Reports

Reports

Analysts’ Viewpoint

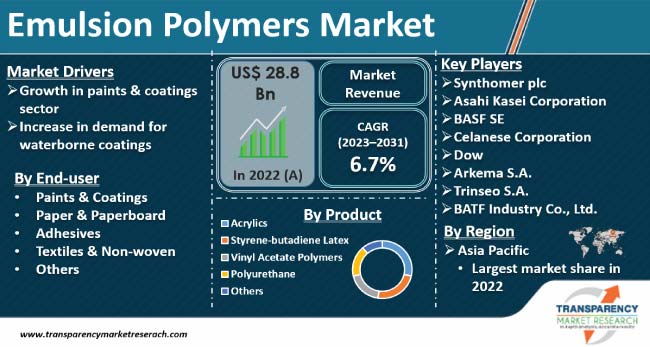

Growth in paints & coatings sector and increase in demand for waterborne coatings are expected to propel the emulsion polymers market size during the forecast period. Emulsion polymers are gaining traction in the manufacture of architectural coatings and adhesives whereas emulsion polymer binders are widely utilized in the textile sector.

Implementation of stringent environmental regulations regarding paints & coatings is likely to offer lucrative opportunities to vendors in the sector. Vendors are investing in the R&D of high-performance polymers to expand their product portfolio. They are also broadening their presence in various end-use industries through strategic mergers & acquisitions. Fluctuations in raw material prices are likely to limit the emulsion polymers market progress in the near future.

Polymer emulsion is the dispersion of polymeric particles of about 100 – 1000 nm size in an aqueous dispersion media. Emulsion polymers are used in the manufacture of many coating formulations. They are employed in a wide range of applications such as paints & coatings, adhesives, and inks. Emulsion polymers in the packaging industry improve the appearance, printability, and protection of the packaging.

Emulsion polymers are utilized in making drug delivery systems, gloves, floor polish, films, and cosmetics. These polymers are known for their low cost and emissions, freeze-thaw stability, zero VOC, and robust shelf-life. Emulsion polymers for adhesives and sealants offer several advantages in terms of ease of handling, water-based formulation, and the ability to customize properties.

Polymer emulsions act as binders for primers. They help enhance the adhesion of primers to walls or other surfaces. They also act as a protective layer on the surface of the primer. This aids in protecting and maintaining the color of primers. Majority of emulsion polymers are used in manufacturing architectural coatings.

Expansion in the paints & coatings sector is projected to spur the emulsion polymers market growth during the forecast period. According to the PCI magazine, the sales figures of coatings companies in the U.S. and internationally increased in 2021 compared to 2020.

Water-based paints & coating make up the majority of household paints sold as they offer fewer odors for interior house paint and heavy-duty protective coatings. This property is also beneficial for applications in confined spaces. Emulsion polymers in paper coatings are typically water-based. Evaporation of solvents can harm workers in poorly ventilated spaces. Thus, demand for waterborne coatings is high in end-use industries that deal with confined and poorly ventilated spaces. This, in turn, is anticipated to fuel the emulsion polymers market revenue in the near future.

Implementation of stringent environmental regulations is boosting demand for waterborne coatings. Most solvents release Volatile Organic Compounds (VOCs) that can cause various health effects. Some VOCs also have the capability to cause cancer. These health concerns are prompting several governments worldwide to regulate the use of VOCs. Hence, end-use industries are increasingly employing water-based coatings to comply with stringent environmental regulations, which is estimated to augment the emulsion polymers market expansion in the next few years.

According to the latest emulsion polymers market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Growth in the construction sector is boosting demand for paints & coatings and adhesives, which is fueling the market dynamics of the region. Growth in the construction sector can be ascribed to the rise in the inflow of foreign tourists and increase in investments in renewable energy infrastructure, telecommunications, and manufacturing. Asia Pacific is estimated to account for 40% of the global constriction sector’s output value by 2030, according to Euromonitor International.

Rise in investment in the automotive sector is estimated to drive the emulsion polymers market statistics in China in the next few years. Emulsion polymers are widely employed in the manufacture of paints & coatings used in the automotive sector. These polymers are optimized for filler content, adhesion, and flexibility. According to data from Rhodium, a U.S. research group, direct European investment in China’s automotive sector reached US$ 6.6 Bn in 2022.

Particle Size Distribution (PSD) significantly impacts the end-use properties of the polymers. Thus, vendors in the global emulsion polymers industry are investing significantly in the modeling and control of PSD to expand their product portfolio. They are also adopting partnership, collaboration, and M&A strategies to increase their emulsion polymers market share.

Arkema S.A., Asahi Kasei Corporation, BASF SE, BATF Industry Co., Ltd., Celanese Corporation, DIC Corporation, JSR Corporation, OMNOVA Solutions Inc., Koninklijke DSM N.V., Shanxi Sanwei Group Co., Ltd., Synthomer plc, Dow, The Lubrizol Corporation, Trinseo S.A., and Wacker Chemie AG are key companies operating in this market.

Each of these players has been profiled in the emulsion polymers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 28.8 Bn |

| Market Forecast Value in 2031 | US$ 51.7 Bn |

| Growth Rate (CAGR) | 6.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Kilo Tons of Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 28.8 Bn in 2022

It is projected to reach US$ 51.7 Bn by the end of 2031

It is anticipated to be 6.7% from 2023 to 2031

Growth in paints & coatings sector and increase in demand for waterborne coatings

Asia Pacific is expected to account for major share during the forecast period

Arkema S.A., Asahi Kasei Corporation, BASF SE, BATF Industry Co., Ltd., Celanese Corporation, DIC Corporation, JSR Corporation, OMNOVA Solutions Inc., Koninklijke DSM N.V., Shanxi Sanwei Group Co., Ltd., Synthomer plc, Dow, The Lubrizol Corporation, Trinseo S.A., and Wacker Chemie AG

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Emulsion Polymers Market Analysis and Forecast, 2023-2031

2.6.1. Global Emulsion Polymers Market Volume (Kilo Tons)

2.6.2. Global Emulsion Polymers Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Emulsion Polymers

3.2. Impact on Demand for Emulsion Polymers– Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Product

6.2. Price Trend Analysis by Region

7. Global Emulsion Polymers Market Analysis and Forecast, by Product, 2023–2031

7.1. Introduction and Definitions

7.2. Global Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

7.2.1. Acrylics

7.2.2. Styrene-butadiene Latex

7.2.3. Vinyl Acetate Polymers

7.2.4. Polyurethane

7.2.5. Others

7.3. Global Emulsion Polymers Market Attractiveness, by Product

8. Global Emulsion Polymers Market Analysis and Forecast, by End-user, 2023–2031

8.1. Introduction and Definitions

8.2. Global Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

8.2.1. Paints & Coatings

8.2.2. Paper & Paperboard

8.2.3. Adhesives

8.2.4. Textiles & Non-woven

8.2.5. Others

8.3. Global Emulsion Polymers Market Attractiveness, by End-user

9. Global Emulsion Polymers Market Analysis and Forecast, by Region, 2023–2031

9.1. Key Findings

9.2. Global Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Emulsion Polymers Market Attractiveness, by Region

10. North America Emulsion Polymers Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. North America Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

10.3. North America Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

10.4. North America Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2023–2031

10.4.1. U.S. Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

10.4.2. U.S. Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

10.4.3. Canada Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

10.4.4. Canada Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

10.5. North America Emulsion Polymers Market Attractiveness Analysis

11. Europe Emulsion Polymers Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Europe Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.3. Europe Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

11.4. Europe Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. Germany Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023–2031

11.4.2. Germany. Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

11.4.3. France Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.4.4. France. Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

11.4.5. U.K. Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.4.6. U.K. Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

11.4.7. Italy Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.4.8. Italy Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

11.4.9. Russia & CIS Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.4.10. Russia & CIS Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

11.4.11. Rest of Europe Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

11.4.12. Rest of Europe Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

11.5. Europe Emulsion Polymers Market Attractiveness Analysis

12. Asia Pacific Emulsion Polymers Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product

12.3. Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

12.4. Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. China Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.4.2. China Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

12.4.3. Japan Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.4.4. Japan Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

12.4.5. India Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.4.6. India Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

12.4.7. ASEAN Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.4.8. ASEAN Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

12.4.9. Rest of Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

12.4.10. Rest of Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

12.5. Asia Pacific Emulsion Polymers Market Attractiveness Analysis

13. Latin America Emulsion Polymers Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Latin America Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.3. Latin America Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

13.4. Latin America Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. Brazil Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.4.2. Brazil Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

13.4.3. Mexico Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.4.4. Mexico Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

13.4.5. Rest of Latin America Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

13.4.6. Rest of Latin America Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

13.5. Latin America Emulsion Polymers Market Attractiveness Analysis

14. Middle East & Africa Emulsion Polymers Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

14.3. Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

14.4. Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

14.4.1. GCC Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

14.4.2. GCC Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

14.4.3. South Africa Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

14.4.4. South Africa Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

14.4.5. Rest of Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2023–2031

14.4.6. Rest of Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-user, 2023–2031

14.5. Middle East & Africa Emulsion Polymers Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Emulsion Polymers Company Market Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Arkema S.A.

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. Asahi Kasei Corporation

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. BASF SE

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. BATF Industry Co., Ltd.

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. Celanese Corporation

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. DIC Corporation

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. JSR Corporation

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. OMNOVA Solutions Inc.

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. Koninklijke DSM N.V.

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. Shanxi Sanwei Group Co., Ltd.

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.11. Synthomer plc

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.12. Dow

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.13. The Lubrizol Corporation

15.2.13.1. Company Revenue

15.2.13.2. Business Overview

15.2.13.3. Product Segments

15.2.13.4. Geographic Footprint

15.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.14. Trinseo S.A.

15.2.14.1. Company Revenue

15.2.14.2. Business Overview

15.2.14.3. Product Segments

15.2.14.4. Geographic Footprint

15.2.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.15. Wacker Chemie AG

15.2.15.1. Company Revenue

15.2.15.2. Business Overview

15.2.15.3. Product Segments

15.2.15.4. Geographic Footprint

15.2.15.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 2: Global Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 3: Global Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 4: Global Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 5: Global Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 6: Global Emulsion Polymers Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 7: North America Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 8: North America Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 9: North America Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 10: North America Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 11: North America Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 12: North America Emulsion Polymers Market Value (US$ Bn) Forecast, by Country, 2023–2031

Table 13: U.S. Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 14: U.S. Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 15: U.S. Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 16: U.S. Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 17: Canada Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 18: Canada Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 19: Canada Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 20: Canada Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 21: Europe Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 22: Europe Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 23: Europe Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 24: Europe Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 25: Europe Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 26: Europe Emulsion Polymers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 27: Germany Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 28: Germany Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 29: Germany Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 30: Germany Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 31: France Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 32: France Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 33: France Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 34: France Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 35: U.K. Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 36: U.K. Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 37: U.K. Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 38: U.K. Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 39: Italy Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 40: Italy Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 41: Italy Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 42: Italy Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 43: Spain Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 44: Spain Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 45: Spain Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 46: Spain Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 47: Russia & CIS Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 48: Russia & CIS Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 49: Russia & CIS Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 50: Russia & CIS Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 51: Rest of Europe Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 52: Rest of Europe Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 53: Rest of Europe Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 54: Rest of Europe Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 55: Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 56: Asia Pacific Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 57: Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 58: Asia Pacific Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 59: Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 60: Asia Pacific Emulsion Polymers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 61: China Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 62: China Emulsion Polymers Market Value (US$ Bn) Forecast, by Product 2023–2031

Table 63: China Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 64: China Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 65: Japan Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 66: Japan Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 67: Japan Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 68: Japan Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 69: India Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 70: India Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 71: India Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 72: India Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 73: ASEAN Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 74: ASEAN Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 75: ASEAN Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 76: ASEAN Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 77: Rest of Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 78: Rest of Asia Pacific Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 79: Rest of Asia Pacific Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 80: Rest of Asia Pacific Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 81: Latin America Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 82: Latin America Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 83: Latin America Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 84: Latin America Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 85: Latin America Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 86: Latin America Emulsion Polymers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 87: Brazil Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 88: Brazil Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 89: Brazil Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 90: Brazil Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 91: Mexico Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 92: Mexico Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 93: Mexico Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 94: Mexico Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 95: Rest of Latin America Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 96: Rest of Latin America Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 97: Rest of Latin America Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 98: Rest of Latin America Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 99: Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 100: Middle East & Africa Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 101: Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 102: Middle East & Africa Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 103: Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 104: Middle East & Africa Emulsion Polymers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 105: GCC Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 106: GCC Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 107: GCC Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 108: GCC Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 109: South Africa Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 110: South Africa Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 111: South Africa Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 112: South Africa Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 113: Rest of Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) Forecast, by Product, 2023–2031

Table 114: Rest of Middle East & Africa Emulsion Polymers Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 115: Rest of Middle East & Africa Emulsion Polymers Market Volume (Kilo Tons) Forecast, by End-user, 2023–2031

Table 116: Rest of Middle East & Africa Emulsion Polymers Market Value (US$ Bn) Forecast, by End-user, 2023–2031

List of Figures

Figure 1: Global Emulsion Polymers Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 2: Global Emulsion Polymers Market Attractiveness, by Product

Figure 3: Global Emulsion Polymers Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 4: Global Emulsion Polymers Market Attractiveness, by End-user

Figure 5: Global Emulsion Polymers Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Emulsion Polymers Market Attractiveness, by Region

Figure 7: North America Emulsion Polymers Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 8: North America Emulsion Polymers Market Attractiveness, by Product

Figure 9: North America Emulsion Polymers Market Attractiveness, by Product

Figure 10: North America Emulsion Polymers Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 11: North America Emulsion Polymers Market Attractiveness, by End-user

Figure 12: North America Emulsion Polymers Market Attractiveness, by Country and Sub-region

Figure 13: Europe Emulsion Polymers Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 14: Europe Emulsion Polymers Market Attractiveness, by Product

Figure 15: Europe Emulsion Polymers Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 16: Europe Emulsion Polymers Market Attractiveness, by End-user

Figure 17: Europe Emulsion Polymers Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Emulsion Polymers Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Emulsion Polymers Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 20: Asia Pacific Emulsion Polymers Market Attractiveness, by Product

Figure 21: Asia Pacific Emulsion Polymers Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 22: Asia Pacific Emulsion Polymers Market Attractiveness, by End-user

Figure 23: Asia Pacific Emulsion Polymers Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Emulsion Polymers Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Emulsion Polymers Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 26: Latin America Emulsion Polymers Market Attractiveness, by Product

Figure 27: Latin America Emulsion Polymers Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 28: Latin America Emulsion Polymers Market Attractiveness, by End-user

Figure 29: Latin America Emulsion Polymers Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Emulsion Polymers Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Emulsion Polymers Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 32: Middle East & Africa Emulsion Polymers Market Attractiveness, by Product

Figure 33: Middle East & Africa Emulsion Polymers Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 34: Middle East & Africa Emulsion Polymers Market Attractiveness, by End-user

Figure 35: Middle East & Africa Emulsion Polymers Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Emulsion Polymers Market Attractiveness, by Country and Sub-region