Reports

Reports

Analysts’ Viewpoint

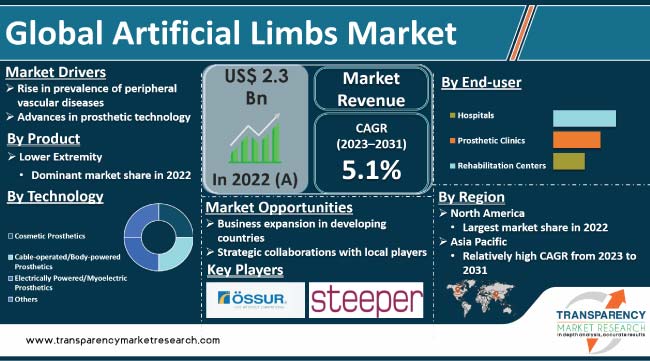

Rise in prevalence of peripheral vascular diseases and advances in prosthetic technology are significant factors driving the global market. Artificial limbs market demand is increasing due to the rise in incidence of diabetic foot ulcer and increase in cases of road accidents across the globe.

Manufacturers in the global market are focusing on the development of more versatile, high-performing, and technology-driven prosthetic devices. Electrically powered/myoelectric prosthetics technology is gaining traction among patients and healthcare professionals. Emergence of artificial intelligence (AI) technology to develop advanced prosthetic devices that are precise, efficient, and offer personalized care for individuals with artificial limbs, is creating value-grab opportunities for market participants. Manufacturers are also investing significantly in research & development to offer innovative and safe products for patients with amputations.

Artificial limb prosthetics are devices used to replace the function of a missing limb. These devices are primarily employed to replace missing or malformed hands or legs. The most common reasons for amputation are vascular diseases, diabetes, cancer, and trauma.

Introduction of new technologies and materials has resulted in the development of improved products for patients. Urethane, silicone, and mineral-based liners are commonly used materials in prosthetic devices. These materials are much more flexible, comfortable, and lightweight as compared to conventional materials such as wood and hard plastics. Increase in use of such materials and technological advancements are contributing to the growth of the global artificial limbs market.

Diabetes and peripheral vascular diseases are the main causes of amputation. Rise in number of people afflicted by these diseases is fueling the demand for prosthetics.

According to The New England Journal of Medicine, the annual incidence of diabetic foot ulcers is rapidly rising across the globe. Around 15% to 25% of patients with diabetes mellitus are likely to develop a diabetic foot ulcer during their lifetime.

According to the International Diabetes Federation, more than 2.4 million people in the U.S. are estimated to be at risk of developing foot ulcers. In diabetics, a foot ulcer, if not properly treated, can lead to amputation.

According to the Amputee Coalition of America, vascular diseases are the primary cause of lower-limb amputation. According to the CDC, over 8.5 million people in the U.S. are affected by peripheral vascular diseases. Rise in prevalence of diabetes and vascular diseases is anticipated to drive the global artificial limbs market during the forecast period. Moreover, governments of several developing countries are launching schemes to cover a certain amount of cost associated with artificial limbs.

In terms of product, the global market segmentation comprises upper extremity, lower extremity, sockets, liners, and others. The lower extremity product segment is anticipated to account for major share of the global artificial limbs market during the forecast period.

Increase in prevalence of peripheral vascular diseases and a growing number of road accidents are the key factors responsible for the growth of this segment. According to the WHO, 20 to 50 million people suffer from non-fatal injuries every year across the world, with many incurring a lower extremity disability as a result of their injury.

Moreover, diabetic foot disease is one of the leading causes of patient disability worldwide. Lower extremity amputations (LEAs) caused due to diabetic foot ulcer affect the quality of life of patients, and also incur significant healthcare costs.

Dysvascular disease is a frequent cause of lower limb amputations. Lower extremity dysvacular amputations occur in 45 per 100000 individuals and disproportionately affect minority individuals in the developed nation. Thus, increase in cases of lower extremity impairment is contributing to the market development.

In terms of technology, the electrically powered/myoelectric prosthetics segment is expected to lead the global market during the forecast period. This segment held more than 40% of the global artificial limbs market share in 2022.

Advancement in myoelectric prosthetics in the form of multi-articulating myoelectric hands allows a lifelike experience for amputees. Moreover, increase in disposable income is also contributing to the demand for electrically powered/myoelectric prosthetic devices, as maintenance cost is high for such products.

According to the latest artificial limbs market forecast report, in terms of end-user, the hospitals end-user segment is anticipated to lead the global industry during the forecast period.

Hospitals provide an extensive range of personalized and innovative solutions for each of the amputees, including state-of-the-art braces, supports, inserts, shoes, and other devices. Increase in investment in improving healthcare infrastructure in several countries across the globe is also fueling the segment.

The prosthetic clinics end-user segment is expected to grow at a rapid pace during the forecast period. Several private prosthetic clinics organize educational programs, workshops, and seminars in collaboration with companies to promote different services and prosthetic products, thereby providing massive opportunities for the artificial limbs market.

North America accounted for the largest share of the global market in 2022. The region is anticipated to lead the global market in the next few years, owing to the presence of prominent manufacturers and growth in healthcare industry in North America.

The U.S. is the key market for artificial limbs. Rise in adoption of myoelectric prosthetic products by hospitals, technological advancements, increase in research & development activities in artificial limbs, and surge in demand for efficient and safe products in the U.S. are fueling market expansion in North America.

The artificial limbs market size in Asia Pacific is projected to grow at a rapid pace, owing to increase in prevalence of diabetic foot ulcers and rise in number of road accidents in the region, which lead to amputation.

In 2021, a total number of 412432 road accidents were reported in India, claiming 153972 lives and causing injuries to 384448 persons. Increase in road accidents, specifically in India, is augmenting the demand for artificial limbs.

The global landscape is consolidated, with the presence of a few leading manufacturers that control majority of the artificial limbs market share. Leading companies are focusing on mergers & acquisitions, new product development, and product portfolio expansion to gain incremental opportunities.

Key players operating in the market are Össur, Ohio Willow Wood Company, Hanger, Inc., Ottobock, PROTEOR, RSL Steeper Group Ltd., Blatchford Group, Fillauer LLC, Liberating Technologies, Inc., Spinal Technology, Inc., and Optimus Prosthetics. These players are following the artificial limbs market trends to avail lucrative revenue opportunities.

Key players have been profiled in the global artificial limbs market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 2.3 Bn |

|

Market Forecast Value in 2031 |

More than US$ 3.5 Bn |

|

CAGR |

5.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 2.3 Bn in 2022

It is projected to reach more than US$ 3.5 Bn by 2031

The CAGR is anticipated to be 5.1% during the forecast period

Rise in prevalence of peripheral vascular diseases and technological advancements in prosthetic limbs development

The lower extremity product segment accounted for leading share in 2022

North America is likely to account for major share during the forecast period.

Össur, Hanger, Inc., Ohio Willow Wood Company, Ottobock, RSL Steeper Group Ltd., PROTEOR, Blatchford Group, Liberating Technologies, Inc., Fillauer LLC, Spinal Technology, Inc., and Optimus Prosthetics

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Artificial Limbs Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Artificial Limbs Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Forces Analysis

5. Key Insights

5.1. Value Chain Analysis

5.2. AI Application in Prosthetics Limbs

5.3. Key Industry Events

6. Global Artificial Limbs Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Upper Extremity

6.3.2. Lower Extremity

6.3.3. Sockets

6.3.4. Liners

6.3.5. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Artificial Limbs Market Analysis and Forecast, by Technology

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Technology, 2017-2031

7.3.1. Cosmetic Prosthetics

7.3.2. Cable-operated/Body-powered Prosthetics

7.3.3. Electrically Powered/Myoelectric Prosthetics

7.3.4. Others

7.4. Market Attractiveness Analysis, by Technology

8. Global Artificial Limbs Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Prosthetic Clinics

8.3.3. Rehabilitation Centers

8.4. Market Attractiveness Analysis, by End-user

9. Global Artificial Limbs Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Artificial Limbs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Upper Extremity

10.2.2. Lower Extremity

10.2.3. Sockets

10.2.4. Liners

10.2.5. Others

10.3. Market Value Forecast, by Technology, 2017-2031

10.3.1. Cosmetic Prosthetics

10.3.2. Cable-operated/Body-powered Prosthetics

10.3.3. Electrically Powered/Myoelectric Prosthetics

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Prosthetic Clinics

10.4.3. Rehabilitation Centers

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Technology

10.6.3. By End-user

10.6.4. By Country

11. Europe Artificial Limbs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Upper Extremity

11.2.2. Lower Extremity

11.2.3. Sockets

11.2.4. Liners

11.2.5. Others

11.3. Market Value Forecast, by Technology, 2017-2031

11.3.1. Cosmetic Prosthetics

11.3.2. Cable-operated/Body-powered Prosthetics

11.3.3. Electrically Powered/Myoelectric Prosthetics

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Prosthetic Clinics

11.4.3. Rehabilitation Centers

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Technology

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Artificial Limbs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Upper Extremity

12.2.2. Lower Extremity

12.2.3. Sockets

12.2.4. Liners

12.2.5. Others

12.3. Market Value Forecast, by Technology, 2017-2031

12.3.1. Cosmetic Prosthetics

12.3.2. Cable-operated/Body-powered Prosthetics

12.3.3. Electrically Powered/Myoelectric Prosthetics

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Prosthetic Clinics

12.4.3. Rehabilitation Centers

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Technology

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Artificial Limbs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. Upper Extremity

13.2.2. Lower Extremity

13.2.3. Sockets

13.2.4. Liners

13.2.5. Others

13.3. Market Value Forecast, by Technology, 2017-2031

13.3.1. Cosmetic Prosthetics

13.3.2. Cable-operated/Body-powered Prosthetics

13.3.3. Electrically Powered/Myoelectric Prosthetics

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Prosthetic Clinics

13.4.3. Rehabilitation Centers

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Technology

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Artificial Limbs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017-2031

14.2.1. Upper Extremity

14.2.2. Lower Extremity

14.2.3. Sockets

14.2.4. Liners

14.2.5. Others

14.3. Market Value Forecast, by Technology, 2017-2031

14.3.1. Cosmetic Prosthetics

14.3.2. Cable-operated/Body-powered Prosthetics

14.3.3. Electrically Powered/Myoelectric Prosthetics

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Prosthetic Clinics

14.4.3. Rehabilitation Centers

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Technology

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Össur

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Hanger, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Ohio Willow Wood Company

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Ottobock

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. RSL Steeper Group Ltd.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. PROTEOR

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Liberating Technologies, Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Fillauer LLC

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Spinal Technology, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Optimus Prosthetics

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Artificial Limbs Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Artificial Limbs Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 03: Global Artificial Limbs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 04: Global Artificial Limbs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Artificial Limbs Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 06: North America Artificial Limbs Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 07: North America Artificial Limbs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 08: North America Artificial Limbs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 09: Europe Artificial Limbs Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 10: Europe Artificial Limbs Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 11: Europe Artificial Limbs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 12: Europe Artificial Limbs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 13: Asia Pacific Artificial Limbs Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 14: Asia Pacific Artificial Limbs Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 15: Asia Pacific Artificial Limbs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Artificial Limbs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 17: Latin America Artificial Limbs Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 18: Latin America Artificial Limbs Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 19: Latin America Artificial Limbs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 20: Latin America Artificial Limbs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 21: Middle East & Africa Artificial Limbs Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 22: Middle East & Africa Artificial Limbs Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 23: Middle East & Africa Artificial Limbs Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 24: Middle East & Africa Artificial Limbs Market Size (US$ Mn) Forecast, by Region, 2017-2031

List of Figures

Figure 01: Global Artificial Limbs Market Value (US$ Mn) Forecast 2017-2031

Figure 02: Global Artificial Limbs Market Value Share by Product 2022

Figure 03: Global Artificial Limbs Market Value Share by Product 2022

Figure 04: Global Artificial Limbs Market Value Share by Technology 2022

Figure 05: Global Artificial Limbs Market Value Share by End-user 2022

Figure 06: Global Artificial Limbs Market Value Share Analysis by Product 2022 and 2031

Figure 07: Global Artificial Limbs Market Value (US$ Mn) by Upper Extremity 2017-2031

Figure 08: Global Artificial Limbs Market Value (US$ Mn) by Lower Extremity 2017-2031

Figure 09: Global Artificial Limbs Market Value (US$ Mn) by Sockets 2017-2031

Figure 10: Global Artificial Limbs Market Value (US$ Mn)by Liners 2017-2032

Figure 11: Global Artificial Limbs Market Value (US$ Mn)by Others 2017-2033

Figure 12: Global Artificial Limbs Market Attractiveness Analysis by Product 2023-2031

Figure 13: Global Artificial Limbs Market Value Share Analysis by Technology 2022 and 2031

Figure 14: Global Artificial Limbs Market Value (US$ Mn) by Cosmetic Prosthetics 2017-2031

Figure 15: Global Artificial Limbs Market Value (US$ Mn) by Cable-operated/Body-powered Prosthetics 2017-2031

Figure 16: Global Artificial Limbs Market Value (US$ Mn) by Electrically Powered/Myoelectric Prosthetics 2017-2031

Figure 17: Global Artificial Limbs Market Value (US$ Mn) by Others 2017-2031

Figure 18: Global Artificial Limbs Market Attractiveness Analysis by Technology 2023-2031

Figure 19: Global Artificial Limbs Market Value Share Analysis by End-user 2022 and 2031

Figure 20: Global Artificial Limbs Market Value (US$ Mn) by Hospitals 2017-2031

Figure 21: Global Artificial Limbs Market Value (US$ Mn) by Prosthetic Clinics 2017-2032

Figure 22: Global Artificial Limbs Market Value (US$ Mn) by Rehabilitation Centers 2017-2031

Figure 23: Global Artificial Limbs Market Attractiveness Analysis by End-user 2023-2031

Figure 24: Global Artificial Limbs Market Value Share Analysis by Region 2022 and 2031

Figure 25: Global Artificial Limbs Market Attractiveness Analysis by Region 2023-2031

Figure 26: North America Artificial Limbs Market Value (US$ Mn) Forecast 2017-2031

Figure 27: North America Artificial Limbs Market Value Share Analysis by Country 2022 and 2031

Figure 28: North America Artificial Limbs Market Attractiveness Analysis by Country 2023-2031

Figure 29: North America Artificial Limbs Market Value Share Analysis by Product 2022 and 2031

Figure 30: North America Artificial Limbs Market Attractiveness Analysis by Product 2023-2031

Figure 31: North America Artificial Limbs Market Value Share Analysis by Technology 2022 and 2031

Figure 32: North America Artificial Limbs Market Attractiveness Analysis by Technology 2023-2031

Figure 33: North America Artificial Limbs Market Value Share Analysis by End-user 2022 and 2031

Figure 34: North America Artificial Limbs Market Attractiveness Analysis by End-user 2023-2031

Figure 35: Europe Artificial Limbs Market Value (US$ Mn) Forecast 2017-2031

Figure 36: Europe Artificial Limbs Market Value Share Analysis by Country 2022 and 2031

Figure 37: Europe Artificial Limbs Market Attractiveness Analysis by Country 2023-2031

Figure 38: Europe Artificial Limbs Market Value Share Analysis by Product 2022 and 2031

Figure 39: Europe Artificial Limbs Market Attractiveness Analysis by Product 2023-2031

Figure 40: Europe Artificial Limbs Market Value Share Analysis by Technology 2022 and 2031

Figure 41: Europe Artificial Limbs Market Attractiveness Analysis by Technology 2023-2031

Figure 42: Europe Artificial Limbs Market Value Share Analysis by End-user 2022 and 2031

Figure 43: Europe Artificial Limbs Market Attractiveness Analysis by End-user 2023-2031

Figure 44: Asia Pacific Artificial Limbs Market Value (US$ Mn) Forecast 2017-2031

Figure 45: Asia Pacific Artificial Limbs Market Value Share Analysis by Country 2022 and 2031

Figure 46: Asia Pacific Artificial Limbs Market Attractiveness Analysis by Country 2023-2031

Figure 47: Asia Pacific Artificial Limbs Market Value Share Analysis by Product 2022 and 2031

Figure 48: Asia Pacific Artificial Limbs Market Attractiveness Analysis by Product 2023-2031

Figure 49: Asia Pacific Artificial Limbs Market Value Share Analysis by Technology 2022 and 2031

Figure 50: Asia Pacific Artificial Limbs Market Attractiveness Analysis by Technology 2023-2031

Figure 51: Asia Pacific Artificial Limbs Market Value Share Analysis by End-user 2022 and 2031

Figure 52: Asia Pacific Artificial Limbs Market Attractiveness Analysis by End-user 2023-2031

Figure 53: Latin America Artificial Limbs Market Value (US$ Mn) Forecast 2017-2031

Figure 54: Latin America Artificial Limbs Market Value Share Analysis by Country 2022 and 2031

Figure 55: Latin America Artificial Limbs Market Attractiveness Analysis by Country 2023-2031

Figure 56: Latin America Artificial Limbs Market Value Share Analysis by Product 2022 and 2031

Figure 57: Latin America Artificial Limbs Market Attractiveness Analysis by Product 2023-2031

Figure 58: Latin America Artificial Limbs Market Value Share Analysis by Technology 2022 and 2031

Figure 59: Latin America Artificial Limbs Market Attractiveness Analysis by Technology 2023-2031

Figure 60: Latin America Artificial Limbs Market Value Share Analysis by End-user 2022 and 2031

Figure 61: Latin America Artificial Limbs Market Attractiveness Analysis by End-user 2023-2031

Figure 62: Middle East & Africa Artificial Limbs Market Value (US$ Mn) 2017-2031

Figure 63: Middle East & Africa Artificial Limbs Market Value Share Analysis by Country 2022 and 2031

Figure 64: Middle East & Africa Artificial Limbs Market Attractiveness by Country 2023-2031

Figure 65: Middle East & Africa Artificial Limbs Market Value Share Analysis by Product 2022 and 2031

Figure 66: Middle East & Africa Artificial Limbs Market Attractiveness by Product 2023-2031

Figure 67: Middle East & Africa Artificial Limbs Market Value Share Analysis by Technology 2022 and 2031

Figure 68: Middle East & Africa Artificial Limbs Market Attractiveness by Technology 2023-2031

Figure 69: Middle East & Africa Artificial Limbs Market Value Share Analysis by End-user 2022 and 2031

Figure 70: Middle East & Africa Artificial Limbs Market Attractiveness by End-user 2023-2031

Figure 71: Company Share Analysis Artificial Limbs 2022