Reports

Reports

The adoption of electrically powered/myoelectric technology is predicted to grow at an aggressive rate during the forecast period. Hence, companies are increasing R&D in electrically powered technology to meet specific requirements of individuals.

Since powered prosthetic devices require a great deal of electricity to function efficiently, researchers are developing innovative skin that stores electricity. For instance, researchers at the University of Glasgow have developed a combination electronic skin to generate and store electricity for prosthetic devices. Thus, manufacturers in the prosthetics market should collaborate with researchers to gain expertise in electrically powered prosthetics.

Researchers are experimenting with innovative materials such as graphite-polyurethane composite covered by graphene. These materials act as electric supercapacitors capable of storing energy and cater to energy conservation needs of end users. Likewise, the graphene component acts as a solar panel that converts sunlight to electricity in order to charge the supercapacitor. Thus, companies in the prosthetics market landscape should adopt such innovations to make their products eco-friendly.

The computer-aided design/computer-aided manufacturing (CAD/CAM) technology is growing popular in the dental prosthetics segment. The CAD/CAM technology has given rise to rapid prototyping (RP), which has resulted in accuracy of prosthetic restorations, as compared to conventional restoration techniques.

Ongoing innovations in digital technology are revolutionizing the prosthetics market. As such, the dental prosthetics product segment of the prosthetics market is projected for exponential growth during the forecast period. Hence, manufacturers are increasing research in RP to digitize dental treatment.

RP offers promising opportunities in dental fields such as fabrication of surgical implant guides, maxillofacial prosthesis, and the likes. The CAD/CAM technology is being used by companies in the prosthetics market to reduce reliance on human variables and overcome limitations of conventional methods. In order to broaden their scope in incremental opportunities, companies are achieving fabrication of high-precision metal parts using selective laser melting technology.

The prosthetics market is undergoing a change with the addition of AI and machine learning to develop mind-controlled prosthetics. Companies are developing prosthetic arms and limbs that are more adaptive and mimic the near-natural function of the human body parts. However, high reimbursement costs associated with these advanced prosthetics are some of the issues that companies need to address in order to sustain in the competitive prosthetics market landscape.

The prosthetics market is highly fragmented with emerging and prominent players accounting for ~80% market share. Thus, it is easier for new players to enter the market, but all companies need to tackle the common problem of high costs and lack of reimbursement policies to sustain in the market. High degree of abandonment by amputees has slowed down innovations and has created a barrier for investment by insurance companies in advanced technologies.

In order to overcome barriers of high costs and inefficient reimbursement policies, companies are increasing awareness and demonstrating the value proposition of prosthetics. This is being achieved by increasing research to develop cutting-edge prosthetics.

Companies are developing user-friendly prosthetics that are improving the quality of life of amputees. They are innovating in novel control systems for 3D-printed prosthetic hand that is capable of performing intricate and natural finger motions with greater accuracy. As such, orthopedic prosthetics product segment of the prosthetics market is estimated to generate second-highest revenue by 2027.

There is a growing demand for user-friendly prosthetics that require minimal training, especially in case of elderly patients. Advantages of user-friendly prosthetics are making them widely accessible for amputees. Companies in the prosthetics market are increasing research in unique control systems using muscle synergy theory to deploy complex movements.

Analysts’ Viewpoint

Researchers are introducing virtual reality programs to help prosthetic limbs feel more connected to the body of amputees. Asia Pacific is projected for exponential growth during the forecast period of the prosthetics market. This is evident as stakeholders in the Indian prosthetics startup, Social Hardware, are aiming to develop prosthetics for low-income rural amputees.

Moreover, the myoelectric prosthetic technology dominates the prosthetics market landscape. However, in order to use these types of prosthetics, amputees need to undergo a lot of training, which is undesirable in individuals. Hence, manufacturers should increase the availability of adaptable 3D-printed prosthetics to overcome the limitations of the myoelectric prosthetic technology.

The global prosthetics market was worth US$ 8.9 Bn and is projected to reach a value of US$ 15 Bn by the end of 2027

Prosthetics market is anticipated to grow at a CAGR of 6% during the forecast period

Europe accounted for a major share of the global prosthetics market

Prosthetics market is driven by rise in prevalence of dental disorders, aging population, growing medical tourism for dental procedures, increase in incidence of diabetes among the population leading to amputations, and surge in accident and trauma cases leading to limb loss

Key players in the global prosthetics market include Straumann AG, Danaher Corporation (Nobel Biocare Services AG), Zimmer Biomet Holdings, Inc., Dentsply Sirona, Inc., BioHorizons, Inc., Hanger, Inc., Össur, Ohio Willow Wood Company, Ottobock SE & Co., GaA, and Blatchford Group

1. Preface

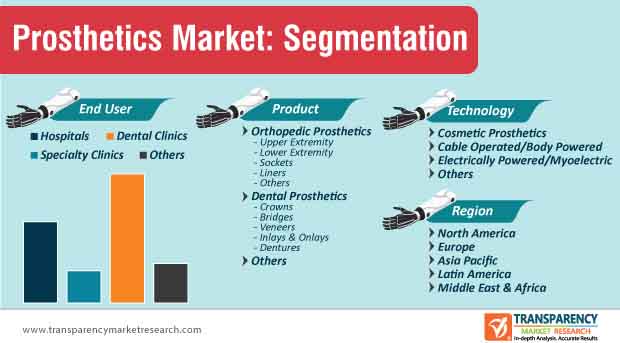

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Acronyms

3. Research Methodology

4. Executive Summary: Global Prosthetics Market

5. Market Overview

5.1. Definition

5.2. Market Indicators

5.3. Market Dynamics

5.3.1. Drivers

5.3.2. Restraints

5.3.3. Opportunities

6. Market Outlook

6.1. Global Prosthetics Market Analysis and Forecast, 2017–2027

6.2. Global Prosthetics Market Outlook

6.3. Regulatory Approval Process

6.4. Key Industry Developments

6.5. Value Chain Analysis

7. Global Prosthetics Market Analysis and Forecast, by Product

7.1. Introduction

7.2. Global Prosthetics Market Value Forecast, by Product, 2017–2027

7.2.1. Orthopedic Prosthetics

7.2.1.1. Upper Extremity

7.2.1.1.1. Shoulder Disarticulation

7.2.1.1.2. Transhumeral

7.2.1.1.3. Elbow Disarticulation

7.2.1.1.4. Transradial

7.2.1.1.5. Wrist Disarticulation and partial hand

7.2.1.2. Lower Extremity

7.2.1.2.1. Foot Amputation

7.2.1.2.2. Transtibial

7.2.1.2.3. Knee Disarticulation

7.2.1.2.4. Transfemoral

7.2.1.2.5. Hip Disarticulation

7.2.1.3. Sockets

7.2.1.4. Liners

7.2.1.5. Others

7.2.2. Dental Prosthetics

7.2.2.1. Crowns

7.2.2.2. Bridges

7.2.2.3. Veneers

7.2.2.4. Inlays & Onlays

7.2.2.5. Dentures

7.2.2.5.1. Partial

7.2.2.5.2. Complete

7.2.3. Others

7.2.4. Market Attractiveness, by Product

8. Global Prosthetics Market Analysis and Forecast, by End-user

8.1. Introduction

8.2. Global Prosthetics Market Value Forecast, by End-user, 2017–2027

8.2.1. Hospitals

8.2.2. Specialty Clinics

8.2.3. Dental Clinics

8.2.4. Others

8.3. Market Attractiveness, by End-user

9. Global Prosthetics Market Analysis and Forecast, by Technology (Orthopedic Prosthetics)

9.1. Introduction

9.2. Global Prosthetics Market Value Forecast, by Technology, 2017–2027

9.2.1. Cosmetic Prosthetics

9.2.2. Cable Operated/Body Powered

9.2.3. Electrically powered/Myoelectric

9.2.4. Others

9.3. Market Attractiveness, by Technology

10. Global Prosthetics Market Analysis and Forecast, by Region

10.1. Regional Outlook

10.2. Global Scenario

10.3. Introduction

10.4. Global Prosthetics Market Value Forecast, by Region

10.4.1. North America

10.4.2. Europe

10.4.3. Asia Pacific

10.4.4. Latin America

10.4.5. Middle East & Africa

10.5. Market Attractiveness, by Region

11. North America Prosthetics Market Analysis and Forecast

11.1. Key Findings

11.2. North America Prosthetics Market Value Forecast, by Product, 2017–2027

11.2.1. Orthopedic Prosthetics

11.2.1.1. Upper Extremity

11.2.1.1.1. Shoulder Disarticulation

11.2.1.1.2. Transhumeral

11.2.1.1.3. Elbow Disarticulation

11.2.1.1.4. Transradial

11.2.1.1.5. Wrist Disarticulation and partial hand

11.2.1.2. Lower Extremity

11.2.1.2.1. Foot Amputation

11.2.1.2.2. Transtibial

11.2.1.2.3. Knee Disarticulation

11.2.1.2.4. Transfemoral

11.2.1.2.5. Hip Disarticulation

11.2.1.3. Sockets

11.2.1.4. Liners

11.2.1.5. Others

11.2.2. Dental Prosthetics

11.2.2.1. Crowns

11.2.2.2. Bridges

11.2.2.3. Veneers

11.2.2.4. Inlays & Onlays

11.2.2.5. Dentures

11.2.2.5.1. Partial

11.2.2.5.2. Complete

11.2.3. Others

11.3. North America Prosthetics Market Value Forecast, by End-user, 2017–2027

11.3.1. Hospitals

11.3.2. Specialty Clinics

11.3.3. Dental Clinics

11.3.4. Others

11.4. North America Prosthetics Market Value Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

11.4.1. Cosmetic Prosthetics

11.4.2. Cable Operated/Body Powered

11.4.3. Electrically powered/Myoelectric

11.4.4. Others

11.5. North America Prosthetics Market Value Forecast, by Country, 2017–2027

11.5.1. U.S.

11.5.2. Canada

11.6. North America Prosthetics Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Indication

11.6.3. By Technology (orthopedic prosthetics)

11.6.4. By Country

12. Europe Prosthetics Market Analysis and Forecast

12.1. Key Findings

12.2. Europe Prosthetics Market Value Forecast, by Product, 2017–2027

12.2.1. Orthopedic Prosthetics

12.2.1.1. Upper Extremity

12.2.1.1.1. Shoulder Disarticulation

12.2.1.1.2. Transhumeral

12.2.1.1.3. Elbow Disarticulation

12.2.1.1.4. Transradial

12.2.1.1.5. Wrist Disarticulation and partial hand

12.2.1.2. Lower Extremity

12.2.1.2.1. Foot Amputation

12.2.1.2.2. Transtibial

12.2.1.2.3. Knee Disarticulation

12.2.1.2.4. Transfemoral

12.2.1.2.5. Hip Disarticulation

12.2.1.3. Sockets

12.2.1.4. Liners

12.2.1.5. Others

12.2.2. Dental Prosthetics

12.2.2.1. Crowns

12.2.2.2. Bridges

12.2.2.3. Veneers

12.2.2.4. Inlays & Onlays

12.2.2.5. Dentures

12.2.2.5.1. Partial

12.2.2.5.2. Complete

12.2.3. Others

12.3. Europe Prosthetics Market Value Forecast, by End-user, 2017–2027

12.3.1. Hospitals

12.3.2. Specialty Clinics

12.3.3. Dental Clinics

12.3.4. Others

12.4. Europe Prosthetics Market Value Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

12.4.1. Cosmetic Prosthetics

12.4.2. Cable Operated/Body Powered

12.4.3. Electrically powered/Myoelectric

12.4.4. Others

12.5. Europe Prosthetics Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. U.K.

12.5.2. Germany

12.5.3. France

12.5.4. Italy

12.5.5. Spain

12.5.6. Rest of Europe

12.6. Europe Prosthetics Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By End-user

12.6.3. By Technology (orthopedic prosthetics)

12.6.4. By Country/Sub-region

13. Asia Pacific Prosthetics Market Analysis and Forecast

13.1. Key Findings

13.2. Asia Pacific Prosthetics Market Value Forecast, by Product, 2017–2027

13.2.1. Orthopedic Prosthetics

14. Upper Extremity

14.1.1.1.1. Shoulder Disarticulation

14.1.1.1.2. Transhumeral

14.1.1.1.3. Elbow Disarticulation

14.1.1.1.4. Transradial

14.1.1.1.5. Wrist Disarticulation and partial hand

14.1.1.2. Lower Extremity

14.1.1.2.1. Foot Amputation

14.1.1.2.2. Transtibial

14.1.1.2.3. Knee Disarticulation

14.1.1.2.4. Transfemoral

14.1.1.2.5. Hip Disarticulation

14.1.1.3. Sockets

14.1.1.4. Liners

14.1.1.5. Others

14.1.2. Dental Prosthetics

14.1.2.1. Crowns

14.1.2.2. Bridges

14.1.2.3. Veneers

14.1.2.4. Inlays & Onlays

14.1.2.5. Dentures

14.1.2.5.1. Partial

14.1.2.5.2. Complete

14.1.3. Others

14.2. Asia Pacific Prosthetics Market Value Forecast, by End-user, 2017–2027

14.2.1. Hospitals

14.2.2. Specialty Clinics

14.2.3. Dental Clinics

14.2.4. Others

14.3. Asia Pacific Prosthetics Market Value Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

14.3.1. Cosmetic Prosthetics

14.3.2. Cable Operated/Body Powered

14.3.3. Electrically powered/Myoelectric

14.3.4. Others

14.4. Asia Pacific Prosthetics Market Value Forecast, by Country/Sub-region, 2017–2027

14.4.1. China

14.4.2. India

14.4.3. Japan

14.4.4. Australia & New Zealand

14.4.5. Rest of Asia Pacific

14.5. Asia Pacific Prosthetics Market Attractiveness Analysis

14.5.1. By Product

14.5.2. By End-user

14.5.3. By Technology (orthopedic prosthetics)

14.5.4. By Country/Sub-region

15. Latin America Prosthetics Market Analysis and Forecast

15.1. Key Findings

15.2. Latin America Prosthetics Market Value Forecast, by Product, 2017–2027

15.2.1. Orthopedic Prosthetics

15.2.1.1. Upper Extremity

15.2.1.1.1. Shoulder Disarticulation

15.2.1.1.2. Transhumeral

15.2.1.1.3. Elbow Disarticulation

15.2.1.1.4. Transradial

15.2.1.1.5. Wrist Disarticulation and partial hand

15.2.1.2. Lower Extremity

15.2.1.2.1. Foot Amputation

15.2.1.2.2. Transtibial

15.2.1.2.3. Knee Disarticulation

15.2.1.2.4. Transfemoral

15.2.1.2.5. Hip Disarticulation

15.2.1.3. Sockets

15.2.1.4. Liners

15.2.1.5. Others

15.2.2. Dental Prosthetics

15.2.2.1. Crowns

15.2.2.2. Bridges

15.2.2.3. Veneers

15.2.2.4. Inlays & Onlays

15.2.2.5. Dentures

15.2.2.5.1. Partial

15.2.2.5.2. Complete

15.2.3. Others

15.3. Latin America Prosthetics Market Value Forecast, by End-user, 2017–2027

15.3.1. Hospitals

15.3.2. Specialty Clinics

15.3.3. Dental Clinics

15.3.4. Others

15.4. Latin America Prosthetics Market Value Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

15.4.1. Cosmetic Prosthetics

15.4.2. Cable Operated/Body Powered

15.4.3. Electrically powered/Myoelectric

15.4.4. Others

15.5. Latin America Prosthetics Market Value Forecast, by Country/Sub-region, 2017–2027

15.5.1. Brazil

15.5.2. Mexico

15.5.3. Rest of Latin America

15.6. Latin America Prosthetics Market Attractiveness Analysis

15.6.1. By Product

15.6.2. By End-user

15.6.3. By Technology (orthopedic prosthetics)

15.6.4. By Country/Sub-region

16. Middle East & Africa Prosthetics Market Analysis and Forecast

16.1. Key Findings

16.2. Middle East & Africa Prosthetics Market Value Forecast, by Product, 2017–2027

16.2.1. Orthopedic Prosthetics

16.2.1.1. Upper Extremity

16.2.1.1.1. Shoulder Disarticulation

16.2.1.1.2. Transhumeral

16.2.1.1.3. Elbow Disarticulation

16.2.1.1.4. Transradial

16.2.1.1.5. Wrist Disarticulation and partial hand

16.2.1.2. Lower Extremity

16.2.1.2.1. Foot Amputation

16.2.1.2.2. Transtibial

16.2.1.2.3. Knee Disarticulation

16.2.1.2.4. Transfemoral

16.2.1.2.5. Hip Disarticulation

16.2.1.3. Sockets

16.2.1.4. Liners

16.2.1.5. Others

16.2.2. Dental Prosthetics

16.2.2.1. Crowns

16.2.2.2. Bridges

16.2.2.3. Veneers

16.2.2.4. Inlays & Onlays

16.2.2.5. Dentures

16.2.2.5.1. Partial

16.2.2.5.2. Complete

16.2.3. Others

16.3. Middle East & Africa Prosthetics Market Value Forecast, by End-user, 2017–2027

16.3.1. Hospitals

16.3.2. Specialty Clinics

16.3.3. Dental Clinics

16.3.4. Others

16.4. Middle East & Africa Prosthetics Market Value Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

16.4.1. Cosmetic Prosthetics

16.4.2. Cable Operated/Body Powered

16.4.3. Electrically powered/Myoelectric

16.1.1. Others

16.5. Middle East & Africa Prosthetics Market Value Forecast, by Country/Sub-region, 2017–2027

16.5.1. GCC Countries

16.5.2. South Africa

16.5.3. Rest of Middle East & Africa

16.6. Middle East & Africa Prosthetics Market Attractiveness Analysis

16.6.1. By Product

16.62. By End-user

16.6.3. By Technology (orthopedic prosthetics)

16.6.4. By Country/Sub-region

17. Competition Landscape

17.1. Competition Matrix

17.2. Market Share Analysis, by Company, 2018

17.3. Company Profiles

17.3.1. Institut Straumann AG

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Financial Overview

17.3.1.3. Product Portfolio

17.3.1.4. Strategic Overview

17.3.1.5. SWOT Analysis

17.3.2. Danaher Corporation (Nobel Biocare Services AG)

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Financial Overview

17.3.2.3. Product Portfolio

17.3.2.4. Strategic Overview

17.3.2.5. SWOT Analysis

17.3.3. Zimmer Biomet Holdings, Inc.

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Financial Overview

17.3.3.3. Product Portfolio

17.3.3.4. Strategic Overview

17.3.3.5. SWOT Analysis

17.3.4. Dentsply Sirona, Inc.

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Financial Overview

17.3.4.3. Product Portfolio

17.3.4.4. Strategic Overview

17.3.4.5. SWOT Analysis

17.3.5. BioHorizons, Inc.

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Financial Overview

17.3.5.3. Product Portfolio

17.3.5.4. Strategic Overview

17.3.5.5. SWOT Analysis

17.3.6. Hanger, Inc.

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Financial Overview

17.3.6.3. Product Portfolio

17.3.6.4. Strategic Overview

17.3.6.5. SWOT Analysis

17.3.7. Össur

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Financial Overview

17.3.7.3. Product Portfolio

17.3.7.4. Strategic Overview

17.3.7.5. SWOT Analysis

17.3.8. Ohio Willow Wood Company

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Financial Overview

17.3.8.3. Product Portfolio

17.3.8.4. Strategic Overview

17.3.8.5. SWOT Analysis

17.3.9. Ottobock SE & Co. KGaA

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Financial Overview

17.3.9.3. Product Portfolio

17.3.9.4. Strategic Overview

17.3.9.5. SWOT Analysis

17.3.10. Blatchford Group (Chas. A. Blatchford & Sons Ltd.)

17.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.10.2. Financial Overview

17.3.10.3. Product Portfolio

17.3.10.4. Strategic Overview

17.3.10.5. SWOT Analysis

List of Tables

Table 01: Global Prosthetics Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 02: Global Prosthetics Market Value (US$ Mn) Forecast, by Orthopedic Prosthetics, 2017–2027

Table 03: Global Prosthetics Market Value (US$ Mn) Forecast, by Upper Extremity, 2017–2027

Table 04: Global Prosthetics Market Value (US$ Mn) Forecast, by Lower Extremity, 2017–2027

Table 05: Global Prosthetics Market Value (US$ Mn) Forecast, by Dental Prosthetics, 2017–2027

Table 06: Global Prosthetics Market Value (US$ Mn) Forecast, by Dentures, 2017–2027

Table 07: Global Prosthetics Market Value (US$ Mn) Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

Table 08: Global Prosthetics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 09: Global Prosthetics Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 10: North America Prosthetics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 11: North America Prosthetics Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 12: North America Prosthetics Market Value (US$ Mn) Forecast, by Orthopedic Prosthetics, 2017–2027

Table 13: North America Prosthetics Market Value (US$ Mn) Forecast, by Upper Extremity, 2017–2027

Table 14: North America Prosthetics Market Value (US$ Mn) Forecast, by Lower Extremity, 2017–2027

Table 15: North America Prosthetics Market Value (US$ Mn) Forecast, by Dental Prosthetics, 2017–2027

Table 16: North America Prosthetics Market Value (US$ Mn) Forecast, by Dentures, 2017–2027

Table 17: North America Prosthetics Market Value (US$ Mn) Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

Table 18: North America Prosthetics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 19: Europe Prosthetics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 20: Europe Prosthetics Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 21: Europe Prosthetics Market Value (US$ Mn) Forecast, by Orthopedic Prosthetics, 2017–2027

Table 22: Europe Prosthetics Market Value (US$ Mn) Forecast, by Upper Extremity, 2017–2027

Table 23: Europe Prosthetics Market Value (US$ Mn) Forecast, by Lower Extremity, 2017–2027

Table 24: Europe Prosthetics Market Value (US$ Mn) Forecast, by Dental Prosthetics, 2017–2027

Table 25: Europe Prosthetics Market Value (US$ Mn) Forecast, by Dentures, 2017–2027

Table 26: Europe Prosthetics Market Value (US$ Mn) Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

Table 27: Europe Prosthetics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 28: Asia Pacific Prosthetics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 29: Asia Pacific Prosthetics Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 30: Asia Pacific Prosthetics Market Value (US$ Mn) Forecast, by Orthopedic Prosthetics, 2017–2027

Table 31: Asia Pacific Prosthetics Market Value (US$ Mn) Forecast, by Upper Extremity, 2017–2027

Table 32: Asia Pacific Prosthetics Market Value (US$ Mn) Forecast, by Lower Extremity, 2017–2027

Table 33: Asia Pacific Prosthetics Market Value (US$ Mn) Forecast, by Dental Prosthetics, 2017–2027

Table 34: Asia Pacific Prosthetics Market Value (US$ Mn) Forecast, by Dentures, 2017–2027

Table 35: Asia Pacific Prosthetics Market Value (US$ Mn) Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

Table 36: Asia Pacific Prosthetics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 37: Latin America Prosthetics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 38: Latin America Prosthetics Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 39: Latin America Prosthetics Market Value (US$ Mn) Forecast, by Orthopedic Prosthetics, 2017–2027

Table 40: Latin America Prosthetics Market Value (US$ Mn) Forecast, by Upper Extremity, 2017–2027

Table 41: Latin America Prosthetics Market Value (US$ Mn) Forecast, by Lower Extremity, 2017–2027

Table 42: Latin America Prosthetics Market Value (US$ Mn) Forecast, by Dental Prosthetics, 2017–2027

Table 43: Latin America Prosthetics Market Value (US$ Mn) Forecast, by Dentures, 2017–2027

Table 44: Latin America Prosthetics Market Value (US$ Mn) Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

Table 45: Latin America Prosthetics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 46: Middle East & Africa Prosthetics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 47: Middle East & Africa Prosthetics Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 48: Middle East & Africa Prosthetics Market Value (US$ Mn) Forecast, by Orthopedic Prosthetics, 2017–2027

Table 49: Middle East & Africa Prosthetics Market Value (US$ Mn) Forecast, by Upper Extremity, 2017–2027

Table 50: Middle East & Africa Prosthetics Market Value (US$ Mn) Forecast, by Lower Extremity, 2017–2027

Table 51: Middle East & Africa Prosthetics Market Value (US$ Mn) Forecast, by Dental Prosthetics, 2017–2027

Table 52: Middle East & Africa Prosthetics Market Value (US$ Mn) Forecast, by Dentures, 2017–2027

Table 53: Middle East & Africa Prosthetics Market Value (US$ Mn) Forecast, by Technology (Orthopedic Prosthetics), 2017–2027

Table 54: Middle East & Africa Prosthetics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Prosthetics Market Snapshot

Figure 02: Global Prosthetics Market Value (US$ Mn) and Distribution (%), by Region, 2019 and 2027

Figure 03: Global Prosthetics Market Value (US$ Mn) Forecast, 2017–2027

Figure 04: Global Prosthetics Market Value Share (%), by Product, 2019

Figure 05: Global Prosthetics Market Value Share (%), by Orthopedic Prosthetics, 2019

Figure 06: Global Prosthetics Market Value Share (%), by Dental Prosthetics, 2019

Figure 07: Global Prosthetics Market Value Share (%), by End-user, 2019

Figure 08: U.S. Medical Device Approval Process

Figure 09: Europe Medical Device Approval Process

Figure 10: Japan Medical Device Approval Process

Figure 11: Prosthetics Market - Key Industry Developments

Figure 12: Value Chain Analysis: Global Dental Prosthetics Market

Figure 13: Value Chain Analysis: Global Orthopedic Prosthetics Market

Figure 14: Global Prosthetics Market Value Share (%), by Product, 2018 and 2027

Figure 15: Global Prosthetics Market Value Share (%), by Orthopedic Prosthetics, 2018 and 2027

Figure 16: Global Prosthetics Market Value Share (%), by Dental Prosthetics, 2018 and 2027

Figure 17: Global Prosthetics Market Value (US$ Mn), by Orthopedic Prosthetics, 2017–2027

Figure 18: Global Prosthetics Market Value (US$ Mn), by Dental Prosthetics, 2017–2027

Figure 19: Global Prosthetics Market Value (US$ Mn), by Others, 2017–2027

Figure 20: Global Prosthetics Market Value (US$ Mn), by Upper Extremity, 2017–2027

Figure 21: Global Prosthetics Market Value (US$ Mn), by Lower Extremity, 2017–2027

Figure 22: Global Prosthetics Market Value (US$ Mn), by Sockets, 2017–2027

Figure 23: Global Prosthetics Market Value (US$ Mn), by Liners, 2017–2027

Figure 24: Global Prosthetics Market Value (US$ Mn), by Others, 2017–2027

Figure 25: Global Prosthetics Market Value (US$ Mn), by Crowns, 2017–2027

Figure 26: Global Prosthetics Market Value (US$ Mn), by Bridges, 2017–2027

Figure 27: Global Prosthetics Market Value (US$ Mn), by Veneers, 2017–2027

Figure 28: Global Prosthetics Market Value (US$ Mn), by Inlays & Onlays, 2017–2027

Figure 29: Global Prosthetics Market Value (US$ Mn), by Dentures, 2017–2027

Figure 30: Global Prosthetics Market Attractiveness Analysis, by Product, 2019–2027

Figure 31: Global Prosthetics Market Attractiveness Analysis, by Orthopedic Prosthetics, 2019–2027

Figure 32: Global Prosthetics Market Attractiveness Analysis, by Dental Prosthetics, 2019–2027

Figure 33: Global Prosthetics Market Value Share (%), by End-user, 2018 and 2027

Figure 34: Global Prosthetics Market Attractiveness Analysis, by Technology (Orthopedic Prosthetics), 2019–2027

Figure 35: Global Prosthetics Market Value (US$ Mn), by Cosmetic Prosthetics, 2017–2027

Figure 36: Global Prosthetics Market Value (US$ Mn), by Cable Operated/Body Powered, 2017–2027

Figure 37: Global Prosthetics Market Value (US$ Mn), by Electrically Powered/Myoelectric, 2017–2027

Figure 38: Global Prosthetics Market Value (US$ Mn), by Others, 2017–2027

Figure 39: Global Prosthetics Market Value Share (%), by End-user, 2018 and 2027

Figure 40: Global Prosthetics Market Value (US$ Mn), by Hospitals, 2017–2027

Figure 41: Global Prosthetics Market Value (US$ Mn), by Specialty Clinics, 2017–2027

Figure 42: Global Prosthetics Market Value (US$ Mn), by Dental Clinics, 2017–2027

Figure 43: Global Prosthetics Market Value (US$ Mn), by Others, 2017–2027

Figure 44: Global Prosthetics Market Attractiveness Analysis, by End-user, 2019–2027

Figure 45: Global Prosthetics Market Value Share Analysis, by Region, 2018 and 2027

Figure 46: Global Prosthetics Market Attractiveness Analysis, by Region, 2019–2027

Figure 47: North America Prosthetics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 48: North America Prosthetics Market Attractiveness Analysis, by Country, 2019–2027

Figure 49: North America Prosthetics Market Value Share Analysis, by Country, 2018 and 2027

Figure 50: North America Prosthetics Market Value Share Analysis, by Product, 2018 and 2027

Figure 51: North America Prosthetics Market Value Share Analysis, by Orthopedic Prosthetics, 2018 and 2027

Figure 52: North America Prosthetics Market Value Share Analysis, by Dental Prosthetics, 2018 and 2027

Figure 53: North America Prosthetics Market Value Share (%), by Technology (Orthopedic Prosthetics), 2018 and 2027

Figure 54: North America Prosthetics Market Value Attractiveness Analysis, by Technology (Orthopedic Prosthetics), 2019–2027

Figure 55: North America Prosthetics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 56: North America Prosthetics Market Attractiveness, by Product, 2019?2027

Figure 57: North America Prosthetics Market Attractiveness, by Orthopedic Prosthetics, 2019?2027

Figure 58: North America Prosthetics Market Attractiveness, by Dental Prosthetics, 2019?2027

Figure 59: North America Prosthetics Market Attractiveness, by End-user, 2019?2027

Figure 60: Europe Prosthetics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 61: Europe Prosthetics Market Attractiveness Analysis, by Country, 2019–2027

Figure 62: Europe Prosthetics Market Value Share Analysis, by Country, 2018 and 2027

Figure 63: Europe Prosthetics Market Value Share Analysis, by Product, 2018 and 2027

Figure 64: Europe Prosthetics Market Value Share Analysis, by Orthopedic Prosthetics, 2018 and 2027

Figure 65: Europe Prosthetics Market Value Share Analysis, by Dental Prosthetics, 2018 and 2027

Figure 66: Europe Prosthetics Market Value Share (%), by Technology (Orthopedic Prosthetics), 2018 and 2027

Figure 67: Europe Prosthetics Market Value Attractiveness Analysis, by Technology (Orthopedic Prosthetics), 2019?2027

Figure 68: Europe Prosthetics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 69: Europe Prosthetics Market Attractiveness, by Product, 2019?2027

Figure 70: Europe Prosthetics Market Attractiveness, by Orthopedic Prosthetics, 2019?2027

Figure 71: Europe Prosthetics Market Attractiveness, by Dental Prosthetics, 2019?2027

Figure 72: Europe Prosthetics Market Attractiveness, by End-user, 2019?2027

Figure 73: Asia Pacific Prosthetics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 74: Asia Pacific Prosthetics Market Attractiveness Analysis, by Country, 2019–2027

Figure 75: Asia Pacific Prosthetics Market Value Share Analysis, by Country, 2018 and 2027

Figure 76: Asia Pacific Prosthetics Market Value Share Analysis, by Product, 2018 and 2027

Figure 77: Asia Pacific Prosthetics Market Value Share Analysis, by Orthopedic Prosthetics, 2018 and 2027

Figure 78: Asia Pacific Prosthetics Market Value Share Analysis, by Dental Prosthetics, 2018 and 2027

Figure 79: Asia Pacific Prosthetics Market Value Share (%), by Technology (Orthopedic Prosthetics), 2018 and 2027

Figure 80: Asia Pacific Prosthetics Market Value Attractiveness Analysis, by Technology (Orthopedic Prosthetics), 2019–2027

Figure 81: Asia Pacific Prosthetics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 82: Asia Pacific Prosthetics Market Attractiveness, by Product, 2019?2027

Figure 83: Asia Pacific Prosthetics Market Attractiveness, by Orthopedic Prosthetics, 2019?2027

Figure 84: Asia Pacific Prosthetics Market Attractiveness, by Dental Prosthetics, 2019?2027

Figure 85: Asia Pacific Prosthetics Market Attractiveness, by End-user, 2019?2027

Figure 86: Latin America Prosthetics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 87: Latin America Prosthetics Market Attractiveness Analysis, by Country, 2019–2027

Figure 88: Latin America Prosthetics Market Value Share Analysis, by Country, 2018 and 2027

Figure 89: Latin America Prosthetics Market Value Share Analysis, by Product, 2018 and 2027

Figure 90: Latin America Prosthetics Market Value Share Analysis, by Orthopedic Prosthetics, 2018 and 2027

Figure 91: Latin America Prosthetics Market Value Share Analysis, by Dental Prosthetics, 2018 and 2027

Figure 92: Latin America Prosthetics Market Value Share (%), by Technology (Orthopedic Prosthetics), 2018 and 2027

Figure 93: Latin America Prosthetics Market Value Attractiveness Analysis, by Technology (Orthopedic Prosthetics), 2019?2027

Figure 94: Latin America Prosthetics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 95: Latin America Prosthetics Market Attractiveness, by Product, 2019?2027

Figure 96: Latin America Prosthetics Market Attractiveness, by Orthopedic Prosthetics, 2019?2027

Figure 97: Latin America Prosthetics Market Attractiveness, by Dental Prosthetics, 2019?2027

Figure 98: Latin America Prosthetics Market Attractiveness, by End-user, 2019?2027

Figure 99: Middle East & Africa Prosthetics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 100: Middle East & Africa Prosthetics Market Attractiveness Analysis, by Country, 2019–2027

Figure 101: Middle East & Africa Prosthetics Market Value Share Analysis, by Country, 2018 and 2027

Figure 102: Middle East & Africa Prosthetics Market Value Share Analysis, by Product, 2018 and 2027

Figure 103: Middle East & Africa Prosthetics Market Value Share Analysis, by Orthopedic Prosthetics, 2018 and 2027

Figure 104: Middle East & Africa Prosthetics Market Value Share Analysis, by Dental Prosthetics, 2018 and 2027

Figure 105: Middle East & Africa Prosthetics Market Value Share (%), by Technology (Orthopedic Prosthetics), 2018 and 2027

Figure 106: Middle East & Africa Prosthetics Market Value Attractiveness Analysis, by Technology (Orthopedic Prosthetics), 2019–2027

Figure 107: Middle East & Africa Prosthetics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 108: Middle East & Africa Prosthetics Market Attractiveness, by Product, 2019?2027

Figure 109: Middle East & Africa Prosthetics Market Attractiveness, by Orthopedic Prosthetics, 2019?2027

Figure 110: Middle East & Africa Prosthetics Market Attractiveness, by Dental Prosthetics, 2019?2027

Figure 111: Middle East & Africa Prosthetics Market Attractiveness, by End-user, 2019?2027

Figure 112: Global Prosthetics Market Share, by Company, 2018