Reports

Reports

Analysts’ Viewpoint

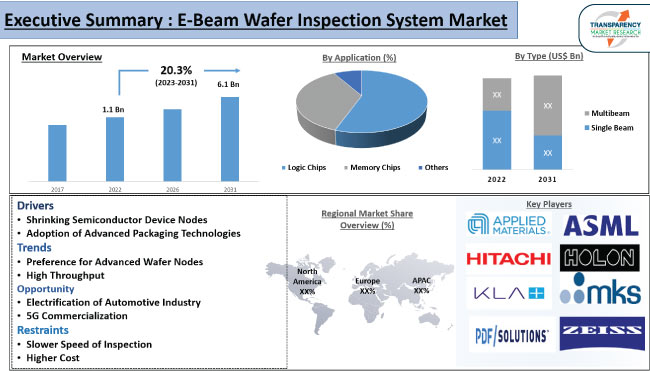

Advanced semiconductor devices often have complex structures and multiple layers. E-beam wafer inspection systems can analyze these structures at high resolution, enabling the detection of defects that may impact device performance or reliability. Thus, shrinking semiconductor devices and their complex structure are driving the e-beam wafer inspection system industry growth.

One of the notable e-beam wafer inspection system market trends is the development and adoption of multi e-beam wafer inspection systems. This trend is driven by the need for higher throughput, improved defect detection, and enhanced process control in semiconductor manufacturing. These systems offer promising capabilities to meet the evolving challenges of semiconductor technology nodes and advanced packaging techniques. Companies compete in the market by continually improving their e-beam wafer inspection systems, enhancing defect detection capabilities, increasing throughput, and offering advanced analytics and data management features.

An e-beam wafer inspection system is a semiconductor production tool that inspects integrated circuit (IC) components or wafers using electron beam scanning. These systems are critical in the semiconductor manufacturing process, because they detect faults and ensure the quality and reliability of the produced integrated circuits.

High-energy electron beams are used in electron beam inspection systems to scan the wafer surface and examine the various layers and architectures of integrated circuits. This allows for the detection of flaws such as particles, pattern deviations, line-width changes, and other irregularities that could affect the functioning and performance of the integrated circuits. High-resolution imaging and analysis capabilities are provided by electron beam scanning, enabling for precise defect characterization and analysis.

Advanced device manufacturers are continuously shrinking semiconductor device nodes, and they are now adopting cutting-edge EUV (Extreme Ultraviolet) technology for lithography. EUV technology enables rapid and highly precise lithography processes, contributing to the ongoing reduction in device dimensions.

The adoption of EUV lithography is shrinking the dimensions of circuit pattern dimensions, which in turn is boosting the demand for reliable, accurate, and repeatable inspection and measurement systems in order to manage production lines and optimize yields. This is especially important to ensure the quality of advanced EUV masks and minimizing variations in circuit dimensions, as well as detecting stochastic defects that are characteristic of EUV lithography.

Consequently, demand for high-throughput, high-resolution inspection and measurement solutions is increasing in order to keep up with the growing number of inspection targets in the semiconductor manufacturing process.

The scaling of semiconductor technology towards 2.5D and 3D architectures has been a driving force for the adoption of electron beam wafer inspection systems. These advanced packaging technologies present new challenges for defect detection and analysis, and e-beam defect inspection systems offer unique capabilities to address these challenges.

Increase in popularity of 2.5D and 3D structures has meant that defect inspection in back-end packaging is becoming increasingly crucial. The interconnect mechanisms of advanced packages involve intricate structures such as bumps, pillars, through-silicon vias (TSV), and redistribution and under bump metallization layers. Ensuring the reliability of the final packaged IC requires repeated inspection of these complex structures throughout the manufacturing process.

The e-beam inspection system plays a vital role in expediting time-to-market for cutting-edge electronic devices by offering a comprehensive understanding of critical defects during the chip manufacturing process. The e-beam inspection system assists in identifying potential issues and implementing necessary improvements promptly by enabling early detection and analysis of these defects. This proactive approach ensures that any defects are addressed early on, leading to faster production cycles and quicker delivery of innovative electronic devices to the market.

Defects are growing increasingly minute, to the point that many are no longer observable with optical inspection, and single beam methods take significantly longer to check the wafer.

The new multibeam inspection system detects these minor faults, while also overcoming previous e-beam throughput constraints, making it more suitable for high-volume industrial situations. Consequently, the multi-beam segment is estimated to account for a significant e-beam wafer inspection system market share during the forecast period.

According to the latest analysis of the region-wise market forecast, Asia Pacific is a major consumer electronics hub, with nations such as China, Japan, South Korea, and Taiwan playing significant roles in the production and export of electronic products. Expansion of the consumer electronics sector, increased industrialization, and infrastructural development are driving the demand for semiconductors chips in this region. Adoption of electric vehicles, growth of telecommunications networks, and incorporation of renewable energy sources all contribute to the region's demand for semiconductor manufacturing equipment.

North America has a developed industry that focuses on advanced electronics. The CHIPS and Science Act is also expected to improve semiconductor research, development, and manufacture in the U.S., ensuring U.S. leadership in the technology that powers everything from automobiles to home appliances to defense systems.

Major players are focusing on the design and development of e-beam wafer inspection systems for high volume production lines. The market is assisted by rapid development of technologies and ever-changing electronic devices.

Key players operating in the market include Applied Materials Inc., ASML Holding N.V., Hitachi Ltd., HOLON CO., LTD., KLA Corporation, MKS Instruments, Inc., PDF Solutions, Photo electron Soul Inc., TASMIT, Inc., Telemark Factory, and ZEISS Semiconductor Manufacturing Technology.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2021 |

US$ 1.1 Bn |

|

Market Forecast Value in 2031 |

US$ 6.1 Bn |

|

Growth Rate (CAGR) |

20.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.1 Bn in 2022

It is expected to expand at a CAGR of 20.3% by 2031

The global business is estimated to reach a value of US$ 6.1 Bn in 2031

Applied Materials Inc., ASML Holding N.V., Hitachi Ltd., HOLON CO., LTD., KLA Corporation, MKS Instruments, Inc., PDF Solutions, Photo electron Soul Inc., TASMIT, Inc., Telemark Factory, ZEISS Semiconductor Manufacturing Technology.

The U.S. accounted for 25.2% of share of the global demand for beam wafer inspection system

Shrinking semiconductor device nodes and adoption of advanced packaging technologies

Asia Pacific and North America were highly lucrative in 2022

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global E-Beam Wafer Inspection System Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Semiconductor Manufacturing Equipment’s Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global E-Beam Wafer Inspection System Market Analysis, by Type

5.1. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Type, 2017-2031

5.1.1. Single Beam

5.1.2. Multi Beam

5.2. Market Attractiveness Analysis, by Type

6. Global E-Beam Wafer Inspection System Market Analysis, by Wafer Node

6.1. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Wafer Node, 2017-2031

6.1.1. Mature Nodes (Above 10nm)

6.1.2. Advance Nodes (10nm, 7nm, 5nm, below)

6.2. Market Attractiveness Analysis, by Wafer Node

7. Global E-Beam Wafer Inspection System Market Analysis, by Application

7.1. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Application, 2017-2031

7.1.1. Logic Chips

7.1.2. Memory Chips

7.1.3. Others

7.2. Market Attractiveness Analysis, by Application

8. Global E-Beam Wafer Inspection System Market Analysis, by End-use Industry

8.1. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

8.1.1. Automotive

8.1.2. Consumer Electronics

8.1.3. IT & Telecom

8.1.4. Industrial

8.1.5. Others

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global E-Beam Wafer Inspection System Market Analysis and Forecast by Region

9.1. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America E-Beam Wafer Inspection System Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Type, 2017-2031

10.3.1. Single Beam

10.3.2. Multi Beam

10.4. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Wafer Node, 2017-2031

10.4.1. Mature Nodes (Above 10nm)

10.4.2. Advance Nodes (10nm, 7nm, 5nm, below)

10.5. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Application, 2017-2031

10.5.1. Logic Chips

10.5.2. Memory Chips

10.5.3. Others

10.6. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

10.6.1. Automotive

10.6.2. Consumer Electronics

10.6.3. IT & Telecom

10.6.4. Industrial

10.6.5. Others

10.7. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Type

10.8.2. By Wafer Node

10.8.3. By Applications

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe E-Beam Wafer Inspection System Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Type, 2017-2031

11.3.1. Single Beam

11.3.2. Multi Beam

11.4. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Wafer Node, 2017-2031

11.4.1. Mature Nodes (Above 10nm)

11.4.2. Advance Nodes (10nm, 7nm, 5nm, below)

11.5. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Application, 2017-2031

11.5.1. Logic Chips

11.5.2. Memory Chips

11.5.3. Others

11.6. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

11.6.1. Automotive

11.6.2. Consumer Electronics

11.6.3. IT & Telecom

11.6.4. Industrial

11.6.5. Others

11.7. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Type

11.8.2. By Wafer Node

11.8.3. By Applications

11.8.4. By End-use Industry

11.8.5. By Country/Sub-region

12. Asia Pacific E-Beam Wafer Inspection System Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Type, 2017-2031

12.3.1. Single Beam

12.3.2. Multi Beam

12.4. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Wafer Node, 2017-2031

12.4.1. Mature Nodes (Above 10nm)

12.4.2. Advance Nodes (10nm, 7nm, 5nm, below)

12.5. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Application, 2017-2031

12.5.1. Logic Chips

12.5.2. Memory Chips

12.5.3. Others

12.6. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

12.6.1. Automotive

12.6.2. Consumer Electronics

12.6.3. IT & Telecom

12.6.4. Industrial

12.6.5. Others

12.7. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Wafer Node

12.8.3. By Applications

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East & Africa E-Beam Wafer Inspection System Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Type, 2017-2031

13.3.1. Single Beam

13.3.2. Multi Beam

13.4. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Wafer Node, 2017-2031

13.4.1. Mature Nodes (Above 10nm)

13.4.2. Advance Nodes (10nm, 7nm, 5nm, below)

13.5. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Application, 2017-2031

13.5.1. Logic Chips

13.5.2. Memory Chips

13.5.3. Others

13.6. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

13.6.1. Automotive

13.6.2. Consumer Electronics

13.6.3. IT & Telecom

13.6.4. Industrial

13.6.5. Others

13.7. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Wafer Node

13.8.3. By Applications

13.8.4. By End-use Industry

13.8.5. By Country/Sub-region

14. South America E-Beam Wafer Inspection System Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Type, 2017-2031

14.3.1. Single Beam

14.3.2. Multi Beam

14.4. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Wafer Node, 2017-2031

14.4.1. Mature Nodes (Above 10nm)

14.4.2. Advance Nodes (10nm, 7nm, 5nm, below)

14.5. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by Application, 2017-2031

14.5.1. Logic Chips

14.5.2. Memory Chips

14.5.3. Others

14.6. E-Beam Wafer Inspection System Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

14.6.1. Automotive

14.6.2. Consumer Electronics

14.6.3. IT & Telecom

14.6.4. Industrial

14.6.5. Others

14.7. E-Beam Wafer Inspection System Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Wafer Node

14.8.3. By Applications

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global E-Beam Wafer Inspection System Market Competition Matrix - a Dashboard View

15.1.1. Global E-Beam Wafer Inspection System Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Applied Materials Inc.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. ASML Holding N.V.

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Hitachi Ltd.

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Holon co., ltd.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. KLA Corporation

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. MKS Instruments, Inc.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. PDF Solutions

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Photo electron Soul Inc.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. TASMIT, Inc.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Telemark Factory

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. ZEISS Semiconductor Manufacturing Technology

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Type

17.1.2. By Wafer Node

17.1.3. By Applications

17.1.4. By End-use Industry

17.1.5. By Region/Country/Sub-region

List of Tables

Table 1: Global E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 2: Global E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Type, 2017-2031

Table 3: Global E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Wafer Node 2017-2031

Table 4: Global E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 5: Global E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 6: Global E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 7: Global E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Region, 2017-2031

Table 8: North America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 9: North America E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Type, 2017-2031

Table 10: North America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Wafer Node 2017-2031

Table 11: North America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 12: North America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 13: North America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 14: North America E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Region, 2017-2031

Table 15: Europe E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 16: Europe E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Type, 2017-2031

Table 17: Europe E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Wafer Node 2017-2031

Table 18: Europe E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 19: Europe E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 20: Europe E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 21: Europe E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Region, 2017-2031

Table 22: Asia Pacific E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 23: Asia Pacific E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Type, 2017-2031

Table 24: Asia Pacific E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Wafer Node 2017-2031

Table 25: Asia Pacific E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 26: Asia Pacific E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 27: Asia Pacific E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 28: Asia Pacific E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Region, 2017-2031

Table 29: Middle East & Africa E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 30: Middle East & Africa E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Type, 2017-2031

Table 31: Middle East & Africa E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Wafer Node 2017-2031

Table 32: Middle East & Africa E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 33: Middle East & Africa E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 34: Middle East & Africa E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 35: Middle East & Africa E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Region, 2017-2031

Table 36: South America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 37: South America E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Type, 2017-2031

Table 38: South America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Wafer Node 2017-2031

Table 39: South America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 40: South America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 41: South America E-Beam Wafer Inspection System Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 42: South America E-Beam Wafer Inspection System Market Volume (Units) & Forecast, by Region, 2017-2031

List of Figures

Figure 01: Global E-Beam Wafer Inspection System Market Forecast, Value (US$ Mn), 2017-2031

Figure 02: Global E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 03: Global E-Beam Wafer Inspection System Market Forecast, Volume (Units), 2017-2031

Figure 04: Global E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 05: Global E-Beam Wafer Inspection System Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 06: Global E-Beam Wafer Inspection System Market Share Analysis, by Type, 2021 and 2031

Figure 07: Global E-Beam Wafer Inspection System Market, Incremental Opportunity, by Type, 2021-2031

Figure 08: Global E-Beam Wafer Inspection System Market Projections by Wafer Node, Value (US$ Mn), 2017-2031

Figure 09: Global E-Beam Wafer Inspection System Market Share Analysis, by Wafer Node, 2021 and 2031

Figure 10: Global E-Beam Wafer Inspection System Market, Incremental Opportunity, by Wafer Node, 2021-2031

Figure 11: Global E-Beam Wafer Inspection System Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 12: Global E-Beam Wafer Inspection System Market Share Analysis, by Application, 2021 and 2031

Figure 13: Global E-Beam Wafer Inspection System Market, Incremental Opportunity, by Application, 2021-2031

Figure 14: Global E-Beam Wafer Inspection System Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 15: Global E-Beam Wafer Inspection System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 16: Global E-Beam Wafer Inspection System Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 17: Global E-Beam Wafer Inspection System Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 18: Global E-Beam Wafer Inspection System Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 19: Global E-Beam Wafer Inspection System Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 20: North America E-Beam Wafer Inspection System Market Forecast, Value (US$ Mn), 2017-2031

Figure 21: North America E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 22: North America E-Beam Wafer Inspection System Market Forecast, Volume (Units), 2017-2031

Figure 23: North America E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 24: North America E-Beam Wafer Inspection System Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 25: North America E-Beam Wafer Inspection System Market Share Analysis, by Type, 2021 and 2031

Figure 26: North America E-Beam Wafer Inspection System Market, Incremental Opportunity, by Type, 2021-2031

Figure 27: North America E-Beam Wafer Inspection System Market Projections by Wafer Node, Value (US$ Mn), 2017-2031

Figure 28: North America E-Beam Wafer Inspection System Market Share Analysis, by Wafer Node, 2021 and 2031

Figure 29: North America E-Beam Wafer Inspection System Market, Incremental Opportunity, by Wafer Node, 2021-2031

Figure 30: North America E-Beam Wafer Inspection System Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 31: North America E-Beam Wafer Inspection System Market Share Analysis, by Application, 2021 and 2031

Figure 32: North America E-Beam Wafer Inspection System Market, Incremental Opportunity, by Application, 2021-2031

Figure 33: North America E-Beam Wafer Inspection System Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 34: North America E-Beam Wafer Inspection System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 35: North America E-Beam Wafer Inspection System Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 36: North America E-Beam Wafer Inspection System Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 37: North America E-Beam Wafer Inspection System Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 38: North America E-Beam Wafer Inspection System Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 39: Europe E-Beam Wafer Inspection System Market Forecast, Value (US$ Mn), 2017-2031

Figure 40: Europe E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 41: Europe E-Beam Wafer Inspection System Market Forecast, Volume (Units), 2017-2031

Figure 42: Europe E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 43: Europe E-Beam Wafer Inspection System Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 44: Europe E-Beam Wafer Inspection System Market Share Analysis, by Type, 2021 and 2031

Figure 45: Europe E-Beam Wafer Inspection System Market, Incremental Opportunity, by Type, 2021-2031

Figure 46: Europe E-Beam Wafer Inspection System Market Projections by Wafer Node, Value (US$ Mn), 2017-2031

Figure 47: Europe E-Beam Wafer Inspection System Market Share Analysis, by Wafer Node, 2021 and 2031

Figure 48: Europe E-Beam Wafer Inspection System Market, Incremental Opportunity, by Wafer Node, 2021-2031

Figure 49: Europe E-Beam Wafer Inspection System Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 50: Europe E-Beam Wafer Inspection System Market Share Analysis, by Application, 2021 and 2031

Figure 51: Europe E-Beam Wafer Inspection System Market, Incremental Opportunity, by Application, 2021-2031

Figure 52: Europe E-Beam Wafer Inspection System Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 53: Europe E-Beam Wafer Inspection System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 54: Europe E-Beam Wafer Inspection System Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 55: Europe E-Beam Wafer Inspection System Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 56: Europe E-Beam Wafer Inspection System Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 57: Europe E-Beam Wafer Inspection System Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 58: Asia Pacific E-Beam Wafer Inspection System Market Forecast, Value (US$ Mn), 2017-2031

Figure 59: Asia Pacific E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 60: Asia Pacific E-Beam Wafer Inspection System Market Forecast, Volume (Units), 2017-2031

Figure 61: Asia Pacific E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 62: Asia Pacific E-Beam Wafer Inspection System Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 63: Asia Pacific E-Beam Wafer Inspection System Market Share Analysis, by Type, 2021 and 2031

Figure 64: Asia Pacific E-Beam Wafer Inspection System Market, Incremental Opportunity, by Type, 2021-2031

Figure 65: Asia Pacific E-Beam Wafer Inspection System Market Projections by Wafer Node, Value (US$ Mn), 2017-2031

Figure 66: Asia Pacific E-Beam Wafer Inspection System Market Share Analysis, by Wafer Node, 2021 and 2031

Figure 67: Asia Pacific E-Beam Wafer Inspection System Market, Incremental Opportunity, by Wafer Node, 2021-2031

Figure 68: Asia Pacific E-Beam Wafer Inspection System Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 69: Asia Pacific E-Beam Wafer Inspection System Market Share Analysis, by Application, 2021 and 2031

Figure 70: Asia Pacific E-Beam Wafer Inspection System Market, Incremental Opportunity, by Application, 2021-2031

Figure 71: Asia Pacific E-Beam Wafer Inspection System Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 72: Asia Pacific E-Beam Wafer Inspection System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 73: Asia Pacific E-Beam Wafer Inspection System Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 74: Asia Pacific E-Beam Wafer Inspection System Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 75: Asia Pacific E-Beam Wafer Inspection System Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 76: Asia Pacific E-Beam Wafer Inspection System Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 77: Middle East & Africa E-Beam Wafer Inspection System Market Forecast, Value (US$ Mn), 2017-2031

Figure 78: Middle East & Africa E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 79: Middle East & Africa E-Beam Wafer Inspection System Market Forecast, Volume (Units), 2017-2031

Figure 80: Middle East & Africa E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 81: Middle East & Africa E-Beam Wafer Inspection System Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 82: Middle East & Africa E-Beam Wafer Inspection System Market Share Analysis, by Type, 2021 and 2031

Figure 83: Middle East & Africa E-Beam Wafer Inspection System Market, Incremental Opportunity, by Type, 2021-2031

Figure 84: Middle East & Africa E-Beam Wafer Inspection System Market Projections by Wafer Node, Value (US$ Mn), 2017-2031

Figure 85: Middle East & Africa E-Beam Wafer Inspection System Market Share Analysis, by Wafer Node, 2021 and 2031

Figure 86: Middle East & Africa E-Beam Wafer Inspection System Market, Incremental Opportunity, by Wafer Node, 2021-2031

Figure 87: Middle East & Africa E-Beam Wafer Inspection System Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 88: Middle East & Africa E-Beam Wafer Inspection System Market Share Analysis, by Application, 2021 and 2031

Figure 89: Middle East & Africa E-Beam Wafer Inspection System Market, Incremental Opportunity, by Application, 2021-2031

Figure 90: Middle East & Africa E-Beam Wafer Inspection System Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 91: Middle East & Africa E-Beam Wafer Inspection System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 92: Middle East & Africa E-Beam Wafer Inspection System Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 93: Middle East & Africa E-Beam Wafer Inspection System Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 94: Middle East & Africa E-Beam Wafer Inspection System Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 95: Middle East & Africa E-Beam Wafer Inspection System Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 96: South America E-Beam Wafer Inspection System Market Forecast, Value (US$ Mn), 2017-2031

Figure 97: South America E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 98: South America E-Beam Wafer Inspection System Market Forecast, Volume (Units), 2017-2031

Figure 99: South America E-Beam Wafer Inspection System Market Forecast, Y-O-Y, Volume (Units), 2017-2031

Figure 100: South America E-Beam Wafer Inspection System Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 101: South America E-Beam Wafer Inspection System Market Share Analysis, by Type, 2021 and 2031

Figure 102: South America E-Beam Wafer Inspection System Market, Incremental Opportunity, by Type, 2021-2031

Figure 103: South America E-Beam Wafer Inspection System Market Projections by Wafer Node, Value (US$ Mn), 2017-2031

Figure 104: South America E-Beam Wafer Inspection System Market Share Analysis, by Wafer Node, 2021 and 2031

Figure 105: South America E-Beam Wafer Inspection System Market, Incremental Opportunity, by Wafer Node, 2021-2031

Figure 106: South America E-Beam Wafer Inspection System Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 107: South America E-Beam Wafer Inspection System Market Share Analysis, by Application, 2021 and 2031

Figure 108: South America E-Beam Wafer Inspection System Market, Incremental Opportunity, by Application, 2021-2031

Figure 109: South America E-Beam Wafer Inspection System Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 110: South America E-Beam Wafer Inspection System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 111: South America E-Beam Wafer Inspection System Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 112: South America E-Beam Wafer Inspection System Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 113: South America E-Beam Wafer Inspection System Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 114: South America E-Beam Wafer Inspection System Market, Incremental Opportunity, by Country and sub-region, 2021-2031