Reports

Reports

At present, consumers are increasingly more conscious about health and wellness worldwide. The significant rise in the number of health-conscious consumers has played an imperative role in increasing the demand for low-calorie and low-sugar food ingredients and products. At the back of growing interest in low-calorie products, consumers are increasingly swaying toward the use of allulose. The demand for allulose is on the rise, as it has emerged as a promising alternative for natural sugar. In addition, several studies have also revealed that apart from containing around one-tenth of the total calories of that in sugar, consumers are leaning toward the use of allulose, as it does not cause dental decay and is relatively safer than sugar.

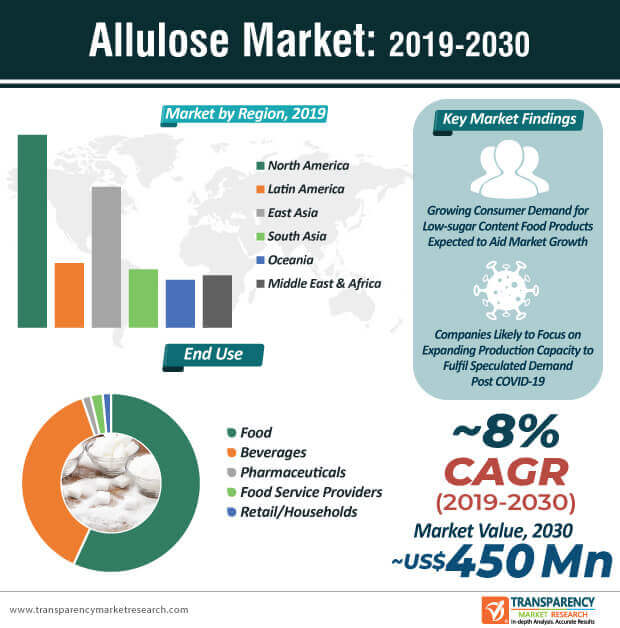

Although a broad range of artificial sweeteners has hit the market in the past couple of decades, consumer demand for allulose is on the rise, thus driving the allulose market. Consumer trends suggest a growing interest in science-based data and transparency from food and beverages manufacturers. The labeling guidance released by the Food and Drug Administration (FDA) has shown the green signal to the use of allulose as a substitute for specific sugars– a factor that is expected to propel the demand for allulose during the forecast period. At the back of these factors, the global allulose market is expected to attain a market value of ~US$ 450 Mn by the end of 2030.

Due to the growing awareness regarding drawbacks of high uptake of natural sugar, a range of sugar alternatives have gained popularity. Despite the higher price range compared to other sugar alternatives, allulose continues to gain popularity among health-conscious consumers. Current observable consumer trends suggest a major shift away from refined and processed food products. In addition, the high prevalence of diabetes across the world is another factor that has accelerated the pursuit of effective sugar alternatives due to which, the demand for allulose is anticipated to grow at a healthy pace in the forthcoming years. Over the next few years, research and activities within the allulose market are projected to gain momentum as dieticians and experts continue to advocate the potential of including allulose in health and weight management programs. Manufacturers operating in the current allulose market landscape are expected to comply with the labeling guidance released by the FDA.

Companies operating in the allulose market are expected to rely on both, organic as well as inorganic growth strategies to gain a competitive edge. Product launches, FDA approval, research and development, and maximizing production capacity and efficiency are likely to remain a priority for market players. For instance, in November 2019, Ingredion announced the opening of a new allulose facility– a move that will enable the company to cater to the markets in Asia Pacific and the Americas. As companies continue to push for the Generally Recognized as Safe (GRAS) certification, particularly in the U.S., the production of allulose is likely to grow at a healthy pace over the next few years. Companies are also expected to focus on the commercialization of allulose sweetener. For instance, in September 2019, Blue California, announced that the company would scale up production of allulose and aims to attain the GRAS status for its allulose products.

The onset of the novel COVID-19 pandemic is expected to affect the growth of the global allulose market, particularly in 2020 and the first half of 2021. As governments across the world continue to combat the pandemic by imposing lockdowns, trade restrictions and disruption in the supply chain within the allulose market are expected to impact the expansion of the market in the next few months. Market players are likely to adopt to contingency strategies in the first half of 2020 to mitigate the impact of the COVID-19 pandemic. Moreover, in the current scenario, as consumers are highly in favor of purchasing only ‘essential goods & services’, the demand for allulose is expected to dip.

Analysts’ Viewpoint

The global allulose market is expected to grow at an impressive CAGR of ~8% during the forecast period. Some of the leading factors that are likely to influence the market growth include high demand for low-calorie and low-carbohydrate food products, a rise in the number of health-conscious consumers, increase in the number of companies receiving the GRAS status for their allulose products, and research and development activities. Market players should focus on maximizing their production capacity in the upcoming years to cater to the growing demand for allulose worldwide. As more number of consumers are leaning toward the use of allulose, the allulose market is expected to grow at a healthy rate during the forecast period.

Allulose Market: Overview

Allulose: Market Frontrunners

Allulose Market: Trends

Increasing Consumer Preference for Natural Ingredients

Allulose Market: Strategies

Target Region for Market

Allulose Market: Players

Allulose Market is projected to reach US$ 450 Mn by the end of 2030

Allulose Market is expected to grow at a CAGR of 8% during 2020 – 2030

Increasing the demand for low-calorie and low-sugar food ingredients and products is expect to drive Allulose Market

North America is a more attractive region for vendors in the Allulose Market

Key vendors in the Allulose Market are Tate & Lyle PLC, CJ Cheil Jedang, Cargill Inc, Ingredion Incorporated, Samyang Corporation, etc

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Opportunity Matrix

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Allulose Market Background

3.1. Global Sweetener Market Overview

3.2. Key Developments and Product Launches

3.3. Overview of Claims and Certifications for Allulose Products

3.4. Overview of Production and Processing Methods

3.5. Macro-Economic Indicators

3.5.1. Global GDP by Region and Country

3.5.2. Global Industry Value Added

3.5.3. Global Food and Beverage Industry Outlook

3.6. Value Chain Analysis

3.6.1. Raw Material Suppliers

3.6.2. Product Manufacturers

3.6.3. Distributors/Suppliers/Wholesalers

3.6.4. Private Label

3.6.5. End Users

3.7. Market Dynamics

3.7.1. Drivers

3.7.2. Restraints

3.7.3. Opportunities

3.7.4. Trends

3.8. Consumer Perception and End User Survey

3.9. Forecast Factors – Relevance and Impact

4. Global Allulose Market Analysis 2015–2019 and Forecast 2020–2030

4.1. Market Size (US$ Mn) and Forecast

4.1.1. Market Size (US$ Mn) and Y-o-Y Growth

4.1.2. Absolute $ Opportunity

5. Global Allulose Market Pricing Analysis

5.1. Regional Average Pricing Analysis (US$)

5.1.1. North America

5.1.2. Latin America

5.1.3. East Asia

5.1.4. South Asia

5.1.5. Oceania

5.1.6. Middle East & Africa

5.2. Pricing Analysis, By Form

6. Global Allulose Market Analysis 2015–2019 and Forecast 2020–2030, by Region

6.1. Introduction

6.2. Historical Market Size (US$ Mn) By Region, 2015–2019

6.3. Market Size (US$ Mn) Forecast By Region, 2019-2030

6.3.1. North America

6.3.2. Latin America

6.3.3. East Asia

6.3.4. South Asia

6.3.5. Oceania

6.3.6. Middle East & Africa

6.4. Attractiveness Analysis by Region

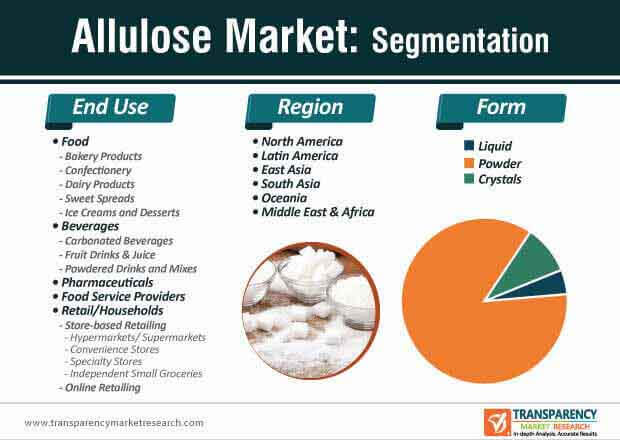

7. Global Allulose Market Analysis 2015–2019 and Forecast 2020–2030, by Form

7.1. Introduction

7.2. Historical Market Size (US$ Mn) By Form, 2015–2019

7.3. Market Size (US$ Mn) Forecast By Form, 2019-2030

7.3.1. Powder

7.3.2. Liquid

7.3.3. Crystals

7.4. Market Attractiveness Analysis By Form

8. Global Allulose Market Analysis 2015–2019 and Forecast 2020–2030, by End Use

8.1. Introduction

8.2. Historical Market Size (US$ Mn) By End Use, 2015–2019

8.3. Market Size (US$ Mn) Forecast By End Use, 2019-2030

8.3.1. Food

8.3.1.1. Bakery Products

8.3.1.2. Confectionery

8.3.1.3. Dairy Products

8.3.1.4. Sweet Spreads

8.3.1.5. Ice Creams and Desserts

8.3.2. Beverages

8.3.2.1. Carbonated Beverages

8.3.2.2. Fruit Drinks & Juice

8.3.2.3. Powdered Drinks and Mixes

8.3.3. Pharmaceuticals

8.3.4. Food Service Providers

8.3.5. Retail/ Households

8.3.5.1. Store-based Retailing

8.3.5.1.1. Hypermarkets/ Supermarkets

8.3.5.1.2. Convenience Stores

8.3.5.1.3. Specialty Stores

8.3.5.1.4. Independent Small Groceries

8.3.5.2. Online Retailing

8.4. Market Attractiveness Analysis By End Use,

9. North America Allulose Market Analysis 2015–2019 and Forecast 2020–2030

9.1. Introduction

9.2. Historical Market Value (US$ Mn) By Market Segments, 2015–2019

9.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2030

9.3.1. By Country

9.3.1.1. U.S.

9.3.1.2. Canada

9.3.2. By Form

9.3.3. By End Use

9.4. Market Attractiveness Analysis

9.4.1. By Country

9.4.2. By Form

9.4.3. By End Use

9.5. Drivers and Restraints: Impact Analysis

9.6. Key Participants Market Presence Intensity Mapping

10. Latin America Allulose Market Analysis 2015–2019 and Forecast 2020–2030

10.1. Introduction

10.2. Historical Market Value (US$ Mn) By Market Segments, 2015–2019

10.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2030

10.3.1. By Country

10.3.1.1. Mexico

10.3.1.2. Brazil

10.3.1.3. Peru

10.3.1.4. Chile

10.3.1.5. Argentina

10.3.1.6. Rest of Latin America

10.3.2. By Form

10.3.3. By End Use

10.4. Market Attractiveness Analysis

10.4.1. By Country

10.4.2. By Form

10.4.3. By End Use

10.5. Drivers and Restraints: Impact Analysis

10.6. Key Participants Market Presence Intensity Mapping

11. East Asia Allulose Market Analysis 2015–2019 and Forecast 2020–2030

11.1. Introduction

11.2. Historical Market Value (US$ Mn) By Market Segments, 2015–2019

11.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2030

11.3.1. By Country

11.3.1.1. China

11.3.1.2. South Korea

11.3.1.3. Japan

11.3.2. By Form

11.3.3. By End Use

11.4. Market Attractiveness Analysis

11.4.1. By Country

11.4.2. By Form

11.4.3. By End Use

11.5. Drivers and Restraints: Impact Analysis

11.6. Key Participants Market Presence Intensity Mapping

12. South Asia Allulose Market Analysis 2015–2019 and Forecast 2020–2030

12.1. Introduction

12.2. Historical Market Value (US$ Mn) By Market Segments, 2015–2019

12.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2030

12.3.1. By Country

12.3.1.1. India

12.3.1.2. Thailand

12.3.1.3. Indonesia

12.3.1.4. Malaysia

12.3.1.5. Singapore

12.3.1.6. Rest of South Asia

12.3.2. By Form

12.3.3. By End Use

12.4. Market Attractiveness Analysis

12.4.1. By Country

12.4.2. By Form

12.4.3. By End Use

12.5. Drivers and Restraints: Impact Analysis

12.6. Key Participants Market Presence Intensity Mapping

13. Oceania Allulose Market Analysis 2015–2019 and Forecast 2020–2030

13.1. Introduction

13.2. Historical Market Value (US$ Mn) By Market Segments, 2015–2019

13.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2030

13.3.1. By Country

13.3.1.1. Australia

13.3.1.2. New Zealand

13.3.2. By Form

13.3.3. By End Use

13.4. Market Attractiveness Analysis

13.4.1. By Country

13.4.2. By Form

13.4.3. By End Use

13.5. Drivers and Restraints: Impact Analysis

13.6. Key Participants Market Presence Intensity Mapping

14. Middle East & Africa Allulose Market Analysis 2015–2019 and Forecast 2020–2030

14.1. Introduction

14.2. Historical Market Value (US$ Mn) By Market Segments, 2015–2019

14.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2030

14.3.1. By Country

14.3.1.1. GCC Countries

14.3.1.2. South Africa

14.3.1.3. Turkey

14.3.1.4. Iran

14.3.1.5. Israel

14.3.1.6. Rest of MEA

14.3.2. By Form

14.3.3. By End Use

14.4. Market Attractiveness Analysis

14.4.1. By Country

14.4.2. By Form

14.4.3. By End Use

14.5. Drivers and Restraints: Impact Analysis

14.6. Key Participants Market Presence Intensity Mapping

15. Allulose Market Industry Structure

15.1. Market Analysis by Tier of Companies

15.2. Market Concentration

15.3. Market Share Analysis of Top 10 Players

15.4. Market Presence Analysis

15.4.1. By Regional Footprint

15.4.2. By Product Footprint

15.4.3. By Channel Footprint

16. Competition Analysis

16.1. Competition Dashboard

16.2. Competition Developments (Mergers, Acquisitions and Expansions)

16.3. Competition Deepdive

16.3.1. Matsutani Chemical Industry Co. Ltd.

16.3.1.1. Overview

16.3.1.2. Product Portfolio

16.3.1.3. Profitability by Market Segments (Product/Channel/Region)

16.3.1.4. Sales Footprint

16.3.1.5. Channel Footprint

16.3.1.6. Strategy Overview

16.3.1.6.1. Marketing Strategy

16.3.1.6.2. Product Strategy

16.3.1.6.3. Channel Strategy

16.3.2. Tate & Lyle PLC

16.3.2.1. Overview

16.3.2.2. Product Portfolio

16.3.2.3. Profitability by Market Segments (Product/Channel/Region)

16.3.2.4. Sales Footprint

16.3.2.5. Channel Footprint

16.3.2.6. Strategy Overview

16.3.2.6.1. Marketing Strategy

16.3.2.6.2. Product Strategy

16.3.2.6.3. Channel Strategy

16.3.3. CJ Cheil Jedang

16.3.3.1. Overview

16.3.3.2. Product Portfolio

16.3.3.3. Profitability by Market Segments (Product/Channel/Region)

16.3.3.4. Sales Footprint

16.3.3.5. Channel Footprint

16.3.3.6. Strategy Overview

16.3.3.6.1. Marketing Strategy

16.3.3.6.2. Product Strategy

16.3.3.6.3. Channel Strategy

16.3.4. Bonumose LLC

16.3.4.1. Overview

16.3.4.2. Product Portfolio

16.3.4.3. Profitability by Market Segments (Product/Channel/Region)

16.3.4.4. Sales Footprint

16.3.4.5. Channel Footprint

16.3.4.6. Strategy Overview

16.3.4.6.1. Marketing Strategy

16.3.4.6.2. Product Strategy

16.3.4.6.3. Channel Strategy

16.3.5. Cargill Inc.

16.3.5.1. Overview

16.3.5.2. Product Portfolio

16.3.5.3. Profitability by Market Segments (Product/Channel/Region)

16.3.5.4. Sales Footprint

16.3.5.5. Channel Footprint

16.3.5.6. Strategy Overview

16.3.5.6.1. Marketing Strategy

16.3.5.6.2. Product Strategy

16.3.5.6.3. Channel Strategy

16.3.6. Ingredion Incorporated

16.3.6.1. Overview

16.3.6.2. Product Portfolio

16.3.6.3. Profitability by Market Segments (Product/Channel/Region)

16.3.6.4. Sales Footprint

16.3.6.5. Channel Footprint

16.3.6.6. Strategy Overview

16.3.6.6.1. Marketing Strategy

16.3.6.6.2. Product Strategy

16.3.6.6.3. Channel Strategy

16.3.7. Samyang Corporation

16.3.7.1. Overview

16.3.7.2. Product Portfolio

16.3.7.3. Profitability by Market Segments (Product/Channel/Region)

16.3.7.4. Sales Footprint

16.3.7.5. Channel Footprint

16.3.7.6. Strategy Overview

16.3.7.6.1. Marketing Strategy

16.3.7.6.2. Product Strategy

16.3.7.6.3. Channel Strategy

16.3.8. Anderson Global Group

16.3.8.1. Overview

16.3.8.2. Product Portfolio

16.3.8.3. Profitability by Market Segments (Product/Channel/Region)

16.3.8.4. Sales Footprint

16.3.8.5. Channel Footprint

16.3.8.6. Strategy Overview

16.3.8.6.1. Marketing Strategy

16.3.8.6.2. Product Strategy

16.3.8.6.3. Channel Strategy

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Global Allulose Historical Market Size (US$ Mn) by Region, 2015–2019

Table 02: Global Allulose Forecast Market Size (US$ Mn) by Region, 2020–2030

Table 03: Global Allulose Historical Market Volume (Metric Tons) by Region, 2015-2019

Table 04: Global Allulose Forecast Market Volume (Metric Tons) by Region, 2020-2030

Table 05: Global Allulose Historical Market Size (US$ Mn) by Form, 2015–2019

Table 06: Global Allulose Forecast Market Size (US$ Mn) by Form, 2020–2030

Table 07: Global Allulose Historical Market Volume (Metric Tons) by Form, 2015-2019

Table 08: Global Allulose Forecast Market Volume (Metric Tons) by Form, 2020-2030

Table 09: Global Allulose Historical Market Size (US$ Mn) by End Use, 2015–2019

Table 10: Global Allulose Forecast Market Size (US$ Mn) by End Use, 2020–2030

Table 11: Global Allulose Historical Market Volume (Metric Tons) by End Use, 2015-2019

Table 12: Global Allulose Forecast Market Volume (Metric Tons) by End Use, 2020-2030

Table 13: North America Allulose Historical Market Size (US$ Mn) by Region, 2015–2019

Table 14: North America Allulose Forecast Market Size (US$ Mn) by Region, 2020–2030

Table 15: North America Allulose Historical Market Volume (Metric Tons) by Region, 2015-2019

Table 16: North America Allulose Forecast Market Volume (Metric Tons) by Region, 2020-2030

Table 17: North America Allulose Historical Market Size (US$ Mn) by Form, 2015–2019

Table 18: North America Allulose Forecast Market Size (US$ Mn) by Form, 2020–2030

Table 19: North America Allulose Historical Market Volume (Metric Tons) by Form, 2015-2019

Table 20: North America Allulose Forecast Market Volume (Metric Tons) by Form, 2020-2030

Table 21: North America Allulose Historical Market Size (US$ Mn) by End Use, 2015–2019

Table 22: North America Allulose Forecast Market Size (US$ Mn) by End Use, 2020–2030

Table 23: North America Allulose Historical Market Volume (Metric Tons) by End Use, 2015-2019

Table 24: North America Allulose Forecast Market Volume (Metric Tons) by End Use, 2020-2030

Table 25: Latin America Allulose Historical Market Size (US$ Mn) by Region, 2015–2019

Table 26: Latin America Allulose Forecast Market Size (US$ Mn) by Region, 2020–2030

Table 27: Latin America Allulose Historical Market Volume (Metric Tons) by Region, 2015-2019

Table 28: Latin America Allulose Forecast Market Volume (Metric Tons) by Region, 2020-2030

Table 29: Latin America Allulose Historical Market Size (US$ Mn) by Form, 2015–2019

Table 30: Latin America Allulose Forecast Market Size (US$ Mn) by Form, 2020–2030

Table 31: Latin America Allulose Historical Market Volume (Metric Tons) by Form, 2015-2019

Table 32: Latin America Allulose Forecast Market Volume (Metric Tons) by Form, 2020-2030

Table 33: Latin America Allulose Historical Market Size (US$ Mn) by End Use, 2015–2019

Table 34: Latin America Allulose Forecast Market Size (US$ Mn) by End Use, 2020–2030

Table 35: Latin America Allulose Historical Market Volume (Metric Tons) by End Use, 2015-2019

Table 36: Latin America Allulose Forecast Market Volume (Metric Tons) by End Use, 2020-2030

Table 37: East Asia Allulose Historical Market Size (US$ Mn) by Region, 2015–2019

Table 38: East Asia Allulose Forecast Market Size (US$ Mn) by Region, 2020–2030

Table 39: East Asia Allulose Historical Market Volume (Metric Tons) by Region, 2015-2019

Table 40: East Asia Allulose Forecast Market Volume (Metric Tons) by Region, 2020-2030

Table 41: East Asia Allulose Historical Market Size (US$ Mn) by Form, 2015–2019

Table 42: East Asia Allulose Forecast Market Size (US$ Mn) by Form, 2020–2030

Table 43: East Asia Allulose Historical Market Volume (Metric Tons) by Form, 2015-2019

Table 44: East Asia Allulose Forecast Market Volume (Metric Tons) by Form, 2020-2030

Table 45: East Asia Allulose Historical Market Size (US$ Mn) by End Use, 2015–2019

Table 46: East Asia Allulose Forecast Market Size (US$ Mn) by End Use, 2020–2030

Table 47: East Asia Allulose Historical Market Volume (Metric Tons) by End Use, 2015-2019

Table 48: East Asia Allulose Forecast Market Volume (Metric Tons) by End Use, 2020-2030

Table 49: South Asia Allulose Historical Market Size (US$ Mn) by Region, 2015–2019

Table 50: South Asia Allulose Forecast Market Size (US$ Mn) by Region, 2020–2030

Table 51: South Asia Allulose Historical Market Volume (Metric Tons) by Region, 2015-2019

Table 52: South Asia Allulose Forecast Market Volume (Metric Tons) by Region, 2020-2030

Table 53: South Asia Allulose Historical Market Size (US$ Mn) by Form, 2015–2019

Table 54: South Asia Allulose Forecast Market Size (US$ Mn) by Form, 2020–2030

Table 55: South Asia Allulose Historical Market Volume (Metric Tons) by Form, 2015-2019

Table 56: South Asia Allulose Forecast Market Volume (Metric Tons) by Form, 2020-2030

Table 57: South Asia Allulose Historical Market Size (US$ Mn) by End Use, 2015–2019

Table 58: South Asia Allulose Forecast Market Size (US$ Mn) by End Use, 2020–2030

Table 59: South Asia Allulose Historical Market Volume (Metric Tons) by End Use, 2015-2019

Table 60: South Asia Allulose Forecast Market Volume (Metric Tons) by End Use, 2020-2030

Table 61: Oceania Allulose Historical Market Size (US$ Mn) by Region, 2015–2019

Table 62: Oceania Allulose Forecast Market Size (US$ Mn) by Region, 2020–2030

Table 63: Oceania Allulose Historical Market Volume (Metric Tons) by Region, 2015-2019

Table 64: Oceania Allulose Forecast Market Volume (Metric Tons) by Region, 2020-2030

Table 65: Oceania Allulose Historical Market Size (US$ Mn) by Form, 2015–2019

Table 66: Oceania Allulose Forecast Market Size (US$ Mn) by Form, 2020–2030

Table 67: Oceania Allulose Historical Market Volume (Metric Tons) by Form, 2015-2019

Table 68: Oceania Allulose Forecast Market Volume (Metric Tons) by Form, 2020-2030

Table 69: Oceania Allulose Historical Market Size (US$ Mn) by End Use, 2015–2019

Table 70: Oceania Allulose Forecast Market Size (US$ Mn) by End Use, 2020–2030

Table 71: Oceania Allulose Historical Market Volume (Metric Tons) by End Use, 2015-2019

Table 72: Oceania Allulose Forecast Market Volume (Metric Tons) by End Use, 2020-2030

Table 73: MEA Allulose Historical Market Size (US$ Mn) by Region, 2015–2019

Table 74: MEA Allulose Forecast Market Size (US$ Mn) by Region, 2020–2030

Table 75: MEA Allulose Historical Market Volume (Metric Tons) by Region, 2015-2019

Table 76: MEA Allulose Forecast Market Volume (Metric Tons) by Region, 2020-2030

Table 77: MEA Allulose Historical Market Size (US$ Mn) by Form, 2015–2019

Table 78: MEA Allulose Forecast Market Size (US$ Mn) by Form, 2020–2030

Table 79: MEA Allulose Historical Market Volume (Metric Tons) by Form, 2015-2019

Table 80: MEA Allulose Forecast Market Volume (Metric Tons) by Form, 2020-2030

Table 81: MEA Allulose Historical Market Size (US$ Mn) by End Use, 2015–2019

Table 82: MEA Allulose Forecast Market Size (US$ Mn) by End Use, 2020–2030

Table 83: MEA Allulose Historical Market Volume (Metric Tons) by End Use, 2015-2019

Table 84: MEA Allulose Forecast Market Volume (Metric Tons) by End Use, 2020-2030

List of Figures

Figure 01: Global Allulose Market Size and Incremental $ Opportunity (US$ Mn), 2015-2030

Figure 02: Global Allulose Market Value Share (%) and BPS Analysis by Form, 2015, 2020 & 2030

Figure 03: Global Allulose Market Y-o-Y Growth (%) Projections by Form, 2016-2030

Figure 04: Global Allulose Market Volume (MT) Analysis by Form, 2020 & 2030

Figure 05: Global Allulose Market Attractiveness, by Form, 2020 to 2030

Figure 06: Global Allulose Market Value Share (%) and BPS Analysis by End-use, 2015, 2020 & 2030

Figure 07: Global Allulose Market Y-o-Y Growth (%) Projections by End-use, 2016-2030

Figure 08: Global Allulose Market Volume (MT) Analysis by End-use, 2020 & 2030

Figure 09: Global Allulose Market Attractiveness, by End-use, 2020 to 2030

Figure 10: Global Allulose Market Value Share (%) and BPS Analysis by Region, 2015, 2020 & 2030

Figure 11: Global Allulose Market Y-o-Y Growth (%) Projections by Region, 2020-2030

Figure 12: Global Allulose Market Volume (MT) Analysis by Region, 2020 & 2030

Figure 13: Global Allulose Market Attractiveness, by Region, 2020 to 2030

Figure 14: North America Allulose Market Value Share (%) and BPS Analysis by Form, 2015, 2020 & 2030

Figure 15: North America Allulose Market Y-o-Y Growth (%) Projections by Form, 2016-2030

Figure 16: North America Allulose Market Volume (MT) Analysis by Form, 2020 & 2030

Figure 17: North America Allulose Market Attractiveness, by Form, 2020 to 2030

Figure 18: North America Allulose Market Value Share (%) and BPS Analysis by End-use, 2015, 2020 & 2030

Figure 19: North America Allulose Market Y-o-Y Growth (%) Projections by End-use, 2016-2030

Figure 20: North America Market Volume (MT) Analysis by End-use, 2020 & 2030

Figure 21: North America Allulose Market Attractiveness, by End-use, 2020 to 2030

Figure 22: North America Allulose Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 23: North America Allulose Market Y-o-Y Growth (%) Projections by Country, 2020-2030

Figure 24: North America Allulose Market Volume (MT) Analysis by Country, 2020 & 2030

Figure 25: North America Allulose Market Attractiveness, by Country, 2020 to 2030

Figure 26: Latin America Allulose Market Value Share (%) and BPS Analysis by Form, 2015, 2020 & 2030

Figure 27: Latin America Allulose Market Y-o-Y Growth (%) Projections by Form, 2016-2030

Figure 28: Latin America Allulose Market Volume (MT) Analysis by Form, 2020 & 2030

Figure 29: Latin America Allulose Market Attractiveness, by Form, 2020 to 2030

Figure 30: Latin America Allulose Market Value Share (%) and BPS Analysis by End-use, 2015, 2020 & 2030

Figure 31: Latin America Allulose Market Y-o-Y Growth (%) Projections by End-use, 2016-2030

Figure 32: Latin America Allulose Market Volume (MT) Analysis by End-use, 2020 & 2030

Figure 33: Latin America Allulose Market Attractiveness, by End-use, 2020 to 2030

Figure 34: Latin America Allulose Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 35: Latin America Allulose Market Y-o-Y Growth (%) Projections by Country, 2020-2030

Figure 36: Latin America Allulose Market Volume (MT) Analysis by Country, 2020 & 2030

Figure 37: Latin America Allulose Market Attractiveness, by Country, 2020 to 2030

Figure 38: East Asia Allulose Market Value Share (%) and BPS Analysis by Form, 2015, 2020 & 2030

Figure 39: East Asia Allulose Market Y-o-Y Growth (%) Projections by Form, 2016-2030

Figure 40: East Asia Allulose Market Volume (MT) Analysis by Form, 2020 & 2030

Figure 41: East Asia Allulose Market Attractiveness, by Form, 2020 to 2030

Figure 42: East Asia Allulose Market Value Share (%) and BPS Analysis by End-use, 2015, 2020 & 2030

Figure 43: East Asia Allulose Market Y-o-Y Growth (%) Projections by End-use, 2016-2030

Figure 44: East Asia Allulose Market Volume (MT) Analysis by End-use, 2020 & 2030

Figure 45: East Asia Allulose Market Attractiveness, by End-use, 2020 to 2030

Figure 46: East Asia Allulose Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 47: East Asia Allulose Market Y-o-Y Growth (%) Projections by Country, 2020-2030

Figure 48: East Asia Allulose Market Volume (MT) Analysis by Country, 2020 & 2030

Figure 49: East Asia Allulose Market Attractiveness, by Country, 2020 to 2030

Figure 50: South Asia Allulose Market Value Share (%) and BPS Analysis by Form, 2015, 2020 & 2030

Figure 51: South Asia Allulose Market Y-o-Y Growth (%) Projections by Form, 2016-2030

Figure 52: South Asia Allulose Market Volume (MT) Analysis by Form, 2020 & 2030

Figure 53: South Asia Allulose Market Attractiveness, by Form, 2020 to 2030

Figure 54: South Asia Allulose Market Value Share (%) and BPS Analysis by End-use, 2015, 2020 & 2030

Figure 55: South Asia Allulose Market Y-o-Y Growth (%) Projections by End-use, 2016-2030

Figure 56: South Asia Allulose Market Volume (MT) Analysis by End-use, 2020 & 2030

Figure 57: South Asia Allulose Market Attractiveness, by End-use, 2020 to 2030

Figure 58: South Asia Allulose Market Value Share (%) and BPS Analysis by Region, 2015, 2020 & 2030

Figure 59: South Asia Allulose Market Y-o-Y Growth (%) Projections by Region, 2020-2030

Figure 60: South Asia Allulose Market Volume (MT) Analysis by Region, 2020 & 2030

Figure 61: South Asia Allulose Market Attractiveness, by Region, 2020 to 2030

Figure 62: Oceania Allulose Market Value Share (%) and BPS Analysis by Form, 2015, 2020 & 2030

Figure 63: Oceania Allulose Market Y-o-Y Growth (%) Projections by Form, 2016-2030

Figure 64: Oceania Allulose Market Volume (MT) Analysis by Form, 2020 & 2030

Figure 65: Oceania Allulose Market Attractiveness, by Form, 2020 to 2030

Figure 66: Oceania Allulose Market Value Share (%) and BPS Analysis by End-use, 2015, 2020 & 2030

Figure 67: Oceania Allulose Market Y-o-Y Growth (%) Projections by End-use, 2016-2030

Figure 68: Oceania Allulose Market Volume (MT) Analysis by End-use, 2020 & 2030

Figure 69: Oceania Allulose Market Attractiveness, by End-use, 2020 to 2030

Figure 70: Oceania Allulose Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 71: Oceania Allulose Market Y-o-Y Growth (%) Projections by Country, 2020-2030

Figure 72: Oceania Allulose Market Volume (MT) Analysis by Country, 2020 & 2030

Figure 73: Oceania Allulose Market Attractiveness, by Country, 2020 to 2030

Figure 74: MEA Allulose Market Value Share (%) and BPS Analysis by Form, 2015, 2020 & 2030

Figure 75: MEA Allulose Market Y-o-Y Growth (%) Projections by Form, 2016-2030

Figure 76: MEA Allulose Market Volume (MT) Analysis by Form, 2020 & 2030

Figure 77: MEA Allulose Market Attractiveness, by Form, 2020 to 2030

Figure 78: MEA Allulose Market Value Share (%) and BPS Analysis by End-use, 2015, 2020 & 2030

Figure 79: MEA Allulose Market Y-o-Y Growth (%) Projections by End-use, 2016-2030

Figure 80: MEA Allulose Market Volume (MT) Analysis by End-use, 2020 & 2030

Figure 81: MEA Allulose Market Attractiveness, by End-use, 2020 to 2030

Figure 82: MEA Allulose Market Value Share (%) and BPS Analysis by Country, 2015, 2020 & 2030

Figure 83: MEA Allulose Market Y-o-Y Growth (%) Projections by Country, 2020-2030

Figure 84: MEA Allulose Market Volume (MT) Analysis by Country, 2020 & 2030

Figure 85: MEA Allulose Market Attractiveness, by Country, 2020 to 2030