Reports

Reports

In recent years, the packaging industry has witnessed a tremendous increase in demand for different products due to change in consumer habits and the introduction of new & innovative products embedded with advanced packaging technologies. Companies are investing heavily in research and development activities to develop products with distinguishable characteristics. Consumer inclination towards convenience products such as packaged food, has resulted in the development of products with advanced packaging technologies that offer longer shelf life through gas absorption and scavenging systems. Across the globe, active packaging is gaining traction for food packaging applications due to its properties that enhance shelf life and the ability to reflect properties of contained food on the packaging. Embedding advanced packaging technologies such as freshness and temperature indicators on food packaging products by a large number of brand owners all over the world, is helping them acquire more customers and gain a competitive advantage in the packaged food industry. Leading packaging companies are collaborating with technology providers to develop advanced packaging technologies for their products. Global food and beverages companies are showing immense interest in adopting packaging solutions with advanced packaging technologies.

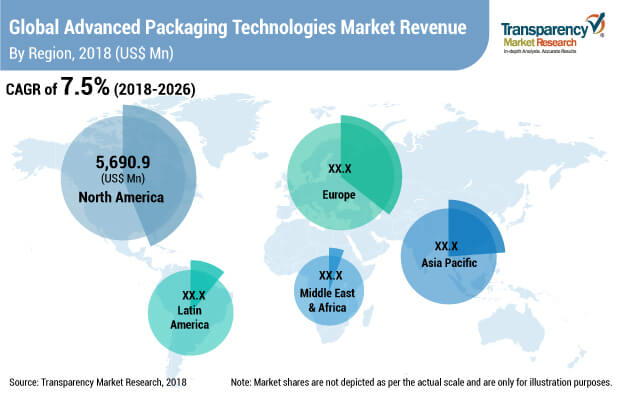

The global demand for advanced packaging technologies is largely fulfilled by the manufacturers present in major countries of Europe and North America regions. It has been noticed that the consumers in these regions have shown great interest in the adoption of products with advanced packaging technologies. According to TMR, more than 30% of the consumers are willing to pay a higher cost for products with the advanced packaging technologies. Consumer inclination towards products with smart packaging solutions and high-barrier properties is creating a wave in the packaging industry which, in turn, is responsible for the high growth in the advanced packaging technologies market. The advanced packaging technologies market is expected to grow at a CAGR value of 7.5%, during the forecast period.

Innovation and new product launches in the global advanced packaging technologies market are the major factors that are being considered by leading packaging manufacturers. Brand owners are rethinking their strategies and planning to launch new products with advanced packaging technologies. Such initiatives are responsible for embarking new products in the advanced packaging technologies market. Brand owners think that products with advanced packaging technologies will create brand differentiation at the point of sale.

On the basis of end use, the advanced packaging technologies market is segmented into Food, Beverages, Pharmaceuticals, Industrial & Chemicals, Cosmetics & Personal Care, Agriculture, and Others. Food segment in the advanced packaging technologies market is further sub-segmented into Meat, Poultry, and Seafood, Fruits & Vegetables, Ready-to-Eat Meals, Dairy Foods, Bakery & Confectionary, Frozen Foods, and Cereals.

The North American region accounts for the largest market share in terms of production of packaging products, with advanced packaging technologies, in both categories i.e. active and smart & intelligent packaging. The U.S. is expected to account for the largest market share in the North American advanced packaging technologies market. However, Canada is expected to witness higher CAGR value of 7.2% during the forecast period. European region occupies the second spot in the global advanced packaging technologies market in terms of both revenue generation and consumption. Germany and Italy are the main production hubs for products embedded with advanced packaging technologies in Europe. Both of these countries export a large proportion of its production to the U.S., China, ASEAN, India, Korea, and Japan. In the Asia-Pacific region, Japan accounts for the second largest market share due to the high consumption of the products with advanced packaging technologies in the country. A large number of advanced packaging manufacturers have already established a good presence in the Japanese market. However, the demand for advanced packaging technologies in Japan is increasing but at a slower rate than other countries in the Asia-Pacific region. Major technology providers such as EVRYTHNG Limited, Selinko SA, Digimarc Corporation, Prime Vision AG, and Waterio Ltd. are collaborating with packaging companies in the region to develop products with advanced packaging technologies and leverage opportunities generated from the high demand for such packaging solutions in the region.

Leading packaging companies such as Tetrapak and Huhtamaki are also planning to launch new products with advanced packaging technologies in the developing countries of the Asia-Pacific and Latin America regions. Countries in the MEA region also offer untapped growth opportunities in the global advanced packaging technologies market.

Some of the key players in the global advanced packaging technologies market include PakSense, Inc, Landec Corporation, Sealed Air Corporation, Bemis Company, Inc, Crown Holdings, Inc., Amcor Limited, 3M Company, Timestrip UK Ltd., Cryolog S.A., Vitsab International AB, Varcode, Ltd., LCR Hallcrest LLC.:, Thin Film Electronics ASA, CCL Industries Inc., Temptime Corporation, Multisorb Technologies, Inc., Coveris Holdings S.A., and others.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Opportunity Analysis

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Background

3.1. Global Active, Smart, and Intelligent Packaging Market Overview

3.2. Technology Roadmap

3.3. Packaging Manufacturers’ Perspective on Advanced Packaging Technologies

3.4. Advanced Packaging: Consumer Sentiment Analysis

3.5. Nanotechnology in Packaging: Short and Long Term Outlook

3.6. Macro-Economic Indicators and Correlation Analysis

3.7. Forecast Factors – Relevance & Impact

3.8. Porter’s Five Forces Analysis for Top 5 Countries

3.9. PESTLE Analysis for Key Countries

3.10. Value Chain Analysis

3.10.1. Key Participants

3.10.1.1. Raw Material Supplier

3.10.1.2. Technology Providers

3.10.1.3. Packaging Manufacturer

3.10.1.4. End Users

3.10.2. Profitability Margin

3.11. Market Dynamics

3.11.1. Drivers

3.11.1.1. Supply Side

3.11.1.2. Demand Side

3.11.2. Restraints

3.11.3. Opportunities

3.11.4. Trends

4. Market Analysis

4.1. Market Value (US$ Mn) and Volume (Mn Units) Analysis & Forecast

4.2. Y-o-Y Growth Projections

4.3. Absolute $ Opportunity Analysis

5. Global Advanced Packaging Technologies Market Analysis and Forecast, by Technology

5.1. Section Summary

5.2. Introduction

5.2.1. Market Share and BPS Analysis, by Technology

5.2.2. Y-o-Y Growth Comparison, by Technology

5.3. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Technology

5.3.1. Active Packaging

5.3.1.1. Active Scavenging Systems

5.3.1.1.1. Oxygen Scavengers

5.3.1.1.2. Moisture Scavengers

5.3.1.1.3. Ethylene Absorbers

5.3.1.2. Active Releasing Systems

5.3.1.2.1. Antioxidant Releasers

5.3.1.2.2. Carbon Dioxide Emitters

5.3.1.3. Modified Atmosphere Packages (MAP)

5.3.1.4. Temperature Control Packaging

5.3.1.5. Anti-Corrosion Films

5.3.2. Smart and Intelligent Packaging

5.3.2.1. Time-Temperature Indicators (TTI)

5.3.2.2. Freshness Indicators

5.3.2.3. Oxygen and Carbon Dioxide Indicators

5.3.2.4. RFID

5.3.2.5. Others

5.4. Market Attractiveness Analysis, by Technology

6. Global Advanced Packaging Technologies Market Analysis, by End Use

6.1. Section Summary

6.2. Introduction

6.2.1. Market Share and BPS Analysis, by End Use

6.2.2. Y-o-Y Growth Comparison, by End Use

6.3. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by End Use

6.3.1. Food

6.3.1.1. Meat, Poultry and Seafood

6.3.1.2. Fruits and Vegetables

6.3.1.3. Ready-to-Eat Meals

6.3.1.4. Dairy Foods

6.3.1.5. Bakery and Confectionery

6.3.1.6. Frozen Foods

6.3.1.7. Cereals

6.3.2. Beverages

6.3.2.1. Alcoholic Beverages

6.3.2.2. Non-Alcoholic Beverages

6.3.3. Pharmaceuticals

6.3.4. Industrial & Chemicals

6.3.5. Cosmetics & Personal Care

6.3.6. Agriculture

6.3.7. Others

6.4. Market Attractiveness Analysis by End Use

7. Global Advanced Packaging Technologies Market Analysis, by Region

7.1. Section Summary

7.2. Introduction

7.2.1. Y-o-Y Growth Projections, by Region

7.2.2. Basis Point Share (BPS) Analysis, by Region

7.3. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Region

7.3.1. North America

7.3.2. Latin America

7.3.3. Europe

7.3.4. APAC

7.3.5. Middle East & Africa

7.4. Market Attractiveness Analysis by Region

8. North America Advanced Packaging Technologies Market Analysis

8.1. Introduction

8.1.1. Basis Point Share (BPS) Analysis by Country

8.1.2. Y-o-Y Growth Projections by Country

8.2. Pricing Analysis

8.3. North America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Country

8.3.1. U.S.

8.3.2. Canada

8.4. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Technology

8.4.1. Active Packaging

8.4.1.1. Active Scavenging Systems

8.4.1.1.1. Oxygen Scavengers

8.4.1.1.2. Moisture Scavengers

8.4.1.1.3. Ethylene Absorbers

8.4.1.2. Active Releasing Systems

8.4.1.2.1. Antioxidant Releasers

8.4.1.2.2. Carbon Dioxide Emitters

8.4.1.3. Modified Atmosphere Packages (MAP)

8.4.1.4. Temperature Control Packaging

8.4.1.5. Anti-Corrosion Films

8.4.2. Smart and Intelligent Packaging

8.4.2.1. Time-Temperature Indicators (TTI)

8.4.2.2. Freshness Indicators

8.4.2.3. Oxygen and Carbon Dioxide Indicators

8.4.2.4. RFID

8.4.2.5. Others

8.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by End Use

8.5.1. Food

8.5.1.1. Meat, Poultry and Seafood

8.5.1.2. Fruits and Vegetables

8.5.1.3. Ready-to-Eat Meals

8.5.1.4. Dairy Foods

8.5.1.5. Bakery and Confectionery

8.5.1.6. Frozen Foods

8.5.1.7. Cereals

8.5.2. Beverages

8.5.2.1. Alcoholic Beverages

8.5.2.2. Non-Alcoholic Beverages

8.5.3. Pharmaceuticals

8.5.4. Industrial & Chemicals

8.5.5. Cosmetics & Personal Care

8.5.6. Agriculture

8.5.7. Others

8.6. Key Market Participants - Intensity Mapping

8.7. Drivers and Restraints: Impact Analysis

9. Latin America Advanced Packaging Technologies Market Analysis

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis by Country

9.1.2. Y-o-Y Growth Projections by Country

9.2. Pricing Analysis

9.3. Latin America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Country

9.3.1. Brazil

9.3.2. Mexico

9.3.3. Argentina

9.3.4. Rest of Latin America

9.4. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Technology

9.4.1. Active Packaging

9.4.1.1. Active Scavenging Systems

9.4.1.1.1. Oxygen Scavengers

9.4.1.1.2. Moisture Scavengers

9.4.1.1.3. Ethylene Absorbers

9.4.1.2. Active Releasing Systems

9.4.1.2.1. Antioxidant Releasers

9.4.1.2.2. Carbon Dioxide Emitters

9.4.1.3. Modified Atmosphere Packages (MAP)

9.4.1.4. Temperature Control Packaging

9.4.1.5. Anti-Corrosion Films

9.4.2. Smart and Intelligent Packaging

9.4.2.1. Time-Temperature Indicators (TTI)

9.4.2.2. Freshness Indicators

9.4.2.3. Oxygen and Carbon Dioxide Indicators

9.4.2.4. RFID

9.4.2.5. Others

9.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by End Use

9.5.1. Food

9.5.1.1. Meat, Poultry and Seafood

9.5.1.2. Fruits and Vegetables

9.5.1.3. Ready-to-Eat Meals

9.5.1.4. Dairy Foods

9.5.1.5. Bakery and Confectionery

9.5.1.6. Frozen Foods

9.5.1.7. Cereals

9.5.2. Beverages

9.5.2.1. Alcoholic Beverages

9.5.2.2. Non-Alcoholic Beverages

9.5.3. Pharmaceuticals

9.5.4. Industrial & Chemicals

9.5.5. Cosmetics & Personal Care

9.5.6. Agriculture

9.5.7. Others

9.6. Key Market Participants - Intensity Mapping

9.7. Drivers and Restraints: Impact Analysis

10. Europe Advanced Packaging Technologies Market Analysis

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis by Country

10.1.2. Y-o-Y Growth Projections by Country

10.2. Pricing Analysis

10.3. Europe Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Country

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Spain

10.3.5. Italy

10.3.6. Benelux

10.3.7. Nordic

10.3.8. Russia

10.3.9. Poland

10.3.10. Rest of Europe

10.4. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Technology

10.4.1. Active Packaging

10.4.1.1. Active Scavenging Systems

10.4.1.1.1. Oxygen Scavengers

10.4.1.1.2. Moisture Scavengers

10.4.1.1.3. Ethylene Absorbers

10.4.1.2. Active Releasing Systems

10.4.1.2.1. Antioxidant Releasers

10.4.1.2.2. Carbon Dioxide Emitters

10.4.1.3. Modified Atmosphere Packages (MAP)

10.4.1.4. Temperature Control Packaging

10.4.1.5. Anti-Corrosion Films

10.4.2. Smart and Intelligent Packaging

10.4.2.1. Time-Temperature Indicators (TTI)

10.4.2.2. Freshness Indicators

10.4.2.3. Oxygen and Carbon Dioxide Indicators

10.4.2.4. RFID

10.4.2.5. Others

10.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by End Use

10.5.1. Food

10.5.1.1. Meat, Poultry and Seafood

10.5.1.2. Fruits and Vegetables

10.5.1.3. Ready-to-Eat Meals

10.5.1.4. Dairy Foods

10.5.1.5. Bakery and Confectionery

10.5.1.6. Frozen Foods

10.5.1.7. Cereals

10.5.2. Beverages

10.5.2.1. Alcoholic Beverages

10.5.2.2. Non-Alcoholic Beverages

10.5.3. Pharmaceuticals

10.5.4. Industrial & Chemicals

10.5.5. Cosmetics & Personal Care

10.5.6. Agriculture

10.5.7. Others

10.6. Key Market Participants - Intensity Mapping

10.7. Drivers and Restraints: Impact Analysis

11. Asia-Pacific Advanced Packaging Technologies Market Analysis

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis by Country

11.1.2. Y-o-Y Growth Projections by Country

11.2. Pricing Analysis

11.3. Asia-Pacific Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Country

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. ASEAN

11.3.5. Rest of APAC

11.4. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Technology

11.4.1. Active Packaging

11.4.1.1. Active Scavenging Systems

11.4.1.1.1. Oxygen Scavengers

11.4.1.1.2. Moisture Scavengers

11.4.1.1.3. Ethylene Absorbers

11.4.1.2. Active Releasing Systems

11.4.1.2.1. Antioxidant Releasers

11.4.1.2.2. Carbon Dioxide Emitters

11.4.1.3. Modified Atmosphere Packages (MAP)

11.4.1.4. Temperature Control Packaging

11.4.1.5. Anti-Corrosion Films

11.4.2. Smart and Intelligent Packaging

11.4.2.1. Time-Temperature Indicators (TTI)

11.4.2.2. Freshness Indicators

11.4.2.3. Oxygen and Carbon Dioxide Indicators

11.4.2.4. RFID

11.4.2.5. Others

11.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by End Use

11.5.1. Food

11.5.1.1. Meat, Poultry and Seafood

11.5.1.2. Fruits and Vegetables

11.5.1.3. Ready-to-Eat Meals

11.5.1.4. Dairy Foods

11.5.1.5. Bakery and Confectionery

11.5.1.6. Frozen Foods

11.5.1.7. Cereals

11.5.2. Beverages

11.5.2.1. Alcoholic Beverages

11.5.2.2. Non-Alcoholic Beverages

11.5.3. Pharmaceuticals

11.5.4. Industrial & Chemicals

11.5.5. Cosmetics & Personal Care

11.5.6. Agriculture

11.5.7. Others

11.6. Key Market Participants - Intensity Mapping

11.7. Drivers and Restraints: Impact Analysis

12. Middle East & Africa Advanced Packaging Technologies Market Analysis

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis by Country

12.1.2. Y-o-Y Growth Projections by Country

12.2. Pricing Analysis

12.3. Middle East & Africa Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Country

12.3.1. GCC Countries

12.3.2. Northern Africa

12.3.3. South Africa

12.3.4. Rest of MEA

12.4. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Technology

12.4.1. Active Packaging

12.4.1.1. Active Scavenging Systems

12.4.1.1.1. Oxygen Scavengers

12.4.1.1.2. Moisture Scavengers

12.4.1.1.3. Ethylene Absorbers

12.4.1.2. Active Releasing Systems

12.4.1.2.1. Antioxidant Releasers

12.4.1.2.2. Carbon Dioxide Emitters

12.4.1.3. Modified Atmosphere Packages (MAP)

12.4.1.4. Temperature Control Packaging

12.4.1.5. Anti-Corrosion Films

12.4.2. Smart and Intelligent Packaging

12.4.2.1. Time-Temperature Indicators (TTI)

12.4.2.2. Freshness Indicators

12.4.2.3. Oxygen and Carbon Dioxide Indicators

12.4.2.4. RFID

12.4.2.5. Others

12.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, by End Use

12.5.1. Food

12.5.1.1. Meat, Poultry and Seafood

12.5.1.2. Fruits and Vegetables

12.5.1.3. Ready-to-Eat Meals

12.5.1.4. Dairy Foods

12.5.1.5. Bakery and Confectionery

12.5.1.6. Frozen Foods

12.5.1.7. Cereals

12.5.2. Beverages

12.5.2.1. Alcoholic Beverages

12.5.2.2. Non-Alcoholic Beverages

12.5.3. Pharmaceuticals

12.5.4. Industrial & Chemicals

12.5.5. Cosmetics & Personal Care

12.5.6. Agriculture

12.5.7. Others

12.6. Key Market Participants - Intensity Mapping

12.7. Drivers and Restraints: Impact Analysis

13. Market Structure Analysis

13.1. Market Analysis by Tier of Companies

13.1.1. By Large, Medium and Small

13.2. Market Concentration

13.2.1. By Top 5 and by Top 10

13.3. Market Share Analysis of Top 10 Players

13.4. Market Presence Analysis

14. Competitive Landscape

14.1. Competition Dashboard

14.2. Competition Benchmarking

14.3. Profitability and Gross Margin Analysis by Competition

14.4. Competition Developments

14.5. Company Market Share Analysis

14.6. Competition Deep Dive (20 Companies)

14.6.1. PakSense Inc.

14.6.1.1. Overview

14.6.1.2. Product Portfolio

14.6.1.3. Profitability

14.6.1.4. Production Footprint

14.6.1.5. Sales Footprint

14.6.1.6. Channel Footprint

14.6.1.7. Competition Benchmarking

14.6.1.8. Strategy

14.6.1.8.1. Marketing Strategy

14.6.1.8.2. Product Strategy

14.6.1.8.3. Channel Strategy

14.6.2. Landec Corporation

14.6.2.1. Overview

14.6.2.2. Product Portfolio

14.6.2.3. Profitability

14.6.2.4. Production Footprint

14.6.2.5. Sales Footprint

14.6.2.6. Channel Footprint

14.6.2.7. Competition Benchmarking

14.6.2.8. Strategy

14.6.2.8.1. Marketing Strategy

14.6.2.8.2. Product Strategy

14.6.2.8.3. Channel Strategy

14.6.3. Sealed Air Corporation

14.6.3.1. Overview

14.6.3.2. Product Portfolio

14.6.3.3. Profitability

14.6.3.4. Production Footprint

14.6.3.5. Sales Footprint

14.6.3.6. Channel Footprint

14.6.3.7. Competition Benchmarking

14.6.3.8. Strategy

14.6.3.8.1. Marketing Strategy

14.6.3.8.2. Product Strategy

14.6.3.8.3. Channel Strategy

14.6.4. Bemis Company, Inc.

14.6.4.1. Overview

14.6.4.2. Product Portfolio

14.6.4.3. Profitability

14.6.4.4. Production Footprint

14.6.4.5. Sales Footprint

14.6.4.6. Channel Footprint

14.6.4.7. Competition Benchmarking

14.6.4.8. Strategy

14.6.4.8.1. Marketing Strategy

14.6.4.8.2. Product Strategy

14.6.4.8.3. Channel Strategy

14.6.5. Crown Holdings, Inc.

14.6.5.1. Overview

14.6.5.2. Product Portfolio

14.6.5.3. Profitability

14.6.5.4. Production Footprint

14.6.5.5. Sales Footprint

14.6.5.6. Channel Footprint

14.6.5.7. Competition Benchmarking

14.6.5.8. Strategy

14.6.5.8.1. Marketing Strategy

14.6.5.8.2. Product Strategy

14.6.5.8.3. Channel Strategy

14.6.6. Amcor Limited

14.6.6.1. Overview

14.6.6.2. Product Portfolio

14.6.6.3. Profitability

14.6.6.4. Production Footprint

14.6.6.5. Sales Footprint

14.6.6.6. Channel Footprint

14.6.6.7. Competition Benchmarking

14.6.6.8. Strategy

14.6.6.8.1. Marketing Strategy

14.6.6.8.2. Product Strategy

14.6.6.8.3. Channel Strategy

14.6.7. 3M Company

14.6.7.1. Overview

14.6.7.2. Product Portfolio

14.6.7.3. Profitability

14.6.7.4. Production Footprint

14.6.7.5. Sales Footprint

14.6.7.6. Channel Footprint

14.6.7.7. Competition Benchmarking

14.6.7.8. Strategy

14.6.7.8.1. Marketing Strategy

14.6.7.8.2. Product Strategy

14.6.7.8.3. Channel Strategy

14.6.8. Timestrip U.K. Ltd.

14.6.8.1. Overview

14.6.8.2. Product Portfolio

14.6.8.3. Profitability

14.6.8.4. Production Footprint

14.6.8.5. Sales Footprint

14.6.8.6. Channel Footprint

14.6.8.7. Competition Benchmarking

14.6.8.8. Strategy

14.6.8.8.1. Marketing Strategy

14.6.8.8.2. Product Strategy

14.6.8.8.3. Channel Strategy

14.6.9. Cryolog S.A.

14.6.9.1. Overview

14.6.9.2. Product Portfolio

14.6.9.3. Profitability

14.6.9.4. Production Footprint

14.6.9.5. Sales Footprint

14.6.9.6. Channel Footprint

14.6.9.7. Competition Benchmarking

14.6.9.8. Strategy

14.6.9.8.1. Marketing Strategy

14.6.9.8.2. Product Strategy

14.6.9.8.3. Channel Strategy

14.6.10. Vitsab International AB

14.6.10.1. Overview

14.6.10.2. Product Portfolio

14.6.10.3. Profitability

14.6.10.4. Production Footprint

14.6.10.5. Sales Footprint

14.6.10.6. Channel Footprint

14.6.10.7. Competition Benchmarking

14.6.10.8. Strategy

14.6.10.8.1. Marketing Strategy

14.6.10.8.2. Product Strategy

14.6.10.8.3. Channel Strategy

14.6.11. Varcode, Ltd.

14.6.11.1. Overview

14.6.11.2. Product Portfolio

14.6.11.3. Profitability

14.6.11.4. Production Footprint

14.6.11.5. Sales Footprint

14.6.11.6. Channel Footprint

14.6.11.7. Competition Benchmarking

14.6.11.8. Strategy

14.6.11.8.1. Marketing Strategy

14.6.11.8.2. Product Strategy

14.6.11.8.3. Channel Strategy

14.6.12. LCR Hallcrest LLC

14.6.12.1. Overview

14.6.12.2. Product Portfolio

14.6.12.3. Profitability

14.6.12.4. Production Footprint

14.6.12.5. Sales Footprint

14.6.12.6. Channel Footprint

14.6.12.7. Competition Benchmarking

14.6.12.8. Strategy

14.6.12.8.1. Marketing Strategy

14.6.12.8.2. Product Strategy

14.6.12.8.3. Channel Strategy

14.6.13. Thin Film Electronics ASA

14.6.13.1. Overview

14.6.13.2. Product Portfolio

14.6.13.3. Profitability

14.6.13.4. Production Footprint

14.6.13.5. Sales Footprint

14.6.13.6. Channel Footprint

14.6.13.7. Competition Benchmarking

14.6.13.8. Strategy

14.6.13.8.1. Marketing Strategy

14.6.13.8.2. Product Strategy

14.6.13.8.3. Channel Strategy

14.6.14. CCL Industries Inc.

14.6.14.1. Overview

14.6.14.2. Product Portfolio

14.6.14.3. Profitability

14.6.14.4. Production Footprint

14.6.14.5. Sales Footprint

14.6.14.6. Channel Footprint

14.6.14.7. Competition Benchmarking

14.6.14.8. Strategy

14.6.14.8.1. Marketing Strategy

14.6.14.8.2. Product Strategy

14.6.14.8.3. Channel Strategy

14.6.15. Temptime Corporation

14.6.15.1. Overview

14.6.15.2. Product Portfolio

14.6.15.3. Profitability

14.6.15.4. Production Footprint

14.6.15.5. Sales Footprint

14.6.15.6. Channel Footprint

14.6.15.7. Competition Benchmarking

14.6.15.8. Strategy

14.6.15.8.1. Marketing Strategy

14.6.15.8.2. Product Strategy

14.6.15.8.3. Channel Strategy

14.6.16. Multisorb Technologies, Inc.

14.6.16.1. Overview

14.6.16.2. Product Portfolio

14.6.16.3. Profitability

14.6.16.4. Production Footprint

14.6.16.5. Sales Footprint

14.6.16.6. Channel Footprint

14.6.16.7. Competition Benchmarking

14.6.16.8. Strategy

14.6.16.8.1. Marketing Strategy

14.6.16.8.2. Product Strategy

14.6.16.8.3. Channel Strategy

14.6.17. Coveris Holdings S.A.

14.6.17.1. Overview

14.6.17.2. Product Portfolio

14.6.17.3. Profitability

14.6.17.4. Production Footprint

14.6.17.5. Sales Footprint

14.6.17.6. Channel Footprint

14.6.17.7. Competition Benchmarking

14.6.17.8. Strategy

14.6.17.8.1. Marketing Strategy

14.6.17.8.2. Product Strategy

14.6.17.8.3. Channel Strategy

14.6.18. Ball Corporation

14.6.18.1. Overview

14.6.18.2. Product Portfolio

14.6.18.3. Profitability

14.6.18.4. Production Footprint

14.6.18.5. Sales Footprint

14.6.18.6. Channel Footprint

14.6.18.7. Competition Benchmarking

14.6.18.8. Strategy

14.6.18.8.1. Marketing Strategy

14.6.18.8.2. Product Strategy

14.6.18.8.3. Channel Strategy

14.6.19. SYSCO Corporation

14.6.19.1. Overview

14.6.19.2. Product Portfolio

14.6.19.3. Profitability

14.6.19.4. Production Footprint

14.6.19.5. Sales Footprint

14.6.19.6. Channel Footprint

14.6.19.7. Competition Benchmarking

14.6.19.8. Strategy

14.6.19.8.1. Marketing Strategy

14.6.19.8.2. Product Strategy

14.6.19.8.3. Channel Strategy

14.6.20. VIP Packaging

14.6.20.1. Overview

14.6.20.2. Product Portfolio

14.6.20.3. Profitability

14.6.20.4. Production Footprint

14.6.20.5. Sales Footprint

14.6.20.6. Channel Footprint

14.6.20.7. Competition Benchmarking

14.6.20.8. Strategy

14.6.20.8.1. Marketing Strategy

14.6.20.8.2. Product Strategy

14.6.20.8.3. Channel Strategy

15. Assumptions and Acronyms Used

16. Research Methodology

List of Tables

Table 01: Global Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 02: Global Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 03: Global Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 04: Global Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by End Use

Table 05: Global Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by End Use

Table 06: Global Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Country

Table 07: North America Advanced Packaging Technologies market Value (US$ Mn) and Volume (Mn Units) Forecast, by Country, 2016(A) – 2026(F

Table 08: North America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 09: North America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 10: North America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 11: North America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by End Use

Table 12: North America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by End Use

Table 13: Latin America Advanced Packaging Technologies market Value (US$ Mn) and Volume (Mn Units) Forecast, by Country, 2016(A) – 2026(F)

Table 14: Latin America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 15: Latin America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 16: Latin America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 17: Latin America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by End Use

Table 18: Latin America Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by End Use

Table 19: Europe Advanced Packaging Technologies market Value (US$ Mn) and Volume (Mn Units) Forecast, by Country, 2016(A) – 2026(F)

Table 20: Europe Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 21: Europe Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 22: Europe Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by Technology

Table 23: Europe Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by End Use

Table 24: Europe Advanced Packaging Technologies Market Value (US$ Mn) and Volume (Mn Units) 2017-2026, by End Use

List of Figures

Figure 01: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, 2017-2026

Figure 02: Global Advanced Packaging Technologies Market Absolute $ Opportunity, 2018-2026

Figure 03: Global Advanced Packaging Technologies Market Value Share and BPS Analysis, by Technology, 2018 & 2026

Figure 04: Global Advanced Packaging Technologies Market Y-o-Y growth, by Technology 2018 & 2026

Figure 05: Global Advanced Packaging Technologies Market Attractiveness Analysis, by Technology, 2018

Figure 06: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) Analysis, by Active Packaging Segment, 2017-2026

Figure 07: Global Advanced Packaging Technologies Market Absolute $ Opportunity, by Active Packaging Segment, 2018-2026

Figure 08: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, by Smart and Intelligent Packaging Segment, 2017-2026

Figure 09: Global Advanced Packaging Technologies Market Absolute $ Opportunity, by Smart and Intelligent Packaging Segment, 2018-2026

Figure 10: Global Advanced Packaging Technologies Market Value Share and BPS Analysis, by End Use, 2018 & 2026

Figure 11: Global Advanced Packaging Technologies Market Y-o-Y Growth, by End Use 2018 & 2026

Figure 12: Global Advanced Packaging Technologies Market Attractiveness Analysis, by End Use, 2018

Figure 13: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, by Food Segment, 2017-2026

Figure 14: Global Advanced Packaging Technologies Market Absolute $ Opportunity, by Food Segment, 2018-2026

Figure 15: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, by Beverages Segment, 2017-2026

Figure 16: Global Advanced Packaging Technologies Market Absolute $ Opportunity, by Beverages Segment, 2018-2026

Figure 17: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, by Pharmaceuticals Segment, 2017-2026

Figure 18: Global Advanced Packaging Technologies Market Absolute $ Opportunity, by Pharmaceuticals Segment, 2018-2026

Figure 19: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) Analysis, By Industrial & Chemicals Segment, 2017-2026

Figure 20: Global Advanced Packaging Technologies Market Absolute $ Opportunity, by Industrial & Chemicals Segment, 2018-2026

Figure 21: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, by Cosmetics & Personal Care Segment, 2017-2026

Figure 22: Global Advanced Packaging Technologies Market Absolute $ Opportunity, by Cosmetics & Personal Care Segment, 2018-2026

Figure 23: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, by Agriculture Segment, 2017-2026

Figure 24: Global Advanced Packaging Technologies Market Absolute $ Opportunity, by Agriculture Segment, 2018-2026

Figure 25: Global Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, by Others Segment, 2017-2026

Figure 26: Global Advanced Packaging Technologies Market Absolute $ Opportunity, by Others Segment, 2018-2026

Figure 27: Global Advanced Packaging Technologies Market Value Share and BPS Analysis, by Region, 2018 & 2026

Figure 28: Global Advanced Packaging Technologies Market Y-o-Y growth, by Region 2018 & 2026

Figure 29: Global Advanced Packaging Technologies Market Attractiveness Analysis, by Region, 2018

Figure 30: North America Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) Analysis, 2017-2026

Figure 31: North America Advanced Packaging Technologies Market Absolute $ Opportunity, 2018-2026

Figure 32: North America Advanced Packaging Technologies Market Value Share 2017, by Country

Figure 33: North America Advanced Packaging Technologies Market Value Share 2017, by End Use

Figure 34: North America Advanced Packaging Technologies Market Value Share 2017, by Technology

Figure 35: North America Advanced Packaging Technologies Market Value Share and BPS Analysis, by Country, 2018 & 2026

Figure 36: North America Advanced Packaging Technologies Market Attractiveness Index, by Country, 2018–2026

Figure 37: North America Advanced Packaging Technologies Market Absolute $ opportunity (2018-2026), by Country

Figure 38: North America Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 39: North America Advanced Packaging Technologies Market Attractiveness Index, by Technology, 2018–2026

Figure 40: North America Advanced Packaging Technologies Market Y-o-Y Growth, by Technology, 2018 & 2026

Figure 41: North America Advanced Packaging Technologies Market Attractiveness Index, by End Use, 2018–2026

Figure 42: North America Advanced Packaging Technologies Market Y-o-Y growth, by End Use, 2018 & 2026

Figure 43: Latin America Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, 2017-2026

Figure 44: Latin America Advanced Packaging Technologies Market Absolute $ Opportunity, 2018-2026

Figure 45: Latin America Advanced Packaging Technologies Market Value Share 2017, by Country

Figure 46: Latin America Advanced Packaging Technologies Market Value Share 2017, by End Use

Figure 47: Latin America Advanced Packaging Technologies Market Value Share 2017, by Technology

Figure 48: Latin America Advanced Packaging Technologies Market Value Share and BPS Analysis, by Country, 2018 & 2026

Figure 49: Latin America Advanced Packaging Technologies Market Attractiveness Index, by Country, 2018–2026

Figure 50: Latin America Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 51: Latin America Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 52: Latin America Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 53: Latin America Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 54: Latin America Advanced Packaging Technologies Market Attractiveness Index, by Technology, 2018–2026

Figure 55: Latin America Advanced Packaging Technologies Market Y-o-Y Growth, by Technology, 2018 & 2026

Figure 56: Latin America Advanced Packaging Technologies Market Attractiveness Index, by End Use, 2018–2026

Figure 57: Latin America Advanced Packaging Technologies Market Y-o-Y Growth, by End Use, 2018 & 2026

Figure 58: Europe Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, 2017-2026

Figure 59: Europe Advanced Packaging Technologies Market Absolute $ Opportunity, 2018-2026

Figure 60: Europe Advanced Packaging Technologies Market Value Share 2017, by Country

Figure 61: Europe Advanced Packaging Technologies Market Value Share 2017, by End Use

Figure 62: Europe Advanced Packaging Technologies Market Value Share 2017, by Technology

Figure 63: Europe Advanced Packaging Technologies Market Value Share and BPS Analysis, by Country, 2018 & 2026

Figure 64: Europe Advanced Packaging Technologies Market Attractiveness Index, by Country, 2018–2026

Figure 65: Europe Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 66: Europe Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 67: Europe Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 68: Europe Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 69: Europe Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 70: Europe Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 71: Europe Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 72: Europe Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 73: Europe Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 74: Europe Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 75: Europe Advanced Packaging Technologies Market Attractiveness Index, by Technology, 2018–2026

Figure 76: Europe Advanced Packaging Technologies Market Y-o-Y Growth, by Technology, 2018 & 2026

Figure 77: Europe Advanced Packaging Technologies Market Attractiveness Index, by End Use, 2018–2026

Figure 78: Europe Advanced Packaging Technologies Market Y-o-Y Growth, by End Use, 2018 & 2026

Figure 79: Asia-Pacific Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) analysis, 2017-2026

Figure 80: Asia-Pacific Advanced Packaging Technologies Market Absolute $ Opportunity, 2018-2026

Figure 81: Asia-Pacific Advanced Packaging Technologies Market Value Share 2017, by Country

Figure 82: Asia-Pacific Advanced Packaging Technologies Market Value Share 2017, by End Use

Figure 83: Asia-Pacific Advanced Packaging Technologies Market Value Share 2017, by Technology

Figure 84: Asia-Pacific Advanced Packaging Technologies Market Value Share and BPS Analysis, by Country, 2018 & 2026

Figure 85: Asia-Pacific Advanced Packaging Technologies Market Attractiveness Index, by Country, 2018–2026

Figure 86: Asia-Pacific Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 87: Asia-Pacific Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 88: Asia-Pacific Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 89: Asia-Pacific Advanced Packaging Technologies Absolute $ Opportunity (2018-2026), by Country

Figure 90: Asia-Pacific Advanced Packaging Technologies Market Absolute $ Opportunity (2018-2026), by Country

Figure 91: Asia-Pacific Advanced Packaging Technologies Market Attractiveness Index, by Technology, 2018–2026

Figure 92: Asia-Pacific Advanced Packaging Technologies Market Y-o-Y Growth, by Technology, 2018 & 2026

Figure 93: Asia-Pacific Advanced Packaging Technologies Market Attractiveness Index, by End Use, 2018–2026

Figure 94: Asia-Pacific Advanced Packaging Technologies Market Y-o-Y Growth, by End Use, 2018 & 2026

Figure 95: MEA Advanced Packaging Technologies Market Value (US$ Mn), and Volume (Mn Units) Analysis, 2017-2026

Figure 96: MEA Advanced Packaging Technologies Market Absolute $ Opportunity, 2018-2026

Figure 97: MEA Advanced Packaging Technologies Market Value Share 2017, by Country

Figure 98: MEA Advanced Packaging Technologies Market Value Share 2017, by End Use

Figure 99: MEA Advanced Packaging Technologies Market Value Share 2017, by Technology

Figure 100: MEA Packaging Machinery Market Value Share and BPS Analysis, by Country, 2018 & 2026

Figure 101: MEA Packaging Machinery Market Attractiveness Index, by Country, 2018–2026

Figure 102: MEA Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 103: MEA Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 104: MEA Packaging Machinery Market absolute $ opportunity (2018-2026), by Country

Figure 105: MEA Packaging Machinery absolute $ opportunity (2018-2026), by Country

Figure 106: MEA Advanced Packaging Technologies Market Attractiveness Index, by Technology, 2018–2026

Figure 107: MEA Advanced Packaging Technologies Market Y-o-Y growth, by Technology, 2018 & 2026

Figure 108: MEA Advanced Packaging Technologies Market Attractiveness Index, by End Use, 2018–2026

Figure 109: MEA Advanced Packaging Technologies Market Y-o-Y growth, by End Use, 2018 & 2026