Reports

Reports

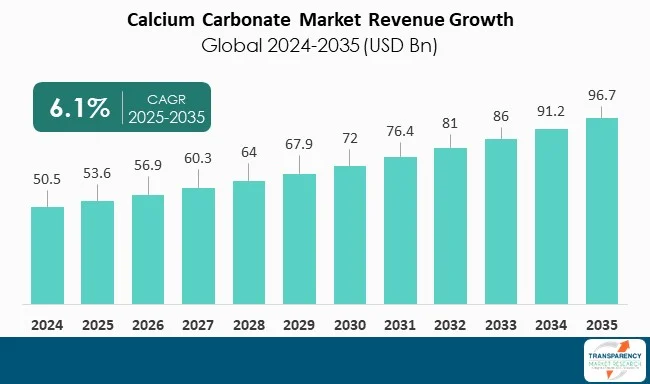

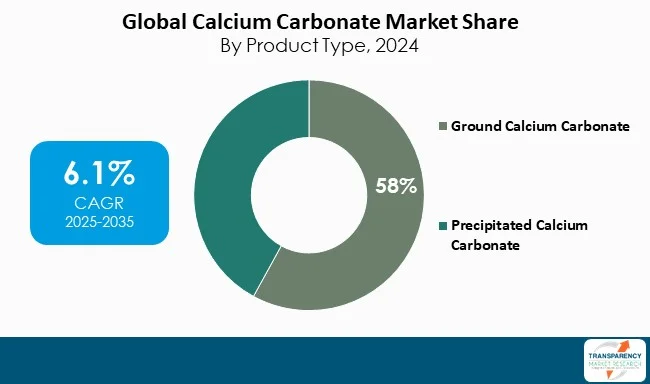

The global market for calcium carbonate continues to have strong traction, displaying a CAGR of 6.1%, which could be attributed to its role as a low-cost, multi-purpose industrial mineral. Ground Calcium Carbonate (GCC) will continue to dominate the product mix part of the market, as it is an adaptable and affordable material with many industrial applications. GCC remains valuable to cost-efficient solutions that enhance mechanical properties and surface quality of fillers in packaging and automotive applications, while also reducing raw materials costs.

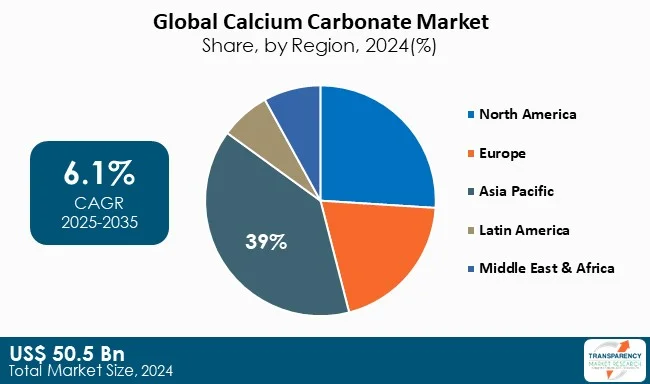

Increased prevalence of osteoporosis in aging population (nearly one-third of women over 50 worldwide), highlights the role of calcium carbonate in daily preventive health and their integration into abundance through fortified food markets within the healthcare and pharmaceutical sector. Geographically, Asia Pacific has the largest market share of 39% driven by the industrial growth of China and India. Calcium carbonate will continue to be indispensable in more mature industries as well as new applications due to calcium carbonate's availability, functionality, and low-cost structure.

Calcium carbonate is a major industrial mineral with high utilization across a wide array of industries owing to its natural availability, diversity of use, and affordability. It exists in two primary forms - Ground Calcium Carbonate (GCC), which is refined from natural limestone or marble, and Precipitated Calcium Carbonate (PCC), which is produced within a controlled chemical process. Calcium carbonate supports various industries like adhesives, construction, healthcare, plastics, paper, and paints and coatings.

One of the primary value aspects of calcium carbonate is how it can be used as a filler and extender in these applications. It is possible to reduce these material inputs while getting better product performance. The paper industry uses calcium carbonate to improve brightness, opacity, and printability of their products, and both GCC and PCC are used in more than 35% of the global paper filler and coating materials.

In the plastic industry, calcium carbonate adds strength, thermal stability, and improves processing, and there is a rapidly increasing demand for calcium carbonate in the packaging and automotive segments. The construction industry uses calcium carbonate as an integral component of cement, concrete and paints, while the healthcare industry uses calcium carbonate as a calcium supplement and inside antacids. The versatility of calcium carbonate is irreplaceable in every major manufacturing and consumer-based industry worldwide.

| Attribute | Detail |

|---|---|

| Calcium Carbonate Market Drivers |

|

The construction industry is one of the largest end-use industries for calcium carbonate, especially with respect to cement, concrete, paints, and coatings. Calcium carbonate is economic as an extender and an added advantage as far as performance, ductility, brightness, and usability. It, as such, supports durability and sustainability in construction.

In cement and concrete products, it optimizes strength within a specified rate format of development by lowering the quantity of clinker required, thus representing cost savings in its production. Infrastructure development programs globally boost demand for calcium carbonate-based construction materials. Some prime examples of current global infrastructure programs with calcium carbonate in a strong end-by-product role include the larger scale housing, road networks, and urban recovery/development programs.

The fillers and additives that contain well over 30% raw materials by weight for several architectural coatings are calcium carbonate-based products. Innovative development often depends on the level of calcium carbonate available in both - the overall coverage and whiteness of decorative paints in residential and commercial projects.

From the standpoint of varied applications, contemporary benefits of calcium carbonate as a versatile, low-cost, reliable, highly processed mineral and abundantly available mineral become a mainstay as an additive that permeates a range of construction applications around the globe.

Calcium carbonate is quickly becoming a leading driver for demand in healthcare and pharmaceuticals industries due to its wide range of functional and economic benefits. Calcium carbonate is used as a dietary calcium supplement, as an effective antacid, and as a pharmaceutical excipient in solid dosage forms. Calcium carbonate is a low-cost, highly bioavailable source of calcium, which is important for promoting bone density and preventing conditions, like osteoporosis that can develop due to bone density loss. With one in three women and one in five men aged 50 and above suffer from osteoporotic fractures, calcium supplementation is of utmost importance.

Calcium carbonate offers a lower cost consideration and is the preferred source of calcium on the part of pharmaceutical and nutraceutical manufacturers. In pharmaceutical applications, calcium carbonate serves as a bulking agent, a tablet base, and as a stabilizer, encouraging manufacturers to achieve consistent targeting, compliance with Quality by Design requirements and overall reduced costs of production. As awareness around preventive healthcare accelerates alongside rising worldwide healthcare costs, the role of calcium carbonate in supplements, pharmaceuticals, and fortified food product formulations will continue to deepen.

Ground Calcium Carbonate has proven to be the overall leader in the calcium carbonate market due to its natural abundance, low cost, and multi-functional properties. Ground Calcium Carbonate is produced naturally from limestone by mechanical grinding non-naturally and is as pure and consistent in particle size as possible. Due to its fine particle size and brightness, Ground Calcium Carbonate can be considered a filler and coating pigment in a wide range of industrial applications.

One major application is in the paper industry that uses Ground Calcium Carbonate as an important pigment in coating. GCC also improves opacity and brightness of white paper and contributes to smoothness when producing substantially reduced costs. Apart from paper, the other industries use GCC in plastics and flexible films, coatings, rubbers, and adhesives. This has added advantages in mechanical strength, dimensional stability and finish. For example, in the polypropylene, GCC filled polypropylene has more stiffness and it reduces the cost of the raw material when producing flexible film packaging and automotive components.

GCC also improves workability and durability in construction materials, particularly in concrete areas and even general cement materials with respect to cost.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific leads Global Market with a share of 39% |

Asia Pacific is the pre-eminent region in the global calcium carbonate market with close to 39% of total share propelled by the rapid industrialization, urbanization, and consumption growth of end-use industries. China and India are the two major countries in Asia Pacific, especially since both of them have sizeable paper manufacturing development, abundant construction, and increasing use of plastics and packaging. For example, in recent years, China has been producing over 120 million metric tons of paper and board product annually, in which GCC and PCC are often the main fillers and coatings to facilitate cost optimization and printability.

Europe is another important region due to advanced manufacturing being witnessed, and the challenging environmental regulations inhibit the use of synthetics in preference to calcium carbonate. Calcium carbonate is a main ingredient in cement and paint; the large construction industry in countries such as In Germany and France has been another equally consistent and significant growth driver.

North America is the other leading market today. The U.S. is the key supplier, and there are several key industries driving demand for calcium carbonate, most significantly in pharmaceuticals, food fortification, and polystyrene plastics. In recent years, the U.S. pharmaceutical products have relied extensively on calcium carbonate in the production of excipients as they are commonly used as filler in pills and ointments and frequently marketed in dietary supplements. With almost US$ 600 Bn in healthcare expenditures in the U.S., it is not surprising that there is a considerable volume usage of calcium carbonate.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 50.5 Bn |

| Market Forecast Value in 2035 | US$ 96.7 Bn |

| Growth Rate (CAGR) | 6.1% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Kilo Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Calcium Carbonate market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The calcium carbonate industry is expected to grow at a CAGR of 6.1% from 2025 to 2035

Growing demand in the construction industry and rising application in the healthcare and pharmaceutical Industry

Ground calcium carbonate was the largest product type segment in the calcium carbonate market.

Asia Pacific was the most lucrative region in 2024

Imerys, Omya AG, Minerals Technologies Inc., Huber Engineered Materials, Mississippi Lime Company, Sibelco, Shiraishi Kogyo Kaisha Ltd., OKUTAMA KOGYO CO., LTD., Newpark Resources Inc., Calcit d.o.o., Nordkalk Corporation, Yuncheng Chemical Industrial CO., Ltd, Changzhou Calcium Carbonate Co. LTD, FUJIAN SANMU NANO CALCIUM CARBONATE CO., LTD., and Maruo Calcium Co..

Table 1 Global Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 2 Global Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 3 Global Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 4 Global Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 5 Global Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Region, 2025 to 2035

Table 6 Global Calcium Carbonate Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 7 North America Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 8 North America Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 9 North America Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 10 North America Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 11 North America Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Country, 2025 to 2035

Table 12 North America Calcium Carbonate Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 13 U.S. Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 14 U.S. Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 15 U.S. Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 16 U.S. Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 17 Canada Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 18 Canada Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 19 Canada Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 20 Canada Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 21 Europe Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 22 Europe Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 23 Europe Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 24 Europe Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 25 Europe Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 26 Europe Calcium Carbonate Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 27 Germany Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 28 Germany Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 29 Germany Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 30 Germany Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 31 France Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 32 France Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 33 France Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 34 France Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 35 U.K. Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 36 U.K. Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 37 U.K. Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 38 U.K. Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 39 Italy Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 40 Italy Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 41 Italy Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 42 Italy Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 43 Spain Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 44 Spain Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 45 Spain Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 46 Spain Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 47 Russia & CIS Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 48 Russia & CIS Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 49 Russia & CIS Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 50 Russia & CIS Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 51 Rest of Europe Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 52 Rest of Europe Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 53 Rest of Europe Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 54 Rest of Europe Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 55 Asia Pacific Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 56 Asia Pacific Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 57 Asia Pacific Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 58 Asia Pacific Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 59 Asia Pacific Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 60 Asia Pacific Calcium Carbonate Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 61 China Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 62 China Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type 2025 to 2035

Table 63 China Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 64 China Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 65 Japan Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 66 Japan Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 67 Japan Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 68 Japan Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 69 India Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 70 India Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 71 India Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 72 India Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 73 ASEAN Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 74 ASEAN Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 75 ASEAN Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 76 ASEAN Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 77 Rest of Asia Pacific Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 78 Rest of Asia Pacific Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 79 Rest of Asia Pacific Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 80 Rest of Asia Pacific Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 81 Latin America Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 82 Latin America Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 83 Latin America Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 84 Latin America Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 85 Latin America Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Latin America Calcium Carbonate Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 Brazil Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 88 Brazil Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 89 Brazil Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 90 Brazil Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 91 Mexico Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 92 Mexico Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 93 Mexico Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 94 Mexico Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 95 Rest of Latin America Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 96 Rest of Latin America Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 97 Rest of Latin America Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 98 Rest of Latin America Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 99 Middle East & Africa Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 100 Middle East & Africa Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 101 Middle East & Africa Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 102 Middle East & Africa Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 103 Middle East & Africa Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 104 Middle East & Africa Calcium Carbonate Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 105 GCC Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 106 GCC Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 107 GCC Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 108 GCC Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 109 South Africa Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 110 South Africa Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 111 South Africa Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 112 South Africa Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 113 Rest of Middle East & Africa Calcium Carbonate Market Volume (Kilo Tons) Forecast, by Product Type, 2025 to 2035

Table 114 Rest of Middle East & Africa Calcium Carbonate Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 115 Rest of Middle East & Africa Calcium Carbonate Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 116 Rest of Middle East & Africa Calcium Carbonate Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Figure 1 Global Calcium Carbonate Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 2 Global Calcium Carbonate Market Attractiveness, by Product Type

Figure 3 Global Calcium Carbonate Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 4 Global Calcium Carbonate Market Attractiveness, by End-use

Figure 5 Global Calcium Carbonate Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 6 Global Calcium Carbonate Market Attractiveness, by Region

Figure 7 North America Calcium Carbonate Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 8 North America Calcium Carbonate Market Attractiveness, by Product Type

Figure 9 North America Calcium Carbonate Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 10 North America Calcium Carbonate Market Attractiveness, by End-use

Figure 11 North America Calcium Carbonate Market Attractiveness, by Country and Sub-region

Figure 12 Europe Calcium Carbonate Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 13 Europe Calcium Carbonate Market Attractiveness, by Product Type

Figure 14 Europe Calcium Carbonate Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 15 Europe Calcium Carbonate Market Attractiveness, by End-use

Figure 16 Europe Calcium Carbonate Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 17 Europe Calcium Carbonate Market Attractiveness, by Country and Sub-region

Figure 18 Asia Pacific Calcium Carbonate Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 19 Asia Pacific Calcium Carbonate Market Attractiveness, by Product Type

Figure 20 Asia Pacific Calcium Carbonate Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 21 Asia Pacific Calcium Carbonate Market Attractiveness, by End-use

Figure 22 Asia Pacific Calcium Carbonate Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 23 Asia Pacific Calcium Carbonate Market Attractiveness, by Country and Sub-region

Figure 24 Latin America Calcium Carbonate Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 25 Latin America Calcium Carbonate Market Attractiveness, by Product Type

Figure 26 Latin America Calcium Carbonate Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 27 Latin America Calcium Carbonate Market Attractiveness, by End-use

Figure 28 Latin America Calcium Carbonate Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 29 Latin America Calcium Carbonate Market Attractiveness, by Country and Sub-region

Figure 30 Middle East & Africa Calcium Carbonate Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 31 Middle East & Africa Calcium Carbonate Market Attractiveness, by Product Type

Figure 32 Middle East & Africa Calcium Carbonate Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 33 Middle East & Africa Calcium Carbonate Market Attractiveness, by End-use

Figure 34 Middle East & Africa Calcium Carbonate Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 35 Middle East & Africa Calcium Carbonate Market Attractiveness, by Country and Sub-region