany Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 50: Germany Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 51: Germany Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 52: Germany Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 53: Germany Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 54: Germany Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 55: France Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 56: France Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 57: France Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 58: France Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 59: France Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 60: France Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 61: France Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 62: France Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 63: U.K. Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 64: U.K. Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 65: U.K. Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 66: U.K. Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 67: U.K. Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 68: U.K. Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 69: U.K. Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 70: U.K. Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 71: Italy Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 72: Italy Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 73: Italy Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 74: Italy Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 75: Italy Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 76: Italy Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 77: Italy Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 78: Italy Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 79: Spain Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 80: Spain Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 81: Spain Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 82: Spain Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 83: Spain Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 84: Spain Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 85: Spain Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 86: Spain Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 87: Russia & CIS Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 88: Russia & CIS Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 89: Russia & CIS Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 90: Russia & CIS Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 91: Russia & CIS Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 92: Russia & CIS Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 93: Russia & CIS Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 94: Russia & CIS Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 95: Rest of Europe Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 96: Rest of Europe Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 97: Rest of Europe Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 98: Rest of Europe Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 99: Rest of Europe Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 100: Rest of Europe Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 101: Rest of Europe Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 102: Rest of Europe Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 103: Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 104: Asia Pacific Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 105: Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 106: Asia Pacific Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 107: Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 108: Asia Pacific Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 109: Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 110: Asia Pacific Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 111: Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Country and Sub-region, 2023–2031

Table 112: Asia Pacific Adhesive Tapes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 113: China Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 114: China Adhesive Tapes Market Value (US$ Bn) Forecast, by Product 2023–2031

Table 115: China Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 116: China Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 117: China Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 118: China Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 119: China Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 120: China Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 121: Japan Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 122: Japan Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 123: Japan Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 124: Japan Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 125: Japan Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 126: Japan Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 127: Japan Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 128: Japan Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 129: India Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 130: India Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 131: India Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 132: India Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 133: India Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 134: India Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 135: India Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 136: India Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 137: ASEAN Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 138: ASEAN Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 139: ASEAN Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 140: ASEAN Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 141: ASEAN Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 142: ASEAN Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 143: ASEAN Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 144: ASEAN Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 145: Rest of Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 146: Rest of Asia Pacific Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 147: Rest of Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 148: Rest of Asia Pacific Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 149: Rest of Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 150: Rest of Asia Pacific Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 151: Rest of Asia Pacific Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 152: Rest of Asia Pacific Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 153: Latin America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 154: Latin America Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 155: Latin America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 156: Latin America Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 157: Latin America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 158: Latin America Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 159: Latin America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 160: Latin America Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 161: Latin America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Country and Sub-region, 2023–2031

Table 162: Latin America Adhesive Tapes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 163: Brazil Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 164: Brazil Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 165: Brazil Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 166: Brazil Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 167: Brazil Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 168: Brazil Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 169: Brazil Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 170: Brazil Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 171: Mexico Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 172: Mexico Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 173: Mexico Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 174: Mexico Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 175: Mexico Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 176: Mexico Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 177: Mexico Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 178: Mexico Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 179: Rest of Latin America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 180: Rest of Latin America Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 181: Rest of Latin America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 182: Rest of Latin America Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 183: Rest of Latin America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 184: Rest of Latin America Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 185: Rest of Latin America Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 186: Rest of Latin America Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 187: Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 188: Middle East & Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 189: Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 190: Middle East & Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 191: Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 192: Middle East & Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 193: Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 194: Middle East & Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 195: Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Country and Sub-region, 2023–2031

Table 196: Middle East & Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 197: GCC Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 198: GCC Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 199: GCC Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 200: GCC Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 201: GCC Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 202: GCC Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 203: GCC Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 204: GCC Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 205: South Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 206: South Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 207: South Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 208: South Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 209: South Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 210: South Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 211: South Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 212: South Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 213: Rest of Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Product, 2023–2031

Table 214: Rest of Middle East & Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 215: Rest of Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Composition, 2023–2031

Table 216: Rest of Middle East & Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Composition, 2023–2031

Table 217: Rest of Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by Backing Material, 2023–2031

Table 218: Rest of Middle East & Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by Backing Material, 2023–2031

Table 219: Rest of Middle East & Africa Adhesive Tapes Market Volume (Million Square Meters) Forecast, by End-use, 2023–2031

Table 220: Rest of Middle East & Africa Adhesive Tapes Market Value (US$ Bn) Forecast, by End-use 2023–2031

List of Figures

Figure 1: Global Adhesive Tapes Market Volume Share Analysis, by Product, 2023, 2027, and 2031

Figure 2: Global Adhesive Tapes Market Attractiveness, by Product

Figure 3: Global Adhesive Tapes Market Volume Share Analysis, by Composition, 2023, 2027, and 2031

Figure 4: Global Adhesive Tapes Market Attractiveness, by Composition

Figure 5: Global Adhesive Tapes Market Volume Share Analysis, by Backing Material, 2023, 2027, and 2031

Figure 6: Global Adhesive Tapes Market Attractiveness, by Backing Material

Figure 7: Global Adhesive Tapes Market Volume Share Analysis, by End-use, 2023, 2027, and 2031

Figure 8: Global Adhesive Tapes Market Attractiveness, by End-use

Figure 9: Global Adhesive Tapes Market Volume Share Analysis, by Region, 2023, 2027, and 2031

Figure 10: Global Adhesive Tapes Market Attractiveness, by Region

Figure 11: North America Adhesive Tapes Market Volume Share Analysis, by Product, 2023, 2027, and 2031

Figure 12: North America Adhesive Tapes Market Attractiveness, by Product

Figure 13: North America Adhesive Tapes Market Attractiveness, by Product

Figure 14: North America Adhesive Tapes Market Volume Share Analysis, by Composition, 2023, 2027, and 2031

Figure 15: North America Adhesive Tapes Market Attractiveness, by Composition

Figure 16: North America Adhesive Tapes Market Volume Share Analysis, by Backing Material, 2023, 2027, and 2031

Figure 17: North America Adhesive Tapes Market Attractiveness, by Backing Material

Figure 18: North America Adhesive Tapes Market Volume Share Analysis, by End-use, 2023, 2027, and 2031

Figure 19: North America Adhesive Tapes Market Attractiveness, by End-use

Figure 20: North America Adhesive Tapes Market Attractiveness, by Country and Sub-region

Figure 21: Europe Adhesive Tapes Market Volume Share Analysis, by Product, 2023, 2027, and 2031

Figure 22: Europe Adhesive Tapes Market Attractiveness, by Product

Figure 23: Europe Adhesive Tapes Market Volume Share Analysis, by Composition, 2023, 2027, and 2031

Figure 24: Europe Adhesive Tapes Market Attractiveness, by Composition

Figure 25: Europe Adhesive Tapes Market Volume Share Analysis, by Backing Material, 2023, 2027, and 2031

Figure 26: Europe Adhesive Tapes Market Attractiveness, by Backing Material

Figure 27: Europe Adhesive Tapes Market Volume Share Analysis, by End-use, 2023, 2027, and 2031

Figure 28: Europe Adhesive Tapes Market Attractiveness, by End-use

Figure 29: Europe Adhesive Tapes Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 30: Europe Adhesive Tapes Market Attractiveness, by Country and Sub-region

Figure 31: Asia Pacific Adhesive Tapes Market Volume Share Analysis, by Product, 2023, 2027, and 2031

Figure 32: Asia Pacific Adhesive Tapes Market Attractiveness, by Product

Figure 33: Asia Pacific Adhesive Tapes Market Volume Share Analysis, by Composition, 2023, 2027, and 2031

Figure 34: Asia Pacific Adhesive Tapes Market Attractiveness, by Composition

Figure 35: Asia Pacific Adhesive Tapes Market Volume Share Analysis, by Backing Material, 2023, 2027, and 2031

Figure 36: Asia Pacific Adhesive Tapes Market Attractiveness, by Backing Material

Figure 37: Asia Pacific Adhesive Tapes Market Volume Share Analysis, by End-use, 2023, 2027, and 2031

Figure 38: Asia Pacific Adhesive Tapes Market Attractiveness, by End-use

Figure 39: Asia Pacific Adhesive Tapes Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 40: Asia Pacific Adhesive Tapes Market Attractiveness, by Country and Sub-region

Figure 41: Latin America Adhesive Tapes Market Volume Share Analysis, by Product, 2023, 2027, and 2031

Figure 42: Latin America Adhesive Tapes Market Attractiveness, by Product

Figure 43: Latin America Adhesive Tapes Market Volume Share Analysis, by Composition, 2023, 2027, and 2031

Figure 44: Latin America Adhesive Tapes Market Attractiveness, by Composition

Figure 45: Latin America Adhesive Tapes Market Volume Share Analysis, by Backing Material, 2023, 2027, and 2031

Figure 46: Latin America Adhesive Tapes Market Attractiveness, by Backing Material

Figure 47: Latin America Adhesive Tapes Market Volume Share Analysis, by End-use, 2023, 2027, and 2031

Figure 48: Latin America Adhesive Tapes Market Attractiveness, by End-use

Figure 49: Latin America Adhesive Tapes Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 50: Latin America Adhesive Tapes Market Attractiveness, by Country and Sub-region

Figure 51: Middle East & Africa Adhesive Tapes Market Volume Share Analysis, by Product, 2023, 2027, and 2031

Figure 52: Middle East & Africa Adhesive Tapes Market Attractiveness, by Product

Figure 53: Middle East & Africa Adhesive Tapes Market Volume Share Analysis, by Composition, 2023, 2027, and 2031

Figure 54: Middle East & Africa Adhesive Tapes Market Attractiveness, by Composition

Figure 55: Middle East & Africa Adhesive Tapes Market Volume Share Analysis, by Backing Material, 2023, 2027, and 2031

Figure 56: Middle East & Africa Adhesive Tapes Market Attractiveness, by Backing Material

Figure 57: Middle East & Africa Adhesive Tapes Market Volume Share Analysis, by End-use, 2023, 2027, and 2031

Figure 58: Middle East & Africa Adhesive Tapes Market Attractiveness, by End-use

Figure 59: Middle East & Africa Adhesive Tapes Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2031

Figure 60: Middle East & Africa Adhesive Tapes Market Attractiveness, by Country and Sub-region