Reports

Reports

The global dimethyl ether (DME) market is going steady. As a clean burning and convenient alternative fuel and chemical intermediate, rise in demand for dimethyl ether has largely been due to its use as a substitute for and blending component of liquefied petroleum gas (LPG) as a cleaner burning fuel source with fewer emissions without making considerable infrastructure changes.

Furthermore, growing use in transportation fuel is due to DME's high cetane number. DME is also used as an aerosol propellant and in chemical synthesis, thereby minimally supporting industrial demand. Generally, DME is produced through methanol dehydration or synthesized from syngas. Increasingly, bio- and renewable DME produced from biomass and waste have been the focus of interest. Players like Oberon Fuels, SHV Energy, and the Mitsubishi Corporation have been investing in renewable DME plants, developing technology partnerships, and entering into strategic partnerships to build DME capacity while looking to diversify uses.

The dimethyl ether (DME) market thrives on a clean, colorless gas that is gaining wide acceptance as an alternative fuel and chemical feedstock. DME is produced by dehydration of methanol, and directly from syngas, and in most cases provides the advantage of being very efficient by burning without producing soot. As DME also has a high cetane number it can also be used as a replacement to diesel in transportation, with less particulate emissions. Apart from fuel, DME is used as a conventional aerosol propellant in many personal care and household products and serves as an intermediate in the chemical industry.

| Attribute | Detail |

|---|---|

| Dimethyl Ether Market Drivers |

|

Governmental and industry groups around the world are under pressure to reduce emissions from household and industrial use of energy. Thus the blending of DHS with liquefied petroleum gas (LPG) has the potential to be one of the major sources of future growth for the global dimethyl ether market. Above and beyond DME’s core properties, when blended with LPG, DME has combustion properties that makes it capable of up to 20% blends without the need for new infrastructure, or changing appliances.

DME is a logical transitional fuel, as it has demonstrated combustion properties that are compatible with LPG. This opportunity for DME is most applicable to developing countries such as India and parts of Southeast Asia when many regions rely upon LPG for cooking, heating, and small industrial use.

DME is often less expensive to produce than from coal, natural gas or as methanol depending on what feedstock is regionally available, providing added flexibility and energy security for energy producers. Companies like Jiutai Energy, Mitsubishi Corporation, and SHV Energy have invested substantial capital in developing DME production plants and joint ventures to supply the LPG blending market at scale.

Dimethyl Ether is turning out to be an attractive option across a variety of industries beyond its use as a fuel. DME is being used more broadly as a chemical feedstock and a propellant. For instance, DME, in the aerosol industry, is increasingly used as an alternative to conventional hydrocarbon-based propellants like butane or chlorofluorocarbons (CFCs).

DME, as compared to traditional propellants, has a fairly low toxicity, is non-ozone depleting, and has excellent solvency capabilities, thereby making it a great fit for personal care products like hair sprays, shaving foam, and deodorants, as well as household cleaning sprays and paints. Moreover, with increasing consumer demand for environmentally-friendly propellants that follow regulations, DME is being used more frequently in these areas of application.

Besides DME’s potential as a feedstock, it can act as an important chemical intermediate for the production of derivatives including dimethyl sulfate, acetic acid, and olefins. Producers of plastics, coatings, pharmaceuticals, and solvents in the petrochemical and specialty chemical industries derive important chemical inputs from these products and their derivatives or downstream products.

A continuing global rise in chemical demand, particularly in the Asia Pacific region, is an indication of DME's expanding role as a feedstock. What makes DME even more compelling is the fact that it can be derived from renewable feedstocks in an era where industries are under pressure to reduce carbon footprints and integrate greener supply chains. From a business point of view, this driver is being fully exploited by companies investing in integrated production facilities to serve both - fuel and chemical markets.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 8.6 Bn |

| Market Forecast Value in 2035 | US$ 22.6 Bn |

| Growth Rate (CAGR) | 9.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Dimethyl Ether Market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The dimethyl ether market was valued at US$ 8.6 Bn in 2024

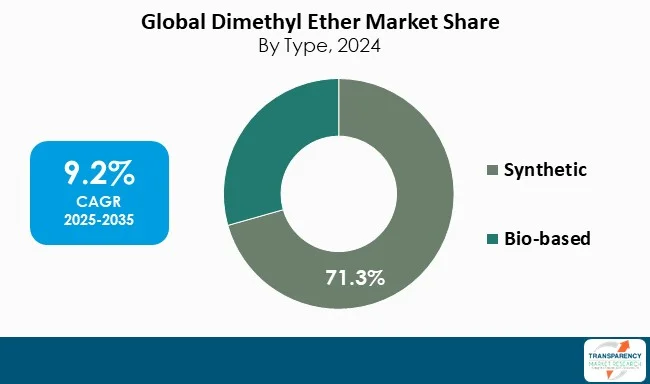

The dimethyl ether industry is expected to grow at a CAGR of 9.2% from 2025 to 2035

Expanding role in LPG blending and growing industrial applications in aerosols and chemical intermediates

Synthetic-based DME was the largest product type segment anticipated to grow at a CAGR of 8.6% during the forecast period

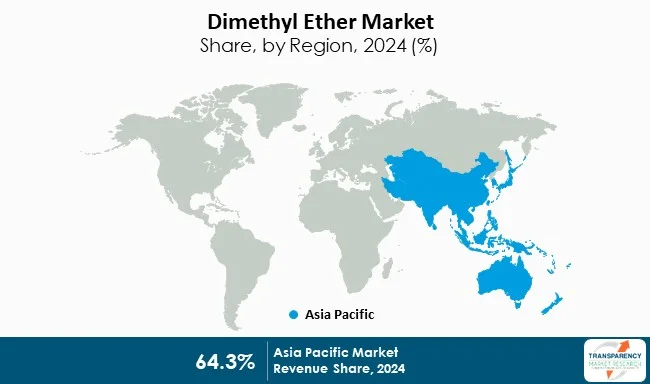

Asia Pacific was the most lucrative region in 2024

Grillo-Werke AG, Oberon Fuels Inc., Linde plc, Mitsubishi Corporation, Toyo Engineering Corporation, Shell Plc, and Nouryon Chemicals Holding BV are the major players in the dimethyl ether market

Table 1 Global Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 2 Global Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 3 Global Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 4 Global Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 5 Global Market Volume (Tons) Forecast, by Production Process 2020 to 2035

Table 6 Global Market Value (US$ Bn) Forecast, by Production Process 2020 to 2035

Table 7 Global Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 8 Global Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 Global Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 10 Global Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 11 Global Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 12 Global Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 13 North America Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 14 North America Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 15 North America Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 16 North America Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 17 North America Market Volume (Tons) Forecast, by Production Process 2020 to 2035

Table 18 North America Market Value (US$ Bn) Forecast, by Production Process 2020 to 2035

Table 19 North America Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 20 North America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 North America Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 North America Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 North America Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 24 North America Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 25 U.S. Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 26 U.S. Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 27 U.S. Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 28 U.S. Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 29 U.S. Market Volume (Tons) Forecast, by Production Process 2020 to 2035

Table 30 U.S. Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 31 U.S. Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 32 U.S. Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 U.S. Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 U.S. Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Canada Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 36 Canada Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 37 Canada Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 38 Canada Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 39 Canada Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 40 Canada Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 41 Canada Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Canada Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Canada Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Canada Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 45 Europe Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 46 Europe Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 47 Europe Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 48 Europe Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 49 Europe Market Volume (Tons) Forecast, by Production Process 2020 to 2035

Table 50 Europe Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 51 Europe Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 Europe Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Europe Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 55 Europe Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 56 Europe Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 57 Germany Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 58 Germany Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 59 Germany Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 60 Germany Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 61 Germany Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 62 Germany Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 63 Germany Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 64 Germany Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Germany Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Germany Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 67 France Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 68 France Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 69 France Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 70 France Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 71 France Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 72 France Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 73 France Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 74 France Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 75 France Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 76 France Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 77 U.K. Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 78 U.K. Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 79 U.K. Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 80 U.K. Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 81 U.K. Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 82 U.K. Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 83 U.K. Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 84 U.K. Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 U.K. Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 U.K. Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 87 Italy Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 88 Italy Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 89 Italy Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 90 Italy Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 91 Italy Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 92 Italy Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 93 Italy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 94 Italy Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 95 Italy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 96 Italy Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 97 Spain Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 98 Spain Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 99 Spain Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 100 Spain Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 101 Spain Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 102 Spain Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 103 Spain Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 104 Spain Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 Spain Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 Spain Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 Russia & CIS Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 108 Russia & CIS Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 109 Russia & CIS Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 110 Russia & CIS Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 111 Russia & CIS Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 112 Russia & CIS Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 113 Russia & CIS Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 114 Russia & CIS Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 115 Russia & CIS Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 116 Russia & CIS Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 117 Rest of Europe Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 118 Rest of Europe Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 119 Rest of Europe Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 120 Rest of Europe Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 121 Rest of Europe Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 122 Rest of Europe Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 123 Rest of Europe Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 124 Rest of Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Rest of Europe Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 126 Rest of Europe Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 127 Asia Pacific Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 128 Asia Pacific Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 129 Asia Pacific Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 130 Asia Pacific Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 131 Asia Pacific Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 132 Asia Pacific Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 133 Asia Pacific Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 134 Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135 Asia Pacific Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 Asia Pacific Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 137 Asia Pacific Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 138 Asia Pacific Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 139 China Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 140 China Market Value (US$ Bn) Forecast, by Type 2020 to 2035

Table 141 China Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 142 China Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 143 China Market Volume (Tons) Forecast, by Production Processe, 2020 to 2035

Table 144 China Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 145 China Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 146 China Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 147 China Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 148 China Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 149 Japan Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 150 Japan Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 151 Japan Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 152 Japan Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 153 Japan Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 154 Japan Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 155 Japan Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 156 Japan Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 Japan Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 Japan Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 159 India Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 160 India Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 161 India Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 162 India Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 163 India Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 164 India Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 165 India Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 166 India Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 167 India Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 168 India Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 169 ASEAN Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 170 ASEAN Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 171 ASEAN Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 172 ASEAN Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 173 ASEAN Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 174 ASEAN Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 175 ASEAN Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 176 ASEAN Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 177 ASEAN Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 ASEAN Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Asia Pacific Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 180 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 181 Rest of Asia Pacific Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 182 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 183 Rest of Asia Pacific Market Volume (Tons) Forecast, byProduction Process, 2020 to 2035

Table 184 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 185 Rest of Asia Pacific Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 186 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 187 Rest of Asia Pacific Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 188 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 189 Latin America Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 190 Latin America Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 191 Latin America Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 192 Latin America Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 193 Latin America Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 194 Latin America Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 195 Latin America Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 196 Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 197 Latin America Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 198 Latin America Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 199 Latin America Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 200 Latin America Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 201 Brazil Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 202 Brazil Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 203 Brazil Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 204 Brazil Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 205 Brazil Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 206 Brazil Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 207 Brazil Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 208 Brazil Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 209 Brazil Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 210 Brazil Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 211 Mexico Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 212 Mexico Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 213 Mexico Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 214 Mexico Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 215 Mexico Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 216 Mexico Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 217 Mexico Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 218 Mexico Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 219 Mexico Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Mexico Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 221 Rest of Latin America Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 222 Rest of Latin America Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 223 Rest of Latin America Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 224 Rest of Latin America Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 225 Rest of Latin America Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 226 Rest of Latin America Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 227 Rest of Latin America Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 228 Rest of Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 229 Rest of Latin America Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 230 Rest of Latin America Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 231 Middle East & Africa Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 232 Middle East & Africa Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 233 Middle East & Africa Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 234 Middle East & Africa Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 235 Middle East & Africa Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 236 Middle East & Africa Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 237 Middle East & Africa Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 238 Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 239 Middle East & Africa Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 240 Middle East & Africa Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 241 Middle East & Africa Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 242 Middle East & Africa Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 243 GCC Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 244 GCC Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 245 GCC Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 246 GCC Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 247 GCC Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 248 GCC Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 249 GCC Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 250 GCC Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 251 GCC Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 252 GCC Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 253 South Africa Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 254 South Africa Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 255 South Africa Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 256 South Africa Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 257 South Africa Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 258 South Africa Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 259 South Africa Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 260 South Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 261 South Africa Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 262 South Africa Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 263 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 264 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 265 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 266 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 267 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 268 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 269 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 270 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 271 Rest of Middle East & Africa Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 272 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 Global Market Attractiveness, by Type

Figure 3 Global Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 4 Global Market Attractiveness, by Source

Figure 5 Global Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 6 Global Market Attractiveness, by Production Process

Figure 7 Global Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 8 Global Market Attractiveness, by Application

Figure 9 Global Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 10 Global Market Attractiveness, by End-use

Figure 11 Global Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 12 Global Market Attractiveness, by Region

Figure 13 North America Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 14 North America Market Attractiveness, by Type

Figure 15 North America Market Attractiveness, by Type

Figure 16 North America Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 17 North America Market Attractiveness, by Source

Figure 18 North America Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 19 North America Market Attractiveness, by Production Process

Figure 20 North America Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 21 North America Market Attractiveness, by Application

Figure 22 North America Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 23 North America Market Attractiveness, by End-use

Figure 24 North America Market Attractiveness, by Country and Sub-region

Figure 25 Europe Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 26 Europe Market Attractiveness, by Type

Figure 27 Europe Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 28 Europe Market Attractiveness, by Source

Figure 29 Europe Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 30 Europe Market Attractiveness, by Production Process

Figure 31 Europe Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 32 Europe Market Attractiveness, by Application

Figure 33 Europe Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 34 Europe Market Attractiveness, by End-use

Figure 35 Europe Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 36 Europe Market Attractiveness, by Country and Sub-region

Figure 37 Asia Pacific Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 38 Asia Pacific Market Attractiveness, by Type

Figure 39 Asia Pacific Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 40 Asia Pacific Market Attractiveness, by Source

Figure 41 Asia Pacific Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 42 Asia Pacific Market Attractiveness, by Production Process

Figure 43 Asia Pacific Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 44 Asia Pacific Market Attractiveness, by Application

Figure 45 Asia Pacific Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 46 Asia Pacific Market Attractiveness, by End-use

Figure 47 Asia Pacific Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Asia Pacific Market Attractiveness, by Country and Sub-region

Figure 49 Latin America Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 50 Latin America Market Attractiveness, by Type

Figure 51 Latin America Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 52 Latin America Market Attractiveness, by Source

Figure 53 Latin America Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 54 Latin America Market Attractiveness, by Production Process

Figure 55 Latin America Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 56 Latin America Market Attractiveness, by Application

Figure 57 Latin America Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 58 Latin America Market Attractiveness, by End-use

Figure 59 Latin America Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 60 Latin America Market Attractiveness, by Country and Sub-region

Figure 61 Middle East & Africa Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 62 Middle East & Africa Market Attractiveness, by Type

Figure 63 Middle East & Africa Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 64 Middle East & Africa Market Attractiveness, by Source

Figure 65 Middle East & Africa Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 66 Middle East & Africa Market Attractiveness, by Production Process

Figure 67 Middle East & Africa Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 68 Middle East & Africa Market Attractiveness, by Application

Figure 69 Middle East & Africa Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 70 Middle East & Africa Market Attractiveness, by End-use

Figure 71 Middle East & Africa Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 72 Middle East & Africa Market Attractiveness, by Country and Sub-region