Reports

Reports

Analyst Viewpoint

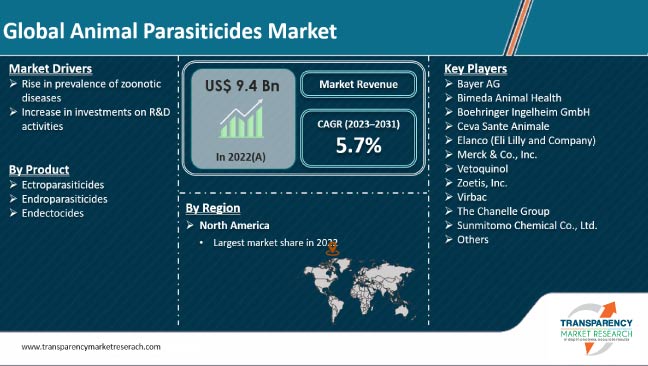

Increase in prevalence of zoonotic and foodborne diseases in livestock and companion animals is bolstering the animal parasiticides industry growth. Rise in pet ownership and awareness among pet owners regarding importance of maintaining animal health is fostering market progress. Furthermore, increase in investments in research and development activities in drug development for animals is surging the demand for animal parasiticides.

Rise in demand for meat and animal byproducts among consumers is boosting market value. Increase in prevalence of infectious diseases among animals caused by parasites is augmenting the growth of the industry. Manufacturers in the market are focusing on introducing new treatments by incorporating advanced technologies to meet consumer demands and gain lucrative animal parasiticides market opportunities.

A parasite is an organism that lives in or on another and takes its nourishment from that organism. Parasites of animals come in various forms, including worms, lice, ticks, mosquitoes, and protozoa. Animal parasiticides are chemicals used to eliminate parasitic organisms that affect the health of companion animals and livestock. Parasiticide products are commonly used in small animal medicine to prevent and treat various parasites, including fleas, ticks and worms.

External parasites often annoy their hosts by biting, embedding, or otherwise irritating the skin. They can cause serious diseases, such as mange and scabies, which affect animals' health and growth. Internal parasites live in the blood or tissues inside an animal's body. Internal parasites are usually treated with medication, such as dog heartworm treatment, while external parasites are eliminated with a topical flea treatment for small dogs that destroys their life cycle.

Zoonotic diseases are infections among animals caused by germs such as bacteria, fungi, viruses, and parasites. Intensity of the diseases vary as some can be severe such as rabies and require proper treatment and special attention while others can be milder and recover on their own. Animal parasiticides are used to treat zoonotic diseases among animals as well as humans. Increase in prevalence of zoonotic diseases among livestock and companion animals is driving market development.

The Centers for Disease Control and Prevention (CDC) estimates that more than 6 out of 10 known infectious diseases are spread from animals, and 3 out of 4 new infectious diseases in humans come from animals. CDC also states that children under 5 years and adults older than 65 years are prone to these diseases if they come in contact with animals frequently.

Increase in prevalence of foodborne diseases, such as salmonellosis, listeriosis, and brucellosis among animals is fueling the animal parasiticides market growth. Anti-parasitic medications for animals are utilized to treat these foodborne diseases. Foodborne diseases can affect animals’ gut health, immunity, and cattle production.

Companion and livestock animals are prone to several diseases caused by animal parasites. Veterinarians are investing in research and development activities to introduce new drugs to treat zoonotic and foodborne diseases among animals. Increase in awareness regarding infectious diseases spread through animals is encouraging companies to invest in new drug development. Animal healthcare is a major concern across the globe which in turn is driving market statistics.

Increase in demand for meat and animal byproducts are driving the demand for animal parasiticides. Parasiticides improve efficiency in protecting pets from severe infections. Increase in endoparasites and ectoparasites infections in livestock production farms is further bolstering the market dynamics. Increase in investment in technological advancements for application of parasiticides on animals through collars, dips, and spot-on spray is also augmenting the animal parasiticides market size.

According to regional animal parasiticides market insights, North America is projected to hold a dominant share in the near future. Rise in trend of animal adoption and increase in per capita animal healthcare expenditure is driving the animal parasiticides industry share in the region. According to American Pet Products Association (APPA) Pet Owners Survey 2021-2022, around 70% of households in the U.S. have a pet that is around 90.5 million houses, with 45.3 million cats and 69 million dogs. Increase in pet ownership in the region is driving the demand for parasiticides, which in turn is fueling market value.

Key players in the market implement various strategies such as business collaborations and new product launches to expand their product range. Companies aim to expand their business to global markets and create awareness among pet owners regarding the importance of maintaining pet health.

Some of the leading companies in the industry are Bayer AG, Bimeda Animal Health, Boehringer Ingelheim GmbH, Ceva Sante Animale, Elanco (Eli Lilly and Company), Merck & Co., Inc., Vetoquinol, Zoetis, Inc., Virbac, The Chanelle Group, Sunmitomo Chemical Co., Ltd., and others. These companies are profiled in the animal parasiticides market report based on factors such as company overview, financial overview, business segments, product portfolio, business strategies, and key developments

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 9.4 Bn |

| Market Forecast (Value) in 2031 | US$ 15.6 Bn |

| Growth Rate (CAGR) | 5.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 9.4 Bn in 2022

It is projected to register a CAGR of 5.7% from 2023 to 2031

Rise in prevalence of zoonotic diseases and increase in investments on R&D activities

North America was the most lucrative region in 2022

Bayer AG, Bimeda Animal Health, Boehringer Ingelheim GmbH, Ceva Sante Animale, Elanco (Eli Lilly and Company), Merck & Co., Inc., Vetoquinol, Zoetis, Inc., Virbac, The Chanelle Group, and Sunmitomo Chemical Co., Ltd.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Animal Parasiticides Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Animal Parasiticides Market Analysis and Forecasts, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. List of Animal Parasiticides Used to Treat Animals

5.3. Disease Prevalence & Incidence Rate Globally With Key Countries

5.4. COVID-19 Pandemic Impact on Industry

6. Animal Parasiticides Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2023–2031

6.3.1. Ectroparasiticides

6.3.1.1. Oral Tablets

6.3.1.2. Dips

6.3.1.3. Spray

6.3.1.4. Spot-on

6.3.1.5. Others

6.3.2. Endroparasiticides

6.3.2.1. Oral Suspension

6.3.2.2. Injectable

6.3.2.3. Feed Additives

6.3.2.4. Others

6.3.3. Endectocides

6.4. Market Attractiveness, by Product

7. Global Animal Parasiticides Market Analysis and Forecast, by Species

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Species, 2023–2031

7.3.1. Food-producing Animals

7.3.1.1. Cattle

7.3.1.2. Poultry

7.3.1.3. Swine

7.3.1.4. Others

7.3.2. Companion Animals

7.3.2.1. Dogs

7.3.2.2. Felines

7.3.2.3. Others

7.3.3. Other Livestock

7.4. Market Attractiveness, by Species

8. Global Animal Parasiticides Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Animal Parasiticides Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2023–2031

9.2.1. Ectroparasiticides

9.2.1.1. Oral Tablets

9.2.1.2. Dips

9.2.1.3. Spray

9.2.1.4. Spot-on

9.2.1.5. Others

9.2.2. Endroparasiticides

9.2.2.1. Oral Suspension

9.2.2.2. Injectable

9.2.2.3. Feed Additives

9.2.2.4. Others

9.2.3. Endectocides

9.3. Market Value Forecast, by Species, 2023–2031

9.3.1. Food-producing Animals

9.3.1.1. Cattle

9.3.1.2. Poultry

9.3.1.3. Swine

9.3.1.4. Others

9.3.2. Companion Animals

9.3.2.1. Dogs

9.3.2.2. Felines

9.3.2.3. Others

9.3.3. Other Livestock

9.4. Market Value Forecast, by Country, 2023–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By Species

9.5.3. By Country

10. Europe Animal Parasiticides Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2023–2031

10.2.1. Ectroparasiticides

10.2.1.1. Oral Tablets

10.2.1.2. Dips

10.2.1.3. Spray

10.2.1.4. Spot-on

10.2.1.5. Others

10.2.2. Endroparasiticides

10.2.2.1. Oral Suspension

10.2.2.2. Injectable

10.2.2.3. Feed Additives

10.2.2.4. Others

10.2.3. Endectocides

10.3. Market Value Forecast, by Species, 2023–2031

10.3.1. Food-producing Animals

10.3.1.1. Cattle

10.3.1.2. Poultry

10.3.1.3. Swine

10.3.1.4. Others

10.3.2. Companion Animals

10.3.2.1. Dogs

10.3.2.2. Felines

10.3.2.3. Others

10.3.3. Other Livestock

10.4. Market Value Forecast, by Country/Sub-region, 2023–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By Species

10.5.3. By Country/Sub-region

11. Asia Pacific Animal Parasiticides Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2023–2031

11.2.1. Ectroparasiticides

11.2.1.1. Oral Tablets

11.2.1.2. Dips

11.2.1.3. Spray

11.2.1.4. Spot-on

11.2.1.5. Others

11.2.2. Endroparasiticides

11.2.2.1. Oral Suspension

11.2.2.2. Injectable

11.2.2.3. Feed Additives

11.2.2.4. Others

11.2.3. Endectocides

11.3. Market Value Forecast, by Species, 2023–2031

11.3.1. Food-producing Animals

11.3.1.1. Cattle

11.3.1.2. Poultry

11.3.1.3. Swine

11.3.1.4. Others

11.3.2. Companion Animals

11.3.2.1. Dogs

11.3.2.2. Felines

11.3.2.3. Others

11.3.3. Other Livestock

11.4. Market Value Forecast, by Country/Sub-region, 2023–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By Species

11.5.3. By Country/Sub-region

12. Latin America Animal Parasiticides Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2023–2031

12.2.1. Ectroparasiticides

12.2.1.1. Oral Tablets

12.2.1.2. Dips

12.2.1.3. Spray

12.2.1.4. Spot-on

12.2.1.5. Others

12.2.2. Endroparasiticides

12.2.2.1. Oral Suspension

12.2.2.2. Injectable

12.2.2.3. Feed Additives

12.2.2.4. Others

12.2.3. Endectocides

12.3. Market Value Forecast, by Species, 2023–2031

12.3.1. Food-producing Animals

12.3.1.1. Cattle

12.3.1.2. Poultry

12.3.1.3. Swine

12.3.1.4. Others

12.3.2. Companion Animals

12.3.2.1. Dogs

12.3.2.2. Felines

12.3.2.3. Others

12.3.3. Other Livestock

12.4. Market Value Forecast, by Country/Sub-region, 2023–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By Species

12.5.3. By Country/Sub-region

13. Middle East & Africa Animal Parasiticides Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2023–2031

13.2.1. Ectroparasiticides

13.2.1.1. Oral Tablets

13.2.1.2. Dips

13.2.1.3. Spray

13.2.1.4. Spot-on

13.2.1.5. Others

13.2.2. Endroparasiticides

13.2.2.1. Oral Suspension

13.2.2.2. Injectable

13.2.2.3. Feed Additives

13.2.2.4. Others

13.2.3. Endectocides

13.3. Market Value Forecast, by Species, 2023–2031

13.3.1. Food-producing Animals

13.3.1.1. Cattle

13.3.1.2. Poultry

13.3.1.3. Swine

13.3.1.4. Others

13.3.2. Companion Animals

13.3.2.1. Dogs

13.3.2.2. Felines

13.3.2.3. Others

13.3.3. Other Livestock

13.4. Market Value Forecast, by Country/Sub-region, 2023–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By Species

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Bayer AG

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Bimeda Animal Health

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Boehringer Ingelheim GmbH

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Ceva Sante Animale

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Elanco (Eli Lilly and Company)

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Merck & Co., Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Vetoquinol

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Zoetis, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Virbac

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. The Chanelle Group

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Sunmitomo Chemical Co., Ltd.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

List of Tables

Table 01: Global Animal Parasiticides Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 02: Global Animal Parasiticides Market Value (US$ Mn) Forecast, by Species, 2023–2031

Table 03: Global Animal Parasiticides Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 04: North America Animal Parasiticides Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 05: North America Animal Parasiticides Market Value (US$ Mn) Forecast, by Species, 2023–2031

Table 06: North America Animal Parasiticides Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 07: Europe Animal Parasiticides Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 08: Europe Animal Parasiticides Market Value (US$ Mn) Forecast, by Species, 2023–2031

Table 09: Europe Animal Parasiticides Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 10: Asia Pacific Animal Parasiticides Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 11: Asia Pacific Animal Parasiticides Market Value (US$ Mn) Forecast, by Species, 2023–2031

Table 12: Asia Pacific Animal Parasiticides Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 13: Latin America Animal Parasiticides Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 14: Latin America Animal Parasiticides Market Value (US$ Mn) Forecast, by Species, 2023–2031

Table 15: Latin America Animal Parasiticides Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 16: Middle East & Africa Animal Parasiticides Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 17: Middle East & Africa Animal Parasiticides Market Value (US$ Mn) Forecast, by Species, 2023–2031

Table 18: Middle East & Africa Animal Parasiticides Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

List of Figures

Figure 01: Global Animal Parasiticides Market Value (US$ Mn) Forecast, 2023–2031

Figure 02: Global Animal Parasiticides Market Value Share Analysis, by Product 2022 and 2031

Figure 03: Global Animal Parasiticides Market Attractiveness Analysis, by Product, 2023–2031

Figure 04: Global Animal Parasiticides Market Value Share Analysis, by Species, 2022 and 2031

Figure 05: Global Animal Parasiticides Market Attractiveness Analysis, by Species, 2023–2031

Figure 06: Global Animal Parasiticides Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Animal Parasiticides Market Attractiveness Analysis, by Region, 2023–2031

Figure 08: North America Animal Parasiticides Market Value (US$ Mn) Forecast, 2023–2031

Figure 09: North America Animal Parasiticides Market Value Share Analysis, by Product, 2022 and 2031

Figure 10: North America Animal Parasiticides Market Attractiveness Analysis, by Product, 2023–2031

Figure 11: North America Animal Parasiticides Market Value Share Analysis, by Species, 2022 and 2031

Figure 12: North America Animal Parasiticides Market Attractiveness Analysis, by Species, 2023–2031

Figure 13: North America Animal Parasiticides Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Animal Parasiticides Market Attractiveness Analysis, by Country, 2023–2031

Figure 15: Europe Animal Parasiticides Market Value (US$ Mn) Forecast, 2023–2031

Figure 16: Europe Animal Parasiticides Market Value Share Analysis, by Product, 2022 and 2031

Figure 17: Europe Animal Parasiticides Market Attractiveness Analysis, by Product, 2023–2031

Figure 18: Europe Animal Parasiticides Market Value Share Analysis, by Species, 2022 and 2031

Figure 19: Europe Animal Parasiticides Market Attractiveness Analysis, by Species, 2023–2031

Figure 20: Europe Animal Parasiticides Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Animal Parasiticides Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 22: Asia Pacific Animal Parasiticides Market Value (US$ Mn) Forecast, 2023–2031

Figure 23: Asia Pacific Animal Parasiticides Market Value Share Analysis, by Product 2022 and 2031

Figure 24: Asia Pacific Animal Parasiticides Market Attractiveness Analysis, by Product, 2023–2031

Figure 25: Asia Pacific Animal Parasiticides Market Value Share Analysis, by Species, 2022 and 2031

Figure 26: Asia Pacific Animal Parasiticides Market Attractiveness Analysis, by Species, 2023–2031

Figure 27: Asia Pacific Animal Parasiticides Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Animal Parasiticides Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Latin America Animal Parasiticides Market Value (US$ Mn) Forecast, 2023–2031

Figure 30: Latin America Animal Parasiticides Market Value Share Analysis, by Product, 2022 and 2031

Figure 31: Latin America Animal Parasiticides Market Attractiveness Analysis, by Product, 2023–2031

Figure 32: Latin America Animal Parasiticides Market Value Share Analysis, by Species, 2022 and 2031

Figure 33: Latin America Animal Parasiticides Market Attractiveness Analysis, by Species, 2023–2031

Figure 34: Latin America Animal Parasiticides Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Animal Parasiticides Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Middle East & Africa Animal Parasiticides Market Value (US$ Mn) Forecast, 2023–2031

Figure 37: Middle East & Africa Animal Parasiticides Market Value Share Analysis, by Product, 2022 and 2031

Figure 38: Middle East & Africa Animal Parasiticides Market Attractiveness Analysis, by Product, 2023–2031

Figure 39: Middle East & Africa Animal Parasiticides Market Value Share Analysis, by Species, 2022 and 2031

Figure 40: Middle East & Africa Animal Parasiticides Market Attractiveness Analysis, by Species, 2023–2031

Figure 41: Middle East & Africa Animal Parasiticides Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Animal Parasiticides Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Global Animal Parasiticides Market Share Analysis, by Company, 2022